Farcaster's Big Transformation: How a16z and Others Spent $180 Million to Reshape Web3 Social

TechFlow Selected TechFlow Selected

Farcaster's Big Transformation: How a16z and Others Spent $180 Million to Reshape Web3 Social

Open protocols can't scale users, content distribution can't drive transactions, and ultimately, the only realistic path left is asset-driven growth.

By Kaori

ABCDE's announcement to halt new project investments and suspend fundraising for its second fund has sparked yet another wave of "VC is dead" lamentations across Crypto Twitter. Yet during the previous cycle, VCs thrived by crafting narratives, inflating valuations, and packaging PowerPoint slides as the future of the internet.

Farcaster, the decentralized social leader that raised $180 million across two bull markets, stands as the quintessential embodiment of the VC narrative. But Farcaster’s trajectory is now becoming clear—not betting on “decentralized imagination,” but on “asset-driven execution.” Farcaster isn’t a failed product; it’s another collapse of narrative within crypto, revealing that VCs don’t actually have the power to restructure the world—they simply cashed out from a story built on pre-inflated valuations.

Farcaster to Warpcast, and Back to Farcaster

Recently, Dan, co-founder of the Farcaster protocol, announced that the team is considering renaming the current official client application, Warpcast, back to Farcaster, along with updating its web domain to farcaster.xyz. The goal is to streamline the branding system and resolve user confusion between the protocol and the application.

In 2021, Farcaster launched as a desktop product, then pivoted in 2023 to become a mobile and web app under the name Warpcast. The initial rebranding was based on the idea that differentiating the client (Warpcast) from the protocol (Farcaster) would encourage other developers to build their own clients atop the protocol, thereby driving broader adoption. In practice, however, this vision never materialized. According to team feedback, the vast majority of users still register accounts and access the protocol exclusively through Warpcast.

Last May, BlockBeats analyzed the Farcaster ecosystem, noting at the time that the front-end app Warpcast controlled core functionalities of the Farcaster protocol—such as direct messages and Channels—resulting in pronounced Matthew effects. Unofficial clients could only survive in the cracks, targeting Warpcast’s pain points with niche features. Despite these constraints, apps like Supercast and Tako pursued differentiated strategies to build their own social platforms.

Now, Farcaster’s official move to rename Warpcast as Farcaster effectively betrays those frontend developers who chose to build on the Farcaster protocol.

This rebranding is merely a microcosm of Farcaster’s broader transformation. Since October last year, the Farcaster protocol has undergone significant adjustments in product updates, strategic direction, and personnel changes.

A telling detail: developer meetings no longer separate discussions into “Farcaster topics” and “Warpcast updates,” instead focusing holistically on specific issues such as growth, direct casts, lowering registration costs, hub stability, FIP governance, and identity systems.

