Thorchain's next phase: DEX order book, LPs with single-sided IL protection, and more chains

TechFlow Selected TechFlow Selected

Thorchain's next phase: DEX order book, LPs with single-sided IL protection, and more chains

Thorchain: Moving toward progressive decentralization and contributing to a multi-chain future that doesn't rely on third-party bridges.

Written by: Ignas

Translated by: TechFlow intern

Thorchain is pioneering a multi-chain future. As early as the 2018 Binance Hackathon, it began enabling decentralized trading of native BTC, ETH, and other assets. With its mainnet launch last month, $RUNE is now ready for its next phase.

THORChain’s (TC) value proposition is simple: earn yield and swap crypto assets in their native form—eliminating the need for wrapped assets like $WBTC or renDOGE.

In theory, this reduces centralization and complexity risks.

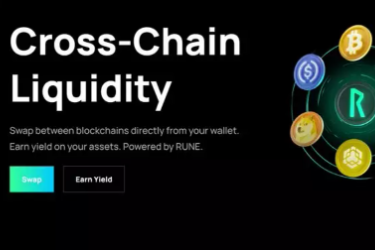

TC functions like a cross-chain Uniswap, where users provide liquidity with $RUNE and native crypto assets to earn rewards. These assets are secured by THORNodes, which use $RUNE as skin-in-the-game to validate transactions. This deters theft, as malicious actors would lose more than they gain.

Currently, all liquidity providers (LPs) must deposit both native assets and $RUNE in a 50/50 ratio to earn yield. This creates two major headaches for LPs:

You’re exposed to downside risk from $RUNE price drops;

Impermanent loss (IL) may exceed earned yield.

TC offers IL protection similar to Bancor V2.1, requiring 100 days of locked liquidity for full coverage. Bancor later removed this restriction and allowed single-asset LPing. However, when the market crashed and Bancor suspended IL protection, this proved fatal.

However, TC’s next phase focuses on adoption, growth, and expansion—including enabling single-sided LP positions with no $RUNE exposure and protected against IL. The goal is to attract TVL by allowing LPs to participate without holding $RUNE, while maintaining the 100-day lock-up requirement for IL protection.

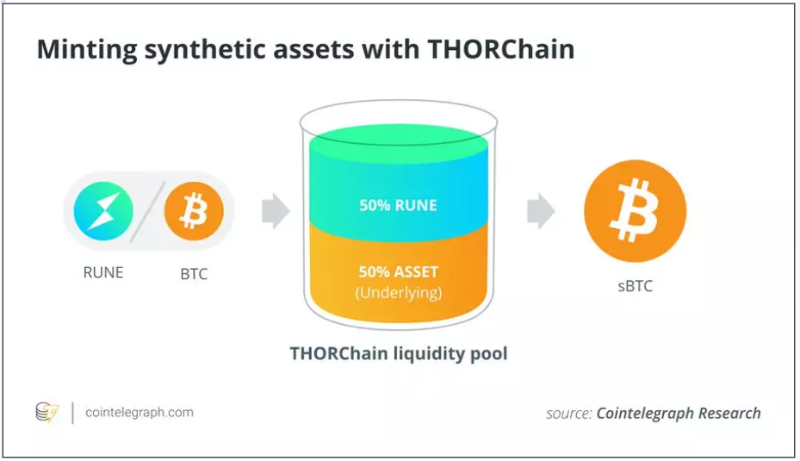

TC allows LPs to mint synthetic assets backed by 50% underlying asset and 50% $RUNE, rather than 100% real assets. This gets technically complex, but the key benefit is capital efficiency—synthetic assets enable faster and more effective arbitrage.

Currently, these synthetic assets help deepen pool liquidity but do not generate yield. The current plan is to “lock” them into vaults to start earning returns. Synthetic assets eliminate IL, though yields are capped at a maximum of 50% compared to traditional dual-sided pools.

Other key elements of the next-phase roadmap include:

Allowing small $RUNE holders to contribute bonded $RUNE to the network;

Multi-signature wallets;

DEX aggregation across more assets;

Adding more chains such as Avalanche, among others.

But to me, the two most exciting upcoming features are:

Order Book

Introducing an order book will attract new user types: market makers and limit-order traders. The design allows pending orders at specific prices to contribute to pool depth and generate revenue for LPs and nodes.

The protocol’s own stablecoin, $TOR

Originally planned following Terra’s $UST. However, TC does not follow $UST’s model, but instead follows Aave’s approach—using already deposited capital as collateral to issue the stablecoin.

I’m particularly interested in $RUNE’s value proposition as it evolves toward progressive decentralization, contributing to a multi-chain future that doesn’t rely on third-party bridges.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News