Two-sided AC: God or Public Enemy in the DeFi World?

TechFlow Selected TechFlow Selected

Two-sided AC: God or Public Enemy in the DeFi World?

What kind of DeFi world does he want to build?

In 2020's crypto world, AC (Andre Cronje) was the undisputed protagonist.

Over the past half-month, this South African sequentially led mergers between his own project Yearn and five others: Pickle, Cream, Cover, Akropolis, and SushiSwap.

Each merger triggered sharp price increases across corresponding tokens, rising from 30% to 80%.

Developer, artist, engineer, creator... Like any rising star, AC has been labeled with countless identities and tags.

Critics call him the next BM—his image could collapse in an instant; believers hail him as DeFi’s Musk or even Satoshi Nakamoto.

People love and hate him, unable to resist. Some vividly liken this state to PUA (Pick-Up Artist) dynamics.

Who exactly is AC beneath the façade? What kind of DeFi world does he want to build? And is it good or bad for the DeFi ecosystem?

God of DeFi or Public Enemy?

Just as Bitcoin purists formed a cult-like "Bitcoin religion" in its early days, in 2020, the Church of AC emerged.

It originated from Andre Cronje’s (hereafter AC) first DeFi project, Yearn (YFI).

From July 17 to September 13, YFI surged from $3 to $43,000—"a two-month rally equivalent to Bitcoin’s decade-long journey."

The 10,000x myth of YFI helped AC capture legions of investors.

These investors are mostly "scientists"—they believe in him, follow him, hoping he will create another YFI, another 10,000x token.

No matter what new project he launches, they rush in immediately—often without even knowing what the project does, charging in once they get the contract address.

Even a simple like from AC can be interpreted as a wealth code.

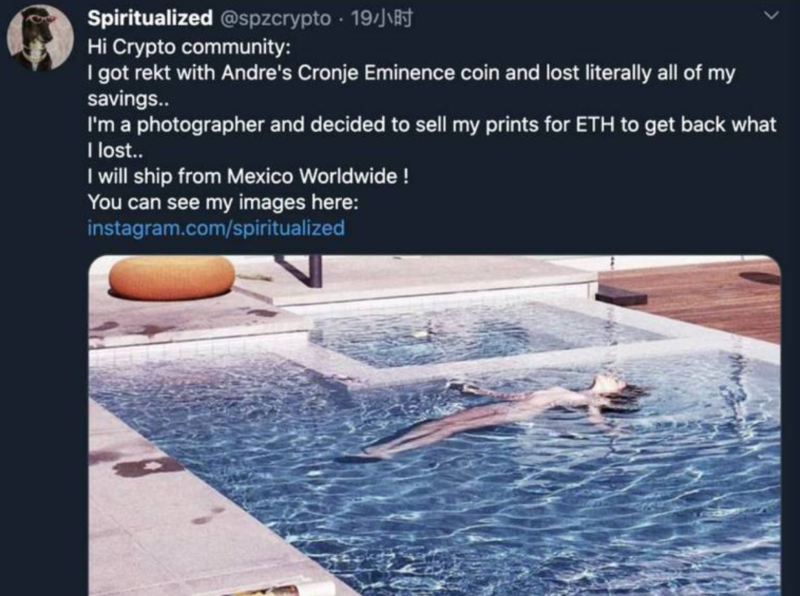

On September 29, AC liked tweets about Eminence.finance (EMN) twice on Twitter. Seeing this, investors rushed funds into the EMN contract.

At that time, EMN was still in testing and had not undergone security audits. Hackers exploited vulnerabilities to steal nearly $15 million.

Shortly after the EMN incident, AC introduced a new token model called Liquidity Income (LBI) on Medium, aiming to reduce impermanent loss.

But due to scientists flooding into the contract and inflating prices, LBI briefly spiked to $1,344, then crashed to $0.3 within seconds, eventually plummeting to $0.0045 overnight.

At this point, everything AC did remained under the shadow and light of YFI—he was still known as the founder or father of YFI. AC only stepped out of YFI’s aura and became a standalone concept starting in late October.

On October 29, AC launched Keep3r Network’s V1 test version—a decentralized on-chain service outsourcing network—with token KP3R. It debuted at 0.0035 ETH and rose to 0.373 ETH within six hours—an over 100x surge.

