Is the leverage tool of USDe a trap or a pie?

TechFlow Selected TechFlow Selected

Is the leverage tool of USDe a trap or a pie?

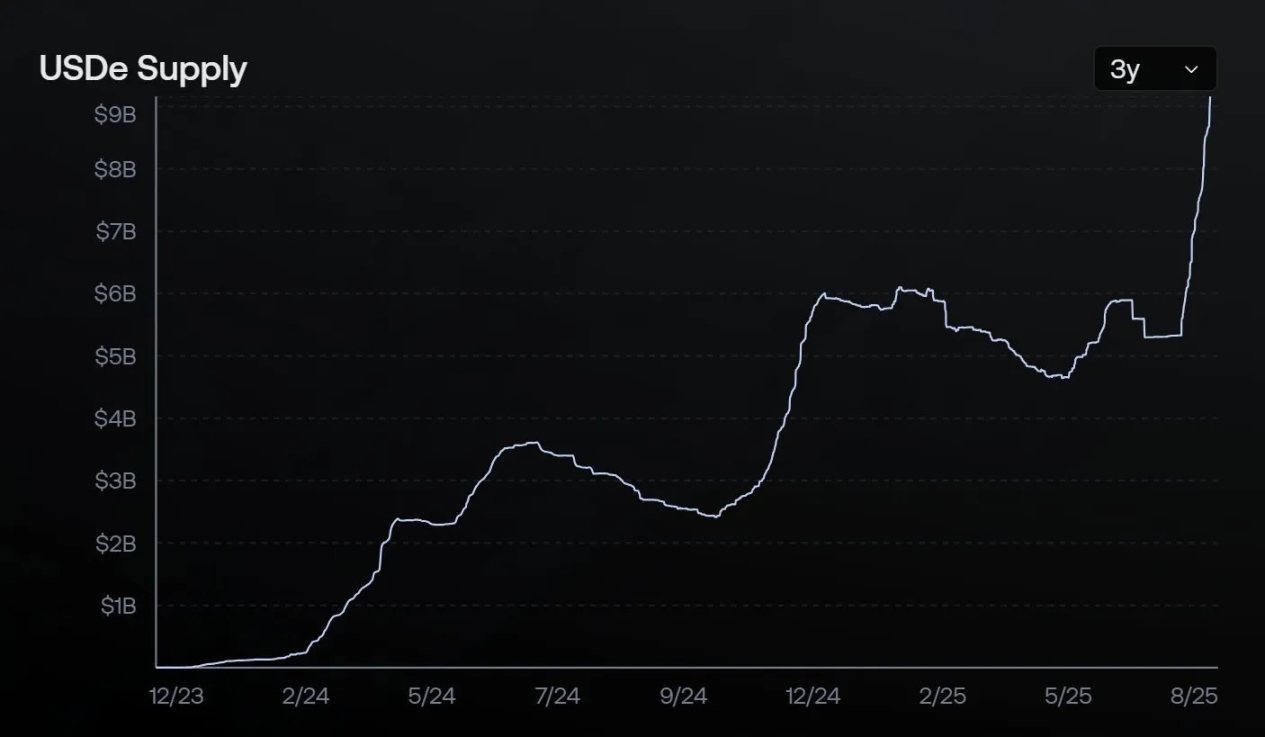

The very mechanism currently driving the surge in USDe's market cap for Ethena will one day become the cause of its collapse.

Author: Duo Nine⚡YCC

Translation: Saoirse, Foresight News

Once shorts return, Ethena and Fluid will severely impact the crypto market.

This is certain, and I will explain below exactly how this will happen.

The very mechanism currently driving the surge in USDe's market cap on Ethena will also be the cause of its eventual collapse.

Where have we seen this before?

At the time of writing, Ethena's USDe stablecoin has a market cap approaching $10 billion, making it the third-largest stablecoin. This should not excite you—it should alarm you. Because this growth is largely built on shaky foundations, more like a house of cards.

In short: a leverage loop is inflating this bubble!

