MIIX Capital: Thorchain Project Research Analysis Report

TechFlow Selected TechFlow Selected

MIIX Capital: Thorchain Project Research Analysis Report

Thorchain is a relatively strong investment opportunity, and the probability of success is not low.

Author: MIIX Capital

1. Report Highlights

1.1 Investment Thesis

From a business development perspective, the Thorchain project is highly promising, featuring a tokenomics model deeply tied to its native token. The growth of Total Value Locked (TVL) is directly correlated with the value of $RUNE. As market conditions improve, rising prices of BTC and ETH are expected to drive corresponding increases in $RUNE, further expanding its business scale. Moreover, compared to other projects in the same sector in terms of capital, ecosystem, and market attention, Thorchain's overall development surpasses that of similar projects. Therefore, Thorchain represents a relatively strong investment opportunity with favorable odds.

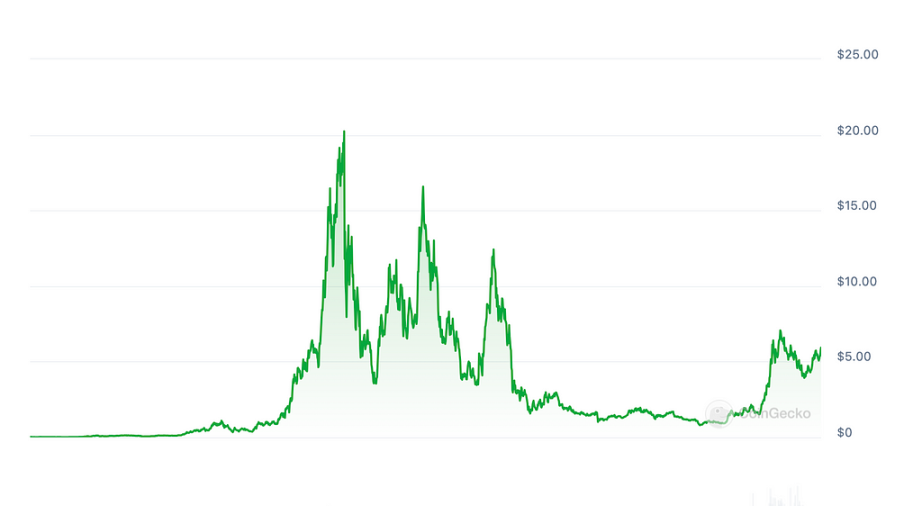

1.2 Valuation Overview

At the peak of the previous bull market, RUNE’s market cap reached $4.6 billion, indicating roughly 4x upside potential today. Additionally, Thorchain has received investment from Multicoin Capital, demonstrating VC validation of its working flywheel economic model. In the new bull cycle, assuming normal operation of this flywheel effect and no major security breaches, TVL is expected to grow significantly, driving positive demand for RUNE and potentially delivering 5–10x growth.

1.3 Key Risks

Although Thorchain has high upside potential, it still carries significant risks, primarily in technology and market aspects:

Technical Risk

Thorchain is fundamentally a cross-chain liquidity protocol. Cross-chain bridges have long been prime targets for hackers. Beyond basic cross-chain swaps, Thorchain also includes synthetic assets, account savings, multi-hop swaps, Proof-of-Liquidity (PoL), and lending—making its functionality highly complex and more susceptible to technical vulnerabilities. Thorchain’s current mitigation strategy involves a dedicated security team monitoring network anomalies, including node suspension mechanisms, bug bounties, transaction throttling, and intervention by the thorsec team.

Market Risk

Lending accounts are highly sensitive to RUNE’s price. When RUNE performs better than non-RUNE assets, the protocol functions well. However, if RUNE’s price drops significantly, it could trigger a cascading wave of loan repayments and redemptions. Furthermore, in the loan design, RUNE-staked positions will always outperform collateralized BTC and ETH, amplifying market risk.

2. Project Overview

Thorchain is a decentralized cross-chain AMM trading protocol created in 2018 by a group of anonymous cryptocurrency developers during Binance’s hackathon. Its goal is to decentralize cryptocurrency liquidity through a public network of ThorNodes and ecosystem products. Any individual, product, or institution can access its native and cross-chain liquidity.

2.1 Scope of Operations

The Thorchain project primarily focuses on native cross-chain swaps, targeting users who require native cross-chain capabilities—typically large-capital users or institutions.