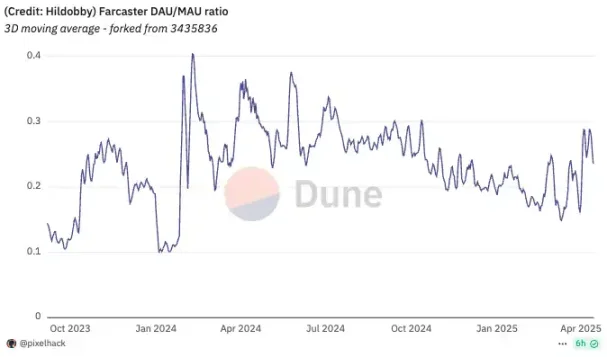

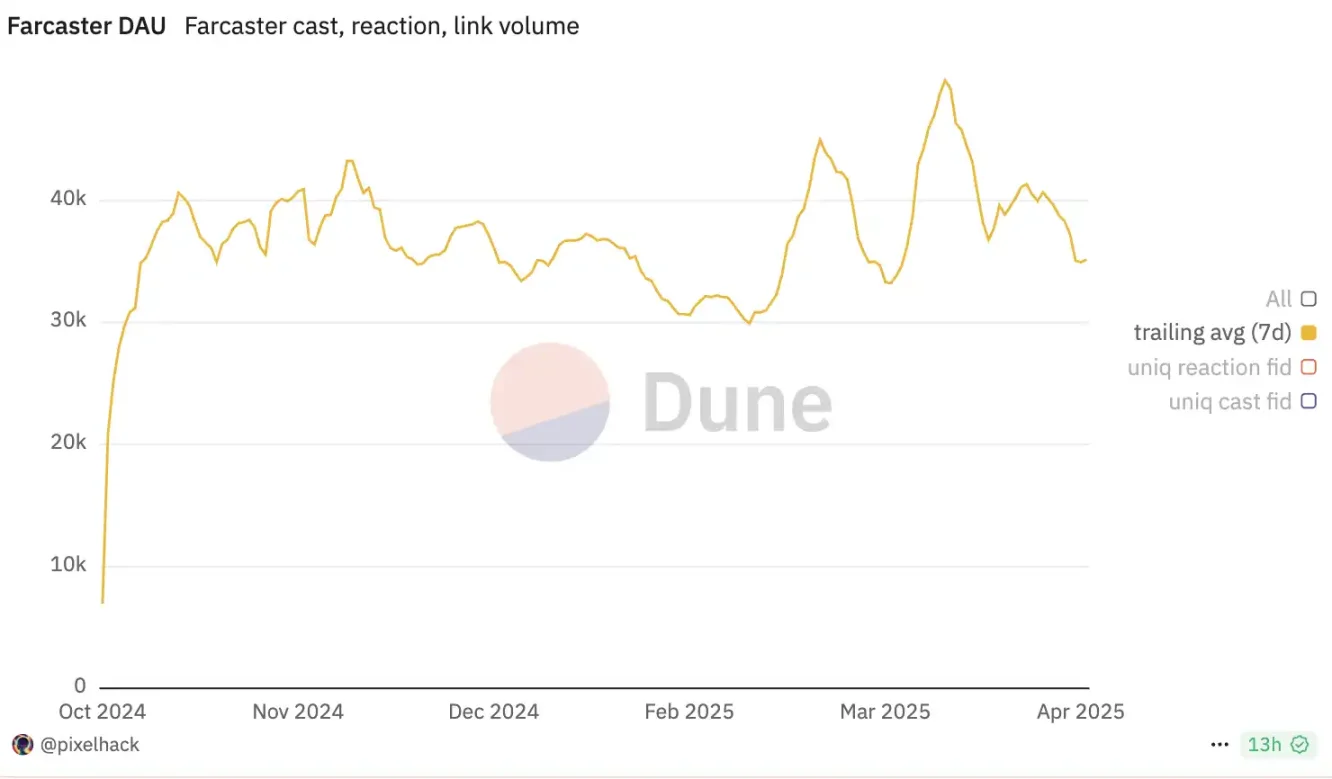

Yet from a user retention standpoint, Farcaster remains trapped in the classic cold-start problem. According to Dune data, since opening registration in late 2023, its DAU/MAU ratio has hovered around 0.2, briefly reaching 0.4 early in 2024 due to the DEGEN craze before quickly falling back down.

The DAU/MAU ratio measures how often users interact with an app each month. A value closer to 1 indicates higher engagement. Below 0.2, an app typically suffers from weak virality and interaction.

In comparison, early Web2 community products like Reddit or Mastodon maintain stable DAU/MAU ratios between 0.25 and 0.3. Even smaller, more niche social apps like Discord servers often sustain engagement above 0.3. Farcaster’s numbers suggest that despite high visibility in the crypto community, habitual usage hasn't taken root. Active users are concentrated among a small group of heavy creators and on-chain natives, without forming a sustainable content consumption or social loop.

Content or Assets? Farcaster Has No Answer

Initially, Farcaster aimed to build a decentralized social graph using content tools. Channels—once hailed as central units for communities and traffic—were expected to anchor this graph. But soon, asset incentives vastly outweighed content-driven self-organization, shifting the product logic entirely.

