Farcaster acquires Clanker to fill financial gap, is the social race picking up again?

TechFlow Selected TechFlow Selected

Farcaster acquires Clanker to fill financial gap, is the social race picking up again?

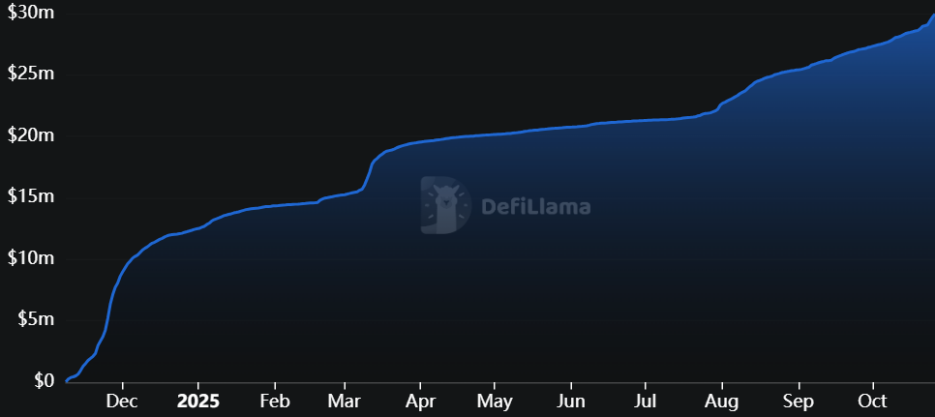

Since its launch in November last year, Clanker has generated nearly $30 million in cumulative fees, emerging as a highly competitive financial infrastructure project in the Base ecosystem thanks to its low operating costs and high profitability.

Author: J.A.E

Recently, the decentralized social protocol Farcaster announced its acquisition of Clanker, a leading token issuance platform on Base. Following the completion of the transaction, Farcaster revealed that Clanker would initiate a buyback and deflationary plan, using two-thirds of its long-term protocol revenue to repurchase CLANKER tokens.

After the announcement, the price of the CLANKER token surged significantly. As of now, it has increased over fourfold within the week. On the surface, this acquisition appears to be part of Farcaster's ecosystem strategy to build value capture through Clanker, but it may also signal the dawn of the next trend in the decentralized social sector.

Clanker’s AI-Powered One-Click Token Launch Empowers Farcaster

The reason Clanker attracted strategic acquisition by the decentralized social protocol Farcaster may lie in its innovative, AI-powered business model and strong revenue-generating capabilities.

Clanker is a token issuance platform deployed on the Base chain. Its unique value lies in an AI Agent-driven one-click function that allows users to easily launch ERC-20 tokens without any complex programming knowledge, significantly simplifying the token creation process and minimizing technical barriers.

Notably, Clanker enables users to create tokens directly on Farcaster by using social tags (tagging @clanker). This integration creates a new paradigm for SocialFi, where AI Agents go beyond being mere chat tools to become high-frequency, efficient, and profitable Web3 financial infrastructure. By combining AI automation with the immediacy and community-driven nature of social media, it transforms social sentiment into on-chain financial actions, drastically reducing friction between "social interaction" and "on-chain transactions."

In addition, Clanker demonstrates exceptional revenue generation capability. Data from clanker.world shows that since its launch last November, Clanker has generated nearly $30 million in cumulative fees.

The protocol earns revenue through a 1% fee on every transaction of tokens issued via Clanker on Uniswap V3. Of this, 60% goes to the protocol and 40% is distributed to the token creators. Clanker’s anonymous co-founder revealed that the protocol has been profitable since day one, with a small team and low operating costs, meaning most of the revenue can be considered net profit—making it one of the most profitable projects in the Base ecosystem.

Decentralized Social Sector Sees Trend Toward “Social Graph + Financialization” Integration

Farcaster’s acquisition of Clanker may indicate that the decentralized social space is moving beyond traditional competition over social graphs, shifting instead toward embedded financialization and direct value capture.

With the acquisition, Clanker’s token deployment tool will be directly integrated into Farcaster’s social graph. This integration represents a deep fusion of artificial intelligence (AI) and SocialFi, forming a unified, highly operable ecosystem. With this move, Farcaster could become a “one-stop center” for community token creation.

This acquisition also marks Farcaster’s evolution from a pure decentralized social protocol into a comprehensive ecosystem integrating social interaction, content creation, and issuance. While decentralized social protocols like Lens focus on data ownership, Farcaster aims to achieve “monetization” through Clanker. The addition of Clanker will help Farcaster offer users the shortest path from “idea” (posting) to “financial product” (token launch), further solidifying its position as the central hub for decentralized social activity on Base and creating strong network effects and competitive moats.

