From Volatility to Stability: The Most Comprehensive Guide to DeFi Fixed-Rate Protocols in History (Part 1)

TechFlow Selected TechFlow Selected

From Volatility to Stability: The Most Comprehensive Guide to DeFi Fixed-Rate Protocols in History (Part 1)

The total outstanding debt across DeFi lending protocols is approximately $23.6 billion. In contrast, the global debt market is estimated at $128 trillion. As more users and institutions enter the DeFi market, demand for fixed interest rates is undoubtedly poised for sustained growth.

Author:

Ethan C., Researcher of EM3DAO, EVG, Hakka Finance

Lucien Lee, CEO of Hakka Finance

Ping Chen, Founder of Hakka Finance

DeFi is evolving rapidly, with trading and lending serving as its two most critical pillars.

In trading, the AMM model—an unprecedented innovation in financial history—has surpassed orderbook systems to become the paradigm for on-chain liquidity. On the lending side, the market has shifted comprehensively from p2p lending to p2pool models.

Aave's predecessor, Ethlend, demonstrated the orderbook-based p2p lending model. Although it offered benefits such as fixed interest rates and defined maturity dates, its lack of sufficient liquidity led to extremely inefficient matching, ultimately causing it to be phased out by the DeFi market.

It was replaced by perpetual pool-based lending models like Compound and Aave, where interest rates are governed by supply and demand.

However, without maturity dates, an alternative mechanism is needed to maintain equilibrium between supply and demand. In lending pools, this is achieved through a feedback control system based on "utilization rate–interest rate": raising rates during high demand to encourage deposits/repayments, and lowering them during oversupply to stimulate borrowing/withdrawals.

Although Aave claims to offer fixed-rate borrowing, it still retains mechanisms to increase interest rates when necessary. Thus, floating interest rates are an inherent feature of perpetual lending pools.

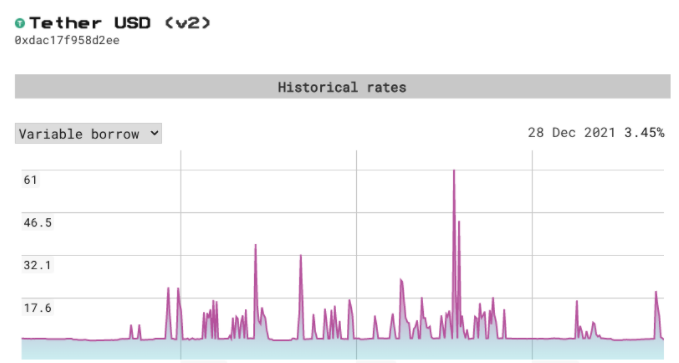

Yet floating rates hinder long-term financial planning and leveraged trading, especially given the high volatility of DeFi interest rates. For instance, in late 2021, Aave’s USDT borrowing rate fluctuated dramatically—from 3.73% to 61% within a single day (October 29–30, 2021). Such unpredictability impedes broader market growth in DeFi. In contrast, traditional finance relies largely on fixed-rate debt markets, where stable and predictable rates give borrowers and lenders greater control over their portfolios, encouraging adoption of more sophisticated financial instruments.

Aave’s USDT borrowing rate fluctuated between 3.16% and 61% in the second half of 2021

As a foundational component for portfolio construction, lending is typically expected to offer predictable interest rates—such as in capital-protected funds built on fixed-income products like mortgage-backed securities or government bonds, or leveraged Bitcoin positions funded via fixed-rate loans. Predictable rates are thus fundamental to developing modern financial products.

At the time of writing, the total outstanding debt across DeFi lending protocols is approximately $23.6 billion. In comparison, the global debt market is estimated at $128 trillion. As more users and institutions enter DeFi, demand for fixed-rate solutions will undoubtedly continue to grow. We therefore boldly predict that fixed-rate protocols will become the new holy grail of DeFi and a cornerstone of the next wave of explosive growth.

Fixed-Rate Mechanisms in DeFi

DeFi is a radiant galaxy interwoven with yield-bearing assets. Whether from lending, AMM LP fees, liquidity mining, or yield aggregation, yield assets permeate every corner of DeFi. However, blockchain-based yields are dynamically determined by market forces and constantly fluctuate. To meet varying risk preferences, many projects have attempted to build fixed-rate DeFi products—with fixed-rate lending being the most prominent. Users seek certainty: depositors want to lock in future returns upfront, while borrowers aim to fix their borrowing costs to avoid unexpected spikes due to market swings. This article covers nine fixed-rate protocols: Yield Protocol, Notional Finance, HiFi, Pendle Finance, Element Finance, Swivel, Sense Protocol, Barnbridge, and Tranche. Each employs distinct mechanisms to achieve fixed rates, which we will categorize accordingly.

