From Volatility to Stability: The Most Comprehensive Guide to Fixed-Rate DeFi Protocols in History (Part 2)

TechFlow Selected TechFlow Selected

From Volatility to Stability: The Most Comprehensive Guide to Fixed-Rate DeFi Protocols in History (Part 2)

In the 1970s, the outbreak of the oil crisis and the collapse of the Bretton Woods system led to severe inflation and higher, more volatile interest rates.

Authors:

Ethan C., Researcher of EM3DAO, EVG, Hakka Finance

Lucien Lee, CEO of Hakka Finance

Ping Chen, Founder of Hakka Finance

The Rise of Fixed-Rate Protocols in DeFi

Yield-bearing assets are ubiquitous in DeFi—lending, AMM LP fees, staking rewards, liquidity mining, yield aggregation, and more. However, interest rates on blockchain are dynamically determined by market forces and can fluctuate violently.

This volatility makes it difficult for investors to secure future returns or control leverage costs, hindering efficient capital allocation and long-term financial planning. This limitation has slowed broader adoption and advancement in DeFi. Although the ecosystem remains in the early stages of innovation, filled with double- and triple-digit APY mining opportunities that desensitize early adopters to rate swings, several DeFi pioneers have recognized the importance of fixed-rate instruments and designed various mechanisms to pioneer this space.

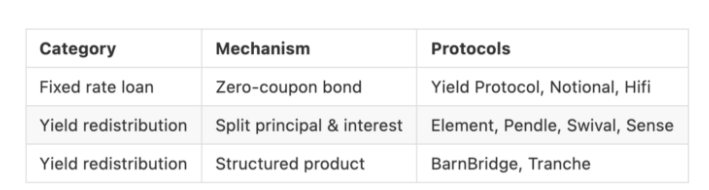

In our previous article, we conducted an in-depth analysis of all major fixed-rate protocols on the market. In summary, they fall into two broad categories and three subtypes:

Category 1: Fixed-Rate Lending

Lending transactions with counterparties at agreed-upon dates, amounts, and fixed interest rates.

1. Zero-Coupon Bonds:

Borrowers issue zero-coupon bonds sold at a discount to lenders; the difference between purchase price and face value represents fixed interest over time.

Category 2: Yield Redistribution

Pooled investment in yield-bearing assets with risk-based distribution of returns.

1. Principal & Interest Separation:

Separating principal from future variable interest of yield assets, packaging each as tradable tokens. Selling future interest forward locks in a known fixed return.

2. Structured Products:

Layering risk and returns such that lower-risk tranches receive predetermined yields first, while residual returns go entirely to higher-risk tranches—which also absorb interest rate fluctuations.

The table below summarizes protocols according to these classifications:

Classification of Fixed-Rate Protocol Mechanisms

These methods generate fixed rates differently, each with distinct advantages and trade-offs. But they share one key trait: they are all built upon underlying yield sources (lending, yield aggregation, etc.) and involve trading both interest and principal. Yet when transitioning from "floating" to "fixed" rates, what we truly care about is hedging against "interest rate volatility."

In other words, we’re less concerned with the principal invested or even the absolute interest rate—we focus on the “difference” between the actual interest earned/paid over time and the initially expected rate. Our goal is to transfer or hedge this fluctuation risk.

In traditional finance, the most common tool for this is the Interest Rate Swap (IRS).

Interest Rate Derivatives

In the 1970s, amid the oil crisis and the collapse of the Bretton Woods system, inflation surged alongside volatile interest rates. To manage this risk, interest rate derivatives began to emerge and gain traction. Since IBM and the World Bank executed the first IRS in 1981, interest rate swaps have become the most traded financial derivative by volume.

Like futures markets, IRS markets consist of participants taking opposite positions on the same underlying rate. You can go long or short on interest rates and profit or lose based on future rate movements. Properly used, IRS contracts can fully offset the PnL of floating-rate (borrowing or lending) exposures.

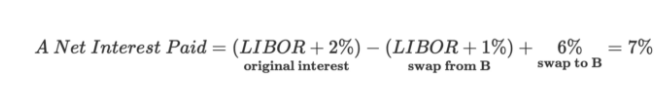

For example, Company A has a $1M loan paying USD 6-month LIBOR + 2%. Expecting rising LIBOR, it wants to lock in its cost. Meanwhile, Company B has a $1M fixed-rate loan at 5%, but holds a floating-rate investment it hopes will cover payments—so it prefers to pay LIBOR instead.

