A Comprehensive Analysis of the Nature and Potential of Intent

TechFlow Selected TechFlow Selected

A Comprehensive Analysis of the Nature and Potential of Intent

To attract more users and drive a bull market, it is essential to improve the user experience of dApps, further highlighting the importance of intent-centric protocols and account abstraction.

Author: Mike, Foresight Ventures

TL;DR

-

Since the release of Paradigm's article on 'Intent-Based Architectures and Their Risks', Web3 has increasingly focused on 'intent-centric architectures'. Many leaders in capital markets have shown strong interest, as this could significantly improve transaction efficiency and security.

-

Here, "intents" refer to a method of conducting transactions and operations on the network via smart contracts. This is a new narrative with many potential applications, but also raises concerns about privacy protection, asset safety, and who can execute these intents.

-

This shift from imperative to declarative models may transform user experience and efficiency, allowing users to define their desired outcomes while relying on specialized third-party networks to carry them out.

-

In the current bear market, the blockchain industry hopes for a revival. In the past, broad crypto adoption drove such recoveries. However, existing applications still pose challenges for traditional Web2 users. To attract more users and fuel a bull market, we need to enhance dApp user experiences—highlighting the importance of intent-centric protocols and account abstraction.

I. Introduction to Intents

If necessity is the mother of invention, then laziness is its father.

You might agree that many technological advances stem from human laziness. Innovations often aim to reduce costs and increase efficiency—for example, bicycles reduced labor and increased speed; trains, airplanes, and ships achieved similar goals in different contexts. AI serves the same purpose: intelligently saving costs and boosting efficiency. In my view, intent-based applications offer digital users a way to execute tasks more efficiently and at lower cost. That is, optimization: automatically selecting and executing the best method based on user intent, achieving the fastest and cheapest outcome.

1.1 What Are Intents?

It sounds mysterious, but it’s actually simple. At its core, an intent-centric protocol is a tool or application that helps users fulfill their intentions. Take an electronic scale at a farmers' market. A traditional scale only shows weight, but what buyers and sellers really care about is price, not just weight. With an electronic scale, vendors can input the unit price, and the scale instantly calculates the total. Thus, both parties’ intent—to know the price—are satisfied.

