When "Intent" Becomes the Standard: How OIF Ends Cross-Chain Fragmentation and Returns Web3 to User Intuition?

TechFlow Selected TechFlow Selected

When "Intent" Becomes the Standard: How OIF Ends Cross-Chain Fragmentation and Returns Web3 to User Intuition?

OIF is not just an attempt to standardize the intent track, but also a key cornerstone for breaking down liquidity silos and transitioning cross-chain experiences from "manual" to "automatic."

Author: imToken

In the previous article on "Ethereum Interop Roadmap," we mentioned that to improve user experience (Improve UX), the Ethereum Foundation (EF) has established a three-phase interoperability strategy: initialization, acceleration, and finalization (see further reading: Ethereum Interop Roadmap: How to Unlock the Last Mile for Mass Adoption).

If we imagine the future Ethereum as a vast highway network, then "acceleration" and "finalization" address road smoothness and speed limits. But before that, there's a more fundamental pain point: different vehicles (DApps/wallets) and different toll booths (L2s/cross-chain bridges) speak completely different languages.

This is precisely the core issue the "initialization" phase aims to solve, and the "Open Intents Framework (OIF)" is the most important "common language" at this stage.

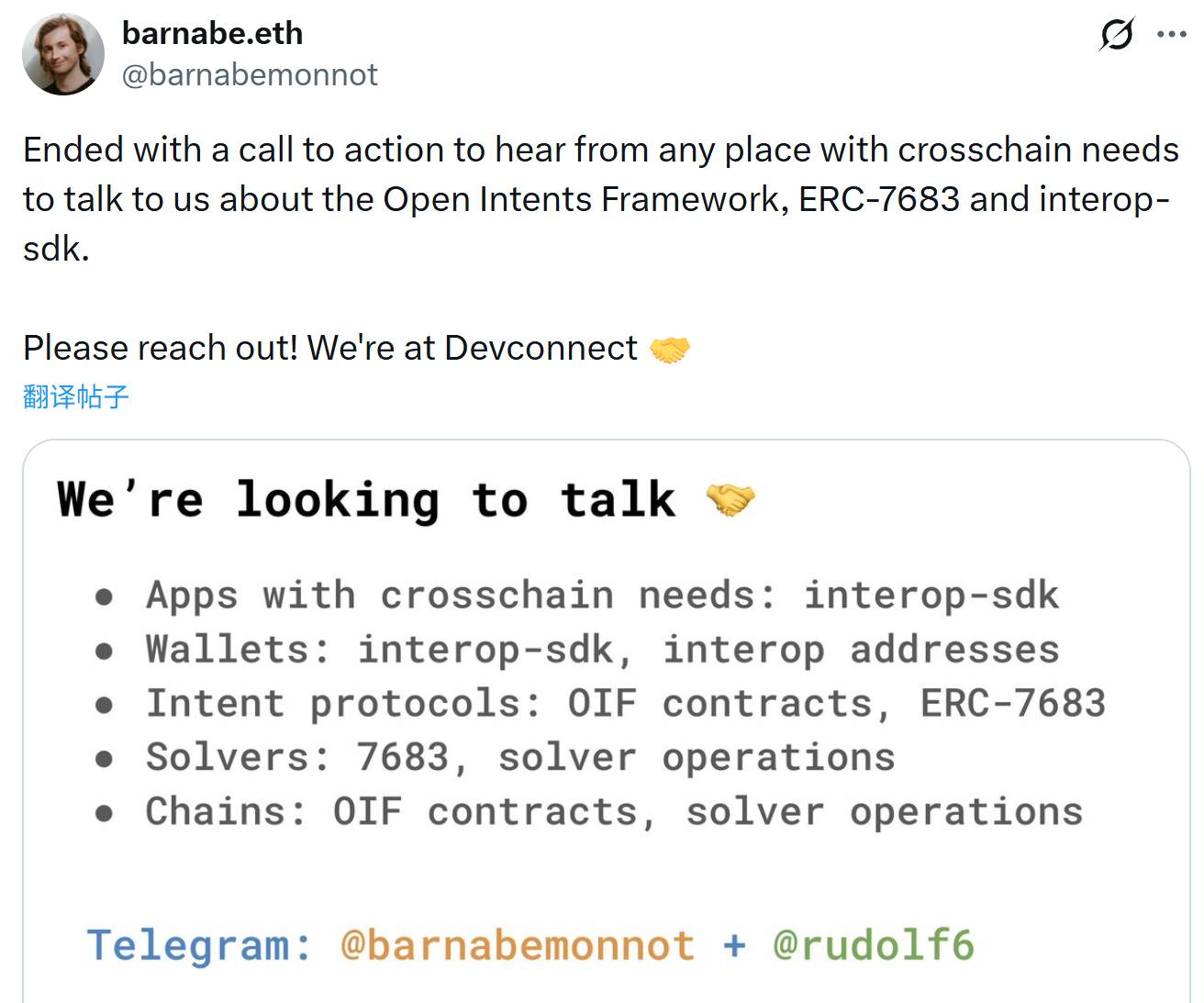

At Devconnect in Argentina, while EIL (Ethereum Interoperability Layer) dominated many discussions, OIF—as the key glue between application and protocol layers—is equally critical and serves as a prerequisite for realizing the EIL vision. Today, let's break down this seemingly obscure yet crucial OIF for user experience.

1. What Exactly Is OIF? A Paradigm Shift from "Instructions" to "Intents"

To understand OIF, first grasp a fundamental shift happening in Web3 interaction logic: from "instructions" (Transaction) to "intents" (Intent).