Mechanism Overview

The key question is: where do “fixed rates” come from? Floating rates in platforms like Compound or Aave stem from supply-demand dynamics within lending pools. To obtain fixed returns unaffected by market fluctuations, one must脱离 direct interaction with pooled liquidity and instead find a counterparty willing to guarantee a set interest payment. These guaranteed payments originate in two ways: either paid directly by the borrower, or redistributed among lenders.

1. Fixed-Rate Loans

The method where borrowers pay fixed interest resembles Bitfinex-style lending—both involve agreed-upon terms including amount, duration, and rate—but adapted to blockchain using p2pool structures and AMMs for price (rate) discovery.

One implementation involves "trading zero-coupon bonds." Zero-coupon bonds pay no periodic interest but trade at a discount to face value, redeemable at par upon maturity. Lenders buy these bonds at a discount, effectively locking in a fixed return redeemable at maturity. Borrowers mint such bonds against collateralized assets, selling them at a discount for immediate cash. To reclaim their collateral, borrowers must repay the bond’s face value at maturity. The difference between the face value and sale proceeds constitutes the borrowing cost. Since borrowing cost equals lending return, market supply and demand determine an equilibrium fixed rate acceptable to both parties.

For example, a borrower mints a one-year zero-coupon bond with a $1,100 face value after posting collateral, then sells it for $1,000. The lender earns a 10% annualized return on a $1,000 investment. At maturity, the borrower repays $1,100 to redeem the bond—equivalent to a one-year fixed-rate loan of $1,000 at 10%. Using zero-coupon bonds eliminates reinvestment risk—the uncertainty of reinvesting periodic interest under changing market rates—making returns fully predictable at purchase.

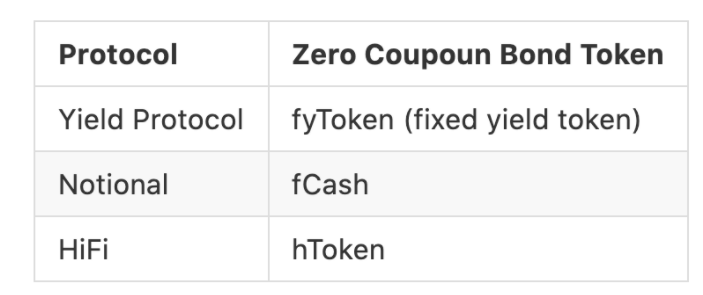

Related protocols: Yield Protocol, Notional Finance, HiFi

2. Yield Redistribution

The former represents an independent lending market, whereas this approach builds upon existing yield sources—such as variable-rate deposits or yield farming—to create secondary markets for trading interest exposure. Depending on design, these can be further categorized into principal-yield splitting and structured products.

2–1. Principal-Yield Splitting

Given a yield source, investment returns can be split into principal and interest components, each priced separately. For example, you could sell “the interest earned from depositing $10,000 USDC into Aave for one year.” If someone pays $400 USDC for it, you’ve locked in a 4% fixed return. Alternatively, imagine two parties—A contributes $9,600 and B contributes $400—to invest together in Aave, agreeing that A receives $10,000 at maturity while B takes any excess. This achieves pre-agreed profit sharing. Technically, this is implemented by tokenizing both principal and interest. Interest tokens are priced based on market expectations of future rates before settlement, while principal tokens function like zero-coupon bonds, redeemable at face value at maturity. Before maturity, they trade at a discount reflecting the asset’s time value.

From this example, it's easy to see how principal-yield separation enables fixed-rate lending. For fixed-rate borrowing, one buys interest tokens at origination. If borrowing and lending rates are highly correlated, the floating cost of borrowing may be offset by gains in interest token value, achieving approximate fixed-rate borrowing. However, since actual rate movements depend on utilization levels and aren't perfectly aligned, only partial hedging is typically achieved.

Related protocols: Element Finance, Pendle Finance, Swivel, Sense Protocol

2–2. Structured Products

Interest earned from deposits in lending protocols fluctuates. Given this uncertainty and differing risk tolerances and opportunity costs, risks can be reallocated according to investor needs.

Structured funds divide yield into tranches with different risk-return profiles, recombining them into derivative products tailored to various market outlooks.

These are essentially leveraged financing vehicles. However, because revenue from issuing fixed-rate notes is often reinvested into the same variable-yield assets, the practical effect resembles principal-yield splitting—a redistribution of interest flows.

For example, consider a two-tier fund structured around a 5% threshold. Class A offers lower risk and priority distribution (fixed rate), while Class B assumes higher risk for potentially higher returns (floating rate). All funds are lent via Aave. If cumulative interest exceeds 5%, Class A receives exactly 5%, and Class B captures all excess. If interest falls short, Class B funds cover the shortfall for Class A until Class B’s entire investment is depleted.

