Could Chainflip, in friendly cooperation with Thorchain, be a qualified challenger to CEXs?

TechFlow Selected TechFlow Selected

Could Chainflip, in friendly cooperation with Thorchain, be a qualified challenger to CEXs?

After the token launch and mainnet going live, the DEX product and continued expansion to support additional chains are Chainflip's next steps.

Written by TechFlow

Introduction

Chainflip, a decentralized, trustless protocol enabling seamless value transfer between any blockchains—including BTC, EVMs, and native chains. According to TechFlow, on November 23, Chainflip officially launched its token $FLIP.

Chainflip’s Just-In-Time (JIT) AMM design addresses cross-chain challenges by minimizing slippage and offering precise pricing. With it, users can swap assets across chains without wrapped tokens, traditional cross-chain bridges, or centralized exchanges.

Does the above description of Chainflip remind you of another omnichain trading platform—THORChain?

Indeed, Chainflip is a direct competitor to THORChain, both focusing on heterogeneous aggregated chains, yet they differ significantly in design:

1) THORChain is built on Cosmos SDK, while Chainflip uses Substrate;

2) THORChain requires a dedicated multi-chain wallet; Chainflip does not. Users don’t need to back up key files, download new browser wallets, or install special software—just a network connection, a browser, and a destination address. Simply send tokens and provide a compatible address to perform trustless cross-chain swaps;

3) Every liquidity pool on THORChain requires RUNE as base asset; Chainflip does not.

Yet, THORChain doesn't seem to view Chainflip as a rival but rather as a "brother" in the same trench. On November 24, THORChain tweeted: "THORChain + Maya + Chainflip will together challenge today's centralized gateways."

This friendly attitude is rare in the Crypto/Web3 community. As one community member put it: "It's like a street with only one restaurant. If a new one opens across the street, more people come to both."

Tokenomics

Tokenomics plays a crucial role in DeFi projects. This year, THORChain’s token RUNE has performed exceptionally well. Despite THORChain’s friendly stance toward Chainflip, investors naturally compare the two tokens’ performance.

RUNE’s value capture mechanism is taken to the extreme—nearly every operation requires RUNE: adding liquidity requires RUNE, running nodes requires staking RUNE, synthetic assets require RUNE. The higher the RUNE trading volume, the greater the fee capture and demand for RUNE—this is why many consider RUNE a “mini Luna.”

What about Chainflip?

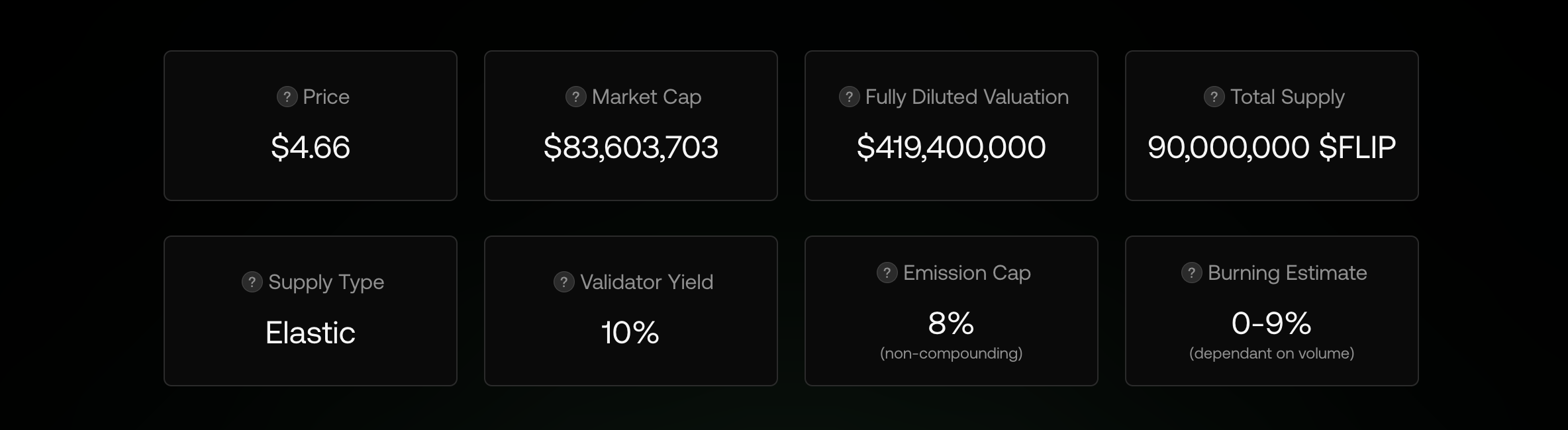

FLIP is Chainflip’s native ERC-20 token, with an initial supply of 90 million and an annual inflation rate of 8%, operating under an inflationary (token issuance) and deflationary (token burning) model. This means the protocol has no fixed or final token supply, and may adjust its token model in the future.

