Project盘点 with Intent-Centric Focus: Emerging Trends in Web3

TechFlow Selected TechFlow Selected

Project盘点 with Intent-Centric Focus: Emerging Trends in Web3

This article will summarize the current development status of projects centered around intent.

By: Nicky, Foresight News

Shortly after Paradigm published its article "Intent-Based Architectures and Their Risks" in June last year, the concept of "intents" began gaining momentum. The following month, "intent-centric protocols and infra" topped Paradigm’s list of ten most promising areas—highlighting just how seriously institutions view this emerging paradigm.

The Concept of “Intents” and “Intent-Centric” Design

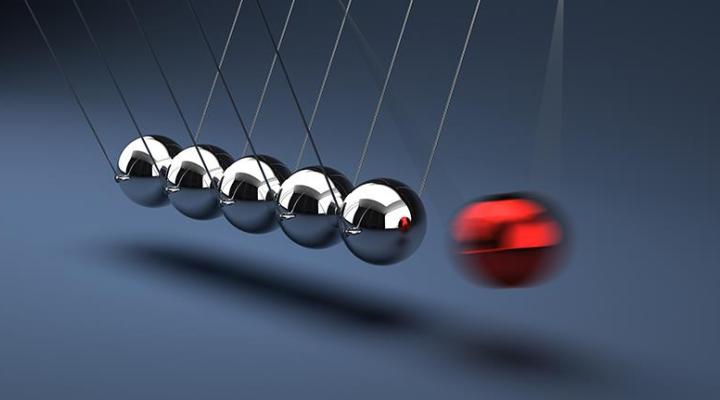

An “intent” simplifies user operations by specifying a starting point and desired outcome, thereby improving user experience.

Intent-based applications offer digital users a way to execute actions more efficiently and at lower cost. At its core, an intent functions as a digital matching mechanism—connecting user needs with feasible solutions, abstracting away complex intermediate steps, and delivering clean, final results.

Image source: Foresight Ventures

Building on this foundation are intent-centric protocols and applications. These allow users to simply state their goals when interacting with a DApp, after which the system automatically interprets and executes the necessary actions to achieve the intended result. This design dramatically streamlines user-DApp interactions, lowers entry barriers, and enables even non-degen users to easily access the benefits of decentralized applications—thereby reducing the onboarding friction for Web3 and attracting broader user adoption.

Overview of Intent-Centric Projects

1. General-Purpose Intent Network Solutions

Across Protocol

Across is an intent-driven interoperability protocol and currently the only live cross-chain intent protocol. It enables fast, low-cost value transfers without compromising security. Developed in collaboration with Uniswap Labs, Across introduced ERC-7683—the first cross-chain intent standard. This universal, intent-based standard aims to enhance connectivity, user experience, and cost efficiency across blockchain networks. In August this year, Optimism announced its adoption of the ERC-7683 standard to enable high-speed ETH and USDC transfers across the Superchain, further advancing application-layer interoperability within the broader Ethereum ecosystem.

In August, cryptocurrency exchange Coinbase added ACX, the native token of Across Protocol, to its listing roadmap.

Anoma

Anoma is a general-purpose intent machine that redefines how decentralized applications (DApps) are built. Moving beyond traditional transaction-based models, Anoma adopts an intent-first approach, allowing users to directly define desired outcomes without navigating complex computational steps. This declarative model simplifies user interaction and makes DApp development more intuitive. Anoma's intent machine not only complements existing virtual machines but also introduces a higher-level abstraction layer, enabling users to interact with blockchains effortlessly, without needing technical expertise. Its universal design ensures compatibility with any blockchain, opening new doors for developers to build intent-driven applications.

Additionally, Anoma introduces unique features such as permissionless intent infrastructure, intent-level composability, information flow control, and heterogeneous trust—unlocking novel use cases that are difficult or impossible to achieve with traditional VMs and driving further ecosystem growth.