Related protocols: Barnbridge, Tranche

Protocol Overviews

Fixed-Rate Lending

The most straightforward way to implement fixed-rate lending in DeFi is through minting/purchasing zero-coupon bonds.

A zero-coupon bond is an IOU where the issuer promises to redeem it at face value upon maturity. Due to time value of money, these bonds trade at a discount before maturity. The discount varies based on market rates and time to maturity—larger discounts imply higher potential returns.

Lenders purchase zero-coupon bonds at a discount and redeem them at par upon maturity—effectively earning fixed interest. Borrowers post collateral, mint zero-coupon bonds, and sell them for cash, thereby locking in a fixed borrowing cost.

Key differences among protocols lie in how zero-coupon bonds are priced in a blockchain-native manner—we’ll explore this further in the AMM section below.

Fixed-rate lending protocol token mapping

Yield Protocol

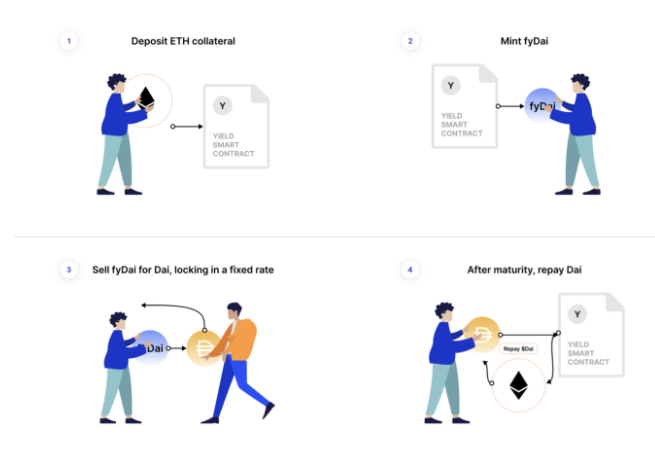

Yield Protocol uses zero-coupon bonds (fyDai) to enable fixed-rate lending, with fyDai redeemable 1:1 for Dai at maturity.

Fixed-rate deposit and borrowing mechanics:

Fixed-rate deposit: Purchase zero-coupon bonds (fyDai) at a discount and redeem at face value upon maturity to earn fixed interest.

Example: Alice buys 1050 fyDai for 1000 Dai. After one year, she redeems 1050 Dai—equivalent to a 5% annualized deposit rate.

Fixed-rate borrowing: Deposit ETH as collateral, mint fyDai, and sell it for Dai. The discount means receiving fewer Dais than the face value—the difference being the locked-in borrowing cost.

Example: Bob posts 1 ETH as collateral and borrows 1000 Dai at 5% annualized. With a one-year term, he owes the system 1050 fyDai, which must be repaid to reclaim his collateral.

Notably, in Yield Protocol V1, the entire service was built atop MakerDAO, allowing positions to migrate into MakerDAO post-maturity—converting fixed rates into floating ones. Depositors could then earn the Dai Savings Rate, while borrowers paid stability fees.

In the newer V2 version, integration with MakerDAO was dropped, removing those constraints and enabling support for additional collateral types—including yvUSDC and ENS—as well as other currencies like USDC.

Moreover, because zero-coupon bond values change over time, Yield Protocol introduced a novel AMM curve called YieldSpace. Its unique properties make it ideal for zero-coupon bond liquidity pools, improving capital efficiency. It has since become a standard AMM model for similar protocols.

Liquidity Position Management

Since each series of zero-coupon bonds has different maturities and prices, separate liquidity pools are required. Currently, Yield Protocol issues new series every six months. To reduce the need for frequent rebalancing by liquidity providers, funds automatically roll over to the newest series upon maturity. This allows LPs to continuously earn trading fees without paying gas for manual transfers.

Notional

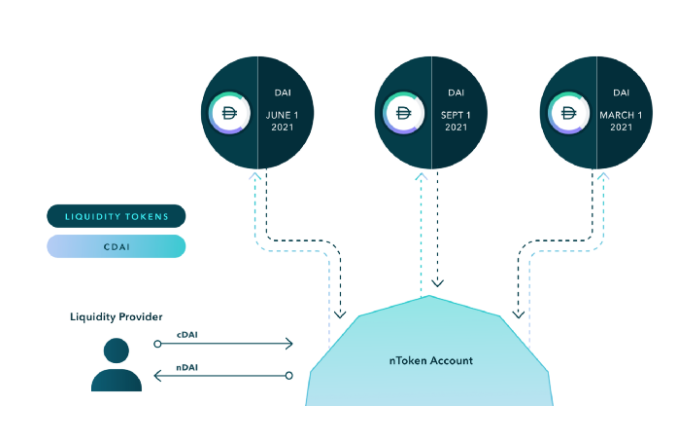

Notional also achieves fixed-rate lending through trading and minting zero-coupon bonds (fCash), with rates determined by market supply and demand.

