LD Capital: The LSD sector has a long runway and strong fundamentals, with stability and high growth sustained throughout the year

TechFlow Selected TechFlow Selected

LD Capital: The LSD sector has a long runway and strong fundamentals, with stability and high growth sustained throughout the year

This article provides an overview of the LSD sector from four aspects: the overall industry growth potential after the Shanghai upgrade, four staking solutions and comparisons among different LSD protocols, the positioning of the DVT sector, and the impact of LSD assets on other on-chain ecosystems.

Introduction:

With the Shanghai upgrade approaching, we believe it is necessary to reassess the future development of the LSD sector and its impact on the entire on-chain ecosystem based on the latest data changes.

This article provides an overview of the LSD landscape from four aspects: post-Shanghai upgrade industry growth potential, comparison of four staking solutions and different LSD protocols, positioning of the DVT sector, and the impact of LSD assets on other on-chain ecosystems.

Summary:

Rising Ethereum staking rates will drive overall protocol fee increases in the LSD sector; long-term, the "Davis Double Play" for the LSD sector has not yet ended.

Currently, Ethereum's staking rate stands at 14.56%. Given that most other PoS public chains have staking rates exceeding 60%, there is significant upside expectation for Ethereum’s staking rate growth.

Assuming LSD sector fees remain unchanged, we estimate that when Ethereum's staking rate rises to 29%, 44%, and 58%, corresponding LSD protocol fee increases would be 1.31x, 1.55x, and 1.76x respectively. From a P/F valuation perspective, the leading LSD project LDO currently trades at 3.89x P/F, which still offers substantial room for appreciation compared to established DeFi protocols such as UNI at 7.12x and AAVE at 10.35x.

After the Shanghai upgrade, relative market shares among LSD protocols may shift. Focus mid-term on sector leaders like Lido and high-yield LSD protocols represented by Frax, and short-term on Rocket Pool's Atlas upgrade.

Post-Shanghai upgrade, early validator withdrawals and increased user staking willingness will create competitive conditions among LSD protocols.

Lido remains unshakable as the leader due to its proven track record across multiple dimensions including brand recognition, capital scale, security, yield, liquidity, and composability;

Latecomers like Frax have achieved cold-start success and early growth through self-held CVX and a dual-token model integrated with the Curve ecosystem, delivering significantly higher staking yields than peers. As yield aggregation products become more widespread, growth momentum for high-yield offerings like Frax could accelerate further. It should be noted that Frax’s high yield will gradually decline as its TVL grows—currently estimated to drop to around 6% when ETH staked reaches 200,000;

Rocket Pool’s upcoming Atlas upgrade deserves attention—it reduces the minimum ETH requirement for node operators from 16 to 8 ETH, increasing protocol capacity while enhancing node incentives, likely driving significant TVL growth.

DVT products represented by SSV, Obol, and Diva are positioned as critical infrastructure for Ethereum staking.

DVT aims to maintain block validation stability while improving network decentralization, reducing operational costs and security risks for node operators.

SSV focuses on building an operator network, where its token serves as both payment medium and governance instrument capturing protocol value;

Obol emphasizes middleware adaptability;

Diva aims to combine LSD and DVT models into an all-in-one solution and is currently in early development stages.

Ethereum staking could spawn a trillion-dollar LSDETH asset class, reshaping or disrupting traditional DeFi protocol revenue structures, while second-layer products built around this new asset class may represent new sources of market α.

Building liquidity for LSDETH/ETH pairs could bring new business volume to DEXs like Curve and Balancer—compared to Curve, Balancer currently sees greater marginal improvement. However, Ethereum staking rewards can be seen as an on-chain, coin-denominated risk-free rate, which raises on-chain liquidity costs and negatively impacts deposit-based lending protocols, whereas CDP-style lending is relatively less affected. Meanwhile, future products built atop this yield-bearing asset—including restaking, yield aggregation, principal-interest separation, and leveraged protocols—will benefit from the massive underlying asset base, achieving high ceilings for business scalability, warranting ongoing tracking and research.

Risks:

Regulatory risks, macroeconomic risks, and technological upgrade delays.

