dappOS Launches Intent Assets: An Innovative Asset Model Combining Yield Generation and Usability

TechFlow Selected TechFlow Selected

dappOS Launches Intent Assets: An Innovative Asset Model Combining Yield Generation and Usability

Intent assets can address the issue of "TVL stagnation" in today's crypto industry, making new optimizations and upgrades in asset yield, usability, and convenience.

Introduction

The current "TVL stagnation" issue in the crypto industry stems from a lack of sufficient on-chain usability for various yield-bearing assets, making it difficult to attract users beyond simple airdrop incentives.

To address this problem, dappOS has introduced Intent Assets—assets that generate yield while remaining instantly usable on-chain.

dappOS is an intent execution network backed by top-tier institutions such as Binance Labs and Polychain, with a latest valuation of $300 million, making it one of the leading projects in the intent space today.

1. Current Industry Problem: Traditional TVL Model Reaches a Deadlock

TVL (Total Value Locked) is commonly used to measure the total amount of assets locked within a project, reflecting user participation and market trust. It was a relatively effective metric in past crypto market cycles because TVL represents actual "skin in the game," which is far more costly to manipulate than metrics like number of addresses or social media engagement. Therefore, projects with higher TVL have clear advantages in marketing and attracting investors. In this context, many projects lure users to deposit assets onto their platforms by offering high yields and airdrop incentives, rapidly inflating their TVL figures to showcase strength and appeal.

However, this approach has revealed issues in the current cycle: after token launches and exchange listings, many projects experience sharp declines in TVL. These TVL figures are not contributed by broad retail participation but rather artificially inflated by a few large holders or pre-arranged partners who temporarily boost TVL through "farm, withdraw, sell" strategies to cash out. This "stagnant TVL" does not reflect genuine ecosystem vitality but rather short-term data manipulation. This phenomenon has triggered broader industry concerns—for example, some high-TVL projects repeatedly delay airdrop distributions or asset unlocks due to fears that their TVL will collapse once released.

As a result, TVL’s credibility and effectiveness as a measure of on-chain ecosystem health are increasingly questioned.

The root cause of TVL stagnation lies in limited absolute returns for ordinary crypto users. Once market volatility occurs, withdrawing or converting assets involves high costs or long waiting periods, potentially causing users to miss market opportunities. In other words, participating in these projects carries too high an opportunity cost for average users, reducing their willingness to engage and leaving TVL dominated by whales using it as a tool for cashing out.

dappOS's Intent Assets were specifically designed to solve this issue.

2. dappOS Intent Assets: Yield-Bearing Assets That Are Always On-Chain Usable

2.1 What Are Intent Assets?

Intent Assets are a new type of asset introduced by dappOS—offering both high yield and instant on-chain usability. Whether transferring Intent Assets natively to exchanges or using them on-chain to buy MEME coins, participate in lending, or stake, users can use them directly—no extra steps, no waiting times, and no high slippage.

At first glance, Intent Assets resemble earlier products like余币宝 (Yu'ebao-style理财产品), sharing the “yield + fast deposit/withdrawal” feature. However, Intent Assets significantly outperform previous offerings in terms of usability, liquidity, and security. In usability, products like余币宝 cannot be directly used in dApps and require manual redemption to the chain, with some yield assets even requiring lengthy withdrawal periods. In security, Intent Assets are protected by dappOS’s OMS (Optimistic Minimum Staking) mechanism, with decentralized, non-custodial underlying assets—making them more secure and trustworthy compared to centralized, opaque solutions like“余币宝”.

2.2 Use Case Examples of Intent Assets

The first batch of launched Intent Assets includes intentBTC, intentETH, and intentUSD.

Here are specific examples illustrating how Intent Assets work:

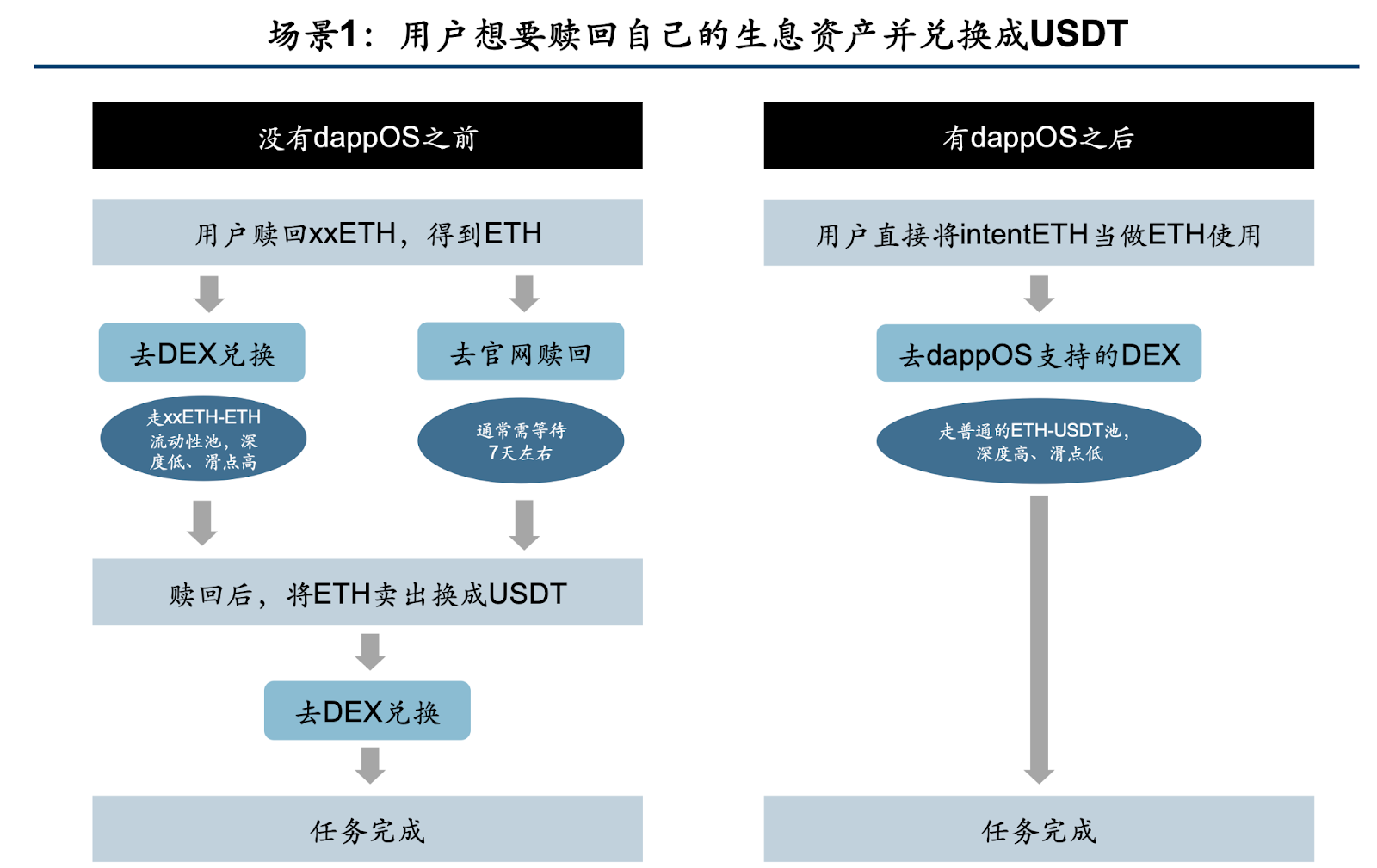

Scenario 1: A user wants to redeem their yield-bearing asset and convert it into USDT

As shown above, without dappOS, if you want to redeem your yield-bearing asset (e.g., xxETH), you typically only have two options: swap directly on a DEX or redeem via the project’s official website. If swapping directly on a DEX, you must use specialized liquidity pools for xxETH, which may suffer from low liquidity, high slippage, and significant financial loss. Redeeming via the official site usually requires a ~7-day waiting period, creating serious problems in urgent situations. After redemption, you still need to manually sell ETH for USDT.

With dappOS, if you hold intentETH, you’ll find that on DEXs supported by dappOS, intentETH can be used exactly like native ETH—one-click conversion to USDT. The liquidity pool used is the deep, standard ETH-USDT pool, eliminating liquidity and slippage issues entirely.

