Altcoin ETFs Fully Opened: Data Insights, Opportunities, and Risk Analysis

TechFlow Selected TechFlow Selected

Altcoin ETFs Fully Opened: Data Insights, Opportunities, and Risk Analysis

This article will systematically outline the overall development trajectory of current altcoin ETFs, focusing on the示范 effect of Bitcoin and Ethereum ETFs, the wave of批量 listings of altcoin ETFs, and potential candidates currently in the application process.

Author: Hotcoin Research

1. Introduction

In the fourth quarter of 2025, the U.S. market entered a concentrated period for altcoin ETF approvals, with multiple single-asset spot ETFs successively approved and listed, forming a rare "batch issuance" scenario in the crypto market. The successful launch of Bitcoin (BTC) and Ethereum (ETH) spot ETFs not only opened the door for institutional investors to allocate digital assets through compliant channels but also established a clear approval framework and product pathway at the regulatory level, directly catalyzing the wave of altcoin ETF filings and accelerating their progress.

With ongoing adjustments by the U.S. Securities and Exchange Commission (SEC) to its crypto ETF approval mechanisms, and active positioning from asset management firms and market participants, Q4 2025 became a critical window for the dense rollout of altcoin ETFs. ETFs based on XRP, SOL, DOGE, LTC, HBAR, LINK, and others gradually went live on exchanges, while the next wave—including AVAX and AAVE—are advancing rapidly. The rapid expansion of altcoin ETFs reflects a clear acceleration in the institutionalization of the crypto market and marks a shift in crypto product structures from being dominated by "core single assets" toward a more diversified and tiered mature phase.

Against this backdrop, this report systematically reviews the current development trajectory of altcoin ETFs by focusing on the示范effect of Bitcoin and Ethereum ETFs, the surge in batch listings of altcoin ETFs, and potential candidates currently under application. It further analyzes specific data such as capital flows, trading activity, asset under management (AUM), and price performance of already-listed altcoin ETFs. Based on this analysis, it explores the opportunities and risks facing altcoin ETFs and offers outlooks on future trends, aiming to provide both retail and institutional investors with a structured, logically rigorous, and valuable industry insight to help clarify judgments and support prudent decision-making in this emerging investment arena.

2. Overview of Altcoin ETFs

1. Demonstration Effect of Bitcoin and Ethereum ETFs

In recent years, the most significant milestone for crypto assets entering traditional finance has been the U.S. approval of Bitcoin (BTC) and Ethereum (ETH) spot ETFs. After the debut of Bitcoin ETFs, massive institutional inflows occurred in a short time, significantly boosting market participation. Ethereum ETFs followed closely, offering more institutions and retail investors compliant access to crypto investments.

This gatekeeper effect profoundly changed the market structure: investor risk tolerance increased, institutional motivation to allocate digital assets strengthened, asset managers began actively expanding their product offerings, and regulators accumulated review experience and confidence in approvals. Under these conditions, a rapid surge in altcoin ETF applications emerged, with numerous asset management firms launching single- or multi-asset ETF products for XRP, DOGE, LTC, HBAR, SUI, LINK, and others.