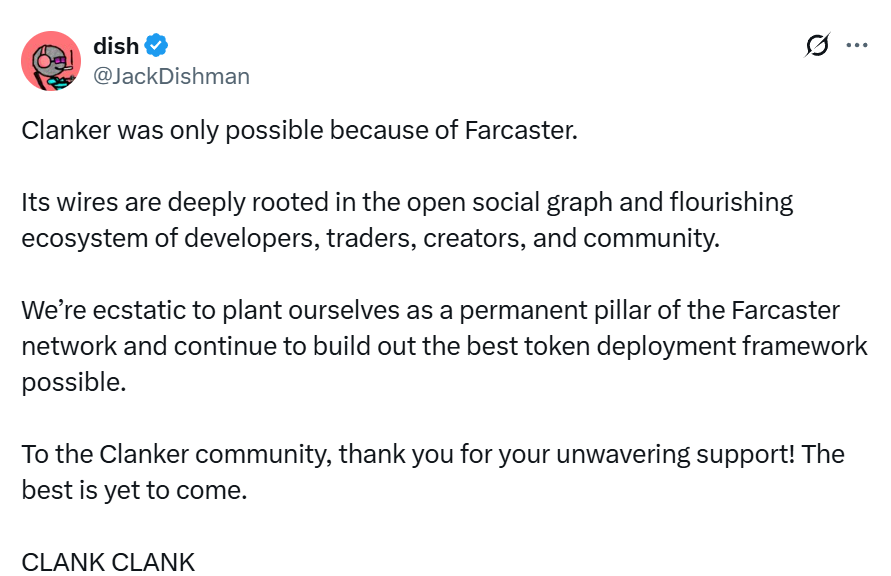

In fact, before Clanker’s successful acquisition, it had already undergone an intense acquisition battle that drew widespread market attention. According to Clanker founder Jack Dishman’s tweet, crypto wallet provider Rainbow approached Clanker in August to discuss an acquisition, proposing to acquire Clanker with 4% of its upcoming RNBW token supply to integrate its token launch functionality. However, Clanker believed that being acquired by Rainbow was not the right fit and rejected the proposal. After receiving the rejection, Rainbow threatened to publicly release the proposal letter if Clanker did not agree to the deal. Despite Clanker declining again, Rainbow released the acquisition terms without consent, and their communication style and inappropriate behavior further intensified Clanker’s dissatisfaction.

In contrast, Farcaster’s acquisition proposal proved to be a better strategic fit, offering strong synergies and a shared ecosystem vision. Jack Dishman emphasized that “Clanker’s success is inseparable from Farcaster,” rooted in “the open social graph and thriving ecosystem.” This indicates that Clanker’s strategic direction aligns more naturally with Farcaster’s social functionality. Moreover, Farcaster’s offer was collaborative, considering both Clanker’s independence and community interests when proposing terms. First, Farcaster preserved Clanker’s original token system and committed to using two-thirds of protocol revenue to repurchase CLANKER tokens. Second, Farcaster burned the early protocol fee pool and allocated 7% of the total supply to a single-sided liquidity position, reducing circulating supply and maximizing benefits for token holders.

Compared to Pump.fun, Clanker Places Greater Emphasis on Creator Incentives

Clanker’s success is not merely a copy; its business model differs significantly from Pump.fun, the meme coin launchpad on Solana.

The key difference between Clanker and Pump.fun lies in their incentive mechanisms. Clanker adopts a creator economy model based on the long tail effect and continuous incentives. Tokens launched via Clanker trade on Uniswap V3, allowing creators to earn ongoing revenue shares (40% of transaction fees). This mechanism encourages creators on Farcaster to view meme coins as sustainable income sources, closely aligning their interests with the token’s long-term liquidity and trading volume—better reflecting Farcaster’s decentralized social ethos.

In contrast, Pump.fun focuses more on incentivizing early users and price discovery through bonding curves, only migrating tokens to DEXs once certain market caps are reached. While this model supports short-term speculation and fair launch culture, it offers far less sustained income security for creators compared to Clanker’s revenue-sharing model.

In terms of liquidity management and trading mechanisms, the two platforms have also adopted different strategies. Clanker uses a long-term 1% Uni V3 transaction fee model, focusing on sustainable liquidity provision and fee accumulation. A key advantage of this model is that liquidity remains consistently on Uni V3—transparent and controllable—ensuring depth and credibility, which helps attract more traders.

Pump.fun, on the other hand, uses bonding curves to determine pricing and only lists tokens on DEXs after reaching certain valuations. While this approach somewhat delays internal selling pressure, it lacks the deep integration with mature DeFi infrastructure seen in Clanker, potentially leaving it at a disadvantage in liquidity management.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News