Premia Finance: The only American-style options protocol on EVM chains

TechFlow Selected TechFlow Selected

Premia Finance: The only American-style options protocol on EVM chains

As we dive deeper into the Arbitrum ecosystem, we've discovered a new options protocol that has demonstrated impressive staking volume, steadily growing trading volume, and various catalysts to drive future growth.

Author: Crypto Andrew

Translation: TechFlow

As we dive deeper into the Arbitrum ecosystem, we've discovered a new options protocol that has shown impressive staking volume, growing trading activity, and multiple catalysts poised to drive future growth. It's Premia Finance.

P.S. I won’t go into every mechanism in detail—only describe how the protocol works.

What is PremiaFinance?

It is an options protocol operating on Ethereum, Arbitrum, Optimism, and Fantom networks.

In fact, it plans to further expand to Polygon and Avalanche.

You could think of it as similar to Dopex—but with some additional unique features.

Premia Finance stands out as the only American-style options project across all EVM-compatible chains.

Unlike European-style options (like those offered by Dopex or Ribbon), American options can be exercised at any time before expiration—opening up new opportunities within DeFi.

Hedging / Trading Process

Enter the app → Choose token (ETH, BTC, LUNA, YFI, LINK, ALCX, and alETH) → Select strike price → Set expiry → Choose option size → Get quote → Buy → Receive American-style option.

Fees and Distribution

Buying Options: A 3% fee on the base premium is charged (included in final quote).

Option Exercise: Upon exercise, a protocol fee equal to 2.5% annualized value of the collateral in the pool is collected to enhance capital efficiency.

Of this, 80% of fees go to holders of $PREMIA (staked $PREMIA), while 20% goes to the PREMIA treasury for further development and growth of the $Premia ecosystem.

Team and Backers

The team remains anonymous but has been active since February 2021, enduring all market volatility without large VC dumps.

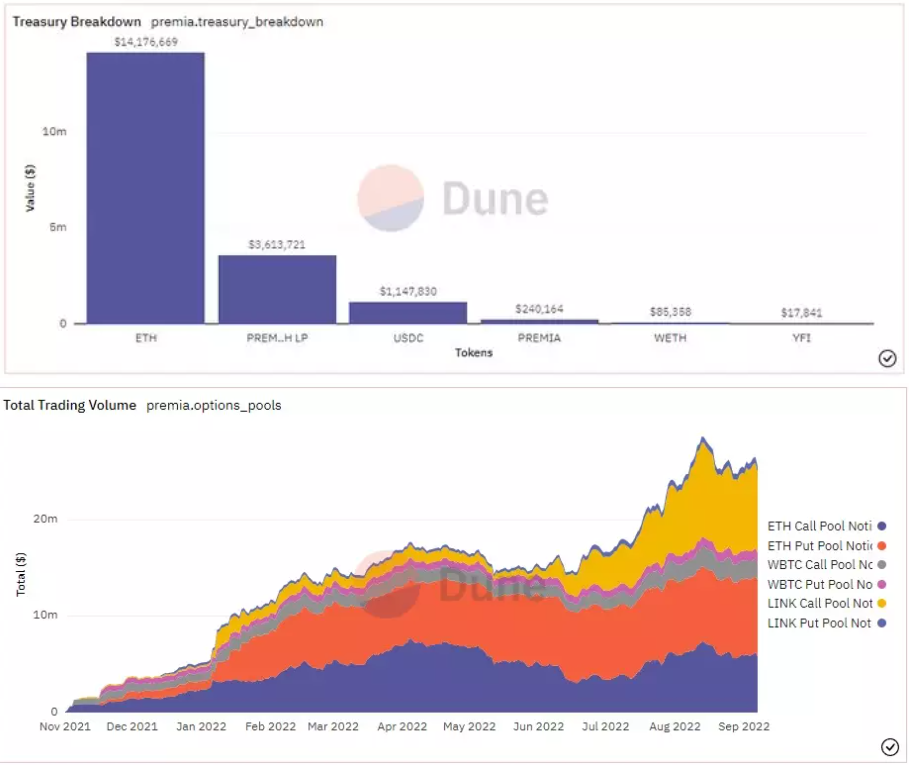

Data shows Premia Finance’s treasury holds $19.2 million (note: less than its market cap), primarily consisting of $ETH, LP tokens, and $USDC.

Its TVL declined during broader market downturns, but recently showed signs of recovery alongside strong growth in trading volume.

