Arthur Hayes: Bitcoin could drop to $80,000, which might be the ticket to a new round of "money printing"

TechFlow Selected TechFlow Selected

Arthur Hayes: Bitcoin could drop to $80,000, which might be the ticket to a new round of "money printing"

The bulls are right—over time, the printing presses will inevitably start "chugging" away.

Written by: Arthur Hayes

Translated and compiled by: BitpushNews

It's that time again when I play amateur meteorologist. Concepts like La Niña and El Niño enter my vocabulary.

Predicting wind direction is as important as forecasting snowfall—it determines which slopes are ideal for skiing. I use my rudimentary knowledge of weather patterns to predict when autumn ends and winter begins in Hokkaido, Japan.

I discuss with other local ski enthusiasts the possibility of an early start to my dream powder season. Instead of constantly refreshing my favorite crypto trading app, I now obsessively check Snow-Forecast.

As data points start coming in, I must decide when to hit the slopes despite incomplete information. Sometimes, it's only the day before strapping on my skis that I learn what the weather pattern will be.

A few seasons ago, arriving in mid-December, I found the mountain covered in dirt. Only one lift was open, serving thousands of eager skiers. Waiting hours in line just to ski a flat, poorly-snow-covered beginner-to-intermediate run. The next day, heavy snow fell, and I experienced one of the most epic powder days at my favorite tree-lined resort.

Bitcoin is the free-market weathervane for global fiat liquidity. Its trading depends on expectations about future fiat supply. Sometimes reality matches expectations; sometimes it doesn't.

Money is politics. And shifting political rhetoric influences market expectations about future dirty fiat supply.

Our imperfect leaders one day call for pumping up their favorite supporters' assets with larger-scale, lower-cost funding, and the next day advocate the opposite to combat inflation that destroys ordinary people—and jeopardizes their re-election or authoritarian continuity.

Like science, in trading, it's worthwhile to hold strong convictions while remaining flexible.

After the debacle of U.S. "Massive Tariff Day" (April 2, 2025), I called for "up only."

I believed President Trump and his Treasury Secretary "Buffalo Bill" Bessent had learned their lesson—not trying to change the world’s financial and trade operating system too quickly.

To regain popularity, they would deliver benefits to their supporters—those holding significant real estate, stocks, and crypto—funded by printed money.

On April 9, Trump "Taco'd" (capitulated), announcing a tariff truce. A crisis that seemed like the start of a depression turned into this year's best buying opportunity. Bitcoin surged 21%, and many altcoins followed—evidenced by Bitcoin's dominance dropping from 63% to 59%.

However, recently, Bitcoin's implied dollar liquidity forecast has deteriorated. Since hitting all-time highs in early October, Bitcoin has dropped 25%, and many altcoins have been hit harder than capitalists during New York City mayoral elections.

What changed?

The Trump administration's rhetoric hasn’t changed. Trump still criticizes the Fed for keeping rates too high. He and his deputies continue talking about pumping up the real estate market through various means.

Most importantly, at every turning point, Trump gives in to China, delaying forced correction of the financial and trade imbalances between the two economic giants because such financial and political pain is unbearable for politicians facing voters every two to four years.

What hasn't changed—but which the market now weighs more heavily than political rhetoric—is the contraction of dollar liquidity.

