To Buy or Not to Buy: How the Chinese-Speaking Crypto Community Views Real Estate

TechFlow Selected TechFlow Selected

To Buy or Not to Buy: How the Chinese-Speaking Crypto Community Views Real Estate

Yield or peace of mind?

⌈Buying a house⌋ has always been one of life's central missions. Yet for contemporary individuals, it has gradually shifted from an absolute priority to a complex decision requiring careful deliberation.

For the affluent, purchasing property may not require much additional consideration. But for those still striving financially, soaring housing prices have forced them to treat homeownership as "not so urgent." For middle-income professionals with genuine housing needs, buying a home is often a bittersweet milestone—on one hand, owning a title deed means having a space truly your own, bringing undeniable peace of mind; on the other, in an uncertain real estate market, buying a home could mean facing continuous losses—emptying multiple wallets only to wake up each day losing money. Faced with such an ambiguous future, ⌈buy or rent?⌋ remains an enduring social debate.

Among crypto-native communities highly sensitive to asset returns, views on real estate—a major physical asset—spark even more radical debates. Over the weekend, the Chinese-speaking crypto community engaged in extensive discussions about home ownership, with diverse and insightful perspectives emerging.

1. The Anti-Purchase Camp: Real Estate Returns Are Too Low—Don’t Buy!

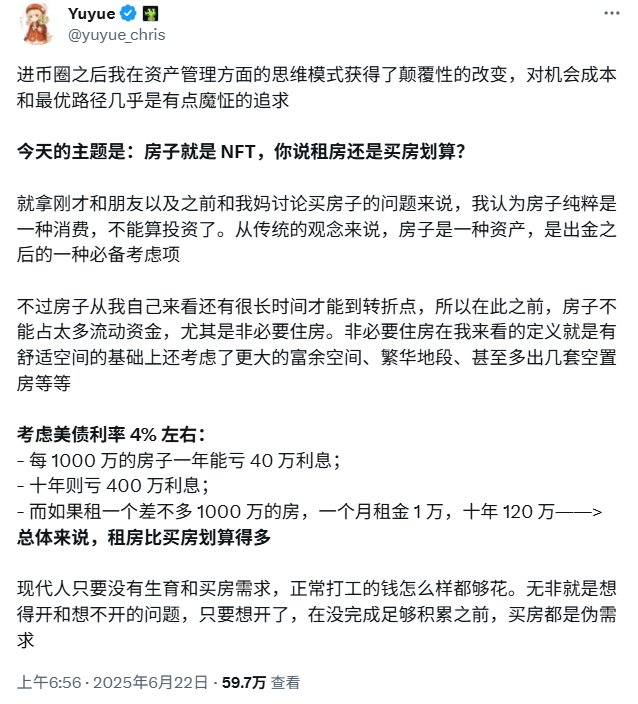

Yuyue (@yuyue_chris): Buying now leads to annual losses

The discussion originated with X user Yuyue.

Yuyue argued that from the standpoint of optimal asset planning, buying property (especially non-essential housing) is currently not a sound financial decision. Using the current U.S. Treasury yield of 4% as a benchmark, purchasing a 10 million RMB house results in an annual opportunity cost of 400,000 RMB in forgone interest. Renting an equivalent home would be far more economical. Thus, buying a home today should be seen purely as consumption—not investment.

0xTodd (@0x_Todd): Buying property is like running 2–4x leverage while paying fees to go long

"Purchasing a 10 million RMB house—the actual construction cost doesn't exceed 10%. The remaining 90% is essentially premium paid for a call option. With a rental yield of just 2.5%, you're effectively losing 2.5% annually—250,000 RMB—in interest, not even counting the inflation differential caused by China printing more yuan than the U.S. prints dollars. And if you take out a mortgage, the annual interest loss becomes even greater."

"If you spend 10 million RMB on a 100 sqm apartment, someone else can live in a 200 sqm unit in the same area using the interest generated from that same amount. While owning might feel better emotionally, the rented option offers double the space. Or they could rent the same 100 sqm unit and use the extra 250,000 RMB for various consumptions and experiences, creating richer memories rather than fewer. Therefore, we must recognize: buying a house is effectively taking 2x–4x leverage while paying ongoing fees to stay long."