Bubble Formation

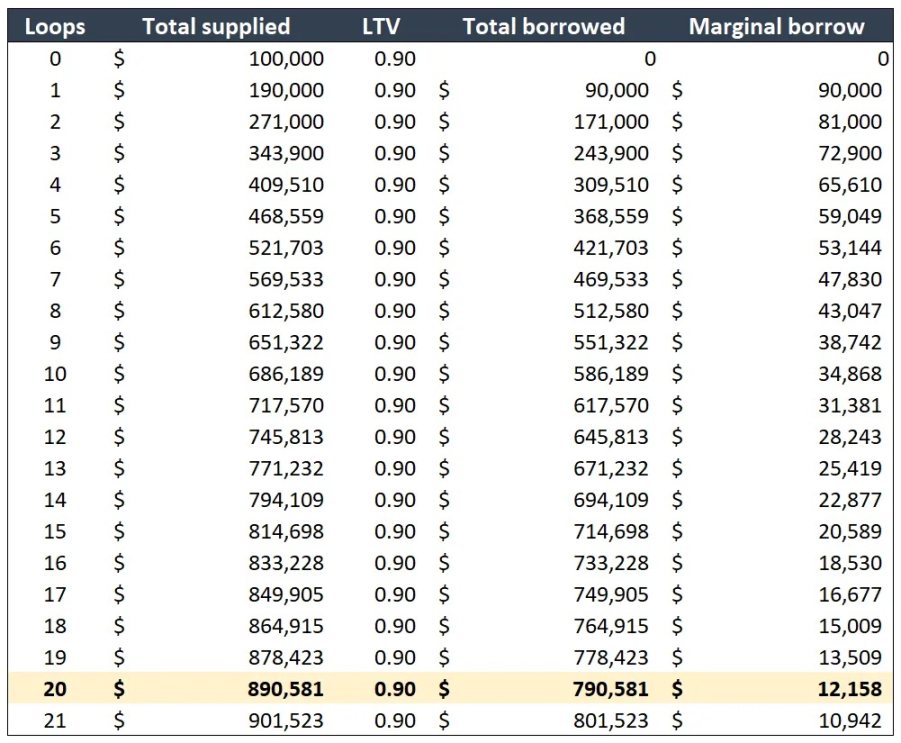

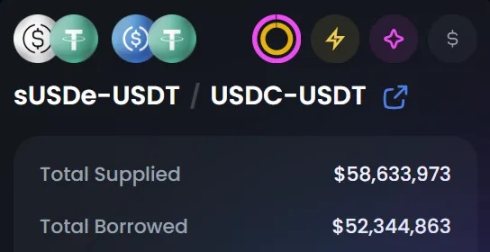

With just $100,000, you can build a position with a total notional value of $1.7 million using this strategy. And on the Fluid protocol, you can do it with a single click of the "leverage" button. This is how they inflate their total value locked (TVL).

(Note: The article refers to a notional asset size of $1.7 million, not actual net capital. It is the sum of total supplied collateral shown in the table below. In essence, leverage loops amplify both liabilities and collateral—not truly "creating" $1.7 million in value.)

You take $100,000 and convert it into USDe, then deposit it as collateral into Fluid’s stablecoin pool (e.g., USDT-USDC pool). Then, you borrow $90,000 in USDT and convert it into $90,000 in USDe.

Deposit that $90,000 in USDe again as collateral, borrow $81,000 in USDT, and convert it into USDe. Repeat this swap-and-borrow cycle 20 times. After 20 rounds, your remaining borrowing capacity is $10,000. Congratulations—you’ve created “magical internet money.”

Chart 1

Thanks to protocols like Fluid, this process is now extremely simple. Check Fluid’s stablecoin pools and you’ll find nearly all of them are close to full capacity.

For example, the loan-to-value ratio in the USDe-USDT/USDC-USDT pool has reached 89.2%, with a maximum collateralization limit of 90%. Liquidation triggers at 92%.

What happens if USDe depegs by 2% against USDT/USDC? That’s explained in detail below.

Why Are People Rushing to Buy USDe?

Because it offers the highest yield!