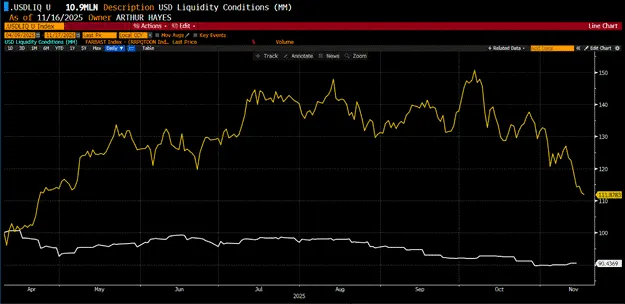

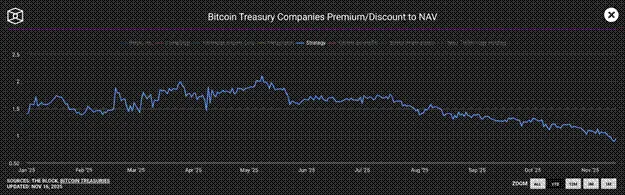

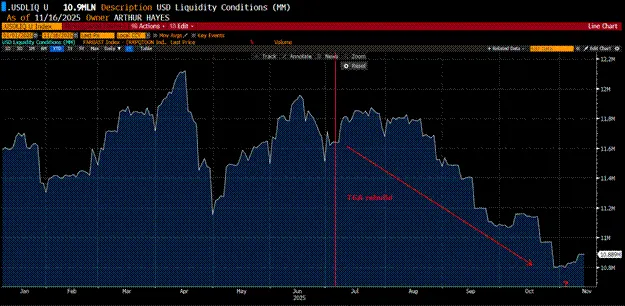

My dollar liquidity index (white line) has declined 10% since April 9, 2025, while Bitcoin (gold line) rose 12%. This divergence was partly due to positive liquidity rhetoric from the Trump administration, and partly because retail investors interpreted inflows into Bitcoin ETFs and DAT mNAV premiums as proof of institutional demand for Bitcoin exposure.

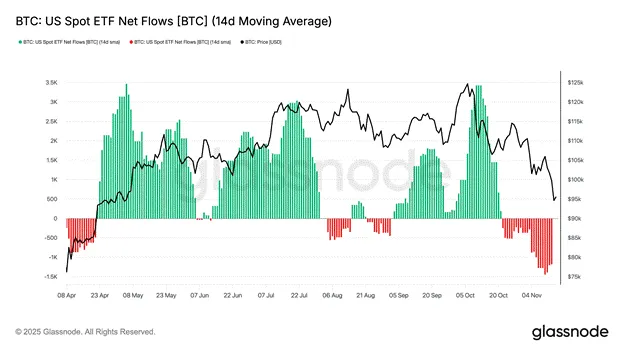

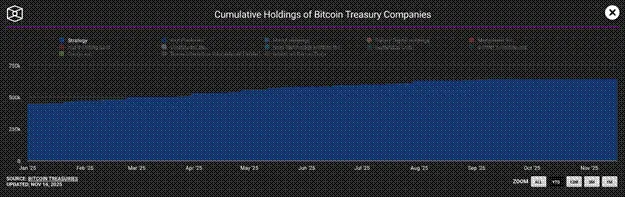

The narrative goes: institutions flooded into Bitcoin ETFs. As you can see, net inflows from April to October provided steady buying pressure despite declining dollar liquidity. I must add a caveat to this chart. The largest holders of the biggest ETF (BlackRock IBIT US) use the ETF as part of a basis trade—they aren't bullish on Bitcoin.

They profit from the spread by shorting CME-listed Bitcoin futures while buying the ETF.

This strategy is capital-efficient, as their brokers typically allow them to use the ETF shares as collateral for their short futures positions.

These are the five largest holders of IBIT US. They are large hedge funds or proprietary trading desks at investment banks, such as Goldman Sachs.

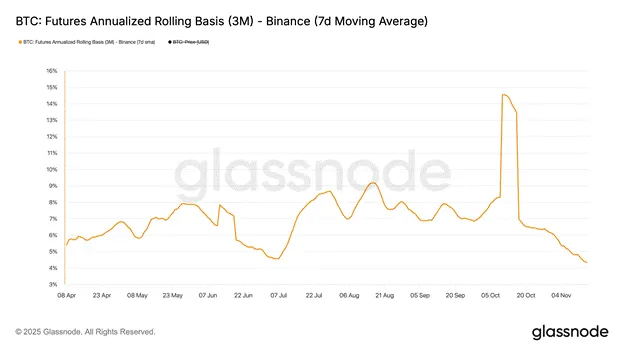

The chart above shows the annualized basis yield these funds earn by buying IBIT US and selling CME futures.