1. Overall Market Potential of the LSD Sector

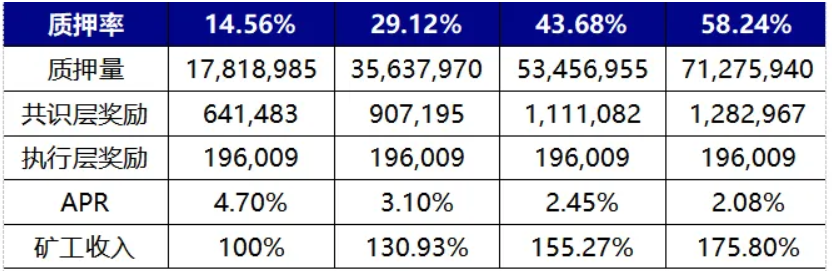

Higher Ethereum staking rates boost miner income, thereby increasing revenues across the LSD sector. Long-term, the sector remains in a dual-growth phase regarding revenue and valuation. Currently, Ethereum’s staking rate is 14.56%. Since most other PoS chains exceed 60% staking rates, strong growth expectations exist for Ethereum. The chart below estimates that if Ethereum’s staking rate doubles, triples, or quadruples—to 29.12%, 43.68%, and 58.24% respectively—LSD protocol fees would increase by 1.31x, 1.55x, and 1.76x. Calculation methods, assumptions, and processes are as follows:

Execution layer rewards depend on Priority Fees. Due to Ethereum’s balanced fee mechanism, we assume execution layer rewards stay constant (a conservative estimate—as network gas fluctuates, these rewards can spike dramatically, e.g., during the March 10 USDC depeg event, when transaction volume surged and execution layer rewards rose 4–6x above normal levels);

Consensus layer rewards are determined by Ethereum block rewards, which scale proportionally to the square root of total staked amount, while consensus layer APR scales inversely to the square root of total staked ETH. The specific formula is: base_reward = effective_balance * (base_reward_factor / (base_rewards_per_epoch * sqrt(sum(active_balance))))

Using current consensus and execution layer rewards at 14.56% staking rate as baseline, under the two assumptions above, we project miner incomes at 2–4x current staking rates. Assuming LSD protocol fee structures remain unchanged, the multiplier effect on miner income directly translates to equivalent growth in LSD protocol fees, as shown below:

Chart 1: Miner Income vs. Staking Rate

Source: LD Capital

It should be noted that rising Ethereum staking rates is a gradual process, and in the 1–2 months following the Shanghai upgrade, we might even observe a temporary dip in staking rates.

Due to limitations on validator entry and exit, changes in Ethereum’s staking rate occur slowly. Currently, there are approximately 556,800 validators on the Ethereum network, with about 1,800 added daily.

After the Shanghai upgrade, validator exits will be permitted, with daily exit capacity matching daily entry (~1,800 validators/day). Early validators may withdraw shortly after the upgrade, potentially causing a slight short-term decline in the staking rate. This assessment is based on the following:

Approximately 10.87 million ETH in the Beacon Chain are staked via LSD protocols and centralized exchanges, already liquid in secondary markets. Most LSDeth/ETH pairs trade close to par, indicating limited redemption pressure post-upgrade due to hard-redemption clauses or profit-taking needs;

The remaining ~6.95 million ETH are staked via staking pools or solo staking, lacking secondary market liquidity. Assuming half choose to redeem post-upgrade, up to 57,600 ETH could be withdrawn daily;Ethereum could face full withdrawal load over the first 60 days post-upgrade;

Current data shows new staking entries average about one-third of maximum possible daily inflows.

Therefore, if new staking inflows fail to reach full capacity immediately post-upgrade, the staking rate may slightly decline over 1–2 months. After initial redemptions clear, growth is expected to resume, with a doubling of staking rate possibly taking 1–2 years.

Source:https://ethereum.org/zh/developers/docs/consensus-mechanisms/pos/rewards-and-penalties/

