When every click becomes an investment: How Web3 is reshaping our attention economy?

TechFlow Selected TechFlow Selected

When every click becomes an investment: How Web3 is reshaping our attention economy?

We are in an excellent position for the emergence of a new social network.

By: Joel John

Translated by: AididiaoJP, Foresight News

In February 2022, Dubai had perfect weather, but my body couldn't enjoy it. My brain was on the verge of "crashing"—with blood sugar so high I risked slipping into a diabetic coma at any moment. Normal blood glucose levels hover around 100mg/dl; mine averaged close to 400. Had someone not recommended a glucose monitor in time, my life might have taken a completely different turn.

During my twenties—busy with migration, career-building, making friends, and settling down—I never imagined I'd face prediabetes. Fortunately, I received excellent medical care, and today my blood sugar is stable.

Along the way, finding fellow patients on Reddit helped immensely. I read stories of partners worrying about their loved ones, parents anxious about their children’s futures, and followed accounts of people gradually restoring normal glucose levels.

Reddit feels humane—curated, and highly shareable.

Developing diabetes at 27, I didn’t have to endure judgmental stares. No overbearing parental concern, no stern lectures from doctors—just real stories shared among ordinary people. Mostly anonymous strangers I’ve never met handed me box after box of "hope." Only years later did I realize how precious this truly was.

The market noticed too. Since Reddit went public in March 2024, the Dow Jones Internet Index rose 42%, while Reddit's stock surged nearly 500%. One reason: “Reddit” ranks as the sixth most searched term on Google, with users routinely adding “+reddit” when searching. Whether judging right from wrong or seeking fashion advice, millennials and Gen Z flock here—even discussing early retirement.

How did a social network composed largely of anonymous users, lacking creator monetization, loosely moderated subcommunities, and often extreme viewpoints become the internet’s last bastion of hope? The answer lies in its “curation” capability. This year, Reddit sued Perplexity for using its data, earning nearly $35 million just from data licensing—an insight for the entire internet.

The evolution of the internet has relied on algorithmic optimization, giving rise to social networks and consumer internet. Without platforms delivering relevant, interesting, useful content, we might still be reading offline. But now, algorithms seem to have gone too far.

Curation offers an alternative. To understand its value, we must examine current online business models and their underlying logic.

The Evolution of Search

Why did “Google” become a verb, while AOL, Yahoo, or AskJeeves did not? Simply put, Google’s PageRank algorithm was superior. It ranked pages based on actual traffic and link quality—practical and precise, much like today’s ChatGPT and Claude.

This was a new form of information interaction—but it needed revenue. At the time, the internet urgently sought models more effective than traditional advertising.

In 2007, Google acquired ad-tech company DoubleClick for $3.1 billion (after buying YouTube in 2006 for $1.65 billion). One capturing cultural phenomena, the other building a complex trading platform—Google was playing a long game.

Google’s “big picture”: Understanding Google means understanding its ad empire. DoubleClick is like the “NASDAQ of human attention.” By 2017, it had become the world’s largest ad exchange.

When a user visits a site (e.g., The Wall Street Journal), three things must happen instantly:

-

Show the most suitable ad;

-

Secure the highest bid for the ad slot;

-

Balance supply and demand between advertisers and user attention.

About 90% of ad auctions actually occur within Google’s ecosystem. Why does it dominate? Because it possesses unique “context”—akin to an exchange seeing every order’s stop-loss and profit points. By both collecting user data and acting as an ad marketplace, this dual role is central to Google’s monopoly.

Where does Google get this context? From user data. It knows which videos you watched, where you’ve been, what you searched for, your email content, even your phone battery level. It knows about meetings you missed, romantic interests, and the flower shop you Googled last week. Imagine a stockbroker recommending stocks based on your shopping and travel history—that’s how Google operates, trading your time and attention.

In fact, the average person is auctioned 747 times per day. Google transfers location and browsing data of European and American users up to 178 trillion times annually. According to Google itself, nearly 4,700 companies access your personal data through it.

Now imagine that same stockbroker also sells you insurance, loans, and credit cards. When displaying ads, Google typically prioritizes its own products. Google’s “triple context advantage” includes:

-

As the internet gateway (search);

-

As an ad exchange (AdX);

-

As a conglomerate with multiple data-collecting products (Nest, Android, YouTube).

Yet Google’s ad share is declining: from 60% of digital ad spending in 2018 to under 50% by 2025. Meanwhile, TikTok—the most attention-grabbing site—accounts for only about 4% of digital ad spending.

This means: platforms capturing attention aren’t profiting, while those controlling monetization are losing users. What’s happening?

Three main reasons:

-

Targeting is harder: Apple’s privacy updates require opt-in tracking;

