Web3's ultimate intent is asset appreciation—dappOS's "intent assets" understand what you need.

TechFlow Selected TechFlow Selected

Web3's ultimate intent is asset appreciation—dappOS's "intent assets" understand what you need.

True alignment between intent and returns at the revenue level—that's exactly what dappOS is doing.

Author: TechFlow

Intent is one of the hottest narratives of this year.

From its coining by Paradigm last year to practical implementation this year, many products are going "intent-based."

But so far, most intent products remain at the level of "technique"—solving specific problems in specific scenarios, such as optimizing limit order flow or improving user experience.

Ask yourself: what is your ultimate intent?

The answer will likely point to "asset yield." Currently, the way assets seek returns has not yet entered the era of intent.

Intent means freedom, not being torn between choices.

Yet if you hold crypto assets, you're always torn—either deposit them as xxETH to chase layered yields, or convert them back to ETH for trading.

Your xxETH can't be used directly in another protocol, nor can it be sold immediately on a CEX.

Why should you care about the difference between aETH and bETH? Why is your ETH different from someone else’s? These aren’t troubles you should have to bear. You just want results—global yield optimization—not getting stuck in fragmented processes.

Therefore, true "philosophy"-level intent means assets flow smoothly wherever you want, finding the returns you seek, with zero friction.

And now, dappOS's recently launched "intent assets" understand exactly what you need.

Previously mocked as a VC-driven concept with little real utility, dappOS is now widely discussed across Chinese CT circles and research reports. Even Binance’s Web3 wallet has launched related campaigns encouraging users to experience the full operational flow of intent assets.

So, what exactly are intent assets?

Here’s a TL;DR version:

They make yield-bearing assets instantly usable on-chain. Whether withdrawing intent assets natively to a CEX, buying Meme coins, participating in lending, or staking—all can be done directly, without extra steps, waiting periods, or high slippage.

Why should you care about intent assets?

For personal asset management, they offer optimal capital efficiency—making asset yield-seeking truly intent-driven. For alpha hunting, projects that solve real problems and sit close to actual trading tend to gain market favor. For farming and free-minting opportunities, dappOS is currently integrating intent assets with multiple on-chain protocols, potentially creating a "picks-and-shovels" effect.

In a relatively sluggish market with few hotspots, exploring such projects early might lead to unexpected discoveries.

Motion and Stillness as One: The Ultimate Intent of Holding Assets Is Appreciation

What are dappOS intent assets? To answer, first we must understand the current issues facing crypto assets.

As mentioned earlier, easier operations and simplified steps are merely means, not ends.

The true purpose of intent is asset appreciation and yield maximization.

Thus, being intent-centric really means centering on the intent of asset growth—enabling smoother asset flows to achieve appreciation and discover higher yields.

Why can't this intent for asset growth be fully realized today?

First, fragmentation across ecosystems creates burdens: L1s/L2s that don’t interoperate directly, gas fees required per transaction, possible transaction failures, multiple non-interoperable USD stablecoins, etc.

Second, asset fragmentation causes friction. Your aETH can’t be used as bETH, can’t be withdrawn to a CEX to sell, and can’t even be swapped directly on a DEX—the ideal path to maximize yield always involves some friction.

And after overcoming that friction, the actual yield outcome is significantly diminished.

For example, converting aETH to ETH often requires a withdrawal period; swapping on DEX may incur slippage due to insufficient liquidity.

At its core, this reflects the contradiction between the “motion” and “stillness” of crypto assets.

When idle, assets are deposited into protocols to earn yield—contributing to a protocol’s TVL. But when you want to move them, the protocol doesn’t help you exit freely—and has no incentive to do so (they’d prefer you stay forever).

Hence, the xxETH tokens you hold are essentially separate tickets for individual rides, not a universal pass to the entire amusement park.

If exchanging tickets is cumbersome, why would newcomers bother visiting the park? Why would experienced users remain active inside?

Ultimately, what you need is an asset that unifies motion and stillness:

Still: Your coins can be placed in various L2s and application protocols to generate yield (e.g., become xxETH via staking).

Motion: You can use xxETH directly wherever you intend to pursue further gains—buying Memes, additional staking, swaps—without worrying about friction-inducing rules like cross-chain transfers, gas token conversion, or withdrawal delays.

An asset that seamlessly transitions between states, with no friction cost during state changes, globally highly available—that is the essence of intent assets.

This is precisely what dappOS is building: true “what you think is what you get” at the yield layer.

Beyond the Fourth Wall: More Than Just a “Yu’ebao”

Now that we understand what intent assets are, let’s see how dappOS makes it happen.