The Abandoned Channel

In February 2024, the social token $DEGEN surged in popularity within the Degen channel on Warpcast, becoming the main catalyst for Farcaster’s breakout moment. Just four months after opening network registration, daily active users surpassed 30,000. As $DEGEN gained momentum and similar tokens like Higher emerged, Farcaster’s DAU peaked at 70,000.

The Farcaster team recognized channels as powerful vessels for gathering people, attention, and liquidity. Founder Dan viewed this as a key differentiator from centralized platforms like Twitter—an ability to host small communities within a larger social graph. Though just a feature within Warpcast, the team planned full decentralization, believing that nurturing small, focused communities would boost engagement and create more intimate social experiences.

The team solidified channels as a core development focus, introducing concepts like channel ownership and moderator rights, even spawning projects and clients centered around channel management. Dan urged users not to squat on channel names, suggesting they should be preserved for brands—a plea underscored when the podcast Bankless clashed with a user over claiming its namesake channel.

But this strategy didn’t last. By July 2024, scalability bottlenecks in the Farcaster network surfaced. During a developer meeting, the team announced they would pause channel decentralization and reevaluate implementation paths.

When asked why users couldn’t post in certain topic-based channels, Dan explained that channels offered no distribution advantage—past attempts had underperformed. He stated, “Channels are good for operating communities, but not for discussing topics. We won’t recommend them to new users.” Given limited resources and minimal impact on user growth, the team has no short-term plans to add new channel features.

Product priorities have shifted decisively toward Mini Apps and Wallets, transforming Farcaster from a content- and social-graph-focused protocol into one optimized for transactions—something better aligned with attracting native crypto users.

Built-in Wallet Deepens Monopoly

In a podcast, Farcaster co-founder Dan shared his evolving view of what constitutes a “user”: light users who merely register and interact superficially may inflate surface-level metrics, but real network value comes from wallet users—those holding crypto assets and engaging in on-chain activity. This refined understanding directly shaped the team’s wallet product strategy.

By late November 2024, Farcaster began exploring in-app integration of a tradable wallet to promote on-chain transactions. The goal was to increase interaction frequency, enhancing ecosystem stickiness and monetization potential. In fact, every Warpcast user already had a default “Farcaster Wallet” created upon registration—used for logging into Warpcast and Frames—but stored locally on devices, functioning primarily for authentication and signing rather than asset movement.

In contrast, the newly launched “Warpcast Wallet” enables sending and receiving assets. Users can auto-generate it during signup and use it to top up, swap, transfer tokens, and perform on-chain interactions.

The timing of Farcaster’s decision to embed a tradable wallet is hard to disentangle from the rise of Clanker.