-

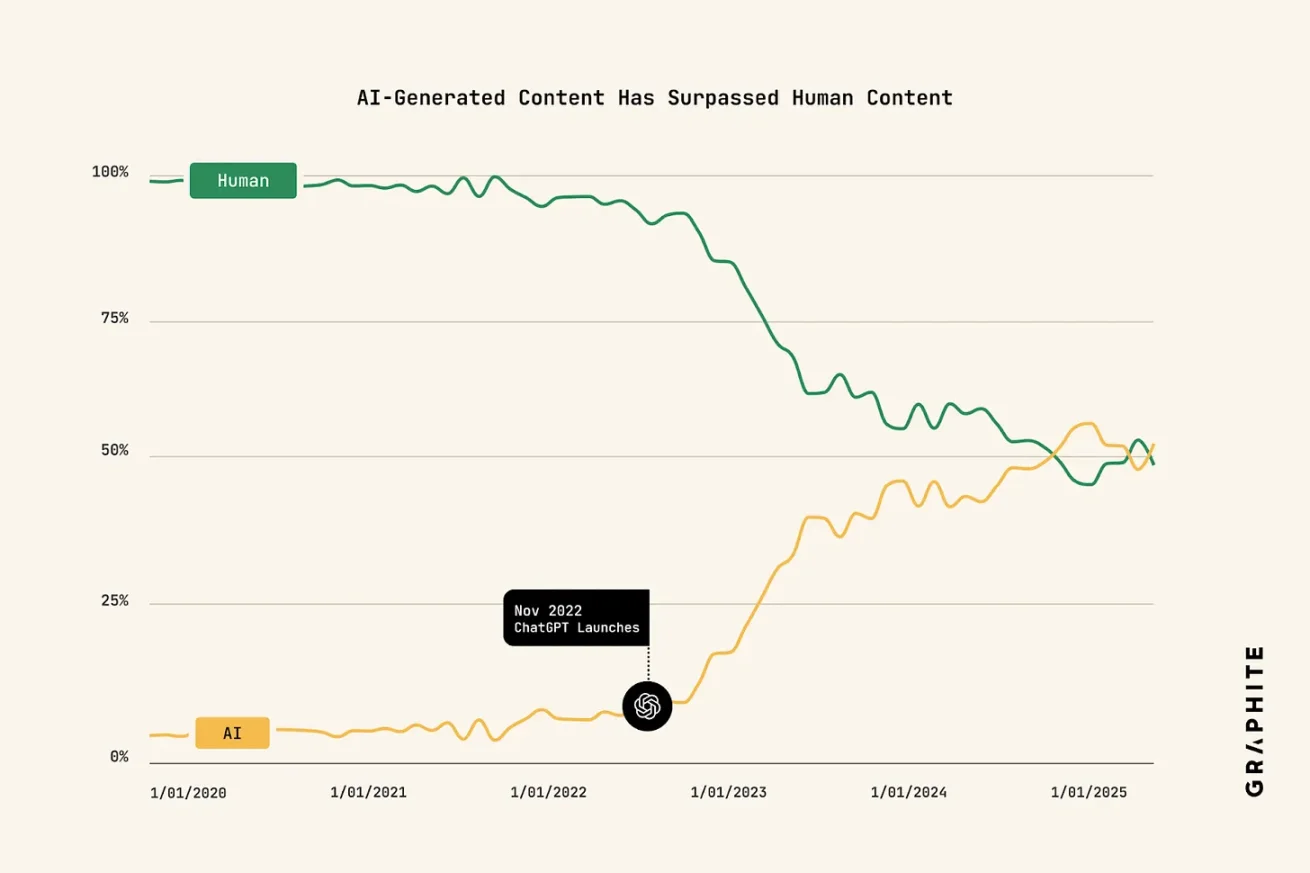

Content degradation: AI-generated content now exceeds human-created content;

-

Search transformation: Users increasingly rely on large models (trained on data from platforms like Reddit) to shape preferences. This explains why Alphabet and Meta are investing most of their 2025 operating expenses into AI.

This is where Reddit’s value emerges. Through its upvote mechanism, users self-curate content. Despite bot issues, within its unique ecosystem of anonymity, voting, and non-algorithmic feeds, it has built a parallel network driven by contribution and curation.

The truth about communities: In 2006, Nielsen observed that 90% of internet users are “lurkers,” 9% contribute occasionally, and only 1% produce most content. When the internet reached 1 billion users, only 0.1% posted content; 0.003% of Wikipedia users made two-thirds of edits; Amazon’s top 100 reviewers wrote nearly 167,000 reviews; one person uploaded 200,000 photos to Google Maps, viewed 11 billion times.

Two patterns emerge: the internet is undergoing “unbundling,” and large data platforms struggle to stay precise. Reddit is the largest experiment—creating niche communities where members decide what deserves attention.

The rise of carefully curated, niche communities is a real trend. We don’t yet know how their business models will evolve—perhaps Web3-native components will power them.

Web3 Curation Mechanisms and Digital Assets

Every new token launch faces the same question: who should receive them? Just as the internet’s core is matching users with products, Web3 lacks mature mechanisms for “finding the right users.” Unlike Google, it lacks the “context” needed to curate content effectively.

Token launches are wealth creation events. When new networks launch, massive capital chases limited tokens, causing most tokens to hit all-time highs within two weeks. Who receives tokens determines who participates in and shapes the economy.

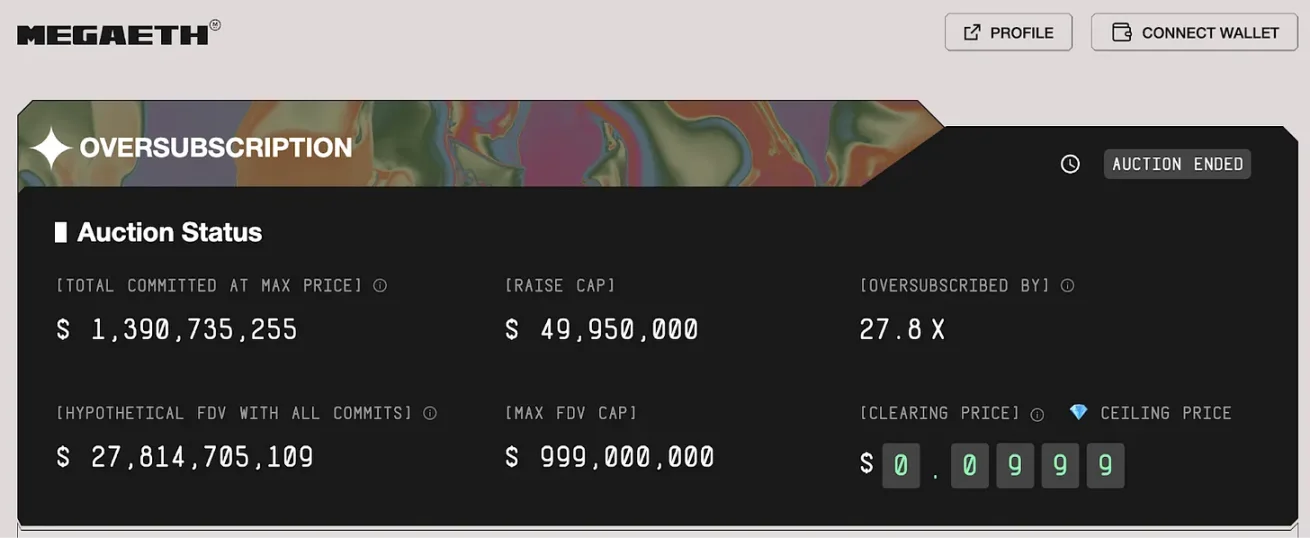

Take MegaETH’s token sale—oversubscribed 28x. How was allocation decided? They required users to bind social profiles and on-chain history to identify holders best aligned with the project.