2.2 Founding Team

The team operates anonymously, so no public information about its members is available. This anonymity is both a characteristic and a risk factor of the Thorchain project.

2.3 Investment Background

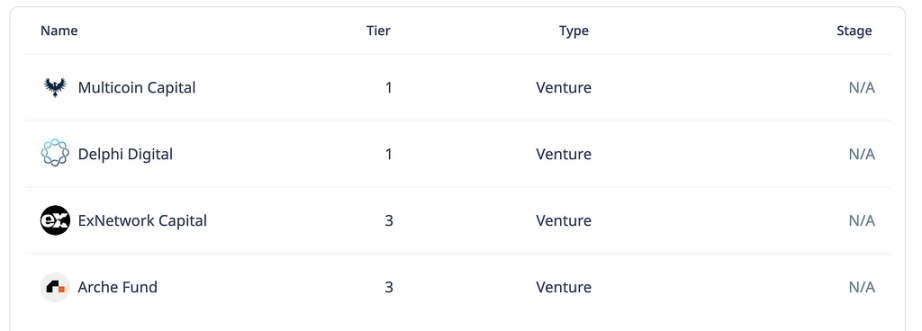

In terms of funding, the project has attracted investments from Multicoin Capital and Delphi Digital—a team known for strong engineering expertise. However, specific funding amounts have not been disclosed. Given the team’s anonymity, there remains a possibility of deep involvement by investors. Additionally, the project has undergone multiple IEOs, all of which delivered participants over 100x returns.

2.4 Project Roadmap and Milestones

Thorchain’s roadmap is relatively straightforward. Based on currently available information, the project aims to implement order book and futures trading functionalities by 2024.

3. Product and Business Status

3.1 Code and Product

On August 21, 2023, Thorchain began developing its cross-chain lending feature. Thorchain’s lending system features no liquidations, no interest, and no maturity date—fundamentally different from traditional lending protocols like Aave.

Thorchain Lend operates using a mechanism conceptually similar to the UST & LUNA design. In simple terms, when users deposit collateral to borrow assets, they do not need to repay debt, pay interest, or face a maturity deadline. The implementation works as follows:

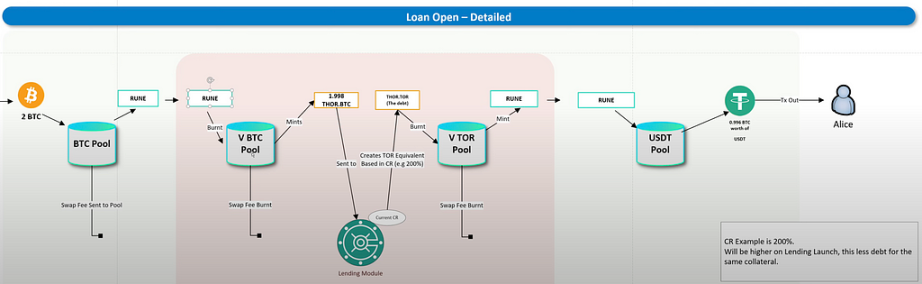

Borrowing Process

First, users deposit BTC as collateral into the BTC Pool, which automatically converts their tokens into RUNE;

Then, the RUNE is burned in a virtual pool (V BTC Pool), generating synthetic asset THOR.BTC and minting RUNE;

Finally, the corresponding amount of RUNE is swapped in the USDT Pool to issue USDT worth the borrowed BTC value to the user, with swap fees distributed to LPs;

For example, suppose a user deposits 2 BTC with a current collateral ratio of 200%, wishing to borrow USDT equivalent to 1 BTC. The system generates 1.998 THOR.TOR (a pricing unit used to calculate USD averages) in the V TOR Pool and issues 0.996 BTC worth of USDT from the USDT Pool. The value of burned RUNE equals: Collateral Value (2 BTC) – Debt (0.996 BTC) + Fee Slippage. From a borrowing standpoint, the system additionally burns RUNE valued at approximately 1/CR. (Assuming RUNE price remains constant).

