How to Build Your Ponzi Economic Empire?

TechFlow Selected TechFlow Selected

How to Build Your Ponzi Economic Empire?

In this industry, we can successfully attract investors only by continuously innovating in storytelling and funding mechanisms—an approach that has been proven effective over time.

Author: Jordi Alexander

Translation: TechFlow

Preface

Zeus, founder of OlympusDAO Famiglia, leads a powerful alliance of crypto enterprises. In its first year of operation, their token $OHM grew into a multi-billion dollar capital market.

My advisors told me you're waiting for my advice on how to build your own Ponzi empire.

Well, it's a complex undertaking, but I'll help you sort it out.

But be prepared—because if you succeed, as a sign of respect and in return, you must mint your wealth empire by purchasing my coin.

If you're ready, then bend down and kiss my arm—I shall become your God.

Chapter One: The Birth of a Ponzi Empire – Caveman Classic

The first thing you need to do is ensure that before the show ends, you won’t end up behind bars.

Some mobsters simply steal money and run, spending their lives hiding from police.

That’s not how my empire operates. Is it deception? Misdirection? Yes—but we always maintain plausible deniability. That’s the key.

Are we bad guys? Who really defines what's bad?

Let’s start with the original Ponzi—Caveman Classic.

It’s as simple as ABC.

A) The Beginning

Two cavemen each "invest" 1 gold coin into a wealth bucket they call the Treasury. (He didn’t write A, so I added it myself.)

Then, for those two coins, they issue 2 PapyrusCoins each, totaling 4 coins. Each PapyrusCoin can be redeemed for 1 gold coin at any time.

Since there are only two gold coins in the Treasury, either caveman could sell their PapyrusCoins and leave the other holding an empty bucket.

But if they agree not to sell immediately and wait for bigger fish to bite…

B) Marketing

The cavemen send out many little blue birds to spread these messages:

PapyrusCoin doubles your wealth!

*chirp chirp* *chirp chirp*

Invest gold, withdraw anytime!

Cavemen become rich one after another. Now the wealth bucket holds 100 gold coins and 200 PapyrusCoins—the two cavemen can now play musical chairs and double their wealth again.

PapyrusCoin backed by a healthily growing Treasury

But why stop at doubling?

C) The Papyrus Printer Starts Working...

For greater returns, it’s time to expand supply…

Every noon, all loyal PapyrusCoin holders can enter the Printing Cave and receive one additional PapyrusCoin for every PapyrusCoin they hold.

They tell their investors: “If we all just hold and don’t sell, we’ll all get richer!”

The next day, the original cavemen will each have 4 coins; by the fifth day, they’ll have 32!

If they cash out those 32 PapyrusCoins now, the bucket still has 100 gold coins—so while others are still grinding, the original cavemen quietly walk away with 32x per coin.

The problem with Caveman Classic is that because it’s too simple, some participants figure it out too early.

But no need to worry—powerful tools of efficient production can keep your Ponzi empire running long enough for you to extract far more.

We’re talking G5s here—yes, a G5 jet.

Chapter Two: Add Complexity and Build a Facade

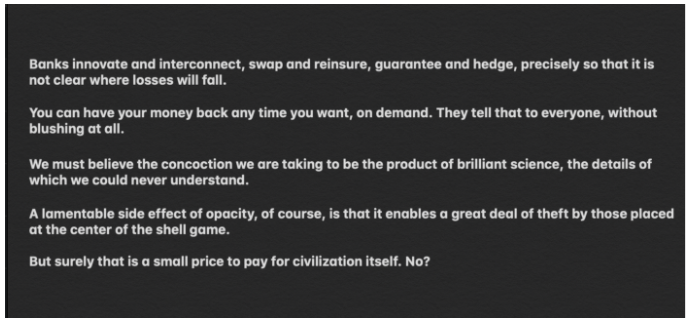

In this industry, innovation in storytelling and financial mechanisms is the proven way to successfully attract investors.

Complexity, obfuscation, and circular logic may seem unattractive, but Hugo Boss suits do the same thing on Wall Street.

Long before 20th-century investment banks launched enticing exotic derivatives and CDO-squared, traditional bankers had already figured out this game.

