The Year of On-Chain User Experience: Vitalik Endorses ENS and CCIP as On-Chain UX Enters the "Intent Era"

TechFlow Selected TechFlow Selected

The Year of On-Chain User Experience: Vitalik Endorses ENS and CCIP as On-Chain UX Enters the "Intent Era"

dappOS does not follow the simple approach of integrating apps within a wallet, but instead uses protocols to elevate the user to the center.

Author: Zuo Ye

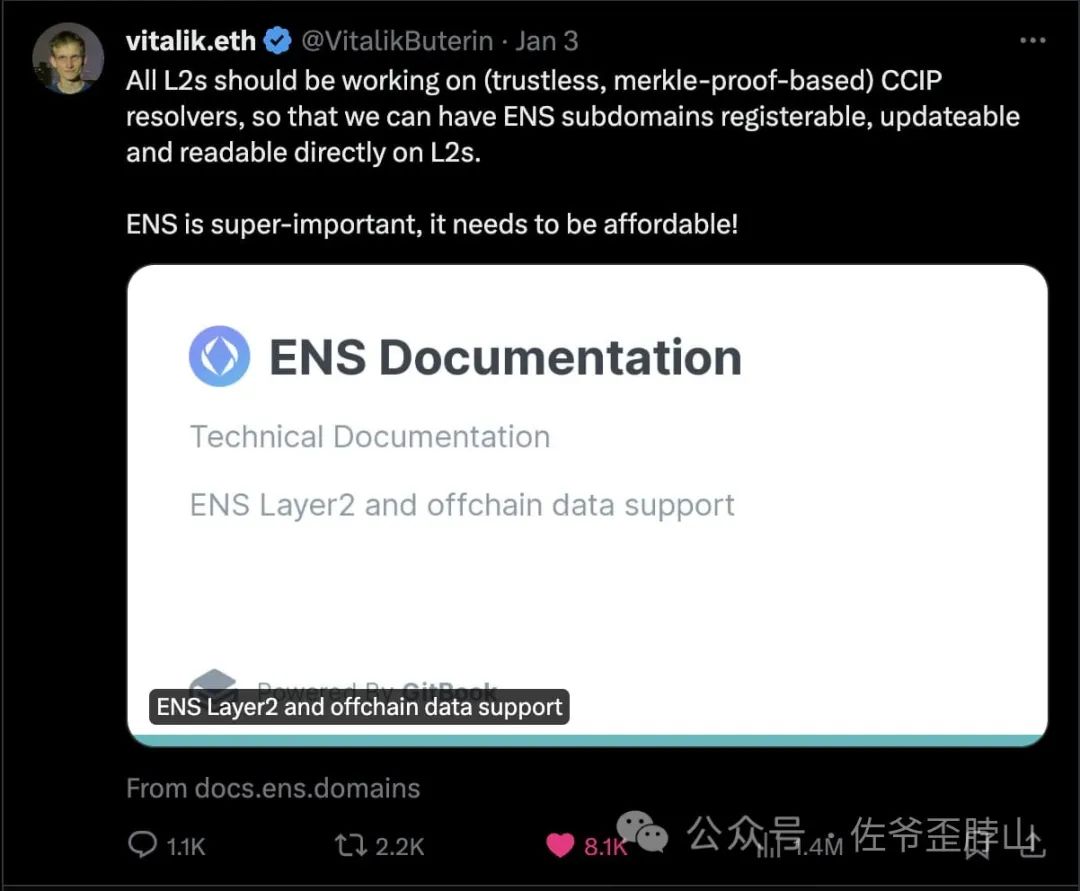

V calls out ENS and CCIP—cross-chain universal solutions have become a hot topic.

A single tweet from Vitalik sent ENS soaring over 30%. Perhaps unintentionally on his part, the community hasn't discussed CCIP much. Yet V’s key point was about extending ENS to L2s via CCIP, building a unified identity system to prevent personality fragmentation within the EVM ecosystem—a “one address, one identity, one logic” credential recognition system.

In today's Web3 landscape, CEXs continue to behave poorly, yet due to their centralized architecture offering superior user experience, most users remain trapped. They keep holding their noses while using these platforms, endlessly dreaming of true decentralization.

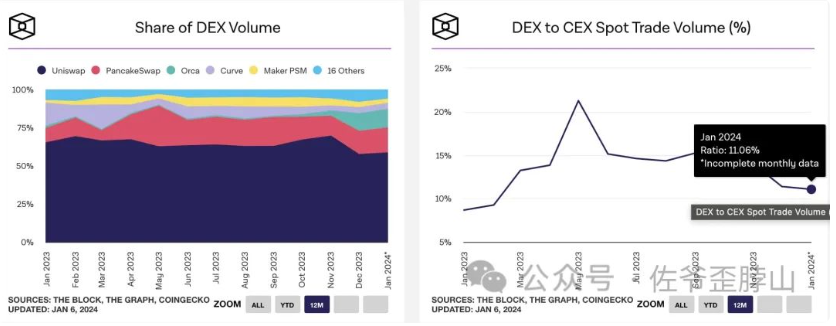

From deposit to withdrawal—and even for various trading functions in between—CEXs still dominate the market. Although Uniswap occasionally matches Coinbase in spot trading volume, DEXs collectively account for only around 10%, at most 20%, of the total spot market share.

Following Vitalik’s idea, we can first resolve identity chaos within the EVM environment, then gradually build a more complete or expansive on-chain unified system—either universally adopting ENS or enabling cross-chain identity interoperability.