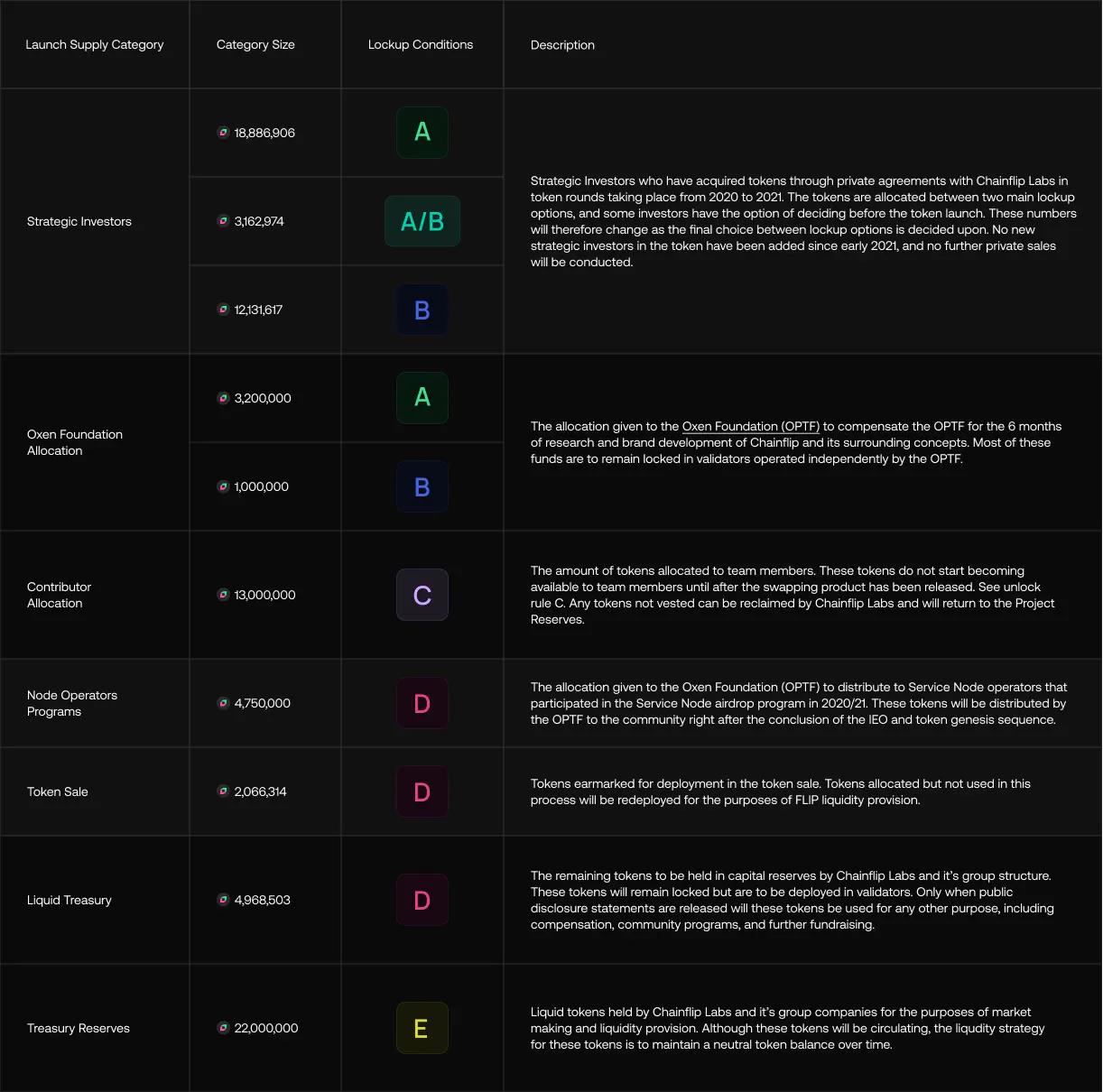

The known initial distribution plan is as follows:

(1) 4.75 million FLIP to be airdropped to service node operators who participated in the Service Node Airdrop Program in 2020 and 2021;

(2) 6.9 million FLIP allocated for token sales;

(3) 13 million FLIP allocated to contributors;

(4) Approximately 34 million FLIP allocated to strategic investors;

(5) 4.2 million FLIP allocated to the Oxen Foundation;

(6) 4,968,503 FLIP reserved as liquidity;

(7) 22 million FLIP held as reserve funds.

Chainflip connects chains by deploying wallets on each chain. Unlike CEXs that rely on centralized databases, Chainflip uses a State Chain to fulfill this role—all protocol events are recorded, executed, or triggered by the State Chain.

To secure each wallet, each supported blockchain has a vault operated by validators. Thus, the validator network forms Chainflip’s core infrastructure, with 150 validators at launch.

Clearly, validator honesty is critical in this system. Validators must lock up substantial amounts of $FLIP as collateral, and the keys they hold cannot be used to transfer protocol funds. Malicious behavior or failure to perform duties risks their staked tokens.

Effectively incentivizing and penalizing validators remains a key challenge. Chainflip has indicated major updates to its slashing rules are coming to ensure long-term system stability.

The number of tokens rewarded to validators does not depend on stake size. Actual validator earnings are determined by competitive auctions. To gain transaction validation rights and earn rewards, validators must continuously bid using their $FLIP tokens.

For every transaction through the Chainflip system, a small fee is charged to users (in USDC), used to buy $FLIP tokens from the built-in USD/FLIP pool. The purchased $FLIP is automatically burned, removing it from circulation.

Gas fees generated by the State Chain are also automatically burned. These fees arise from interactions with the State Chain, including liquidity provider updates, deposit channel requests, validator external fees, etc.

Future Goals

After the token launch and mainnet deployment, Chainflip’s next steps include launching its DEX product and expanding support to additional chains. As per Chainflip’s vision: our mission is to replace centralized exchanges. Chainflip is steadily becoming a credible challenger to CEXs.

The future is multi-chain, with diverse ecosystems flourishing across various chains. To participate in different ecosystem projects, users now more than ever need a decentralized exchange that delivers what centralized exchanges cannot.

Whether Chainflip can influence the ultimate fate of CEXs remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News