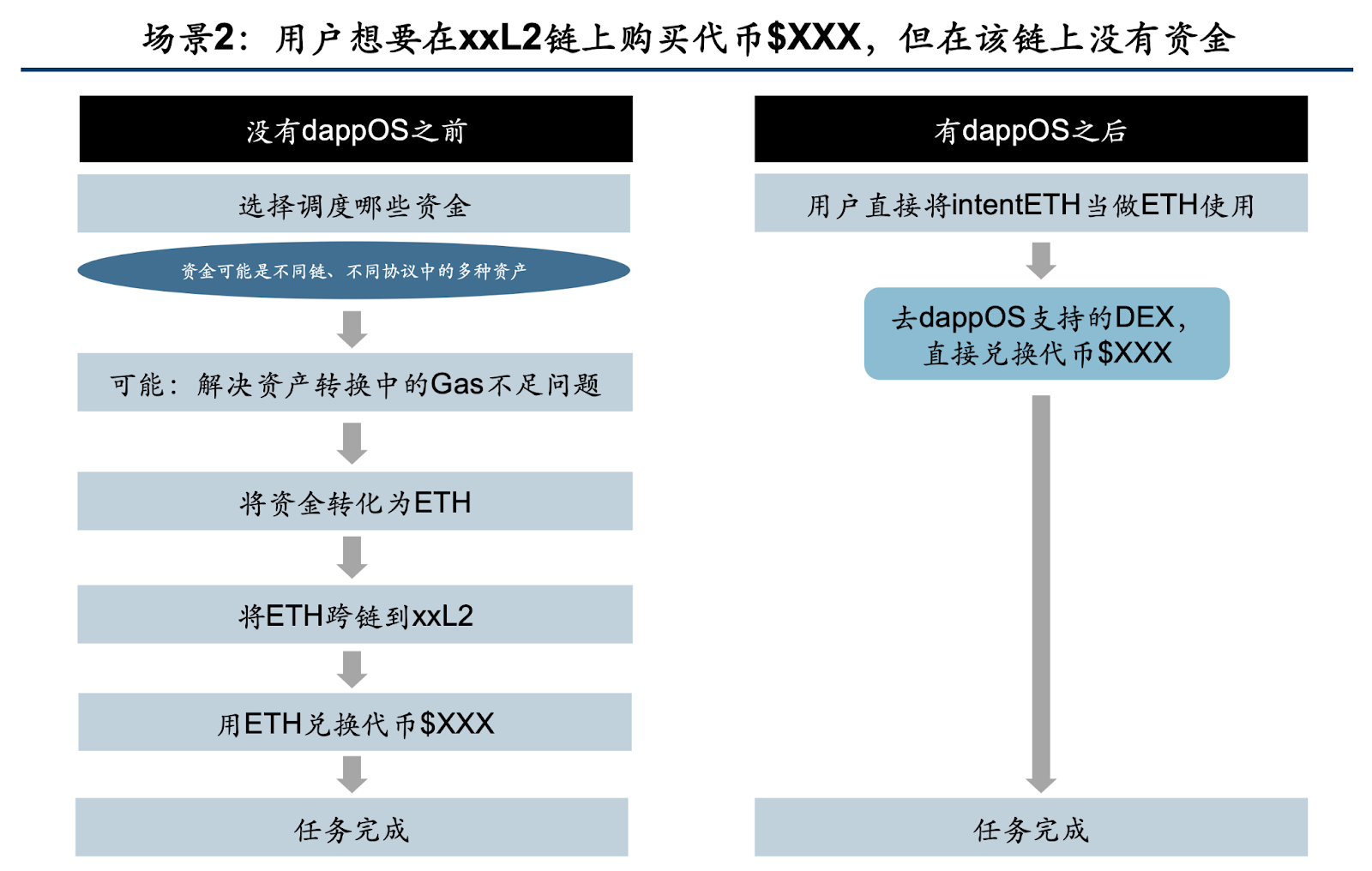

Scenario 2: A user wants to buy token $XXX on xxL2 but currently has no funds there

As shown, without dappOS, performing this seemingly simple task actually requires extensive planning, including:

- Fund allocation: Deciding which chain’s funds to use; determining whether funds are locked in other protocols and which ones to withdraw from

- Form conversion: Your funds may exist as different tokens on other chains. Converting them into ETH often involves trade-offs between high friction and long wait times. If gas fees are insufficient during conversion, figuring out how to obtain additional gas becomes another hurdle

- Cross-chain method: Whether to use on-chain cross-chain bridges or deposit ETH to an exchange and then withdraw to xxL2

With dappOS, you simply need to hold intentETH. You can go directly to a dappOS-supported DEX on xxL2 and purchase the token. You’ll find that intentETH feels exactly like native ETH when buying tokens. Moreover, you no longer need to plan complex operational workflows, enabling greater flexibility in managing and deploying your on-chain assets. For instance, you no longer need to keep reserve funds across every L1/L2 “just in case”—holding Intent Assets alone suffices for spontaneous interactions across chains.