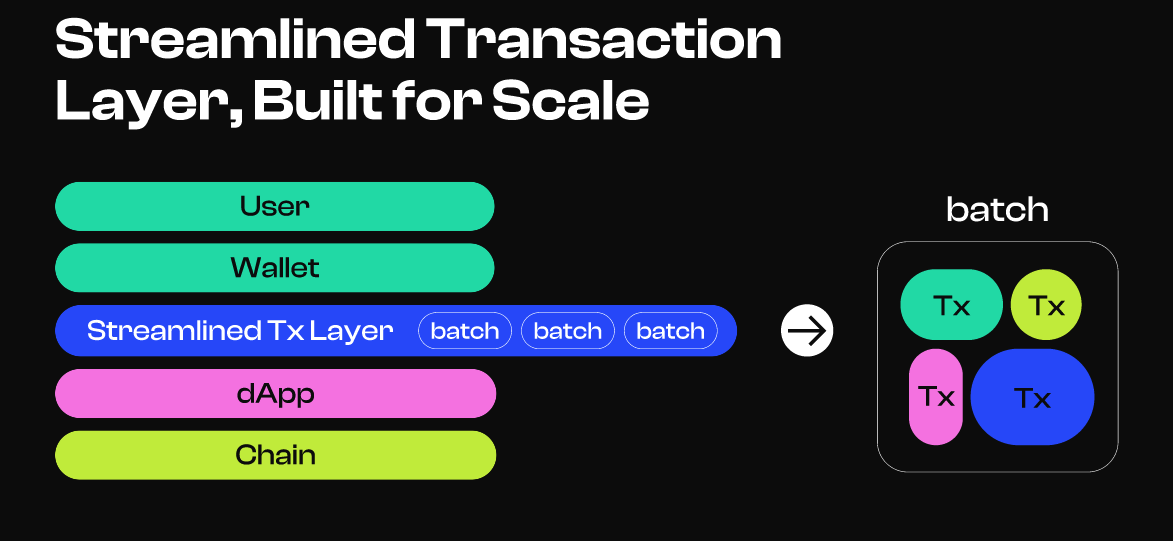

Bento Batch

Bento Batch is an Intent Transaction Layer (ITL) designed to enhance blockchain efficiency. It redefines how wallets interact with decentralized applications (DApps). Within this layer, transactions are optimized to directly achieve intended outcomes. Users no longer need to manually sign each transaction or understand intricate details. Instead, they simply express their goals, and the ITL efficiently fulfills them. This approach drastically simplifies the transaction process, reduces gas fees, and improves user experience.

Cowswap

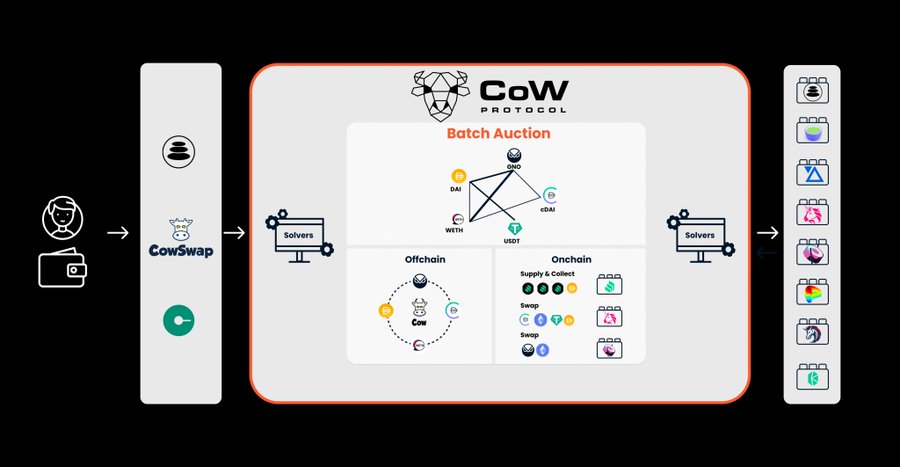

Cow Protocol is a permissionless trading protocol that uses batch auctions to discover prices and maximize liquidity. It identifies "coincidence of wants"—where two users each possess what the other desires—and aggregates all available on-chain liquidity sources. Unlike traditional trading protocols, solvers in Cow Protocol compete to deliver the best solution for fulfilling user intents.

Cow Swap is the front-end interface of Cow Protocol—a decentralized exchange (DEX) that leverages an intent-centric model to find the lowest possible trading prices across all DEXs and aggregators. Designed with privacy and fairness in mind, it protects users from frontrunning and other harmful forms of MEV. Cow Swap’s new feature, Cow Hooks, allows developers and advanced traders to write custom actions (e.g., trading, cross-chain swaps, staking, deposits) and execute them within a single transaction, better fulfilling user trading intents.

Image source: @defi_naly

dappOS

dappOS is an intent execution network with a current valuation of $300 million, making it one of the leading projects in the intent space. In March, dappOS raised $15.3 million in a Series A round led by Polychain Capital, with participation from Nomad Capital, IDG, and others. In July last year, it secured seed funding at a $50 million valuation, led by IDG Capital and Sequoia China, with support from OKX Ventures and HashKey Capital. Additionally, dappOS was selected into Binance Labs’ fifth-season incubation program in November 2022 and received Pre-Seed funding from Binance Labs in June 2023.

Recently, dappOS launched Intent Assets, aimed at addressing the rapid TVL decline often seen after airdrop rewards are distributed.

