Understanding DAO Investment Tools: Web3 Investment Clubs on the Syndicate Protocol

TechFlow Selected TechFlow Selected

Understanding DAO Investment Tools: Web3 Investment Clubs on the Syndicate Protocol

An investment club is a group of individuals who pool their funds for collective investing, share ideas, and aim to achieve mutual learning, increased purchasing power, risk sharing, and reduced transaction costs.

Author: Syndicate

Translation: TechFlow

We are excited to introduce Web3 Investment Clubs, built on the Syndicate protocol—the first mainstream crypto-native social investing tool based on the Syndicate protocol.

Today, it launches its public beta. In seconds, it turns any Ethereum wallet into a powerful investment DAO, with only gas fees required. Click here to join.

Web3 Investment Clubs make investing easier than ever. Friends, angel investors, and Web3 communities can now create and run a DAO-based investment club as easily as starting a group chat in a messaging app. Web3 Investment Clubs on the Syndicate protocol support investments in tokens, NFTs, and off-chain startups and assets, allow legal entity integration, bank account setup, and K-1 issuance. Built on ERC-20 infrastructure, they are plug-and-play compatible with any DAO and Web3 tools (like Gnosis, Snapshot, etc.).

For a long time, powerful collaborative investment tools came with high cost barriers, accessible only to those who could afford expensive SaaS platforms or service providers. Now that barrier is gone—almost anyone can launch and operate a DAO-style investment club via the Syndicate protocol. Compared to existing TradFi and Web2-based investment platforms, it reduces time and costs by 100x.

Our mission is to fundamentally transform investing through convenient, easy, and social Web3 technology—and Web3 Investment Clubs are just the first step. Organizations such as South Park Commons-Script, Global Coin Research (GCR), Chapter One, DAO Jones, Awesome People DAO (Julia Lipton), Vector DAO, The Council DAO, Eve, Morii Music DAO, Chad Capital, We3 DAO, SLCF (SuperLayer-Chainforest), Women in VC DAO, Forefront, and others have already launched or are launching investment clubs powered by the Syndicate protocol.

And this is just the beginning.

Traditional Investment Clubs

Investment clubs have existed for thousands of years, but the first formally documented one was established in Texas during the Wild West era of 1898.

This is roughly what the first investment club looked like

An investment club is a group of individuals who pool capital to invest together, share ideas, learn collectively, increase buying power, diversify risk, and reduce transaction costs. Investment clubs invest in stocks, bonds, real estate, art, collectibles, and today also in startups, tokens, and NFTs.

Since investment clubs are member-driven, almost any social group can form one. Provided certain rules are followed (such as limiting membership to 99 people, invitation-only access, no fees charged, requiring all members to participate in investment decisions, and other requirements outlined in our Gitbook), investment clubs are typically exempt from SEC regulation in the United States.

Historically, investment club members enjoyed meeting in person to discuss and co-invest. But from 1898 to today is a long time—much has changed. People now organize and collaborate online. Running an investment club today should be far more internet-native, yet unfortunately, significant challenges remain:

Slow, difficult, and costly to set up and manage;

Hard to maintain compliance with legal and regulatory requirements;

Lack of modern, internet-native tools for jointly investing in digital-native assets;

But with the emergence of the Syndicate protocol, teams can now easily create and operate investment clubs natively on the internet, leveraging the full functionality and interoperability of Web3.

Web3 Investment Clubs

Web3 Investment Clubs on the Syndicate protocol provide friends, angel investors, and Web3 communities with a tool to launch and operate internet-native, DAO-based investment clubs.

Web3 Investment Clubs on the Syndicate Protocol

Here are key benefits of running an investment club on the Syndicate protocol:

1) Web3-native: Operates natively on the internet via the Syndicate protocol on Ethereum (coming soon to other blockchains).

2) Turn any wallet into a DAO: Use your preferred Ethereum wallet (e.g., MetaMask, Ledger, Gnosis) to create and run an investment club.

3) 100x faster, simpler, cheaper: Create an on-chain investment club in seconds, paying only gas fees.

