Legacy DeFi protocol Thorchain surges over 400%—what updates has it made?

TechFlow Selected TechFlow Selected

Legacy DeFi protocol Thorchain surges over 400%—what updates has it made?

Thorchain's primary business is a decentralized cross-chain AMM that allows users to exchange and trade different blockchain assets directly without trusting third-party institutions.

Author: dt X Gryphsis Academy, DODOResearch

Compared to the booming BTC ecosystem and the sudden surge in AI-related projects, Ethereum DeFi projects have appeared relatively sluggish during this market upswing. However, one protocol has been quietly gaining momentum—rising over fourfold in the last quarter of 2023 and more than sixfold from its annual low—while consistently delivering product updates throughout the bear market. This standout performer in today’s DeFi landscape is none other than Thorchain, the cross-chain DEX protocol.

This week, Dr.DODO teams up with Gryphsis Academy to explore what this veteran DeFi protocol Thorchain is all about, examine its recent upgrades, and introduce other promising projects in the cross-chain DEX space beyond Thorchain.

What is Thorchain?

Thorchain is among the oldest DeFi projects on-chain, with its team established as early as 2018 and its product launched in 2019. Despite enduring multiple hacker attacks, backed by a resilient team and a loyal community, Thorchain continues to deliver consistently and has emerged as a blue-chip project ranked within the top 50 by market capitalization.

Thorchain's core offering is a decentralized cross-chain AMM that enables users to swap assets across different blockchains without relying on trusted third parties. Unlike centralized exchanges, Thorchain operates on a custom-designed trustless protocol. Users simply deposit funds into liquidity pools to enable seamless, frictionless loss-free cross-chain asset swaps. Unlike cross-chain bridges that rely on wrapped tokens, Thorchain facilitates native asset transfers across chains. Built using the Cosmos SDK, Thorchain runs its own blockchain and employs an AMM model to create liquidity pools between native tokens (such as BTC, ETH) and its native token $RUNE. When users perform a cross-chain swap, they are effectively swapping their source chain’s native asset for RUNE, which is then swapped for the target chain’s native asset.

Technically, Thorchain leverages an advanced cross-chain messaging system combined with a customized Byzantine Fault Tolerant (BFT) consensus algorithm. After each security incident, the team has continuously improved the system to enhance the safety of cross-chain message transmission. Thorchain is widely regarded as one of the most promising cross-chain infrastructure solutions, addressing key pain points in cross-chain liquidity and trading efficiency, and currently serves as the deepest liquidity route for BTC-ETH cross-chain swaps.

What Updates Has Thorchain Made?

This year, Thorchain introduced two major upgrades. The first was Streaming Swaps, a mechanism enabling users to execute large-volume cross-chain swaps instantly, overcoming previous limitations caused by insufficient liquidity that deterred user adoption. Here's how Streaming Swap works:

-

A user initiates a large cross-chain swap—for example, exchanging 10 BTC for 3000 ETH.

-

The protocol splits this transaction into multiple smaller streaming swaps, each handling 0.1 BTC.

-

After executing each 0.1 BTC swap (receiving approximately 30 ETH), the ETH is immediately sent to the user.

-

This process repeats until the full 10 BTC → 3000 ETH conversion is completed.

This streaming mechanism enables instant settlement for large trades, significantly reduces slippage, improves capital efficiency, and enhances the protocol’s resilience against saturation attacks.