The key difference lies in Notional’s underlying asset: cTokens (Compound’s deposit receipts). The liquidity pool trades fCash against cToken, ensuring that deposited funds continue earning interest over time—enhancing capital efficiency for liquidity providers.

Mechanics of fixed-rate deposit and borrowing:

Fixed-rate deposit: A borrower deposits DAI, which the system first converts into cDAI via Compound, then uses to purchase zero-coupon bonds (fDAI) in the liquidity pool. The purchase price determines the fixed interest rate.

Fixed-rate borrowing: After posting ETH as collateral, users mint fDAI, sell it for cDAI, and finally withdraw DAI from Compound—achieving fixed-rate borrowing. The difference between fDAI and DAI amounts represents the borrowing cost.

Because the underlying assets in the pool are cTokens, fixed rates automatically convert to Compound’s floating rates upon maturity.

Unified Liquidity Management

Although Notional hosts multiple series of zero-coupon bonds, liquidity providers simply deposit cTokens into a unified entry point. The system automatically allocates pooled liquidity across individual pools, with allocation ratios determined by community governance.

This eliminates the need for LPs to frequently switch pools near maturity. Governance can optimize capital efficiency across the protocol.

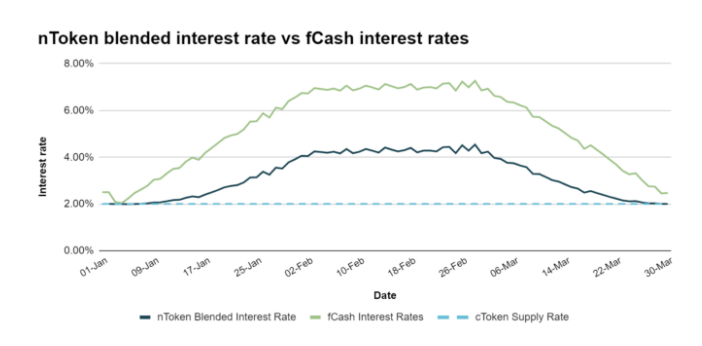

Depositing cTokens yields nTokens as proof. These have no expiration and can be redeemed anytime. Part of the deposited cTokens are used to purchase fCash, combining fCash and cToken to form liquidity. Thus, the blended interest rate of nTokens lies between that of zero-coupon bonds and Compound’s deposit rate.

While nToken returns are lower than directly purchasing fCash, LPs benefit from earning trading fees. Additionally, Notional supports using nTokens as collateral, enabling LPs to borrow assets, reinvest them for more nTokens, and leverage their position (similar to Alpha strategies) to amplify returns.

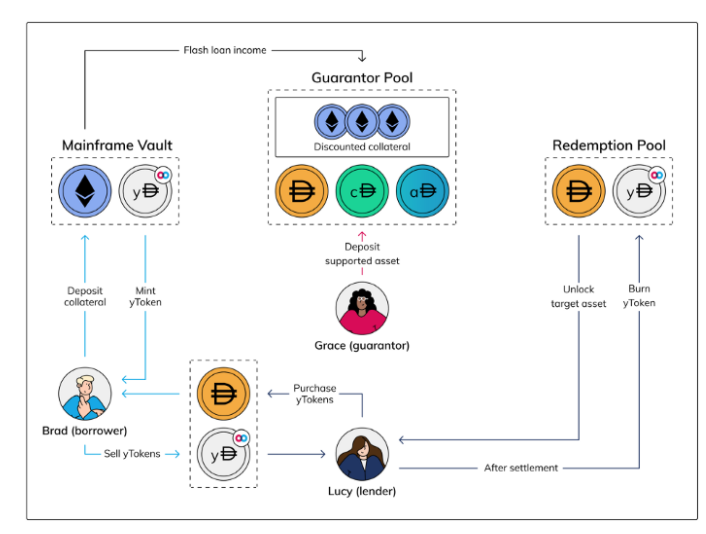

HiFi

HiFi Finance, formerly Mainframe, is another fixed-rate lending protocol based on zero-coupon bonds, conceptually similar to Yield. Borrowers post collateral, issue zero-coupon bonds, and sell them to lenders to lock in fixed rates. In its v0 whitepaper, a notable feature was a liquidation safeguard pool designed to directly clear undercollateralized debts (similar to Liquity’s mechanism). Both the safeguard pool and collateral could also be used for flash loans to generate yield from idle capital.

