Reviewing the six major competitors for USDH minting rights, I'm betting on Ethena

TechFlow Selected TechFlow Selected

Reviewing the six major competitors for USDH minting rights, I'm betting on Ethena

If Ethena wins, I will gain over 10x returns.

Author: Naruto11.eth

Translation: AididiaoJP, Foresight News

If you've been in crypto for at least three months, by now you should know what Hyperliquid is. If not, in short: it's one of the most successful projects in the cryptocurrency space, highly profitable, with a loyal community, and represents the future of decentralized finance.

Right now, everyone’s eyes are on the proposals for Hyperliquid and USDH.

What is USDH?

Essentially, it's a "Hyperliquid-first native stablecoin."

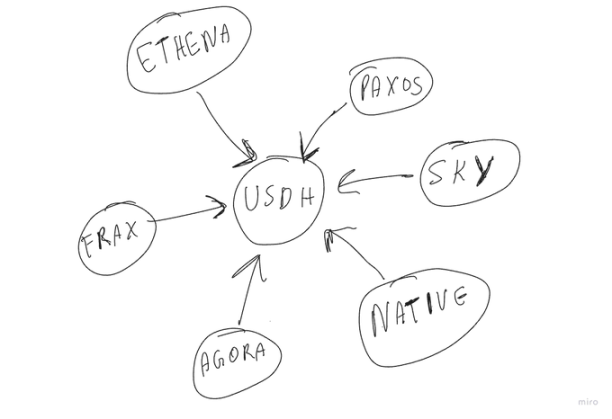

There have already been multiple proposals, even WLFI wanted to get involved. For simplicity, we’ll skip the weaker ones.

Here are the main contenders:

And the latest Polymarket data:

Native Markets

Native Markets: Co-founded by @fiege_max and his team, leading in Polymarket votes.

Some interesting ideas from Native Markets:

-

USDH is built with GENIUS Act compliance, institutional reserve management via custody, and designed to be issuer-agnostic.

-

Hyperliquid Foundation: 50% of reserve earnings go directly and immutably to the Hyperliquid Foundation, while the other 50% is reinvested into USDH growth. This mirrors past Hyperliquid fee-sharing precedents (HIP-3, deployer fees), community ownership, and long-term alignment with Hyperliquid.

-

Developed the CoreRouter smart contract, a first-of-its-kind contract enabling atomic minting of USDH on HyperEVM and cross-chain bridging to HyperCore.

Overall, many people currently support Native’s proposal.

Ethena

Ethena: I learned this morning from @gdog97_ that this is actually a very strong proposal backed by many community members and external parties. Ethena also has an exceptionally strong team with extensive experience in stablecoin issuance. Here are some highlights:

-

USDH initially 100% backed by USDtb (held via Anchorage Digital Bank, compliant with GENIUS Act), indirectly supported by BlackRock BUIDL. Emphasis on institutions + compliance + ample early liquidity.

-

A personal favorite aspect of the proposal: The current USDtb supply exceeds the total cumulative supply of all other pure-Treasury-backed stablecoin issuers who have filed applications to date. Including USDe, Ethena's product scale is about 10x the sum of all other such issuers combined, excluding Sky. To date, Ethena has minted and redeemed over $23 billion in tokenized dollar assets without any security issues or downtime.

-

Revenue for the community: Commitment to allocate no less than 95% of USDH reserve net income to Hyperliquid (Foundation + HYPE buybacks; later may vote to share with staked HYPE and validators).

-

Ethena will cover all transaction costs for migrating from USDC to USDH.

-

Security provided by an elected Hyperliquid body with authority to freeze and reissue, avoiding any severe damage or failure.

-

Liquidity and microstructure advantages: Immediate USDH, USDC, and USDT liquidity swaps through Ethena market maker relationships and fee tiers; aims to have no liquidity disadvantage compared to USDT pairs on CEXs.

-

GENIUS Act advantage: Currently the only clearly defined path to full GENIUS compliance via ADB; NYDFS and MTL paths may be slower and uncertain.

-

Strong ecosystem showcase: $13 billion USDe balance sheet, largest natural counterparty in perpetuals; committed $75 million to $150 million in incentives for HIP-3 frontends.

What truly won hearts? The prophecy that each point could be worth $800 might come true through Ethena.

Agora

Agora: Personally supporting the proposal by @withAUSD and @Nick_van_Eck. Agora's stablecoin infrastructure for USDH is actually excellent. Key points include:

-

Reserves managed by State Street ($49 trillion AUM) and VanEck ($130 billion AUM); liquidity management banks (Cross River, Customers Bank), providing institutional-grade setup and early credibility.

-

100% net profits returned to Hyperliquid: All reserve earnings and buyback fund. Simple, maximizing value accrual.

-

Hyperliquid-first and neutral issuer: USDH natively issued on Hyperliquid; Agora has no competing chains, brokerage, or exchange (frictionless alignment).

-

Compliant with GENIUS Act requirements.

-

Strong distribution network: Rain + LayerZero + EtherFi. Brings new users and more liquidity to Hyperliquid, especially through crypto card usage.

-

Upfront liquidity of $10 million on day one.

My thoughts: @Nick_van_Eck and other team members bring significant experience from traditional finance and @vaneck_us itself—this is why I believe they can win the vote and make USDH great. I'm also a big fan of the @withAUSD team.