Start with a real pain point faced by ordinary users. Suppose you want to swap USDC on Arbitrum for ETH on Base. In today’s Ethereum ecosystem, this often means an “operational marathon”:

You must manually switch your wallet to Arbitrum, authorize a cross-chain bridge contract, sign a cross-chain transaction, open another aggregator, and finally convert the USDC bridged to Base into ETH. Throughout this process, you not only have to calculate gas and slippage yourself but also constantly guard against cross-chain latency and smart contract risks—a tedious sequence built on a pile of technical details, rather than a simple, clear path to fulfill a need.

This reflects the traditional "instruction" model in Web3: like hailing a taxi to the airport and having to plan the route yourself—"turn left, go straight 500 meters, enter the expressway, exit the ramp..." On-chain, it translates to users manually executing step-by-step operations such as cross-chain transfer, approval (Approve), and swap (Swap). If any step fails, it may waste gas or even result in fund loss.

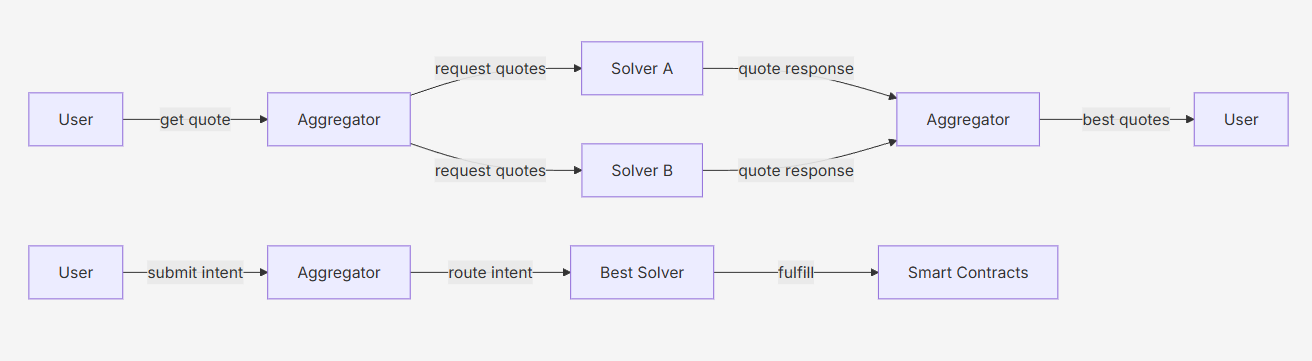

The emerging "intent" model eliminates these intermediate complexities entirely. You just tell the driver, “I want to go to the airport and am willing to pay $50.” The driver decides the route and navigation method; the user doesn’t care, as long as the goal is achieved. On-chain, this means users only need to sign an intent stating “I want to exchange USDC on Chain A for ETH on Chain B,” leaving the rest to specialized solvers to execute.

If intents are so great, why do we still need the Open Intents Framework (OIF)?

Simply put, today’s intent market is a fragmented "wild west." UniswapX has its own intent standard, CowSwap has its own, Across has its own. Solvers must adapt to dozens of protocols, wallets must integrate dozens of SDKs—extremely inefficient.