A picture is worth a thousand words—let’s walk through the actual product interface.

-

Asset Redemption Scenario

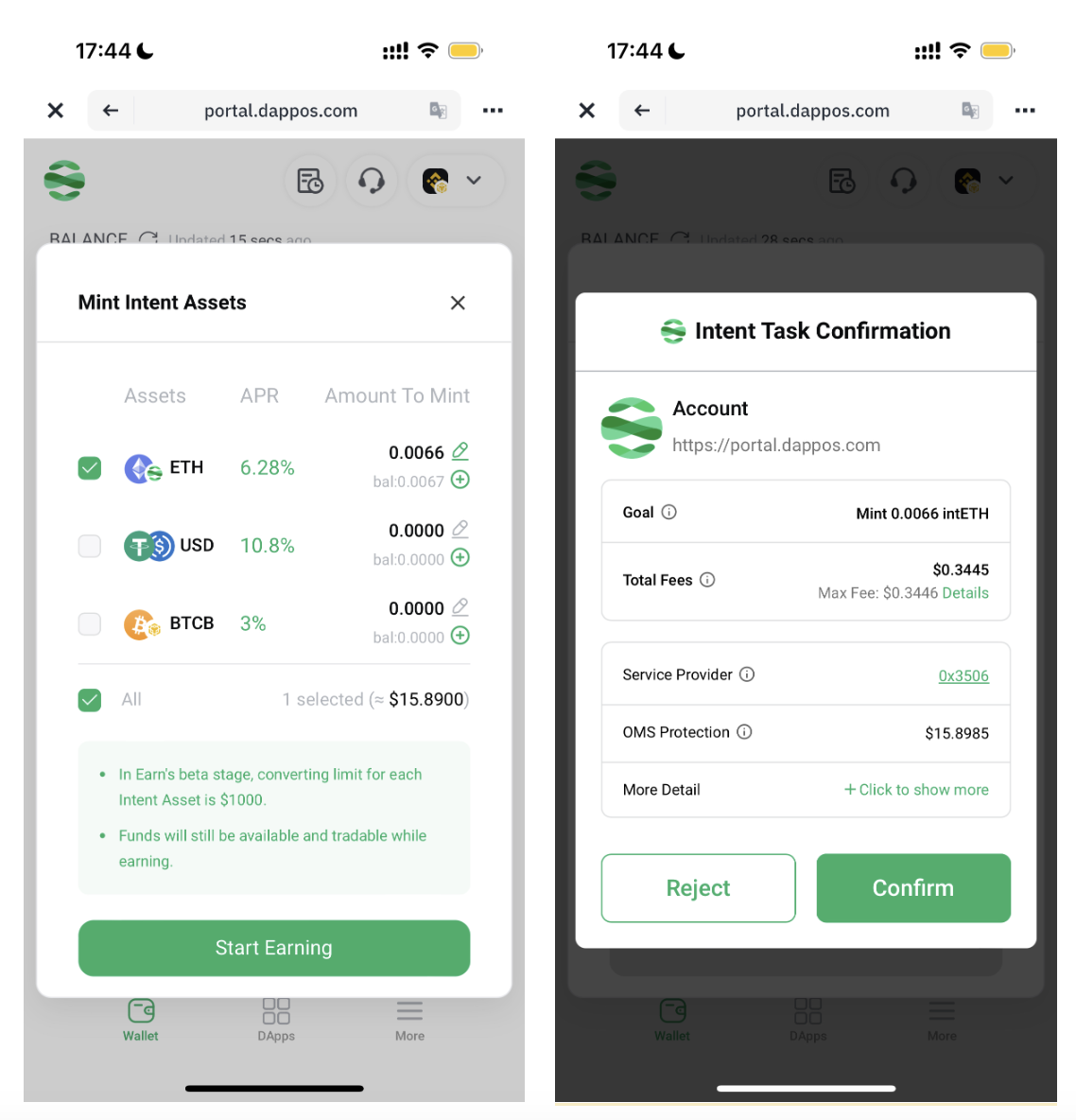

Suppose you hold ETH across various L1s/L2s. You can directly mint them into intent assets—intentETH—via dappOS’s wallet page.

Traditionally, when wanting to redeem xxETH back to ETH, you’d usually go to a DEX where liquidity might be thin. Or, redeeming via original channels could involve varying lock-up periods.

With intentETH, however, you can simply use it like ETH within supported apps under the DApps tab on the same page—no redemption or conversion needed. When returning to a CEX, you can withdraw intentETH directly as ETH, with no lock-up period and low fees.