They enter a 3-year $1M notional IRS where A pays 6% fixed to receive LIBOR + 1% from B. The outcomes are:

Company A: Effectively pays a fixed rate of 7%

Company B: Pays a floating rate of LIBOR

In practice, only the net difference is settled—e.g., from A’s perspective, (5% – LIBOR)/2 per period.

Example:

Period 1: LIBOR = 4.8%, A pays B $1M × 0.1%

Note: 0.1% = (5% – 4.8%)/2

Period 2: LIBOR = 5.2%, A receives $1M × 0.1% from B

Note: -0.1% = (5% – 5.2%)/2

As seen above, IRS offers high capital efficiency because settlements are based solely on rate differentials without exchanging principal. Participants post small collateral to hedge large notional amounts.

Inspired by this model, we believe the ideal direction for DeFi fixed-rate protocols is a leveraged interest rate derivatives market—enabling users to trade large notional interest exposure with minimal capital. This led us to create iGain — Interest Rate Synth.

iGain — Interest Rate Synth

iGain is a DeFi derivatives framework proposed by Hakka Finance. It uses floating rates from yield protocols (e.g., lending platforms) as settlement indices, turning abstract interest rates into tradable synthetic assets—creating an unprecedented interest rate trading market in DeFi.

Design Concept

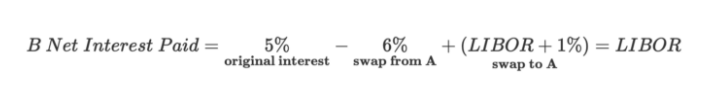

iGain uses a Long/Short dual-token design, enabling directional bets on any index. In IRS terms, holding Long means bullish on rates, Short means bearish.

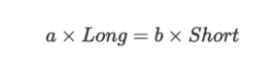

The core mechanism ensures that the sum of Long and Short prices always equals $1:

1 Long + 1 Short = $1

The Long token's settlement price depends on the accumulated rate during the period and ranges between $0 and $1. The Short token’s price is defined as 1 – Long, creating a natural inverse relationship: if Long rises, Short falls, and vice versa.

The sum of Long and Short prices always equals $1

All Long and Short tokens are minted by depositing underlying assets. Due to the 1:1 minting ratio, every deposit creates one Long and one Short. Conversely, burning equal amounts of Long and Short redeems the original deposited asset.

Build-in DEX

To enable trading, iGain includes a built-in decentralized exchange using the constant product market maker model x×y=k. The liquidity pool consists of Long and Short tokens. If the pool contains 'a' Long and 'b' Short tokens, their values satisfy:

Using DAI as an example and applying the equation 1 Long + 1 Short = $1 DAI, we derive pricing formulas for Long and Short:

Any trade alters the quantities of a and b, thereby affecting Long and Short prices.

Notably, iGain does not support Long/DAI or Short/DAI pairs. Users can only swap between Long and Short. To buy Long with DAI, one must first mint equal amounts of Long and Short with DAI, then swap Short for additional Long in the pool.

Process for Adding Liquidity and Purchasing Long & Short Tokens

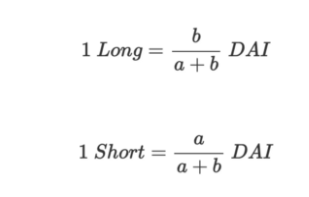

Conversely, to sell Long for DAI, one must first swap some Long for Short, then redeem equal quantities of Long and Short for DAI.

Process for Selling A Units of Long for X DAI

Price Settlement

By changing the settlement index, iGain can support various financial derivatives.

The first version of Interest Rate Synth (IRS) supports Aave, with plans to add Yearn and other yield protocols. For Aave, Long’s settlement price is based on “accumulated borrowing interest” over the term—the higher the interest, the higher Long’s price, and thus the lower Short’s.

