Attention Arbitrage: Memes Are Now More Valuable Than Whitepapers

TechFlow Selected TechFlow Selected

Attention Arbitrage: Memes Are Now More Valuable Than Whitepapers

Success belongs to those who pay attention to everything but cling to nothing.

Author: tradinghoe

Translation: TechFlow

Are Memecoins a Scam?

Everyone says so, but in reality, memecoins are the most honest part of the crypto space. Their persistence through every market narrative reveals an uncomfortable truth: perhaps they are the signal, and everything else is noise.

Crypto promised to democratize finance. That goal has indeed been achieved—just not in the way anyone expected.

This "democratization" isn't about everyone gaining access to decentralized finance (DeFi) primitives or governance participation. It's that anyone with a few SOL (depending on the blockchain) and a touch of irony can launch a token, latch onto the latest popular narrative, and potentially earn more than engineers building real infrastructure.

Memecoin speculation—fraudulent, leveraged bets on 100x gains—survives every bear market, every regulatory crackdown, every deep-dive analysis claiming “this is the peak.” Why? Because they’ve cracked the essence of crypto: a global casino, always open, where narratives are the product.

And this product has a formula.

The formula becomes self-evident when you study specific cases. Three narratives, three waves of memecoins—each following the same script.

-

@Plasma launched in September 2025 as a high-speed, EVM-compatible L1 blockchain designed for stablecoins, offering zero-fee transfers and Bitcoin-level security. They raised over $70 million through public sales and multiple funding rounds.

Within just one week, Plasma attracted $5.5 billion in total value locked (TVL), and its XPL token surged to a $2.3 billion market cap. By all metrics, it was a successful launch.

But speculation doesn’t care about your roadmap.

This is where memecoin traders gain their edge: they aren’t analyzing Plasma’s technology—they’re counting word frequency.