-

Interacting with Multi-Chain dApps

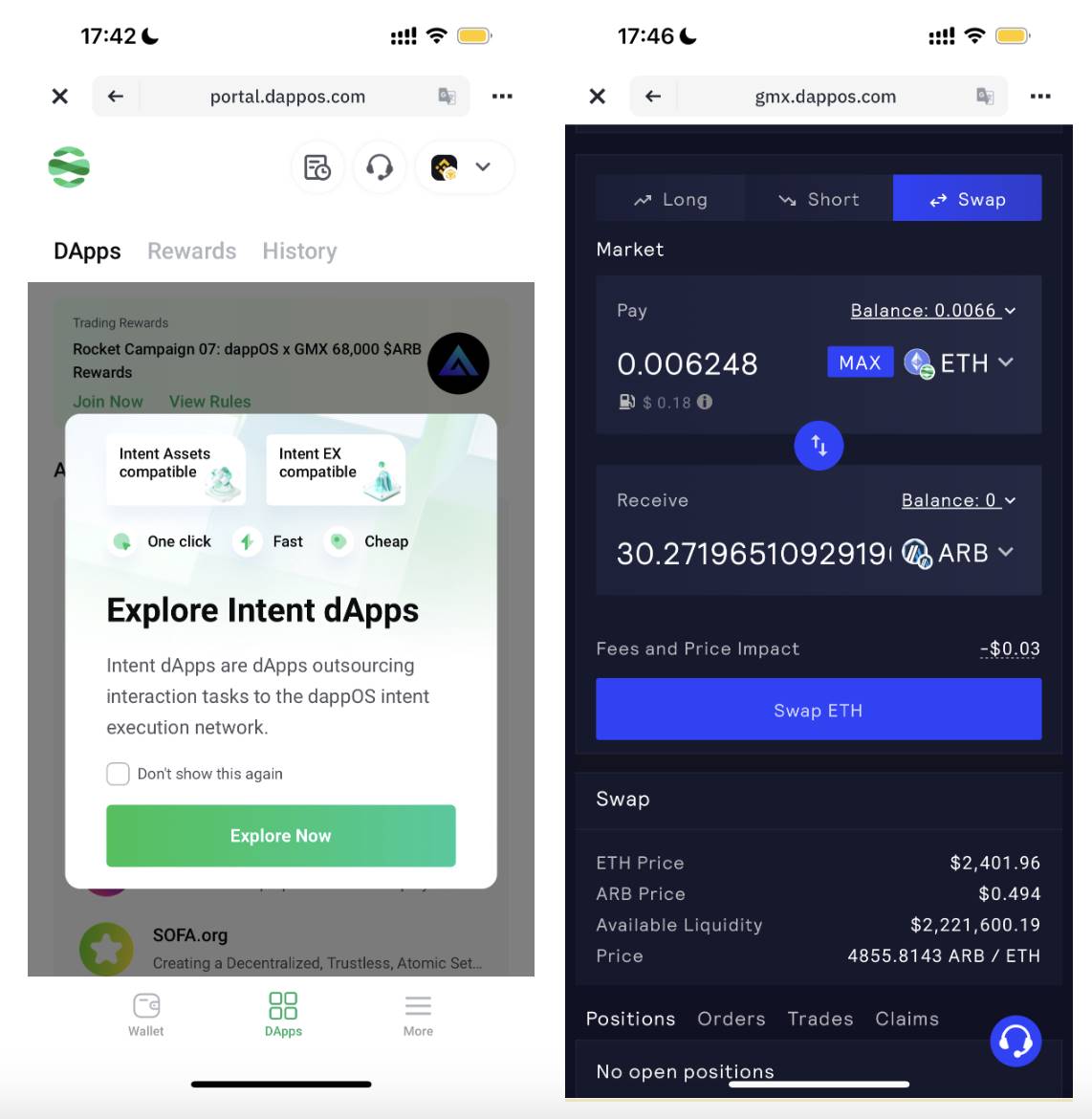

Likewise, you might want to convert back to ETH because there’s a better opportunity on another chain.

For instance, you want to trade contracts on GMX on Arbitrum, but currently have no funds there. Traditionally, you'd bridge ETH over, then interact with GMX. If multiple chains present opportunities, you’d have to split your ETH, keeping gas and starter funds on each.

With intentETH, you can directly use it for contract trading on GMX—treating intentETH as ETH natively—bypassing the whole process of “ETH → cross-chain → reserve gas on target chain → swap to local token → operate on app.” Fewer considerations, better experience.