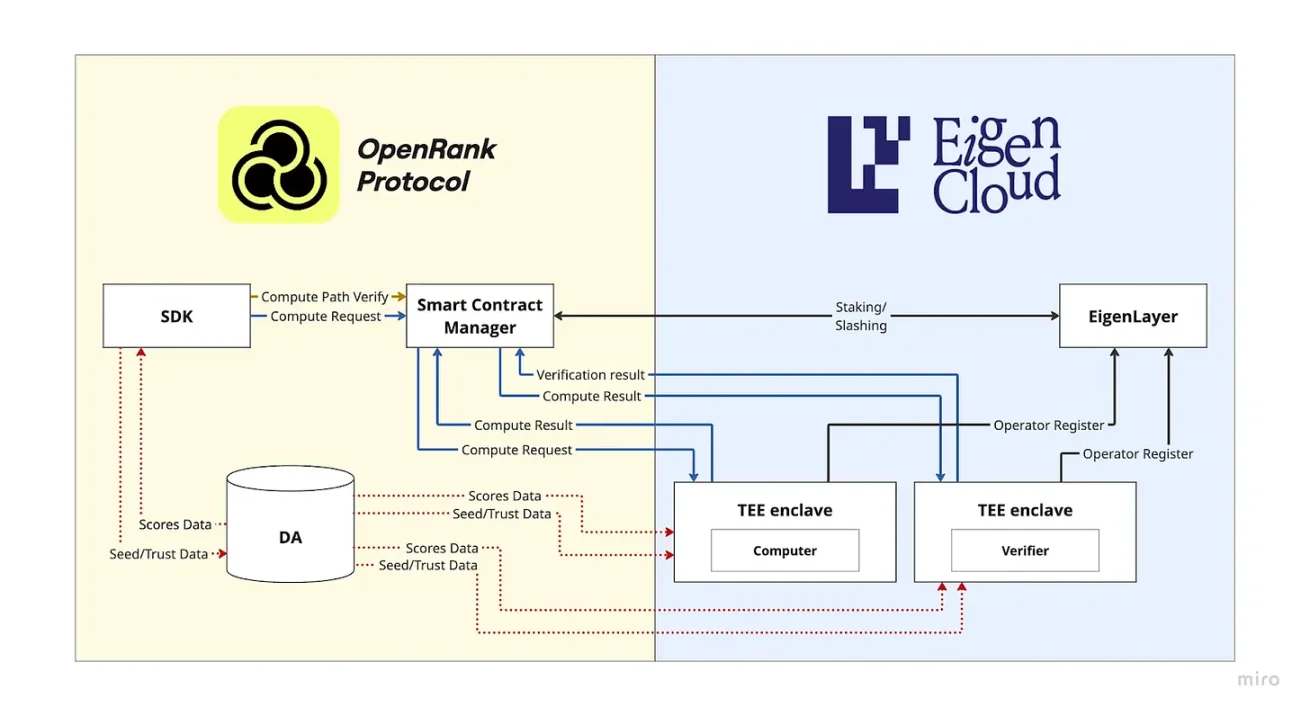

Every limited token project wants to do this. It’s like each project building its own data index instead of using Dune. Open curation infrastructure will play a key role in crypto capital formation.

These are, in fact, the “wealth creators” of the digital asset era.

According to Dragonfly’s filing with the U.S. SEC, about $26 billion in airdrops were distributed from 2021–2023. Conservatively, protocols allocate ~$5 billion annually to users. Including NFTs, token purchase quotas, and grants, the annual scale may approach $10 billion—roughly 1% of today’s digital ad economy. Can it grow 100x? I believe so.

As assets go on-chain, stablecoin economies expand, and regulations clarify, ad spending within ecosystems will increase. But we still lack tools to find valuable users and content. Don’t dismiss this as fantasy—over the past five years, stablecoin supply and prediction market volume have grown 100x. We’ve seen miracles before.