Currently, all necessary technical components are in place. The only missing piece is widespread user acceptance of full on-chain logic:

-

Stablecoins: DAI, Flatcoin;

-

Oracles: ChainLink, Hyper Oracle, Pyth Network;

-

Identity layer: ENS;

-

Intent: dappOS;

-

Interoperability: Cross-chain bridges like Zetachain, LayerZero;

-

Trading systems: On-chain derivatives DEXs such as GMX, versatile Uniswap V4, and aggregated DEXs like CowSwap;

-

Entry points: AA wallets.

This categorization is somewhat crude—mixing projects with second-level categories—but the core logic remains consistent: the timing and technology to replace dominant super-CEXs are now mature. Usability is largely there; what's lacking is user awareness and ease of use.

Unlike Binance’s one-stop solution, relying entirely on an on-chain system requires users to manually assemble numerous products and concepts. Let alone how low survival rates are for newcomers navigating this dark forest.

On-chain user experience boils down to how users interact with chains

Vitalik highlights ENS and CCIP as keys to unified on-chain interaction experiences, but they’re not the only path. Among 2023’s many innovations, the value of intent has been severely underestimated. Unlike concrete products such as inscriptions or ETFs, intent is essentially internet jargon—technically speaking, it aligns with OOP (Object-Oriented Programming), shifting focus away from complex processes toward fulfilling object/user needs.

In plain terms, it’s about achieving ultimate user experience. Pinduoduo excels here—from rural-themed videos and rock-bottom prices to referral-based group discounts, buyer-favoring no-reason refund policies, and its highly cost-effective J&T logistics network.

By analogy, on-chain UX should aim to create a Binance-level all-in-one trading experience—not centered around any specific chain or identity (which risks inevitable centralization or KYC tendencies), but rather centered on "user experience."

"Intent" is marketing gold but engineering hell. It clearly lacks a subject. A more accurate description would be placing *user intent* at the center—with decentralization as the guiding principle.

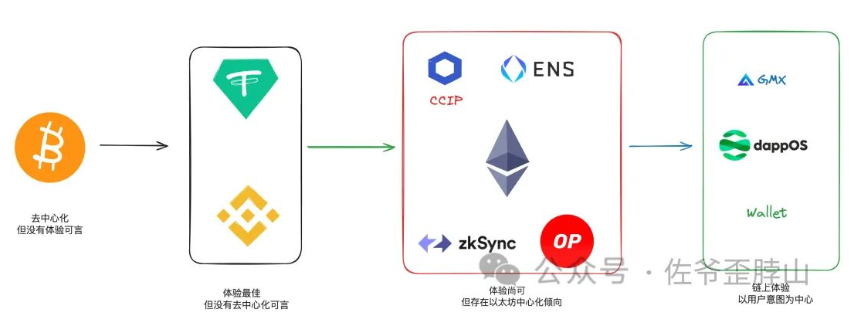

If we outline the evolution of on-chain user experience, it roughly falls into four stages:

-

Bitcoin Era: Extreme decentralization, but virtually zero user experience;

-

Strong Centralization Era: Represented by Binance and USDT, fully centralized and KYC-driven;

-

Ethereum Era: Decentralized, yet fragmented products and liquidity scattered across chaotic disorder;

-

Intent Era: Decentralized on-chain products combined with user experience rivaling centralized platforms—unified entry, decentralized usage.

Currently, we exist in a叠加 state of eras 1/2/3. Intent remains largely conceptual. Current practical efforts are focused on three directions: dappOS (wallet/entry), Cow Swap (aggregated trading), and GMX (on-chain derivatives).

Intent is the accelerator for on-chain scalability

Previously, on-chain DEXs existed mainly as alternatives or options to CEXs. But after Uniswap V4, DEX functionality has matured significantly. Usage of Cow Swap or 1inch is steadily rising—a gradual, step-by-step encroachment on CEX market share.

Next, on-chain derivatives like GMX—thanks to L2 high performance—have seen multiple chains and L2s launching their own derivative DEXs following dYdX. However, similar to spot DEXs, they will eventually face the same problem of fragmented ecosystems.

To solve ecosystem fragmentation, two paths exist: cross-chain bridges and intent. Bridges remain functional tools—they cannot serve as daily engagement hubs or value storage destinations. Only intent-based products can host asset management, interactions, identity creation and usage, forming the foundation for expansion across all chains.

Take GMX as an example: users can access it directly through its website, switching among dozens of wallets and two mainnets—or simply use GMX via dappOS. This hides a powerful scale effect. If creating a wallet just for a few dappOS apps already incurs high gas fees, imagine when dappOS connects more and more products—the marginal return on that wallet creation cost keeps increasing.

The concern here is potential centralization from a single entry point. On-chain activity entry ≠ archiving of funds and relationships. But a single product inherently becomes a source of influence. Uniswap doesn’t control user funds, yet its 60% market share alone constitutes centralized influence. Moreover, Uniswap once actively blocked addresses linked to Tornado Cash on its frontend.

Only by fully decentralizing every aspect—including frontend, governance, custody, transaction censorship—can we ensure the ideal outcome of intent: complete user control over their on-chain presence.

Haotian tweeted emphasizing the importance of interoperability—this is a functional perspective. From the user’s standpoint, it means creating a unified operational logic. Take the dappOS V2 SDK as an example: it allows users on Chain A to directly interact with Chain B, effectively channeling Ethereum traffic to other public chains and eventually across all chains—without needing layered designs for wallets, gas fee tokens, or user guides. Users operate everything under one consistent logic, scaling seamlessly across chains.

Conclusion: User-Centric, Asset-Decentralized

The concept of intent was formulated in 2023, but concrete product forms are still being explored. dappOS isn’t merely implementing apps inside a wallet—it uses protocols to elevate the user to the center. People use different apps on iPhone because iOS enforces consistent standards. Today, such an "iOS" for blockchain hasn’t emerged yet. Here’s to hoping 2024 brings progress for those building products dedicated to improving Web3 usability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News