LD Capital: Reviewing the Risks and Opportunities in the USDC Depegging Incident

TechFlow Selected TechFlow Selected

LD Capital: Reviewing the Risks and Opportunities in the USDC Depegging Incident

This article will examine the performance of lending and trading protocols, decentralized stablecoin systems most affected by the USDC depegging crisis, as well as potential trading opportunities.

This article will explore the performance of lending and trading protocols, decentralized stablecoin systems most affected during the USDC depeg crisis, as well as potential trading opportunities.

Overview of the USDC Crisis

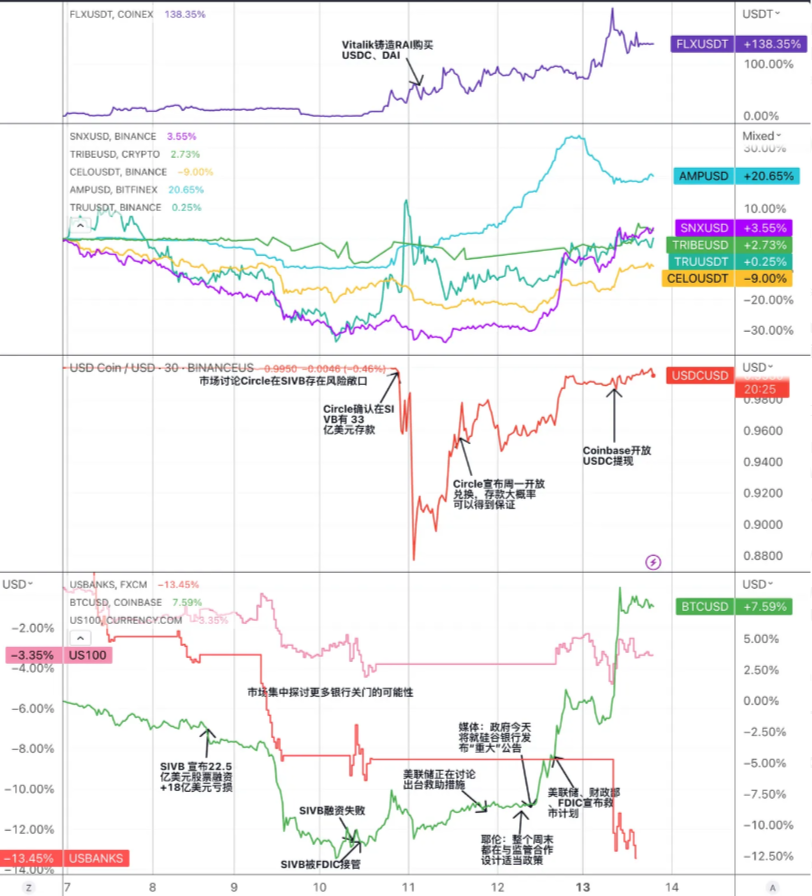

USDC is a centralized stablecoin pegged to the U.S. dollar, issued by Circle and Coinbase. On March 11, 2023, due to Silicon Valley Bank (SVB) filing for bankruptcy, part of Circle’s cash reserves held at SVB were frozen, leading to a decline in market confidence in USDC and triggering massive redemptions and sell-offs. The price of USDC dropped from $1 to $0.878, creating significant spreads with other stablecoins such as DAI and BUSD. Subsequently, on March 13, following the announcement of a joint market rescue plan by the Federal Reserve, Treasury Department, and FDIC, market panic gradually subsided, and USDC's price returned close to its normal level.

Chart: Key Events During the USDC Depeg Crisis and Price Trends of Related Stablecoin Sector Tokens

Source: Trend Research, Tradingview

To address this crisis, Circle took the following measures:

-

Negotiated with SVB to unfreeze partial funds and transfer them to other banks.

-

Burned part of USDC to reduce circulating supply and boost market confidence in reserve adequacy.

-

Cooperated with other stablecoin issuers to open 1:1 exchange channels to alleviate market pressure.

-

Collaborated with centralized exchanges to pause or restrict USDC deposit and withdrawal services to prevent malicious arbitrage.

The entire USDC depeg event triggered panic and volatility across the cryptocurrency market, affecting investor confidence and trading activity. In particular, projects in the following sectors faced certain risks:

-

Centralized Stablecoin Market: The USDC depeg may harm its position and reputation within the centralized stablecoin market. Initially, it caused widespread skepticism and panic selling among all stablecoins, but subsequently created opportunities for competitors (such as TUSD, USDP) to capture market share. Meanwhile, the temporary price drops of unaffected stablecoins like BUSD and USDP during the panic period actually presented low-risk arbitrage opportunities.