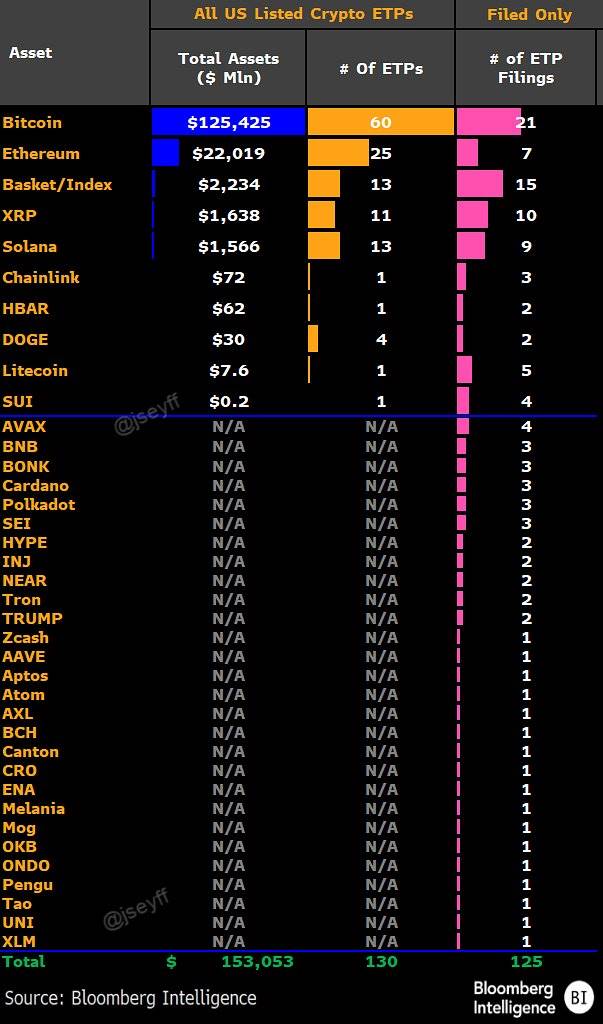

Source:https://x.com/Minh_BNB10000/status/1999307817430462471?s=20

Another driving force is the SEC's gradual adjustment in regulatory policy. In September 2025, the SEC officially approved revised "General Listing Standards for Commodity Trust Shares," providing clearer entry criteria and shorter review times for crypto asset ETFs—reducing the typical approval cycle from around 240 days down to approximately 60–75 days. This streamlined process eliminated the need for lengthy case-by-case reviews for qualified assets, forming a crucial institutional foundation for the wave of batch applications and concentrated listings of altcoin ETFs.

Additionally, a key opportunity arose during the U.S. government shutdown in November 2025, which created a regulatory gap. Under certain legal provisions (e.g., Section 8(a) of the Securities Act of 1933), some fund registration statements without delay clauses could automatically become effective, indirectly creating a fast-track "silent approval channel." These factors collectively fueled the recent surge in altcoin ETF listings.

2. The Wave of Batch Listings for Altcoin ETFs

Since the second half of 2025, the pace of approval and listing for U.S. altcoin ETFs has clearly accelerated, exhibiting a “queue-to-list + staggered batch approvals” pattern.

-

Solana ETF: In October 2025, the Solana (SOL) ETF passed review and began trading on exchanges like NYSE, marking the first true altcoin spot ETF to be successfully launched and traded in the U.S.

-

Hedera ETF: That same month, multiple HBAR ETF applications were submitted and entered review. Institutions such as Canary Capital completed amendments to their HBAR ETF registration statements, paving the way for imminent approval and listing within weeks.

-

XRP ETF: In November 2025, the XRP ETF became the second major altcoin spot ETF to gain concentrated approval and rapid listing. XRP ETFs launched by Canary Capital, Grayscale, and 21Shares successively began trading on platforms like NYSE Arca, attracting substantial capital inflows shortly after launch.

-

DOGE ETF: Also in November 2025, the DOGE (Dogecoin) ETF received DEC approval for listing, representing cautious regulatory recognition of meme coins.

-

LTC ETF: The long-standing altcoin LTC (Litecoin) ETF was also approved in November. Although inflows have been relatively modest, it laid the groundwork for future applications of other established altcoins.

-

LINK ETF: Following XRP, SOL, DOGE, and LTC, the LINK (Chainlink) ETF officially broke through and began trading in early December. On its first day, the LINK ETF attracted tens of millions of dollars in capital, indicating real investor interest in ETFs tied to blockchain infrastructure assets with solid ecosystems and practical utility.

-

SUI ETF: On December 5, the U.S. Securities and Exchange Commission (SEC) approved the first 2x leveraged SUI ETF (TXXS), issued by 21Shares and now listed on Nasdaq.

3. Altcoin ETFs Currently Under Application

Beyond already-listed altcoin ETFs, a large number of potential products remain in the SEC’s review pipeline. Their filing activity constitutes another core driver for market attention in the coming stages.

High-profile assets currently under review include:

-

AVAX ETF: Avalanche, as a major smart contract platform, possesses compliance readiness and market fundamentals, and has entered an accelerated approval process, making it one of the likely next candidates for approval.

-

BNB ETF: ETF applications related to BNB are primarily driven by asset managers such as VanEck, REX Shares, and Osprey Funds, and are now under SEC review—indicating BNB may become the first Binance-ecosystem-related ETF approved in the U.S.

