Yield Bonding: Spiral DAO's Innovative Solution to Increase Revenue for LPs and Reduce Token Inflation

TechFlow Selected TechFlow Selected

Yield Bonding: Spiral DAO's Innovative Solution to Increase Revenue for LPs and Reduce Token Inflation

How can the new concept called Yield Bonding, advocated by Spiral DAO, transform the DeFi space?

Written by: DeFi Made Here

Compiled by: TechFlow

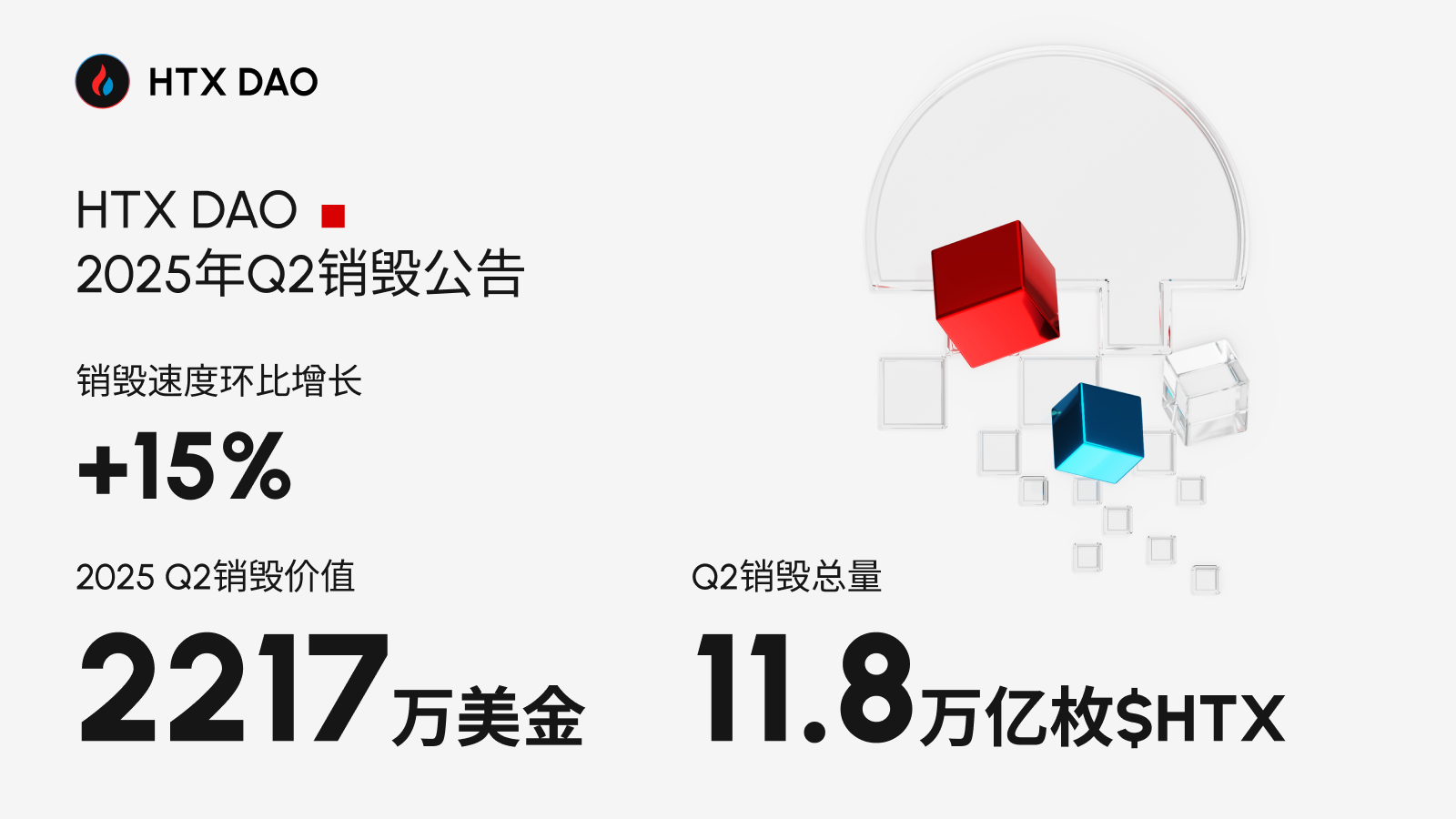

DeFi projects have consistently faced significant challenges in retaining their Total Value Locked (TVL) and ensuring sustainable yields for liquidity providers. This is especially true for tokens like $CRV, $BAL, and $FXS, which have long struggled with inflationary pressures and the "mine-and-dump" behavior.

However, a new concept called Yield Bonding, pioneered by Spiral DAO, aims to change this dynamic by offering liquidity providers the opportunity to bond their yield rewards and receive higher returns in return. This article will explore this innovative concept and how it could potentially revolutionize the DeFi space.

What's wrong with $CRV, $BAL, and $FXS now?