-

Decentralized Stablecoins: The USDC depeg impacted decentralized stablecoins that use USDC as collateral or reserve assets (such as DAI, FRAX, MIM), causing them to significantly depeg alongside associated liquidation risks and arbitrage opportunities. At the same time, it could stimulate innovation and development in decentralized stablecoins not reliant on fiat reserves or collateral (such as sUSD, LUSD, RAI).

-

On-Chain Lending: The USDC depeg affected on-chain lending platforms (such as Aave, Compound) using USDC as a lending asset or collateral, resulting in interest rate fluctuations, USDT liquidity shortages, or liquidation events. Moreover, Compound, which assumes USDC's value remains fixed at $1, faces higher risk exposure.

-

DEXs: The USDC depeg may have impacted decentralized exchanges (such as Uniswap, Curve) using USDC as trading pairs or liquidity pool assets, causing price slippage or arbitrage opportunities. It may also push DEXs to improve their trading efficiency and flexibility to adapt to market changes.

Impact and Opportunities for Stablecoin Systems

Synthetix

Launched in 2018, Synthetix initially functioned as a synthetic asset protocol before gradually evolving into a decentralized liquidity provision protocol built on Ethereum and Optimism.

Users stake the protocol’s governance token SNX to mint the stablecoin sUSD. The current scale of sUSD is approximately $55 million. The collateral ratio for minting sUSD with SNX is 400%, with a liquidation threshold at 160%. This high collateralization ratio results in low capital efficiency. However, it is necessary because SNX is the protocol's own governance token, subject to significant price volatility; a higher collateral ratio helps mitigate extreme market risks and maintain system stability.

sUSD maintains its price peg through an arbitrage mechanism. The minting price of sUSD is always $1. When the market price exceeds $1, arbitrageurs can mint new sUSD and sell it at the higher market price, increasing supply and bringing the price back down. When the market price falls below $1, arbitrageurs buy sUSD from the market and burn it to reduce debt.

sUSD's application scenarios are built upon the “debt pool” formed by SNX staking. The debt pool is a unique mechanism of Synthetix. All users who stake SNX to mint sUSD share one common debt pool. When a user mints sUSD, the amount they mint represents their proportion of the total sUSD supply—i.e., their share of the system’s overall debt. If one user’s investment strategy yields profit (e.g., buying sETH with sUSD when sETH rises), it increases the debt burden for others.

The debt pool provides liquidity, zero-slippage trades, acts as a counterparty, and offers liquidity services to various protocols, demonstrating strong composability.

Based on this debt pool, SNX has developed its ecosystem. Synthetix does not directly provide any frontend but serves as a backend liquidity provider for some DeFi protocols. Current ecosystem partners include Curve, perpetual exchange Kwenta, and options exchange Lyra.

sUSD has relatively stable use cases. Recently, Kwenta’s trading volume and revenue data have shown significant growth.

During this USDC crisis, although sUSD’s underlying assets do not include USDC, its price was still slightly affected, dropping as low as ~$0.96. However, it quickly reverted to parity through arbitrage. The sell-off was primarily sentiment-driven since Synthetix has no direct exposure to USDC-related risks. Furthermore, falling prices of non-sUSD synthetic assets during the same period reduced liabilities (and thus liquidation risk) for sUSD minters. Therefore, compared to stablecoin projects holding large amounts of USDC on their balance sheets, sUSD had a higher certainty of re-pegging.

Chart: sUSD vs. USDC Price Comparison

Source: Trend Research, CMC

Additionally, there was theoretically an internal arbitrage opportunity—for example, purchasing sUSD at $0.95 on secondary markets, exchanging it for another synthetic asset like sETH at a 1:1 rate via the Synthetix system, then selling sETH above $0.95 on secondary markets, generating arbitrage profits if friction costs are sufficiently low.

Synthetix is currently working on upgrading to V3. In V3, additional collateral types beyond SNX—including ETH and other crypto tokens—will be allowed to mint sUSD. Previously, sUSD issuance was limited by SNX’s market cap. With V3 implementation, this constraint will be lifted, enhancing sUSD’s scalability. As more capital flows into Optimism, Synthetix aims to build a richer ecosystem and expand its market size.