-

Other potential assets: ETF filings for ADA (Cardano), DOT (Polkadot), INJ (Injective), SEI, APTOS, and AAVE have also entered the regulatory queue. Bloomberg Intelligence analyst James Seyffart noted that the SEC currently holds dozens of pending asset-based ETF applications, with altcoin categories making up a significant share.

-

Multicoin ETFs: Some institutions are strategically exploring innovative products such as "multi-asset combination ETFs," staking-yield versions, and even theme-based Memecoin ETFs. If approved, these new products would further expand the boundaries of compliant altcoin investing.

Overall, over the next 6–12 months, the approval pace for U.S. altcoin ETFs is expected to remain high-density. The already-approved XRP, SOL, DOGE, LTC, HBAR, and LINK ETFs represent only the "first wave," with many more applicants waiting in line, forming a systemic market trend.

3. Performance Review of Listed Altcoin ETFs

The debut of altcoin spot ETFs has become a major focal point in the crypto market. Despite weak overall sentiment around major assets, certain altcoin ETFs still attracted notable capital interest.

1. XRP Spot ETF

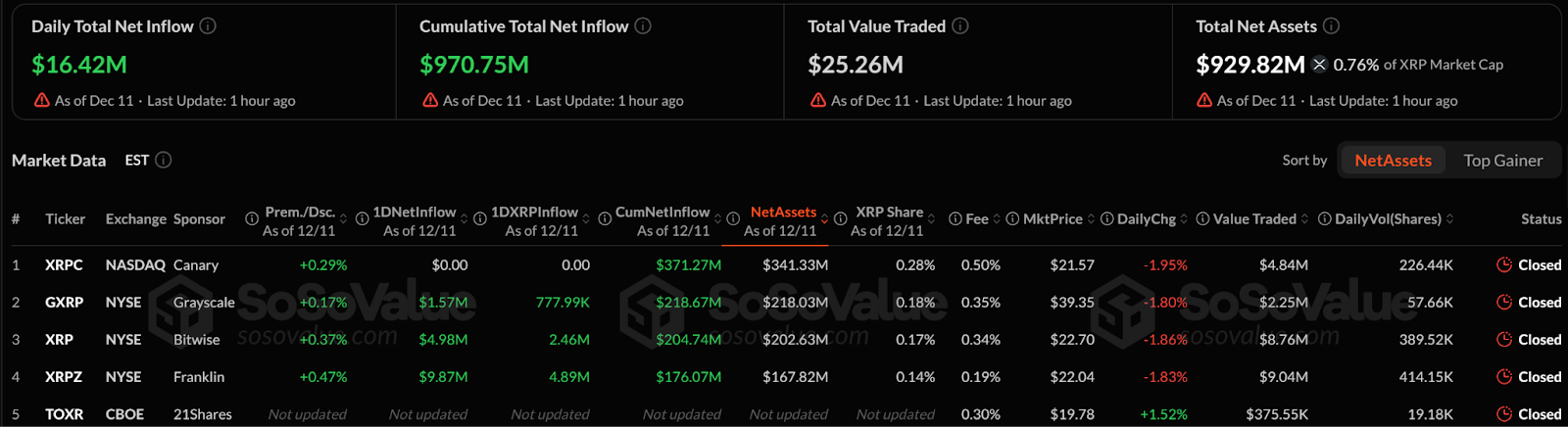

Source:https://sosovalue.com/assets/etf

Multiple asset managers—including Canary Capital, Grayscale, Franklin Templeton, and Bitwise—have launched XRP spot ETFs, making it one of the most widely issued and institutionally active altcoin ETFs.

The XRP ETF demonstrated strong capital attraction post-launch, recording cumulative net inflows of approximately $970 million since inception. All XRP funds combined manage over $929 million in AUM, with continuous daily net inflows recorded since its listing on November 13—accumulating about $756 million across the past 11 trading sessions.

XRP ETF is currently among the most popular altcoin ETFs, becoming the "preferred entry point" for institutional allocation due to multiple issuers, robust inflows, and large AUM scale.