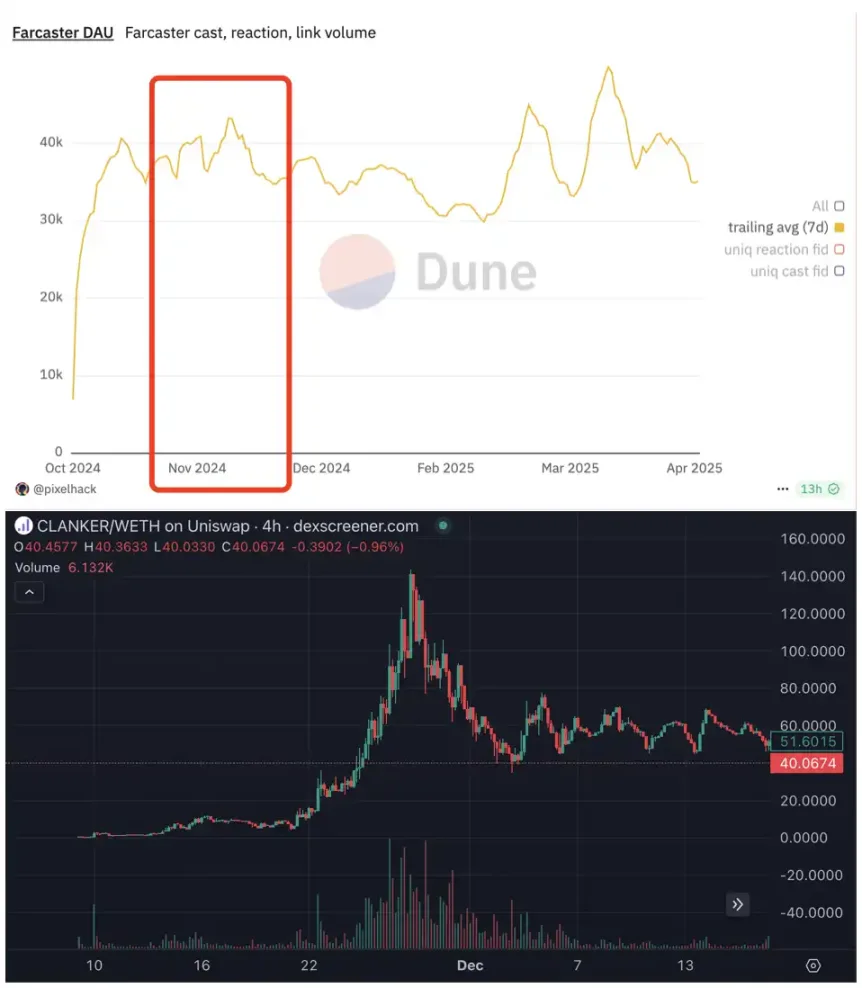

Clanker is an AI agent on Warpcast that allows users to launch tradable tokens on Uniswap by posting and tagging it. Its native token $CLANKER surged 20x in November last year, positioning Base and Warpcast as contenders against Solana in the AI narrative race. Thanks to $CLANKER’s wealth-generation effect, Farcaster’s DAU hit a new high since the previous summer.

Unlike $DEGEN, which emerged organically, $CLANKER received immediate attention and support from the core team and inner circles. Yet during this boom, agents, DEXs, and C-end wallets all benefited—while Warpcast itself captured no direct revenue.

Clanker’s success made the team realize that relying solely on open protocols and third-party integrations wouldn’t keep on-chain activity within the Farcaster ecosystem. To truly capture value, they needed a native tradable wallet—thus giving birth to Warpcast Wallet.

From a design perspective, Warpcast Wallet acts as a bridge between social interaction and on-chain behavior—users can complete trades, tips, or claim airdrops directly via Frame clicks, without switching apps or connecting external wallets. This “social-as-finance” model makes Farcaster resemble a crypto “Singapore”—small user base, but high wallet activity and per-user capital volume.