Although the exchange shown is Binance, the CME annualized basis is essentially identical. When the basis is significantly higher than the federal funds rate, hedge funds rush into the trade, creating substantial and sustained net inflows into ETFs.

This creates an illusion for those unaware of market microstructure—that institutional investors have massive interest in holding Bitcoin exposure—when in reality, they don’t care about Bitcoin at all. They’re just playing in our sandbox to earn a few extra percentage points over the fed funds rate. When the basis narrows, they quickly unwind their positions. Recently, as the basis declined, the ETF complex recorded massive net outflows.

Now retail investors believe these institutions dislike Bitcoin, creating a negative feedback loop that prompts selling, further reducing the basis, ultimately forcing more institutional investors to sell ETFs.

Digital Asset Trusts (DATs) offer another way for institutions to gain Bitcoin exposure. Strategy (ticker: MSTR US) is the largest DAT holding Bitcoin. When its stock trades at a significant premium to the value of its Bitcoin holdings (known as mNAV), the company can issue new shares and raise capital cheaply to acquire more Bitcoin. As the premium turns into a discount, Strategy slows its Bitcoin accumulation.

This is a cumulative holdings chart, not a rate-of-change chart, but you can see that as Strategy’s mNAV premium disappeared, its pace of Bitcoin accumulation slowed.

Despite tightening dollar liquidity since April 9, Bitcoin climbed thanks to ETF inflows and DAT purchases. But that era is over.

The basis is no longer attractive enough to sustain institutional ETF buying, and most DATs now trade at discounts to mNAV. Investors are now avoiding these Bitcoin derivative securities. Without these flows masking negative liquidity conditions, Bitcoin must fall to reflect current short-term concerns—namely, that dollar liquidity will contract or grow slower than politicians promised.

Show Me the Money…

Now it’s time for Trump and Bessent to show results or shut up. Either they can force the Treasury to override the Fed, create another real estate bubble, distribute more stimulus checks, etc., or they’re just weak, powerless frauds.

Making matters worse, Blue Team Democrats have discovered (unsurprisingly) that campaigning on affordability themes is a winning strategy. Whether the opposition party can actually deliver free transit cards, vast rent-controlled apartments, or government-run grocery stores isn’t the point. The point is that people want to feel heard and can at least delude themselves into believing someone powerful is fighting for them. People don’t want Trump and his MAGA social media influencer army whitewashing the inflation they see and feel daily with fake news.

They want to be heard—just as Trump told them in 2016 and 2020 that he would crack down on China and expel “colored people,” so their high-paying jobs would magically return.

For those with multi-year horizons, these short-term pauses in fiat creation are irrelevant. If the Red Team Republicans can’t print enough money, the stock and bond markets will collapse, forcing doctrinaire members of both parties back into the satanic cult of money printing.

Trump is a shrewd politician, much like former President Biden—who also faced similar backlash from ordinary citizens suffering inflation caused by COVID stimulus. He’ll publicly pivot, blaming the Fed as the culprit behind inflation hurting regular voters. But don’t worry—Trump won’t forget the wealthy asset holders who funded his campaign. "Buffalo Bill" Bessent will receive strict orders to print money in creatively opaque ways that ordinary people can’t understand.

Remember this photo from 2022? Our favorite "yes-man," Fed Chair Powell, got lectured by then-President Biden ("Slow Joe") and Treasury Secretary Yellen ("Bad Gurl"). Biden explained to his supporters that Powell would crush inflation. Then, because he needed to boost financial assets for the rich who got him elected, he told Yellen to reverse all of Powell’s rate hikes and balance sheet contraction—no matter the cost.