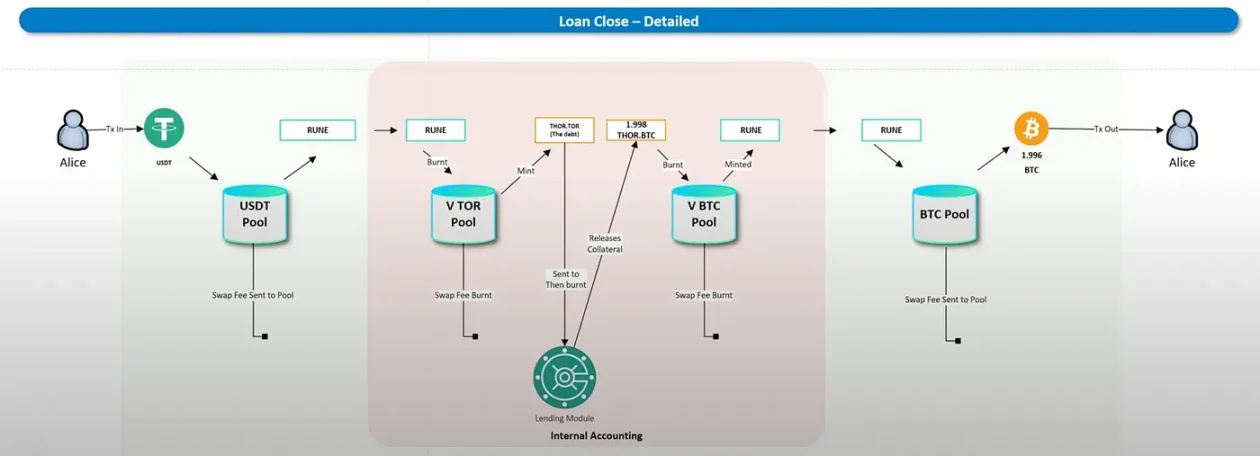

Repayment Process

First, the user deposits USDT into the USDT Pool to receive RUNE, then exchanges it in the virtual pool for THOR.TOR, directing it to the lending module for repayment;

Next, the synthetic asset THOR.BTC is withdrawn and deposited back into the V BTC Pool to mint RUNE;

Finally, the newly minted RUNE is swapped in the BTC Pool to retrieve BTC assets;

The value of newly minted RUNE equals: Collateral Value (1.998 BTC) – Debt (0.996 BTC) + Fee Slippage. From a repayment standpoint, the system mints additional RUNE valued at approximately 1/CR. (Assuming RUNE price remains constant).

From the borrowing and repayment flows, there are a total of eight transactions involved, each incurring fees. Both borrowed assets and redeemed collateral suffer slippage. Thus, the more active the trading, the greater the amount of RUNE burned. The process is fully linked to DEX activity, meaning the lending function indirectly drives demand for DEX usage and $RUNE.

Further analysis reveals that borrowers are effectively shorting USD and long on collateral assets (conversely, the protocol is long USD and short collateral). Unlike Aave-style lending pools backed by real collateral, Thorchain’s lending pool uses synthetically generated assets—essentially just vouchers—converted via RUNE while collecting fees. There is naturally no liquidation mechanism because the deposited BTC has already been sold upon entering the lending system; nor is there interest, as revenue comes entirely from transaction fees. Effectively, the lending module acts as the counterparty to users.

The counterparties to lending users are holders of RUNE, who benefit when users borrow but never repay—this reduces circulating supply of RUNE. Conversely, when users repay, RUNE supply increases. Typically, users only have incentive to repay when collateral value rises; otherwise, they lack motivation. Since RUNE serves as an intermediary within trading pools to dispense borrowed assets, liquidity providers (LPs) in these pools are effectively the lenders.

Additional Borrowing Details - Even if collateral appreciates in value, users cannot borrow more unless they deposit new collateral; - Users may partially repay debt, but must clear all debt before reclaiming collateral; - A 30-day lock-up period applies before repayment, though this may change based on protocol updates; - If RUNE’s value relative to BTC remains unchanged between loan initiation and repayment, there will be no net inflationary impact on $RUNE (burned amount equals minted minus transaction fees); - If collateral appreciates in value relative to RUNE between loan start and end, $RUNE supply will experience net inflation;