However, HiFi v1 now mirrors Yield closely—not only adopting the YieldSpace AMM model but also eliminating the liquidation safeguard pool. Instead, it provides scripting tools allowing liquidators to use Uniswap v2 flash swaps to clear debt—a mechanism common among other protocols.

Yield Redistribution

As discussed earlier, fixed-rate lending can be achieved by treating loan receipts as zero-coupon bonds and selling them at a discount to depositors—the interest derived from market-matched supply and demand.

An alternative approach involves depositing all funds into lending protocols or yield aggregators to earn floating rates, then redistributing the interest according to risk appetite.

This redistribution of lender interest falls into two categories: “principal-yield token separation” and “structured products,” detailed below:

-

Principal–Yield Separation

After depositing funds into a lending or yield aggregation protocol, the principal and future interest can be separated and tokenized.

Principal tokens can be redeemed 1:1 for the underlying asset at maturity. Though no borrowing occurs here, their nature is equivalent to zero-coupon bonds. Yield tokens represent future interest earnings, with redemption mechanisms varying by protocol.

Main differences lie in how principal and yield tokens are priced on-chain—discussed in detail in the AMM section below.

Yield tokens operate under two models:

-

Drag — Realized yield accumulates and is delivered only at maturity

-

Collect — Realized yield is continuously transferred to holders before maturity

Principal-yield separation protocol token mapping

Element

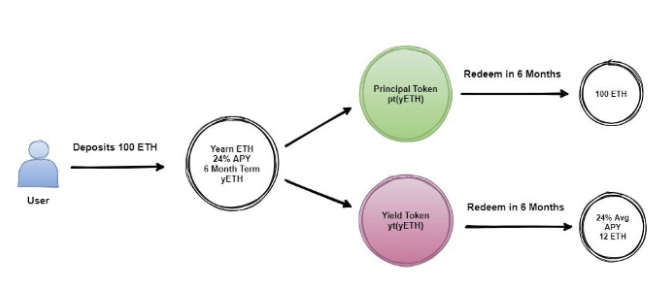

In Element, all funds are deposited into Yearn Finance and split into Principal Tokens (PT) and Yield Tokens (YT).

Principal tokens act like zero-coupon bonds, redeemable at maturity. Yield tokens represent future interest and can be exchanged for accrued yield upon maturity.

Within this system, markets for “fixed-rate deposits” and “leveraged yield speculation” emerge

-

Fixed-Rate Deposit

Purchasing a principal token is equivalent to making a fixed-rate deposit. The annualized rate is determined by the PT’s market price—lower prices imply higher returns and higher rates.

Alternatively, users can deposit funds into Element, immediately sell the issued YT, and lock in a fixed yield upfront.

-

Leveraged Long on Future Yields

The price of yield tokens (YT) reflects market expectations of future yields—the higher the accumulated yield, the higher the settlement value.

Users can leverage long on yields by buying YT—if redemption value exceeds purchase cost, they profit.

Besides direct purchases, users can deposit funds into Element, sell the resulting PT, reuse the proceeds to deposit again, and repeat—maximizing YT holdings and leverage.

Pendle

Pendle Finance, similar to Element Finance, splits deposited funds into Ownership Tokens (OT) and Yield Tokens (YT), with key differences in yield token mechanics.

In Element, interest generated accrues within the YT and is settled at maturity. In Pendle, interest is distributed directly to YT holders. Holding YT grants the right to receive ongoing yield until maturity. As maturity approaches, this time-based right diminishes, eventually reaching zero.

-

Fixed-Rate Deposit

To achieve fixed-rate deposits on Pendle, users deposit funds, mint OT and YT, then sell YT to lock in future yield and secure fixed returns.

-

Leveraged Long on Future Yields

Similarly, yield bulls can buy YT to speculate on rising rates—profiting if earned yield exceeds purchase cost. Alternatively, users can deposit funds, sell OT, reinvest proceeds, and repeat—maximizing YT holdings and leverage.

Fixed-Rate AMM LP Fee Trading

Beyond lending and yield aggregation, Pendle supports Sushi LP tokens as underlying assets, tokenizing future fee revenues—enabling fixed-rate deposits or leveraged yield speculation.

Swivel

Formerly DefiHedge, Swivel follows the same principle: funds are deposited into yield protocols and split into principal tokens (zcTokens) and interest tokens (nTokens). Selling interest tokens upfront while holding principal tokens locks in a fixed rate; the buyer receives floating yield. Interest distribution resembles Pendle’s—paid continuously to holders.

Swivel’s distinguishing feature is its choice of off-chain order books over AMMs for trading—unlike others who rely on AMMs for liquidity provision. The rationale will be explored in the AMM section.