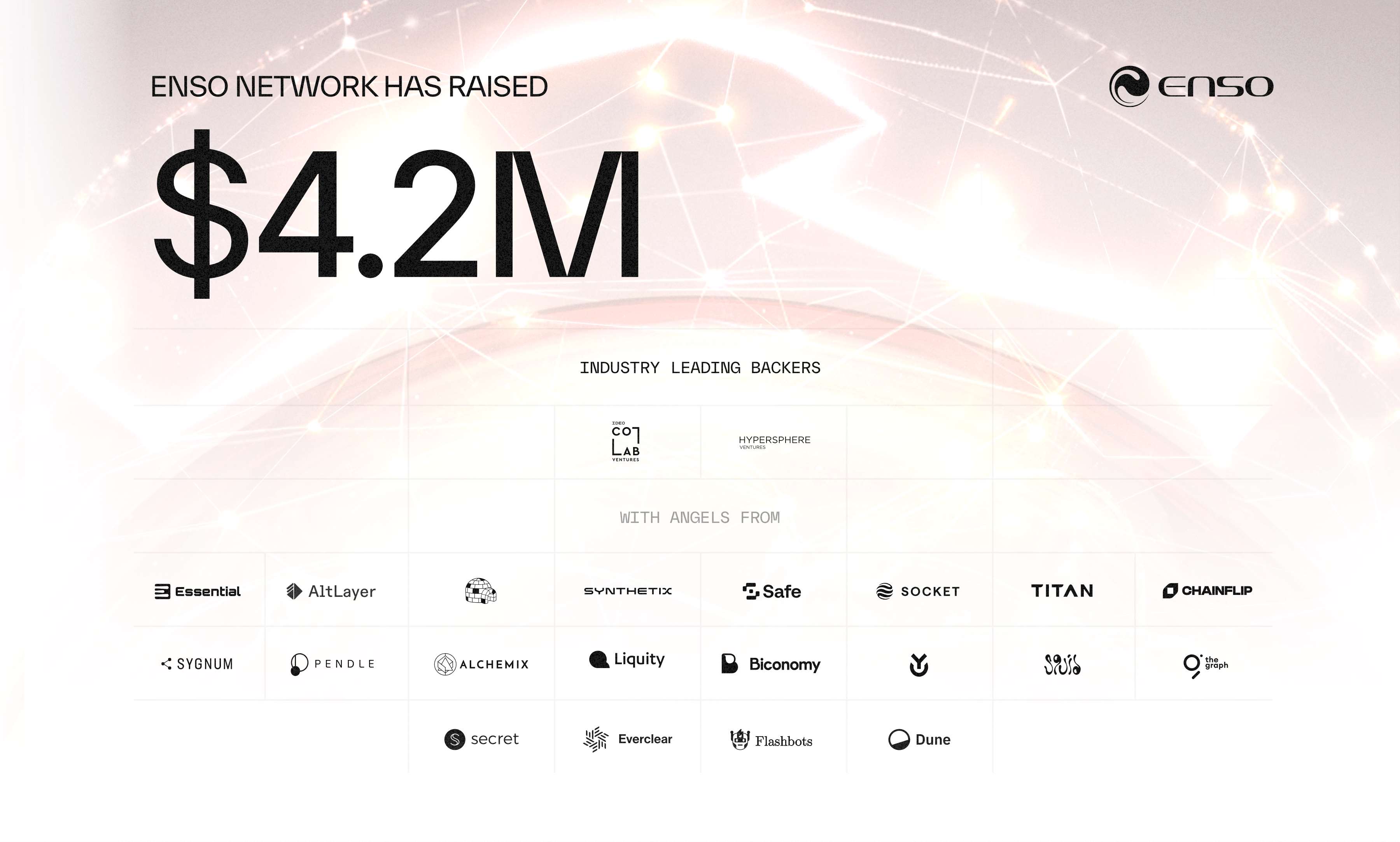

Enso Finance

Enso Finance is an intent engine shaping the future of intent-centric computing. As an independent Tendermint-based L1 blockchain, Enso is driven by network participants and delivers efficient execution with broad integration capabilities. Previously, Enso Finance launched the shared network state Enso Intent Engine, designed to simplify smart contract interactions across blockchains and support tradable data construction within various blockchain frameworks. By sharing maps of smart contract interactions, the Enso Intent Engine enables developers to express their intent and have complex blockchain operations handled automatically. This greatly simplifies integration with smart contracts and blockchains, effectively managing requests related to state changes, token transfers, NFT trades, and DeFi strategy execution.

In June, ENSO announced a $4.2 million funding round led by IDEO Ventures and Hypersphere, with over 60 angel investors participating. The funds will be used to launch its Cosmos-based L1 blockchain and continue product development later this year.

Essential

Essential is reimagining blockchain interactions from first principles using a declarative, intent-based architecture—making blockchain technology more intuitive and accessible to developers and users worldwide. In August, Essential, an intent-driven crypto infrastructure company, completed an $11 million Series A round led by Archetype, with participation from IOSG and Spartan. In September last year, it raised $5.15 million in a seed round led by Maven11, with Robot Ventures and Karatage among the participants.

Recently, Essential introduced Pint, its declarative smart contract language based on constraint modeling that operates directly on blockchain state changes. Combining modern programming features like type safety, user-defined types, and extensibility, Pint simplifies protocol logic implementation through intuitive interfaces. Unlike imperative languages, Pint’s declarative contracts give developers a WYSIWYG experience, significantly simplifying smart contract development and comprehension.

FluxLayer

FluxLayer is a cross-chain intent liquidity layer powered by EigenLayer. In August, Binance Labs Fund revealed the second batch of projects in its seventh incubation season, including FluxLayer.