Sky

Sky (formerly MakerDAO): @SkyEcosystem and @RuneKek also submitted a strong proposal. Everyone knows MakerDAO and its importance as an ecosystem player in crypto. Here’s what I’ve gathered:

-

Sky is the fourth-largest stablecoin project: $8B+ USDS, $13B collateral, 7+ years uptime, zero security incidents.

-

But Sky also brings liquidity advantages: 2.2B USDC instant redemption via Peg Stability Module (PSM) + seamless transition to USDH margin perps and spot pairs. Sky deploys its $8B+ balance sheet into Hyperliquid.

-

Uses LayerZero.

-

All 4.85% returns on USDH across Hyperliquid go entirely to HYPE buybacks via the buyback fund. Optional sUSDS integration and immediate access to Sky savings rate (currently 4.75%).

-

Commitment to invest $25 million establishing a DeFi incubator “Hyperliquid Genesis Star” token mining program, similar to Spark (TVL $1.2B). Sky’s annual $250M+ profit buybacks may migrate to Hyperliquid. Adds liquidity and sets a standard for protocol buybacks.

-

The rest largely overlaps. GENIUS-compliant, risk-managed, transparent, real-time monitoring, long-term plan: USDH becomes its own "Sky genesis asset".

One tweet really resonated with me—I think Sky is also well-positioned.

Frax Finance

Frax Finance: Below are some brief points from the @fraxfinance team.

-

Frax commits to distributing 100% of treasury revenue to Hyperliquid. No cuts taken—no tokens, no revenue sharing in any form.

-

In their updated proposal, they state they have a federally regulated U.S. bank (name not yet disclosed) + GENIUS Act compliance.

-

U.S. Treasuries held via Blackrock, Superstate, WisdomTree, etc.

-

Frax distribution: connectivity across 20+ chains, but USDH remains native to Hyperliquid. Rewards flow programmatically and transparently on-chain; governance chooses recipients.

-

Community-first.

Expected economic impact: $55B deposits + 4% U.S. Treasury yield = $220M annual revenue. All flows back to Hyperliquid:

-

Boost HYPE staking yields

-

Buyback fund purchases

-

Trader rebates or USDH holder rewards

Paxos

Paxos: The final strong contender is @paxos. They’ve submitted a V2 version for the USDH proposal, similar to $PYUSD.

Key highlights of Paxos and their proposal:

-

Paxos promotes Hyperliquid globally.

-

Distribution efforts: HYPE listed on PayPal and Venmo, and USDH offers free fiat on/off ramps.

-

Commitment of $20 million in incentives, plus $20 million in incentives pledged by PayPal within the Hype ecosystem.

-

Checkout integrations: PayPal Checkout, Braintree, Venmo P2P, Hyperwallet mass payments, Xoom remittances (100+ countries).

Revised aid fund revenue structure:

-

Begins with 20% allocated to buyback fund (TVL < $1B), gradually increases, reaching 70% allocation to aid fund when USDH > $5B.

-

Paxos charges 0% before $1B, capped at 5% after $5B, fees held in HYPE.

-

Governance votes at each major milestone, supervised by the community.

More important things:

-

Users could trade Hyperliquid liquidity without even knowing it.

-

Paxos as an asset issuer brings RWA to HIP-3 perpetuals.

-

Paxos will build a HyperEVM "Earn" product + retail and institutionally scaled structured tokenized HLP products.

These are the six main proposals. While I like them all, I lean more toward Ethena because of their strong, serious proposal, or Agora due to their traditional finance relationships that could elevate Hyperliquid to a higher level.

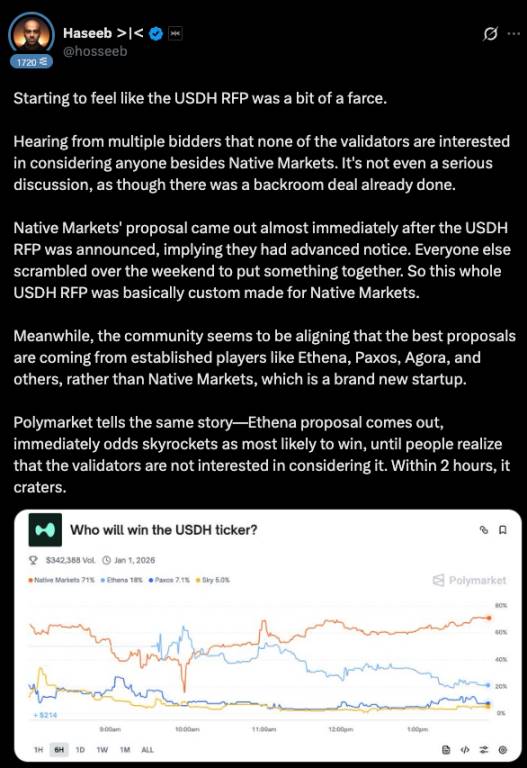

Many people are betting on Native, and rumors keep circulating that the winner was decided even before bidding started. If you consider how quickly Native was formed and how their proposal lacks real weight compared to Agora or Ethena, this makes some sense.

In the past four days, I've spoken with multiple Hyperliquid members and read extensively on Twitter—almost all say this isn’t true. Validators haven’t decided on any proposal, and no winner could possibly be chosen beforehand.

Yet personally, I agree with @hosseeb that there’s some truth here, or at least it was the initial expectation, and the winner was somewhat pre-determined. Either way, this is actually great marketing for Hyperliquid and all participating companies.

What happens now? Nobody knows—we’ll soon see who wins. My money’s on Ethena. What about you?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News