Sense Protocol

Sense continues the same model, splitting funds into principal tokens (Zeros) and yield tokens (Claims). Like Pendle, interest is continuously distributed to yield token holders. However, its trading mechanism differs slightly—explored further in the AMM Curve section.

-

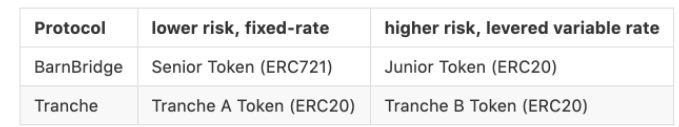

Structured Products

Structured funds, also known as tranched funds, redistribute returns or net asset value into tiers with varying risk-return profiles. Typically divided into two classes: one offering fixed returns with priority payout, the other capturing residual returns with higher risk.

We refer to the lower-risk, senior-distribution portion as “Class A shares,” and the higher-risk, junior-distribution segment as “Class B shares.” Class B essentially “borrows” from Class A to amplify returns, exhibiting leverage. Because of this, Class B bears the obligation to pay Class A a predetermined interest rate.

Structured product token mapping

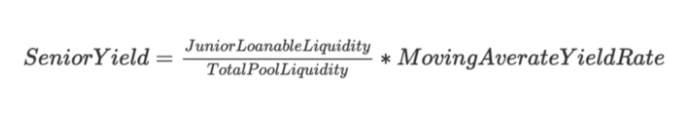

BarnBridge

BarnBridge offers structured yield products composed of a Junior Pool and Senior Bonds. Both pools invest in underlying protocols (Compound, Aave) to generate yield, but distribute returns differently.

Junior Pool LPs receive ERC-20 tokens representing their share. Junior positions have no maturity and earn variable returns. Senior Bond buyers select investment durations (up to one year), with positions held as ERC-721 NFTs. Seniors receive fixed returns but cannot redeem early—only transfer the NFT.

Since underlying protocol rates are variable and may suddenly drop, part of Junior liquidity is locked to ensure Senior Bondholders can redeem promised principal and interest at maturity. Thus, Junior redemptions follow specific procedures:

1. Immediate redemption: Deduct the amount committed to Seniors upfront; only the remainder is withdrawable

2. Bond conversion for delayed redemption: Mint an NFT based on weighted Senior maturity date, redeemable later without extra fees

Senior Bond rates are determined by the following formula:

Where yield rate is the 3-day average of Compound/Aave rates, discounted by pool utilization to become Senior Yield. Since Senior Yield ≤ current underlying rate, Juniors earn excess returns long-term—but may earn less or even lose money if rates plummet suddenly.

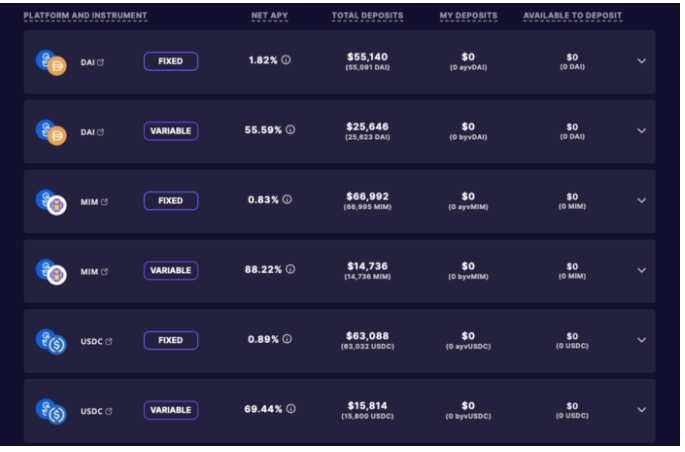

Tranche

Tranche Finance, similar to BarnBridge, is a structured product with fixed-rate Tranche A and floating-rate Tranche B (both ERC-20 tokens). Unlike BarnBridge, which adjusts rates based on pool composition, Tranche lacks automated rate-setting. Instead, the DAO (token holders) votes to determine the interest paid to Tranche A. Thus, Tranche A isn’t truly fixed-rate—it can be unilaterally adjusted up or down via governance votes.

Note the large spread between FIXED and VARIABLE returns, and that governance can unilaterally adjust the FIXED rate.

AMMs for Zero-Coupon Bonds and Principal/Yield Tokens

Whether zero-coupon bonds, principal tokens, or yield tokens—they all require liquidity to be tradable. Centralized exchanges use order matching, where buyers and sellers provide liquidity. While efficient for price discovery, this model is ill-suited for blockchains due to limited computational and storage resources. Hence, Automated Market Makers (AMMs)—native to DeFi—were developed. In AMMs, third-party liquidity providers (LPs) supply funds, and pricing follows predefined mathematical formulas.

