The Battle for Hyperliquid: Who Will Claim the $5.6 Billion Treasury?

TechFlow Selected TechFlow Selected

The Battle for Hyperliquid: Who Will Claim the $5.6 Billion Treasury?

Each generation has its own business battles, and the next one to take center stage is the USDH war.

Author: Tristero Research

Translation: TechFlow

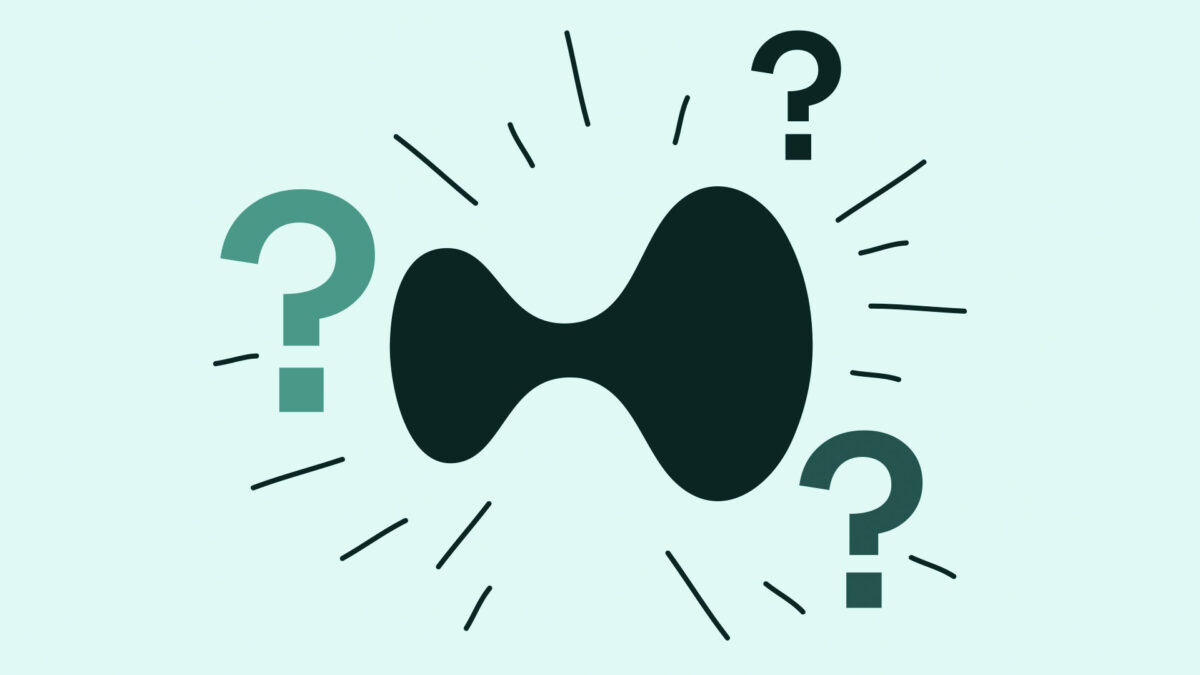

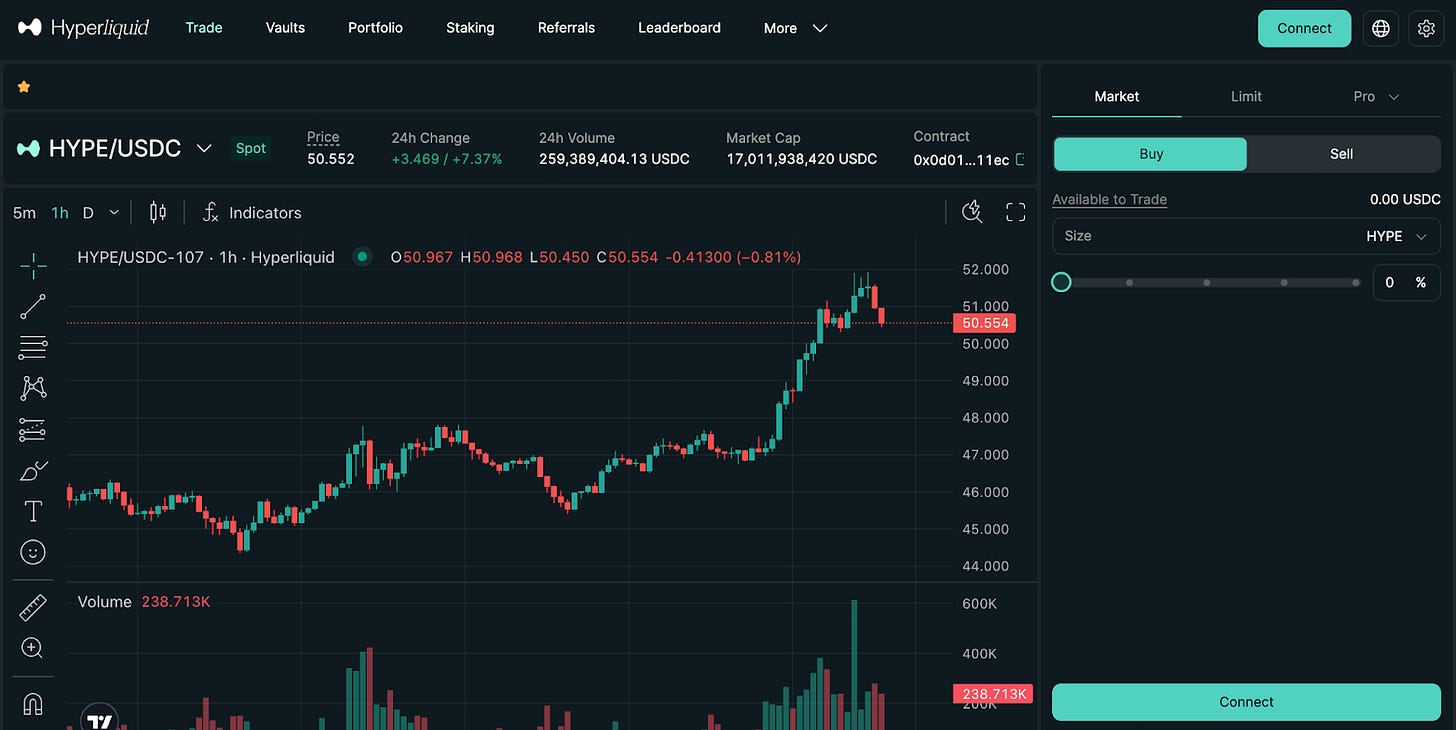

Hyperliquid is one of the fastest-growing perpetual contract exchanges in DeFi, securing billions of dollars in locked value. With an exceptionally smooth user experience and a rapidly expanding user base, the exchange has become a dominant platform for on-chain derivatives trading. Currently, its trading engine is powered by over $5.6 billion in stablecoins, the vast majority being Circle’s USDC.

This capital generates massive revenue streams through underlying reserves, but currently these earnings flow to external institutions. Now, the Hyperliquid community is moving to reclaim them.

On September 14, Hyperliquid will face a decisive showdown. Its validators will cast a critical vote to determine who holds the keys to USDH—the platform’s first native stablecoin. This vote is about far more than just token ownership; it’s about control over a financial engine capable of funneling tens of millions in revenue back into the ecosystem. The process resembles multi-billion-dollar requests for quotation (RFQs) or government bond auctions—but it will happen transparently on-chain. Validators, who stake HYPE to secure network safety, also act as a “hiring committee,” deciding who mints USDH and how billions in yield are redistributed.

The contrast between candidates is stark—one side consists of crypto-native developer teams promising full alignment, while the other comprises institutional finance giants with deep capital and proven operational frameworks.

