The Federal Reserve raised interest rates by 25 basis points as expected, signaling that the rate hike cycle is nearing its end.

TechFlow Selected TechFlow Selected

The Federal Reserve raised interest rates by 25 basis points as expected, signaling that the rate hike cycle is nearing its end.

The statement removed the phrase "ongoing rate hikes are appropriate" and replaced it with "some additional policy firming may be appropriate," which was interpreted as a dovish tone. The "dot plot" still maintains the year-end interest rate projection at 5.1%, suggesting only one more modest hike may be possible. The statement said U.S. banks are healthy and resilient.

Publisher: Wall Street Horizon

Author: Du Yushi

On Wednesday, March 22, the Federal Reserve raised interest rates by 25 basis points as expected, lifting the target range for the federal funds rate to 4.75%-5.0%, the highest level since September 2007—just before the onset of the global financial crisis.

This marks the Fed's ninth consecutive rate hike since March last year and the second in a row at a reduced pace of 25 basis points. Following the decision, markets continue to anticipate that the U.S. hiking cycle is nearing its end, with potential rate cuts beginning later this year, possibly bringing rates down to 4.19% amid signs of economic slowdown.

Major Shift in Statement Language: New Warnings on Banking Crisis Add Flexibility for Future Pause

The statement removed previous language stating that the Russia-Ukraine conflict "is causing immense human and economic hardship and is exacerbating global uncertainties." It noted consumer spending and production have seen "modest growth," while employment gains "have picked up in recent months and are running at a strong pace," with unemployment remaining low and inflation still elevated. The phrase "inflation has moderated" was dropped from the description of price pressures.

Analysts interpret this statement as signaling that the Fed’s hiking cycle may be nearing its conclusion, as it eliminated the phrase used in the prior eight statements—"ongoing increases will be appropriate"—replacing it with "some additional policy firming may be appropriate," thereby introducing flexibility to pause rate hikes going forward.

The statement also added new commentary addressing the recent banking turmoil. In addition to a new line stating, "the Committee will closely monitor incoming data and assess its implications for monetary policy," it reiterated readiness "to adjust policy stance as needed":

“The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly focused on inflation risks.”

Notably, the 25-basis-point rate hike passed unanimously among voting members. There had been speculation that newly appointed Chicago Fed President Austan Goolsbee might favor holding rates steady, but no dissent emerged.

At the same time, the statement reaffirmed the Fed’s commitment to fighting inflation. Beyond stating that "inflation remains elevated," the Fed reiterated it is "strongly committed to returning inflation to its 2 percent objective" through maintaining a "sufficiently restrictive monetary policy stance."

Additionally, the Fed raised the interest rate on reserve balances by 25 basis points to 4.90% and increased the discount rate to 5.0%, both in line with expectations. The central bank will continue reducing its balance sheet at the current pace—up to $60 billion per month in maturing Treasury securities and up to $35 billion in mortgage-backed securities principal runoffs.

Multiple analyses suggest that while the statement implies further rate hikes remain possible, the cautious tone regarding the recent banking crisis reflects growing concerns among officials about downside economic risks. The overall softening in language signals that the tightening cycle may soon conclude.

However, the statement also indicates it is too early to determine how significantly banking sector stress might slow economic growth. The continued emphasis on high inflation suggests the Fed currently views persistent price pressures as a greater threat to the economy than banking instability.

Dot Plot Keeps Year-End Rate Forecast Unchanged at 5.1%, Suggesting Just One More 25-Basis-Point Hike

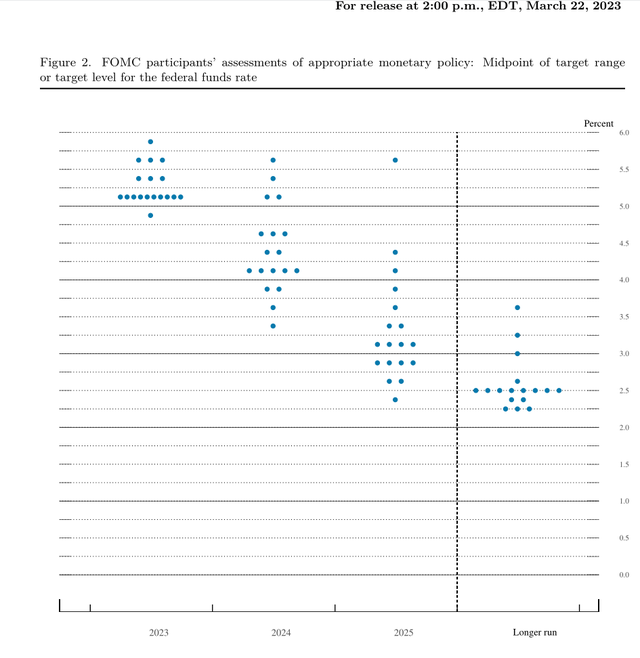

Support for the view that the Fed is nearing the end of its hiking cycle can also be found in the so-called "dot plot," which reflects policymakers’ individual rate projections.