Yellen issued more Treasury bills than notes or bonds from Q3 2022 to Q1 2025, draining $2.5 trillion from the Fed’s reverse repo facility, thereby pumping stocks, housing, gold, and crypto.

To the average voter—and perhaps some readers here—what I just wrote might sound like gibberish. And that’s precisely the point. The inflation you personally feel is directly caused by the very politician claiming to care about your cost-of-living burden.

"Buffalo Bill" Bessent must now perform similar magic. I am 100% confident he will engineer a comparable outcome. He is one of the most sophisticated masters of monetary market plumbing and currency operations in history.

The Situation

The market setups in late 2023 and late 2025 are strikingly similar. Debt ceiling battles ended in midsummer (June 3, 2023, and July 4, 2025), forcing the Treasury to rebuild the Treasury General Account (TGA), sucking liquidity from the system.

2023:

2025:

"Bad girl" Yellen pleased her boss. Can "Buffalo Bill" Bessent find his "BB" and reshape the market with Bismarckian resolve, so the Red Team Republicans win votes from financially-asset-holding voters in the 2026 midterms?

Whenever politicians listen too closely to the majority of citizens suffering under inflation, they verbally toughen their stance against central bankers and treasury officials who love printing money.

To dispel any notion of allowing credit contraction, markets present a Hobson’s Choice: after investors realize printing is temporarily banned, stock and bond prices plummet rapidly. Politicians must then either print money to save the highly leveraged, dirty-fiat financial system that supports the broader economy—causing inflation to accelerate again—or allow credit contraction, which destroys wealthy asset holders and triggers mass unemployment as over-leveraged businesses cut output and jobs.

Typically, the latter is politically unacceptable—1930s-style unemployment and financial hardship are always election losers—while inflation is a silent killer, easily masked by subsidies to the poor funded by printed money.

Just as I trust Hokkaido’s snow machines, I am 100% confident Trump and Bessent want the Red Team Republicans to stay in power. Therefore, they will find a way to appear tough on inflation while printing the necessary money to sustain the Keynesian "fractional reserve banking" scam underpinning the current U.S. and global economic status quo.

On the mountain, arriving too early sometimes lands you on dirt. In financial markets, before we return to "Up Only," in Nelly’s words, the market must first "Drop Down and Get Their Eagle On." (By the way, they don’t make music videos like that anymore.)

The Bull Case

The counterargument to my bearish dollar liquidity thesis is that as the U.S. government resumes operations post-shutdown, the TGA will rapidly shrink by $100–150 billion toward its $850 billion target, injecting liquidity into the system. Additionally, the Fed will stop balance sheet runoff on December 1 and soon restart expansion via quantitative easing (QE).

I was initially optimistic about risk assets post-shutdown. However, digging deeper into the data, I noticed roughly $1 trillion in dollar liquidity has evaporated since July according to my index. Adding $150 billion helps, but then what?

Although several Fed governors suggest QE is needed to rebuild bank reserves and ensure smooth functioning of money markets, this remains talk. We’ll know they’re serious only when the Fed whisperer—the Wall Street Journal’s Nick Timiraos—announces QE has been greenlit. We’re not there yet. Meanwhile, the Standing Repo Facility will be used to print hundreds of billions to ensure money markets can absorb massive Treasury issuance.

Theoretically, Bessent could reduce the TGA to zero. Unfortunately, because the Treasury must roll over tens of billions in bills weekly, it needs a large cash buffer to prevent surprises. It cannot risk a bill maturity default, ruling out an immediate injection of the remaining $850 billion into financial markets.

Privatization of government-sponsored mortgage enterprises Fannie Mae and Freddie Mac will certainly happen, but not within the next few weeks. Banks will also fulfill their "duty" by lending to those making bombs, nuclear reactors, semiconductors, etc.—but again, this unfolds over longer cycles and won’t immediately flow into dollar money market veins.

Bulls are right: over time, the printing presses will inevitably start churning.

But first, markets must retrace gains since April to better align with liquidity fundamentals.