MakerDAO

MakerDAO is a smart contract system launched in 2014 on Ethereum, operating as a DAO (decentralized autonomous organization) to issue DAI, a decentralized stablecoin pegged 1:1 to the U.S. dollar.

The protocol issues the stablecoin DAI by over-collateralizing various types of crypto assets at specific collateral ratios—an essentially trustless form of over-collateralized lending. When the value of collateral drops below the minimum collateral ratio (150%), users’ collateral may be liquidated (forcibly sold to repay DAI), ensuring Maker’s system avoids debt shortfalls.

DAI is designed to minimize cryptocurrency volatility, but market behavior often causes deviations from its $1 peg. Thus, Maker’s primary goal is maintaining DAI’s price stability.

One method Maker uses to stabilize DAI’s price is adjusting the stability fee. Since the stability fee represents the borrowing cost for DAI, altering it influences user borrowing behavior. However, adjustments require MKR holder votes, making the governance cycle long and slowing price stabilization. Additionally, actual market dynamics show that DAI demand decreases as ETH rises and increases as ETH falls—yet the supply rules are inverted.

To address these two issues, Maker introduced the Peg Stability Module (PSM). The first PSM implementation was USDC PSM, allowing users to deposit USDC and withdraw DAI at a 1:1 rate for only a 0.1% fee. This module operates as a fixed-price currency swap agreement, akin to a rigid redemption mechanism with set limits, providing bilateral buffer protection for DAI’s price.

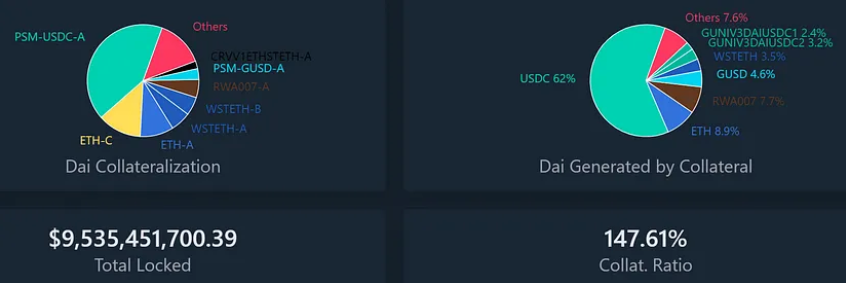

PSM largely solved DAI’s price stability problem and reduced the need for frequent stability fee adjustments, keeping borrowing costs predictable for users. The rapid expansion of PSM led USDC to become DAI’s largest source of collateral. Ironically, this seamless conversion mechanism caused a flood of USDC pouring into PSM during the recent crisis. Currently, the USDC PSM DAI minting limit has reached its debt ceiling, while withdrawals occurred from pools backed by more volatile assets (e.g., MATIC). As a result, USDC-backed DAI issuance rose from 40% to 62%.

Chart: MakerDAO Locked Asset Value and DAI Debt Composition

Source: Trend Research, Daistas.com

MakerDAO’s DAI has weathered multiple market crises, mainly falling into two categories:

- When most collateral suffers price declines due to stablecoin panic

On March 12, 2020, Ethereum’s price plummeted 43% in a single day, causing severe under-collateralization for many users (known as Maker Vaults) who used ETH and other cryptos as collateral to generate DAI. These undercollateralized Vaults were forcibly liquidated, with their collateral auctioned off to repay debts and penalties. However, due to market panic, network congestion, and system failures, some auctions received zero bids—allowing participants to win large amounts of collateral with 0 DAI. This resulted in approximately $5.4 million in losses for the MakerDAO system and a sharp reduction in DAI supply.

With DAI demand far exceeding supply, the peg broke, and DAI traded at a premium of up to 10%. At that point, shorting DAI awaiting price convergence—or even further downside—offered a highly favorable risk-reward ratio.

- When only USDC experiences sustained discounting

This recent USDC depeg marked the first time such a scenario unfolded, posing a major risk to the DAI system, as half of DAI is currently backed by USDC. If USDC loses its peg, DAI would be impacted, risking price volatility or unredeemability. To prevent this, the MakerDAO community passed several emergency proposals, reducing debt ceilings for several liquidity pools—including those involving USDC—to zero DAI, meaning no new tokens could be issued.

Additionally, the daily issuance limit for USDC exposure via the so-called “Stability Module” (PSM) was reduced from 950 million DAI to just 250 million DAI, and fees increased from 0% to 1%.

