One-Stop Guide to FTX's Latest IEO Project "PsyOptions" - Daily Planet Project Interpretation and Analysis

TechFlow Selected TechFlow Selected

One-Stop Guide to FTX's Latest IEO Project "PsyOptions" - Daily Planet Project Interpretation and Analysis

PsyOptions is a decentralized options protocol built on the Solana blockchain, distinguished by its focus on physical delivery and American-style options.

Author: Qin Xiaofeng, Planet Daily

On January 4, FTX announced its latest IEO project would be PsyOptions, a DeFi options protocol (specific rules at the end of the article).

PsyOptions is a decentralized options protocol built on the Solana blockchain. Its distinguishing feature lies in focusing on physical delivery and American-style options. According to its official description, PsyOptions aims to "bring TradFi feel to DeFi" by building a decentralized, permissionless, community-owned financial services platform.

The founding team of PsyOptions has long focused on Solana ecosystem development, having participated twice in the Solana & Serum DeFi "hackathons." During the first hackathon, inspired by Chainlink, the team created an oracle project but failed to place and was eliminated; however, in the February hackathon this year, targeting the DeFi derivatives space, they developed a Solana-based DeFi options protocol and ultimately won first prize—giving birth to PsyOptions.

After nearly six months of preparation (technical development and legal compliance), PsyOptions officially launched on the Solana mainnet in August last year, releasing version v1. PsyOptions V1 serves as the clearing and settlement layer for options on Solana. Without external dependencies (i.e., oracles), anyone can create options for any SPL-standard token—including tokens, NFTs, and tokenized stocks—in a fully trustless manner at any time.

"The core protocol is fully trustless and makes no assumptions about how options should be traded or priced, allowing users to price according to their own preferences. Serum market makers will price options as they see fit," said PsyOptions.

An option grants the buyer the right—but not the obligation—to buy or sell an underlying asset at a specified price and date. A PsyOptions option involves five key concepts: underlying asset, quote asset, contract size, strike price, and expiration date. Below, we detail the use cases of PsyOptions options.

Assume the current SOL price is 170 USDT. User Xiao Qin believes SOL’s price will fall or remain range-bound in the future, while user Xiao Zhang expects SOL’s price to surge. They can hedge risk via options trading. Suppose they agree that one month later, Xiao Zhang will purchase 100 SOL from Xiao Qin at 190 USDT each. To ensure contract fulfillment, both parties generate a SOL/USDT call option through the PsyOptions protocol: Xiao Zhang becomes the call option buyer, and Xiao Qin the seller. In this example, the underlying asset is SOL, the quote asset is USDT, the contract size is 100, the strike price is 190 USDT, and the expiration date is one month later.

In practical operation, Xiao Qin must first deposit 100 SOL into the options protocol to guarantee future payment obligations. After depositing, he receives two tokens—option tokens and equity tokens—both compliant with the SPL token standard.

The "option token" can be sold by Xiao Qin to Xiao Zhang at a self-determined price, potentially at a premium. Upon expiry, if SOL rises to 170 USD or higher, Xiao Zhang can exercise the option token to buy the agreed quantity of SOL at the strike price of 170 USD. If SOL remains below 170 USD, Xiao Zhang may choose not to exercise and simply forfeit it. Regardless, the option token is burned after expiration.

The "equity token" represents a claim on the underlying asset. After the option expires and the buyer's debt is settled, any remaining underlying assets belong to the equity token holder. For instance, if after expiry Xiao Zhang takes 70 SOL, Xiao Qin’s "equity token" balance reduces to 30 SOL; if Xiao Zhang forfeits, the equity token still holds 100 SOL.

From the above explanation, we see that PsyOptions options are represented as SPL tokens, meaning they can be traded on any DEX supporting SPL tokens and serve as foundational building blocks combinable with other DeFi protocols. For example, option tokens and equity tokens can be used as collateral for borrowing before expiry, although their value may decay over time. This design highlights the flexibility and composability of the PsyOptions protocol.

Additionally, final settlement of PsyOptions options occurs via physical delivery, enabling users to receive the underlying asset (e.g., SOL mentioned earlier, or other coin-denominated assets). In contrast, most existing options or futures contracts use cash settlement (using stablecoins like USDT as settlement medium).

Each method has pros and cons. Coin-denominated loyalists may prefer physical settlement. However, on infrastructures where cross-chain tools are underdeveloped—such as the current Solana blockchain, which locks fewer than several thousand BTC—physical settlement faces limitations, making cash settlement more favorable. Moreover, the PsyOptions protocol requires users to lock up the underlying asset, preventing these locked tokens from being used for governance or other yield-generating strategies.

In terms of funding, in October last year, PsyOptions announced a $3.5 million seed round led by Alameda Research, with participation from CMS Holdings, Ledger Prime, MGNR, Wintermute, and Airspeed18.

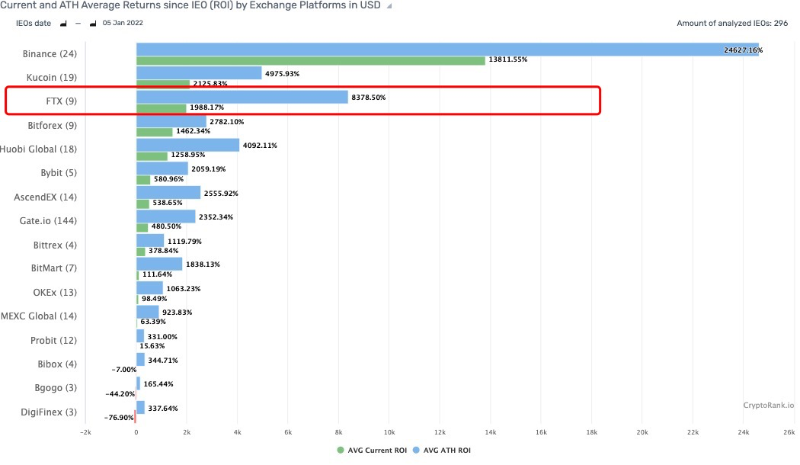

Regarding tokens, the native token of the PsyOptions protocol is PSY, also serving as the governance token, allowing holders to vote on revenue generated by the protocol. A staking mechanism will be introduced in the future. According to official plans, 3% of the total PSY supply will soon undergo IEO on FTX and Gate. Cryptorank data shows that FTX IEO projects have generally delivered high returns over the past two years, ranking second highest historically and currently third in return rates, as shown below:

FTX today released specific rules for participating in the PsyOptions IEO. For details, please refer to the official announcement: https://help.ftx.com/hc/zh-cn/articles/4414515394836

-

Only users who stake ≥150 FTT and complete KYC Level 2 verification before January 17, 2022, 13:00 UTC can participate in this PsyOptions presale.

-

Due to the recent surge in identity verification applications, users submitting verification requests after January 11, 2022, 13:00 UTC cannot be guaranteed participation in the presale event.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News