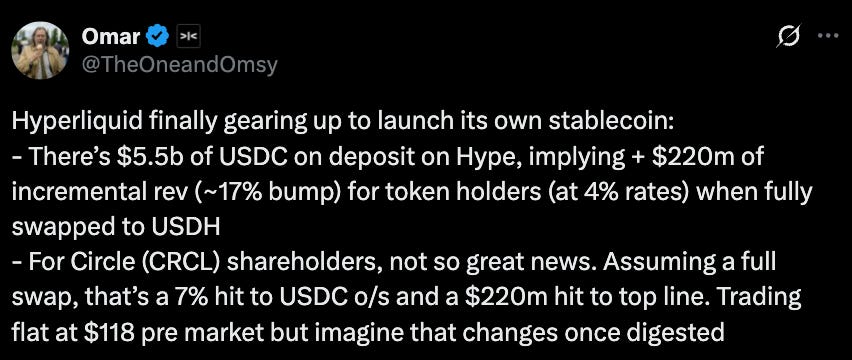

Mature Model: A Potential $220 Million Annual Opportunity

To understand the stakes, follow the money. Currently, USDC sits atop the stablecoin throne. Its issuer, Circle, quietly accumulates wealth by investing reserves in U.S. Treasuries and capturing yield—earning $658 million in just one quarter. This is precisely the business model Hyperliquid aims to replicate.

By replacing third-party stablecoins with its own native USDH, the platform can prevent value leakage and redirect cash flows inward. Based on current balances, USDH reserves alone could generate $220 million in annual revenue. This marks Hyperliquid’s shift from “tenant” to “landlord”—no longer a customer of external stablecoins, but owner of its own financial foundation. For Circle, this competition is critical: losing Hyperliquid’s reserve capital could instantly reduce its income by as much as 10%, exposing its heavy reliance on interest revenue.

The only question facing the community is not whether to pursue this prize, but whom to trust in achieving it.

Yet Circle does not intend to relinquish its position easily. Before the USDH proposal emerged, Circle moved to solidify its standing on Hyperliquid, announcing in late July the launch of native USDC and CCTP V2. This upgrade promises seamless USDC transfers across supported blockchains, improving capital efficiency—no wrapped tokens, no traditional cross-chain bridges. Circle also introduced its institutional-grade fiat on/off ramps via Circle Mint. The message is clear: as the listed issuer of USDC, Circle won’t readily cede Hyperliquid’s liquidity to competitors.

Candidates: A Clash of Visions

Divergent visions for USDH have emerged, each representing a different strategic path for Hyperliquid.

Native Markets, the Hyperliquid-native team, quickly entered the race after the USDH announcement, proposing a stablecoin compliant with the GENIUS Act, built specifically for the platform. Their plan includes integrating fiat gateways to streamline deposits and withdrawals, and sharing revenue with the Hyperliquid Assistance Fund. The team includes seasoned figures like MC Lader, former president of Uniswap Labs, though some community members questioned the timing and funding sources of their proposal. Positioned as the most localized option, they combine compliance, on-chain expertise, and a commitment to recycling value back into the ecosystem. Advantages are clear: a credible local project aligned with regulatory standards and tightly coupled with $HYPE. Disadvantages include skepticism around timing and whether the team has sufficient resources to scale.

