Bitcoin ETF Launch: 5 Charts Show Why Thorchain Benefits First

TechFlow Selected TechFlow Selected

Bitcoin ETF Launch: 5 Charts Show Why Thorchain Benefits First

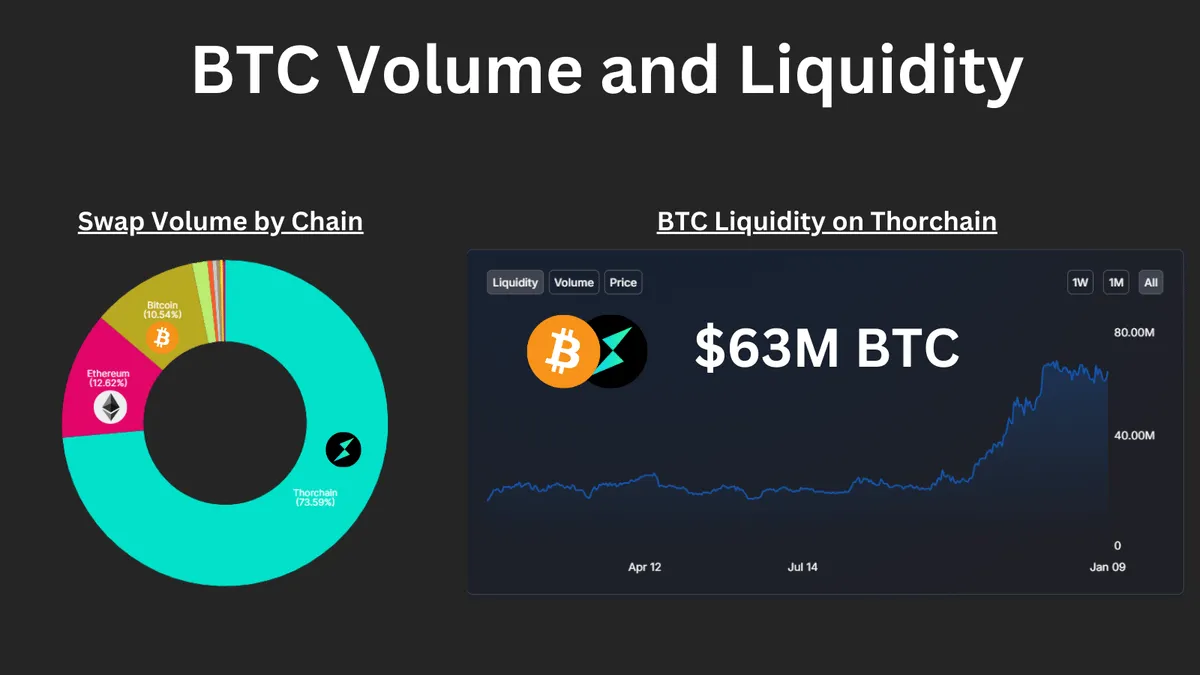

Over 22% of the trading volume on Thorchain DEX comes from Bitcoin and Ethereum users.

Author: DEEBS DEFI

Translation: TechFlow

Crypto researcher DEEBS DEFI argues that the launch of Bitcoin ETFs could benefit Thorchain ($RUNE). The article analyzes Thorchain's unique positioning in enabling native Bitcoin swaps and yield generation, along with how Bitcoin ETFs may drive increased trading volume and impact the $RUNE price. TechFlow has translated the full piece.

The $BTC ETF has the potential to bring billions of dollars on-chain and send other altcoins to Valhalla. The following six charts explain why $RUNE could be among the first to benefit. Why $RUNE might benefit first

Thorchain ($RUNE) has a very strong connection with Bitcoin:

-

Over $60 million worth of Bitcoin is stored on Thorchain

-

More than 22% of trading volume on the Thorchain DEX comes from Bitcoin and Ethereum users

Why is this the case? The reason is simple:

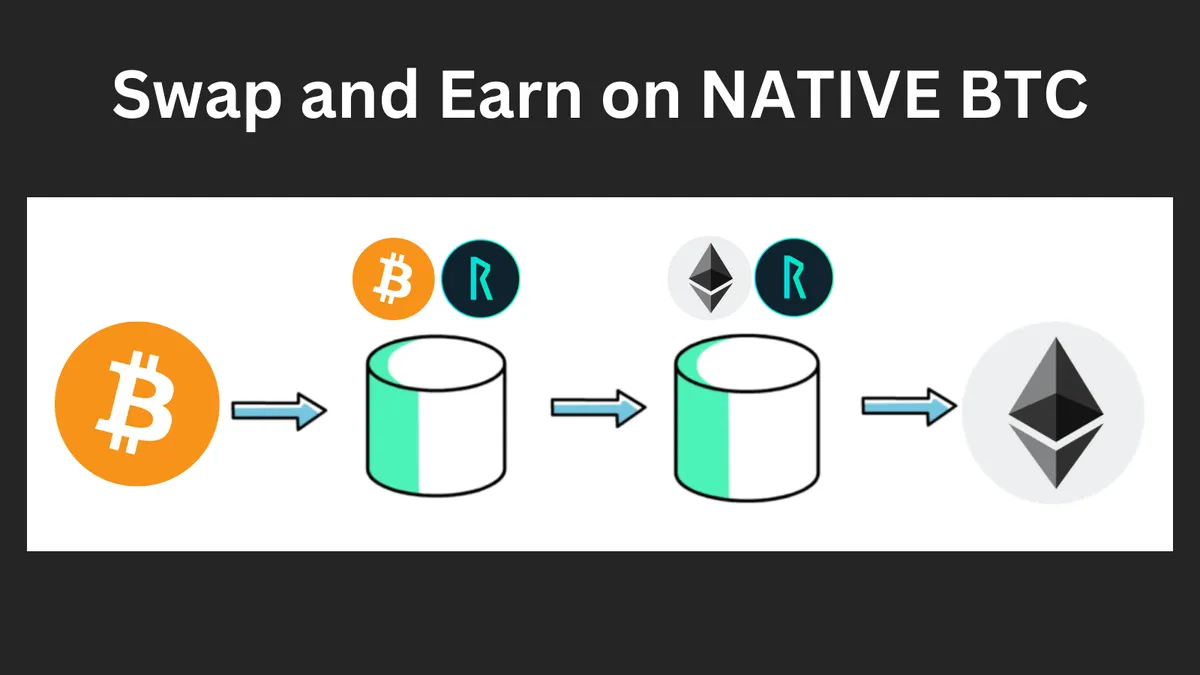

Thorchain is one of the few DEXs capable of doing the following:

-

Swapping native Bitcoin for native tokens (e.g., ETH)

-

Depositing native Bitcoin to earn yield

This gives Thorchain a unique advantage to benefit from the BTC ETF.