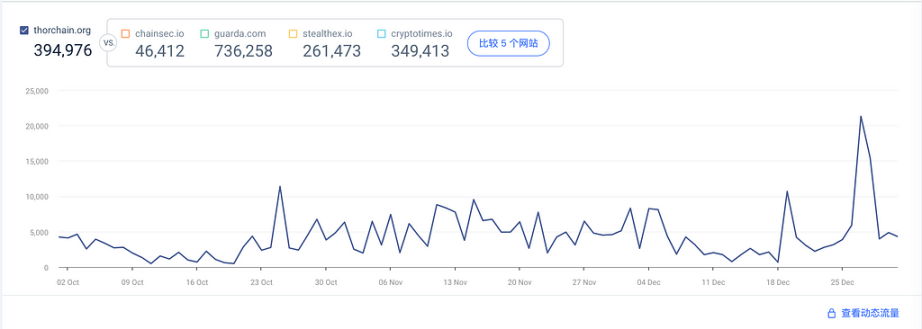

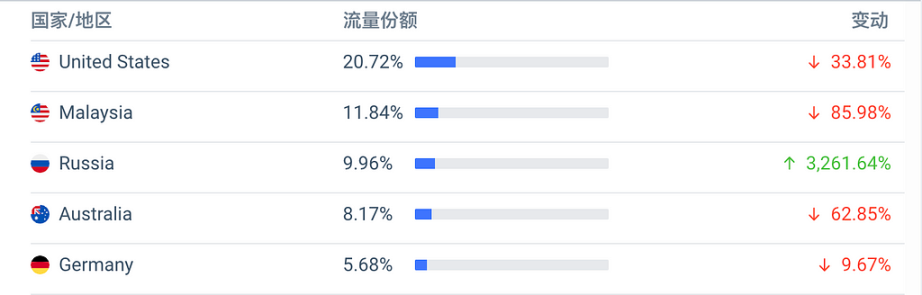

3.2 Official Website Data

The official website receives fewer than 5,000 daily average visits, with primary traffic originating from the United States, Malaysia, and Russia. Based on practical analysis, this data appears somewhat unreliable and should be taken only as reference.

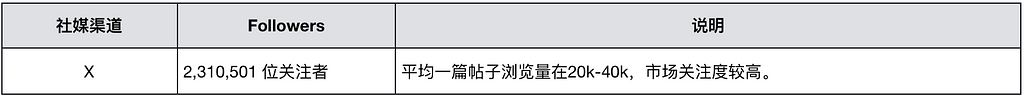

3.3 Social Media Data

The project lacks comprehensive social media presence. Developers occasionally participate in AMAs, but remain anonymous.

3.4 Community Data

4. Business Analysis

4.1 Market Size and Potential

Other Cosmos-based projects in the cross-chain swap space include Injective and Kujira. Last month, the entire Cosmos ecosystem saw TVL and project token prices approach ATH levels, raising concerns about overvaluation. However, the market generally remains optimistic about the future of cross-chain applications within the Cosmos ecosystem, giving these projects strong momentum.

4.2 Competitive Landscape

Thorchain’s main competitors currently include Injective, Kujira, and Chainflip, detailed below:

-

Injective’s advantage lies in strong backing from major investors such as Jump and Binance Labs. However, its market cap often leads ahead of actual ecosystem development, resulting in apparent overvaluation in the short term;

-

Kujira excels in product development and steady TVL growth, but lacks institutional capital support, placing it at a relative disadvantage in competition;

-

Chainflip is still under development, currently supporting only limited token swaps between ETH and DOT. Its competitiveness depends on future progress and market trends;

-

Thorchain benefits from support by Binance Labs, possesses superior tokenomics, and features strong staking incentives tied to its native token RUNE. It enjoys high market visibility and competes most directly with Injective;

The key differences among these projects lie in their tokenomics models. However, since all aim to provide cross-chain liquidity, Thorchain emerges as the most suitable investment candidate upon comparison.