2. SOL Spot ETF

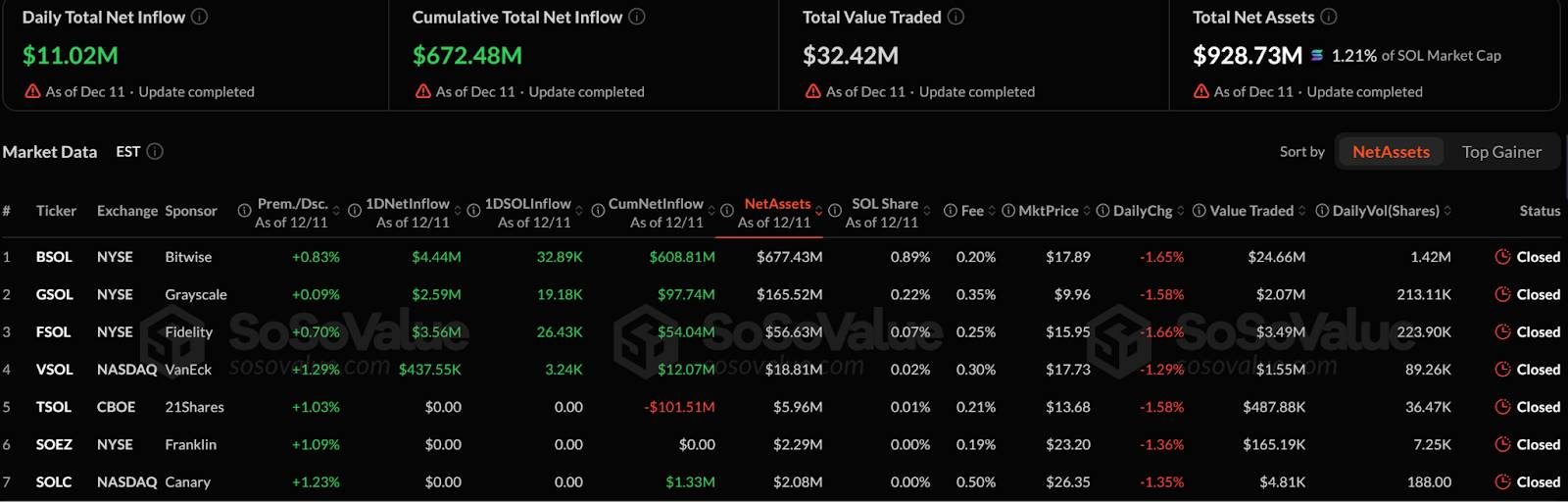

Source:https://sosovalue.com/assets/etf

The Solana ETF was jointly promoted by several asset managers. Since launch, Solana ETFs have seen cumulative net inflows of about $672 million, with total AUM reaching approximately $928 million. This makes Solana ETF the largest in scale among altcoin products and a representative of sustained capital absorption.

However, unlike XRP, Solana ETF inflows show a phased pattern: massive initial capital entry, followed by a steady rather than explosive growth rate in subsequent weeks. This suggests investors may prioritize long-term allocation over short-term arbitrage.

The performance of the Solana ETF highlights the potential of altcoin ETFs to attract institutional capital and reflects a market characterized by "patient positioning." While leading in ETF size among peers, the disconnect between price and capital flows indicates lingering short-term volatility risks.

3. HBAR Spot ETF

Source:https://sosovalue.com/assets/etf

Hedera (HBAR) ETF has entered the market and gained moderate attention. Early HBAR ETFs have gathered around $82 million in net inflows, placing them in the mid-tier category among altcoin ETFs. Compared to XRP and SOL, HBAR’s capital volume remains relatively small.

The HBAR ETF exhibits consistent weekly net inflows, showing persistent capital flow—even if weekly volumes are modest, there has been no large-scale outflow. This stability is closely linked to its ecosystem foundation and real-world use cases. However, prices have still been affected by broader market weakness, with HBAR declining nearly 20% since the ETF’s launch.

4. LTC Spot ETF

Source:https://sosovalue.com/assets/etf

LTC (Litecoin), one of the earliest altcoins, had its spot ETF successfully launched by institutions like Canary Capital in late October 2025, making it one of the first batch of approved altcoin ETFs. Despite its prominent history and high trading activity, its capital-raising ability and market attention post-launch were clearly lower than top-tier altcoin ETFs like XRP and SOL.

According to SoSoValue data, as of mid-November 2025, the LTC ETF (commonly abbreviated as LTCC) recorded cumulative net inflows of about $7.67 million, with several days showing zero net inflow. Compared to the hundreds of millions flowing into XRP ETF and tens to hundreds of millions into SOL ETF, LTC’s capital absorption was insufficient, failing to establish itself as a core holding in investors’ altcoin ETF portfolios.