4) Invest in crypto and real-world assets: Invest in tokens and NFTs directly, and in startups and real-world assets via legal entities.

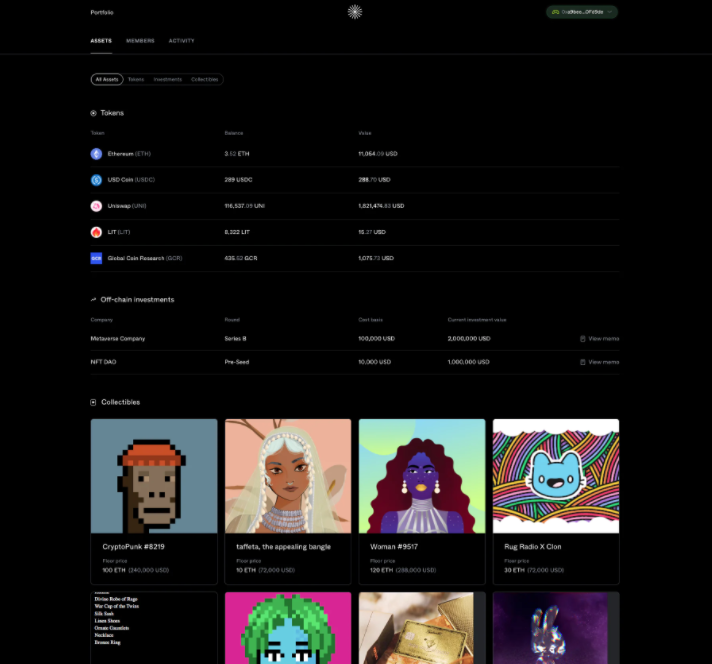

5) On-chain portfolio and cap table management: Real-time dashboard for managing investments (tokens, collectibles, startups) and club members.

6) Composability: Built on ERC-20 infrastructure, fully compatible with future Syndicate tools and the broader ecosystem of DAOs and Web3 tools.

7) Legal infrastructure: Access DAO legal entities, legal documents, EINs, bank accounts, and K-1 tax forms through our partner doola.

More features coming soon…

Let’s now take a closer look at some of the most exciting features of Web3 Investment Clubs on the Syndicate protocol.

1. Powerful Investment DAOs at the Click of a Button

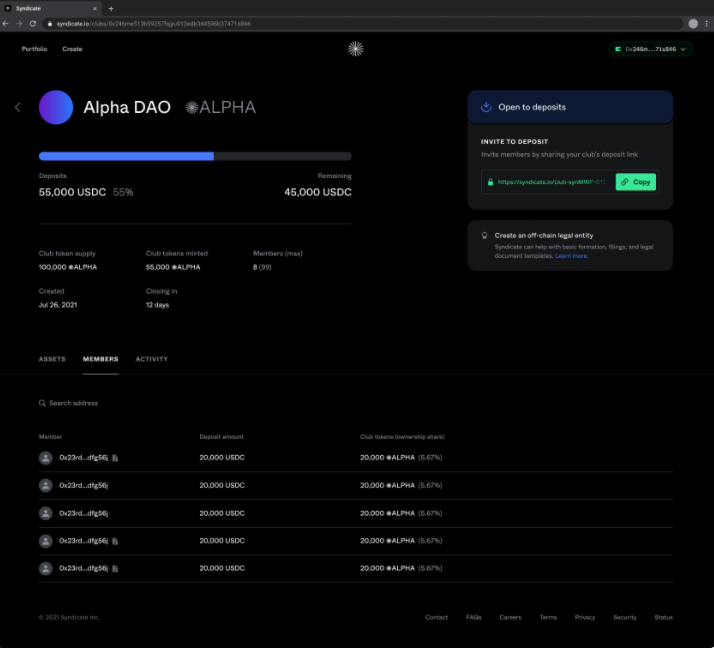

With just a few seconds and a few clicks, you can turn any wallet (MetaMask, Ledger, Gnosis) into a powerful investment DAO, paying only gas fees. The Syndicate protocol gives wallets new Web3 investment superpowers—including on-chain contribution tracking, cap tables ("mirrortables"), governance tokens ("mirrorshares"), and portfolio dashboards.

