Pendle Explained: A Casino for Interest Rates

TechFlow Selected TechFlow Selected

Pendle Explained: A Casino for Interest Rates

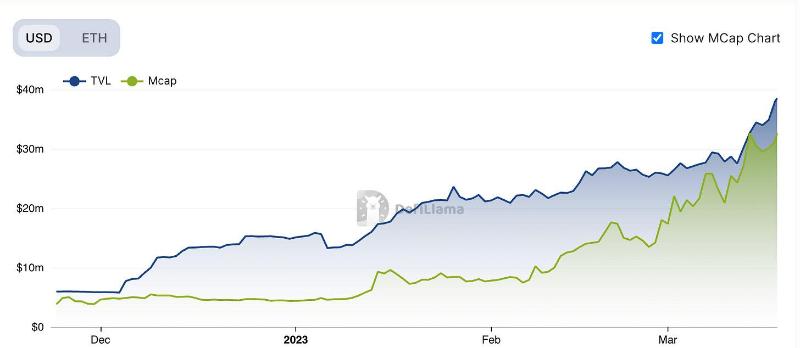

With both token price and TVL achieving a 500% increase, Pendle has emerged as a rejuvenated project in the fixed-rate yield sector—a space previously considered "disproven."

With both token price and TVL achieving a 500% increase, the once "disproven" fixed-rate sector has seen Pendle emerge as a rejuvenated project.

Fixed interest rates? No—this is actually a casino of interest rates! In this industry, it's always gambling that draws the most attention.

This article will walk you through Pendle’s mechanism with practical examples, show how yield-bearing asset enthusiasts (such as LSD and GLP holders) can better profit from it, and explore the promising derivatives赛道 of interest rate swaps.

Overview

Pendle is an interest rate swap platform. In short:

It splits a yield-bearing asset (SY) into principal tokens (PT) and yield tokens (YT) over a specific time period.

PT/YT prices are determined by an internal AMM whose algorithm parameters define the liquidity curve, with final pricing set by the free market.

At its core, converting SY into PT locks in a fixed interest rate for a given term, while YT serves as a leveraged instrument to bet on rising yields.

Practical Example

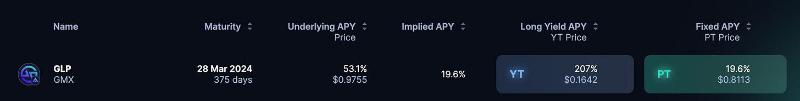

Let’s take GLP as an example. Current data:

GLP = $0.9755

YT = $0.1642

PT = $0.8113

Maturity = 375 days

This means all GLP yield over these 375 days goes entirely to YT, while PT allows redemption of GLP at a 1:1 ratio after maturity.

PT

Suppose you spend 1 GLP to buy $0.9755 / $0.8113 = 1.202 PT.

After 375 days, you’ll receive 1.202 GLP.

Converted into annualized yield (APY): 1.202^(365/375) - 1 = 19.6%.

This means regardless of how much trading fee revenue GLP actually earns over the next year+, you’re guaranteed a 19.6% APY.

This is the fixed-rate functionality offered by PT.

YT

Suppose you spend 1 GLP to buy $0.9755 / $0.1642 = 5.941 YT.

How much will you earn after 375 days? That depends entirely on GLP’s actual performance.

Actual Rate = Implied Rate

The so-called implied APY is 19.6%, meaning we assume GLP’s actual APY over the next 375 days equals 19.6%.

Each YT would then yield: 1.196^(375/365) - 1 = 0.202 GLP.

Thus, 5.941 YT bought with 1 GLP becomes 5.941 × 0.202 = 1.200 GLP.

Converted into APY: 1.2^(365/375) - 1 = 19.6% (slight discrepancy due to rounding).

Actual Rate > Implied Rate

Now suppose GLP maintains its current 53.1% APY over the next 375 days.

