Attention Capital vs. Social Capital: The Twin Value Primitives of the Cryptoeconomy

TechFlow Selected TechFlow Selected

Attention Capital vs. Social Capital: The Twin Value Primitives of the Cryptoeconomy

When people misunderstand the two, it often leads to rug pull incidents.

Author: Dino

Translation: Luffy, Foresight News

Historically, financial capital has been the dominant lens through which we measure and exchange value. Financial capital includes cash, equity, and other liquid or investable instruments. It flows through banking systems, investment funds, and public markets—where it is priced, traded, and optimized for returns.

But value in today’s economic system extends far beyond the financial.

Attention capital arises from the scarcity of attention. In an information-saturated world, what people choose to focus on and think about becomes a valuable resource.

Social capital, built on trust, reputation, and influence, represents value accumulated through interpersonal networks and relationships. It manifests as others’ perceptions of your credibility, competence, and alignment with shared values.

Thanks to artificial intelligence and blockchain, we are entering a new era—one where attention can be easily quantified, traded, and speculated upon, and social capital can be staked, slashed, and collateralized. These are no longer abstract concepts but programmable primitives. They are giving rise to two new types of markets.

Attention ≠ Social Capital

It's crucial to clearly distinguish between attention and social capital:

-

Attention capital reflects what people see, click on, or react to in the moment. It's measured by short-term engagement metrics like impressions, views, likes, and shares, and driven by virality and trends.

-

Social capital reflects who people genuinely trust, respect, or want to associate with. It must not only be "earned" but also "recognized." It accumulates slowly, relying on consistent behavior and community validation.

The key difference is that attention is easier to manipulate. Bots, clickbait, emotional provocation, or meme hype can boost visibility without substance. Social capital, however, is extremely difficult to fake—it requires time, reputation, and real commitment.

Which Capital Are You Trading?

Some platforms operate entirely on attention capital, such as:

Pump.fun is built entirely around viral reflexivity. Token appeal depends on short-lived memes, influencer pushes, and cultural moments—making it a pure attention market characterized by high liquidity, sensitivity to hype, and reflexivity. The recent Loud! experiment was an extreme example.

Noise allows users to speculate on popular crypto projects, tokenizing "mindshare" (rather than belief). Noise is built on Kaito—which popularized the concept of mindshare in crypto, claiming its scoring integrates X interaction data weighted by reputation. This appears closer to social capital. Yet many remain skeptical, noting that top spots on mindshare leaderboards may not reflect genuine, high-quality community engagement.

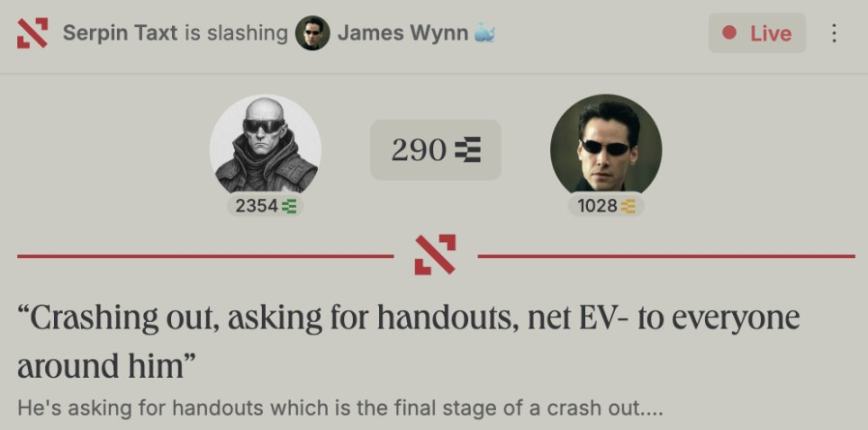

Ethos is a true social capital market. Users can back others by staking ETH, binding trust to financial consequences. If someone misbehaves, their backers face slashing. This gives trust both financial stakes and reputational costs. Ethos also introduces market mechanisms, allowing users to go long or short on reputation.