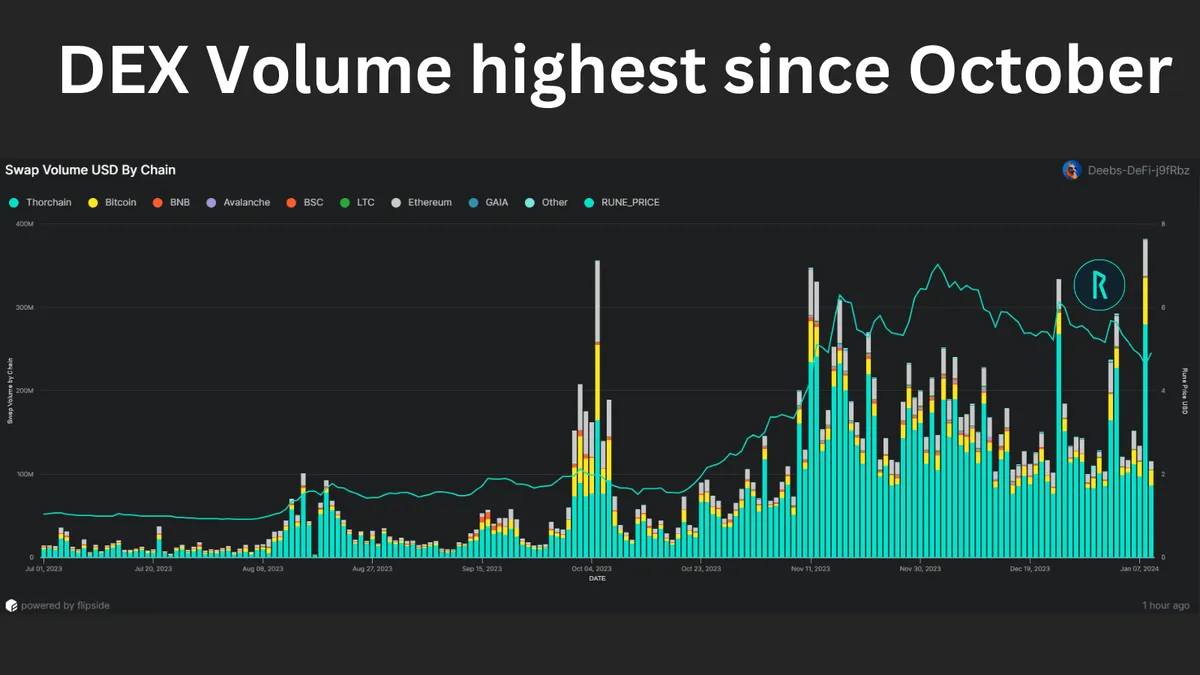

Trading volume surges on Thorchain following the ETF launch

The recent surge in trading volume may reflect users rotating out of other altcoins into Bitcoin. We last saw such high volumes in October last year.

Shortly after that, $RUNE experienced a significant rally—and there’s a good reason for it.

