Can 155 pending altcoin ETFs bring a full bull market?

TechFlow Selected TechFlow Selected

Can 155 pending altcoin ETFs bring a full bull market?

The hope of the entire village.

Author: Dami-Defi

Translation: AididiaoJP, Foresight News

Bloomberg predicts that following Bitcoin and Ethereum ETFs, over 200 additional crypto ETFs will launch in the future. Will altcoins receive similar favor, or face greater volatility? Let's dive in:

-

Historical Background

-

DATs: Collateral Risks and MNAV Observations

-

Bullish and Bearish Cases for Altcoin ETFs

-

How We Got Here: Key Catalysts

-

Macro Impact: $300 Billion Stablecoin Liquidity to Fuel DeFi Bull Run

-

Contrarian Signals

-

What to Watch During ETF Launches

-

Three High-Impact ETFs to Watch

Historical Background

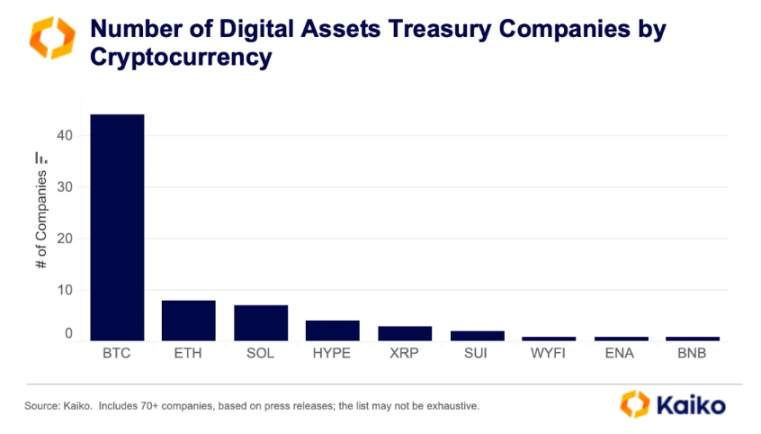

Since the debut of the first ETFs, the crypto ETF landscape has transformed dramatically. The total net assets of U.S. spot Bitcoin ETFs have surpassed $146 billion, solidifying Bitcoin’s dominance with a 59% share of the crypto market. Ethereum ETFs rank second, holding approximately $25 billion in assets. Cumulative net inflows into spot Bitcoin ETFs now exceed $50 billion, with the market consistently seeing daily inflows. Before crypto ETFs emerged, traditional finance accessed digital assets through vehicles like GBTC and MSTR. This approach gave rise to Digital Asset Treasury companies (DATs), which accumulate specific altcoins such as ETH, SOL, XRP, etc., allowing investors exposure via equities. DATs serve as a bridge between the pre-ETF era and today’s pending altcoin ETF approvals—and they are also where risks emerge.

DATs: Collateral Risks and MNAV Observations

Market cap to Net Asset Value multiple (MNAV) matters because it reflects how easily a DAT can raise capital. When the multiple is above 1, debt financing becomes accessible, enabling more token purchases. If it remains below 1, funding dries up, and reserve sales become a real risk.

Closely monitor top DATs’ MNAV and premiums, PIPE unlock dates, liquidity, and any balance sheet mentions in 10-Q filings or operational updates. Stress may spread; troubles at smaller DATs could affect larger ones, or concerns at the top may ripple downward.

Bullish and Bearish Cases for Altcoin ETFs

Bullish Case

The rise of altcoin ETFs could soon deliver significant liquidity boosts to the market. Take the ProShares CoinDesk 20 ETF as an example; it includes key assets such as HBAR, ICP, XRP, and SOL. In total, 155 ETPs tracking 35 cryptocurrencies await approval. A surge of liquidity into these ETFs could lift prices of related altcoins, continuing the momentum seen with Bitcoin and Ethereum ETFs.

Moreover, ETF inflows drive market attention toward underlying tokens, prompting some allocators to buy higher-beta DATs. These DATs then raise capital and accumulate more tokens, potentially reinforcing the altcoin narrative. Crucially, issuers like BlackRock, Fidelity, VanEck, and Grayscale offer a credible gateway—potentially unlocking larger, more stable investment flows than exchange-only access.

Bearish Case

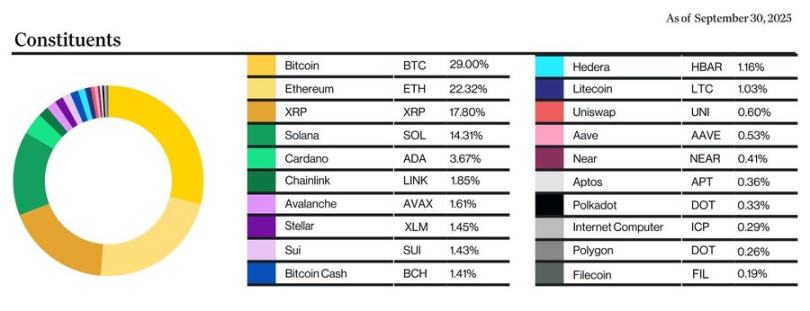

On the other hand, altcoins struggle to regain their typical bull-market hype, and this weak demand could limit performance. The CoinDesk 20 Index highlights this issue: BTC and ETH dominate with 29% and 22% weights, while altcoins like ICP and FIL account for only 0.2% in the basket. This concentration means more capital will flow to major coins, benefiting them disproportionately.

Additionally, if funds shift from DAT stocks to altcoin ETFs, DATs’ Market-to-Net-Asset-Value (MNAV) could fall below 1, leading to funding shortages. This might force reserve sales, creating direct selling pressure on those altcoins.