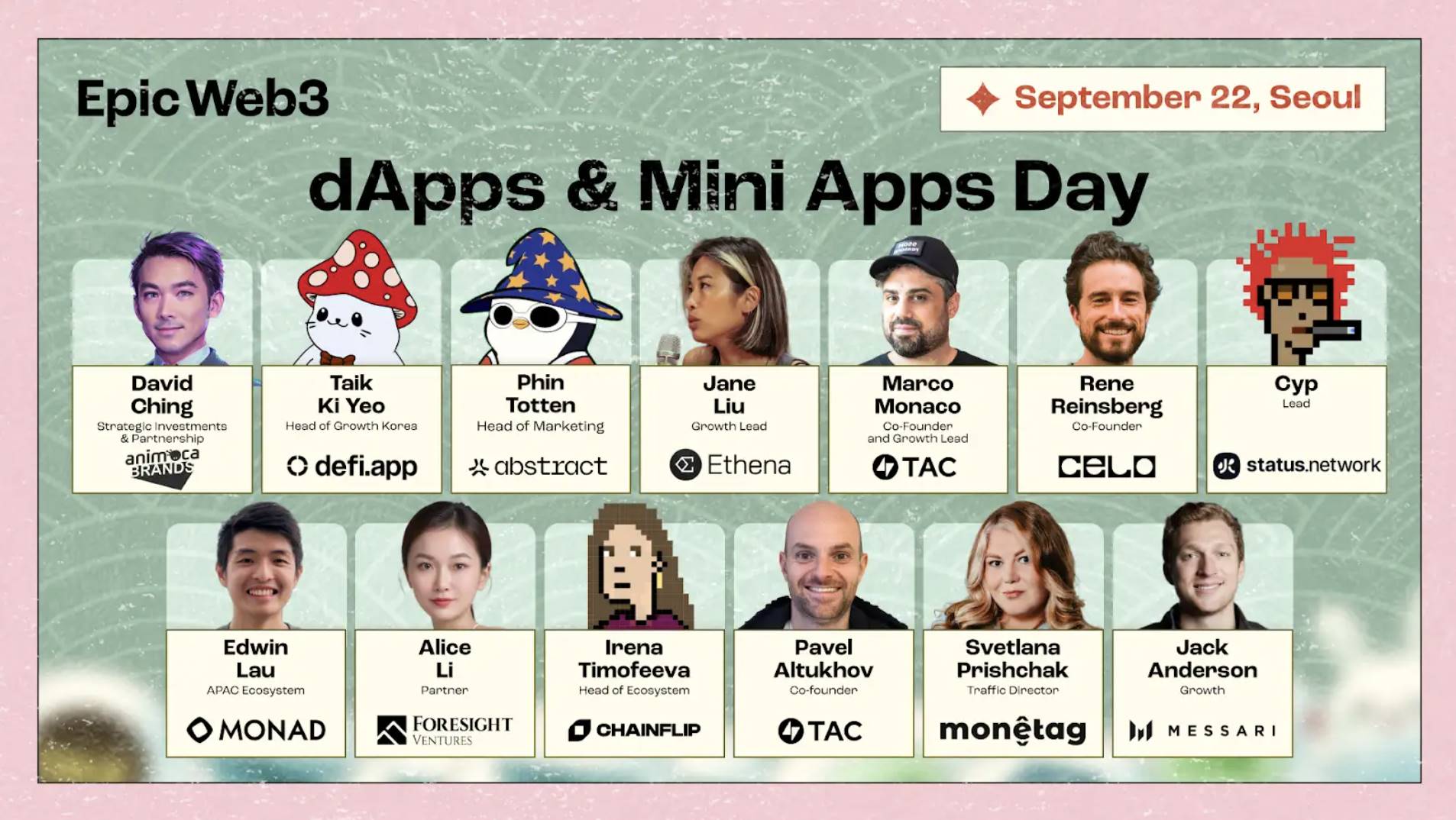

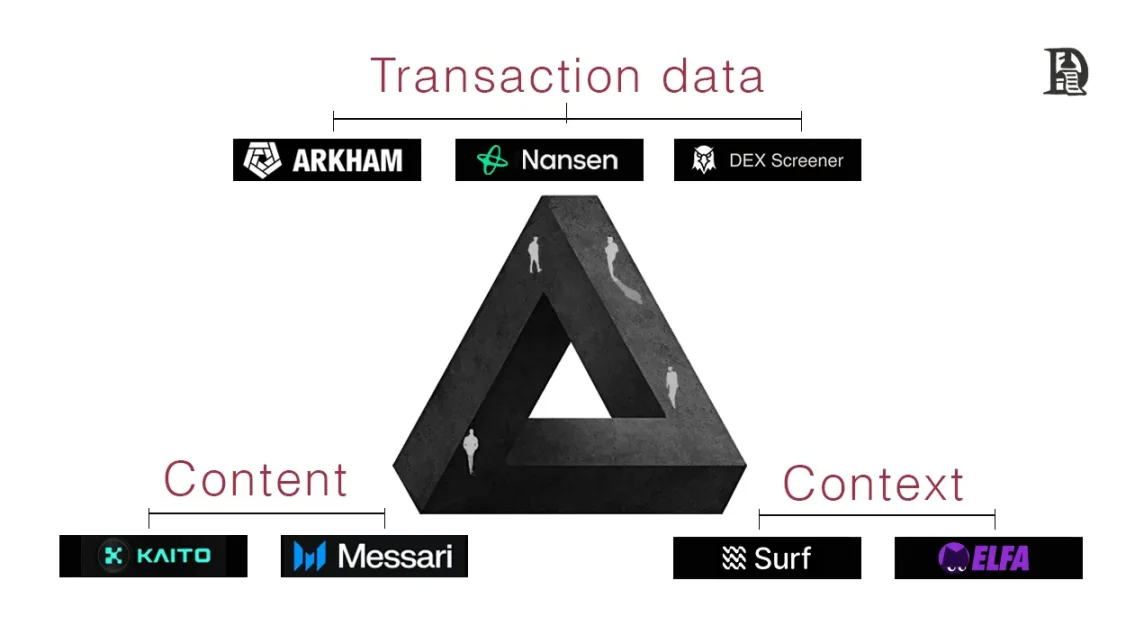

Several startups are pioneering this space, focusing on three verticals—context, transactions, and content—to reveal how the digital economy functions in real time.

-

Kaito: Crawls X (formerly Twitter) content, ranking users by influence and high-value followers—logic similar to PageRank. It maps creators, connects protocols, and provides verifiable influence metrics—functionally like Google AdX, but distribution happens on X. Recently, it integrated transaction revenue via launch platforms, building a parallel economy around crypto Twitter content.