5. DOGE Spot ETF

Source:https://sosovalue.com/assets/etf

DOGE (Dogecoin), one of the most iconic meme coins, has long been viewed as a community-sentiment-driven asset. With the SEC approving Rex-Osprey and other institutions to list DOGE ETFs in November 2025, DOGE became one of the most symbolic projects among the first meme coin ETFs.

Latest SoSoValue data shows the DOGE spot ETF has recorded historical cumulative net inflows of about $2.05 million, indicating extremely limited capital allocation. In terms of trading activity, DOGE ETF volumes remain generally low. While daily volumes briefly reached several million dollars at launch, the overall trading structure is unbalanced, often accompanied by sparse capital movements. This trading behavior suggests institutional capital is unwilling to make deep allocations into DOGE ETFs.

6. LINK Spot ETF

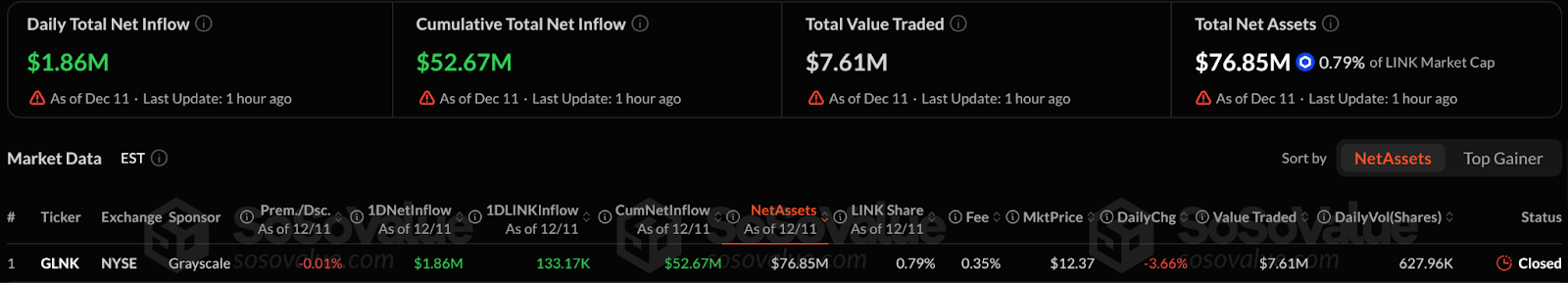

Source:https://sosovalue.com/assets/etf

The first U.S.-listed spot ETF supporting LINK (Chainlink)—the Grayscale Chainlink Trust ETF (GLNK)—officially began trading on the New York Stock Exchange (NYSE) on December 2, 2024, Eastern Time. Since launch, the LINK ETF has seen approximately $52 million in net inflows, with AUM reaching $76 million. Its appeal partly stems from Chainlink’s real-world utility in blockchain data infrastructure, prompting strategic allocations from some long-term institutional investors.

On the price front, LINK itself remains subject to broad market swings, but ETF-based capital allocation may provide a relatively stable base-level demand in the future.

7. Summary of Listed Altcoin ETF Performance

From the above performances, it is evident that the U.S. altcoin spot ETF market is experiencing clear "divergent development":

-

Capital is heavily concentrated in XRP and Solana ETFs—these products feature multiple issuers, rapid capital accumulation, and large AUM, making them central focuses in the altcoin ETF space.

-

Mid-sized assets like HBAR and LINK show stable performance, achieving a relative balance between ecosystem value and institutional recognition, though they still struggle to compete with top-tier assets.

-

LTC and DOGE ETFs show signs of marginalization, with small capital scales, low trading activity, and lack of price support, resulting in limited market attention.

-

Overall, prices of underlying assets have generally declined after ETF launches, indicating that market sentiment and macro factors still dominate pricing, and ETF capital attraction has not immediately translated into upward price momentum.

Overall, while altcoin ETFs have yet to match the depth and scale of BTC/ETH ETFs, they already exhibit trends of segmented allocation, sustained long-term inflows, and rising institutional participation—forming the early shape of a "institutionalized investment" era for altcoins.