This time, KP3R didn’t crash after the spike. At the time of writing, KP3R stabilized around $444.

Then on November 10, AC announced a collaboration between YFI and decentralized options platform Hegic. After the announcement, Hegic briefly surged by 30%.

On November 23, AC unveiled Deriswap—a trading platform integrating exchange, options, and lending functions. "Just as cross-chain restructured the public chain race, Deriswap represents a higher-dimensional integration," noted one crypto analyst.

From November 24 to December 1, AC successively announced integrations between YFI and Pickle, Cream, Cover, Akropolis, and Sushi, triggering short-term gains of 20%–80% in each project’s token. Pickle rose 80%, Cream 70%, Sushi 30%—remarkable in an otherwise stagnant market.

After this series of moves, people realized AC wasn’t trying to make another YFI—he was attempting to overhaul the entire DeFi system.

Now, the title "YFI founder" faded—the AC concept ("universe", "empire") took center stage. Beyond scientists, more retail investors joined the Church of AC, becoming devoted followers.

Followers flocked to AC. They believed in him, followed him—whatever AC launched, they rushed in. That meant wealth.

Currently, the AC ecosystem spans swaps, options, lending, insurance, aggregators, and more. Investors now speculate: who will be the next to join the AC universe? Early investment means catching the wave.

"AC’s DeFi stack still lacks stablecoins and cross-chain assets," said investor Wu Yi, who is positioning himself in these areas, preparing to "ambush" AC.

AC has become the most influential figure in DeFi. Among the top 10 DeFi projects by TVL, three are linked to AC: Curve, SushiSwap, and YFI.

Believers crown AC as DeFi’s Musk and Satoshi, while "heretics" label him the next BM, waiting for the bubble to burst.

AC, the Next BM?

Since launching YFI, criticism toward AC has never ceased—it’s only intensified.

After Yearn, Andre developed or co-developed several other projects including Eminence, Liquidity Income, Keep3R, and Deriswap (not yet launched).

For ordinary people, building and operating one project is already challenging—but for AC, juggling ten projects seems effortless.

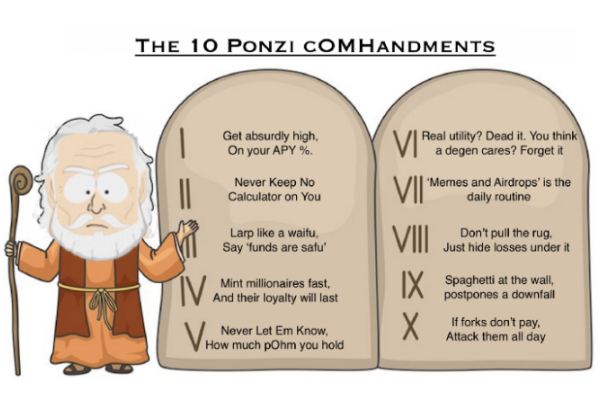

In superhero lore, there’s a famous adage: “With great power comes great responsibility.” Now it appears AC is living this principle. He’s thus dubbed the “token minting maniac”. He relentlessly opens new frontiers, regardless of cost or consequence.

Besides managing multiple projects simultaneously, AC is also known for “not caring about token value.”

"People have realized the product is a lie, adoption is a lie—all these products are garbage, and now the token itself is the new product," he reflected on ICO lessons in an interview.

When YFI skyrocketed thousands of times, AC stated he wasn’t interested in its sky-high price, even downplaying it by saying YFI’s real value was zero.

"I don't serve speculators," AC wrote. "Tokens are designed for specific systems; price doesn't matter."

Backed by the 10,000x legend and his selfless, no-vesting, no-inflation ethos, AC seemed like Jesus in the DeFi world.

Yet on the other hand, AC faces heavy scrutiny over pricing issues.

On September 29, hackers used a flash loan attack on EMN, stealing nearly $15 million, later returning $8 million to AC’s wallet.

AC’s reputation suffered greatly—even receiving death threats. He went silent for over ten days.

AC writes in his Twitter bio: "I test in prod." He refers to testing new products directly on the Ethereum mainnet. But investors rush into contracts based on AC’s testing activity—this is the core reason behind much of the backlash against him.

And AC prefers direct mainnet testing. For him, showcasing his testing process on mainnet is like publicly creating art in real-time.