As shown below, I minted intentETH on BNB Chain but was able to use it seamlessly within GMX.

The intuitive experience? intentETH eliminates the "fragmentation" of ETH across chains—it's ready-to-use upon arrival. In motion, it acts as a globally accepted ETH; at rest, simply holding intentETH earns passive yield.

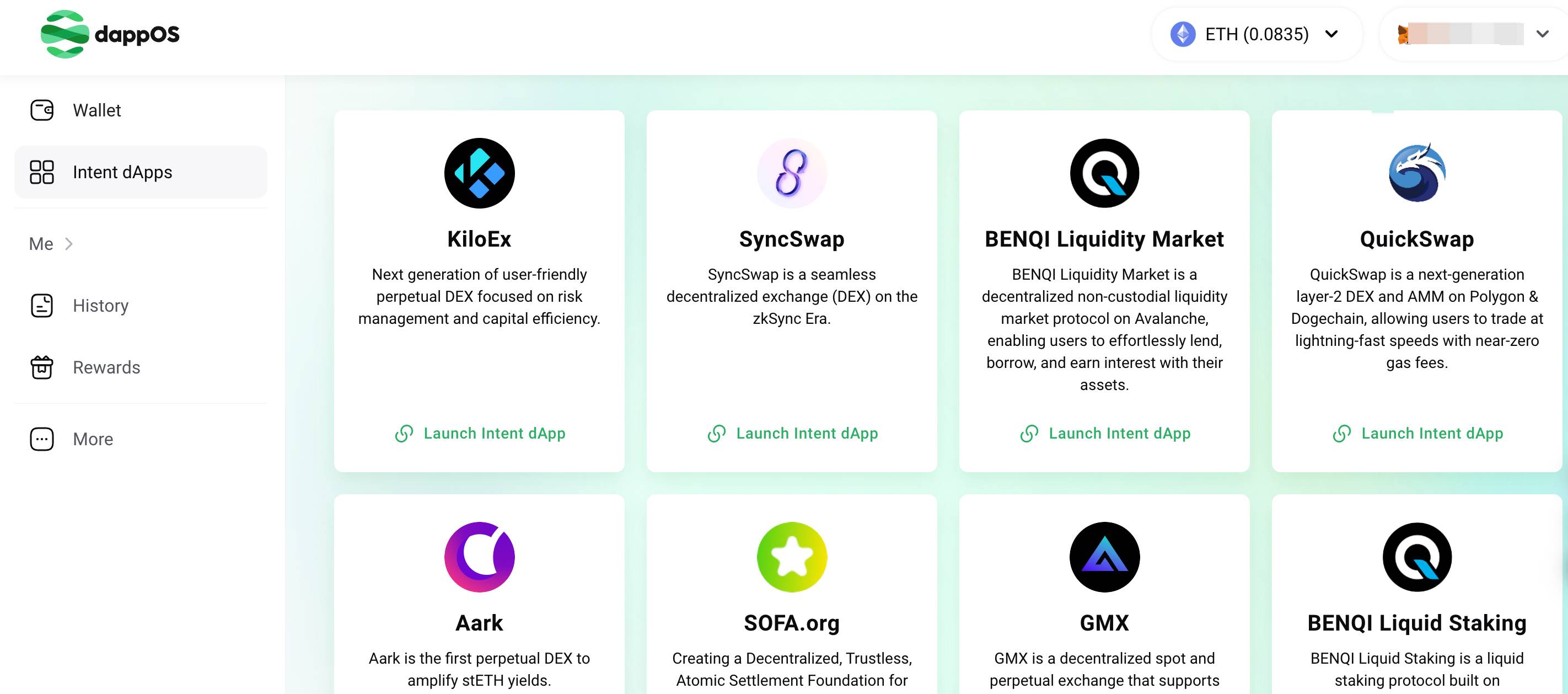

As seen above, dappOS already supports direct interaction with numerous dApps using intent assets—including many well-known ones. From standard crypto assets to intent assets,再到 multi-chain support—how is all this achieved behind the scenes?