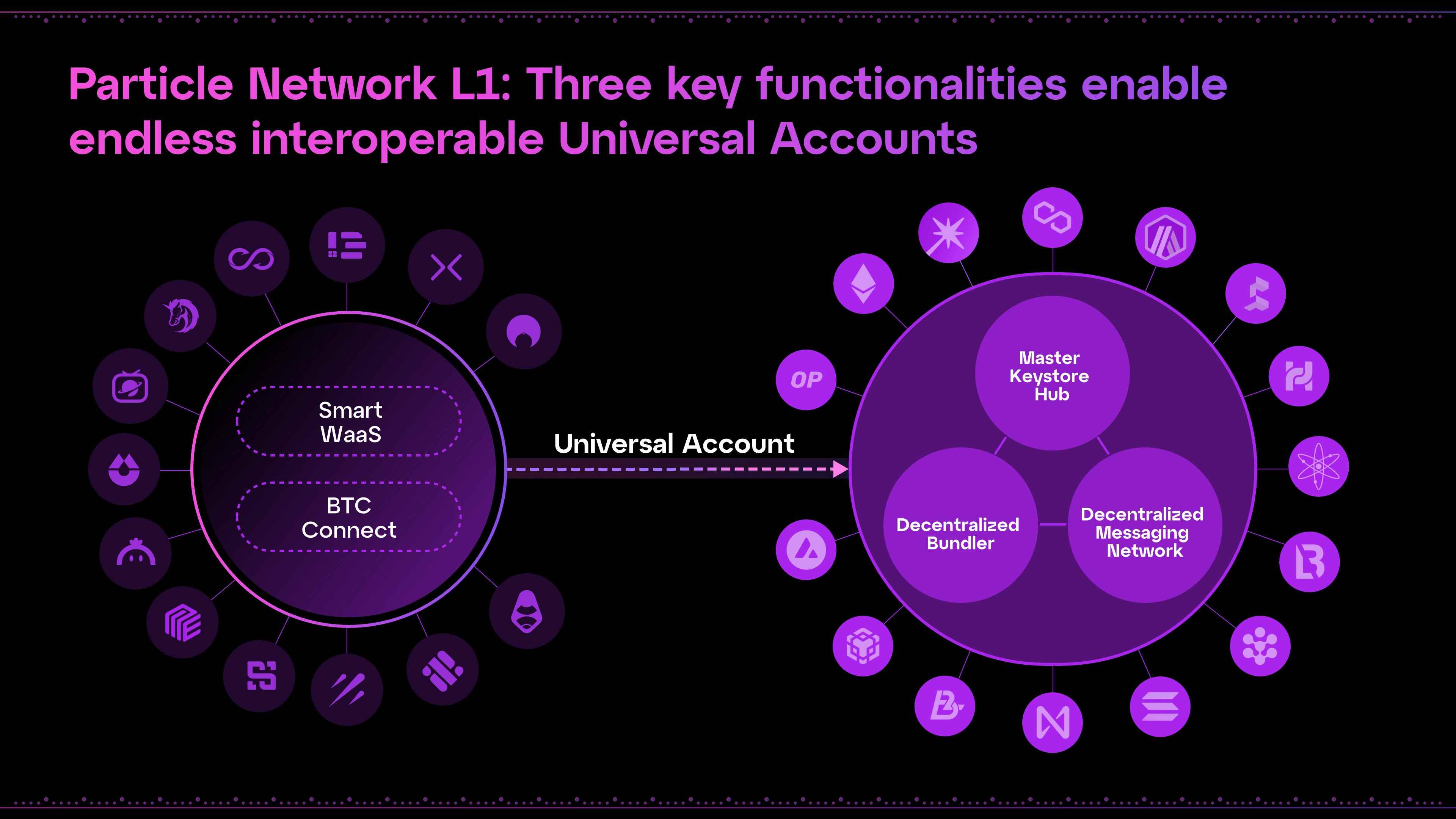

Particle Network

Particle Network is the first intent-centric modular access layer for Web3, aiming to improve user onboarding, interaction efficiency, data autonomy, and modular adaptability throughout the entire user journey. Its flagship product, the "Universal Account," enables users to interact using funds from multiple blockchains.

In June, Particle Network announced a $15 million Series A round co-led by Spartan Group and Gumi Cryptos Capital, with SevenX Ventures among the participants. This brings Particle’s total funding to $25 million. In August, Binance Labs announced an investment in Particle Network, with new funds allocated toward global team expansion, enhancing its chain abstraction ecosystem, and launching its L1 mainnet later this year.

Ruby Protocol

Ruby Protocol is an intent-centric account and access layer building a private, interoperable Web3 infrastructure. Offering account abstraction (AA), asset bridging (AB), and access control (AC), Ruby aims to accelerate Web3 development and mass adoption. Through integrations with platforms like LayerZero Labs, Arbitrum, and Optimism, it provides a scalable, interoperable, and privacy-preserving chain abstraction layer for Web3.