Then, investing 1 GLP into YT today would result in:

5.941 × (1.531^(375/365) - 1) = 3.261 GLP

Converted into APY: 3.261^(365/375) - 1 = 207%.

Yes—you’d make a killing buying YT in this scenario.

Actual Rate < Implied Rate

But what if GLP’s actual APY is only 10%?

Then: 5.941 × (1.1^(375/365) - 1) = 0.611 GLP.

Yes—you’d lose nearly 0.4 GLP on your YT investment.

In summary:

If actual SY yield equals implied yield, YT returns match the implied rate.

If actual SY yield exceeds implied yield, YT acts like a leveraged play capturing excess yield.

If actual SY yield falls below implied yield, YT suffers leveraged losses—possibly losing even principal.

Pricing & AMM

How are YT and PT priced and traded?

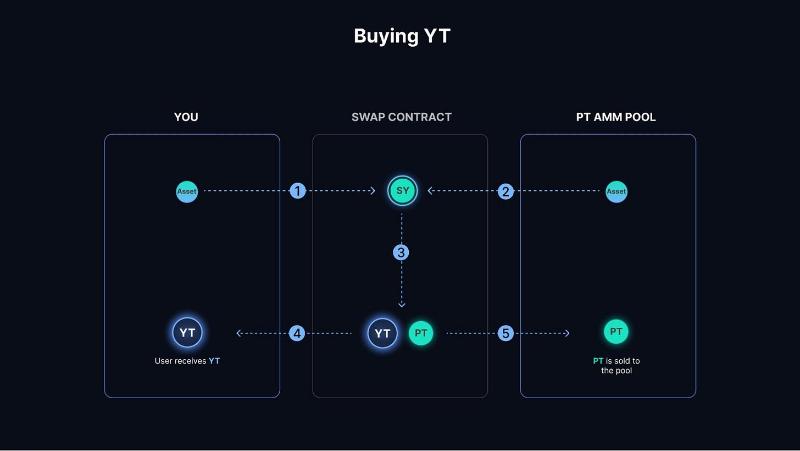

Pendle features an internal AMM for PT/SY, allowing external liquidity providers to participate. Users trade PT directly via this AMM. Trading YT is more complex:

User initiates a trade: 1 SY → X YT

Pendle contract withdraws (X-1) SY from the AMM pool

Combines the two SY amounts and splits X SY into X PT + X YT

Sends X YT to user, returns X PT to the AMM. Since X PT = (X-1) SY = X SY - X YT, total pool assets remain unchanged

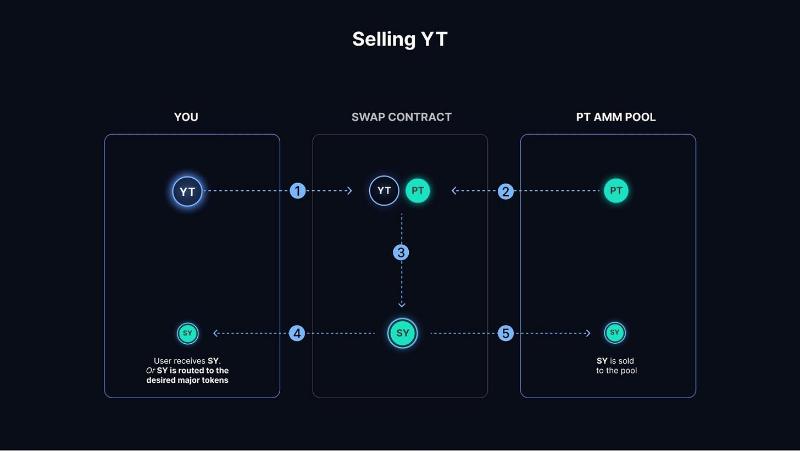

Selling YT reverses this process—see diagram below:

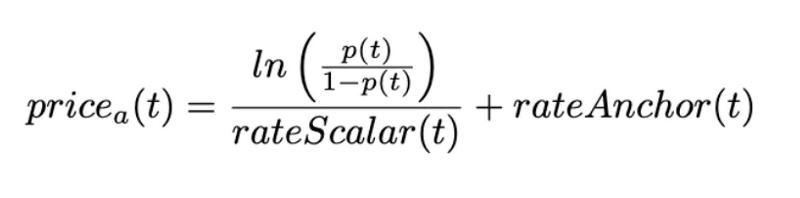

How does Pendle’s AMM determine pricing?