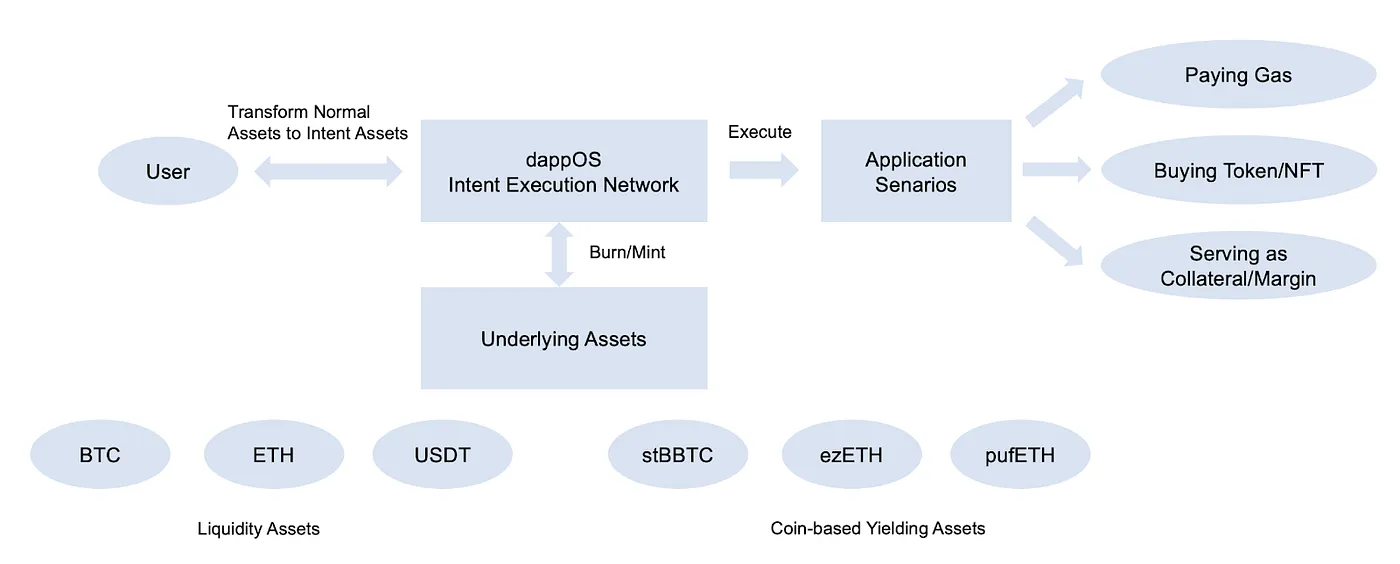

The key lies in dappOS’s own Intent Execution Network.

This network handles the transformation and application of intent assets, ensuring users can utilize their assets in diverse scenarios while offloading complex tasks like minting, burning, and conversions to backend service providers.

You don’t even need to worry about whether this network exists—it’s designed to keep complexity hidden and deliver simplicity to users.

In short: you declare your final intent, and it executes on your behalf.

“Executing on your behalf” means users can choose to transfer assets across chains and seek yield—but in practice, the dappOS Intent Execution Network handles everything.

Security-conscious users may ask: why let others execute on my behalf?

First, efficiency comes first.