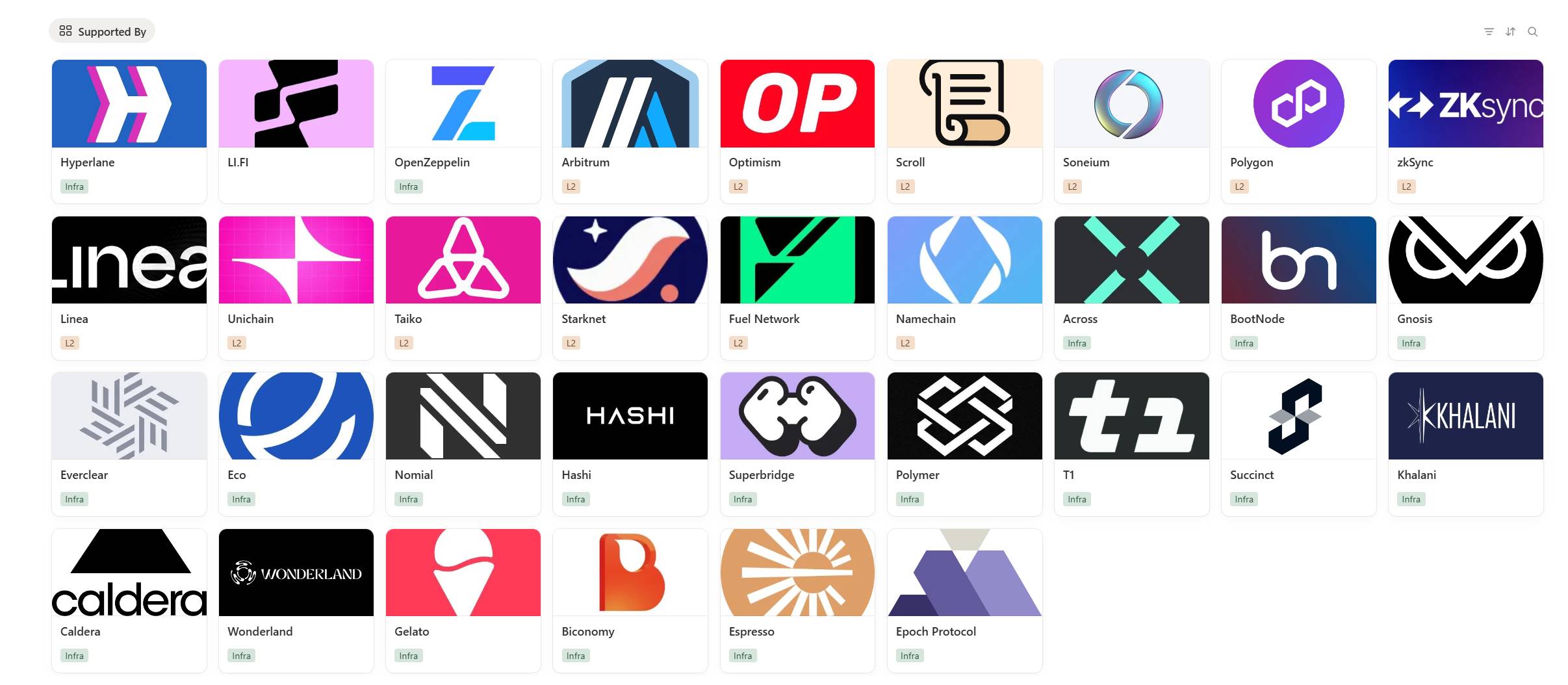

OIF aims to end this chaos by establishing a standardized "intent framework" for the entire Ethereum ecosystem, providing a universal protocol stack for wallets, bridges, Rollups, and market makers/solvers. As a modular intent stack jointly driven by the Ethereum Foundation, Across, Arbitrum, Hyperlane, and other leading projects, OIF is not a single protocol but a set of universal interface standards.

It defines what an "intent" should look like, how it should be verified and settled, enabling any wallet, DApp, or solver to communicate on the same channel. It supports various intent-based trading models, and developers can use OIF to extend new trading modes such as cross-chain Dutch auctions, order book matching, and automated arbitrage.

2. The Core Value of OIF: More Than Just Another Cross-Chain Aggregator

You might ask, how is OIF different from today’s cross-chain aggregators?

The essential difference lies in standardization. Most current cross-chain aggregators can be seen as building closed-loop systems—defining their own intent formats, selecting bridges, routing paths, managing risk control and monitoring. To integrate, any wallet or DApp must individually connect to each aggregator’s API and security assumptions.

In contrast, OIF is more like a neutral, open-source library of standard components, designed from the start as public infrastructure co-built by multiple parties, not a private standard owned by any single project: Data formats, signature methods, auction/bidding logic all use common settlement and validation modules. Wallets or DApps need only integrate OIF once to connect with multiple backends, bridges, and solvers.