-

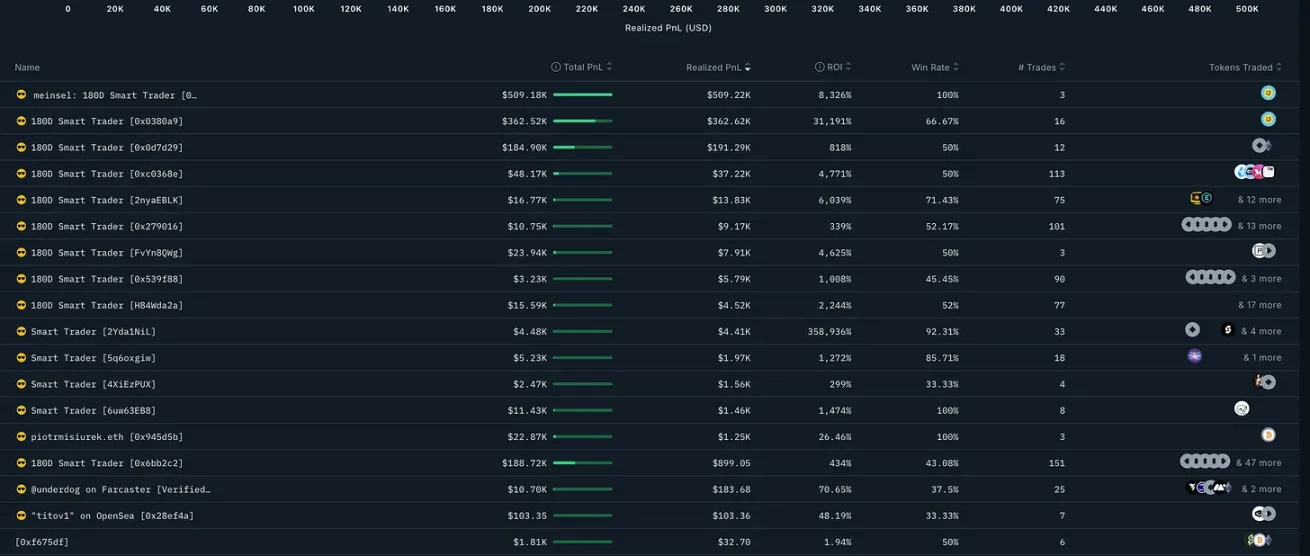

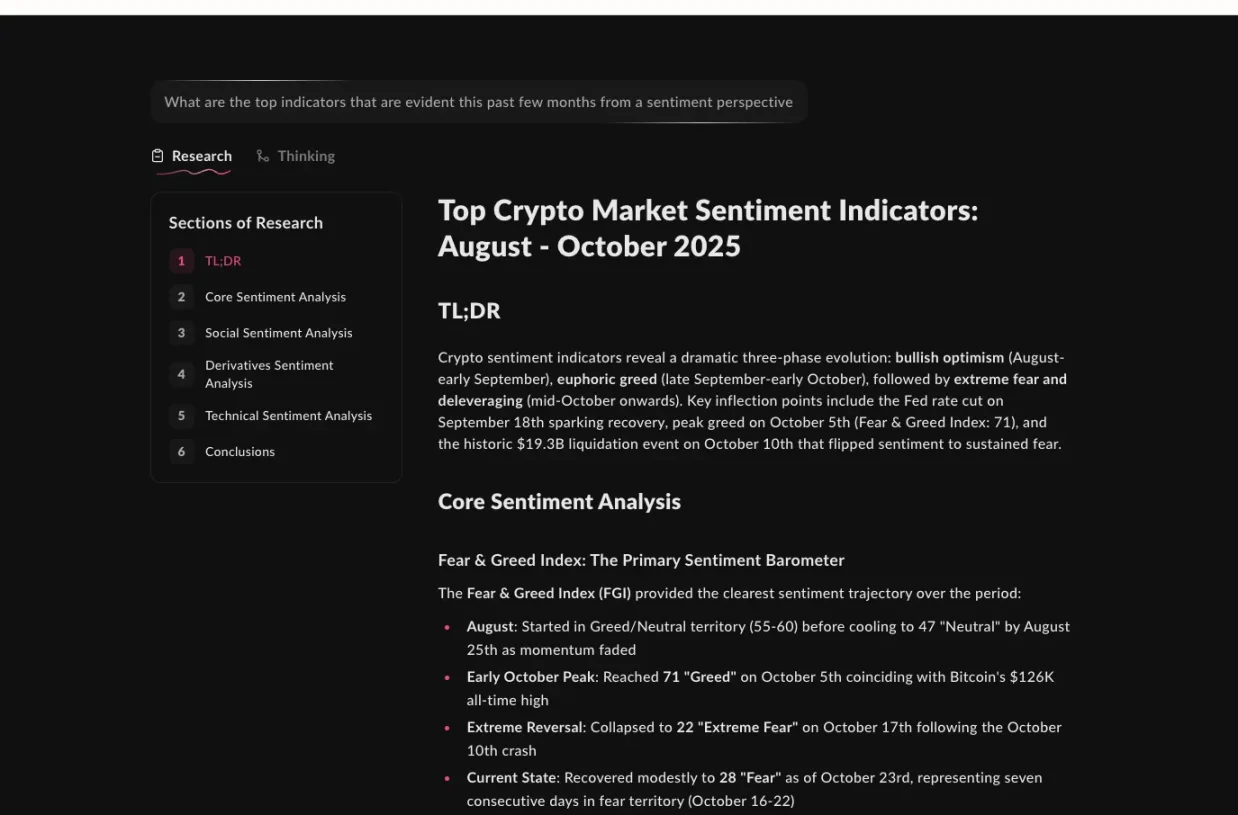

Nansen: Launched an AI product in 2021 focused on labeling wallet activity. In 2025, it fully pivoted to AI, primarily delivered via mobile apps. Users can query tokens within specific market caps showing smart money inflows. Its price dropped from $1,000 to $49 as AI generates real-time context from transaction data. Revenue may not come from pricing but from nearly $2 billion in assets staked by ~400,000 users. Soon, users may directly query and buy tokens on Nansen. It mimics Google: users are drawn to its labels across millions of wallets (like Google Maps), while revenue comes from transaction shares.

-

AskSurf: Focuses on qualitative research in crypto, answering niche questions like DeFi pool APYs, airdrop timing, and high-income projects. It aggregates highly contextualized information, serving as a personal “context layer” for understanding the industry. In the future, major exchanges could integrate it, allowing users to easily conduct due diligence before buying tokens.

We now have tools to find creators, label wallets, and create context—but they operate in silos. Human life isn’t fragmented this way. Facebook’s early strength was integrating personal, professional, and niche interests into one platform. These isolated graphs limit crypto’s potential.

This matters especially as concert tickets, product rewards, foreign currencies, artworks, and other niche assets become tokenized. For example, Motif allows users to create non-speculative investment portfolios using blockchain and AI.

Finance is moving on-chain. Wherever our attention goes—politics, sports, pop culture, technology—there’s an underlying financial market.

Content is the foundation connecting these two worlds.

Curation will make individuals safer when interacting with these micro-markets, as everything steadily becomes “marketized.”

Tools like Mymind show early signs of a future curation economy (though unlinked to social graphs). Algorithms filter personal feeds based on user preferences.

Curation is the glue binding context, transaction data, and creator content in the digital realm. This already happened in Web2: when electronics shopping moved online, creators like Linus Tech Tips, Marques Brownlee, and Dave2D helped buyers make informed decisions; Packy, Ben Thomson, and others curated tech news and directed attention.

In Web2, attention markets (like X feeds, Facebook) are separate from transaction engines (like AdX), and creators rarely benefit from transactions they drive. In Web3, capital markets (like Hyperliquid) directly share trading revenue with users, but struggle to match traditional social networks’ attention scale.

Web3 social networks like Farcaster can merge three elements: contextual feeds, transaction revenue, and diverse digital assets. Curation by individuals with taste and knowledge will drive this shift.

Curation Is Our Last Bastion

Facing algorithmic content, individual high-quality sharing becomes a counterbalance. Perhaps it stems from human instinct: sending friends short videos, creating playlists for loved ones, sharing articles with colleagues. In the digital age, we maintain bonds by saying, “This reminded me of you.”

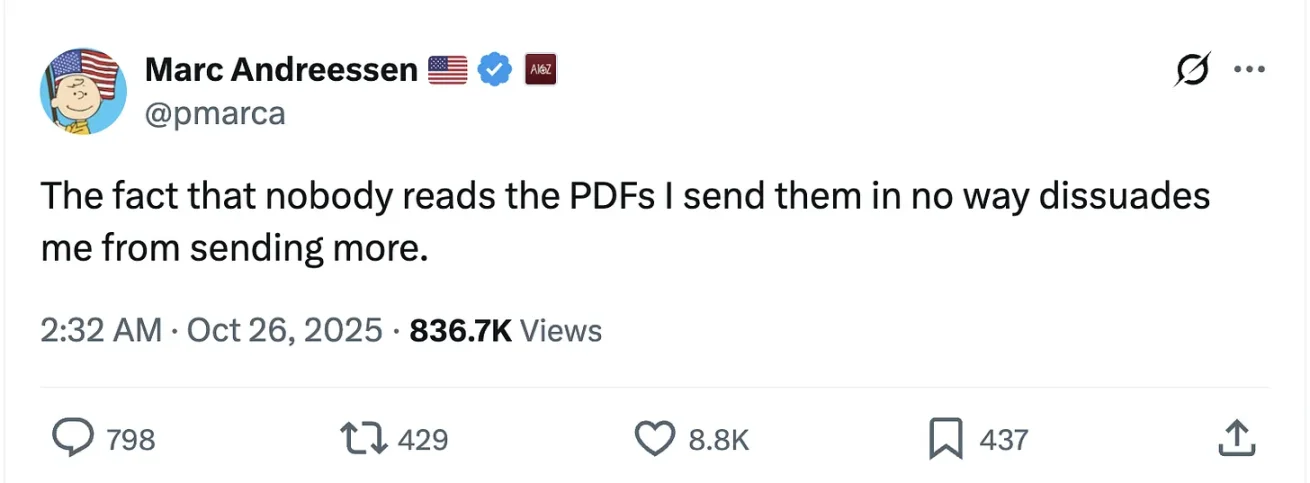

Deep down, we all wish someone would share an annotated PDF with us.