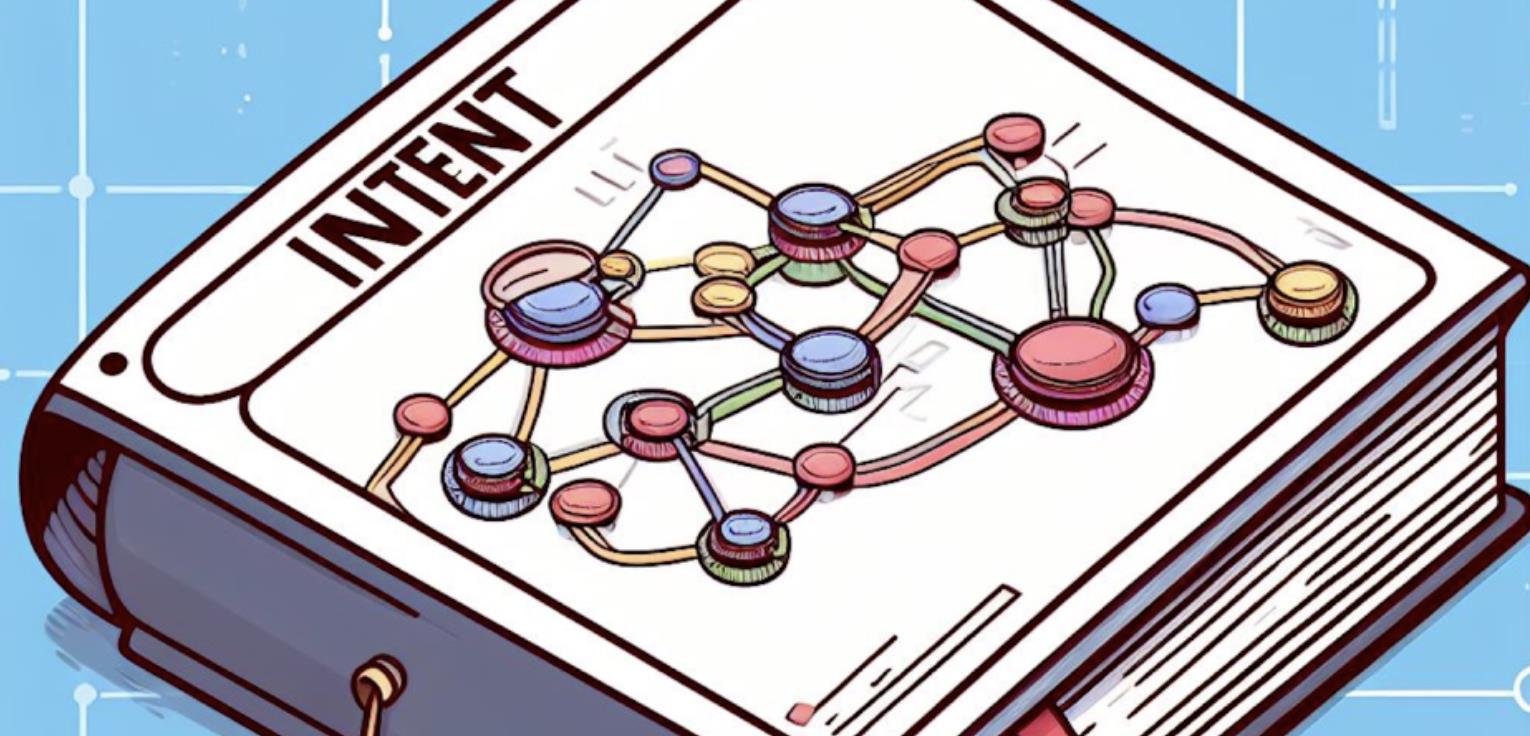

Essentially, intents can be seen as digital matching mechanisms. They work by connecting user needs with feasible solutions, simplifying complex intermediate steps and delivering a clean final result.

Consider Web2 services: a clear example is Uber. When someone needs transportation, they simply enter their current location and destination in the Uber app. The platform then uses algorithms and data to match them with a suitable driver. All complexities—route optimization, driver availability, dynamic pricing—are handled behind the scenes. The user’s primary interaction is intent-based: “I want to go from point A to point B.”

By contrast, the traditional approach might require hailing a taxi on the street or checking public transit schedules, involving uncertainty and inconvenience. In this context, Uber acts as an intent layer for transportation, simplifying user experience by addressing the core intent.

In fact, popular Web2 platforms like Amazon, Taobao, Airbnb, and Google Maps can all be considered intent-centric applications. They fulfill specific user intents within their domains: shopping, lodging, navigation. One common trait? Plug-and-play simplicity.

1.2 Why Does Blockchain Need Intent-Centric Applications?

In the evolving blockchain industry, market dynamics play a crucial role in shaping trends and adoption rates. Currently, we are in a bear market, and there is a strong desire within the community to spark the next bull cycle. Historically, each bull phase has coincided with increased crypto adoption, demonstrating the sector’s growth potential.

However, a major obstacle remains: the user experience (UX) gap between traditional Web2 apps and emerging Web3 platforms. For mainstream users accustomed to intuitive Web2 interfaces, today’s crypto applications can seem dauntingly complex. Bridging this gap and enabling mass adoption will require more than incremental improvements—it demands a paradigm shift in how dApps are designed and interacted with. Web3 offers immense value for retail users, but currently provides uneven tools, forcing users to dig for themselves. Often, users don’t want the hassle.

This is where intent-centric protocols and account abstraction become critical:

For ordinary people, interacting with blockchain can be highly complex. Traditional transactions require precise understanding of operational procedures, creating a barrier to entry. The composability and versatility of blockchain applications further complicate user interactions.

Intents simplify this by focusing on desired outcomes rather than processes. Users only need to express their end goal (“what”), making crypto transactions feel more like everyday tasks—and thus more accessible.