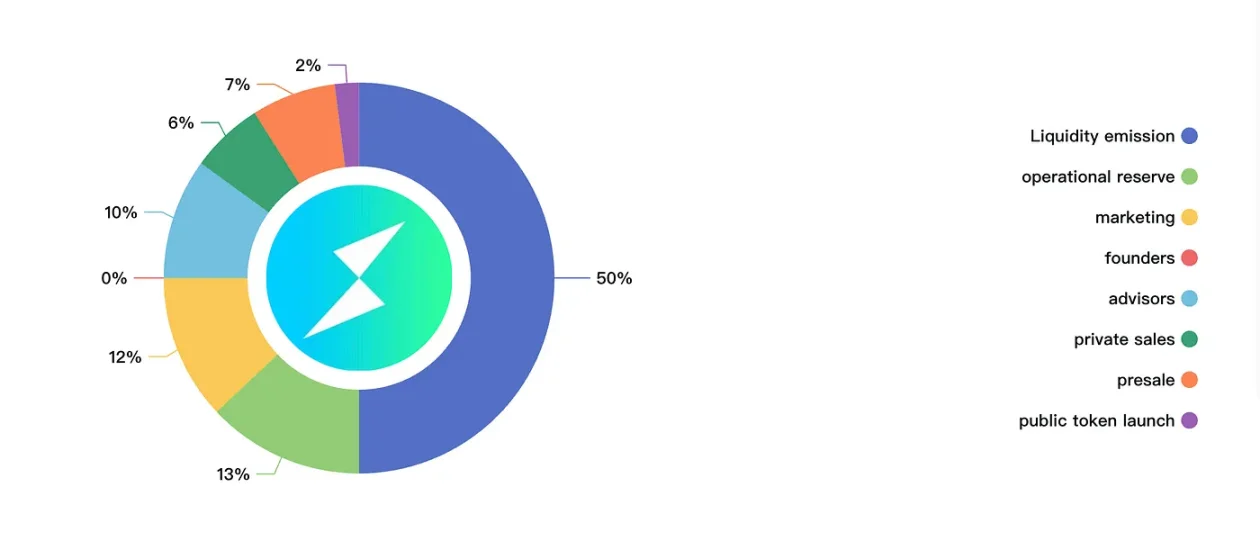

5. Token Circulation and Distribution

5.1 Total and Circulating Supply

A total of 500 million tokens were issued. All tokens are fully unlocked and in circulation, but approximately 200 million are currently staked, leaving 300 million actively circulating in the market.

5.2 Distribution, Staking, and Release Schedule

Regarding token distribution and liquidity release, all tokens are now fully circulating. Nearly 100 million tokens are staked, while 200 million are held by the team as reserve funds for emergency use.

5.3 Token Mechanics

-

Liquidity Provision: In DEX liquidity pools, RUNE acts as an intermediary, serving as a 1:1 pairing asset between two traded tokens;

-

Incentives: Liquidity Providers (LPs) earn trading fees and system rewards paid in RUNE, averaging around 3.6%;

-

Security and Stability: Node operators must stake RUNE to participate in network consensus and governance, helping ensure network security and decentralization;

-

Governance: RUNE holders can participate in Thorchain governance decisions, such as voting on protocol upgrades and fee structures;

-

Transaction Fees: A portion of transaction fees on Thorchain must be paid in RUNE, increasing demand for the token;

-

Collateral and Debt: Within the Thorchain ecosystem, RUNE can also serve as collateral or be used to settle network debts;

-

Cross-chain Transactions: Thorchain supports cross-chain swaps, with RUNE acting as the bridge connecting assets across different blockchains;

RUNE directly participates in the lending mechanism. On average, this implies that the value of RUNE required in the network is three times the value of locked non-RUNE assets. For instance, if $1,000,000 worth of non-RUNE tokens are deposited into Thorchain, the market cap of RUNE must be at least $3,000,000. This represents only the minimum or deterministic valuation for RUNE.

5.4 Market Performance Outlook

Currently, the RUNE token trades at $5.93, ranked #56 on Coingecko, with a market cap of $1.778 billion and FDV of $2.958 billion. Due to the 1:3 minimum mechanism, RUNE’s market cap enjoys a fundamental floor. As asset prices of ETH, BTC, etc., rise, holding RUNE-denominated values constant, RUNE’s support price will increase proportionally at a 1:3 ratio relative to ETH/BTC. Additionally, increased protocol usage will gradually reduce the circulating supply of RUNE.

6. Investment Value Assessment

Currently, the Thorchain project is in a mature phase. Given its robust tokenomics and strong market attention, it is poised to benefit significantly from broader market upswings and likely to outperform during bullish trends.

Medium- to long-term, as long as BTC and ETH market caps continue to grow, Thorchain’s TVL will inevitably rise, pushing up the price of RUNE. With the introduction of new features and expanded use cases, RUNE’s appreciation could significantly exceed that of BTC and ETH. Consider gradual accumulation during consolidation phases within reasonable price ranges.

7. Conclusion

Thorchain features a deeply integrated tokenomics model tightly coupled with its native token. Growth in TVL directly enhances the value of $RUNE, and rising values of BTC and ETH are expected to correspondingly boost RUNE. Compared to peers in capital, ecosystem, and market attention, Thorchain demonstrates stronger overall development. Looking ahead, as Thorchain expands its business scale and further refines its tokenomics, order book, and futures trading capabilities, RUNE is highly likely to deliver outstanding performance—an investment opportunity worthy of long-term attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News