Why Are Crypto Treasuries a Better Solution Than Spot ETFs?

TechFlow Selected TechFlow Selected

Why Are Crypto Treasuries a Better Solution Than Spot ETFs?

Unlike ETFs that passively hold crypto assets, DATs are dynamic capital market vehicles with the potential to amplify asset exposure, capture protocol yields, and optimize capital allocation.

Author: Lorenzo Valente

Translation: Chopper, Foresight News

From August to September 2025, digital asset treasuries (DATs) became the central vehicle for mainstream Wall Street adoption of crypto assets. This shift likely surprised many in the industry who expected exchange-traded funds (ETFs) to maintain dominance rather than being gradually supplanted by DATs.

What exactly happened? A few years ago, Strategy pioneered the Bitcoin DAT model, but investors at the time did not yet understand how to apply it to other digital assets. This article will explore in depth the market landscape and controversies surrounding DATs.

Definition of DATs

A digital asset treasury (DAT) refers to a company that directly holds cryptocurrencies such as Bitcoin, Ethereum, and Solana on its balance sheet, allowing investors to gain indirect exposure to digital assets by purchasing its stock.

Unlike spot Bitcoin/Ethereum ETFs regulated by the U.S. Securities and Exchange Commission (SEC), which passively hold crypto with shares pegged 1:1 to underlying holdings, DATs are operating companies that can manage their positions through leverage, corporate strategy, or financing tools. While ETFs serve as regulated public investment vehicles offering compliant exposure, DATs introduce corporate-level risks, with returns or losses potentially exceeding the volatility of the underlying asset itself.

Well before the term "digital asset treasury" emerged, Strategy had already created the first Bitcoin DAT. Under Michael Saylor’s leadership, the company de-emphasized its enterprise software business and focused entirely on accumulating Bitcoin. As of September 15, 2025, Strategy purchased over 632,000 Bitcoins for $46.5 billion, at an average price of $73,527 per BTC. Currently, the company holds more than 3% of Bitcoin’s total supply of 21 million coins.

Strategy accumulated its Bitcoin holdings through multiple financing strategies: initially issuing convertible preferred notes, followed by senior secured notes with a 6.125% coupon rate, with the real breakthrough coming from its at-the-market (ATM) equity issuance program. Because its stock (ticker MSTR) traded at a significant premium to its market net asset value (mNAV), Saylor diluted existing shareholders by issuing new shares, using the proceeds to buy more Bitcoin and increase per-share Bitcoin exposure. Essentially, shareholder capital provided leveraged support for Strategy's Bitcoin position.

This model has sparked widespread controversy. Critics argue that DATs are “selling $1 of assets for $2.” If a DAT trades at twice its mNAV, investors must pay $2 in stock price for every $1 of Bitcoin on its balance sheet. To them, this premium is neither justified nor sustainable.

Yet so far, Strategy’s stock performance has defied this criticism, delivering substantial returns to shareholders. Except for a brief period of discount during the bear market from March 2022 to January 2024, MSTR has consistently maintained a significant mNAV premium. More importantly, Saylor strategically leveraged this premium—issuing shares at prices well above book value to continuously acquire more Bitcoin and grow holdings. The result is that since its first Bitcoin purchase in August 2020, MSTR has not only compounded shareholder exposure to Bitcoin but also significantly outperformed a simple buy-and-hold Bitcoin strategy.

Market Landscape of DATs

Five years after Strategy’s first Bitcoin purchase, hundreds of new DATs have now emerged. These new entities are accumulating various digital assets including Ethereum, SOL, HYPE, ADA, ENA, BNB, XRP, TRON, DOGE, SUI, and AVAX.