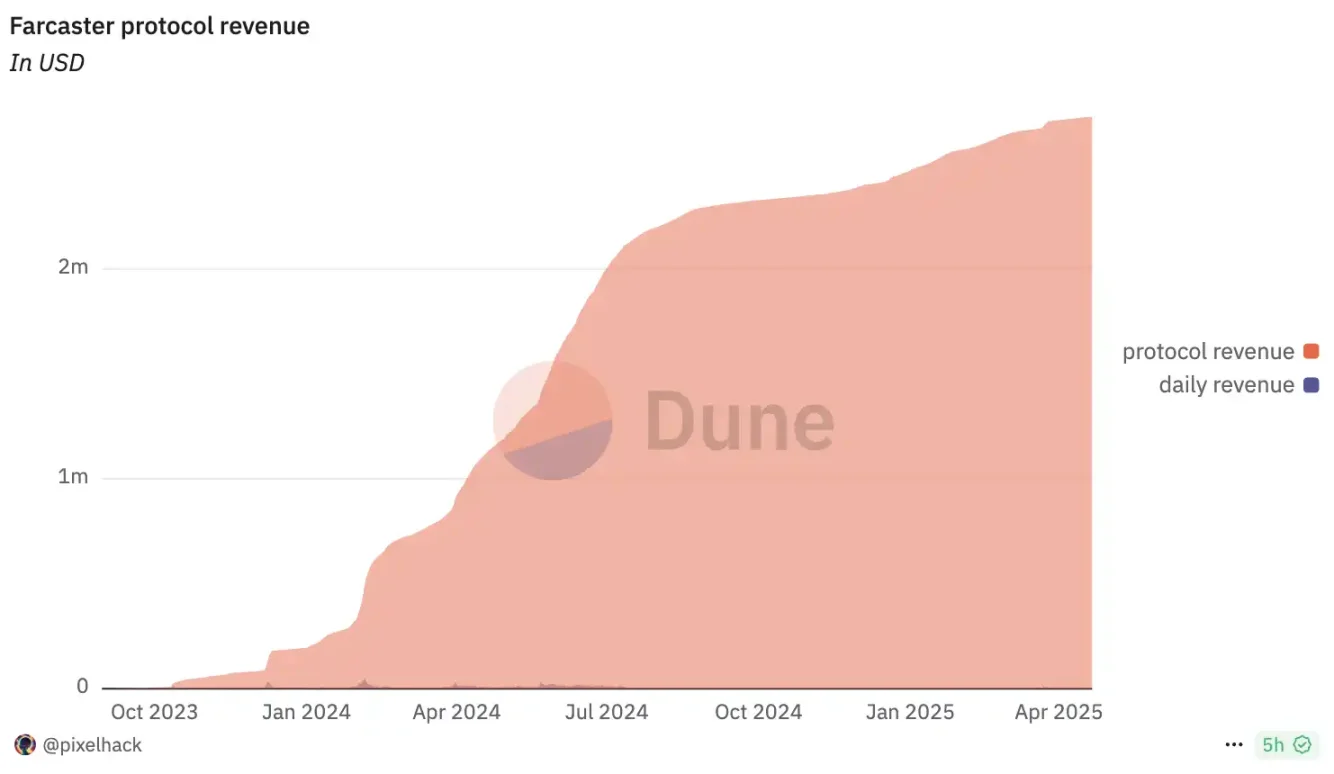

According to official documentation, users pay a 0.85% fee when using Warpcast Wallet: 0.15% goes to the 0x protocol providing routing, and 0.70% flows directly to Warpcast revenue. Dune data shows a steady upward trend in Farcaster protocol revenues since launch, preliminarily validating the embedded wallet as a viable monetization path.

However, it's important to note that the Warpcast wallet is not written into the protocol layer. Combined with the plan to rename the Warpcast client to Farcaster, some Farcaster developers believe the protocol is becoming increasingly centralized and monopolistic, according to BlockBeats.

The Biggest Innovation Is Just "WeChat Mini Programs"

With the introduction of the built-in wallet, Farcaster advanced further toward becoming an asset-oriented social application. Officials stated one purpose of launching the wallet was to attract developers to build applications on the Frame framework, merging transaction behaviors with content distribution.

Frame was first introduced in early 2024 as a lightweight app standard running on the Farcaster protocol, allowing developers to embed mini-programs into social clients. When users click a Frame, developers can identify their wallet address and push content or trigger interactions. However, as overall Farcaster热度 declined, Frame usage showed clear signs of decay.

To counter this, Farcaster launched Frame v2 by the end of 2024. The new version supports building near-native-experience apps using HTML, CSS, and JavaScript, and offers a Mini App SDK for rapid deployment without app store approval. Frame v2 significantly increased interaction complexity and deepened integration with the built-in wallet, further strengthening transaction capabilities—making the experience strikingly similar to WeChat Mini Programs.

In March 2025, Linda Xie, co-founder of Scalar Capital and Bountycaster, joined the Farcaster team to lead developer relations, focusing on advancing and promoting Frame. At the same time, Farcaster launched an “airdrop program” to incentivize developers to build apps using Frame v2 and reach users via token drops. While not involving official token airdrops, this mechanism effectively boosted user growth. Mid-March saw Farcaster’s DAU briefly exceed 40,000, hitting a new peak.

In early April 2025, Farcaster officially rebranded Frame as Mini App, placing it alongside Wallet in the bottom navigation bar of the Warpcast client.

Currently, a number of lightweight, on-chain interactive apps are integrated within Warpcast, making Mini App a core part of the ecosystem. Yet from a user acquisition standpoint, Mini App’s growth-driving capability remains underwhelming, and its long-term role is still uncertain.

