Weekly Crypto Market Outlook (11.03-11.09): Market Recovers from Panic, Altcoin Capital Remains Active

TechFlow Selected TechFlow Selected

Weekly Crypto Market Outlook (11.03-11.09): Market Recovers from Panic, Altcoin Capital Remains Active

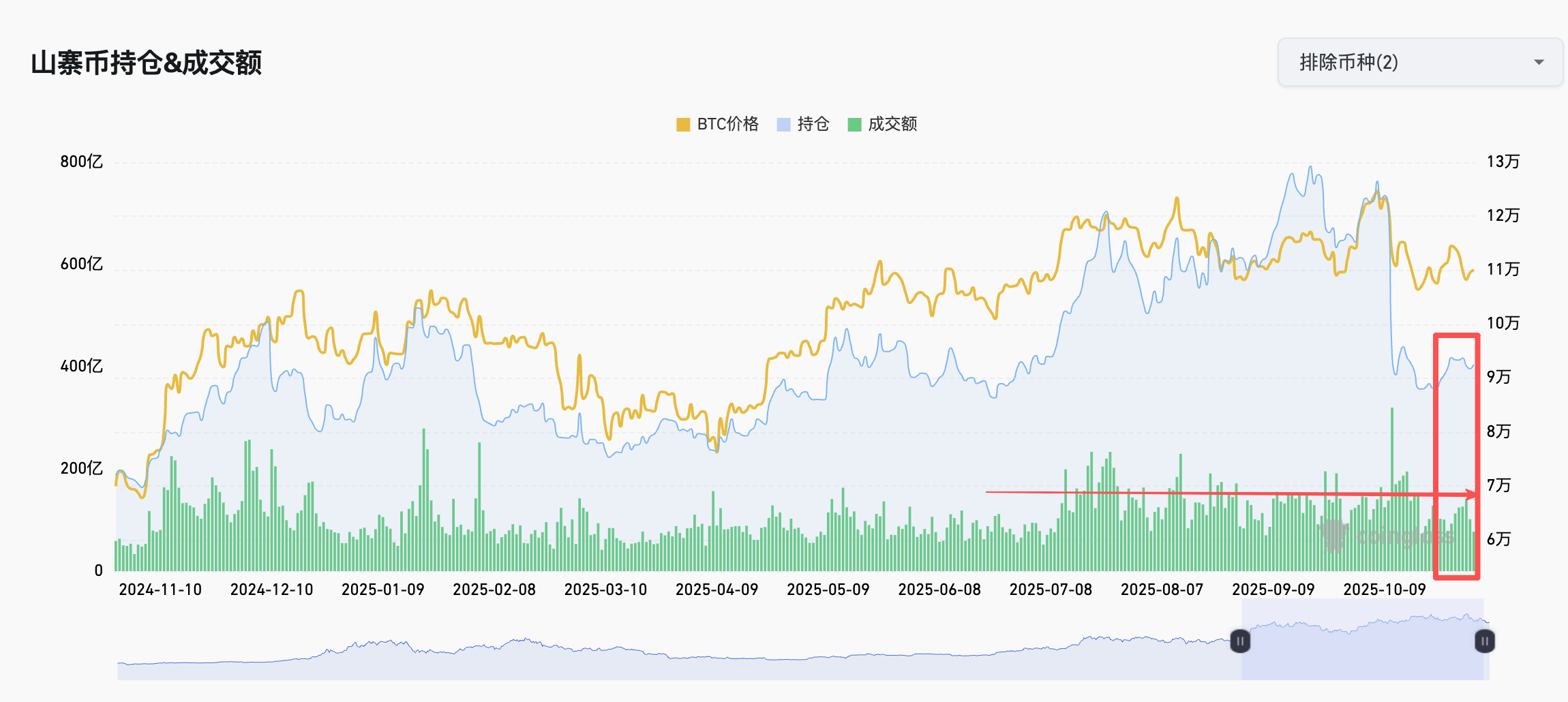

Last week, altcoin contract positions on exchanges remained low after October 11, while trading volume gradually recovered to pre-October 11 levels.

Author: TechFlow

I. Overall Performance

1. Market Sentiment

Last week, market sentiment experienced a shift from panic to recovery. From November 3 to November 4, temporary tightening of liquidity due to the U.S. government shutdown, lingering impacts from the October 11 crash, and FUD surrounding multiple DAT companies announcing token sales drove continuous market declines. BTC dropped as low as $98,950, falling 11% over two days; ETH fell to $3,057, down 22% over the same period. The market then oscillated at lower levels before breaking out of its consolidation range on November 9, boosted by news of the U.S. government reopening, marking the beginning of sentiment recovery.

The chart below shows the Coinglass Fear & Greed Index. For all seven days last week, market sentiment remained in the "fear" zone. It hit a weekly low of 21 on November 8 and has since recovered to 30, indicating improving market sentiment.