In summary, when holding intentETH, its usage experience in non-yield scenarios is indistinguishable from native ETH—except that it passively earns substantial yield.

3. How Intent Assets Work

3.1 Intent Execution Network

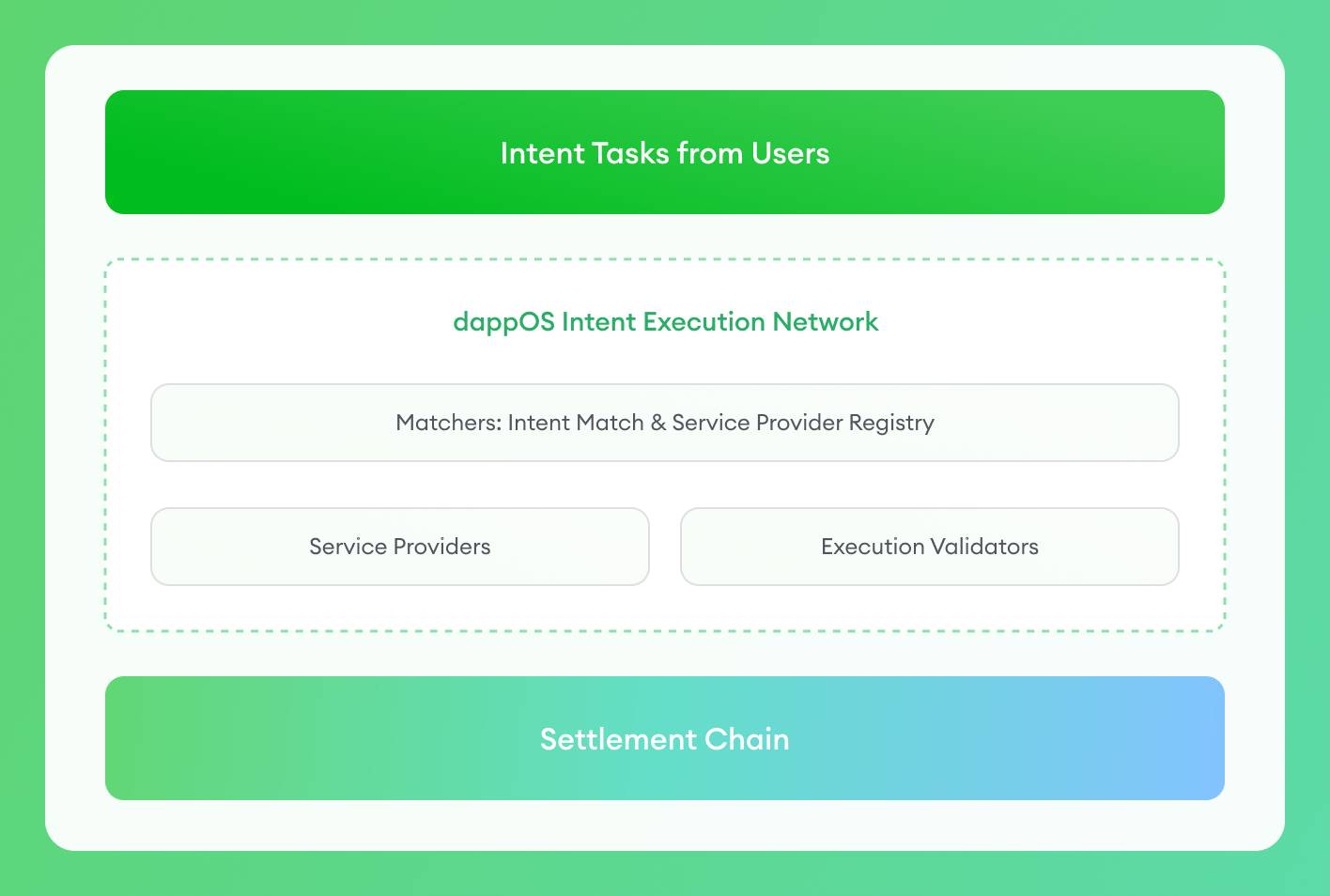

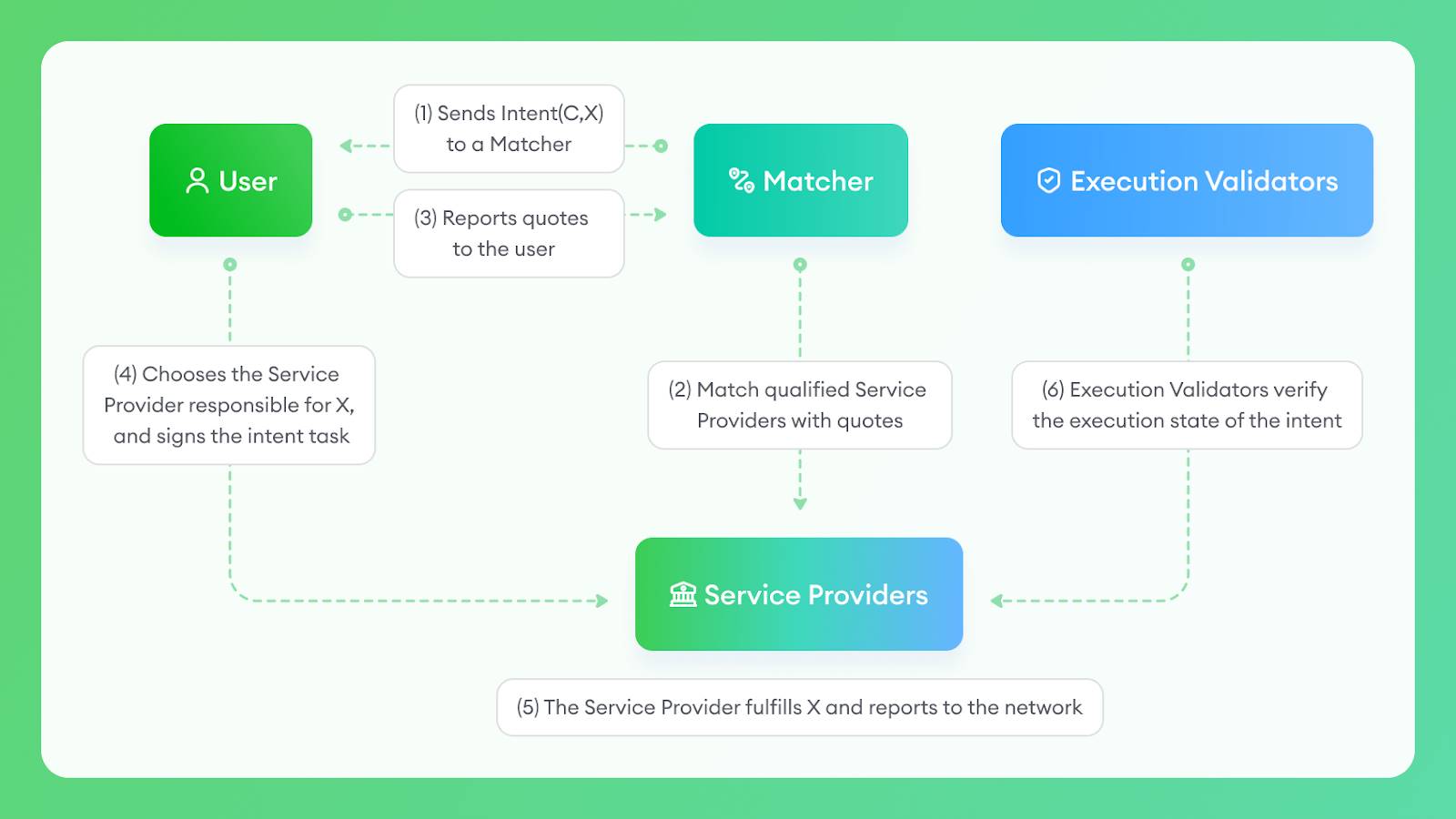

To explain how Intent Assets work, we must first introduce the dappOS Intent Execution Network behind them. In dappOS, an “intent” refers simply to a task a user wishes to complete.

As shown above, the architecture and roles in the dappOS network are as follows:

- Users: Publish intents.

- Service Providers: Execute intent tasks. After staking a certain amount of dappOS tokens as collateral, they can accept user intents and earn revenue.

- Validators (Execution Validators): Verify service node performance. If a service node fails to complete a task as required, validators may vote to penalize it.

- Matchers: Match user intents with service providers.

In practice, users send intents via a frontend interface to matchers. Matchers query relevant service providers and select the most favorable quote to present to the user. The user then signs the transaction and transfers the necessary resources to the service provider, who executes the intent.