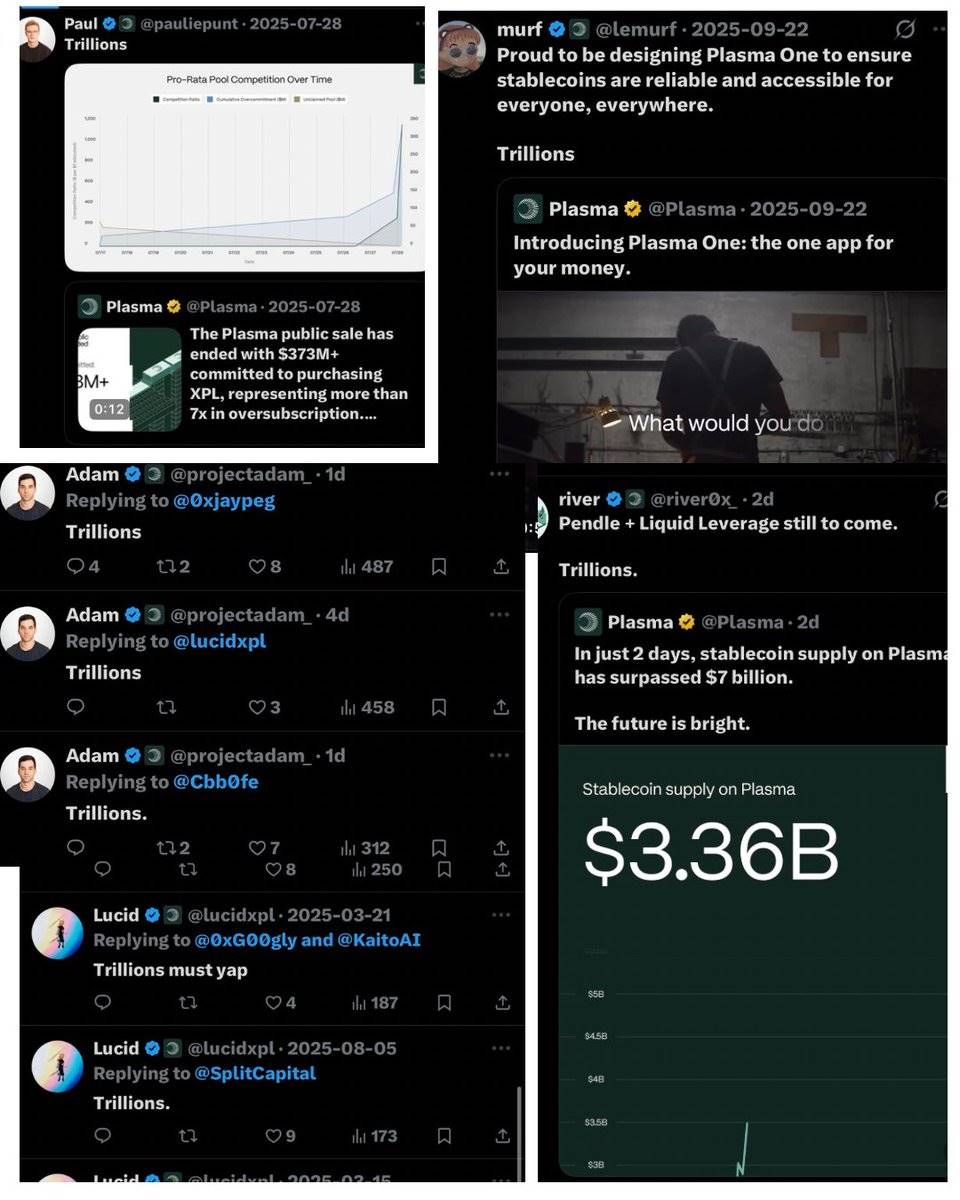

In the week of Plasma’s launch, the word “trillions” appeared countless times across team accounts, articles, announcements, and KOL coverage. “Trillion-dollar stablecoin volume.” “Trillions in transactions.”

Image: The word “TRILLIONS” became synonymous with Plasma’s narrative

Memecoin traders saw a simple equation: high narrative velocity (stablecoins) + repeated meme + fresh liquidity = attention arbitrage

Within days, $TRILLIONS launched—a memecoin that does nothing except exist on Plasma and embody the chain’s most repeated word.

Image: This is how narrative velocity turns into a ticker symbol

Their advantage isn’t technical analysis—it’s pattern recognition: spot the narrative, capture the meme, deploy before the hype peaks.

This is attention arbitrage: trading narrative velocity, not fundamentals.

DEX Wars: Three Competitors, One Memecoin

Prior to Plasma’s launch, three perpetual DEXs emerged, each backed by a major exchange:

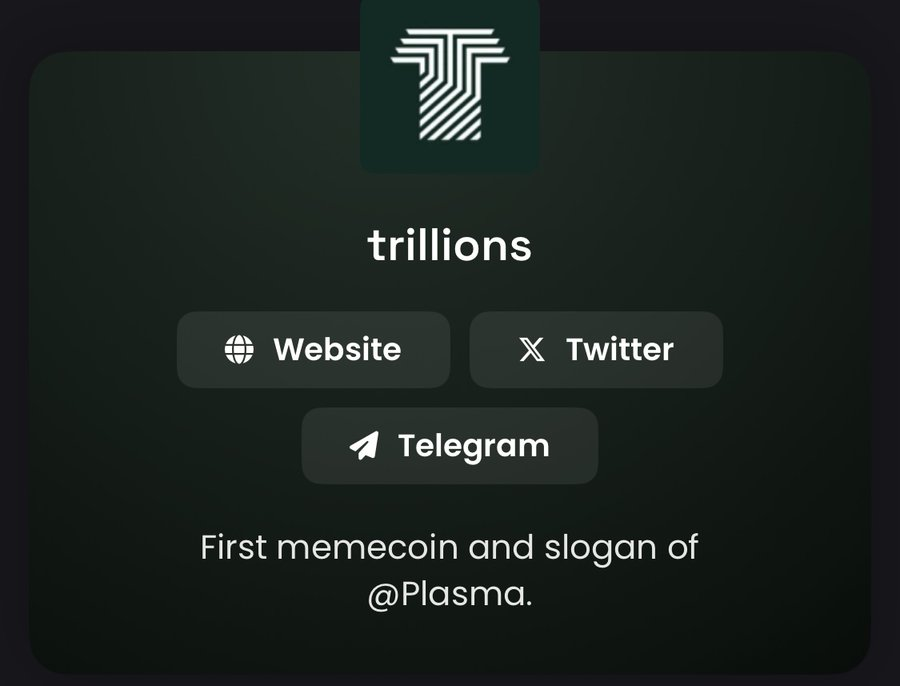

1.@avantisfi (Base/Coinbase ecosystem)

-

Launched on Coinbase’s Base L2

-

Backed by Pantera Capital

-

Hailed as “the top perpetual DEX on Base”

-

$23 million TVL at launch

Image: Coinbase founder Jesse tweets praising AVNT as the top perpetual DEX on Base

2.@Aster_DEX (BNB Chain / Binance ecosystem)

-

Backed by Yzi Labs

-

Developed by former Binance team, with Binance founder CZ as advisor

-

Reached $46 billion in trading volume, briefly surpassing Hyperliquid

- (Bybit ecosystem)

-

Backed by Bybit

-

Token buyback program

Narrative: Exchanges competing for DEX dominance, each trying to replicate Hyperliquid’s success within their ecosystem.