Implementation

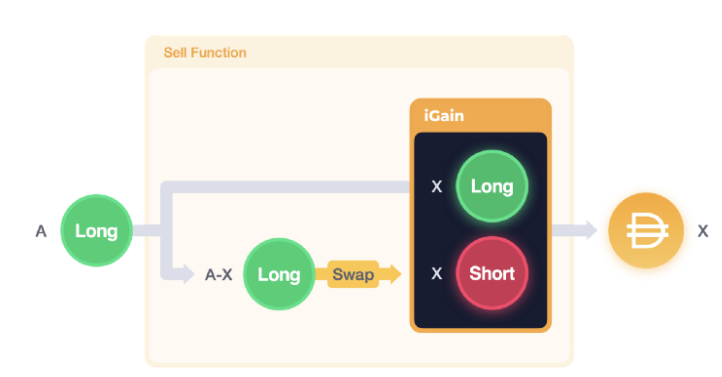

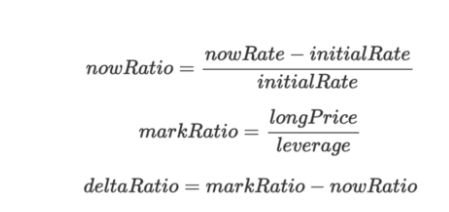

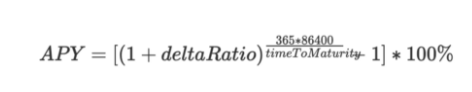

When borrowing at variable rates on Aave, debt tokens are issued whose exchange rate is determined by the `getReserveNormalizedVariableDebt` function. As interest accrues, this value increases. IRS uses the change in this value over time to calculate accrued interest and determine Long’s settlement price.

At contract initialization:

initialRate = AAVE.getReserveNormalizedVariableDebt(asset)

At maturity:

endRate = AAVE.getReserveNormalizedVariableDebt(asset)

With initialRate and endRate, we compute the interest growth rate:

ratio = (endRate - initialRate) / initialRate

For instance, if ratio = 0.04, 4% interest accrued. Without leverage, Long settles at $0.04, Short at $0.96.

To improve capital efficiency, we apply historical backtesting to introduce appropriate leverage. With 10x leverage, Long settles at $0.4, Short at $0.6.

_bPrice = leverage * rate

Long’s final settlement price is capped at $1:

Long settlement price: bPrice = min(_bPrice, 1)

Short settlement price: 1 - bPrice

How to Achieve Fixed Rates

Fixed-Rate Lending

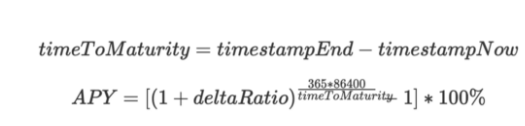

After depositing on Aave, your yield fluctuates with utilization rate. By purchasing a corresponding amount of Short tokens (betting against rates), you establish an inverse position that hedges future rate changes, locking in a predictable total return at maturity (see note). See below for details on quantity and locked rate.

Required Quantity:

To perfectly hedge a deposit’s rate exposure, you need to buy a specific amount of Short, which depends on leverage. Higher leverage means fewer tokens needed.

For example, a 1000 DAI deposit requires 1000 Short tokens without leverage. At 10x leverage, only 100 Short are needed.

Required Amount = Deposit Size / Leverage

Higher leverage improves capital efficiency.

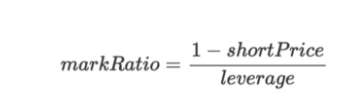

Locked Interest Rate:

As shown earlier, Long’s price is determined by accrued interest and leverage.

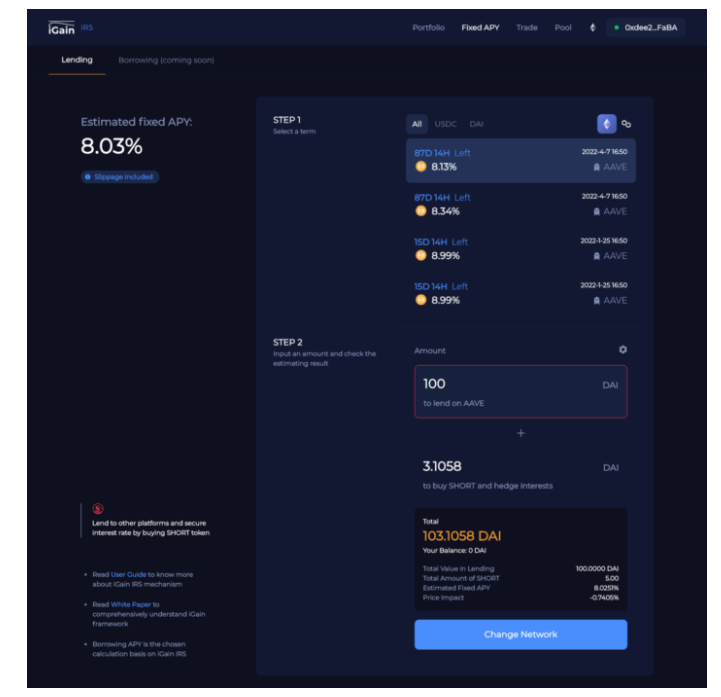

At settlement, the realized rate (nowRatio) determines Long’s payout. Conversely, from Long’s average purchase price, we infer the implied rate (markRatio). The difference deltaRatio is the hedged rate.