In June, Ruby Protocol’s native token RUBY was listed on exchanges including Bybit.

Self Chain

Self Chain is a modular, intent-centric Layer 1 blockchain and keyless wallet infrastructure enabling multi-chain Web3 access via MPC-TSS/AA technology. The system leverages large language models (LLMs) to interpret user intent, simplifying UX while ensuring asset security and self-custody through keyless wallets. By combining account abstraction and MPC-TSS, Self Chain delivers secure signing and low-cost transactions, enhancing both security and usability in blockchain interactions.

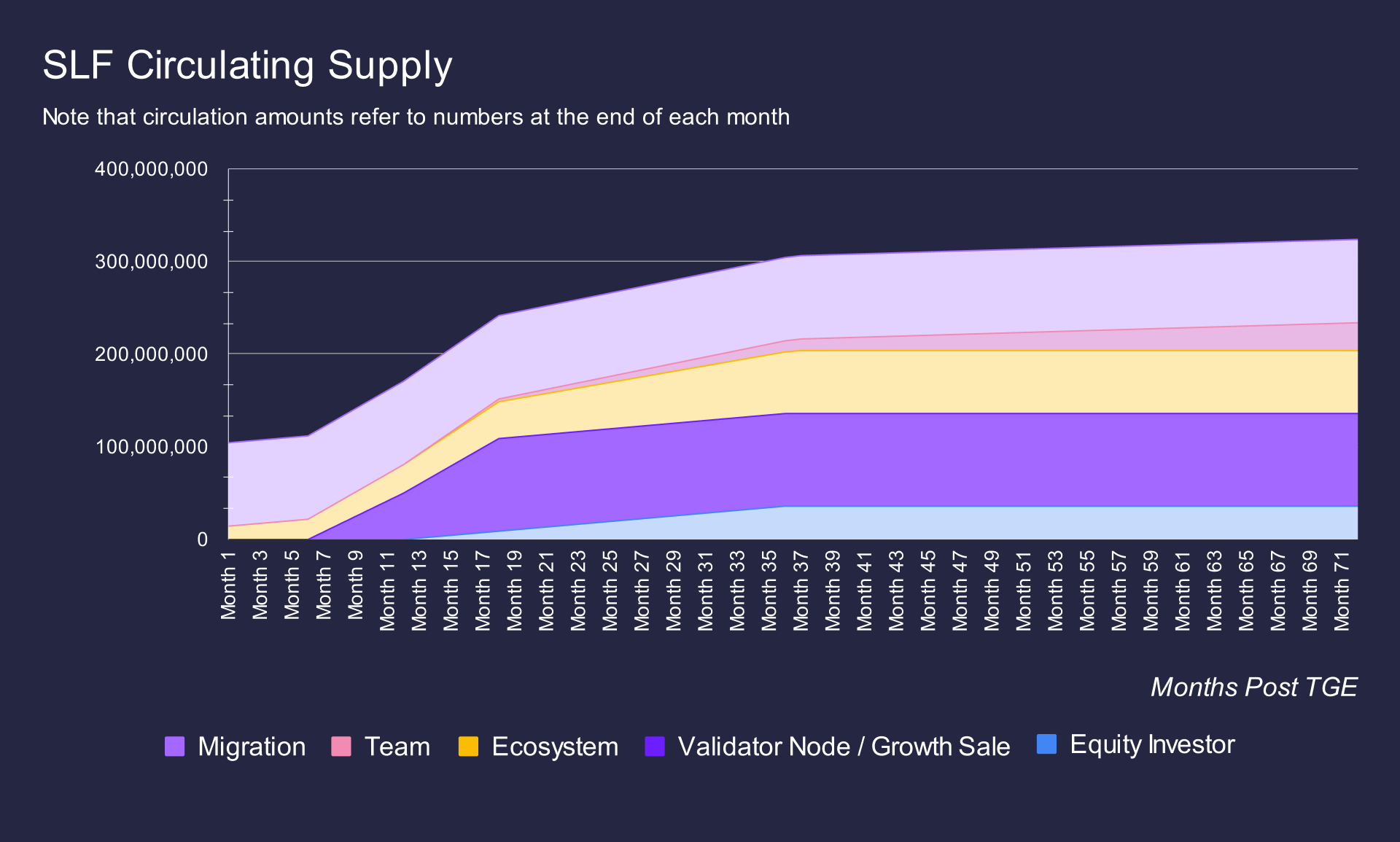

Self Chain (SLF) is a rebrand of Frontier (FRONT), expanding from a wallet project into a Cosmos-SDK-based Layer 1 blockchain with a redesigned tokenomics model. SLF has a total supply of 360 million tokens: 36 million permanently locked for foundation nodes, 90 million migrated from FRONT, 10 million allocated to new investors as validators (18-month lockup), 36 million to equity investors (36-month lockup), 30 million to the core team (6-year lockup), and 68 million reserved for the ecosystem (releasing 1.5 million monthly).