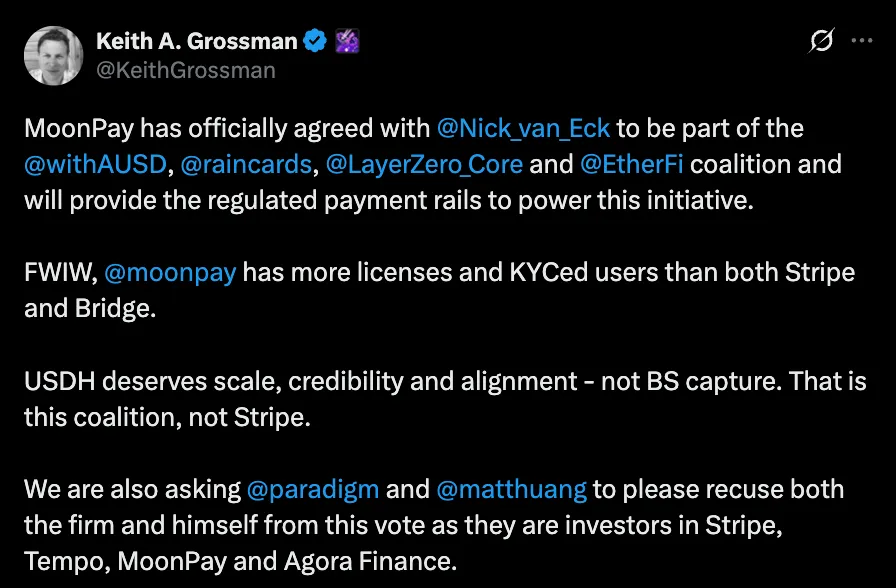

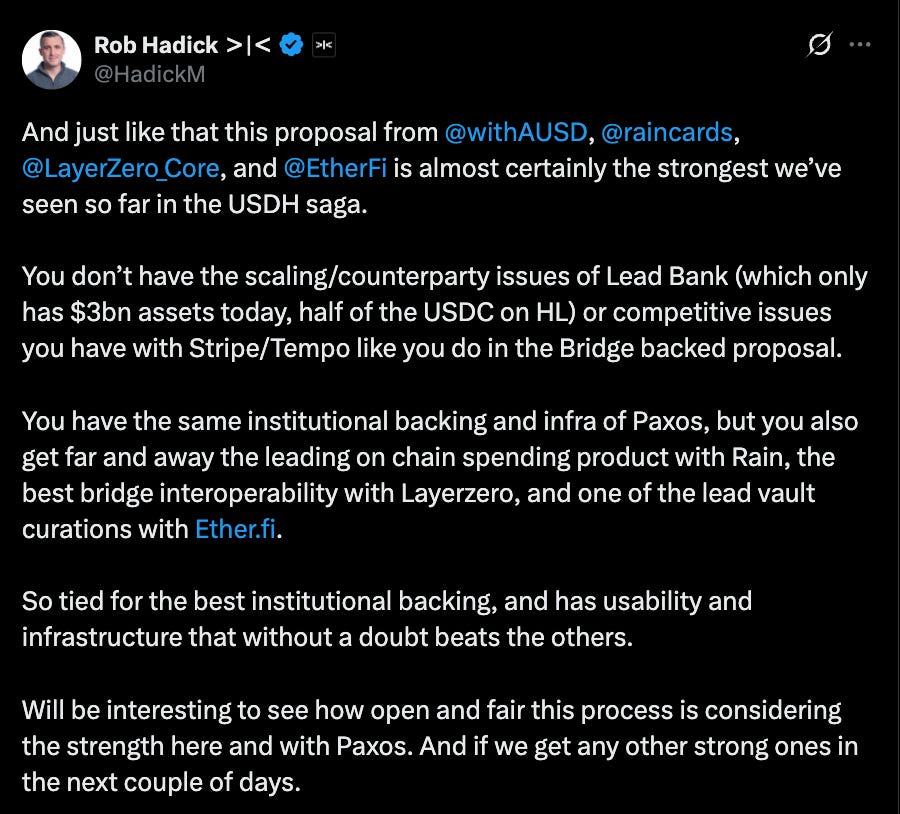

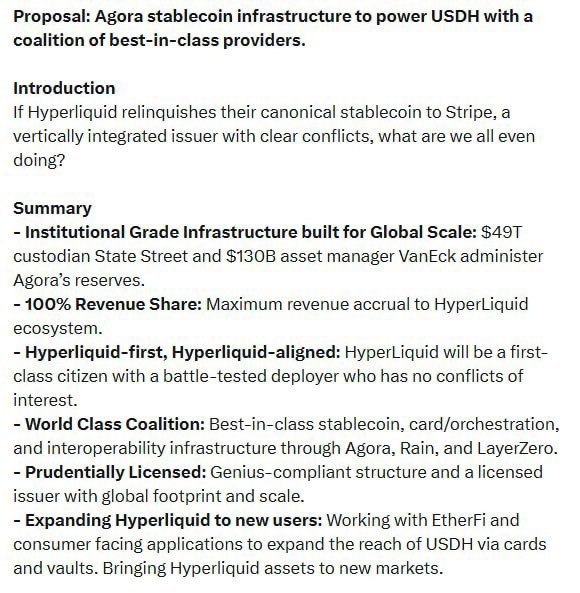

A proposal gaining significant momentum comes from Agora, a stablecoin infrastructure provider, which has assembled a consortium of established partners. Agora is backed by MoonPay, a crypto on-ramp service whose licensed jurisdictions and number of KYC-verified users exceed those of Stripe;

Rain, offering seamless on-chain spending and card services; and LayerZero, delivering best-in-class cross-chain interoperability.