Imagine Degen Bob’s typical day: he unlocks MetaMask, claims staking rewards, converts tokens into USDT, then bridges them to an L2 network to buy some hot NFTs. After purchasing, he’s drawn into a DAO governance vote. An attractive yield farming opportunity catches his eye, so he approves a smart contract and provides liquidity. While minting synthetic assets on another dApp, his dwindling ETH balance prompts a quick token swap. By evening, he browses Discord for airdrop updates, realizes his ETH gas is insufficient, swaps tokens for ETH, and monitors gas prices to avoid stuck transactions. Finally, reviewing his portfolio, he discovers several failed transactions needing attention. Exhausted, Bob ends his day muttering, “That’s the life of a degen.”

Bob is a seasoned crypto user, possibly even coding-savvy, so he can tolerate this workload and complexity. But what about a Web2 newcomer? They’d likely be overwhelmed. So how do we achieve mass adoption?

Intent-centric architectures emerge to streamline this process. They encapsulate intermediate steps, optimizing time and cost. Essentially, a sequence of operations A-B-C-D-E can be effectively simplified to A-E. Technologies like ZK (zero-knowledge proofs) and the Lightning Network share similar goals—improving transaction efficiency and privacy. Methodologically, whether in custodial or non-custodial formats, the main objective remains consistent: optimize user experience (UX).

In blockchain, ‘intents’ primarily refer to the goal of using certain assets to achieve a specific outcome. Traditionally, fulfilling such an intent involves multiple procedural steps—from multi-signature approvals and high gas fees to MEV resistance.

II. Characteristics

The core idea of intents is quite simple—like making a wish. These applications essentially parse your needs and leverage extensive market resources to fulfill them. A familiar analogy is an order book: a platform where buyers’ and sellers’ various intents converge, each seeking to buy or sell, with trades executed based on mutual price agreement. A typical intent-centric protocol may exhibit the following characteristics:

1) Feature: Automation

The key advantage of intent-centric models is their ability to automate complex processes. When a user expresses a simple intent—such as swapping one cryptocurrency for another—the underlying system automatically handles all the intricate steps required to fulfill it.

Impact: Automation allows users to participate without needing to be blockchain experts. By abstracting technical details, intent-driven automation greatly reduces the learning curve, making the crypto space more accessible to the general public.

2) Feature: Consistency

A challenge in today’s crypto ecosystem is the variability in user experience across different platforms and services. Intent-centric approaches promote consistency. Regardless of backend changes or platform differences, user interaction remains uniform: express an intent, let the system handle the rest.

Impact: Consistent UX reduces confusion and increases user confidence. It also ensures that once users are familiar with one intent-driven platform, they can easily transition to others, fostering a more cohesive and user-friendly crypto ecosystem.

3) Feature: Optimization

By focusing on the end goal (the intent) rather than individual steps, systems can continuously seek the most efficient way to fulfill that intent. This might involve choosing the most cost-effective transaction path, optimizing speed, or selecting methods that maximize user rewards.

Impact: Users save not only time but also resources. In blockchain, where transaction costs (e.g., gas fees) fluctuate, optimization can lead to significant savings. Moreover, it ensures users consistently achieve optimal results without manually researching or adjusting behavior under changing conditions.

4) Feature: Matching

Intent-centric models naturally introduce the concept of matching. Once a user’s intent is broadcast, various service providers or platforms can “bid” to fulfill it—offering better exchange rates, faster execution, or added value services.

Impact: Matching empowers users by promoting competition among service providers. This competition can lower costs, improve service quality, and drive innovation in service delivery. For users, this means more choices, better rates, and enhanced overall value.

5) Feature: Aggregation

In intent-centric models, aggregation becomes a standout feature. It involves collecting various options, services, or data from multiple sources in response to a single intent. Instead of requiring users to manually search across different platforms, the system curates and presents the most relevant solutions from numerous providers.