Solvers Protocol

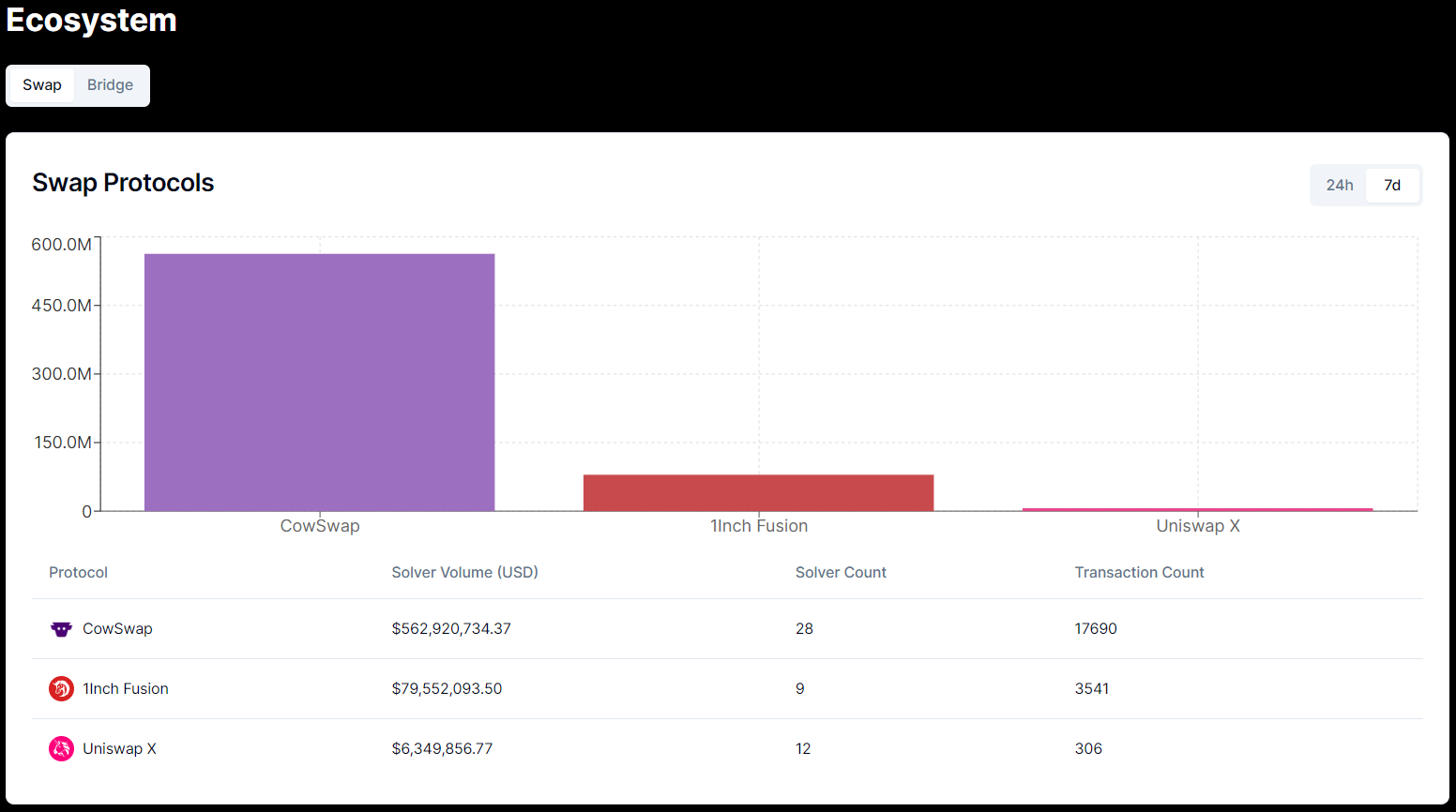

Solvers Protocol provides cross-chain infrastructure for solvers and intent protocols. It has launched Solverscan, a data retrieval platform tailored for solvers and intent protocols. Currently supporting CowSwap, UniswapX, and 1inch Fusion, Solverscan offers dedicated analytics dashboards for each solver, including leaderboards to track performance over time. More intent protocols are expected to join the ecosystem in the future.

SUAVE

SUAVE, developed by Flashbots, aims to fully decentralize block building by decoupling the mempool from block builders. SUAVE plans to achieve its vision of an intent-centric blockchain ecosystem through a three-phase rollout. In July last year, Flashbots raised $60 million in a Series B round at a $1 billion valuation, with funds directed toward developing the Suave platform—which promises cheaper and more private transactions on blockchains.