Issuing DAI against USDC is not over-collateralized, so Vault liquidations aren't possible. If USDC trades below $1, users minting DAI with USDC face a shortfall—they’d need to repay more DAI than the dollar value of their redeemed USDC. This exposes them to losses or inability to exit, potentially paralyzing the system. There’s even a possibility of auctioning the governance token $MKR to cover deficits, explaining why $MKR plunged over 30% during the crisis—but quickly rebounded once the USDC situation stabilized.

Chart: Price Changes of USDC and MKR During the Depeg Crisis

Source: Trend Research, Tradingview

Beyond the recovery trade in MKR’s value, DAI itself presented trading opportunities. Since the aggregate collateral ratio backing DAI typically exceeds 150%, DAI can be viewed as a "supercharged" version of USDC. When DAI trades below USDC—and especially after confirmation of USDC risk resolution—it should rebound faster. The chart below shows that as the crisis began resolving on the 11th, DAI consistently traded slightly above USDC.

Chart: Price Changes of DAI and MKR During the Depeg Crisis

Source: Trend Research, Tradingview

Notably, during this crisis, the PSM saw an influx of 950 million USDC, while deposits of unaffected GUSD sharply declined, along with outflows from other collateral pools—exhibiting a “bad money drives out good” effect. How to handle such structural risks deserves greater attention and discussion.

Liquity

Launched in April 2021, Liquity is a decentralized stablecoin lending platform based on Ethereum. Users can only mint the dollar-pegged stablecoin LUSD by over-collateralizing ETH. Liquity charges no interest, only one-time minting and redemption fees, encouraging long-term holding of LUSD. Managed entirely by smart contracts and immutable post-deployment, Liquity does not run its own frontend—users interact via third-party interfaces—making it strongly decentralized and censorship-resistant.

Currently, $LUSD supply is about $243 million, TVL $572 million, with 388k ETH staked and a total collateral ratio of 235.1%.

Liquity’s minimum collateral ratio is 110%. Below 150%, the system enters Recovery Mode; below 110%, liquidations trigger. In Recovery Mode, vaults with less than 150% collateral may be liquidated, and actions lowering the total collateral ratio are prohibited. The goal is to rapidly raise the system-wide collateral ratio above 150% to reduce systemic risk.

Liquity employs a tiered liquidation mechanism to maintain stability. The Stability Pool incentivizes users to deposit LUSD via liquidity mining and destroys debt while acquiring ETH during liquidations. When the Stability Pool is depleted, the system redistributes remaining debt and ETH proportionally to other vault holders.

Stability Pool providers and frontend operators earn the governance token LQTY. LQTY grants rights to protocol revenues (minting and redemption fees) and governance (voting power).

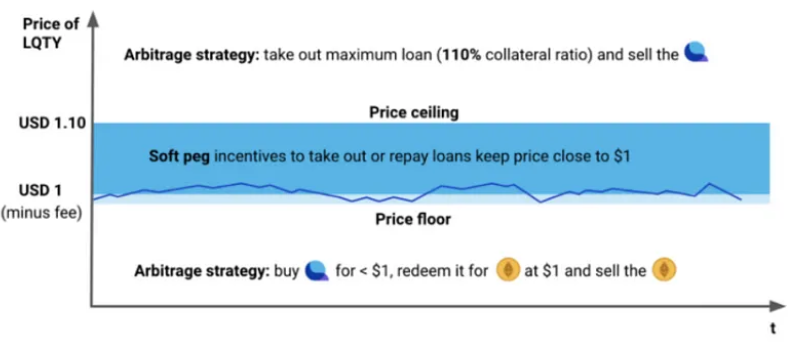

When LUSD trades below $1, users can buy it cheaply and redeem ETH at $1 for profit. When LUSD trades above $1 (e.g., $1.10), users can mint LUSD by pledging ETH and sell it at a premium. Thus, LUSD fluctuates between (1 - redemption fee, 1.10) and gravitates toward $1. This is LUSD’s hard peg mechanism. Additionally, since users can always mint or burn LUSD at $1, a psychological expectation (Schelling point) forms: 1 LUSD = 1 USD.

Chart: LUSD’s Peg Mechanism

Source: Trend Research, Liquity

On May 19, 2021, ETH price crashed from $3,400 to $1,800, triggering over 300 liquidations. Liquity activated Recovery Mode twice, though recovery was so fast (collateral ratio rebounded above 150% immediately) that Dune data failed to capture it. A total of 93.5 million LUSD debt was liquidated, distributing 48,668 ETH to Stability Pool depositors—all handled by the Stability Pool without triggering redistribution. This stress test demonstrated Liquity’s model robustness.