The Disappearance of "Web3," the Failure of Silicon Valley Legends

In truth, Farcaster’s evolution isn’t unique—it simply exposes the structural困境 facing the entire Web3 social sector: open protocols fail to achieve scale, content fails to drive transactions, leaving asset-driven models as the only viable path forward.

Do we really need a “decentralized social platform”?

From $DEGEN to $CLANKER, nearly every breakout moment for Farcaster has been tied to assets. What truly drives spikes in daily active users isn’t protocol upgrades or client innovations, but repeated wealth effects fueled by tokens. This recurring pattern reveals a fundamental truth: Farcaster isn’t “unused”—it’s only used when there’s money to be made. These platforms do meet a market demand, but their role isn’t as social networks—they’re asset distributors.

This is no accident, but the inevitable result of a persistent misalignment between crypto narratives and real-world usage.

In 2020, BlockBeats published an article titled *The World Hates Today’s Social Media*, arguing that decentralization and protocolization might be the only way out of the “platform trap”—that open protocols carried hopes for a “new social order” amid tightening content moderation and platform monopolies.

At the time, Twitter was seen as a failed attempt at protocolization: it briefly opened its API to encourage ecosystem development, but ultimately reverted to the old path of ad platforms and data monopolies. Farcaster’s original ambition was precisely to “not become the second Twitter,” declaring its intent to connect developers, users, and assets through an open protocol to build a co-owned, decentralized social network.

Three years later, however, Farcaster hasn’t replicated Twitter’s early protocol ideal—it has instead mirrored Twitter’s later platform logic. Dan, once urging others to “build your own client on the protocol,” is now unifying the client under the Farcaster name, tightly binding “protocol” and “product.”

This shift is rational—at times even a realistic compromise—from a product-market fit perspective. But it also shows how the idea of an “open ecosystem” has quietly become a narrative tool for user growth. Developers aren’t truly empowered; they’re used to tell stories. Like Twitter shutting down its API, developer ecosystems serve only as temporary fuel toward a closed platform loop.

In three years, Farcaster has proven one thing: in the context of crypto, social protocols cannot form the kind of ecosystem we envisioned in 2020. Not because no one builds clients, but because no one uses them. Not because they’re insufficiently decentralized, but because decentralization simply isn’t something users care about.

Today, SocialFi, much like GameFi, is increasingly labeled a “dead” category. Recently, a prominent KOL criticized a founder of a decentralized social app: “After all this time building traffic, your follower count isn’t even higher than mine as an individual regular KOL. What skills do you really have? Your company raised $2M—what did you actually do? I make more profit from a single SOL wallet.” Amid the laughter, one can’t help but reflect: the era of building infrastructure on narratives is over. The entire VC valuation system is being restructured.

Crypto Is Not the "Next Internet"

a16z was one of the biggest evangelists of this narrative, having invested early in Twitter, Facebook, and other social platforms. When a dominant player like this encounters decentralized social products, it naturally feels compelled to participate. As one Google executive put it: “They act like lunatics, arrogantly inserting themselves into every deal.”

a16z, short for Andreessen Horowitz, takes its name from co-founders Marc Andreessen and Ben Horowitz, established in 2009. Known as legendary software investors, they’ve backed nearly every major internet giant: Facebook, Twitter, Airbnb, Okta, GitHub, Stripe, etc., combining early-stage sensitivity with mid-stage boldness—investing in Instagram at seed stage, securing a spot in GitHub’s Series A, and leading Roblox’s $150 million Series G.

Their foresight and aggressive investment style are even more evident in crypto. Their 2013 bet on Coinbase reached a peak market cap of $85.8 billion at IPO—one of the largest tech exits in history. After cashing out $4.4 billion, a16z still holds 7% of the company. OpenSea, Uniswap, dYdX, and other major crypto projects are also among a16z’s notable portfolio.