Chart: Market sentiment gradually recovering from fear last week

Data source: Coinglass

2. Macro Events

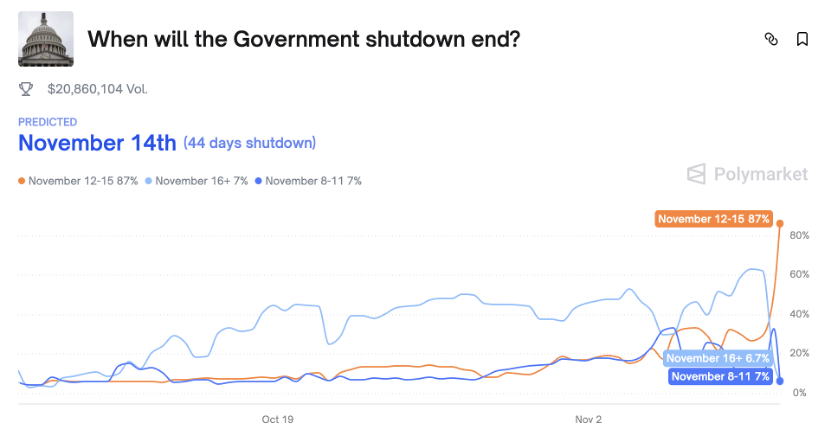

The key macro event last week was the reopening of the U.S. government. Currently, Republicans secured 60 votes in a procedural test vote in the Senate. The process will now move to a formal vote, where the government re-funding bill only requires a simple majority of 51 votes to pass. Afterward, it will proceed to the House for voting and finally be submitted to the President’s office for Trump's signature. This entire process is expected to take 2–5 days. Given that Republicans hold 53 seats in the Senate and face minimal resistance in the House, some traders have already priced in the reopening of the U.S. government this week. On Polymarket, the probability of the U.S. government shutdown ending between November 12 and 15 has risen to 87%.

Chart: 87% probability of U.S. government shutdown ending between November 12–15

Data source: Polymarket

3. Specific Data

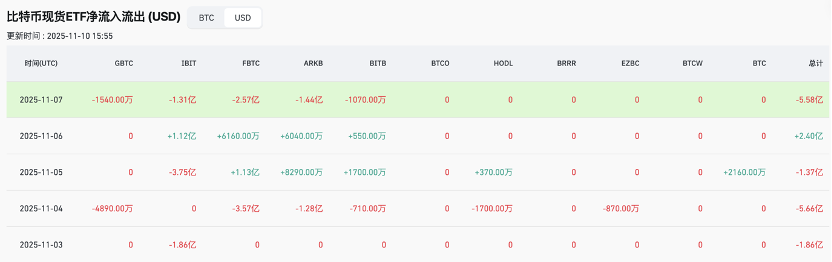

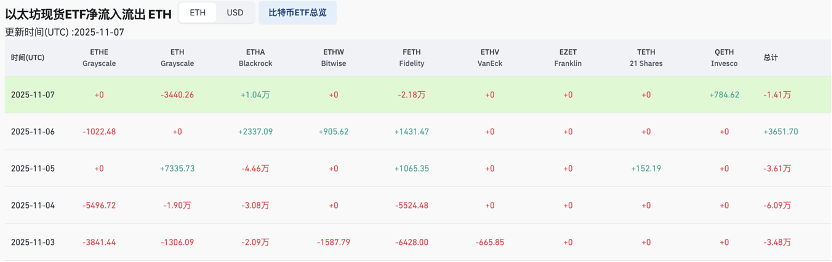

Last week, BTC ETFs saw outflows of $207 million, a 50% increase week-on-week; ETH ETFs recorded outflows of $510 million, shifting from inflows (October 27–31 saw $16.4 million in inflows).