Tools like Sublime allow individuals to create sharable lists and recommend similar content—a 2025 version of Pocket. Chat-based communities have become curation hubs, combining reputation, context, and content—yet lack monetization tools.

WhatsApp has gradually increased group sizes from 32 to 256, aligning with this trend. To scale such groups, three things are needed:

A shared unit of value (linked to social reputation or tradable on-chain assets);

User-owned social graphs;

The ability to recommend relevant content based on (1) and (2).

Early attempts to incentivize contributors already exist online: Reddit gives badges to long-term contributors (not convertible to capital); Twitter allows creators to monetize contributions (~$1–2 per million impressions, distributing $45 million last year to ~15,000 users). In contrast, YouTube paid nearly $70 billion over the past three years to ~3 million channels. Social networks have tried rewarding users, but the “fields” creators cultivate still belong to third parties.

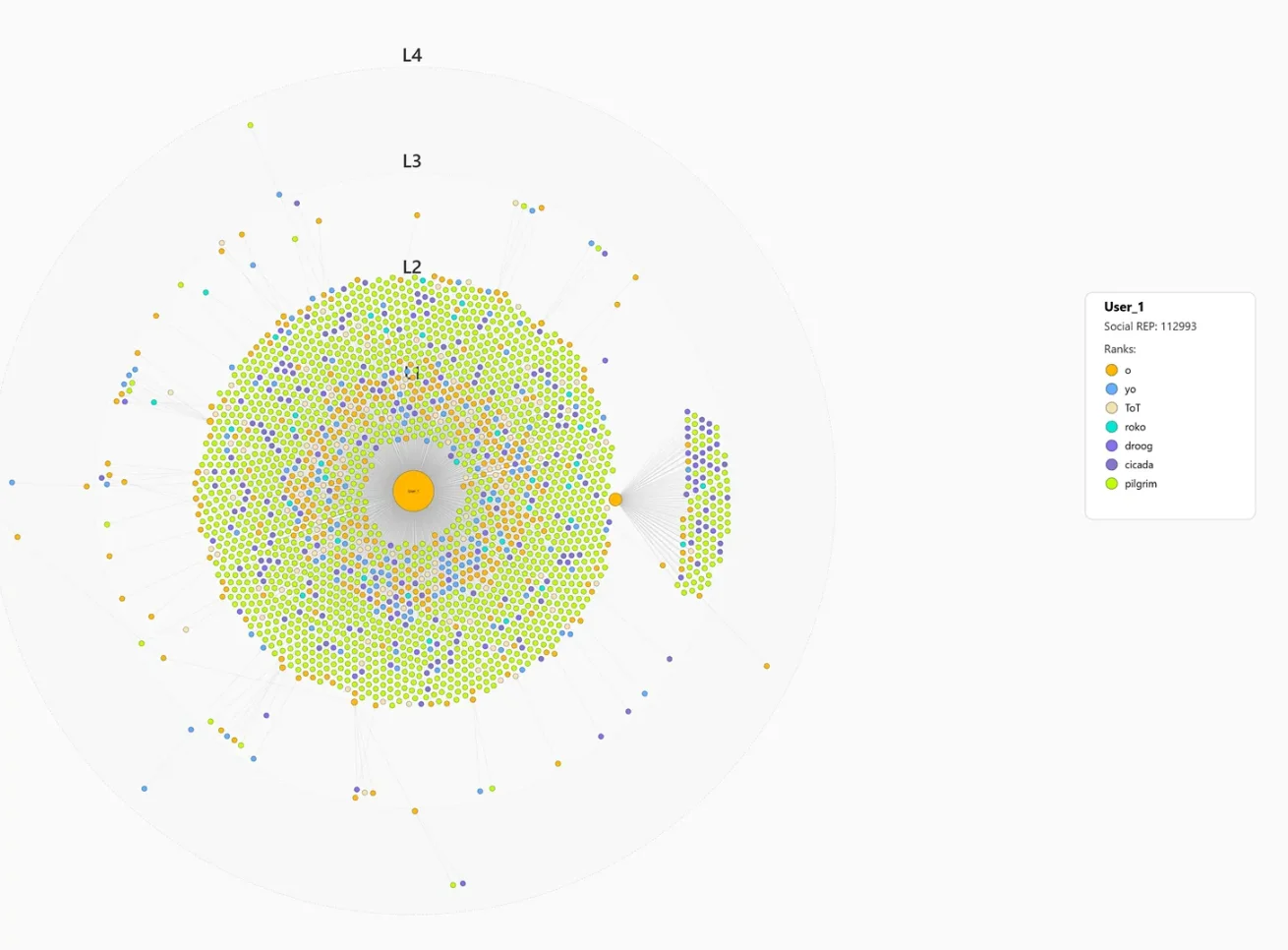

Project REP explores this space innovatively: it links Telegram users’ platform reputation with on-chain activity. Thus, users active in prominent groups (like LobsterDAO) and early contributors to DeFi protocols can be identified and rewarded. It maps social graphs via user invitations and uses “Telegram Gifts” (manually purchased via app stores to verify authenticity) to assess legitimacy. Such verifiable, identifiable, and value-transfer systems don’t exist in traditional Web2 social networks.

For new projects, REP offers a powerful mechanism to identify real users.

How is reputation built? Communities need verifiable mechanisms to confirm users and scale. In an age of bots, reputation systems like REP can identify potential members and grant access. The internet’s appeal lies in open access, but without effective mechanisms to filter out bad actors and bring in the right people, communities cannot thrive. Tools like REP fill this gap, merging Web2 and Web3 reputation systems.

Despite Web3’s talk of community, tools for verifying, confirming, and incentivizing members remain immature. We barely know the algorithmic details behind Kaito dashboards or Nansen wallet rankings—data is public, but algorithms are black boxes. Ecosystem maturity requires verifiable credential systems for social networks.