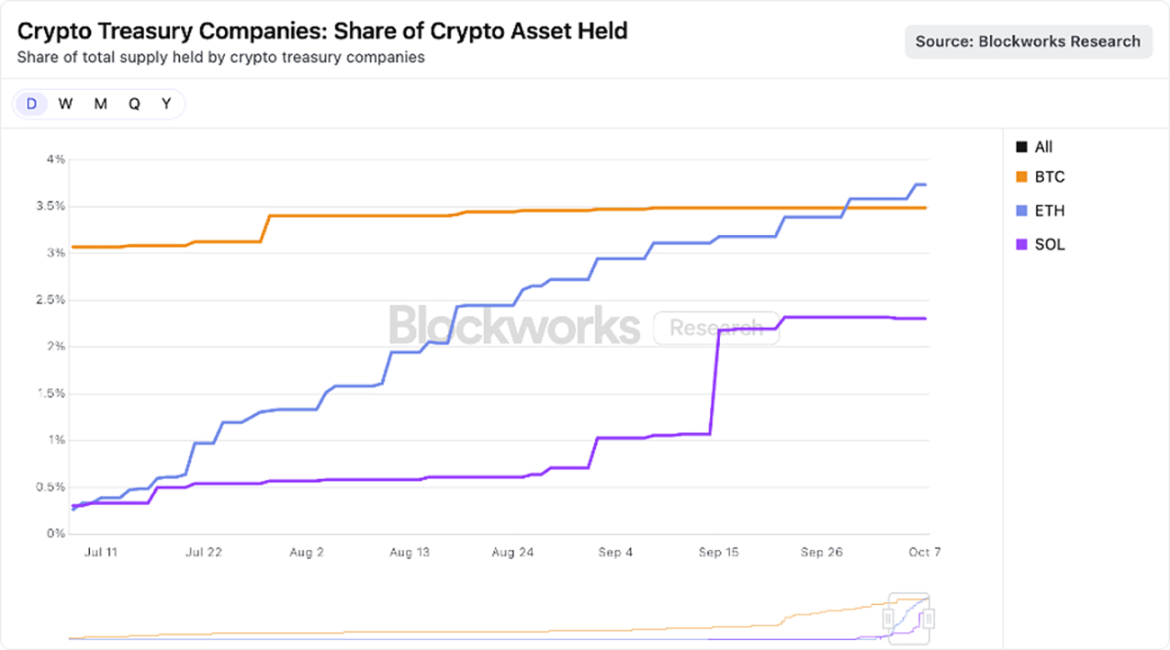

The market is now consolidating around large-cap assets, with several well-capitalized DATs competing to accumulate ETH and SOL. As shown in the chart below, ETH-focused DATs collectively hold 3.74% of Ethereum’s total supply, while Solana-based DATs hold 2.31% of SOL’s supply.

Source: Blockworks, as of August 25, 2025

In our view, although some DATs may have been established for short-term speculation, the ultimate winners could become more efficient crypto asset vehicles than spot ETFs. Leveraging corporate structure advantages, DATs can employ leverage, corporate financing, and strategic options—capabilities unavailable to ETFs. As long as their mNAV premiums remain sustainable, these advantages will persist, a topic explored further in the following sections.

Why Are DAT mNAV Premiums Justified?

As a major asset manager with significant exposure to cryptocurrencies, ARK Invest has shown strong interest in the emerging DAT space, recently investing in Bitmine Immersion, a leading Ethereum DAT. While we remain cautious about DATs and closely monitor their rapid evolution, we recognize several reasons why certain DATs command mNAV premiums:

Income / Staking Yields

Smart contract L1 blockchains, especially Ethereum, offer native yield through staking mechanisms that reward users for securing network safety. Within the crypto ecosystem, this yield functions essentially as a “risk-free rate,” generated internally by the protocol without counterparty risk.

In contrast, U.S. spot ETFs are not permitted to earn staking rewards on their underlying assets. Even if regulators change their stance, design limitations within the Ethereum network would restrict ETFs to staking only a small portion of holdings (likely less than 50%). Ethereum’s “activation and exit queue” limits the number of validators that can join or leave each epoch—a critical security feature preventing malicious actors from instantly launching or shutting down large numbers of validators, which could collapse consensus or state management. This results in staking or unstaking ETH taking up to two weeks. While ETFs might use liquid staking protocols to bypass this, compliance, liquidity, and centralization risks may prevent large-scale staking.

DATs, however, enjoy greater operational flexibility. A typical DAT is leanly staffed, often run by a small team, yet capable of generating meaningful returns. For example, if Bitmine Immersion reaches a $10 billion market cap with all ETH staked, it could generate approximately $300 million in annual free cash flow. These funds could be redeployed into M&A, token purchases, on-chain opportunities, or dividends.

Accumulation Speed

The speed of asset accumulation and growth in per-share crypto holdings is a key reason DATs earn a premium to book value. The rate at which a DAT increases its per-share crypto holdings may exceed the price appreciation of the underlying asset itself, accelerating revenue growth through staking yields.