They share revenue, attract liquidity, and create flywheels—but they're also experiencing rampant inflation.

These tokens continue to suffer from "stake-and-sell" behavior by liquidity providers. As native token prices fall, protocols lose TVL, triggering a negative cycle: declining TVL leads to reduced trading volume, lower fees, and even weaker demand for the native token. But what if liquidity providers didn't sell their yield rewards—what if they bonded them instead?

This is exactly what Spiral DAO aims to achieve—an intriguing concept. Let me explain.

Liquidity providers give up their yield rewards ($crv, $bal, $fxs) in exchange for $COIL at a rate higher than the base yield. My first thought was: who pays for this? Is this just another Ponzi scheme?

Spiral will launch a governance token and use StakeDAO to wrap its liquidity. The liquidity-wrapped tokens will support the price of $COIL. At the same time, Spiral gains governance rights and access to the underlying yield from these tokens.

Since Spiral may become a major player in the bribery market, it can effectively arbitrage bribes. For example, bribing Curve markets is more efficient than on Balancer. Spiral would sell votes on Balancer and buy them on Curve, capturing the spread.

If $CVX / $AURA trades below $CRV / $BAL (on a voting power basis), Spiral will allocate POL (Protocol Owned Liquidity) to $CVX / $AURA, filling market inefficiencies.

Thus, Spiral will be able to pay additional rewards to LPs through:

• Bribes;

• Native yield from governance tokens;

• Arbitrage of market inefficiencies.

The formula for extra APY for LPs: Additional yield = ($SPR MC / Treasury Value - 1) * 0.4

If $SPR has a market cap of $15 million and treasury value of $10 million, the additional yield would be:

(15M / 10M - 1) * 0.4 = 0.2

Therefore, with a base pool yield of 30%, $COIL holders would earn 36%.

$SPR is the staked version of $COIL, similar to $OHM. Spiral shares many similarities with Olympus, but it's optimized for yield rather than liquidity, with controlled inflation.

Spiral will also offer token holders a fair exit mechanism. If $SPR trades below net asset value by 5–10%, funds will be allocated to protect the price.

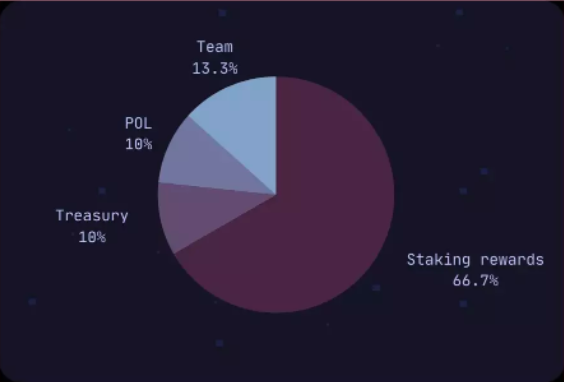

A 20% performance fee is charged on all yields. When the protocol issues 100 $COIL yield bonds, 50 additional $COIL are minted and distributed as follows:

• 15 $COIL for DAO needs

• 15 $COIL for POL maintenance

• 20 $COIL for the team (with a 6-month lock-up)

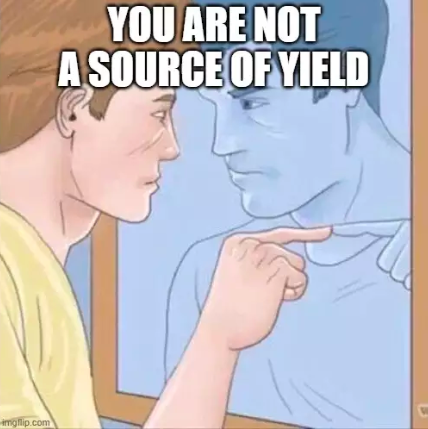

Who pays for the extra yield?

No, you're not the source of the yield.

Bribes, trading fees, market inefficiencies, and the new concept of yield bonds (which increase governance rights and rewards) are the sources.

Who benefits from Spiral?

• Liquidity providers earn higher yields.

• Curve Finance / Balancer / Frax Finance, as their native tokens may be permanently locked.

• StakeDAO, as its liquidity locker will gain substantial TVL.

And speaking of StakeDAO, it could see a massive boost in TVL from liquidity locking. If Spiral sells its entire Initial Treasury Offering (ITO) from Day 1, the $BAL liquidity vault would gain +50% in TVL.

Who should participate in the ITO?

First, if you're seeking yield from $CRV/$BAL/$SDT/$FXS, participating in the ITO makes sense.

For OHM-like projects, early participation when market cap equals treasury backing almost eliminates downside risk.

ITO participants (airdrop recipients) face only 3–5% dilution, with limited downside. Therefore, if there’s any intrinsic value growth over the next 6 months (until team tokens unlock), there’s strong incentive to buy and hold $COIL instead of holding a basket of ITO tokens.

Conclusion

Spiral is introducing a novel Yield Bonding concept to DeFi that favors veTokenomics and, in theory, should enhance yields for liquidity providers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News