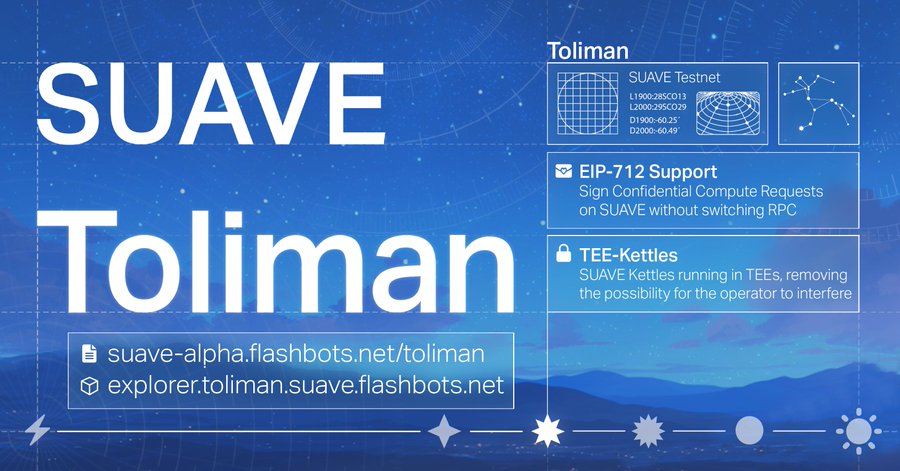

In August, SUAVE launched its first public testnet, Toliman. Developers can now build intent systems, auctions, and AI agents using Toliman, leveraging two new features: EIP-712 signed transactions and high-performance computing via TEE Kettle. These enhancements improve user experience and provide greater flexibility in order flow control and privacy for decentralized application developers.

2. Specialized Intent Solutions

DeFi

Aperture Finance

Aperture Finance is an AI-powered platform that simplifies DeFi operations through intent-based automation. In May, Aperture Finance raised $6.7 million in a Series A round at a $250 million valuation, led by Skyland Ventures and supported by Alchemy. Its native token APTR was listed on exchanges including Bybit at the end of May.

According to its roadmap, Aperture plans to provide full liquidity tooling and intent functionality for Aerodrome Slipstream on Base during Q3 this year. It will also develop an analytics system capable of monitoring liquidity positions at both individual and cross-position levels, enabling deeper insights and optimization of liquidity management.

DEX

1inch Fusion

1inch Fusion is an intent-based trading mode introduced by 1inch Network, converting user trading demands (intents) into actual trades without requiring manual configuration of complex trade parameters.

Fusion combines 1inch’s limit order and aggregation protocols, utilizing a decentralized trading and matching system that incorporates professional market makers (Resolvers) to provide both centralized and decentralized liquidity. Under Fusion, Resolvers fulfill user orders and pay the gas fees. Users sign off-chain orders (intents) via the 1inch platform—specifying assets, amounts, prices, and time windows—then broadcast these intents to the Resolver network. Resolvers compete to execute the orders via Dutch auctions, where prices start high and gradually decrease until the first accepting Resolver wins. Once executed, the trade settles on-chain with no further user action required.

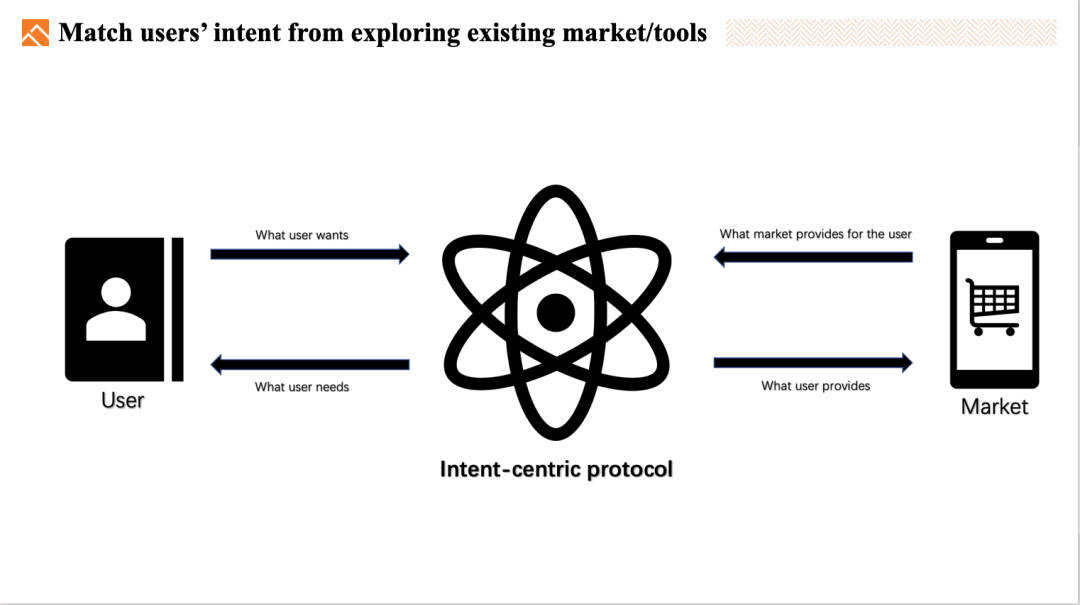

UniswapX

UniswapX introduces an intent-centric trading architecture focused on simplifying user experience: users only need to specify their goal (e.g., “swap X Token for as much Y Token as possible”) without dealing with execution complexity. By combining off-chain intelligent matching with on-chain settlement, UniswapX enables efficient and transparent trading. After users submit their intent, it is published to a cluster of order book services, where specialized builders (Fillers) scan multiple liquidity pools, analyze real-time data, predict price trends, and submit optimal quotes for on-chain execution. This mechanism enhances trading efficiency while maintaining transparency.