2. LSD Sector Landscape

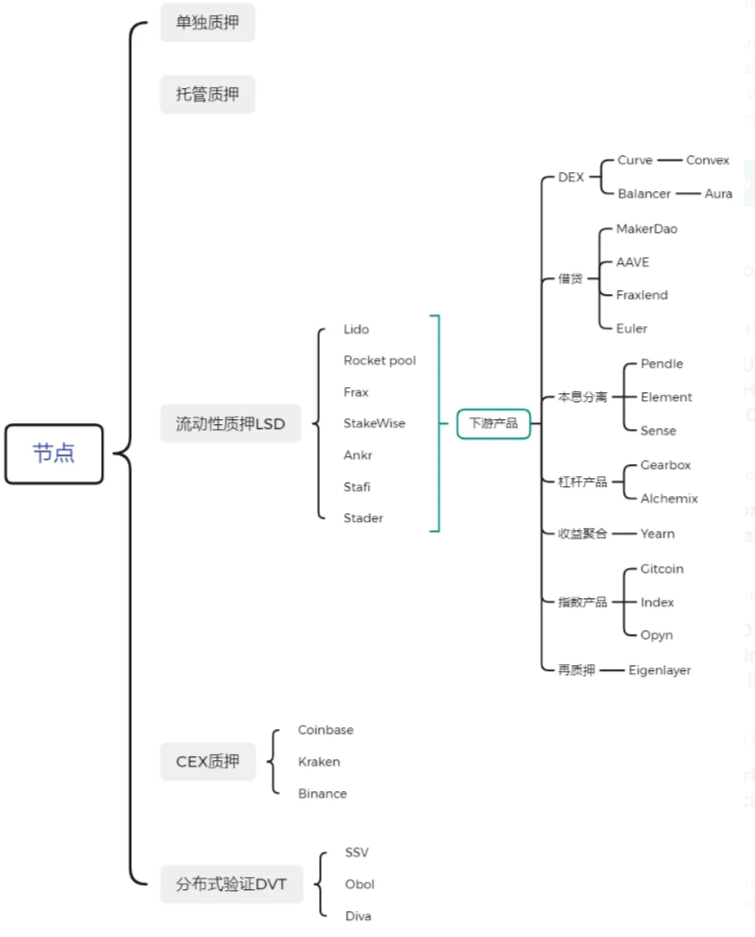

The LSD sector encompasses Ethereum staking solutions and their derivatives, including four competing staking models, DVT technologies enhancing security and decentralization, and second-layer products such as yield-enhancing instruments, leverage protocols, and index funds built around LSD staking tokens.

Chart 2: LSD Sector Overview

Source: LD Capital

2.1 Among Four Staking Solutions, LSD Holds Highest Market Share and Is Likely to Expand Further

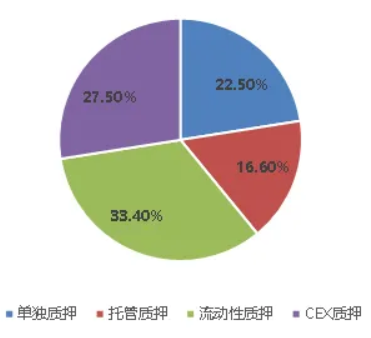

There are four types of Ethereum staking solutions: solo staking, custodial staking, liquid staking (LSD), and centralized exchange staking. LSD and CEX staking dominate market share due to advantages such as enabling small investors to participate, eliminating hardware requirements, and re-liquifying staked assets via staking derivatives. Based on validator count, LSD currently holds 33.4% market share, CEX 27.5%, staking pools 16.6%, and solo staking 22.5%.

Chart 3: Current Distribution Across Staking Solutions

Source: beaconchain, LD Capital

Detailed breakdown of each staking solution:

Solo Staking: Requires at least 32 ETH and a dedicated computer with reliable internet and power; users receive full staking rewards and retain complete control over assets; funds were locked pre-Shanghai upgrade but can now exit under certain conditions post-upgrade.

Custodial Staking: Requires at least 32 ETH, no hardware needed; users delegate ETH to node operators to earn staking rewards; requires uploading signing keys allowing service providers to validate on their behalf; funds were locked pre-Shanghai, now withdrawable post-upgrade.

Liquid Staking (LSD): No 32 ETH threshold or hardware required; users delegate any amount of ETH to LSD protocols, which pair deposits and assign validators to stake; users typically share part of rewards with the protocol and node operators; funds can usually exit anytime via LSDeth liquidity on secondary markets or be leveraged for yield enhancement; currently highly centralized.

Centralized Exchange Staking: No 32 ETH or hardware requirement, and sometimes no wallet needed; users access staking via platforms like Coinbase, earning most of the staking rewards minus platform fees; easiest user experience; supports immediate unstaking or secondary market exits via staking tokens, and enables leverage through lending protocols; faces highest regulatory scrutiny; currently the most centralized option.