Impact: Aggregation enhances efficiency and convenience. Users gain comprehensive visibility into available options, enabling informed decisions without manual research. This saves time and ensures users access the best market opportunities, promoting transparency and trust. In areas like DeFi, aggregation translates to better yield opportunities, more liquidity options, and optimized trading routes.

III. Exploring and Applying the Intent Layer

As blockchain and decentralized finance continue to evolve, we see entirely new innovations aimed at simplifying user experience and improving efficiency. While many are already familiar with well-known projects like Anoma, SUAVE, solvers, UniswapX, and Cowswap, we should also pay attention to pioneers leveraging “intents” to build unique applications tailored to diverse user needs. Below, we briefly explore several notable projects that leverage matching capabilities to enhance user experience:

1) Unibot: Telegram Trading Bot

Unibot breaks from traditional platforms by bringing DeFi trading tools directly into Telegram. As a bot, it supports various commands—from simple token swaps to complex cross-chain asset transfers. Unibot stands out by enabling instant, intuitive trading within Telegram, earning widespread praise and leading in revenue generation.

2) Grindery: Web3 Zapier

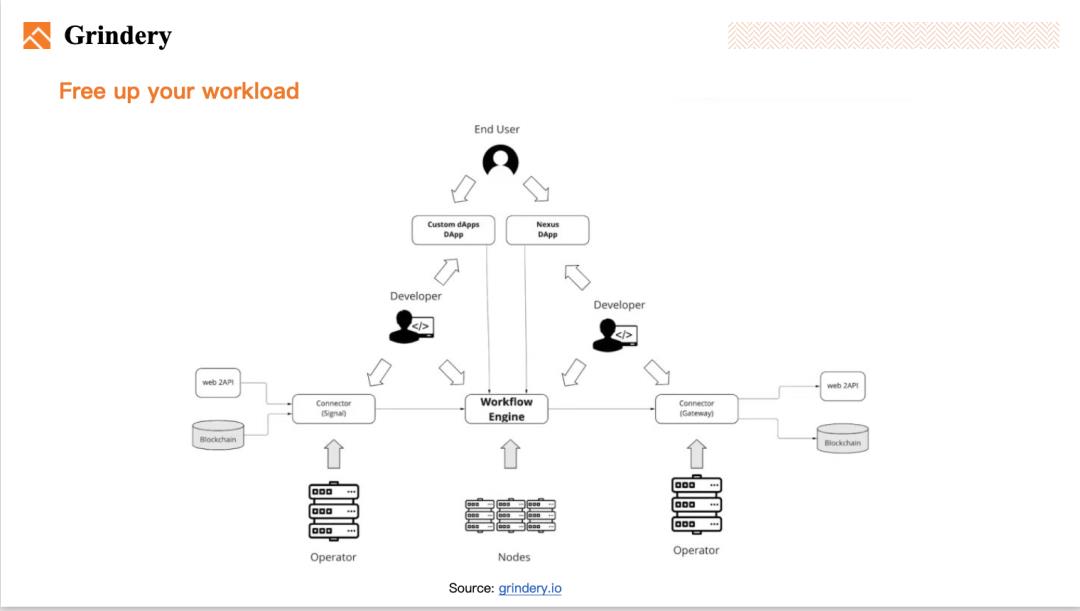

Grindery is a no-code/low-code middleware designed to bridge apps and dApps across various chains and protocols. As a decentralized system, it integrates with smart contracts and Web2 APIs. Grindery allows users to create workflows triggered by specific times, states, or events, which can initiate transactions via smart contracts or Web2 APIs. In short, Grindery is a comprehensive integration platform operating on-chain, cross-chain, and off-chain.

This diagram illustrates Grindery’s architecture. Users encounter two types of dApps: custom dApps and Nexus dApps. The latter are central to Grindery, using pre-built connectors for no-code integration, similar to Zapier. Grindery’s workflow engine separates operations into Web2 and Web3. Web2 operations involve HTTP calls to public or private APIs (via Web2 gateways), while Web3 operations follow standard patterns for smart contract automation, enabling wallet-funded transactions. Each blockchain requires specific connectivity, with gateway descriptors stored in JSON format within the system.