Currently, the $1.7 million position built from $100,000 generates $30,000 in annual returns. After deducting borrowing costs (8% annual yield on collateral minus 5% annual cost on debt—see Chart 1), the net annual yield still reaches 30%.

(Note: Annualized yield = (Collateral yield - Borrowing cost) / Initial capital. Calculated based on total collateral and total debt after 20 cycles in Chart 1: APY = (890,581 × 8% - 790,581 × 5%) / 100,000 ≈ 31.717%)

If sUSDe basis trade yields rise further, the same principal could generate annualized returns of 50% or even 100%. Sounds smart, right?

But only exiting before the music stops counts as being smart. As history shows, there’s no such thing as a free lunch. Someone always pays the price, and you must ensure that person isn’t you.

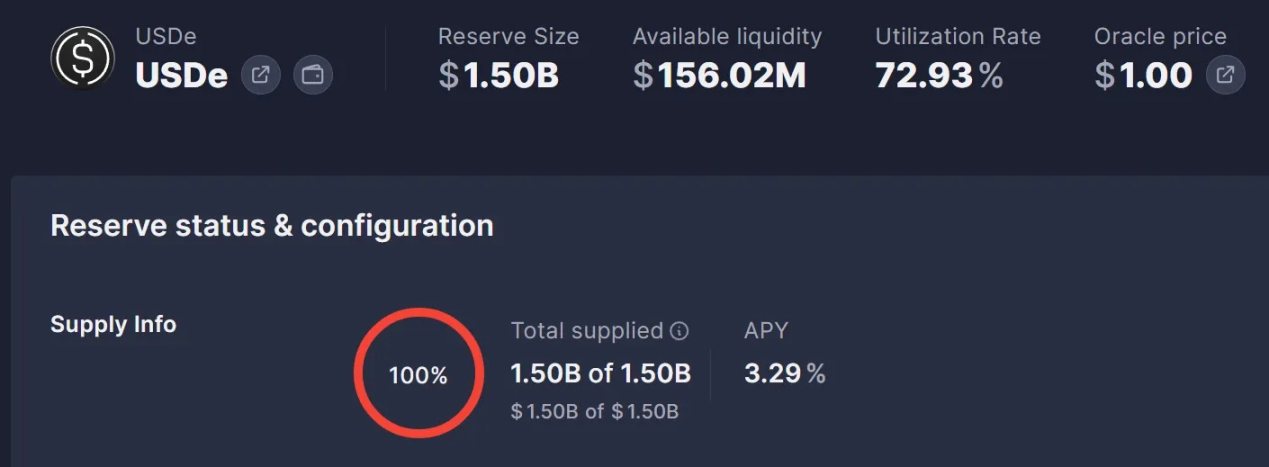

Otherwise, your entire principal could vanish overnight—especially if you reinvest your profits back into the loop. At the time of writing, AAVE on Ethereum has already hit its $1.5 billion supply cap for USDe, showing people are pushing this leveraged strategy to the extreme.

Before the bubble bursts, USDe’s market cap will keep setting new records. When its daily growth reaches around $1 billion, it’s time to exit completely. The top is near, and someone must pay for this feast.

Make sure it’s not you!

Inevitability of Collapse

Right now, one thing is certain: collapse will happen. Why make such a bold claim?

Because the larger USDe’s market cap becomes, the greater the pressure when “the music stops.”

In essence, the higher USDe’s market cap, the faster and wider the depeg will be when shorts return. Just a 2% depeg is enough to trigger massive liquidations on Fluid, which would worsen the crisis.

⚠️ USDe depegging is the “safety valve” of this massive bubble!

When that happens, every user running leverage loops on Fluid and other protocols will face liquidation. Hundreds of millions of dollars worth of USDe will suddenly flood the open market for selling.

As a chain reaction of liquidations begins, USDe could depeg by 5% or more. Countless people will lose everything, potentially triggering systemic risk across the entire decentralized finance ecosystem. The situation could deteriorate rapidly.