Chart 4: Comparison of Four Staking Solutions

Source: LD Capital

However, it must be emphasized thatboth CEX and LSD staking solutions face unresolved regulatory questions from the U.S. SEC. Whether staking constitutes a securities offering lacks authoritative clarification. Kraken’s staking service was previously targeted by the SEC, though major players like Coinbase and Lido haven’t been materially impacted—mainly because Kraken operated opaquely without disclosing fund flows and promised abnormally high yields, triggering enforcement. Yet under the Howey Test, Kraken, Coinbase, and Lido all involve pooling user funds for staking, making them functionally similar. Thus, the LSD sector currently faces regulatory uncertainty from U.S. authorities.

From a product standpoint, although staked ETH can now be redeemed in primary markets post-Shanghai, the volume is capped—currently ~57,600 ETH per day (1,800 validators). LSD’s advantages—enabling small investors to participate, unlocking liquidity via staking tokens, and enabling yield composability—ensure it will continue dominating market share. In fact, shortly after the upgrade, as early solo or custodial stakers redeem for principal repayment or profits, LSD protocols may see their market share passively increase.

From a competitive LSD protocol perspective, key factors shaping protocol development include brand awareness, yield, fund safety, peg stability, degree of decentralization, and composability. These dimensions help analyze differences among major LSD protocols.

Lido is currently the largest LSD protocol by TVL, 13x larger than second-place Rocket Pool. Lido uses a whitelist system to select operators, ensuring reliable node performance to avoid yield loss or slashing. Additionally, Lido compounds execution-layer rewards, allowing users to achieve 4.5%-5% annual yield even after a 10% fee cut—second only to Frax among mainstream LSDs and ahead of Rocket Pool, StakeWise, Ankr, etc. Notably, Lido plans a V2 upgrade around mid-May introducing a staking router module allowing anyone to run nodes and integrate DVT, aiming to enhance decentralization while maintaining network stability and security.

Rocket Pool’s uniqueness lies in permissionless node operation—anyone can become a node operator by creating a Minipool. Operators must deposit 16 ETH (the other 16 come from user deposits) plus at least 1.6 ETH worth of RPL as a junior collateral buffer against slashing. Rocket Pool currently subsidizes RPL to incentivize node deployment. The upcoming Atlas upgrade—one of the most significant since launch—will greatly impact business trajectory. Key features include:

1. LEB16 → LEB8: Reduces minimum ETH requirement for node operators from 16 to 8 ETH. This change will significantly alleviate current scalability constraints on the node side. Assuming total ETH supply among operators remains constant, this could theoretically double protocol TVL and triple deposit capacity. With improved node-side scalability, dynamic deposit pool size becomes a leading indicator for Rocket Pool’s TVL growth;

2. Increased node incentives: Excluding RPL rewards, LEB8 nodes will earn 25% more than LEB16;

3. Tools introduced to allow solo stakers to migrate to Rocket Pool without exiting their validator;

4. Optimization of the dynamic deposit pool: When the minipool queue requires more than 5,000 ETH, the deposit pool cap will automatically increase.

Frax Ether stands out for its currently high staking yield. sfrxETH previously delivered yields between 7%–10%, thanks to Frax’s dual-token model: frxETH and sfrxETH. By providing frxETH/ETH liquidity on Curve and leveraging Frax’s CRV voting power, additional CRV rewards are captured and distributed entirely to sfrxETH holders. Effectively, Frax Ether achieves superior yields by adding a CRV reward layer absent in other liquid staking products. This yield boost depends on factors like frxETH/ETH gauge weight, Frax Ether’s TVL, and CRV/ETH price ratio. Based on current metrics, when Frax Ether’s staked ETH reaches 200,000, sfrxETH yield is projected to fall to ~6%.

These three major LSD protocols represent three dominant ETH staking models. Smaller LSD protocols mainly refine pain points of these top three. For example, Stafi and Stader improve upon Rocket Pool’s requirement of 16 ETH per node operator—a low capital efficiency and forced exposure to RPL risk. Both require only 4 ETH from operators and offer solutions avoiding protocol token exposure. However, arbitrarily lowering ETH collateral ratios may increase user fund risks. Unlike Rocket Pool, Stafi currently faces challenges in growing user-side deposits.