Its AMM is adapted from Notional, featuring a complex formula. Here are the key insights:

The longer until maturity, the wider the liquidity distribution; the shorter, the more concentrated.

Liquidity centers around the current actual APY of SY. For example, Curve V1 concentrates liquidity around the 1:1 ratio.

When PT占比 fluctuates between 10%-90%, interest rates vary within [0, Max], where Max is a parameter estimating the maximum possible APY.

This design likely stems from two assumptions:

Implied rates formed by trading should cluster near actual rates, justifying central concentration.

Longer maturities entail greater uncertainty about future rates, requiring broader liquidity to accommodate larger deviations.

Thanks to these innovations, Pendle delivers a functional market-driven interest rate trading experience, serving both fixed-income seekers and speculative traders.

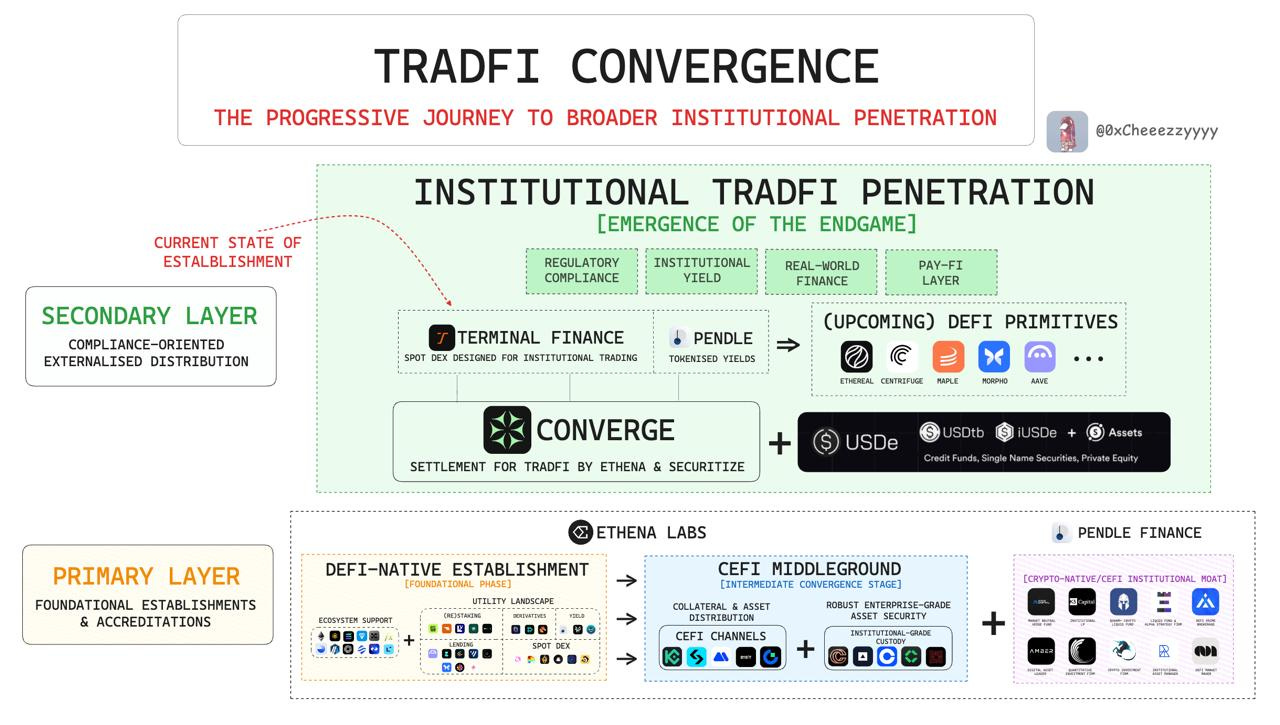

Value Capture

Past attempts at fixed-rate protocols failed largely because they didn’t balance certainty with speculation. Pendle succeeds here, and with the rise of LSDs and perpetual DEXs generating abundant yield-bearing assets, Pendle has seized another growth opportunity.

Having explained the mechanics, it's clear Pendle offers solid product value. However, its token’s value capture remains limited.

Its primary value capture mechanisms are:

Trading fees on PT/YT: ~0.1%, dynamically adjusted, with 80% going to vePENDLE and 20% to LPs.