Source: https://www.interfluidity.com/v2/2669.html

Many investors have suffered losses before. Since they instinctively doubt such schemes, all we need to do is provide enough answers to dispel their skepticism. Deep down, most people want to hear a hopeful voice telling them they’ve finally found the path to wealth.

Let’s recognize the importance of an effective facade organization for the enterprise.

https://www.olympusdao.finance/

Many Ponzis use food names as facades; others use arcade themes.

But trends change, so we decided on an eternal Ponzi facade—becoming the new “world reserve currency.” That’s timeless.

I know what you’re thinking—people naming everything in life after Ponzi coins hasn’t happened yet. Or maybe we’re just ahead of our time. Good luck to all!

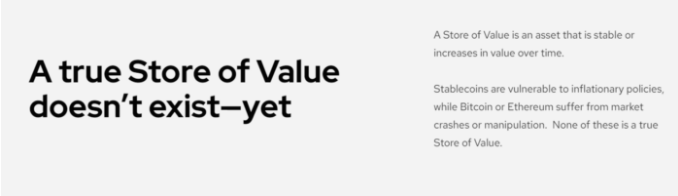

Now let’s reverse the facade: present a “problem” to the world and sprinkle in some fancy-sounding but meaningless terms:

Dollars, BTC, ETH? All terrible in some way!

Ultimately, it doesn’t matter what outcome you promise the cavemen—as long as they keep believing you until you’ve converted your PapyrusCoins into cash.

So enjoy being the “reserve currency of DeFi” or “the reserve currency of gaming.”

Maybe even the reserve currency of Seinfeld, promising everyone soup.

Of course, the fancier the terminology, the better—pull out your dictionary and play Smoke and Mirrors.

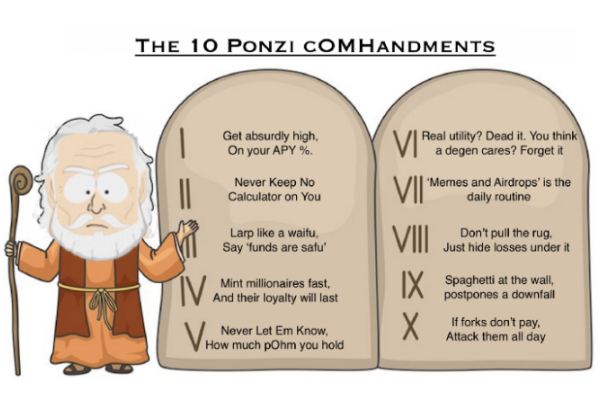

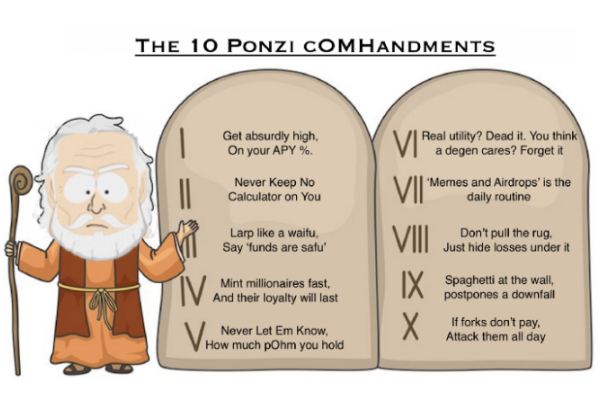

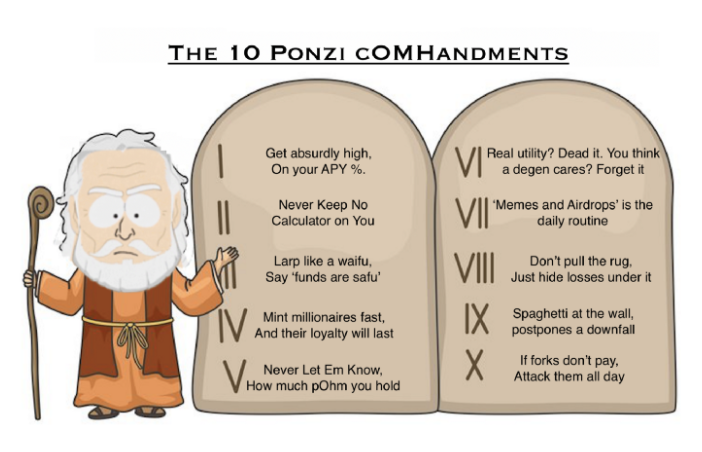

Chapter Three: The First Six Ponzi Commandments

To fully enter the family, you must first undergo the initiation ritual. Extend your hand and bleed for it.