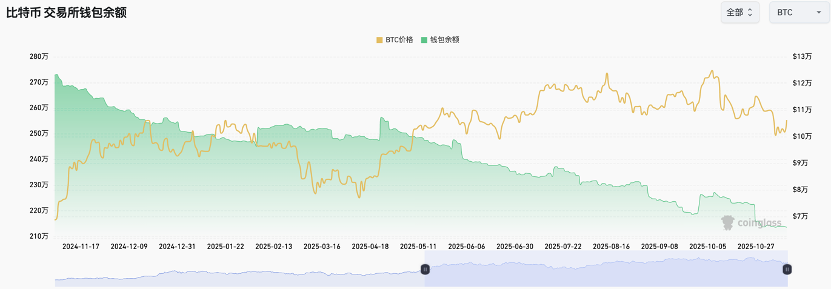

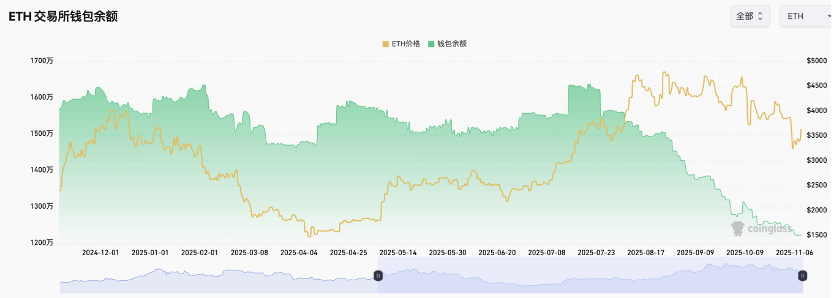

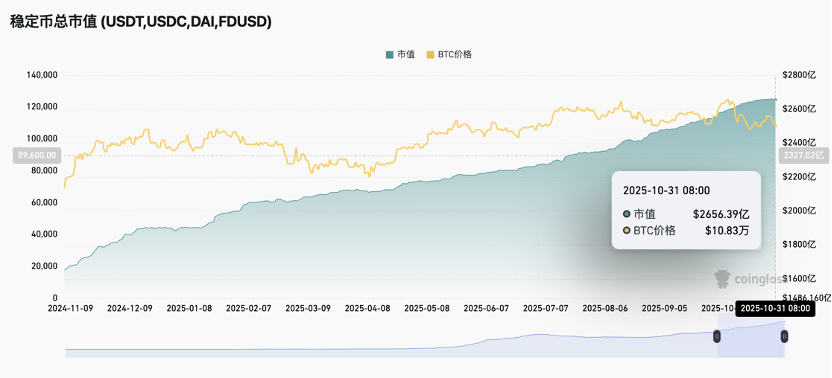

Currently, BTC exchange reserves stand at 2.14 million, unchanged week-on-week; ETH exchange reserves are at 12.22 million, down 1.1% week-on-week. As of October 31, stablecoin market cap remains unchanged at $265.6 billion week-on-week.

Chart: BTC ETF outflows of $207 million, up 50% week-on-week

Data source: Coinglass

Chart: ETH ETF outflows of $510 million, turning from inflow to outflow week-on-week

Data source: Coinglass

Chart: BTC exchange reserves unchanged week-on-week

Data source: Coinglass

Chart: ETH exchange reserves down 1.1% week-on-week

Data source: Coinglass

Chart: Stablecoin market cap unchanged week-on-week

Data source: Coinglass

II. Local Highlights

1. Last week, capital within exchanges was active, with privacy-focused assets led by ZEC leading the market rally. ZEC surged 73% for the week without showing signs of exhaustion, supported by continuous bullish commentary from Arthur Hayes. The privacy effect achieved by combining Near's internet bridge with ZEC's privacy pool surpasses that of Monero + Tornado.

Data source: Rootdata

2. The explosive growth in AI computing has created strong demand for high-capacity, high-speed data storage. However, expanding production capacity takes time, causing a significant supply-demand imbalance in the current phase. Raw material wafer prices continue to rise, with SanDisk (a brand of Western Digital) increasing NAND flash contract prices by 50%, and signaling limited supply growth through 2026, further fueling market sentiment.

Related stocks have seen massive gains: Western Digital (WDC) rose sixfold recently, STX fivefold, and MU fourfold. Meanwhile, the U.S. storage theme has spilled into the crypto market, with FIL up 73% and AR up 46% for the week. Notably, FIL's paid storage transaction volume reached 51% last week, exceeding miner self-generated data for the first time.

Data source: Rootdata

3. Last week, small-cap assets related to Alpha+ contracts, Binance Memes, POW sector, Grayscale themes, privacy concepts, and Sui ecosystem were continuously hyped within exchanges. Altcoin capital was active but showed rapid rotation, with most targets lacking follow-through strength. This pattern manifested as mid-week activity followed by weekend calm, resembling institutional trading behavior.