Yield from YT: 3% directed to vePENDLE.

ve-tokenomics: Voting power determines which pools receive incentives.

Over the past 7 days, trading volume was ~$1M. Annualized fee revenue: $1M × 52 × 0.001 × 0.8 = $40k.

Current TVL: $34M, including low-yield assets like LSDs and high-yield ones like GLP. Estimated average yield: ~10%.

Annualized yield revenue: $34M × 0.1 × 0.03 = $100k.

Total annual revenue: ~$140k—which is quite low. Even a tenfold increase wouldn't be substantial. Future growth hinges on whether bribe markets can develop. Given LSD projects are significant bribe spenders, success here could unlock meaningful revenue.

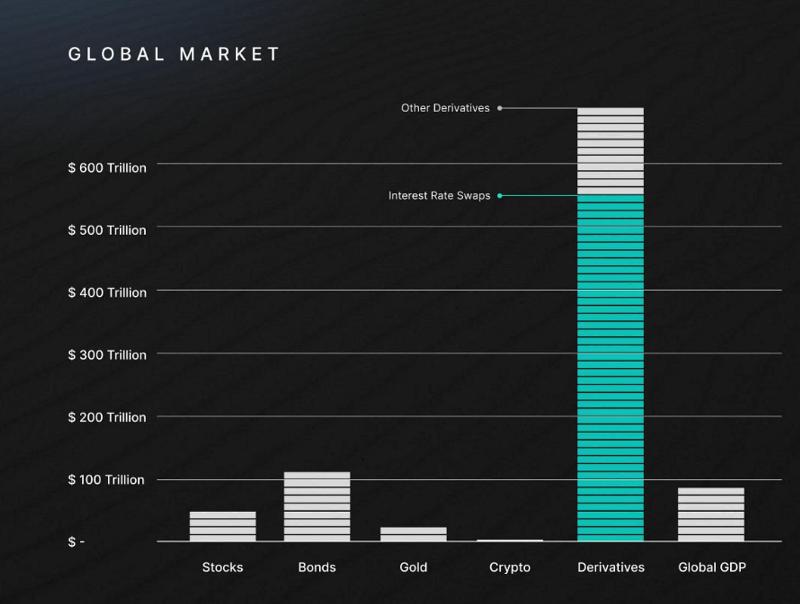

Sector Outlook

Interest rate swaps are vital in traditional finance, especially for institutional players. Yet during the last DeFi boom, these optimistic visions lacked real traction—fixed-rate protocols became synonymous with “disproven” concepts.

Today, with the rise of Real Yield, yield-bearing assets are becoming more sustainable. With further refinements in UX and mechanics, this old赛道 may bloom again—and Pendle exemplifies that potential.

Conclusion

For fans of yield-generating assets like GLP and LSD, Pendle enables both locking in fixed rates and speculating on yield movements. Its token’s value capture remains modest today—DYOR before investing. For deeper discussions on GLP/LSD and related assets, see this link.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News