An Overview of the Options Protocol PlutusDAO

TechFlow Selected TechFlow Selected

An Overview of the Options Protocol PlutusDAO

Are you in favor of option agreements?

Written by: The DeFi Investor

Translated by: TechFlow

Are you bullish on options protocols?

PlutusDAO is the largest governance aggregator for both Dopex and Jones DAO. If you believe these two protocols will succeed, then you should pay attention to Plutus. This article covers everything about Plutus DAO.

Plutus can be thought of as the Convex for Dopex and Jones DAO—the project’s mission is to accumulate as much veDPX and veJONES as possible. Recently, the team announced that the protocol will also begin acquiring esGMX through Plutus Vaults.

Stakers of $PLS will be able to control the voting power of veAssets and earn bribes in exchange for their votes. Users who convert their $DPX or $JONES into $plsDPX / $plsJONES on Plutus and stake them will receive high rewards paid in $PLS (Plutus’ governance token).

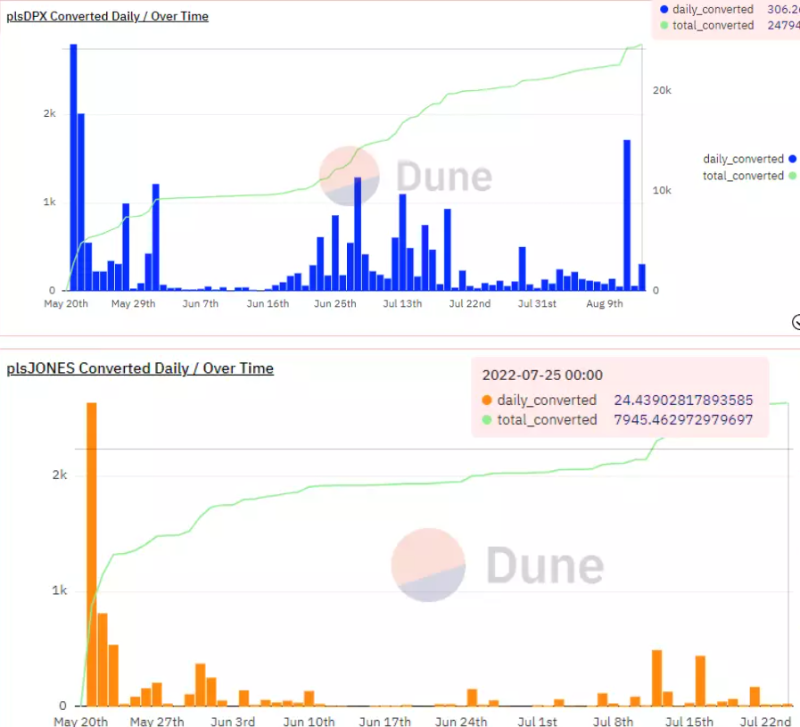

As shown in the chart below, the protocol's holdings of $DPX and $JONES continue to grow—every 100 locked $PLS tokens control nearly 0.34 $DPX voting rights.

Currently, $PLS trades at $0.65. Each $PLS token will receive bribes worth approximately $1.63 in Dopex voting incentives.

There are rumors that Hidden Hand (Balancer’s largest bribe marketplace) will come to Arbitrum and deploy a bribe market for Plutus.

Why would other protocols bribe $PLS holders?

Because as more vaults get deployed, certain projects may want to incentivize liquidity for their options vaults on Dopex. Jones also plans to allow $JONES holders to vote on gauge weights for Jones vaults.

Bribes will be the cheapest solution for these projects to secure $DPX and $JONES emissions for their vaults. But that’s not all—Dopex also shares a portion of its revenue with veDPX holders. So if you buy $PLS, you're essentially betting on the future success of both Dopex and Jones DAO.

The team recently announced the launch of the project’s first vault. This vault is built on top of GLP and automatically compounds GLP rewards.

Plutus will charge a 2% withdrawal fee and a 10% performance fee on GLP earnings, which may flow to $PLS stakers or the treasury.

Plutus will lock GLP rewards in the form of esGMX (locked GMX) to boost GLP yields. Users depositing GLP into the Plutus Vault will also earn $PLS rewards. A new locked version of $PLS (vlPLS), along with a governance module, will be launched in the coming months.

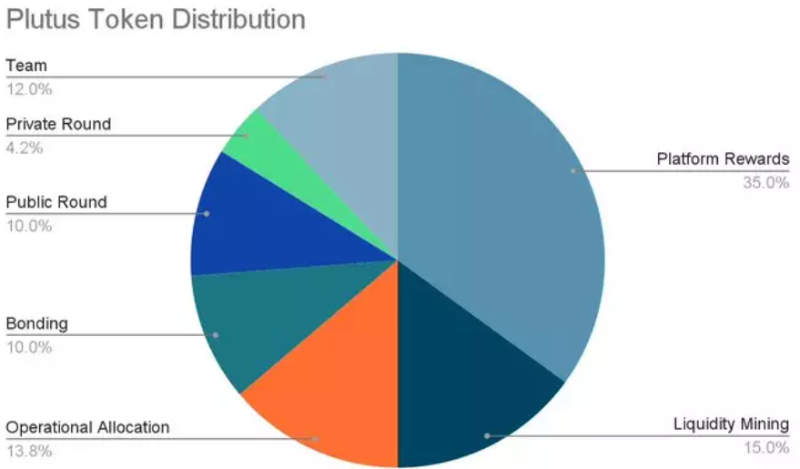

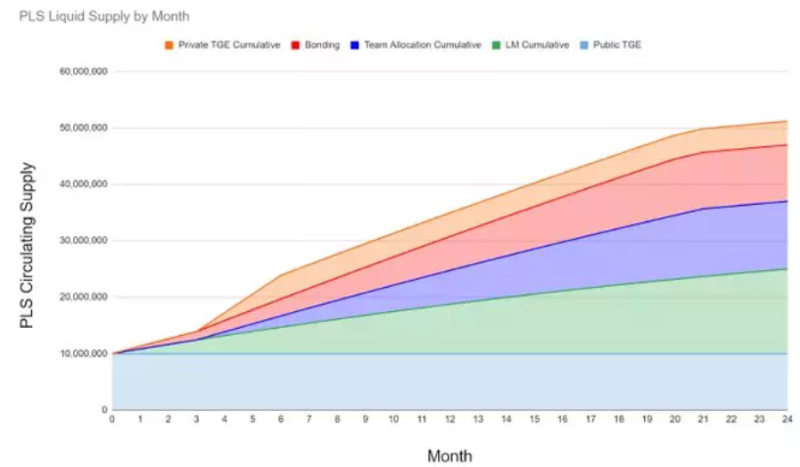

$PLS has a market cap of $7.1 million, with 11% of the token supply currently circulating. It can be locked into plsJONES and plsDPX to earn a share of platform fees. The project’s ultimate goal is to build a productive treasury and multiple income streams for $PLS stakers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News