Additionally, the trigger for collapse could also be fading demand: when USDe basis trade yields continue falling (even turning negative) until the leverage loop becomes unprofitable—when borrowing costs exceed returns—the crisis erupts.

This would first send margin calls to leveraged users on Fluid. If cascading liquidations follow, USDe’s peg mechanism could completely break down. No one can predict the exact timing, but given the current pace, it’s inevitable.

Only those without liquidation points or with extremely high thresholds will survive. Only after leverage is fully cleared might USDe restore its peg.

The ideal scenario for mitigating the crisis is a slow, orderly deflation of the USDe bubble—but under current market conditions, this is almost impossible. Especially for a bubble exceeding $10 billion, market reversals tend to be extremely violent.

History Repeats Itself

This time is no exception. It mirrors every cycle I’ve experienced. Ethena, Fluid, and numerous protocols are actively creating the conditions for this crash.

Nobody talks about it because it’s not “sexy” enough.

Ethena welcomes it—soaring USDe market cap means soaring revenue. Fluid welcomes it too—exploding TVL means growing income. But remember: they aren’t the ones paying; they’re the restaurant owners.

This is precisely the root of cyclical volatility in crypto markets!

Bear markets are cycles of deleveraging; bull markets are cycles of leverage-fueled bubbles.

There’s nothing new under the sun.

Personal View

I participated in Ethena’s yield farming early on, and their achievements so far are impressive. But I currently hold no USDe and have no plans to, as the risk is simply too high.

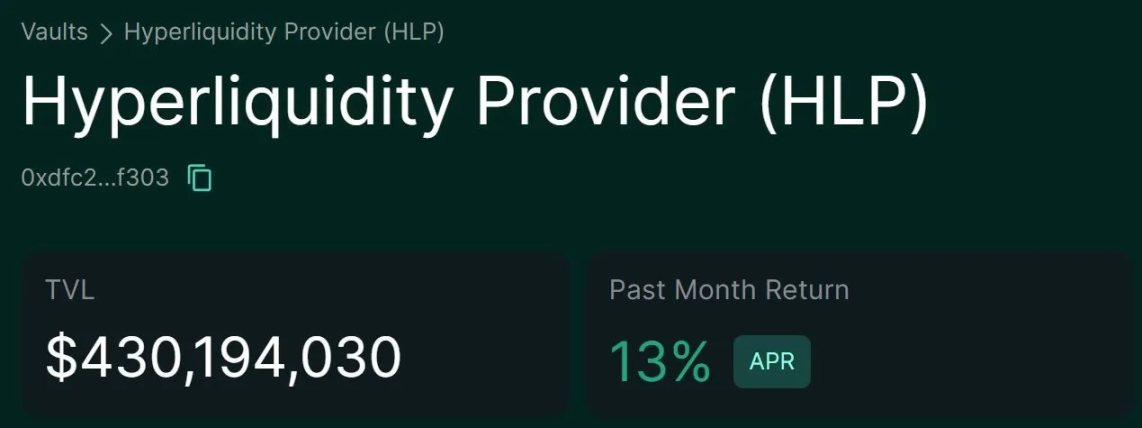

There are better protocols in the market offering comparable or even higher annual yields at much lower risk. For example, Resolv’s USR/RLP or Hyperliquid’s HLP vault. HLP does not support leverage looping—that’s exactly its advantage.

As for Fluid, they’ve indeed innovated: enabling higher yields on stablecoins and simplifying leverage loops to be accessible to everyone. Judging by their growth, this model has clearly succeeded.

Yet both protocols—and all projects built on Ethena or Fluid—are collectively inflating a massive bubble. I’m issuing this warning because I’ve seen this script play out too many times.

I bear no ill will toward these protocols—they’re simply the biggest drivers of the current bubble, and followers are multiplying.

Finally, Bitcoin is the ultimate source of liquidity in the crypto market. This means when the crisis hits, Bitcoin will absorb the shock, its price will come under pressure, providing a buffer for people caught in their self-made bubble. Also watch Saylor and the MSTR bubble closely.

Each cycle brings new players, but the story never changes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News