Chart 5: Comparison of Three Major LSD Protocols

Source: LD Capital

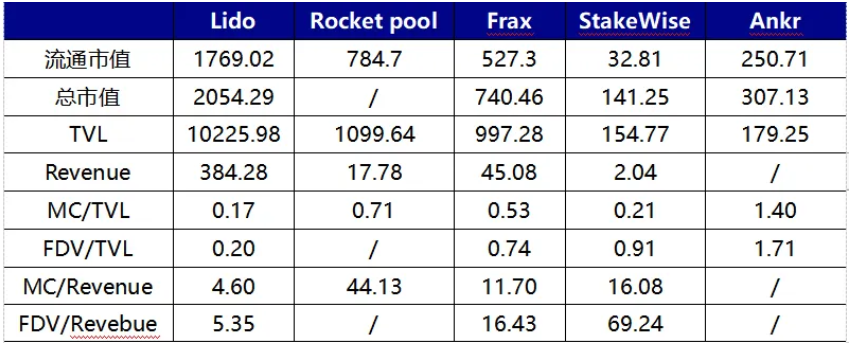

From a valuation perspective, whether measured by FDV/Revenue or FDV/TVL, Lido appears relatively undervalued. However, LDO currently only confers governance rights, whereas RPL and FXS offer additional utility, justifying premium valuations.

Frax currently holds about 3.5 million CVX, making it the largest holder within the CVXDAO

Chart 6: Valuation Comparison Across LSD Protocols

Source: LD Capital, Token Terminal

3. DVT Products Will Become Critical Infrastructure for Ethereum Staking

Decentralization and security are core tenets of Ethereum, giving rise to Distributed Validator Technology (DVT). Existing staking solutions face a tension between decentralization and reliable validator operation. Take Lido and Rocket Pool as examples:

To protect users from losses due to offline or faulty nodes, Lido currently relies on whitelisted qualified operators to ensure block validity, traceability, and fund safety—this introduces centralization concerns;

Rocket Pool aligns interests between users and node operators via shared staking and requires RPL as junior collateral for slashing protection—but this increases node operating costs. While RPL incentives help offset this, they add protocol expenses and limit scalability.

DVT solves this by fragmenting private keys and rotating lead nodes, transforming the one-to-one relationship between operator and node into a many-to-one structure, thereby enhancing system security and robustness from the foundational architecture while enabling higher decentralization.

Technical Principles:

DVT consists of four key components: Distributed Key Generation (DKG), BLS Shamir Secret Sharing, Multi-Party Computation (MPC), and IBFT consensus layer:

Distributed Key Generation (DKG) is the first step in implementing DVT—it splits a validator’s private key into 3n+1 fragments, distributing them across multiple operators. DKG forms the foundation of DVT;

BLS signature secret sharing complements DKG by enabling multi-party aggregate signatures—fragmented signatures from multiple parties are combined into a single valid signature. Fragmented keys and aggregated signatures form the backbone of DVT;

Multi-Party Computation (MPC) securely distributes split keys among nodes to perform verification duties without reconstructing the full key on any single device, eliminating the risk of private key concentration;

Istanbul BFT (IBFT) randomly selects a leader node within each DVT cluster to propose blocks. If most nodes agree on block validity, it is added to the chain. If the leader goes offline, the algorithm elects a new leader within 12 seconds, ensuring system stability.

In summary, DVT uses DKG to fragment validator keys across multiple operators, BLS to enable multi-party aggregate signatures, MPC to ensure secure computation, and IBFT to rotate leadership and prevent malicious or failed block proposals—effectively allowing one validator to be operated collaboratively by multiple parties instead of a single entity. This significantly improves system robustness beyond current industry standards.

3.1 Comparison of Current DVT Products: SSV.Network, Obol Labs, and Diva

SSV Network builds a DVT-based operator network, the most advanced in development within the DVT space, having received $188k from the Ethereum Foundation and $100k in LDO from Lido DAO. SSV is the only project in the space to issue a token. SSV tokens serve as payment medium and governance tool within the network. Participants must pay node operators in SSV tokens, and operators currently remit 25% of earnings to the SSV treasury (fee set by DAO)—all transactions use SSV. SSV plans to hold a community meeting on March 30 to discuss mainnet launch timing.