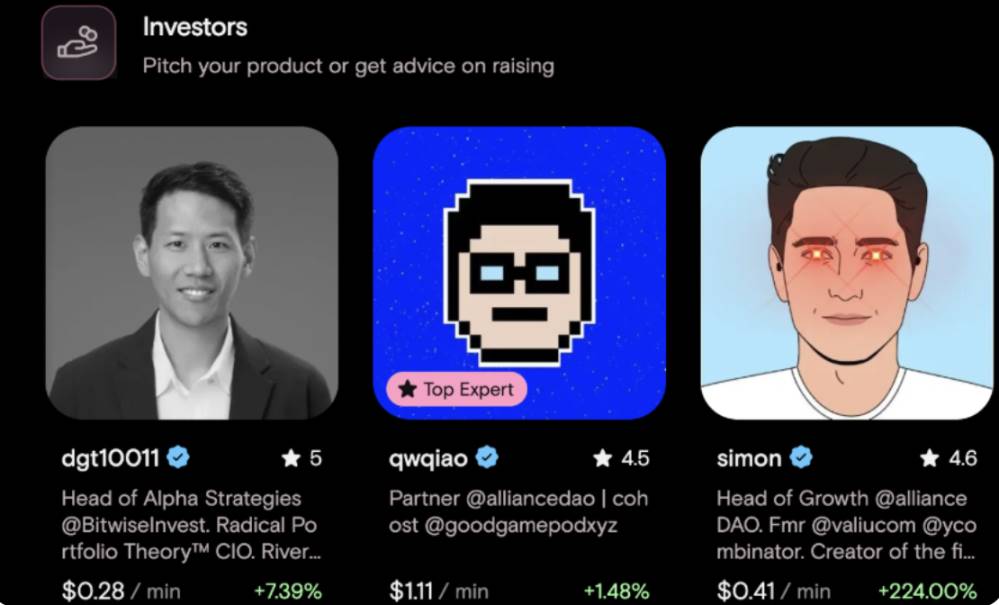

Time.fun occupies a hybrid space: asset value stems primarily from social capital, with some attention capital mixed in. Users can purchase access to interact with well-known crypto founders, builders, and investors. Its value proposition isn't based on "who's trending," but on "whose time is worth having"—placing it mainly within the social capital market.

Fantasy.top and Pump Pals also fall into hybrid categories: their asset values are primarily driven by attention capital, with some social capital elements. These platforms assess the social performance and engagement of influential crypto figures (on X) and adult entertainers (on Instagram, OnlyFans, and PornHub), respectively. Despite differing natures of "performance," social activity and interactions here are currently treated as proxies for "attention."

Notably, both incorporate some reputation indicators into their scoring systems. If long-term credibility and consistency become more important than raw metrics in determining value, they could shift toward social capital markets. For instance, Fantasy.top might integrate Ethos reputation scores, while Pump Pals could analyze core fan engagement continuity over specific periods.

Why the Distinction Matters

In the wave of cultural financialization, many platforms appear to enable trust-based outcomes but actually only drive attention-based outputs. This leads to misaligned incentives, distorted pricing, and systems that collapse under the pressure of hype.

Mistaking attention capital for social capital often results in "rug" events. Someone may seem trustworthy simply because they’ve gained massive attention. Reputation markets can help filter out this noise.

Rug events also occur when "performative trust" is mistaken for "real trust." A person may appear credible due to using the right buzzwords, aligning with popular sentiments, or signaling certain affiliations—but in reality, they aren’t as trustworthy as they appear. Verifiable actions and staking-backed guarantees can reveal true credibility.

Of course, rug events happen even when genuinely trusted individuals decide to convert their social capital into financial or attention capital. Slashing mechanisms alone cannot solve this completely, but incentive structures ("carrots and sticks") can shape behavior.

Attention and social capital are fundamentally different, with distinct behavioral patterns. They typically require different primitives, mechanisms, and safeguards. Recognizing this distinction allows builders to design more durable and ethical systems—ensuring viral popularity doesn't masquerade as trust.

Why This Matters Now

The attention economy is rapidly showing cracks: people are increasingly aware that "mindshare alone is not enough." Too many hollow trends. Too many hype cycles ending in wreckage.

But this frustration isn't the end of the story—it's the beginning of a more complex one. When attention capital and social capital are seen as independent yet complementary forces, new markets emerge. These markets won't just capture eyeballs—they'll cultivate trust. Attention provides surface signals; social capital gives those signals depth and foundation.

Imagine a platform integrating Kaito scores, Ethos scores, and other contextual reputation metrics. Imagine seeing these layers across all the apps you use daily—giving you a holistic view of financial, attention, and social capital dynamics. There are many promising experiments underway that could serve as counterbalancing mechanisms, improving decision-making, filtering noise, and enabling more responsible, human-centered collaboration systems.

If we get this right, we won’t just build better social tools—we’ll redefine value in the digital age.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News