Chart: Liquity System Collateral Ratio Changes (TCR = Total Collateral Ratio)

Source: Trend Research, Dune

During the recent USDC panic, LUSD also fluctuated—low of $0.96, high of $1.03—but was quickly arbitraged back to par. Specifically, users could buy LUSD at $0.96 on secondary markets, repay LUSD loans in the Liquity system to redeem ETH, and since the system values LUSD at $1, the ETH recovered was worth more than the LUSD spent—locking in arbitrage profits.

Source: Trend Research, Dune

The reason for LUSD’s rise during market turmoil includes: users needing to repay LUSD to avoid liquidation, existing users depositing LUSD into the Stability Pool hoping to acquire discounted ETH at low cost, both driving LUSD demand. Additionally, panicked USDC holders fleeing USDC/LUSD liquidity pools inadvertently boosted LUSD’s price.

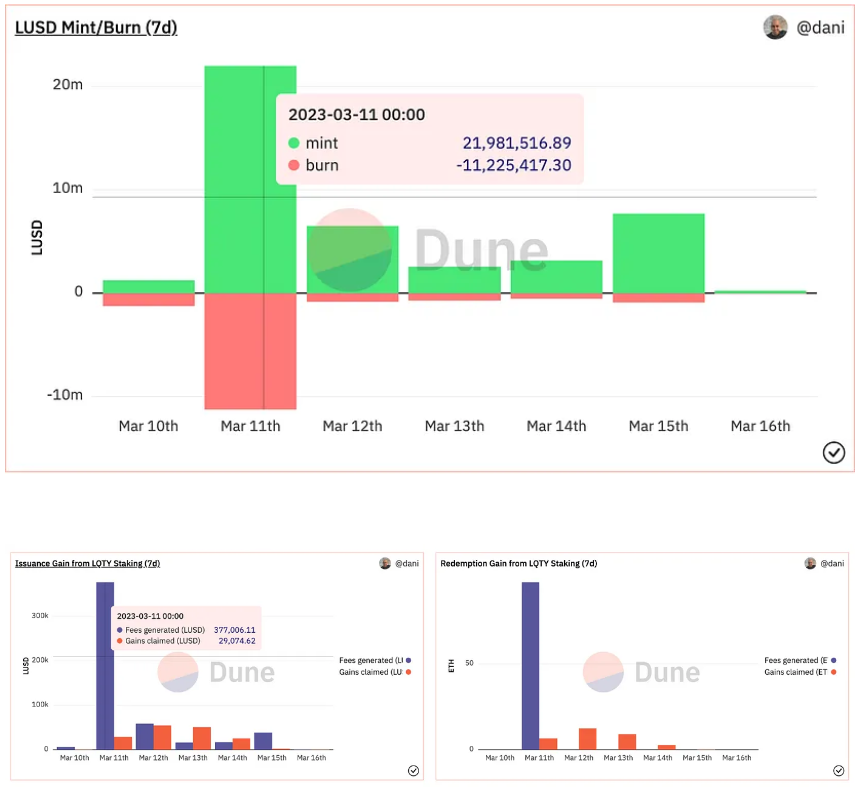

On the day of the USDC scare, price volatility created arbitrage opportunities, causing spikes in LUSD minting and burning. New mints totaled 21.98 million, burns 11.22 million, net supply increase ~10 million (~4% of total supply), leading to a sharp rise in protocol revenue on March 11—377,000 LUSD from minting fees and 97.4 ETH from redemptions, all flowing to LQTY stakers, temporarily spiking LQTY yields. Additionally, heightened awareness of robust decentralized stablecoins like LUSD drove adoption—supply and Trove count rose steadily, increasing ~12% from March 11–16.

Chart: LUSD Minting/Burning, Protocol Insurance Revenue, Redemption Income

Source: Trend Research, Dune

Reflexer

Reflexer is an over-collateralized decentralized stablecoin platform where users can pledge ETH to mint RAI—a stablecoin not pegged to any fiat or asset.

RAI’s redemption price is algorithmically adjusted by market supply-demand and a PID controller to achieve low volatility. Users over-collateralize ETH to mint RAI, pay a 2% annual interest, and redeem ETH upon repayment. Liquidation occurs below 145%, though current collateral ratios range between 300%-400%. Reflexer has three-tier liquidation mechanisms for safety and collects a 2% stability fee as surplus buffer. FLX is Reflexer’s governance token and acts as the system’s lender of last resort.