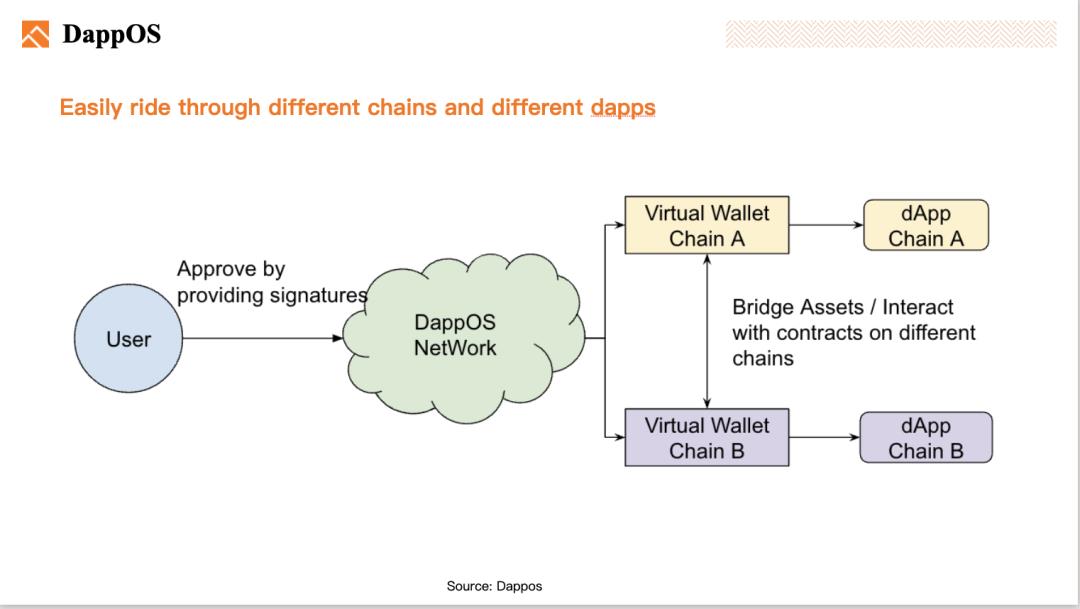

3) DappOS: Redefining DApp Interaction

Many dApps face usability challenges. Consider liquidity mining: beginners typically endure a lengthy process involving around five contract interactions—approving tokens A/B, adding liquidity, approving LP tokens, and depositing. Complexity increases when interacting with dApps across multiple chains. For instance, a BNB Chain user engaging with Perpetual on Optimism might go through over ten steps. DappOS aims to solve this:

A user initiates an order, authorizing an entire workflow with a single signature. This includes interactions across potentially multiple chains, asset bridging, and DappOS network fees. DApps forward this order to the DappOS network via JSON-RPC. The DappOS network assigns the order to a permissionless node, guaranteeing successful execution or compensating users for any losses. Driven by potential rewards, the selected node completes the full process—including asset bridging and on-chain transactions—transferring funds from the user’s virtual wallet to the appropriate dApp contract.

4) Hyper Oracle: Application of Zero-Knowledge Proofs

Hyper Oracle introduces a programmable zkOracle protocol that enhances blockchain security and decentralization. It consists of three main components: zkPoS, zkGraph, and zkWASM. zkAutomation and zkIndexing provide secure automation for smart contracts and indexing/querying of blockchain data. Compared to traditional oracle networks, Hyper Oracle offers a trustless infrastructure powered by zk technology.

zkPoS uses a zk proof to verify Ethereum consensus, accessible from anywhere. This enables zkOracle to obtain a valid block header as a foundation for subsequent operations.

zkWASM, referred to as zkVM in the diagram, serves as the execution environment for zkGraph, granting zk capabilities to every zkGraph in the Hyper Oracle Network. Its essence is similar to zkEVM in ZK Rollups.

zkGraphs executed within zkWASM describe flexible, programmable off-chain computations related to zkOracle nodes and their apps—akin to smart contracts for the Hyper Oracle Network.