DAO Dashboard for Investment Clubs on Syndicate Protocol

We’re also excited to announce our partnership with doola. This enables investment DAOs on Syndicate to obtain legal entities, open fiat bank accounts, file state compliance paperwork, and issue K-1s quickly and affordably. This is game-changing—but only the starting point for deeper integrations and capabilities we’ll bring to Syndicate DAOs together.

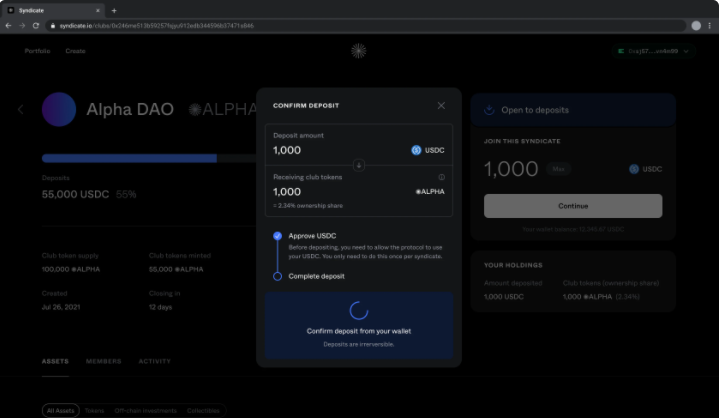

2. DAO Contribution Links, Mirrortables, and Mirrorshares

No more manually tracking contributions and cap tables via surveys and spreadsheets. The Syndicate protocol automatically generates a contribution link and sends it to members. When someone contributes capital, the Web3 investment club automatically updates their on-chain cap table ("mirrortable") and issues them a corresponding amount of ERC-20 "mirrorshares" (non-transferable by default), as envisioned in Balaji's recent article.

ERC-20-based mirrortables and mirrorshares in Syndicate-powered investment clubs

Mirrortables and mirrorshares in Web3 investment clubs are built on ERC-20 infrastructure, making them fully compatible with any DAO or Web3 tools (like Snapshot, Gnosis, Coordinape, Guild) for on-chain governance, automated distributions and airdrops, contributor recognition, token-gated access, and more.

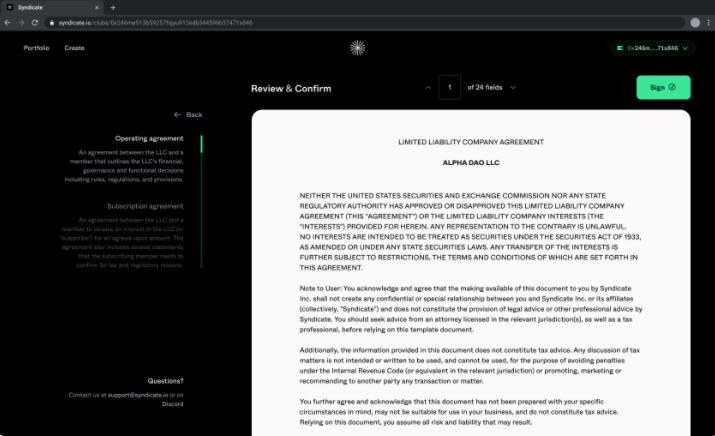

3. DAO Legal Document Generation and Web3 Signatures

Even harder than manually tracking contributions and cap tables is manually managing legal documents—creating, customizing, sending, and collecting signed copies from members joining the DAO.

Syndicate makes this simple. You can generate, send, and collect signed copies through Syndicate’s web application—all in a Web3-native way. No centralized servers are used, so nothing (files, PII, data) is stored on any centralized server anywhere, ensuring maximum privacy, security, and user control. With legal guidance from global law firm Latham & Watkins, we’ve created standardized legal documents for Web3 Investment Clubs on the Syndicate protocol.

We're building Web3-native tools that handle the heavy lifting, reducing your workload.