As the blood drips, kneel and swear allegiance to the Ponzi commandments.

This is the code you've lived by thus far—memorize it well.

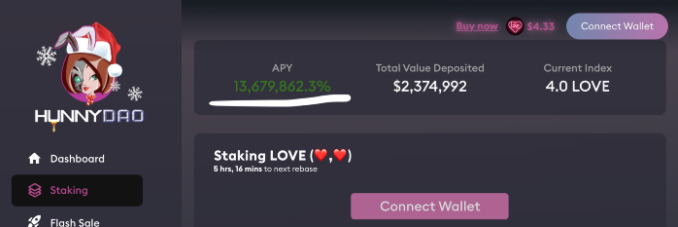

Commandment 1: Make Your APY Ridiculously High

Headline Rule: Ignite Greed Within.

When people feel they’re in a land of abundance, their primal instinct is to grab first and think later.

To exploit this powerful drive, offer the prospect of billions in returns.

Now, if you don’t have that money, you can’t guarantee these returns will be actual dollars—remember, plausible deniability!

But you can pay in your own tokens, which you can print infinitely and for free! So take them down the dopamine highway—give them absurdly sweet APYs!

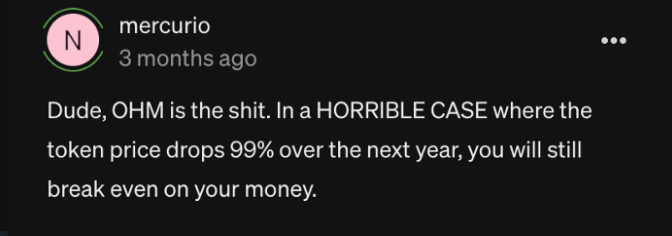

Of course, extremely high APY means the token value dilutes at an extremely high rate.

But unless explicitly explained, many investors believe yield and token price are independent variables—even if they “unfortunately” lose on price, they can make up for it via APY.

Retail users arrive at an impeccable conclusion

Why correct them? Better to include limited-supply, yield-generating projects in the legitimate category.

Even established blockchains like Ethereum and Solana offer shareholder yields without clearly explaining dilution! Not to mention protocols offering yields on tokens with capped total supply.

In fact, APY should be called SPY—Speed of Robbing You.

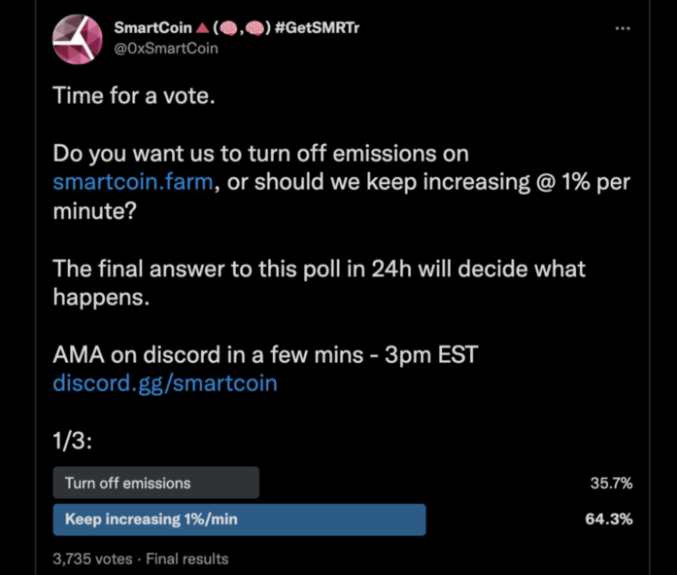

Here’s an anecdote—a rival family, SmartCoin, ran a Twitter poll asking their diamond hands whether they should increase APY further.