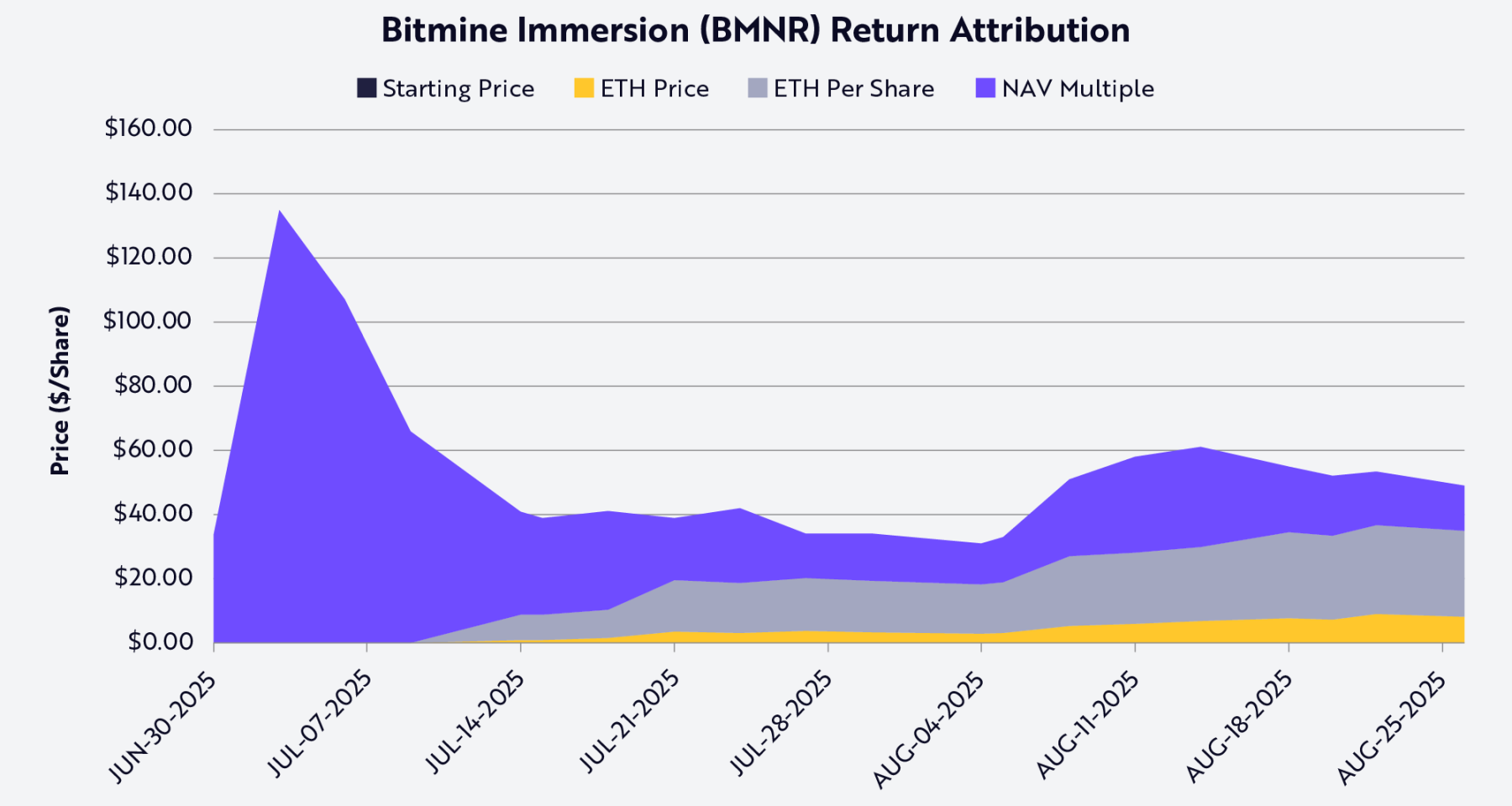

Take Bitmine as an example. On July 13, the company held 163,142 ETH across approximately 56 million fully diluted shares; at an ETH price of $2,914, this equated to 0.0029 ETH per share, worth $8.45. Just 31 days later, we estimate Bitmine’s ETH holdings grew to 1.15 million, with fully diluted shares increasing to 173 million; at an ETH price of $4,700, this translated to 0.0066 ETH per share, worth $32.43.

In one month, ETH’s price rose about 60%, while Bitmine’s per-share ETH holding increased by 130%. In other words, Bitmine’s arbitrage strategy combining “at-the-market (ATM) equity issuance + accretive acquisitions” created far more value than simply holding ETH directly.

Of course, this dynamic only works when an mNAV premium exists and ATM issuance remains accretive. If the premium narrows or turns into a discount, DATs will be forced to rely on alternative capital markets tools, such as selling part of their token holdings to repurchase stock.

Using Shapley value decomposition, Bitmine’s (ticker BMNR) stock performance can be attributed to three variables: ETH price, growth in ETH per share, and changes in mNAV premium or discount (see chart below). As of August 25, growth in ETH per share was the largest driver of BMNR’s stock price and shareholder returns.

Source: ARK Invest, as of August 25, 2025; Note: Based on Shapley average values using only public data

Liquidity and Low-Cost Capital

Liquidity is a core reason for DAT premiums. At-the-market (ATM) equity issuance and convertible bonds are only viable when stocks are liquid: ATM requires sufficient daily trading volume, enabling DATs to issue shares continuously without depressing the stock price; similarly, convertible bonds depend on liquidity—the investor buys a “bond + conversion option,” and the value of that option relies on the stock being liquid enough for efficient sale or hedging. Illiquid instruments either fail to attract investors or force issuers to accept prohibitively high financing costs.