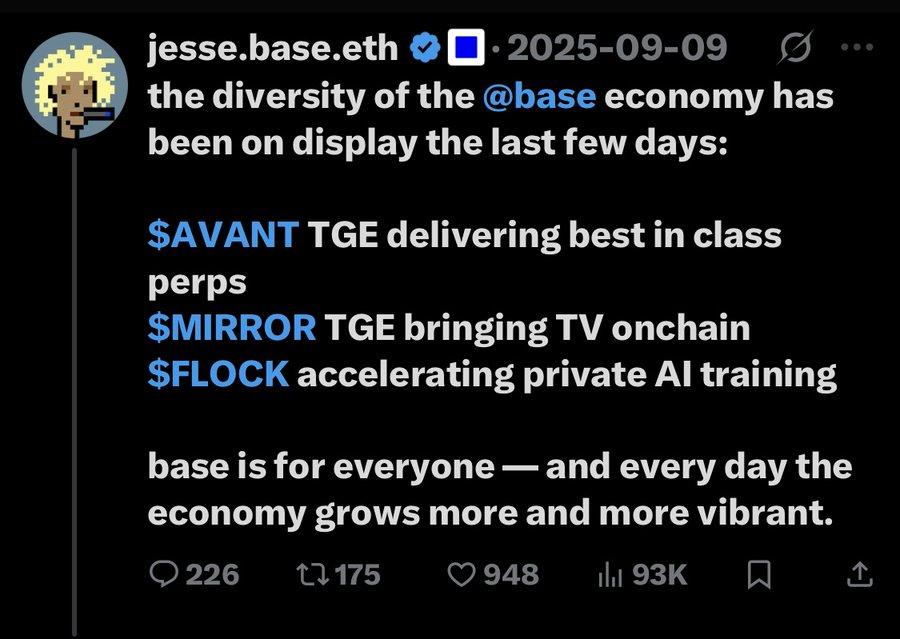

Memecoin traders saw this: everywhere, “Hyperliquid competitors.” Three similar projects, same positioning, all vying to be the “Hyperliquid killer.”

Traders grew tired of endless comparisons between Hyperliquid rivals and the constant rotation among the three.

Within days, @niggaliquidx launched on Solana.

Image: Here’s NiggaLiquid: a joke as a product

No backing, not a competitor to Hyperliquid. Just a memecoin on Solana, capitalizing on the current attention economy around the DEX wars.

This is attention arbitrage in its purest form: the DEX war drew attention through real development activity—AVNT building on Base, Aster hitting $46 billion in volume (thanks to liquidity mining), Apex integrating with Bybit.

Meanwhile, NiggaLiquid captured the same level of attention within hours simply by existing as a memecoin during the peak of DEX war discussions. It was just a token ticker that happened to emerge at the height of “Hyperliquid competitor” fatigue.

Conclusion

Edge: Playing both sides of the casino.

The advantage of attention arbitrage traders: they don’t choose between fundamentals and memecoins—they do both simultaneously.

The best memecoin traders aren’t ignorant of DeFi or crypto events; they understand them better than most. They read Plasma’s whitepaper, follow partnership announcements, monitor team accounts—not because they’re investing in infrastructure, but to pinpoint exactly where and when attention will peak.

This is the attention asymmetry most traders miss:

-

DeFi Fundamentalists: Spend months researching new tech, analyzing tokenomics, waiting for the perfect entry. But by the time they invest, the attention window has already opened and closed. They aim for 2-5x returns over years—which is great for platforms at scale—but too slow for this game.

-

Memecoin Gamblers: Chase pumps without understanding why they happen. No narrative context, no pattern recognition—pure blind speculation. They sometimes hit 100x, but usually give profits back to the market.

Attention arbitrage traders combine both: they have the information edge of researchers, plus the execution speed of memecoin gamblers.

>They can analyze Plasma’s $5.5 billion TVL surge while deploying $TRILLIONS ahead of the crowd.

Image: An early buyer of $trillions

>They can compare Hyperliquid’s rivals while launching NiggaLiquid.

They understand narratives deeply enough to know when “trillions” will become Plasma’s catchphrase. They closely track the DEX wars, spotting when “Hyperliquid competitor” fatigue peaks. They don’t wait for fundamentals to play out—they act before attention is generated by those fundamentals.

Speculation won’t die because it isn’t separate from “serious crypto”—it’s the same people, playing a different game.

The formula is simple: spot the narrative → identify the opportunity → front-run before hype peaks → exit before attention shifts → repeat

Success belongs to those who watch everything but commit to nothing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News