Backed by a recent $50 million raise led by Paradigm, Agora emphasizes compliance through proof-of-reserves and positions itself as fully aligned with Hyperliquid’s interests. Its reserves would be custodied by State Street, managed by VanEck, and verified by Chaos Labs. The team also pledges at least $10 million in initial liquidity through partners like Cross River and Customers Bank. Their proposal offers an institutionally-backed mature model and a core promise: every dollar of net income from USDH reserves will flow back into the Hyperliquid ecosystem. In practice, this means growth in the stablecoin directly translates into gains for HYPE holders. Advantages include institutional credibility, capital backing, and distribution strength. But reliance on banks and custodians may reintroduce the off-chain bottlenecks USDH was meant to avoid.

Stripe enters with a proposal following its $1.1 billion acquisition of Bridge, aiming to make USDH the backbone of a global stablecoin payment network. Bridge’s infrastructure already enables businesses to accept and settle stablecoin payments (like USDC) in over 100 countries with low fees and near-instant speed, and integration with Stripe brings regulatory credibility, developer-friendly API stacks, and seamless card/payment connectivity. The company also plans to launch its own fiat-backed stablecoin, USDB, within the Bridge ecosystem, aiming to bypass external blockchain costs and build defensive moats. Advantages are evident: Stripe’s scale, brand, and distribution power could propel USDH into mainstream commerce. Yet risks lie in strategic control—a vertically integrated fintech firm with its own chain (Tempo) and wallet (Privy) might ultimately dominate Hyperliquid’s core monetary layer.

Other candidates have taken different paths. Paxos, a regulated trust company based in New York, offers the most conservative option: compliance-first. Paxos promises that 95% of USDH reserve interest will go directly toward HYPE buybacks. Paxos also commits to listing HYPE across its supported networks—including PayPal, Venmo, and MercadoLibre—an institutional distribution channel unmatched by other bidders. Despite a friendlier regulatory environment under a potential Trump administration, Paxos remains the top choice for those prioritizing durability and regulatory approval as the cornerstone of USDH’s long-term legitimacy. Its weakness lies in full dependence on fiat custody, exposing it to U.S. banking and regulatory risks—the same vulnerabilities that led to BUSD’s downfall.

In contrast, Frax Finance offers a DeFi-native approach. Born from the crypto ecosystem, Frax’s proposal prioritizes on-chain mechanisms, deep community governance, and a revenue-sharing strategy appealing to crypto purists. Their campaign is a bet on a more decentralized, community-centric vision for USDH’s future. Their design backs USDH 1:1 with frxUSD and U.S. Treasuries managed by asset giants like BlackRock, enabling seamless conversion to USDC, USDT, frxUSD, and fiat. Frax also pledges to distribute 100% of profits directly to Hyperliquid users, with governance fully controlled by validators. Advantages include a proven, high-yield, community-driven model highly aligned with crypto ideals; weaknesses include reliance on frxUSD and off-chain Treasuries introducing external risks and limiting adoption relative to traditional financial institutions.

Konelia is a smaller, lesser-known participant in the USDH race, submitting a bid through the same on-chain auction process as larger contenders. Their plan emphasizes compliant issuance, reserve management, and ecosystem alignment tailored to Hyperliquid’s high-performance Layer 1. Unlike top-tier candidates, the proposal lacks public details and has attracted limited community attention. Though formally recognized as a valid bidder, Konelia is seen more as a fringe player than a frontrunner. Advantages include formal eligibility and L1-specific customization, but lack of transparency, brand recognition, and community support puts it at a disadvantage against well-capitalized rivals.

Finally, the xDFi team—comprised of DeFi veterans from SushiSwap and LayerZero—proposes a fully crypto-collateralized, multichain stablecoin USDH, live across 23 EVM chains from day one. Backed by assets such as ETH, BTC, USDC, and AVAX, balances would sync natively across chains via xD infrastructure, eliminating cross-chain bridging and fragmentation. The design allocates 69% of revenue to $HYPE governance, 30% to validators, and 1% to protocol maintenance, making USDH community-owned and free from banks or custodians. Its appeal lies in censorship-resistant, crypto-pure design that strengthens Hyperliquid’s role as a liquidity hub; risks include stability relying on volatile crypto collateral and lack of regulatory backing needed for mainstream adoption.