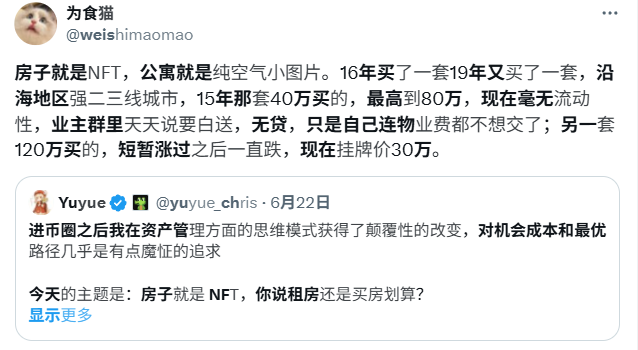

More homeowners sharing firsthand experiences:

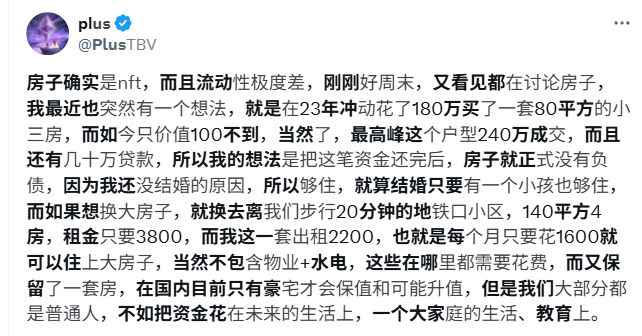

X users @weishimaomao and @PlusTBV shared personal stories illustrating the feeling of “blow-up losses” from home purchases, suggesting that allocating large capital toward real estate may be less fulfilling than spending it directly on life experiences.

2. The Pro-Purchase Camp: Emotional Value + Asset Value Make It Worthwhile

Ice_Frog (@Ice_Frog666666): If feasible, owning a home accumulates emotional wealth

"Beyond improving living standards, a house can carry and record precious memories. This effect is especially pronounced when buying a villa with a large yard in the suburbs.

When there are several children in the family, this house becomes their entire childhood—the backdrop of every joyful moment growing up. It turns into an invisible family photo album.

The warmth of these moments, the accumulation of emotional value across time—that’s what true 'legacy' means."

Tangtang (@lichuan679): Homeownership is asset allocation; the pledgeability of real estate is underestimated

"Although the upfront cost is high, buying a house is fundamentally 'forced savings + holding hard assets long-term.' If you purchase a scarce property in a prime location, its inflation resistance and risk hedging capabilities are significantly stronger."

"Real estate—particularly high-quality properties in first-tier cities—can still secure low-interest loans from banks during systemic financial crises. That gives you a powerful weapon—'offensive when possible, defensive when needed.' The underlying reality: China’s—and many regions’—financial systems favor real estate collateral far more than other asset classes. This isn’t about market efficiency—it’s institutional privilege."

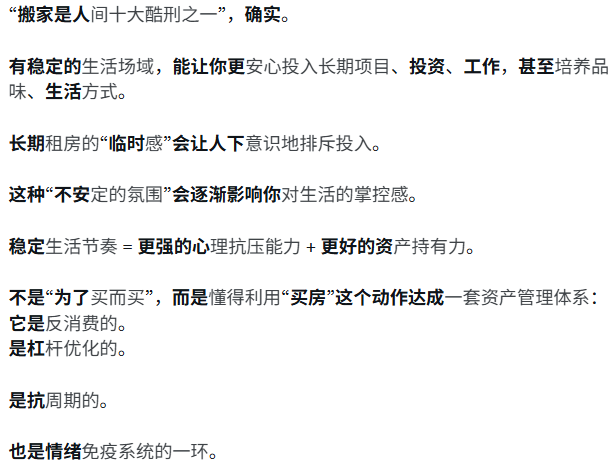

"The 'temporary' mindset of long-term renters subconsciously discourages investment in their surroundings. This sense of instability gradually erodes control over life. Stable routines = stronger psychological resilience + better ability to hold assets. It's not about 'buying for the sake of buying,' but understanding how 'buying a house' can form part of a comprehensive asset management system—one that counters consumption, optimizes leverage, withstands cycles, and strengthens emotional immunity."

upzhu.eth (@bubblegold2): Real estate holds advantages in asset preservation

"From a pure rent-to-price ratio perspective, renting is clearly cheaper—especially for luxury homes where the ratio is even lower.