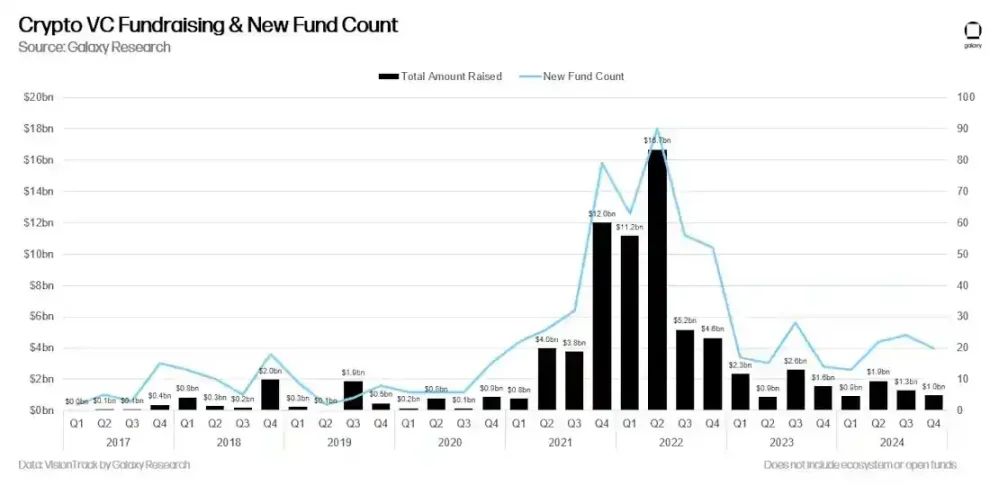

The crypto bull market since 2021 sent VC portfolio valuations soaring, delivering returns of 20x or even 100x. Crypto venture capital suddenly looked like a printing press. Limited partners poured in, eager to catch the next wave. Fund sizes grew ten to a hundredfold, driven by the belief that such outsized returns could be replicated.

Farcaster was born at the peak of this liquidity surge. In July 2022, Farcaster announced a $30 million round led by a16z. Two years later, it raised another $150 million at a $1 billion valuation, led by Paradigm and joined by top-tier VCs including a16z crypto, Haun, USV, Variant, and Standard Crypto. This made it the largest funding round in Web3 social history. At the time, Fortune magazine noted that this valuation reflected internal fund dynamics more than actual market demand.

As crypto investor Liron Shapira observed: “If a VC still has LP capital available, choosing to deploy $150 million instead of returning it generates an extra $20–30 million in management fees.” This wasn’t market validation for Web3 social—it was a self-sustaining capital loop. Fortune also cited an anonymous source constrained by business relationships, saying—as with most protocols—he expects Farcaster will eventually launch a token, which investors will eagerly monetize at full dilution.

An a16z partner once argued that “technological waves often emerge in clusters,” using this to justify the convergence of Web3, AI, and hardware. But they ignored a basic truth: every leap in mobile internet—from smartphones to search engines—was rooted in real user pain points and genuine technological breakthroughs, not structural bubbles fueled by capital narratives.

“Software is eating the world” was once a radical yet accurate thesis, but it presupposes that technology holds overwhelming superiority at a foundational level. AI exploded because it challenges individual intelligence—a structural shift no one can resist. Blockchain, however, challenges sovereign currency and a two-thousand-year-old trust system. It won’t disrupt society explosively like the internet or AI, but will slowly evolve over long cycles, absorbed and co-opted by existing power structures, ultimately rewritten as part of the old order.

Thus, the reality is that almost every crypto system accepted by users and creating real value operates on “mechanism-driven + liquidity-first” principles. From Uniswap to Lido, GMX to friend.tech, they rely on financial gravity, not idealism. The VC model of “investors changing the world” simply doesn’t work here.

Crypto has never lacked social tools. The so-called protocol ideal is merely the industry’s nostalgic projection onto the internet platform era—an attempt to replace business models with consensus mechanisms, only to defer structural problems until the asset monetization phase.

The biggest crisis in crypto today isn’t regulation or technology—it’s strategic confusion and demand vacuum. Beyond gambling logic and cross-border payments, hardly any sector demonstrates sustained capacity to generate user value. The failure of VCs is fundamentally a directional silence in the absence of value: if the industry lacks intrinsic worth, value discovery was impossible from the start.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News