Shogun

Shogun is an intent-centric DeFi protocol aiming to maximize traders’ extractable value (TEV) through optimized order flow and full chain abstraction. In May, Shogun’s developer Intensity Labs raised $6.9 million in a seed round co-led by Polychain Capital and DAO5, with participation from Arrington Capital and Arthur Hayes. The round was structured as a SAFE with token warrants, resulting in a fully diluted token valuation of $69 million. In February, Binance Labs included Shogun in the first batch of its S6 incubation program.

Derivatives

IntentX

IntentX is a next-generation OTC derivatives exchange offering perpetual futures trading. Integrating cross-chain communication, account abstraction, and SYMMIO, the platform achieves omnichain deployment, reduces fees, improves liquidity and capital efficiency, and enhances scalability. Using an intent-based architecture instead of traditional order books or vAMMs, IntentX allows traders to express their trading intent, which is then executed by external solvers. In February, IntentX completed a strategic funding round raising $1.8 million, led by Selini Capital with participation from Orbs and Mantle Ecofund. The funding aims to strengthen IntentX’s partnerships with market makers and the broader DeFi ecosystem.

According to its official roadmap, future updates will include account abstraction and instant trading capabilities.

Perpetual Hub

In May, Orbs, a Layer3 blockchain, launched Perpetual Hub—an intent-based, on-chain perpetual futures trading solution developed in collaboration with THENA, SYMMIO, and IntentX. Leveraging Orbs’ L3 technology, Perpetual Hub equips traders with tools to execute perpetual futures on-chain at CeFi-grade speed. The service includes components such as Hedger, Liquidator, and Price Oracle.

SYMMIO

SYMMIO is a global derivatives settlement layer built with modularity and intent-centric design. Through bilaterally isolated instances, SYMMIO enables builders and market makers to issue highly liquid derivatives on-chain while mitigating systemic risk. The design optimizes pre-trade quoting without requiring capital locking, uses intent-based execution, and ensures highly secure settlement. SYMMIO fosters a free market environment where market makers, solvers, oracles, intent providers, and DEXs can compete and collaborate to build a global risk settlement layer.

Wallets

MetaMask

In January, MetaMask began testing a new “transaction routing” feature aimed at delivering optimal execution and improved user experience. Developed by Special Mechanism Group—acquired last year by Consensys, MetaMask’s parent company—this technology could transform MetaMask into an intent-centric protocol, enabling users to rely on third parties to find the best transaction paths.

Cross-Chain Interop Protocols

Owlto Finance

Owlto Finance is an intent-centric cross-chain interoperability protocol and omnichain bridge, currently connected to over 45 networks across the BTC, ETH, and SOL ecosystems. In May, Owlto Finance raised $8 million in a strategic funding round co-led by Bixin Ventures and CE Innovation Capital, with participation from Presto and GSR. In July, it secured another round at a $150 million valuation, with Matrixport among the investors.

AI

Optopia

Optopia is an AI-driven, intent-centric Layer 2 network supporting permissionless intent creation. Powered by token incentives that drive AI agents to execute intents, Optopia builds a smart and active L2 ecosystem that simplifies Web3 operations, lowers entry barriers, and unlocks Web3’s potential. In May, Optopia completed its seed round with participation from G·Ventures and Kucoin Ventures. In July, it unveiled the OPAI tokenomics: total supply of 10 billion OPAI, with 50% reserved for Booster Events, 25% for ecosystem rewards, 10% for community, 7% for early investors, 5% for marketing, and 3% for liquidity. Ten percent of the total supply will be distributed to participants of the first Booster Event at TGE.

On-Chain Tools

Khalani Network

Khalani is a decentralized solver platform enhancing user experience in the Web3 ecosystem. Through a multi-chain collaborative network, Khalani connects solvers and intent applications to address issues like fragmented liquidity, complex UX, and inefficient transaction execution. The platform significantly lowers the cost of building and operating solvers, empowering developers to create intent-based applications. In August, Khalani raised $2.5 million in a seed round led by Ethereal Ventures, with Nascent and Arthur Hayes among the participants.

Conclusion

The application of “intent-centric” design in blockchain is rapidly expanding across domains such as cross-chain trading, crypto infrastructure, DeFi, modular blockchains, data sharing, wallets, and interoperability protocols. By streamlining processes, optimizing user experience, and increasing efficiency, intent-based projects are driving innovation and growth in the Web3 ecosystem. As more projects emerge and the technology matures, the intent-centric paradigm is poised to play an increasingly transformative role in Web3—delivering more seamless, efficient, and accessible experiences for digital users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News