After the designated time window, if someone detects a failed execution, they can challenge it. The network’s validators then reach consensus via DPoS voting. If consensus confirms failure, the service provider must compensate the user from their staked collateral.

The core security mechanism of dappOS is Optimistic Minimum Staking (OMS), allowing service providers to stake only slightly more than the total value of unfulfilled intent tasks (minimum) while continuing to execute tasks before final validation (optimistic). When validators successfully verify execution results, service nodes receive payment. If failure is detected, the system penalizes the node, and users receive predefined compensation. The OMS mechanism aims to balance user task efficiency, provider capital efficiency, and overall system security—ensuring successful task completion while minimizing capital costs for service providers.

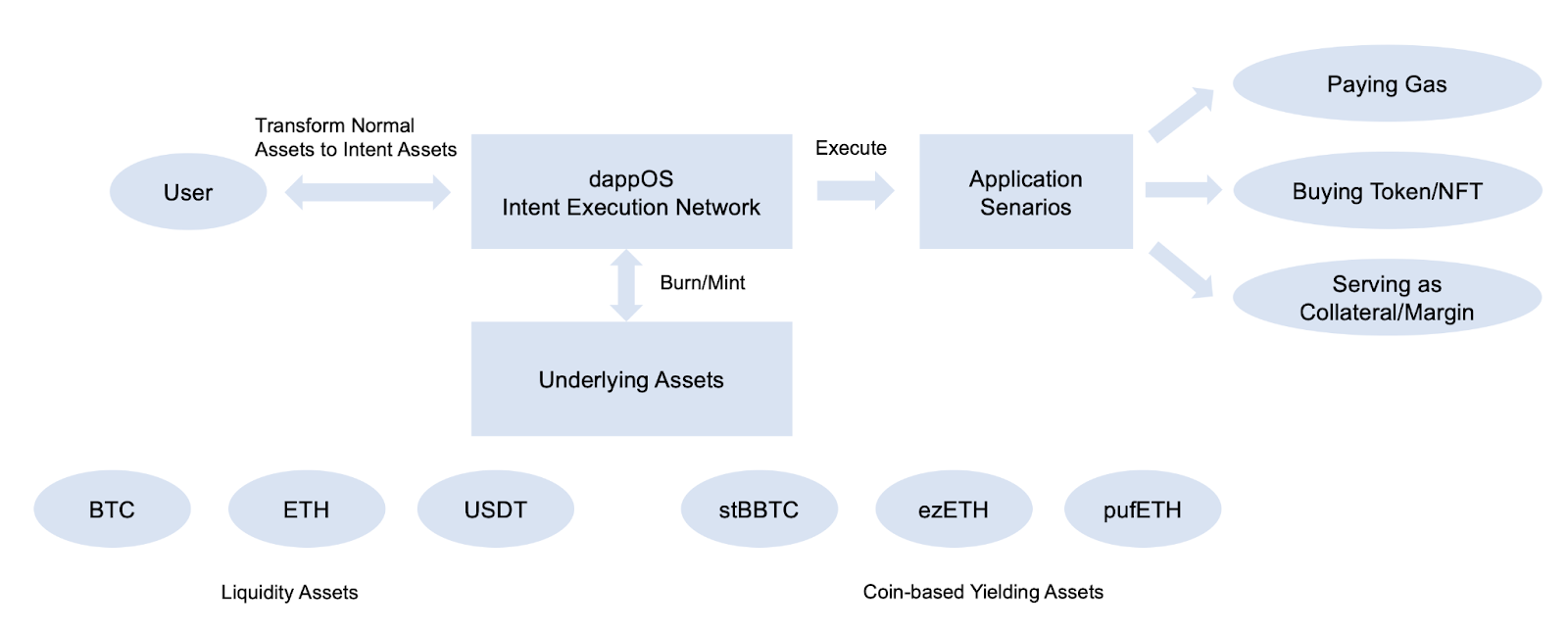

3.2 Intent Assets

Once the intent execution network is understood, Intent Assets become intuitive. As shown above, when a user has the intent “I want to use my Intent Asset directly in a certain scenario,” they can do so with one click. Behind the scenes, using an Intent Asset is itself an intent task delegated to the dappOS Intent Execution Network—the user provides the Intent Asset as input, and service providers handle the rest to achieve the desired outcome. All complexity involved in on-chain operations is managed by service providers within the dappOS network. Due to their competitive, professional nature, these tasks are executed at low cost and high efficiency.