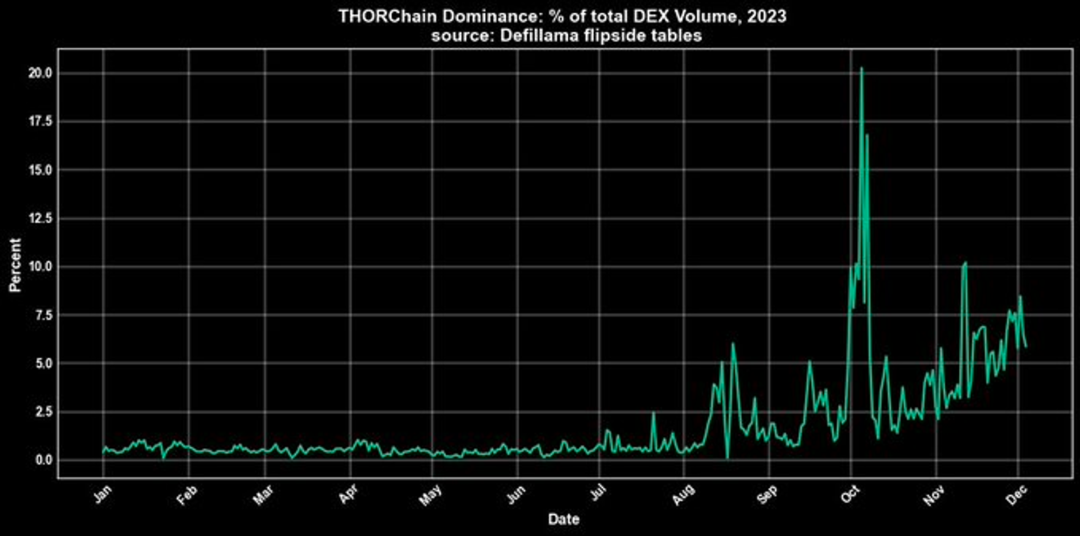

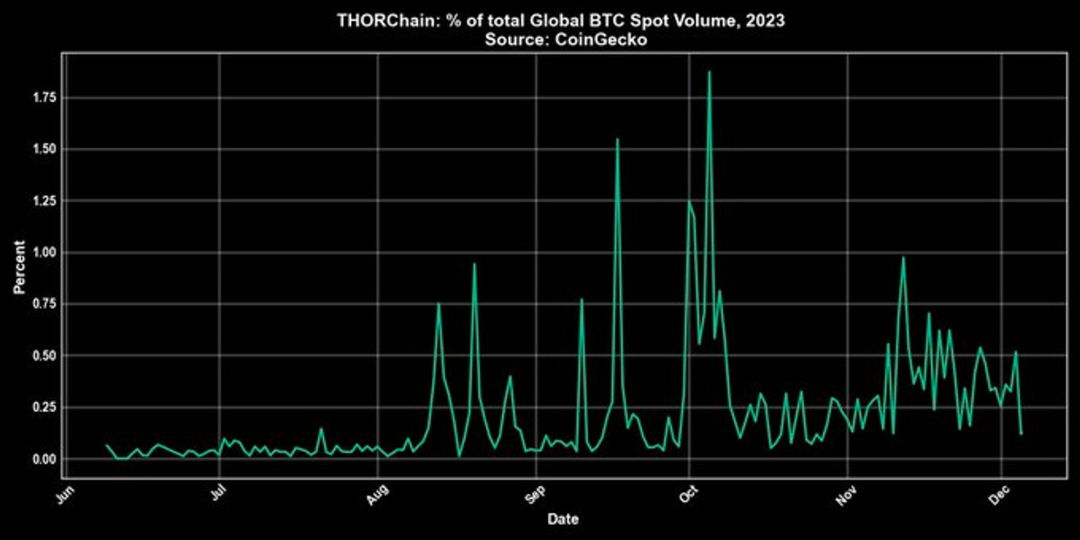

From a data perspective, since the launch of Streaming Swaps in Q3, transaction volumes have surged dramatically, with BTC pairs remaining the dominant trading pair. This demonstrates Thorchain’s success in delivering efficient and convenient cross-chain trading solutions and its growing appeal to users.

Thorchain’s DEX market share trendline Source: Defillama

Thorchain’s share of total BTC trading volume Source: Coingecko

The second major update is the long-discussed Thorchain Lending, which has finally gone live after nearly two years of community discussion. Thorchain Lending offers a unique borrowing product featuring zero interest rates, no forced liquidations, and no maturity dates, fulfilling user needs for leverage and credit. But how is such a model possible?

Key reasons include:

-

Interest is covered by yield generated from staked collateral, not paid by borrowers, enabling truly interest-free loans.

-

High over-collateralization ratios (150%-250%) reduce liquidation risk; all liquidation decisions are governed by smart contracts and protocol rules without human intervention.

-

Borrowers can maintain long-term access to funds simply by topping up collateral, eliminating pressure from fixed repayment deadlines—the loan duration depends only on collateral sustainability.

-

Users stake ETH to borrow stablecoins, while ETH earns yield through liquidity mining, potentially offsetting borrowing costs and generating net positive returns.

-

Liquidations occur via premium transfer of excess collateral, meaning borrowers do not bear additional financial risk and can manage exposure effectively.

Alongside Lending, the introduction of Thorchain Saver Vault has further boosted the protocol’s Total Value Locked (TVL). The Saver Vault allows DeFi users to deposit native assets without exposure to $RUNE price volatility, attracting new deposits and providing a solid base for long-term staking. These innovations offer greater flexibility and convenience to users while fostering sustainable growth of the Thorchain ecosystem.

Competitor in the Space - Maya

Maya Protocol is a decentralized cross-chain protocol built atop Thorchain’s foundation. Launched in March this year, it is considered a friendly fork of Thorchain and enjoys support from the Thorchain community. While sharing similarities with Thorchain’s cross-chain AMM mechanics, Maya differs in several key aspects:

-

As a friendly fork of Thorchain, Maya aims not to replace but to complement and strengthen Thorchain by serving as redundant infrastructure—akin to dual engines enhancing reliability in aviation.