4. Opportunities and Risks Analysis of Altcoin ETFs

As U.S. altcoin spot ETFs receive密集approval and go live one after another, the market is entering a new phase of institutionalized investing. Though still far smaller in scale than Bitcoin and Ethereum ETFs, their growth potential and示范effects cannot be ignored.

1. From Institutionalization to Divergence: Structural Opportunities in Altcoin ETFs

1) Institutional红利realized: The success of Bitcoin and Ethereum spot ETFs opened a compliant pathway for altcoin products. In 2025, the SEC revised ETF general listing standards and introduced mechanisms such as the "fast track" and Section 8(a) of the Securities Act of 1933, enabling altcoin ETFs to enter exchange markets more efficiently. This transformation shortens approval timelines, increases product diversity, and lowers institutional entry barriers overall.

2) Opportunity for institutional portfolio rebalancing: Market data from November 2025 showed that while Bitcoin and Ethereum spot ETFs experienced massive outflows, altcoin ETFs逆势attracted around $1.3 billion in capital, primarily flowing into XRP and Solana-related products. This indicates institutions are willing to reevaluate altcoin allocations in the short term. More importantly, this capital shift is not purely sentiment-driven but reflects institutional investors' selective pursuit of assets with solid fundamentals, compliance clarity, and ecosystem value. For example:

-

XRP ETF drew attention due to its cross-border payment use case and relatively clear regulatory path;

-

Solana ETF combines yield-generating structures like staking, appealing to institutions seeking long-term exposure.

This capital movement from BTC/ETH into altcoin ETFs not only shows diversification of investment focus but also signals growing institutional acceptance of "altcoins as long-term value investments."

3) ETFs as compliant gateways for retail and institutional investors: Altcoin ETFs offer retail investors a simplified way to access on-chain assets—without managing wallets or private keys, relying on centralized exchanges, or bearing custody risks. For institutional investors, ETFs serve as mature, compliant instruments that can be integrated into traditional frameworks such as pension funds, hedge funds, and wealth management portfolios, thereby expanding the capital base.

The existence of ETFs also enhances industry visibility and transparency, allowing altcoin investments to move beyond decentralized trading and OTC liquidity into traditional financial vehicles suitable for portfolio inclusion.

2. Core Risks: Market, Regulatory, and Technical Challenges Coexist

Despite the opportunities, altcoin ETFs face significant risks stemming from both asset characteristics and broader macro and regulatory environments.

1) Regulatory uncertainty persists: Although the approval process has improved, the SEC remains highly cautious toward altcoin ETFs overall. Legal classification, categorization standards, and potential changes in compliance requirements could impact ETF operations and liquidity. The SEC’s stance on whether certain assets are securities vs. commodities remains a key review focus—any policy reversal or judicial ruling could lead to product adjustments or suspensions. Moreover, although the approval wave has accelerated, the rapid "default-effective" mechanism raises market concerns, implying some products may still require post-listing compliance optimization. This uncertainty can affect price volatility and capital allocation.

2) Market depth and liquidity risks are evident: Compared to the deep liquidity of BTC or ETH, many altcoins still suffer from shallow markets. Large ETF inflows may cause significant market impact, while redemption pressures during downturns could exacerbate liquidity crunches. For instance, despite strong capital inflows, the Solana ETF faced downward pressure on SOL prices, which failed to rise alongside inflows—showing altcoin pricing is not solely driven by capital flows but also influenced by sentiment and liquidity conditions. Additionally, for more niche altcoins like DOGE and LTC, weak ETF inflows reflect insufficient market depth to support large institutional trades, potentially leading to higher slippage during volatile periods.

3) Market saturation and product competition risks: As the number of altcoin ETFs surges, capital may become fragmented across products, limiting individual ETF scale growth and weakening price momentum and visibility. Over 100 crypto ETF filings are already pending at the SEC, diluting investor attention. If supply exceeds demand and "ETF fee wars" become common, lowering fees to attract capital might compromise product quality and investment value—harming long-term holders.

4) High volatility and price risk: Altcoin assets are inherently more volatile than BTC/ETH, meaning even with compliant ETF access, prices can swing violently. Just as some altcoin ETFs failed to sustain price gains post-launch, capital inflows do not guarantee price appreciation. Markets may experience sharp corrections due to macro sentiment shifts, liquidity tightening, or mass liquidations—posing challenges for investors with low risk tolerance. Especially in products with high retail participation, altcoin ETFs are more susceptible to emotional market swings, amplifying irrational behavior.