Then, using time to maturity, we compute the fixed APY via compounding:

Note: Since IRS settles based on borrowing rates, depositors cannot perfectly offset deposit rate changes. There may be slight discrepancies between actual and calculated returns at settlement.

iGain — IRS Offers One-Click Fixed-Rate Lending

Fixed-Rate Borrowing

To achieve fixed-rate borrowing, purchase Long tokens to bet on rising rates, locking in your borrowing cost. The required number of Long tokens follows the same formula:

Required Amount = Loan Size / Leverage

To compute the effective borrowing APY, use the Short token’s average price instead:

Remaining steps mirror fixed-rate lending, resulting in:

Real-World Example

Holding Long/Short does not directly convert floating rates to fixed in lending protocols. Instead, fixed-rate exposure is achieved by establishing an opposing position in the derivatives market.

Below is an example of fixed-rate borrowing using iGain.

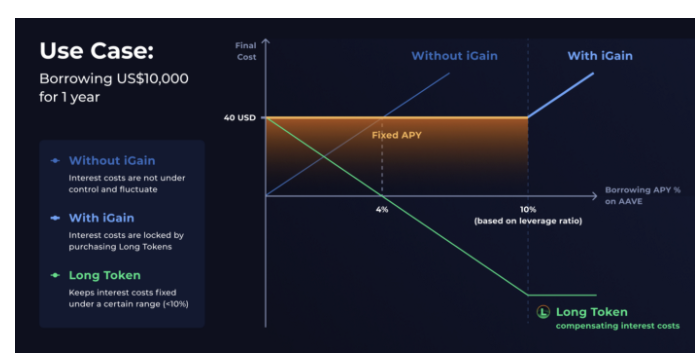

Suppose an iGain series matures in one year with 10x leverage.

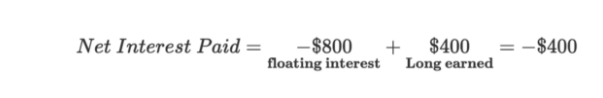

Jack borrows $10,000 on Aave and buys 1,000 Long tokens at an average price of $0.4 ($400 total), aiming for a 4% fixed borrowing rate.

We examine outcomes under different scenarios:

Case 1:

After one year, Jack’s realized borrowing rate on Aave is 8%.

Total interest paid: $800. Long settles at $0.8, returning $800. Net gain on Long: $400.

Combining Aave and Long positions, Jack effectively paid $400—equivalent to 4% borrowing.

Case 2:

After one year, Jack’s realized rate is 3%.

Interest paid: $300. Long settles at $0.3, returning $300. Net loss on Long: $100.

Total cost: $400—still equivalent to 4% borrowing.

In both cases, regardless of whether the floating rate ends above or below 4%, holding sufficient Long tokens results in a net cost of exactly 4%. Gains and losses offset perfectly.

Summary of All Scenarios:

with iGain = without iGain + Long Token PnL

Leverage determines the hedgeable rate range: max hedgeable rate = 100% / leverage.

The purchase price of Long or Short determines the locked fixed rate: lower entry price = better fixed rate.

Advantages of iGain — IRS

Unlike existing fixed-rate protocols using spot-based mechanisms, iGain builds a derivatives market. Compared to others, we offer four key advantages:

1. High Capital Efficiency

While interest originates from principal in yield-bearing assets, achieving fixed rates should focus on the “rate differential”—not the principal. By settling only on interest differences without involving principal, iGain achieves high leverage. Traders can hedge large notional exposures with minimal margin.

2. Sensitive Price Discovery

Due to high leverage, even small capital can move IRS prices significantly. When arbitrage opportunities arise between internal and external rates, IRS corrects faster than zero-coupon bond AMMs (e.g., Yield Protocol, Notional, Element, Pendle), which require large capital to mint tokens and adjust prices. Thus, IRS reflects real market conditions more responsively.