When market supply-demand imbalances occur, Reflexer actively adjusts RAI’s redemption price, incentivizing arbitrageurs to bring market prices back to redemption levels. The system uses a PID control (proportional-integral-derivative) mechanism with a series of parameters to fine-tune this process.

When a user’s collateral-to-debt ratio falls below a threshold, liquidation triggers. Liquidators obtain the ETH collateral at a discount via auction and repay the RAI debt. If the surplus buffer is insufficient to cover bad debt, the protocol initiates a “debt auction,” issuing new FLX tokens to buy back RAI in the market to settle debt.

The 2% stability fee collected by Reflexer is allocated to three destinations: Stability Fee Treasury smart contract, FLX stakers, and Buyback and Burn.

RAI Use Cases

- Money Markets

Reflexer algorithmically adjusts RAI’s redemption price based on market demand. When market price exceeds redemption price, users can mint RAI by pledging ETH and sell it on the market for profit.

Other use cases include Stacked funding rates; Yield aggregator—leveraging positive/negative redemption rates (when redemption rate is positive, optimize yield on lending protocols); and Sophisticated arbitrage tools.

Overall, Reflexer boasts full decentralization, a path toward governance minimization, and a rare non-fiat-pegged collateral mechanism, with endorsements from Vitalik and support from the Ethereum community. However, it lacks passive demand and use cases, suffers from low capital efficiency due to high collateral ratios (300%-400%, currently 357%), poor token value capture, and insufficient incentive tokens (allocated FLX may fall short for future use-case promotion).

-

In terms of capital efficiency, Liquity outperforms Reflexer (Liquity 260% collateral ratio vs. Reflexer 357%).

-

In terms of borrowing volume, Liquity’s loan volume is several times that of Reflexer; judging by P/S valuation, FLX appears undervalued relative to LQTY.

During this crisis, Vitalik minted RAI to purchase USDC and USDT, seemingly endorsing fully decentralized (non-fiat-pegged) stablecoins backed by ETH. However, without a fixed peg, RAI remains inherently unstable—making it difficult for mainstream users to adopt RAI under current conditions.

Moreover, Vitalik proposed improvements to Reflexer’s collateral mechanism in January, arguing that ETH holders need stronger incentives to over-collateralize ETH and borrow RAI on Reflexer, given that staking ETH already yields a risk-free ~5% return. Unless the floating redemption rate arbitrage gains significantly exceed 5%, the incentive is weak. However, the community rejected proposals to allow staked ETH as collateral due to concerns about added contract-layer risk.

Celo

Celo is a mobile-first open-source payment network whose mainnet launched in April 2020. Combining PoS consensus and EVM compatibility, Celo offers various DeFi services, including stablecoins as remittance and cross-border payment mediums, multi-token gas fee payments, and phone number-to-wallet address mapping to simplify transfers. It also launched native stablecoins CUSD, CEUR, and CREAL.

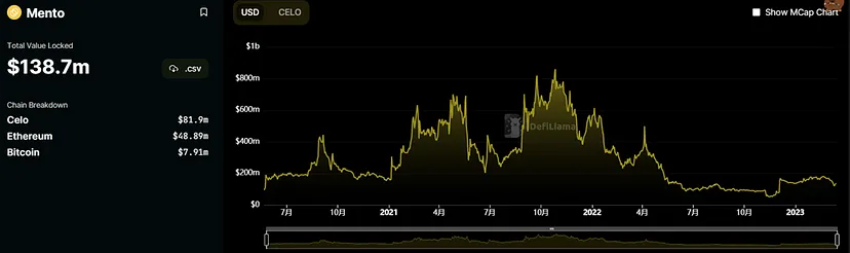

Celo’s stablecoin mechanism allows users to send $1 worth of CELO to the official Mento pool to receive $1 of cUSD, or reverse the process. Under this mechanism, if cUSD trades below $1, arbitrageurs buy it cheaply and redeem $1 worth of CELO, pushing the price back up. Conversely, if cUSD trades above $1, users mint cUSD with CELO and sell it for profit. Arbitrage ensures cUSD stays close to its peg. Current reserves backing stablecoins consist of CELO ($81.9 million), ETH ($48.89 million), and BTC ($7.91 million):

Source: Trend Research, Defillama

The key difference between Celo and the former LUNA/UST mechanism is: Besides the CELO token, CUSD, cEUR, and cREAL are also backed by ETH

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News