5) Technology and operational risks: As financial instruments, ETFs depend on exchange custody, clearing mechanisms, and underlying asset security. Risks such as smart contract vulnerabilities, custodial failures, and zombie order books (widened bid-ask spreads due to low trading activity) could pose technical threats to ETF operations. For smaller altcoins, assets may suffer from "trading island effects"—if ETF growth slows, these risks could quickly surface.

5. Outlook and Conclusion on Altcoin ETF Trends

Looking ahead, the development of altcoin ETFs will continue to profoundly reshape the crypto asset landscape. With institutional benefits gradually realized, regulatory clarity improving, and institutional interest growing, this niche segment is entering a pivotal stage—from infancy to maturity.

-

From a regulatory standpoint, the SEC has made significant adjustments to crypto ETF approval rules, introducing general listing standards and drastically reducing review times—from procedures lasting hundreds of days down to around 75 days—offering greater efficiency and predictability for altcoin ETFs. This institutional optimization not only improves regulatory signaling but also paves the way for more assets like SOL, XRP, LTC, and HBAR to enter the ETF market, pushing the industry from case-by-case approvals toward scalable deployment. Therefore, in the coming quarters, we are likely to see a growing number of altcoin ETFs receiving listing approvals and going live.

-

On the market sentiment front, industry participants and analysts widely expect high approval probabilities for altcoin ETFs. Bloomberg ETF analysts indicate that mainstream altcoins such as Solana, XRP, and LTC have over 90% chances of ETF approval, with some viewing certain approvals as virtually "guaranteed," expected to materialize within the next few months. This cautious optimism reflects regulatory recognition of compliance, transparency, and market maturity, helping attract more institutions and long-term capital into the space.

-

Internationally, altcoin ETF trends are progressing in parallel across multiple markets. Canada, Europe, and Asia already host crypto ETFs or similar products, each with unique designs and regulatory frameworks. These not only provide reference points for the U.S. but also foster complementary and comparative effects in global digital asset allocation. For example, French and German support for crypto index ETFs, along with Asian exchanges launching altcoin options/futures tools, offer broader data and strategy references for U.S. investors.

-

Within the market, a "tiered allocation" strategy is emerging: top-tier assets like XRP, SOL, ETH, and BTC remain core holdings for institutional and compliant portfolios, while mid- and small-cap altcoins (e.g., DOT, ADA, AVAX, INJ) may appeal to investors seeking high-risk, high-return opportunities. As product counts grow, investors will increasingly focus on ecosystem value, liquidity, and long-term fundamentals when building portfolios—not just chasing short-term hype.

It should be noted that despite favorable overall trends, altcoin ETFs still carry cyclical and structural risks. Minor regulatory changes, liquidity fluctuations, and macroeconomic impacts on risk asset pricing can all lead to divergent asset performance. Investors must therefore emphasize risk management and dynamic adjustments when allocating to ETFs, closely monitoring policy shifts, market sentiment, and capital flows.

In conclusion, altcoin ETFs are an inevitable outcome of the convergence between traditional finance and the crypto market, aligning with trends of market segmentation and regulatory adaptation. By the first half of 2026, as regulators accumulate experience and approval processes further improve, dozens to hundreds of altcoin ETF applications from over a dozen asset managers are expected to go live, forming a more mature, diverse, and layered ETF ecosystem. For retail investors, this provides compliant and convenient investment avenues, pushing the entire crypto market into a new phase characterized by institutionalization, decentralization, and professionalization. The altcoin ETF wave has begun—opportunities and risks coexist, and the key lies in rational participation and strategic positioning.

About Us

Hotcoin Research, as the core research arm of Hotcoin Exchange, is dedicated to transforming professional insights into practical tools for investors. Through our "Weekly Insights" and "In-depth Reports," we analyze market dynamics; with our exclusive column "Top Coin Selection" (powered by AI and expert screening), we identify promising assets and reduce trial-and-error costs. Each week, our researchers engage directly with you via live streams to explain hot topics and forecast trends. We believe that warm, personalized guidance paired with professional expertise can help more investors navigate market cycles and capture Web3 value opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing inherently involves risk. We strongly recommend that investors fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News