Currently, major Ethereum players including Arbitrum, Optimism, Polygon, ZKsync, and Across—spanning L2s, cross-chain bridges, and aggregators—have already joined.

Today’s Ethereum ecosystem faces a liquidity fragmentation challenge far more complex than ever—L2s are blooming everywhere, liquidity is scattered, and users are forced to frequently switch networks, bridge assets, and re-authorize. From this perspective, OIF’s emergence isn’t just about cleaner code—it holds profound commercial and experiential value for mass Web3 adoption.

First, for users, under the OIF framework, they no longer need to be aware of which chain they're on. You could initiate a transaction on Optimism with the intent to buy an NFT on Arbitrum. Previously, this required first bridging assets, waiting for confirmation, switching networks, and finally purchasing the NFT.

Once integrated with OIF, wallets like imToken can directly recognize your intent, generate a standardized order, and have a solver front-run funds and complete the purchase on the target chain—all requiring just one signature from the user. This is the so-called "chain abstraction" experience, and OIF is the underlying syntax enabling it.

Meanwhile, for overall network liquidity, OIF breaks down silos and enables global sharing. Currently, Ethereum L2 liquidity is isolated—Uniswap’s liquidity on Base cannot directly serve users on Arbitrum. But through the OIF standard (especially ERC-7683), all intent orders can converge into a globally shared order book.

A professional market maker (Solver) can monitor demand across all chains and deploy capital wherever needed. This dramatically increases liquidity utilization and delivers better pricing to users.

Finally, for developers and wallets, it means "integrate once, work everywhere." For wallet or DApp developers like imToken, OIF significantly reduces development burden—no longer needing to build separate adapters for every cross-chain bridge or intent protocol.

Once OIF is integrated, they immediately gain access to the entire Ethereum ecosystem’s intent network and support all solvers compliant with the standard.

3. Where Is OIF Now in Its Development?

As mentioned above, according to public statements from the Ethereum Foundation, OIF is led by the EF Protocol team and jointly advanced with teams including Across, Arbitrum, Hyperlane, LI.FI, OpenZeppelin, and Taiko, with more infrastructure providers and wallets expected to join discussions and testing throughout 2025.

While recent Devconnect events spotlighted many new concepts, the OIF puzzle is being concretely assembled, particularly in terms of standard-setting and ecosystem alliance building. At this year’s Devconnect Interop main stage, nearly the entire day revolved around topics like "intent, interoperability, account abstraction," with OIF repeatedly featured in agendas and presentations, explicitly positioned as one of the key components for future multi-chain UX.

Although there are no large-scale applications for general users yet, judging by meeting frequency and participating parties, the community has largely reached consensus: In the coming years, the best wallets and applications will very likely build their cross-chain capabilities atop public frameworks like OIF.

This includes the oft-discussed ERC-7683—one of OIF’s most tangible achievements so far—jointly proposed by Uniswap Labs and Across Protocol, aiming to establish a universal structure for cross-chain intents.

During Devconnect, discussions around ERC-7683 deepened further, with growing support from developers, solvers, and market makers, signaling a shift from proprietary protocols toward public utilities in cross-chain intent trading.

Additionally, OIF complements another core thread in the Interop series—the Ethereum Interoperability Layer (EIL). OIF operates at the upper layer, providing "intent and UX," while EIL provides "trust-minimized message channels across L2s" at the base layer. Together, they form a foundational part of the future Ethereum interoperability stack.

The Ethereum Foundation plays a coordinator rather than a controller role here. Through documents like Protocol Update, EF has clearly positioned OIF as the initialization phase of the interoperability roadmap, giving the market strong confidence—intents (Intent) are not a fleeting narrative but a long-term evolution direction officially endorsed by Ethereum.

For the entire Ethereum ecosystem, OIF is transforming "interoperability" from a whitepaper concept into an engineering reality that can be replicated, audited, and widely integrated. Perhaps in the near future, when using your wallet, you’ll gradually notice a change: you’ll only need to state what you want to do, without worrying about which chain or which bridge to use—that’s OIF and similar infrastructure quietly at work.

Thus, the "initialization" piece of interoperability is beginning to take shape.

Yet according to EF’s roadmap, merely understanding intents isn't enough—we also need speed and stability. In the next article of our Interop series, we’ll dive into the core topic of Devconnect: EIL (Ethereum Interoperability Layer), exploring how Ethereum, through the "Acceleration" phase, builds a permissionless, censorship-resistant cross-L2 trust channel, ultimately achieving the vision where all Rollups "appear as one chain."

Stay tuned.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News