Legal document generation and Web3 signature tools on Syndicate

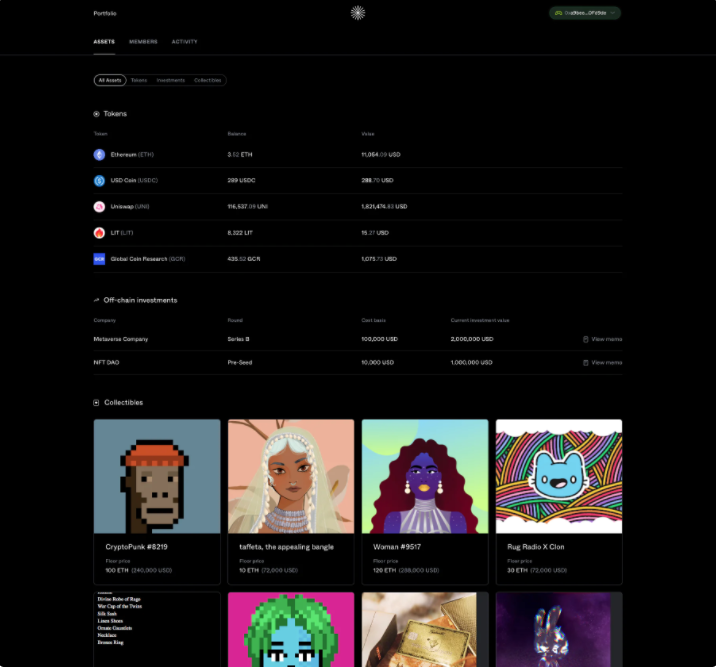

4. Real-Time On-Chain Investment Dashboard

Web3 Investment Clubs on Syndicate feature a real-time dashboard where users can visually track token and NFT investments on Ethereum (with support for additional blockchains coming soon).

This investment dashboard is accessible to all club members at any time.

Syndicate’s DAO dashboard showing real-time token and NFT investments

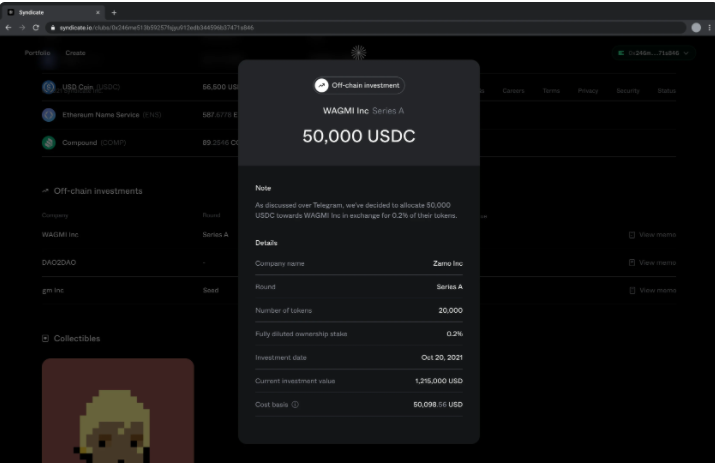

5. Off-Chain Investment Memos and Metadata

With Syndicate, you can also record investments in off-chain assets (e.g., startup equity, SAFE, convertible notes) and attach off-chain memos, metadata, and links, which appear directly on the investment club’s dashboard. This makes Syndicate a powerful tool not only for on-chain token and NFT investing but also for off-chain angel investing and venture capital in pre-IPO companies and startups.

This feature was co-designed with partners including IDEO CoLab Ventures, Electric Capital, Delphi Digital, Variant, CoinFund, and other Web3 investors. We're building many Web3-native tools to connect DAOs with the off-chain world—and this is just one of them.

Off-chain investment memos can be added and displayed on the Syndicate DAO dashboard

The Transformation Has Begun

In the coming weeks and months, we will roll out a suite of powerful new features and integrations across community management, governance and voting, reporting and taxes, social networking, incentives, and economic collaboration for our Web3 Investment Clubs. This is our first product and initial feature set—we’re just getting started, with many more capabilities in development.

The future of investing will be decentralized, democratized, and community-driven. This transformation begins with Web3—and today, with investment clubs on the Syndicate protocol.

Join us. Join the revolution. We’ve got this (WAGMI).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News