3. Composability & Network Effects

Since iGain — IRS is built atop existing yield protocols, it leverages their liquidity and user base. Unlike standalone fixed-rate lending platforms (e.g., Yield, Notional), which fragment liquidity, IRS users keep primary positions on Aave/Compound/Yearn, only allocating small funds for hedging. This composability strengthens network effects—driving new users to DeFi while increasing TVL for underlying protocols.

4. Enables Interest Rate Shorting

Existing DeFi fixed-rate protocols only allow hedging—they don’t enable true rate shorting. “Yield redistribution” models create “fixed income” and “long rate” markets (e.g., interest tokens in principal-split protocols), but no leveraged short market exists. With IRS, the Short token allows bearish bets without depositing capital—making iGain the first protocol to offer leveraged interest rate shorting in DeFi.

iGain + Aave = Win-Win?

iGain’s first derivative is built on Aave. While Aave already offers stable-rate borrowing, iGain adds advanced functionality without fragmenting liquidity.

First, iGain introduces fixed-rate **depositing**—a feature many new DeFi users prefer. Traditional finance users expect predictable returns, not volatile yields. We believe Aave + IRS can attract a broader audience.

Second, Aave’s current fixed and variable rates differ significantly. iGain IRS, being a derivative with 1:1 Long/Short minting, eliminates bid-ask spreads and effectively matches fixed-rate lenders and borrowers, narrowing Aave’s overall rate spread.

Conclusion

In traditional finance, most debt markets are dominated by fixed-rate loans—about 90% of U.S. mortgages are fixed-rate. Predictable rates reduce risk and build confidence, encouraging adoption of complex financial products.

As foundational building blocks of portfolios, lending instruments are expected to offer predictable yields. Fixed-income instruments like mortgage-backed securities or government bonds form the basis of capital-protected funds or leveraged Bitcoin positions. Fixed rates are essential for developing sophisticated financial products. Whether attracting traditional finance users or enabling advanced DeFi applications, fixed-rate protocols will serve as critical primitives.

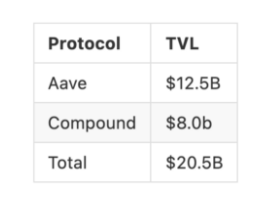

Yet in DeFi, floating-rate protocols vastly outpace fixed-rate ones in market size.

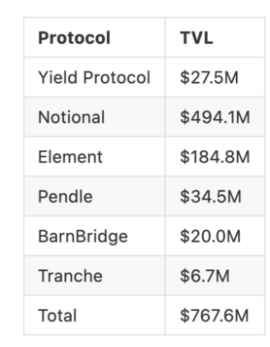

Aave and Compound together exceed $20.5B in TVL, while all major fixed-rate protocols—including Yield Protocol, Notional, Element, Pendle, BarnBridge, Tranche—total only ~$767M.

TVL of Floating-Rate Protocols as of 2022/01/09. Source: DefiLlama

TVL of Fixed-Rate Protocols as of 2022/01/09. Source: DefiLlama

Thus, we project significant growth potential for DeFi fixed-rate markets. Indeed, 2021 saw numerous innovative protocols emerge—especially Yield Protocol, which pioneered the YieldSpace AMM model for zero-coupon bonds, setting a benchmark in the field.

Today, around twenty DeFi fixed-rate lending protocols have launched or are launching. Despite their numbers, many are minor variations of each other, suggesting fierce competition ahead. Fortunately, the market is vast enough that one or two leaders may emerge in each of the three main categories, bringing exciting new products and use cases.

However, most current “spot” fixed-rate protocols remain trapped in principal-trading paradigms. In contrast, traditional finance shows that IRS dominates OTC derivatives. According to BIS, interest rate derivatives account for 80% of all derivatives trading, with IRS making up over 75% of that—and outstanding notional exceeding $372 trillion as of mid-2021.

The dominance of IRS stems from its high capital efficiency through differential-only settlement. Inspired by this, we’ve reimagined IRS for blockchain—eliminating the need for bilateral matching of non-standardized contracts—by creating a standardized, composable interest rate derivatives market: iGain — Interest Rate Synth.

We believe DeFi’s power lies in permissionless, frictionless access—where anyone can efficiently meet diverse financial needs. Through composability, DeFi protocols can unite, generate massive network effects, and collectively challenge the giants of traditional finance!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News