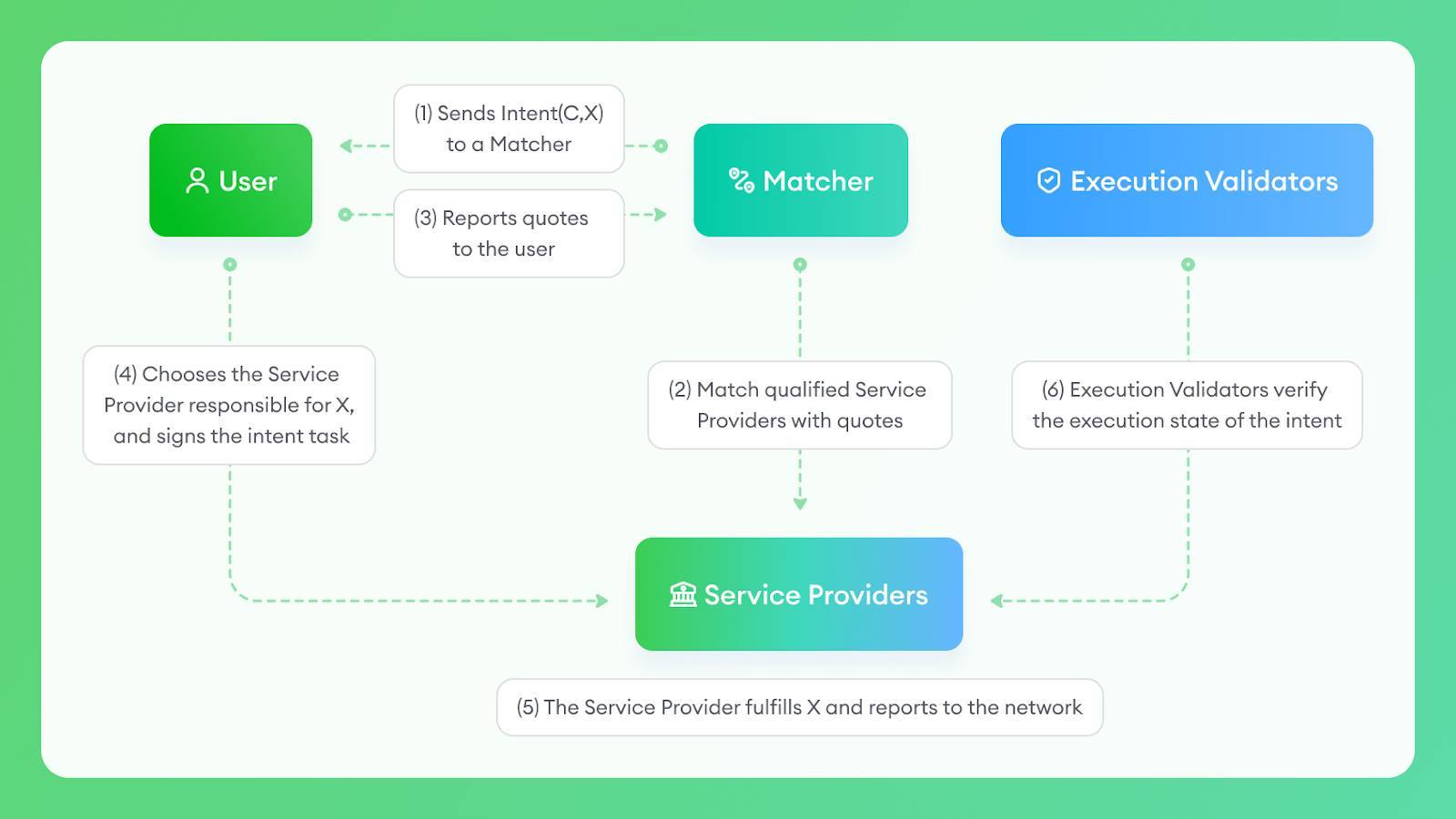

The Intent Execution Network delivers institutional-grade cost efficiency to ordinary users. How?

Within the dappOS network, various service providers execute user tasks—such as asset exchange, finding optimal paths, etc. Since node operators form a free market, they compete via bidding for execution rights. In this competitive environment, only nodes with superior execution efficiency and lower costs prevail.

These professional nodes possess execution strategies unavailable to regular users:

- Netting inflows and outflows among multiple users

- Securing low-cost loans to front-run redemption payouts

- Aggregating interest-bearing assets and redeeming en masse as large holders, avoiding slippage from low DEX liquidity

The dappOS Intent Execution Network effectively empowers users with institutional-grade execution capabilities, delivering a seamless intent asset experience.

Second, security isn’t compromised.

Intent assets are backed by a diversified basket of underlying assets and function essentially as withdrawal receipts. Users retain the ability to call contracts to mint/burn directly. This ensures that even in extreme cases, intent assets can be redeemed into underlying assets. Moreover, if any single yield asset fails, user exposure remains limited.

During redemption and usage via the dappOS network, the system employs OMS (Optimistic Minimal Staking), a core trust-minimized security mechanism: each service provider’s total assigned task value cannot exceed their staked amount. Additionally, users transfer redemption-related risks to capable service providers instead of signing multiple transactions across platforms themselves—reducing the risk of human error.

As shown above, users only need to publish their intent. Service providers execute, validators verify, matchmakers coordinate task allocation—under economic incentives, each role performs its duty.

Does this sound like a “decentralized Yu’ebao”? Indeed, it does. Many past products claimed to be “on-chain Yu’ebao,” but were more akin to money market funds—offering only basic yield generation with very limited usability. But in reality, “Yu’ebao” allows daily spending and transfers—people use it for shopping and payments. In contrast, money market funds typically require redemption before use, often involving waiting periods. Hence, the key difference lies in immediate usability and breadth of application. Compared to Web3 “save-and-earn” products limited to “deposit-withdraw-yield,” dappOS intent assets are not only decentralized and non-custodial—they’re closer to a true Yu’ebao, leveraging the Intent Execution Network to enable low-cost, high-efficiency usage across nearly all scenarios.

In terms of usability, liquidity, and security, intent assets clearly surpass previous similar offerings:

-

Low friction: Just express your intent. Cross-ecosystem and cross-chain movements minimize friction everywhere;

-

High security: Non-custodial, not controlled by any central party. You retain signing authority—only outsourcing intent execution. If execution fails, the OMS mechanism provides compensation.