Scale matters too, because bond markets typically serve large corporations. Investment banks and institutional lenders rely on secondary market demand, which depends on company market cap and liquidity. In practice, most syndicated loans and institutional convertible bond offerings are only available to companies with market caps above $1–2 billion. Below that threshold, financing costs rise sharply, and access is usually limited to bespoke or venture-style credit instruments. For instance, Strategy was able to issue multiple rounds of convertible bonds totaling billions of dollars precisely because its stock was liquid and its market cap reached tens of billions at the time.

This also applies to preferred stock issuance. Strategy’s structured equity deals required both a strong balance sheet and secondary market liquidity to attract institutional investors—preferred shareholders must believe they can exit or hedge their positions. Illiquid DATs cannot access this funding channel.

In short, liquidity reduces financing costs. To compensate for illiquidity risk, investors demand higher returns, forcing less liquid DATs to pay via one or more of the following: deeper equity discounts, higher bond coupons, or stricter covenants. Conversely, liquid DATs can raise capital at lower cost to accumulate Bitcoin or Ethereum, creating a self-reinforcing flywheel that strengthens their premium.

Strategic Optionality

Many investors compare digital assets—especially L1 tokens—to stocks, commodities, or currencies, but their differences outweigh their similarities. DATs highlight this distinction and demonstrate why ETFs may be inefficient carriers of L1 assets. The corporate structure of DATs provides “strategic optionality corresponding to book value premiums.” Large DATs can make discounted token acquisitions during distress events (e.g., FTX bankruptcy sales) or acquire other DATs trading below mNAV.

For example, a $10 billion Bitmine Immersion could issue just 2%-3% of its stock to acquire a $200 million ETH-focused DAT at a discount, achieving an accretive acquisition. Beyond M&A, ecosystems like Solana and Ethereum offer additional opportunities: these networks host hundreds of billions in liquidity and applications, enabling sufficiently large DATs to profit through “on-chain security provision” or “liquidity provisioning.” In fact, protocols may offer incentives to attract well-capitalized participants into their ecosystems.

Another arbitrage opportunity lies in the “spread between traditional and on-chain interest rates,” which sometimes exceeds 500 basis points (5%). In low-rate environments, DATs can borrow USD cheaply in traditional markets and deploy capital into on-chain lending pools for significantly higher yields. Currently, stablecoin pools like sUSDS, sUSDe, and SyrupUSDC offer annualized yields of about 7%, roughly 300 basis points (3%) above U.S. Treasury yields, giving DATs an opportunity to generate additional income streams beyond simple token appreciation.

Risks

While DATs offer investors a new way to access crypto assets, they also carry significant risks that require careful consideration.

First is dependence on market premiums. The DAT model—particularly growth in per-share crypto holdings—relies on stock prices trading above mNAV. When premiums narrow, the ability of DATs to issue shares accretively weakens or disappears, forcing them to slow acquisitions or sell tokens to repurchase stock.

Second, liquidity is a double-edged sword. While liquidity enables DATs to secure low-cost capital, it can also trigger liquidity crises during market downturns. In prolonged bear markets, DATs may enter negative feedback loops: plummeting stock prices, rising financing costs, and potential redemption pressures forcing token sales.

Third, regulatory uncertainty is growing. Unlike ETFs, DATs operate in a regulatory gray area and may face scrutiny over accounting treatment and disclosure requirements—standards more suited to investment funds than operating companies. Regulatory intervention could impact their access to capital markets or limit strategic flexibility.

Fourth, governance and operational risks may be underestimated. Many DATs entrust small teams with multi-billion-dollar asset treasuries. Weak internal controls, poor risk management, or misaligned incentives could rapidly erode value. In worst-case scenarios, some DATs could become “disguised aggressive on-chain hedge funds”—chasing yield, leveraging up, and lacking transparency in capital allocation, hiding risks or even leading to insolvency.

Conclusion

The rise of DATs has introduced a new way for investors to access crypto assets. From Strategy’s seemingly eccentric bet to a broad phenomenon, DATs have rapidly proliferated across major L1 blockchain protocols like Ethereum and Solana. While critics dismiss their model as “selling $1 of assets for $2,” the reality is more nuanced.

DATs’ corporate structures offer unique potential advantages that ETFs cannot match—this is why they command premiums to book value: they can grow the value of per-share ETH or SOL faster than the underlying asset’s price appreciation; they benefit from liquidity and scale to access cheap capital across their capital structure; and they possess opportunities for M&A, token purchases, and on-chain investments.

Unlike passive crypto-holding ETFs, DATs are dynamic capital markets vehicles with the potential to amplify asset exposure, capture protocol yields, and optimize capital allocation. For certain assets, DATs may not only be more sustainable than ETFs but also more efficient. They are far from fleeting arbitrage tools—they may become enduring institutions bridging traditional financial markets and the new world of crypto assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News