What’s really happening? The higher the APY, the more gold coins the protocol distributes. Great, right?

Well, when people are led to believe real wealth flows from the protocol to users as yield, the protocol actually loses nothing. In such a system, creating heat from nothing violates the first law of thermodynamics.

It’s actually PvP mode—wealth transfers from “brave” diamond hands to those happy to sell their ever-increasing APY rewards.

By draining real assets from the liquidity pool, more and more useless Ponzi tokens remain. Thus, whoever sells fastest in the liquidity pool earns the most.

So use easy APY gains strategically. If people think 1000% annual interest sounds too good to be true, they’ll ask: “Where is all this new wealth coming from?”

Then, tell them these rewards are gifts from God for obeying these rules and having faith!

Commandment 2: Larp Like Waifu, Say “Funds Are Saifu”

Once you’ve ignited their greed, you must now guard against their fear. Their anxious hearts whisper: “This deal is too good to be true.”

First, our Famiglia uses the time-tested strategy of creating an aura of complexity with fancy jargon. So go ahead—“leverage the power of game theory.”

Use this halo of complexity to make people believe you’re a financial genius who’s devised an incredible, almost incomprehensible monetary solution.

Gigabrain Financial Mentor

Terms like “investment protection” sound familiar—like what people hear when depositing money at local banks. Use suggestive language whenever possible—say things like funds are safe!

Go to our designed treasure trove—advertising support! Say it’s all “backed by a growing, revenue-generating treasury.”

From all revenues, set aside a portion—say 25%—as a reserve. This way, people aren’t afraid your token has no backing.

You can continue “growing the treasury”—so even if token count grows faster, each token still has minimal backing.

This gives you the best of both worlds! While retaining dollar backing, you still enjoy 75%.

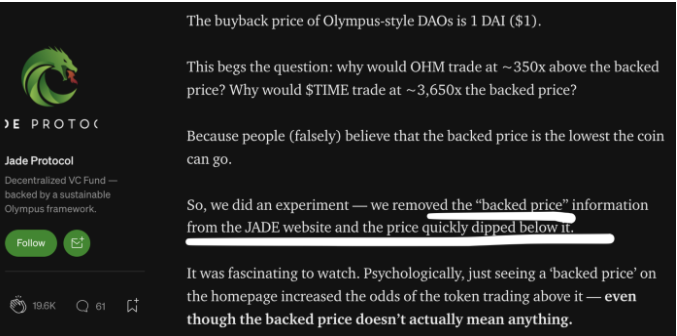

Rival Jade Protocol shows what happens when you remove these reassuring words from your website. Continue the story—when you take away this security blanket, people panic, and prices quickly drop from $100 to under $18!

So, use words like “sustainable” to create a sense of financial safety.

How is it sustainable?

It means if you give me $400, I’ll give you a $1 token with 7614% APY.

Don’t worry about doing APY math to recover your $400 on your $1 token. APY keeps dropping at an unpredictable rate, so you can’t calculate it.

That’s rule number three!

Commandment 3: Never Carry a Calculator

You know the saying about lies—there are lies, damned lies, and statistics. Our official documents put even untrustworthy statisticians to shame.

As long as you keep quant analysts wanting to play “Math Cops and Robbers” away, you’ll get away with it.

Stay far from that guy and his calculator.

If your “freedom” with math goes too far, best to quickly ditch your calculator and pretend ignorance.

Take the basic game theory matrix in our documents. The entire pagan cult—oops, Famiglia—is built on the idea that cavemen don’t sell but instead hold creamy cannolis, green pistachio (3,3) cannolis…

Of course, this mathematical assumption doesn’t hold—not even in official documents—but remember, people just want to believe.

So why tell them what they really need is a hidden assumption—that there will always be infinite new suckers joining at higher prices! (3,3,-6)—better erased from history.

Better to coldly fill pages with disclaimers saying “numbers are hypothetical, approximate values only.” That way, you get the benefits of math without ending up embarrassed like bankrupt girl Matt Levine:

Admittedly, I stay up late because there are some red flags inside—maybe one day they’ll be exposed and cause us trouble.