Integrating Context, Content, and Transactions

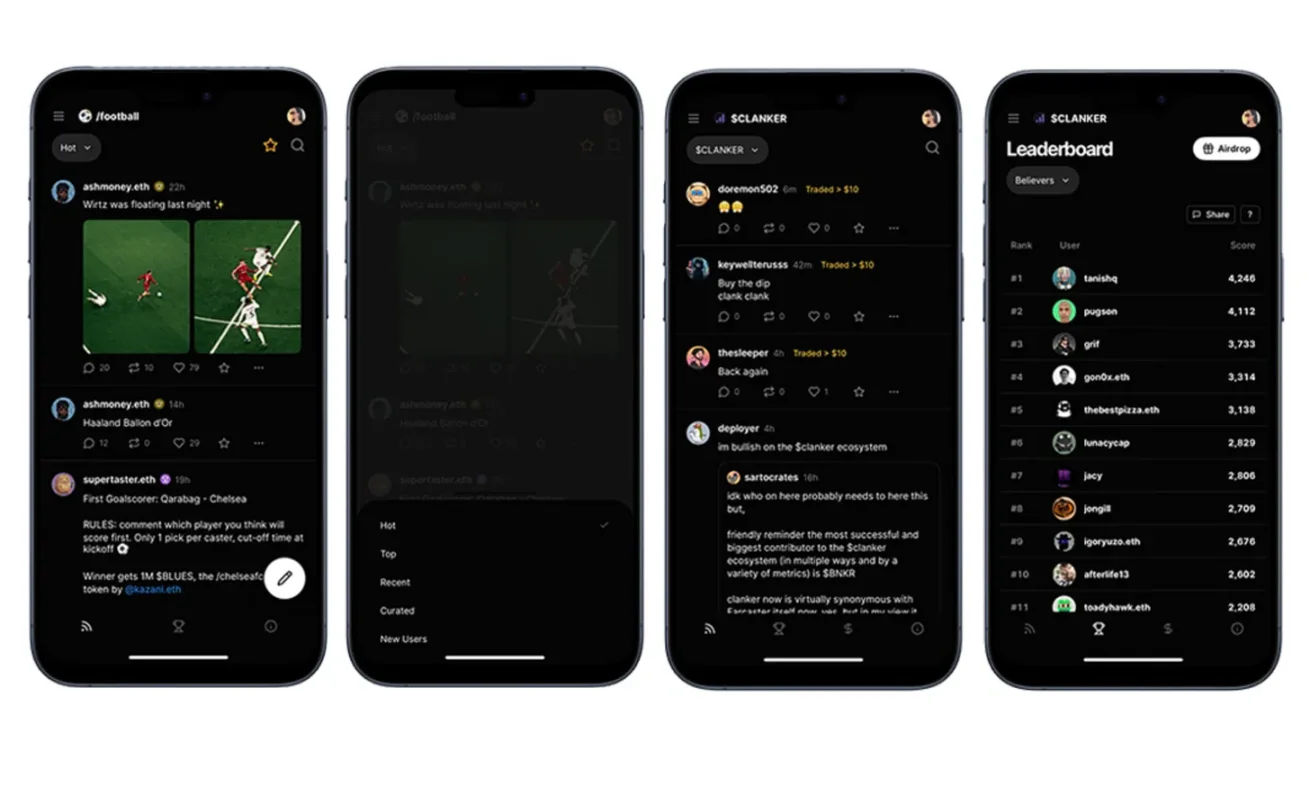

Farcaster’s landing page shows it’s undergoing a transformation, with a clear mission: discover new people, projects, and ideas in crypto. It aims to integrate wallets and social networks into a single interface.

The idea: crypto-natives love “financialization of everything.” We enjoy content, but we love trading even more.

Farcaster is merging both. Earlier this month, it acquired Clanker, a tool for token launches and liquidity management. Tokens launched via Clanker distribute 40% of pool fees to creators.

What we’re seeing on Farcaster is the slow, steady financialization of social feeds. Unlike X or Meta, its core product isn’t a feature designed to capture attention, but the user’s wallet—the transaction powers the network. But last year taught us: simply launching tokens doesn’t automatically create sustainable communities.

To understand community, consider religion or sports: the Catholic Church and football leagues offer three core elements:

-

A sense of belonging in shared spaces;

-

A culture-driven common language;

-

Curation of hierarchy, events, and shared spaces.

Crypto communities struggle to sustain because profit incentives drive culture—and these incentives are often too fleeting to foster belonging. These communities live fast, die young, lacking shared spaces, legends, or lasting content, leaving only frenzied profit-seeking amid price swings.

This is a moment of reflection in crypto’s evolution. Crypto is crossing the chasm, becoming relevant to edge users. Prediction markets are eroding sports and politics—we’re witnessing this shift in real time.

How do we retain, sustain, and empower these communities? Web3 has opened financial channels and stands on the brink of mainstream breakthrough. Now we can empower individuals, validate and verify content delivery. Why? Otherwise, we’ll cycle through “capital incentives attract attention → hard to retain → user churn.”

People won’t return to places where they consistently lose money. That’s why people visit casinos once a year but cafes weekly. Crypto’s obsession with hyper-speculation scares off users who could otherwise benefit from these tools.

Solution? Three components:

Influence hierarchy: All communities operate on hierarchies. Identify the most influential users and incentivize their continued contributions. Leaderboards work. Token communities can reward users who share information and educate others.

Crucially, ranking systems must be publicly verifiable. All human communities develop hierarchies: tribes have elders, kingdoms have kings, companies have CEOs. Reasons for leadership are usually transparent. But social platforms assign influence without explaining how weights are determined. Open rankings are vital—they bring fairness to this large online game.

Curation capability: This can happen bottom-up. Individuals can bring in and share content from anywhere online. On X, sharing links used to be penalized. In Web3-native systems, this behavior should be rewarded—micro-tips for discovering, filtering, and sharing the best links.

Higher-ranked users’ opinions gain more weight. Those who actively contribute and maintain communities far outweigh constant spammers.

Ongoing incentives: Users ranked high in hierarchy (direct posters) and curation (third-party content) should be regularly rewarded. Unlike Zora’s model of tokenizing everything, communities should have a single token, gradually released to top contributors over time.

In fact, Reddit explored this path in 2020 but paused due to IPO preparations. Limiting community token releases while expanding community reach is the only way to build healthy, token-linked communities.

Why would people join such communities? Beyond tokens, what can crypto offer? Hope lies in verifying content origin, distribution, and validation. It can also unite users, traders, and contributors through incentives tied to verifiable reputation systems.

Web2 social networks often fall victim to misinformation, with long-term consequences like democratic erosion and genocide. In the age of AI misinformation, blockchain offers mechanisms to trace news sources, spreaders, and origins. This isn’t a distant dream—it already exists on Farcaster.