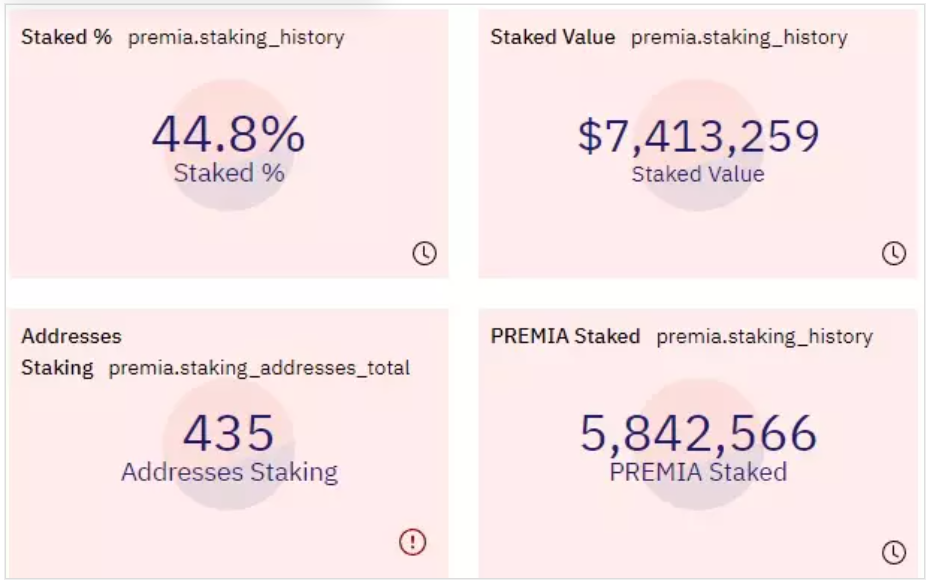

Market Cap: $14.2M, FDV: $134M, with nearly 45% of circulating supply staked. Liquidity sits around $4M, and trading volume increases with rising positive staking—now averaging $600K–$800K daily.

Token distribution breakdown:

- 30% Cross-chain liquidity mining

- 20% Development fund

- 10% Security/insurance module

- 10% Initial distribution

- 10% Founder allocation (vested)

- 10% Future incentives program

- 5% Marketing and education fund

- 5% Ecosystem grants fund

$PREMIA Staking

Stake $PREMIA to receive $xPREMIA and earn protocol fees paid in $PREMIA. By locking $xPREMIA for up to 12 months, users gain discounts on all protocol fees (up to 95% off).

However, the project will soon replace $xPREMIA with $vePREMIA:

- All rewards will be denominated in $USDC (RealYield)

- Lock-up period of 4 years

- Governance module enabled

Potential future catalysts that may boost $PREMIA include:

- Launch of V3

- New tokenomics and RealYield narrative

- Growth of Arbitrum

- Expansion to AVAX and MATIC

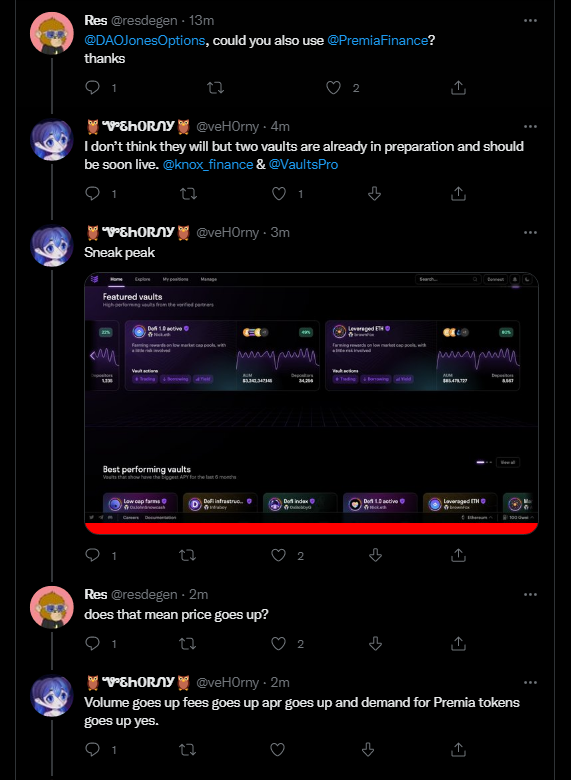

- Other projects building on top (increasing volume, fees, and token demand)

But $PREMIA still faces challenges today: overlooked by CT and mainstream media, low visibility, and trading volume that remains modest.

Conclusion

Premia Finance is a solid small-cap alpha play. Once V3 launches, they are well-positioned to become a focal point for options strategies.

There are indeed promising catalysts ahead for Premia Finance. If both trading volume and traction within the crypto community improve, it could become an attractive opportunity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News