If you swear secrecy, I’ll tell you an especially embarrassing secret. I might’ve gone too far on this one.

See, to convince other cavemen their money is safe, in our official FAQ we described what happens if a bank run occurs.

Our Famiglia business premise is that holders can sit back enjoying their (3,3) life without fearing dumps from others.

Assume everyone’s holdings double, but since no one sells, prices stay unchanged—then theoretically, everyone seems richer! But in a closed system, wealth isn’t created or destroyed. Where did it go?

Yes, it hides in illiquidity! When all tokens sell with no liquidity, all we see is the marginal price before people start selling.

Thus, market cap calculation (token Price × quantity) is deeply flawed: the first seller exits at 2.0x, lowering the price.

The next gets 1.9x, and so on—until the last brave Spartan diamond hand realizes they funded every winner’s gains.

So how does the official document claim holders are protected, doing better in a bank run if they don’t sell shares? It starts at $500, assuming sellers keep selling far above support price, down to a single cannoli price. Here’s the hidden secret:

-

What actually happens?

In a bank run scenario, the earlier you sell to AMM and escape Olympus, the better. Once all blue areas are drained by sellers, the last standing stake drops over 90% to $38!!

-

What does the official document say happens?

96.7% of holders sold to AMM. Why 96.7%? I made it up.

Because if 96.7% of OHM cash out to AMM, it’s indeed great for the remaining 3.3%, as many OHM sellers dump at ultra-low prices (far below per-share RFV).

In this fictional scenario, the remaining 3.3% capture the green area in the chart, mysteriously abandoned by ultimate sellers. They end up with all the wealth, “proving (3,3) is real.” Remember, stay serious.

From our support requests, a typical PhD with 40 years of experience won’t catch this.

So don’t worry—leave your calculator at home, because preventing this mathematical crime requires giants to spend all day doing actual math. And that’ll never happen... right?

Commandment 4: Quickly Create Millionaires—Their Loyalty Will Last

A successful ad doesn’t just show a product—it gives vivid examples, like “the fat guy got muscles.”

The implied message is powerful: “If you invest and follow instructions, you’ll succeed too!”

For a successful Ponzi, the equivalent marketing tactic is making some early investors rich—because their success spreads the word and keeps them in the community.

As long as they believe and don’t cash out early, it’s not hard to achieve.

Say you have 5,000 people investing $100K each.

That’s $500 million. Design a mechanism where the first 100 people get 10x returns. For growth, it’s an expensive but worthwhile $100 million investment.

These 100 people will be active, mobile, and tweet proof your protocol makes cavemen wealthy.

Even better, most will be so grateful they won’t cash out paper profits.

By “borrowing” others’ money to change some lives, you also create extra incentives—the winners of this wealth redistribution will be your loyal rebels till the end.

They’ll fiercely defend the Famiglia against anyone slandering it on social media. They’ll evangelize to everyone they know. They’ll work harder for you than any paid employee.

That’s the difference between hired soldiers and rebels fighting for a cause.

Commandment 5: Never Let Them Know How Much pOhm You Hold

Since we’ve thrown such a great party for everyone and spared no effort bringing new “customers” to sell, surely we should reserve some cannolis for ourselves, right?

A good magician knows how to create dazzling performances and psyops to keep eyes off his nimble hands while stuffing cannolis into his pockets.

We designed a method to retain our share in this zero-sum game—we named our cannolis “pOhm.” To avoid legal liability, we announced this mechanism long ago, then went to feast buffet-style! Dig in!

pOhm holders get 11.8% extra dilution—official document

Every $1 million market cap cuts $118,000—it’s a spicy meatball!

Here’s some extra magic: we can pretend we’re under long-term incentive alignment. This incentive targets maximum pOhm supply—we’ll have to wait until $5 billion OHM is printed. Everyone’s incentives align! Well, not quite yet…

Stay serious!

Want to know another Famiglia secret? One even our top bosses haven’t realized.

Truth is, how much pOhm we allocate to the team doesn’t matter! Recall that under extremely high APY, prices fall as numbers rise.

Numerical calculations of OHM make no difference. At any moment, pOhm already held has 11.8% of market cap available to dump. Whether it’s 11.8% of 5 million tokens or 11.8% of 5 billion tokens!