Officials' median projection remains unchanged: a peak federal funds rate of 5.1% in 2023, matching the December 2022 forecast. The projected rate for the end of 2024 was revised up slightly to 4.3% from 4.1%, while forecasts for 2025 and the longer term were held steady at 3.1% and 2.5%, respectively.

The 5.1% forecast for this year suggests the Fed has room for only one more 25-basis-point rate increase. Among 18 officials, 10 support this outlook—a clear majority—while seven believe rates should go above 5.1%.

Some analysts note that beyond this year’s relatively consistent forecast, there is significant divergence among officials in their outlooks for the next two years. However, the median projection implies a 0.8-percentage-point decline in rates by the end of 2024 and a further 1.2-percentage-point drop by 2025.

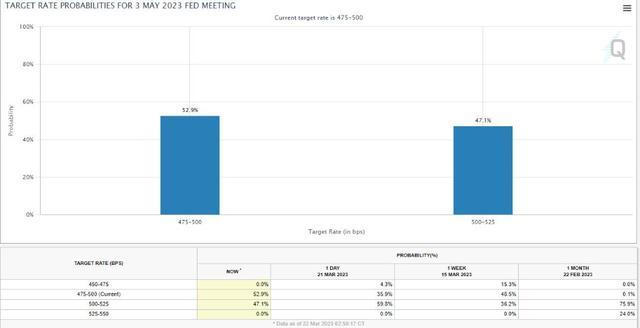

Following the announcement, CME Group’s FedWatch tool showed the probability of the Fed holding rates steady in May rose to 53% from 36% a day earlier, while the chance of another 25-basis-point hike fell to 47% from 60%. Interest rate swaps indicate traders expect rates to fall to 4.19% by year-end—suggesting market expectations are more dovish than those of Fed officials.

Commentators observed a large gap between the dot plot and overnight index swap (OIS) pricing, indicating that markets expect the Fed to enter a cutting cycle sooner—or end its hiking campaign faster—than the central bank itself anticipates. Market pricing suggests investors see room for as many as two rate cuts this year.

Ashish Shah, Chief Investment Officer of Goldman Sachs’ Public Investment Business, said given the high degree of uncertainty ahead, the firm has chosen to downplay the significance of the latest dot plot and economic projections in such a rapidly evolving environment.

Fed Lowers GDP Forecasts for This and Next Year, Raises Core Inflation Outlook Further, Keeps Unemployment Projections Stable

In its quarterly economic projections, the Fed lowered its forecasts for U.S. economic growth in both 2023 and 2024, particularly for next year:

Reduced 2023 U.S. GDP growth forecast to 0.4%, down from 0.5% in December 2022.

Lowered 2024 U.S. GDP growth projection to 1.2%, compared to 1.6% previously.

Raised 2025 U.S. GDP growth forecast to 1.9%, up from 1.8%.

Maintained long-term U.S. GDP growth projection at 1.8%.

The Fed also adjusted its unemployment rate projections:

Lowered 2023 unemployment forecast to 4.5%, down from 4.6% in December.

Kept 2024 unemployment forecast unchanged at 4.6%.

Raised 2025 unemployment forecast to 4.6%, up from 4.5%.

Held long-term unemployment projection steady at 4.0%.

At the same time, the Fed further raised its inflation outlook—for both headline and core PCE prices:

Increased 2023 PCE inflation forecast to 3.3%, up from 3.1% in December.

Kept 2024 PCE inflation forecast at 2.5%.

Left 2025 PCE inflation forecast unchanged at 2.1%.

Maintained longer-term PCE inflation expectation at 2.0%.

Raised 2023 core PCE inflation forecast to 3.6%, up from 3.5%.

Increased 2024 core PCE inflation forecast to 2.6%, from 2.5%.

Held 2025 core PCE inflation forecast steady at 2.1%.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News