But from an asset preservation standpoint, owning property has inherent advantages, particularly quality homes in first-tier cities. Compared to volatile digital assets, good real estate doesn’t lose value as easily or rapidly, and it can generate bank liquidity.

So if you’ve made money in crypto, you still need to buy a solid home. At least if you ever lose everything in the crypto world, you’ll still have a safety net and won’t fall back into poverty."

3. Mixed Viewpoints: It Depends on the Individual—Focusing Solely on ROI Isn’t Always Best

SweetY (@shirleyusy): Buying a house loses less money than buying NFTs

"Look at it differently: buying a Bored Ape lost 99%; using funds from that loss to buy a luxury home in a first-tier city might only result in a 20% loss. When investing turns into unavoidable consumption, you might as well consume wisely."

cryptoolddog (@CryptoOlddog): Financially unwise, but brings peace of mind

"1. From a purely financial perspective, real estate is a poor financial product. If capital is tight, don’t buy.

2. But houses do provide emotional value—similar to buying a luxury car:

Emotion One:

You can customize your space, invest freely in lifestyle upgrades—like a 30,000 RMB mattress—without fear of eviction.

Emotion Two:

The security of knowing you have a place to live, even in worst-case scenarios.

Emotion Three:

A defensive asset. In the high-risk crypto industry, if things go south, you still have tangible assets in the real world.

Emotion Four:

Marriage, dating, social interactions—no matter how persuasive words may be, nothing reduces communication costs quite like that red property deed. Just like driving a Maybach sends signals instantly—sometimes objects speak louder than words."

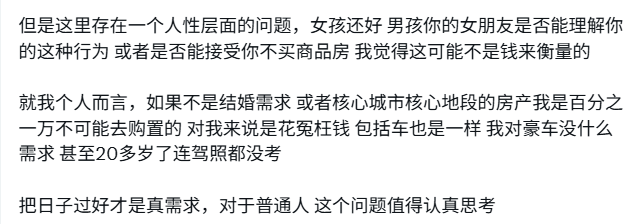

BY (@By_Web3): Housing demand also involves human nature

For ordinary people, buying a home isn’t just an economic decision—it includes life milestones like marriage.

TingHu (@TingHu888): Investment decisions must account for human nature—owning property is safer than all-in speculation

"It’s simple: when real estate makes up a small portion of total assets, you won’t obsess over its cost-effectiveness.

Many people sell or mortgage their homes to invest—all 99.9% end tragically. Meanwhile, those who cash out gains to buy property may face drawdowns, but at least preserve most of their profits.

Investing isn’t just about return ratios—you must also consider the negative aspects of human psychology. If you can’t control excessive greed, playing it safe is wiser."

Whether to buy a home is ultimately a deeply personal choice.

Judging from the discussion, participants used factual examples to support their positions. But stepping beyond any single viewpoint, ⌈low property returns⌋ and ⌈the joy of homeownership⌋ aren’t mutually exclusive. Many people’s hesitation toward home buying may not simply stem from real estate being “insufficiently excellent” as an asset—rather, excessively high prices and weak economic outlooks are the dominant factors.

As a basic necessity, whether to rent or buy depends on individual circumstances and values. Those with sufficient means can reasonably treat housing as consumption without worrying about returns; those with tighter budgets choosing to rent are making rational choices under their conditions.

Neither ⌈absolutely must buy⌋ nor ⌈absolutely never buy⌋ should become ideological dogmas.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News