The underlying yield of Intent Assets comes from yield-bearing assets such as LRTs and Pendle PTs (e.g., wstETH, sUSDe, sDAI, stBBTC). User-held Intent Assets function as redeemable vouchers. Theoretically, without the dappOS Intent Execution Network, users could manually move assets across chains and seek yield opportunities themselves.

But in practice, users prefer the intent execution network because:

- Users don’t want to think about intermediate steps—they demand simplicity

In current blockchain interactions, completing a single task often requires navigating numerous intermediate steps. With the intent execution network, regardless of process complexity, any verifiable outcome can be achieved with just one confirmation—professionals handle execution.

- The intent execution network enables retail users to achieve institutional-grade cost efficiency

Ordinary users typically cannot compete with professional service providers on cost and speed. Within the dappOS network, competition among service providers drives prices down to optimal levels, benefiting users. By extending institutional and whale-level access to everyday users, they gain institutional-grade cost and speed.

For example, redeeming an LRT asset usually forces retail users to choose between DEX swaps and ~7-day official redemption windows. But service providers, handling massive volumes, have optimization tools: advancing assets and charging interest; netting inflows/outflows across users; batching transactions to reduce Ethereum gas; or leveraging scale for deeper partnerships enabling faster redemptions. Similarly, for token purchases, professional providers access diverse channels (including exchanges), enjoy fee advantages, direct project integrations, and superior MEV protection—capabilities beyond ordinary users.

- The intent execution network enhances Intent Asset security

Thanks to the OMS mechanism, when a service provider accepts a “use Intent Asset” task, user assets are already protected: either the task succeeds, or the user receives guaranteed compensation. Effectively, users transfer redemption-related risks to service providers, who are better equipped to bear them.

4. Why Intent Assets Solve the Industry’s “TVL Stagnation” Problem

As mentioned at the beginning, “TVL stagnation” is a major industry challenge caused by low asset usability in TVL projects, resulting in prohibitively high opportunity costs for ordinary users. So why can Intent Assets achieve what most TVL projects cannot—giving yield-bearing assets true on-chain usability?

In fact, many TVL projects recognize the usability issue and have attempted optimizations—but with limited success. Their main approaches are:

- Direct redemption: Users request asset redemption and receive native assets after a waiting period.

- Issuing derivative tokens: Projects issue synthetic assets (e.g., xxETH) and create liquidity pools between derivatives (xxETH) and native assets (ETH).

Regardless of the method, ensuring good liquidity requires sufficient native assets on-chain, which entails ongoing maintenance costs (since holding native assets may mean sacrificing yield). In approach 1, the project bears these costs, hence users face long redemption delays. In approach 2, liquidity providers (LPs) on DEXs bear the costs, leading to shallow pools and high slippage. During high volatility, price gaps between synthetic and native assets can exceed 20%.

In contrast, the dappOS intent execution network eliminates the need for permanently maintaining on-chain liquidity. Instead, availability costs dynamically balance with actual demand. Furthermore, service providers’ maintenance costs are significantly lower—due to economies of scale, superior capabilities, exclusive channels, and the OMS mechanism enabling one collateral pool to support multiple concurrent tasks. Thanks to competitive bidding, these cost savings are ultimately passed on to users as improved experience.

Solving problems that current architectures cannot—that is the innovation and appeal of the dappOS intent execution network.

5. Conclusion and Outlook

5.1 Summary of Intent Asset Advantages

Intent Assets are a novel composite asset introduced by dappOS—delivering high yield while remaining instantly usable on-chain. The key advantages of Intent Assets can be summarized as follows:

1. Enables assets to earn yield while remaining instantly usable on-chain

2. Requires only one-click interaction—simple to use—while achieving institutional-grade cost efficiency

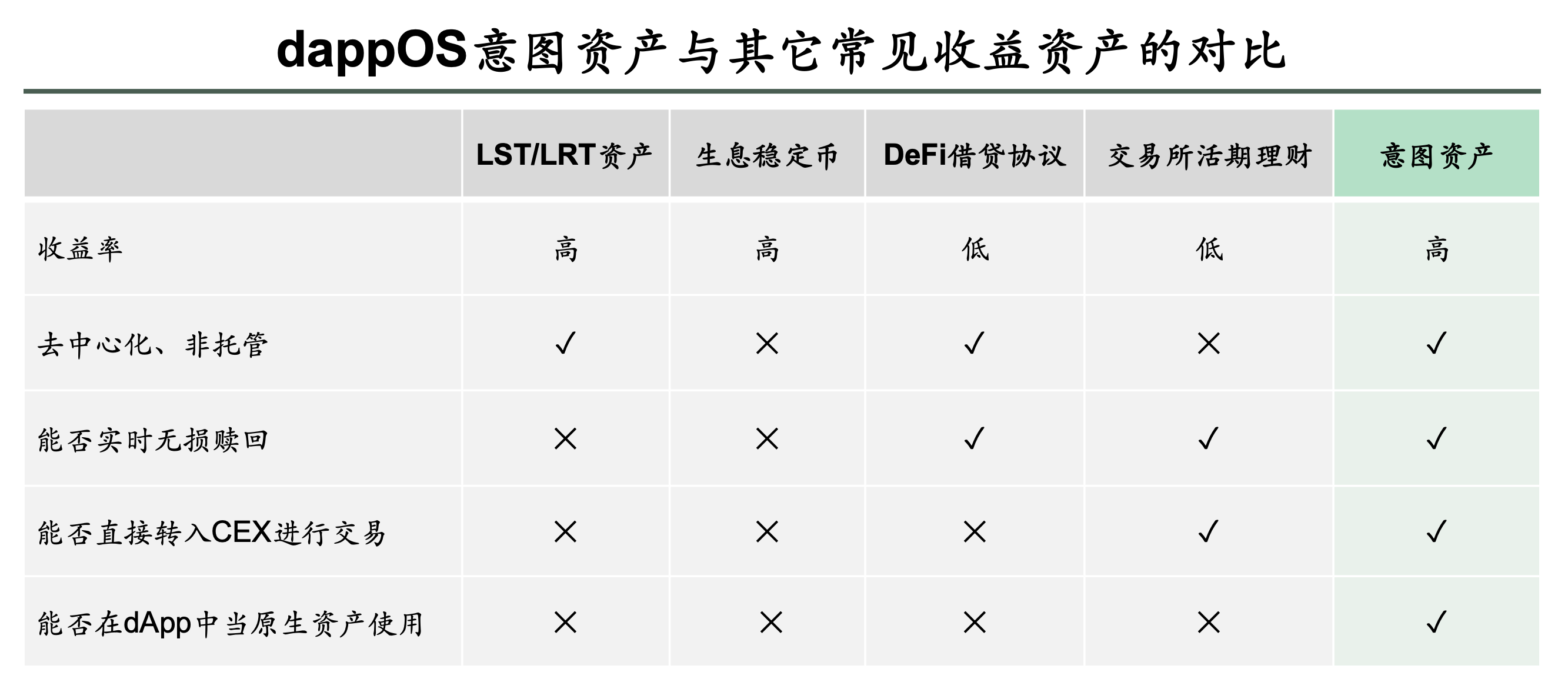

Compared to other typical yield-bearing assets, Intent Assets offer clear relative advantages, summarized in the table below:

5.2 Future Outlook for Intent Assets

Intent Assets address the crypto industry’s “TVL stagnation” problem, introducing a new level of optimization in asset yield, usability, and convenience. Superior user experience is the key to bringing millions—or even billions—of new users into crypto and achieving mass adoption.

Currently, the crypto industry remains in its early stages. Deep users may have grown accustomed to many “realities”—such as non-interoperable L1/L2 chains, paying gas for every transaction with risk of failure, and fragmented, non-interchangeable stablecoins. Yet in the Web2 world, these concepts don’t even exist. Newcomers to crypto shouldn’t need to learn “What’s the difference between L1 and L2?” or “How do I bridge?” any more than they’d need to understand interbank clearing systems. They simply want to fulfill their goals directly. Bridging this vast experience gap is precisely what dappOS and the intent sector are striving to achieve.

Meanwhile, Intent Assets are gaining strong support from mainstream Web3 products. Leading projects across the Web3 landscape—including Babylon, Benqi, Berachain, BounceBit, Ether.Fi, GMX, KiloEx, Manta, Puffer, Pendle, QuickSwap, Taiko, and Zirkuit—have joined dappOS’s Intent Asset network, providing use cases and yield sources.

As more mainstream products adopt the Intent Asset standard, a more unified, secure, and user-friendly Web3 asset ecosystem will gradually emerge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News