Different formulas define different curves, allowing customized pricing logic based on traded assets.

For example, Uniswap v2 uses the constant product model:

x × y = k

This gives marginal price = y/x—the ratio of reserves—and suits volatile assets.

Conversely, mStable uses a constant sum model:

x + y = k

This fixes price = 1 regardless of reserve changes—ideal for stablecoin swaps.

However, zero-coupon bonds, principal tokens, and yield tokens share a key trait: their value evolves over time. Neither of the above models adequately captures this dynamic. Next, we examine how to design effective AMM models for these instruments.

Pricing and Properties of Zero-Coupon Bonds

Zero-coupon bond prices depend on interest rate and time to maturity. They are priced at a discount to face value, reflecting present value of future cash flows via compounding:

Bond Price (PV) = Face Value (FV) ÷ (1 + r)^n

Face Value: Nominal value redeemable at maturity

r: Annual interest rate

n: Number of periods (years)

From this formula, even if market rates remain constant, bond prices rise over time—approaching face value as maturity nears, converging to a 1:1 exchange rate.

Conversely, if bond price remains unchanged, APY increases as maturity approaches.

What AMM Curve Suits Zero-Coupon Bonds?

Using Uniswap’s x × y = k, if no trades occur and reserves stay constant, bond price remains fixed. As maturity approaches, APY rises, attracting arbitrageurs and exposing LPs to losses. Using mStable’s x + y = k, bond price is always 1—preventing discounted trading and failing to reflect time value.

Thus, we need a curve that automatically adjusts pricing over time—sensitive to market conditions initially, then smoothly converging to 1:1 near maturity.

Yield Protocol and Notional use zero-coupon bonds for fixed-rate lending; Element, Pendle, and Sense split assets into principal and yield tokens—where principal tokens are effectively zero-coupon bonds. Below we analyze the AMM curves used by these five protocols, followed by Swivel, which uses order books instead.

YieldSpace

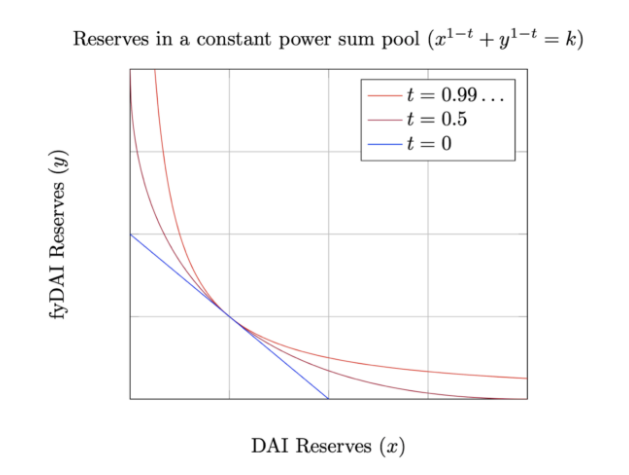

Yield Protocol designed YieldSpace, a custom curve for zero-coupon bonds. It includes a time parameter t, where larger t means farther from maturity, approaching zero as maturity nears.

Calculus shows that at t=1, YieldSpace equals x × y = k; at t=0, it becomes x + y = k. This allows market-driven trading before maturity, with price automatically approaching $1, enabling 1:1 redemption—matching zero-coupon bond behavior.

Additionally, YieldSpace has a crucial property: “constant rate.”

If market demand for zero-coupon bonds remains constant, the rate should stay unchanged. In x × y = k, constant demand implies fixed reserves and thus fixed price. But from the bond pricing formula, to keep rate constant over time, price must increase. Standard AMMs fail to reflect this. YieldSpace’s time-adjusted pricing delivers the vital “constant rate” effect.

Thus, if market rates are stable, no time-related price changes create arbitrage opportunities—LPs avoid time-dependent impermanent loss.

For example, a one-year zero-coupon bond at 10%:

Initial price: $0.9091 ÷ (1.1)^1 = 0.909

After 6 months: $1 ÷ (1.1)^0.5 ≈ 0.953

After 1 year: $1 ÷ (1.1)^0 = 1

With no trades, reserves (x,y) unchanged and market rate steady at 10%, as t decreases, the curve’s slope adjusts—the bond price rises to $0.953 after six months, $0.976 after nine, and finally $1.

Dynamic Fees

Most AMMs charge a fixed percentage of trade volume (e.g., Uniswap V2: 0.3%). This doesn’t suit zero-coupon bond pools, where 0.3% fees disproportionately impact annualized returns near maturity.