5) Caddi: Transaction Optimization Tool

Caddi is a trading tool that optimizes trade execution by evaluating swaps across decentralized and centralized exchanges, ensuring users get the best rates. It actively compares and displays the most cost-effective swap routes, including all fees and gas estimates. Beyond its core function, Caddi prioritizes user security, offering robust phishing protection that alerts users to potential scam tokens or suspicious swaps.

Caddi comprehensively evaluates liquidity and fees across DEXs and CEXs, providing users with clear trade recommendations. With Caddi, users can confidently execute optimal trades while benefiting from comprehensive security safeguards.

6) 0xScope: On-Chain Data Knowledge Graph Protocol

In the blockchain world, data transparency is a core value. 0xScope fully recognizes this, offering a powerful on-chain analytics tool designed to help users deeply explore blockchain data.

Key features of 0xScope include:

-

Transaction History Query: Users can quickly look up relevant transaction details by simply entering an address or transaction hash.

-

Smart Contract Analysis: For developers and researchers, deep insight into smart contract behaviors and interactions is crucial. 0xScope provides detailed analysis tools for this purpose.

-

Token Tracking: This feature allows users to monitor real-time on-chain activities of tokens they care about—such as trading volume and holder count.

-

Liquidity and Order Book Depth Charts: For traders and market makers, understanding liquidity and market depth is essential. 0xScope provides intuitive charts to support smarter trading decisions.

0xScope not only delivers comprehensive blockchain data to its users but also features an interface design that makes this data easy to understand and interpret—whether you're an experienced developer or a beginner.

IV. The Future: Limitless Possibilities for Intent-Centric Applications on Blockchain

In today’s digital ecosystem, the convergence of blockchain and intent-centric applications heralds the dawn of a new era.

1) Permissionless Interoperability

Web2 brought many innovations, yet remained constrained by permissions, limiting interoperability between apps. For example, Apple’s iOS and Google’s Android struggle to share data, let alone execute cross-platform actions. But the arrival of Web3 and blockchain is changing this.

Imagine a metaverse where items from one game can be used in another. Or a DeFi app seamlessly integrating with gaming or music platforms. The only limit is imagination.

2) Smart Contract Automation

The potential of smart contracts extends beyond transactions.

-

Automatic Execution: In the Web3 world, users no longer need to wait or manually operate—smart contracts handle everything automatically.

-

Dynamic Interaction: Smart contracts can adjust in real-time based on market conditions.

-

Enhanced Security: Smart contracts reduce risks of errors and malicious interference.

-

Cost Savings: Smart contracts can optimize transactions based on network congestion, saving users money.

3) Integration with AI

AI can help systems better understand and respond to user intents.

-

Understanding User Intent: AI can analyze user behavior and language to determine true intent.

-

Dynamic Response: Based on context and user behavior, AI can adapt its responses.

-

Predictive Behavior: AI can anticipate user actions and prepare accordingly.

-

Enhanced User Experience: AI can continuously optimize the system based on user feedback.

-

Security and Anomaly Detection: AI can detect unusual behavior, enhancing system security.

V. A Future Scenario You Can Expect

In the future, intent-based technologies will automate many manual tasks. Imagine being an investor wanting to use assets on BSC to purchase GLP. You open DappOS and execute the trade with a single click, bypassing complex cross-chain procedures. Within DappOS, you can also claim LP rewards from Kyberswap and plan to track a large order opportunity identified earlier on 0xScope. Meanwhile, Caddi finds the optimal trade route, ensuring you get the best price while protecting against potential phishing threats.

More tasks await. Over the past two days, you’ve received numerous investment proposals on Telegram. Rather than checking them manually, you instruct an AI via Grindery: “Review all Telegram messages from the last two days and filter out startup projects valued over $10 million.” The system automatically processes this information and delivers a neatly organized Google Sheet listing the most promising opportunities within minutes.

This foreshadows a future where you can focus on what truly matters, freed from daily drudgery. As these technologies advance further, our lives will become increasingly efficient and convenient.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News