Curve takes a unique approach, positioning itself as a partner rather than competitor. Leveraging its crvUSD LLAMMA mechanism, Curve proposes a dual-stablecoin system: a regulated USDH backed by Paxos or Agora, and a decentralized dUSDH backed by HYPE and HLP but running on Curve’s CDP infrastructure, governed by Hyperliquid. This setup could unlock looping, leverage, and yield strategies while creating powerful flywheels for HYPE and HLP value. Curve highlights crvUSD’s resilience and stable peg during volatile markets, offers flexible licensing terms, and notes its CDP model has generated $2.5–10 million annually at a $100 million scale. Advantages include a balanced “best-of-both-worlds” solution—regulatory coverage plus decentralized options; disadvantages include potential liquidity and brand dilution from splitting into two tokens, and reflexive risk from using Hyperliquid’s own assets as collateral.

Decentralized Empowerment

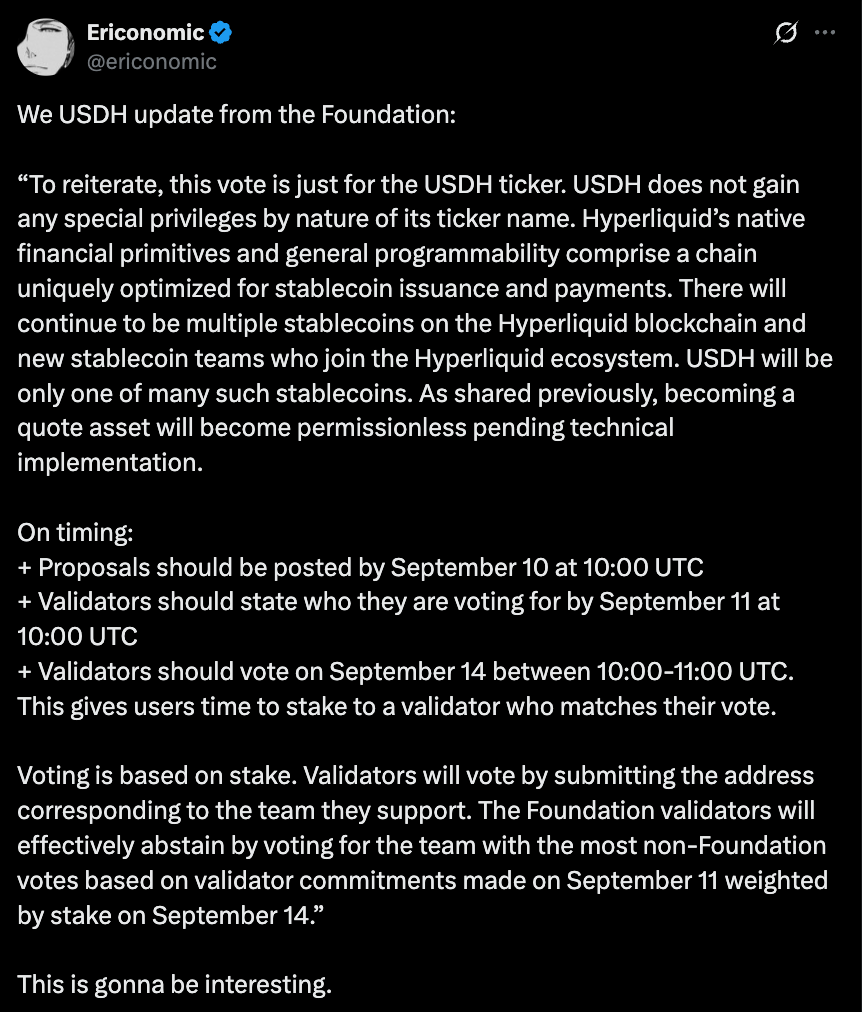

The final decision will rest with Hyperliquid’s validators through on-chain voting. To ensure a fair, community-driven outcome, the Hyperliquid Foundation has announced it will abstain from voting—a significant move.

By pledging to support the majority opinion, the Foundation steps back—alleviating concerns over centralization and clearly signaling that decisions lie entirely in the hands of stakeholders.

September 14 will be more than just a vote—it will be a test of DeFi governance maturity, shifting from symbolic debates over fee changes to community-voted awards of billion-dollar contracts.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News