"If you don't understand it, don't use it." Although AC pinned a warning about risks on Twitter, it does little to stop people chasing wealth. People love and hate AC in equal measure.

Some compare AC to EOS’s BM (Daniel Larimer): BM too was a “token minting maniac,” launching or co-launching BitShares, Steemit, EOS—each entering the top 10 cryptocurrencies by market cap, with EOS raising over $4 billion.

After EOS launched, BM fell from grace when Block.one’s investment secrets were exposed and EOS’s price declined.

Will AC suffer the same fate as BM?

"Both AC and BM are stars of their era, but AC achieves better synergy between projects and higher capital efficiency," believes crypto blogger 'Exploration Cat'.

But in my observation, unlike BM who aimed to build an empire, AC clearly has different ambitions. To him, DeFi is more like a Lego game.

AC’s Lego Game

Notably, today’s YFI, worth $500 million, was built entirely by AC alone—not by a company or team.

YFI originated from AC’s personal and friends’ investment needs. "Yearn actually started because I had a small stablecoin portfolio I wanted to manage like a savings account," he said on the FTX podcast on July 29, adding that he preferred stablecoins and disliked dealing with impermanent loss.

DeFi made solo entrepreneurship possible for AC. The composability among DeFi protocols allows platforms to serve as building blocks for higher-order applications. Variant Fund founder Jesse Walden defines composability as such: if a platform’s existing resources can be reused and programmed into advanced apps, it is composable.

Composability matters because it enables developers to do more with less, accelerating innovation in compound ways.

"DeFi lets us collaborate, coexist, and remain individuals at the same time. We don’t know what to call this model, but I’m very excited about it," AC said.

After announcing multiple collaborations, AC is seen as stacking Legos across DeFi—just like in his favorite game, World of Warcraft.

"Playing token games wastes too much time, energy, and capital compared to product games. In the long run, product games benefit tokens," AC said.

Looking back at AC’s actions in DeFi, it resembles collecting gear, completing quests, and earning rewards in a game—the dopamine rush, the cheers of followers.

This explains why AC remains passionate despite being involved in over ten projects.

"Once I find an interesting theory, I want to try it out—if it works, I'm happy. Solving the puzzle satisfies me. Once I finish what I set out to do, I leave. The community continues doing what I can't," AC said.

Yet the DeFi world doesn’t always offer instant feedback like a video game.

"Waiting for feedback is painful—it feels like 'wasting' time, preventing me from starting new work," AC tweeted a week ago, referring to the agonizing wait for test results from Pickle, Cream, Cover, and others.

This may be a game AC enjoys alone, but to many in DeFi, AC isn’t so welcome.

The China lead of MakerDAO described the process as AC’s PUA on DeFi: “AC to DeFi is like PUA to love.”

"AC has spread himself too thin—no one knows how this will end. Momentum is easy, but building is hard. AC loves making noise, but not doing the work," said Cao Yin, YFII evangelist and Digital Renaissance Foundation partner.

Compared to YFI’s aggressive merger spree, YFII has reacted far more cautiously. YFII only recently announced its first merger with Unisave, scheduled for implementation in 2021.

AC admits this too: "I enjoy thinking. I prototype ideas quickly and effectively, but I’m not good at product development. That’s why I handed Yearn over to the Waifu community—I trust them to turn my prototypes into real products."

In fact, some of AC’s followers are gradually waking up from their frenzy. "AC is slowly selling off his credibility," said Wu Yi.

No one knows how long AC’s Lego game will last.

"DeFi has made me neglect my life, my health, my mental well-being. I must put that first," AC said. "I have no vision, no plan. Right now it’s fun, but maybe next month it’ll bore me, and I’ll just go home to play World of Warcraft."

What will AC leave behind before he leaves DeFi?

"Judging solely by AC’s contributions, he pushed early DeFi development, created the YFI legend—this alone is an indelible achievement. His later proposals, including merging various projects, address critical industry pain points. Regardless of whether AC creates another myth, the AC ecosystem is already formed. Its outcomes deserve our study and learning," said Chen Mo, head of Bitouq.

Perhaps, as AC himself says, even if projects fail, the value of trying exceeds anything all critics might claim.

*TechFlow reminds all investors to beware of high-risk chasing behavior. The views expressed herein do not constitute investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News