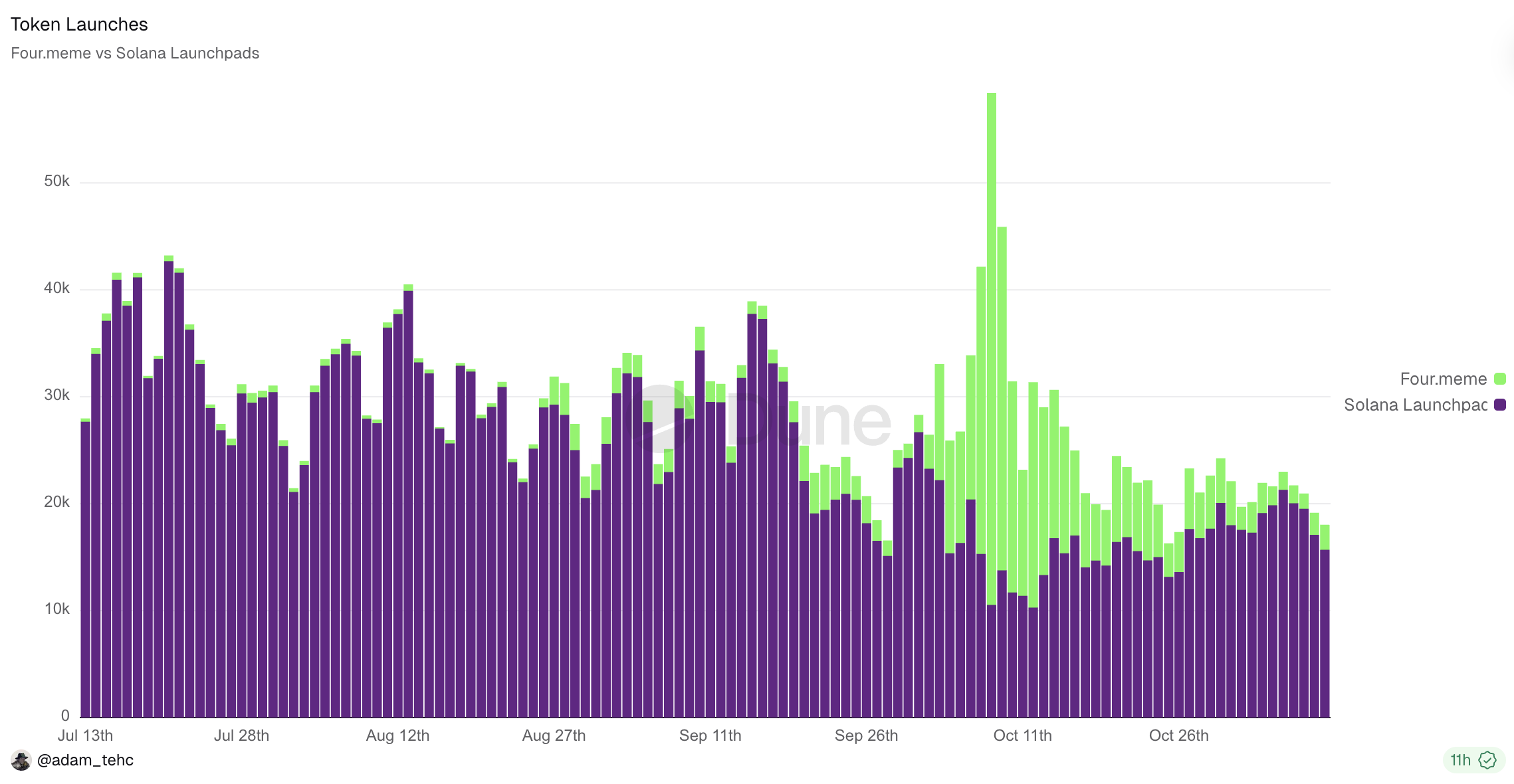

Currently, Trump-related and privacy themes still attract high attention. X402, after a week of silence, is showing signs of revival, with Ping transitioning into an x402 launchpad. On-chain, due to constant pumping of BSC Memes, wealth creation effects have weakened, while Solana Memes are becoming more active.

After October 11, altcoin futures positions on exchanges remained low, but trading volume has gradually recovered to pre-October 11 levels, reflected in price action by significantly higher volatility in popular altcoins than before.

Data source: Coinglass

Last week, the issuance of Meme coins on BSC sharply declined, rapidly cooling down; in contrast, Meme coin issuance on Solana increased, with capital gradually becoming more active.

Data source: Dune

4. Key news last week:

The U.S. Senate advanced a temporary funding bill, securing 60 votes in a procedural vote;

Ripple completed a $500 million financing round led by Fortress and Citadel Securities;

JPMorgan invested in Bitmine, the leader in Ethereum reserves, with a holding value of $102 million;

U.S.-listed BTC treasury company Sequans confirmed it sold 970 bitcoins to reduce debt;

Tom Lee: The October 11 crash and DeFi protocol failures still require several weeks to digest;

Arthur Hayes: Stealth QE may restart, potentially acting as a catalyst for the next Bitcoin bull run.

III. Focus for This Week

1. Macro events:

November 12: Expected end of the U.S. government shutdown; previously stalled cryptocurrency regulatory bills and ETF approvals caused by the shutdown may resume;

November 12: U.S. Treasury Secretary Bessent speech;

November 13: U.S. October CPI data release;

November 14: U.S. October PPI data.

2. Token unlocks:

Read more: This week, major token unlocks are expected for APT, LINEA, AVAX, etc., totaling over $200 million

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News