The only real incentive is dumping when market cap peaks—when you believe the caveman party is at its peak, their bucket full of gold.

In fact, if anything, because pOhm exercise cost is $1, it’s actually better to dump early—before price is diluted close to face value—rather than after. If the team waits too long, OHM converges to $1 expected price per mechanism, leaving them with worthless pOhm call options!

How about incentives?

The final perk of this mechanism is—even if you dump it all, the genius setup means all newly printed tokens soon start earning more pOhm, gradually approaching 11.8% again, ready for another dump!

That’s why you can never let them know how much Ohm you truly hold. Badabing, badaboom. It’s just business.

Commandment 6: Real Utility? Destroy It! Do You Think Degen Cares? Don’t Be Delusional!

$OHM should exist to increase utility by being a better store of value than dollars, Bitcoin/ETH. But the truth is harsh—what matters most to people is the story.

Sure, someone might have ideas on improving the world, but a real Chad knows—it’s not about how much utility you add, but how much value you have.

If you have ideas, people will find flaws and deem them insufficient! But if you have no ideas, you can say you’re “pre-idea,” a pure potential player.

Say you’re “flatcoin” without suggesting any basket to peg to—just pure play.

Say you have no implementation ideas, but you’ll design better monetary policy than central banks—pure play.

If asked, say it comes from collective wisdom of 1,000 DAO members. Most can’t distinguish “repo man” from “repo rate.”

If you go the utility route, you’ll end up like your first competitor.

Look at Reflexer Labs—the guy spent years trying to solve the same stablecoin problem with actual “ideas”—now he can’t even afford a Kia Sedona from Jay Peg’s Auto Mart:

Instead, if you want to innovate on something—raise the stakes for your users to new degenerate levels.

For extra degens, create utility by giving them chances to take more risks and spike adrenaline.

If we don’t offer this crazy gambling game, they’ll sadly turn to rivals’ gang casinos. I mean, have you seen how insane their APYs are?

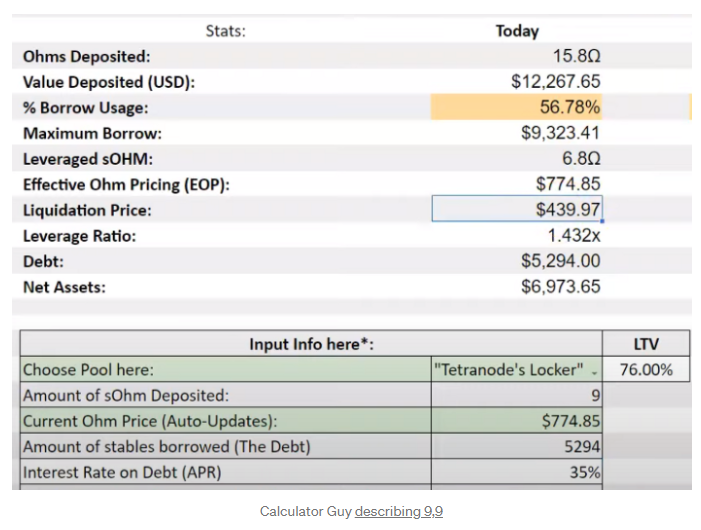

So we handle the tricky part too. For cryptobros, heroin means leverage! So we open turf to nearby loan sharks “Turknode,” letting him sit on the corner, giving Ohmers some real degenerate cracks.

Ohmers craving more than standard staking returns can get their “3,3 yield,” then use staked Ohm as collateral to borrow more USD, buy more Ohm, stake, borrow more USD… They call it poison (9,9).

Calculators describe (9,9): when times are good, (9,9) people get a larger share of inflation gains, diluting the (3,3) crowd.

Of course, until prices drop. A 40% price fall causes 100% loss for degens, plus massive liquidation fees.

According to protocol design, price decline is inevitable.

It’s all a ticking bomb sustaining the Ponzi life cycle—those seeking (9,9) get liquidated, their corpses feeding the other side.

If you wish to become a Made Man, study these first six commandments and stay tuned for the epic trilogy’s finale.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News