If it’s still not clear enough, the diagram below offers a comprehensive comparison across asset usability breadth, yield, and security.

Demanding efficiency, high availability, and security simultaneously might not be wishful thinking—it could be what crypto assets were meant to deliver all along.

Branching Out: Reaching Across the Ecosystem

After reviewing the product, let’s examine dappOS’s feasibility.

A project’s success hinges on backing and ecosystem support.

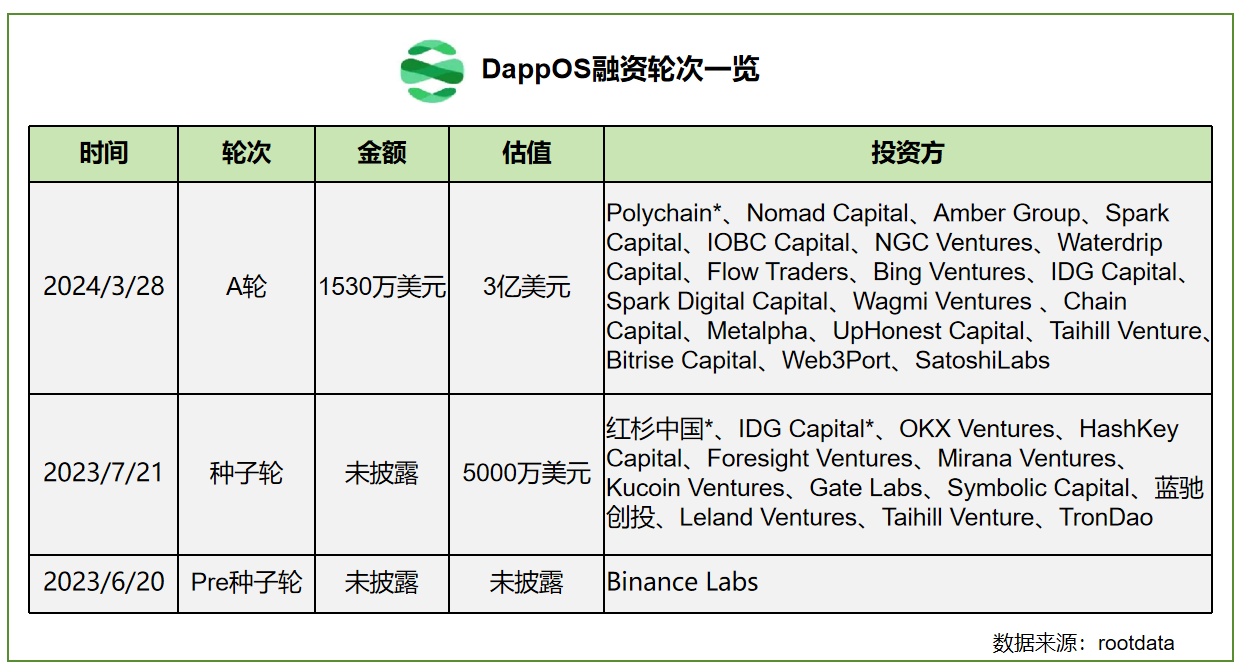

In terms of funding, dappOS initially received support from Binance Labs, and in recent rounds attracted top-tier VCs including Polychain, Sequoia China, IDG, and OKX Ventures.

While the market is increasingly reflecting on “VC tokens” and who ultimately bears the cost, capital inflow undeniably boosts legitimacy and credibility from a project development standpoint. Regardless of how the project’s token unlocks or performs, for yield seekers and opportunity hunters at different stages, such endorsements provide strong signals.

On ecosystem development, the fluidity of intent assets depends on broader partner integration. Currently, dappOS has strategic partnerships with over ten players shown below—including applications, L1s, and L2s. Notably, the underlying yield sources for intent assets come from leading platforms listed on major exchanges, with billions in TVL—ensuring both safety and yield reliability.

For an asset-focused project, the number of supporting projects and ecosystems directly determines its influence and ceiling.

Currently, dappOS’s intentBTC, intentETH, and intentUSD derive underlying yields from various LRTs and Pendle PTs (e.g., wstETH, sUSDe, sDAI, stBBTC).

Intent assets already cover Bitcoin and Ethereum ecosystems at launch. Due to network effects, once an asset begins branching out, each new partner multiplies its liquidity and usability.

Beyond infrastructure, players care most about tangible benefits and yield.

Recently, Binance Web3 Wallet and dappOS jointly launched a user incentive campaign with a 500,000 USDC reward pool.