Microstructure at launch: Even under a medium-term bullish outlook, expect 24–72 hours of “sell the news” volatility around ETF listings.

How We Got Here: Key Catalysts

Growing interest in altcoin ETFs is driven by several converging factors:

On September 17, the U.S. Securities and Exchange Commission (SEC) introduced the “commodity trust shares universal listing standard.” This shortens approval timelines for new ETFs and makes the process more predictable. Thanks to the SEC’s universal standard, we could see multiple ETF approvals within days once the government reopens.

Earlier, in July, the SEC allowed non-Bitcoin crypto ETFs to conduct in-kind redemptions, aligning them with traditional commodity ETFs. This reduces liquidity friction and attracts more institutional capital.

The success of spot Bitcoin and Ethereum ETFs has also driven broader adoption—by mid-2025, 59% of institutions allocated over 10% of their portfolios to digital assets.

Rule of thumb (strict criteria): Spot trading venues regulated by ISG, or at least six months of regulated futures trading with data sharing, or tracking accuracy above 40% in existing listed ETFs. This clears the path for many large- and mid-cap tokens.

Macro Impact: $300 Billion Stablecoin Liquidity to Fuel DeFi Bull Run

As of October 2025, nearly $300 billion in stablecoin liquidity circulates globally. This vast infrastructure sets the stage for ETF-driven capital catalysts, channeling institutional funds into the DeFi ecosystem and amplifying returns.

The synergy between $300 billion in stablecoin liquidity and anticipated inflows into altcoin ETFs could create a multiplier effect. As observed with Bitcoin ETFs, inflows correlate with market cap multiples—suggesting each dollar of ETF capital may inflate market caps by multiple dollars. If altcoin ETFs gain traction, this could release tens of billions in capital, pushing total crypto market cap to new highs by end-2025.

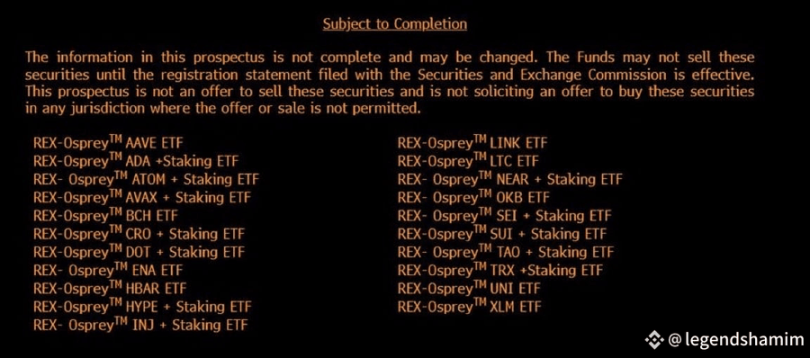

With increased regulatory clarity under Trump-era policies, institutional capital influx could significantly boost DeFi protocols—especially those integrating assets like LINK and HBAR that bridge traditional finance and blockchain, or REX-Osprey’s staking ETF applications for altcoins such as TAO and INJ.

Furthermore, amid a weakening dollar and risk assets nearing all-time highs, ETFs provide institutions a convenient path to rotate along the risk curve—from BTC to large-cap altcoins, then to mid-caps and DeFi.

Multiplier caveat: The impact of inflows on valuations depends on sustained net creations and healthy funding bases. DAT stress (MNAV < 1 or unlock events) may temporarily suppress this multiplier.

Contrarian Signals

As a consistent contrarian investor, Jim Cramer recently urged investors to sell crypto and move into equities. Given his history of being wrong at key turning points, I believe now is the time to hold crypto assets even more firmly.

Fears that ETFs will erode DATs and trigger liquidations coexist with unprecedented market access, clarity, ETF channels, and approval pipelines. If weekly inflows remain strong post-launch, this mismatch could signal a bullish setup. Historically, high anxiety over DAT stress coinciding with improved market access often marks accumulation phases—not market tops.

What to Watch During ETF Launches

-

Days 0–3: Anticipate front-running and “sell the news” risks. Monitor net creations versus redemptions and displayed bid-ask spreads.

-

Weeks 1–4: If net inflows stay strong and spot prices align with perpetual contract prices, a dip-buying bias may persist.

-

Rotation signals: Higher weekly highs/lows in other coins relative to BTC indicate expanding altcoin demand. Absence of this signal favors staying overweight in BTC.

-

Cross-asset clues: Improving DAT premiums alongside ETF inflows create a positive feedback loop.

Three High-Impact ETFs to Watch

-

Solana: Beyond BTC and ETH ETFs, SOL stands as the strongest conviction altcoin most likely to benefit from diversification. Among 155 pending crypto ETFs, 23 target Solana. This strong institutional demand signals potential capital flows. Therefore, SOL-tracking ETFs are among the most important to watch and could deliver outsized returns.

-

ProShares CoinDesk 20 ETF: Tracks 20 top cryptocurrencies including BTC, ETH, and altcoins like XRP, enabling diversified institutional exposure.

-

REX-Osprey 21-Asset ETF: Designed to provide exposure to specific cryptocurrencies, with staking functionality for tokens such as ADA, AVAX, DOT, NEAR, SEI, SUI, TAO, and HYPE.

The fourth quarter could quickly become dominated by the ETF narrative, lifting related sectors like DeFi. Whether altcoins capture the same demand as BTC or not, this momentum is undeniable. Stay confident and position for the coming altcoin ETF narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News