-

Maya introduces unique designs focused on capital efficiency, security, and value accrual, including liquidity nodes, a dual-token model, and impermanent loss protection.

-

Maya plans to expand support to additional public chains such as Arbitrum, Cardano, and privacy-focused smart contract platforms like Aztec, helping broaden the overall cross-chain ecosystem.

-

The two protocols have also integrated certain functionalities, such as one-click aggregated cross-platform trading and streaming swaps, enabling seamless user operations across both platforms.

Overall, Maya and Thorchain together form a complementary cross-chain alliance, overcoming the limitations of single-solution architectures and jointly advancing the development of decentralized finance.

Competitor in the Space - ChainFlip

Unlike Maya Protocol, which originated as a community-driven fork, Chainflip is a heavyweight project backed by significant funding. It raised $16 million across two rounds in 2021 and 2022 led by Framework Ventures, with participation from Blockchain Capital and Pantera Capital. After much anticipation, Chainflip launched its mainnet this year—though its core product remains unavailable to the public.

Chainflip positions itself as a hybrid decentralized exchange protocol designed to enable seamless value transfers between any blockchain—including BTC, EVM chains, and base-layer networks—aiming to combine the best features of centralized and decentralized exchanges for efficient trading and risk management.

Its biggest innovation is the Just-in-Time (Jit) AMM mechanism, which minimizes slippage and provides precise pricing to address cross-chain challenges. This design specifically tackles a key weakness in Thorchain: the substantial impermanent loss faced by liquidity providers. Jit AMM allows market makers to provide unilateral liquidity. Additionally, Chainflip improves upon Thorchain’s user experience, which requires installing specific wallets. In contrast, Chainflip allows users to conduct cross-chain value transfers using standard wallets.

In summary, Chainflip claims superior product design and user experience compared to Thorchain. However, despite mainnet launch, its flagship cross-chain DEX product is not yet open for use. Whether it can attract meaningful TVL will be critical to its long-term survival—especially given Thorchain’s deep roots and strong position in the space after years of development. Capturing market share from an established leader like Thorchain will require considerable effort.

Author Perspectives

Scott @GryphsisAcademy

I’ll analyze this from a trading perspective. We initially added $RUNE to our watchlist due to the explosion of Bitcoin inscriptions in May, when we conducted a comprehensive review of the Bitcoin ecosystem. ThorChain stood out as a native cross-chain DEX on Bitcoin and warranted inclusion. Furthermore, ThorChain is built on the Cosmos SDK. Over the past month, the surge in Cosmos-based tokens such as TIA, INJ, and KUJI has drawn investor attention back to the Cosmos ecosystem. Thus, ThorChain benefits from dual exposure—riding both the Bitcoin and Cosmos ecosystem waves (double beta).

Moreover, ThorChain’s strong economic model with robust value capture, first-mover advantage, and proactive innovation during the late bear market—such as launching Streaming Swaps and the so-called “Ponzi” lending in July and August—sparked widespread discussion and positioned the protocol well ahead of the bull market for TVL and volume growth. As a result, ThorChain has demonstrated strong alpha generation within both the Bitcoin and Cosmos ecosystems.

Emerging competitors like Maya Protocol and ChainFlip now serve as valuation benchmarks for ThorChain. At the time, many analysts on Twitter conducted comparable multiplier analyses, leading to bullish outlooks on $CACAO and $FLIP. In Web3’s token economy, new entrants often disrupt established players by offering higher token incentives—a fascinating dynamic. However, increased competition inevitably fragments investor attention. Therefore, we’ve recently adjusted our positions accordingly based on macro and capital flow indicators.

@19971122 DT

In my view, given the current trend favoring the rapidly expanding Bitcoin ecosystem, demand for cross-chain interoperability between BTC and EVM chains—or even hot ecosystems like Solana—is only going to grow stronger. Cross-chain DEXs are clearly an upward-trending sector. However, Rune’s recent surge appears more closely tied to the launch of Thorchain Lending, which expanded Rune’s utility and triggered a deflationary flywheel effect, rather than being purely driven by growth in cross-chain DEX activity. That said, in the current bullish sentiment, short-term thematic rotation among related assets is entirely normal. Looking ahead, I remain focused on Thorchain itself. Personally, I believe Thorchain’s success stems less from technical superiority and more from the exceptionally strong bond between its team and community. A wealth of educational content—much of it created organically by community members—demonstrates this synergy. Moreover, the team’s perseverance through repeated hacks underscores their determination. For these reasons, Thorchain remains the undisputed leader in this space and is likely to retain that position in the near term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News