Obol Labs aims to build a staking middleware called Charon, enabling any node to join a distributed validator cluster. Obol also received $100k in LDO from Lido DAO and raised $12.5M in Series A funding led by Pantera Capital and Archetype, with participation from Coinbase, Nascent, Block Tower, and others. Development-wise, Obol is currently on Bia testnet, planning to launch Circe testnet in June before mainnet. Its progress lags slightly behind SSV.

Diva is a newcomer to the DVT space, recently raising $3.5M in seed funding led by A&T Capital, with participation from Gnosis, Bankless, OKX, and others. Diva aims to merge LSD and DVT models into an all-in-one liquid staking and distributed validation solution.

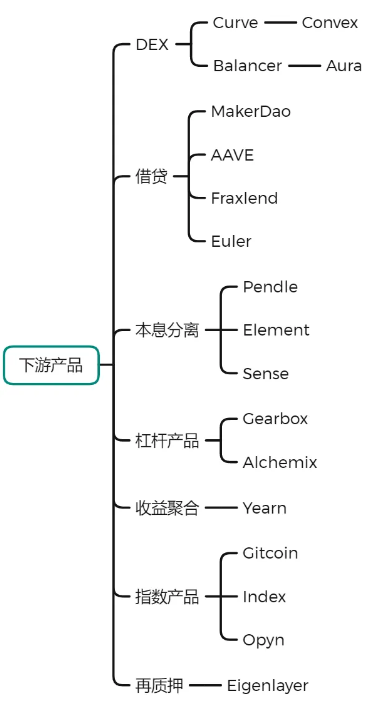

4. Future Trends in the LSD Sector and Impact on Major DeFi Categories

After the Shanghai upgrade, Beacon Chain-staked ETH became withdrawable, boosting user staking interest and driving higher staking rates—expanding the scale of LSDETH as a yield-bearing asset. Beyond more liquid staking protocols, DeFi products built around LSDETH are poised for a new growth curve.

Decentralized Exchanges (DEXs): Liquidity provisioning for LSDETH is crucial for LSD protocols. LSDETH/ETH pairs, being similar assets, are best suited for Curve and similar stableswap platforms. As more LSD protocols emerge, competition to bootstrap LSDETH liquidity could spark a new “Curve War.” Notably, liquidity bootstrapping costs are currently lower on Balancer than Curve. Given Balancer’s smaller base, the rise of LSDETH will have a proportionally greater impact on Balancer than Curve (relevant protocols: Aura, Convex, Balancer, Curve).

Lending Protocols: Demand for leveraged LSDETH positions will drive lending activity around this asset class. Two main use cases exist:

First, looping loans for yield boosting, currently dominated by Aave—users deposit stETH to borrow ETH, up to 90% LTV, enabling up to 10x leverage (excluding fees). However, ETH borrowing rates on Aave tend to be high (post-Shanghai, Aave’s ETH deposit rate may converge with staking yield, making borrowing costlier than staking return, undermining loop demand). The core issue is that borrowing rates must cover depositor opportunity costs. Future alternatives may involve CDP-style minting of ETH-pegged stablecoins, replacing depositor costs with more efficient liquidity mechanisms, enhancing composability and better serving leveraged yield strategies (related protocols: Aave, Compound).

Second, using LSDETH as collateral to borrow stablecoins, increasing portfolio risk exposure—operable via standard lending or CDP models (related protocols: Fraxlend, MakerDAO).

Principal-Interest Separation and Derivatives: As a floating-rate yield asset, LSDETH enables financial derivatives like principal-interest separation and interest rate swaps. Principal-interest separation allows users to go short future yields (sell interest tokens, buy principal tokens—low leverage, used to lock in gains), go long future yields (sell principal tokens, buy interest tokens—high leverage, speculative), or enhance yield. Before the LSD boom, such derivatives were mostly tied to stablecoin LPs—assets smaller in scale and lower yielding than LSDETH, with fragmented liquidity. The emergence of LSDETH will significantly boost demand and scalability for these derivative products (related protocols: Pendle, Element, Sense).

Restaking: Concept introduced by Eigenlayer. Eigenlayer modifies Ethereum’s base client to allow validators to re-stake their ETH stakes to validate other protocols—like oracles and data availability layers—in parallel. Importantly, Eigenlayer grants staked ETH a second yield stream but sacrifices some liquidity and exposes users to additional AVS (Actively Validated Services) security risks, introducing a new slashing vector for restaked ETH.

Chart 7: Downstream Products Based on LSDETH

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News