The campaign includes two tasks: “Intent Asset Minting” and “Intent dApp Interaction,” encouraging users to experience intent assets and dApps powered by dappOS’s Intent Execution Network via the Binance Web3 Wallet.

Interested users can learn more here.

Outlook: Democratizing Intent

In the end, intent starts as narrative but must land in reality.

Products that genuinely solve high asset availability and capital efficiency—bringing intent to life—are loved by both supply and demand sides of the crypto economy.

For end users (demand side), assets must generate more yield. Better liquidity and easier usage naturally remove barriers and rejection points. If using dappOS unlocks new possibilities while maintaining security, why not?

On the supply side, with hundreds of chains and thousands of projects already in fierce competition, applications need users. Beyond offering rewards, they also hope users can seamlessly migrate to their platform—small reductions in migration cost can mean big jumps in TVL.

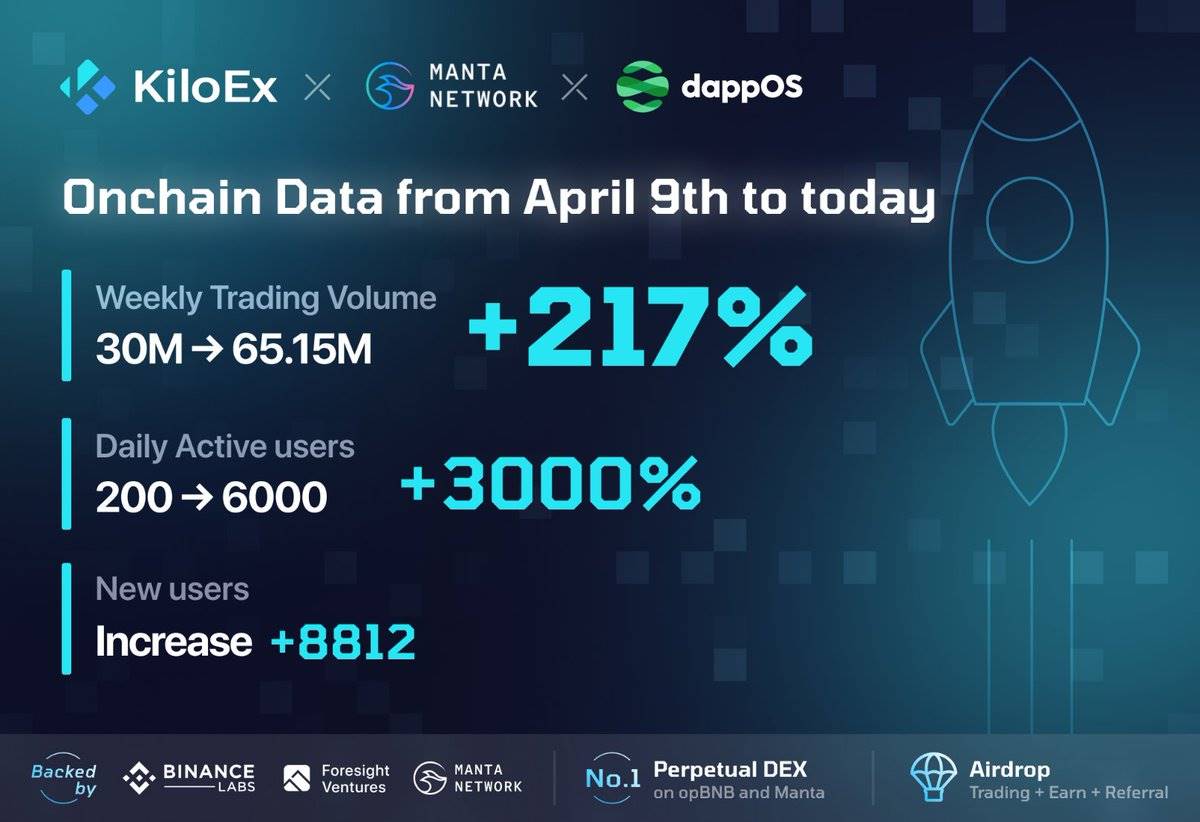

Historical data shows that, all else equal, projects integrated with dappOS have seen significant increases in user count and TVL.

This reveals the “Dao” (way) of crypto: maximizing capital efficiency and optimizing user experience. A truly inclusive intent—one that benefits everyone—is better than one stuck in narrative or mere “technique.”

Those who follow the Dao gain support. As we enjoy the water, let’s remember the well-diggers. May there be more innovators like dappOS, benefiting the entire crypto ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News