Assume a zero-coupon bond with fixed 10% APY. Impact of 0.3% fee at different times:

The closer to maturity, the more severe the fee’s impact on APY—growing exponentially.

Thus, YieldSpace charges fees as a fixed percentage of accrued interest—decreasing as maturity approaches.

Virtual Liquidity: Enhancing Capital Efficiency

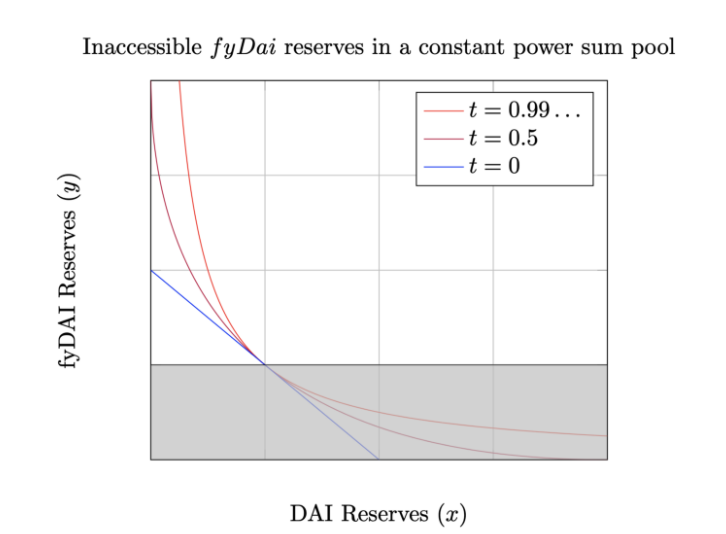

Under normal conditions, a zero-coupon bond’s value should never exceed face value—its exchange rate should not surpass 1. Otherwise, arbitrage arises.

But in standard AMM designs, liquidity is symmetric around x=y (rate=1). Since zero-coupon bonds never trade above $1, half the pool’s liquidity remains idle. To address this, YieldSpace introduces virtual reserves—one side of the pool is partially simulated—allowing much higher capital efficiency without sacrificing core properties.

Gray area represents virtual liquidity. Trading is blocked if fyDAI price exceeds 1 DAI

Notional

From the YieldSpace discussion, a suitable AMM curve for zero-coupon bonds must satisfy three conditions:

1) Automatically adjust price as maturity nears—even with no trades—to maintain constant yield.

2) Become flatter near maturity—reducing price sensitivity to reserve changes.

3) Fees must decrease toward zero as maturity approaches—avoiding excessive fee impacts.

Notional addresses these with three parameters:

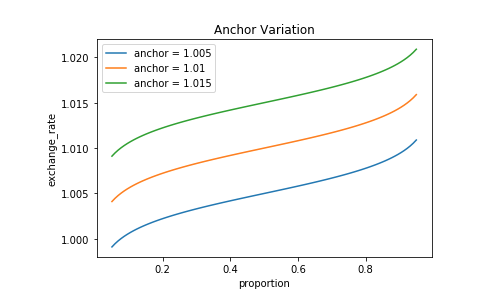

Anchor

Controls the center of the price curve. Exchange rate (fCash per Currency) decreases over time, converging to 1.

Ignoring slippage, Anchor adjustment keeps yield constant, preventing time decay from affecting rate.

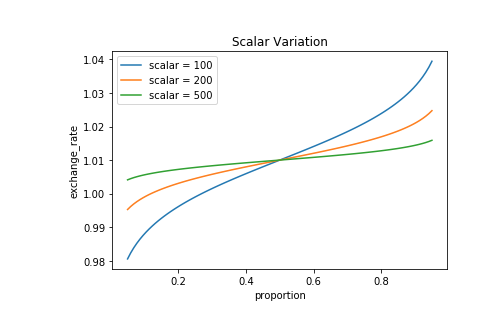

Scalar

Represents price sensitivity to demand. Smaller scalar = steeper curve = larger price movement. As maturity nears, the curve flattens, concentrating liquidity around the anchor price.

Trading Fee

Fee size decreases linearly to zero over time—minimizing impact on annualized yield.

Notional AMM Curve

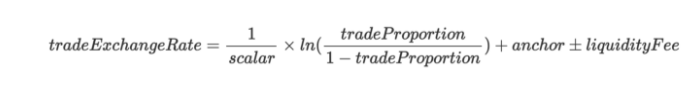

Combining these parameters yields Notional’s AMM pricing formula:

Element Finance

In Element Finance, deposited funds are split into principal and yield tokens—each requiring different liquidity pools due to differing properties.

Principal Token Pool:

Principal tokens are redeemable at maturity—functionally zero-coupon bonds. Thus, Element uses the YieldSpace AMM curve for principal tokens.

Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News