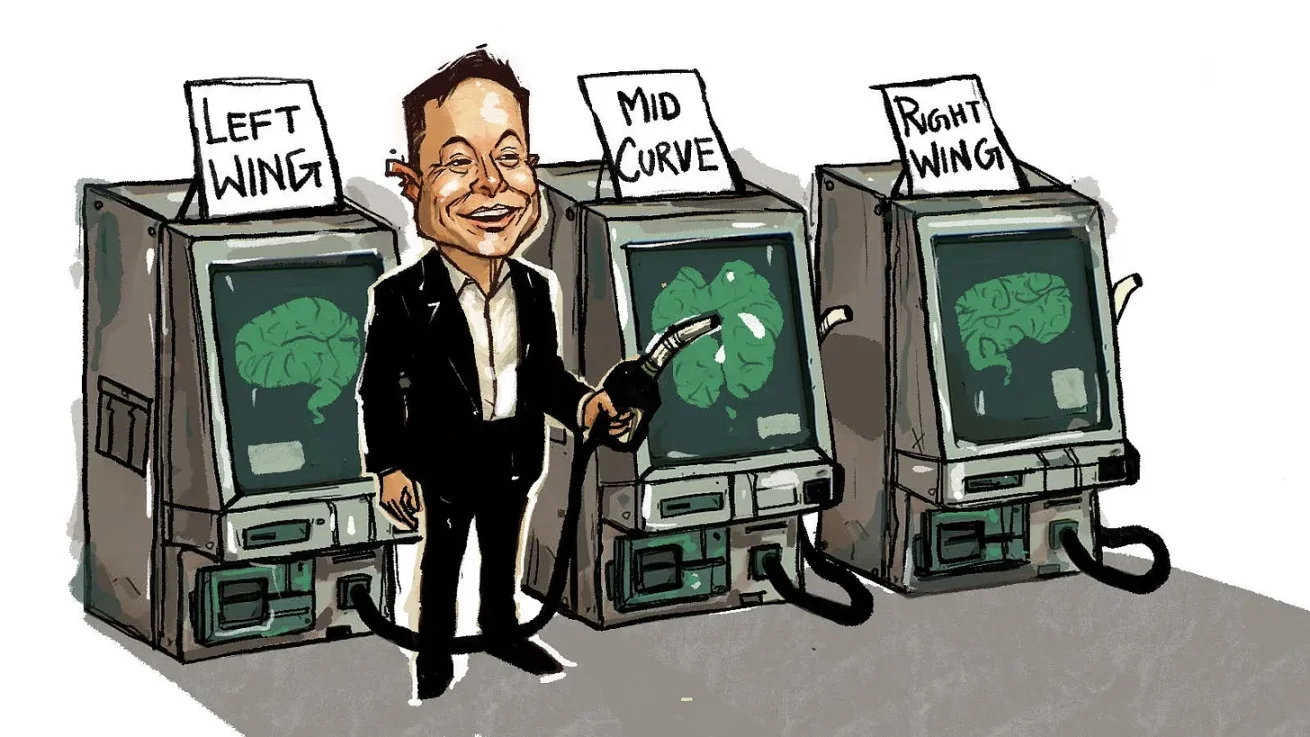

On X, the owner (Elon Musk) can promote his own posts. These black-box algorithms define how social networks operate. Making rankings and algorithms verifiable, and letting users customize content display, is essential.

A football fan might want only content about their team; a hyper-local community may need only local news. While algorithms currently handle these adjustments, understanding why content appears and verifying its basis is crucial.

Why does this matter? We’re witnessing the evolution of online business models. Brands will directly incentivize core users instead of paying Google to mine data via black-box targeting. Imagine: visiting the Dubai subreddit, finding the top coffee discussants, and sending them free coffee vouchers; or identifying top fashion contributors and offering brand discounts.

Currently, platforms own this data. As social graphs and transaction data move on-chain, primitives for discovery, value distribution, and user incentives will become the new Google AdX.

Will this change today’s social networks? Likely. It will enable smaller, niche communities to form, coordinate, and self-govern. Today, brands only notice communities above certain sizes. Tools for creating niche communities (like Dubai coffee lovers) are missing because their business models are unclear. Combining on-chain micro-payments (e.g., tips) with verifiable social graphs offers an alternative.

Communities should aim to become hubs where brands distribute perks and communicate with users. Currently, this happens via exaggerated influencer claims or data-holding platforms. Long-term retention of community attention is key to this shift—and curation is the wedge enabling it.

The influencer economy is the precursor to a curation economy. We already trust individuals and their taste. Curation turns influence into a multiplayer game focused on specific niches, transforming cults of personality into collaborative efforts.

1,000 True Core Curators

In 2008, Kevin Kelly wrote “1,000 True Fans,” laying the foundation for today’s creator economy. The dream: find 1,000 fans willing to pay a few dollars, enabling creators to earn a living. Nearly two decades later, we’re still far from this ideal.

Most creators never reach 1,000 paying fans. Browse Substack—countless writers lament the internet’s power law working against them. Blockchain payment rails make payouts easier, and innovations like x402 may help more creators get paid. But perhaps the solution isn’t better payment models—it’s better communities.

The real privilege of today’s top creators is the ability to rest. Most know that constantly producing high-quality content leads to burnout. Hence, writers like Packy and Ben Thomson now run multiple affiliated brands—core outlets draw attention, while other creators attach themselves to these established names. Essentially, these brands are micro-communities, with creators acting as top-down tastemakers.

What if communities in open social spaces made these decisions? Individual creators could rest, step away, and return to caring, curated niche groups. Creators would have time to think, share art and ideas that advance humanity—not just play the attention game.

In this world, creators transform from “farmers” toiling in algorithmic feed fields into “landowners” with property rights. Their work gets amplified by the community, supported by top contributors. Ideally, community GDP correlates with member activity levels. This may seem distant, but 11AM is already experimenting with blending content and capital markets.

Today, Substack is the only platform where writers can do this (owning direct relationships via email lists). We’ll see versions of this model emerge on-chain. Excitingly, decision-makers and curators will directly incentivize and reward participating users.

This isn’t science fiction: LobsterDAO holders frequently receive airdrops (recently from Monad). Early contributors keep getting rewarded, as early participation is seen as a trust signal. Social spaces are increasingly resembling what we envision as “museums.”

Early contributors set the tone, culture, and character of community content. This balanced model of curation, creation, and community is precisely how the internet can heal itself from being an “outrage machine.”

In 2023, I proposed a new vision for the internet, believing blockchain would disrupt the flow of value in social networks. Maybe I spoke too soon—but here we are today:

You can verify, confirm, and independently audit why content appears;

You can inspect leaderboards and understand why creators are valued;

You can adjust algorithms to show different types of content.

The underlying network has evolved—low-cost payments are possible; culture has shifted—from selling monkey JPEGs for thousands to paying $1 to support curation; social media fatigue is rising, pushing people toward networks like Substack. Combine these elements, and you realize: we’re in the perfect position for a new social network to emerge.

Like the secret ingredient in a home-cooked meal, perhaps the key to better information diets is a little curation—and people who make sharing worthwhile.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News