Finally, before discussing Maelstrom’s positions, I do not accept the "four-year cycle" as valid. Bitcoin and certain altcoins will only reach new all-time highs after the market has shaken out enough weak hands to accelerate money printing.

Maelstrom’s Position

Last weekend, I increased our dollar stablecoin allocation, anticipating lower crypto prices. In the short term, I believe the only cryptocurrency capable of outperforming amid negative dollar liquidity is Zcash ($ZEC).

With AI, Big Tech, and Big Government advancing, privacy across most of the internet has died. Privacy coins like Zcash, using zero-knowledge proof cryptography, represent humanity’s only chance to resist this new reality. That’s why thinkers like Balaji believe the privacy narrative will drive crypto markets for years to come.

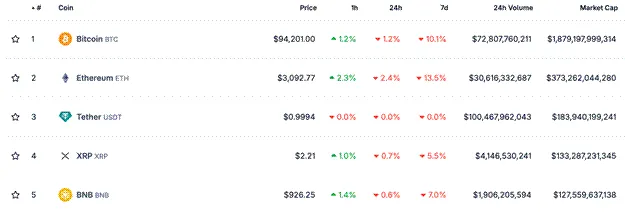

As a follower of Satoshi, I’m offended that the third, fourth, and fifth largest cryptocurrencies are dollar derivatives, a coin doing nothing useful on a lazy chain, and CZ’s centralized computer.

If in 15 years, these remain the top cryptos after Bitcoin and Ethereum, what exactly are we doing?

I have no personal grudge against Paolo, Garlinghouse, or CZ—they’re masters at creating value for their token holders. Kudos to all founders. But Zcash or a similar privacy coin should rank right after Ethereum.

I believe grassroots crypto communities are awakening—to realize that by endorsing these types of coins or tokens with massive valuations, we implicitly support something contradictory to a decentralized future where flesh-and-blood humans retain agency against oppressive technology, governments, and AI giants.

Therefore, while we wait for Bessent to regain his printing rhythm, Zcash or another privacy-focused cryptocurrency will enjoy long-term price appreciation.

Maelstrom remains structurally long. If I must buy back at higher prices (as I did earlier this year), that’s fine—I proudly accept my loss, knowing I kept dry powder to boldly bet and win big, making it truly count. Having liquidity when the April 2025 scenario repeats will determine your full-cycle profitability far more than giving back small profits due to trading losses.

Bitcoin falling from $125,000 to a low of $90,000, while the S&P 500 and Nasdaq 100 hover near all-time highs, tells me a credit event is brewing.

When I examine my dollar liquidity index declining since July, I confirm this view.

If I’m correct, a 10% to 20% stock market correction, combined with 10-year Treasury yields nearing 5%, will create enough urgency to prompt the Fed, Treasury, or another U.S. government agency to launch some form of money-printing program.

During this weakness, Bitcoin could absolutely fall to $80,000–$85,000. If broader risk markets implode and the Fed and Treasury accelerate their printing farce, Bitcoin could surge to $200,000 or $250,000 by year-end.

I still believe China will reflate. But China will only pull the trigger after the U.S. clearly accelerates dollar creation. Rightly or wrongly, they want to maintain RMB strength against the USD, preventing a large increase in broad money supply. Signs: the PBOC made its first modest purchase of government bonds since January. This marks the beginning of Chinese QE. The dragon will awaken and pour Maotai onto the raging fire of the 2026 crypto bull run.

One final thought on China before I head off to dance tango in beautiful Argentina: Isn’t it fascinating that Beijing is upset about the U.S. "stealing" Bitcoin belonging to a Chinese citizen suspected of fraud? Clearly, leaders view Bitcoin as a valuable asset that should be held and protected by China or its nationals—not the U.S. government.

If leaders of the "world’s two largest economies" both believe in Bitcoin’s value, what reason do you have not to be structurally bullish?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News