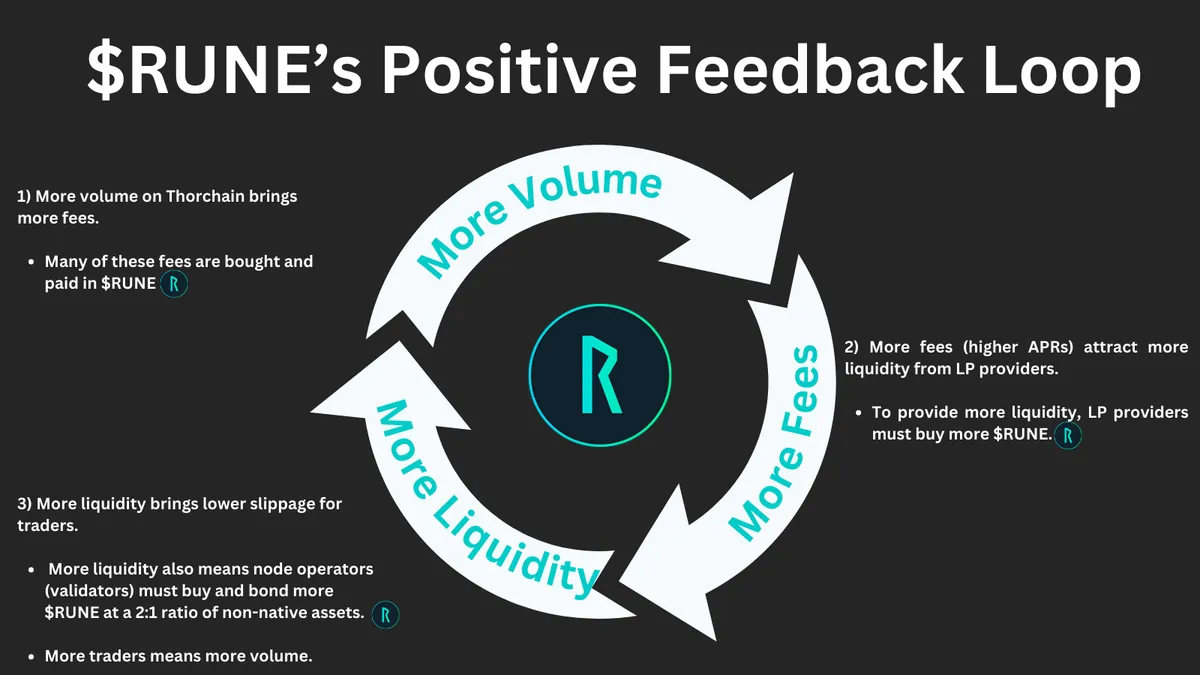

Increased trading volume on Thorchain drives buying pressure for $RUNE

The chart below illustrates this point clearly. It's easy to envision a scenario where ETF-driven liquidity leads to higher trading volume, increased BTC deposits, and rising RUNE prices. But how do we know whether this phenomenon is already being reflected in the market?

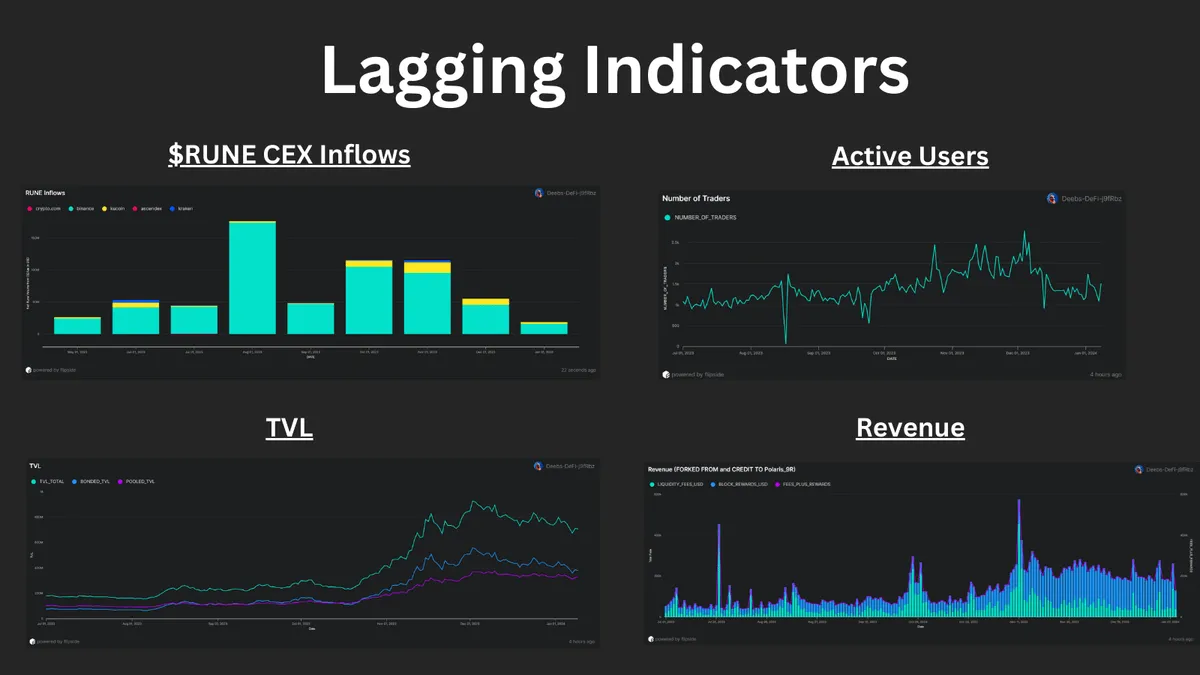

$RUNE price lags behind

Not only is the $RUNE price lagging, but its total value locked (TVL), revenue, and CEX buy volume are all hovering around weekly or monthly averages.

However, this could change quickly as ETF-related trading volume spikes.

How can I be sure Thorchain will see more trading volume?

I can't be certain. But consider these facts:

-

Thorchain receives substantial daily trading volume from BTC and ETH

-

It's one of the few places in DeFi where you can earn yield on BTC (with $63 million deposited)

-

WBTC accounts for less than 1% of BTC supply—people want native Bitcoin

I have no doubt about this—I believe Thorchain will see even greater trading volume.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News