Powell signals possible rate cuts in Congress, Bitcoin cautiously bullish outlook | Hotcoin Research Market Insights

TechFlow Selected TechFlow Selected

Powell signals possible rate cuts in Congress, Bitcoin cautiously bullish outlook | Hotcoin Research Market Insights

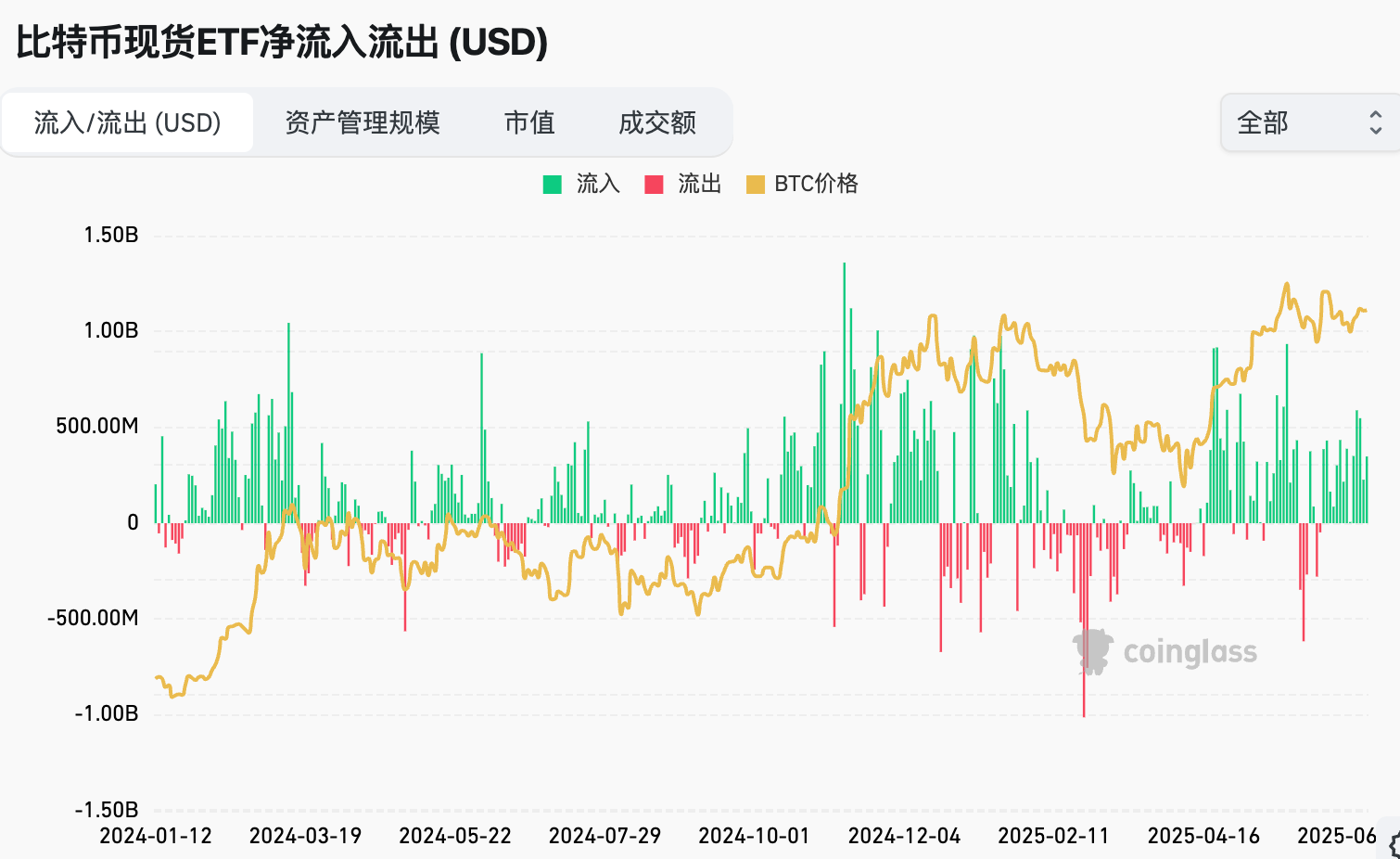

Stablecoins continued to be issued this week, with U.S. spot Bitcoin ETFs seeing significant net inflows and spot Ethereum ETFs experiencing net inflows.

Cryptocurrency Market Performance

The current total market capitalization of cryptocurrencies stands at $3.31 trillion, with BTC accounting for 64.8%, or $2.14 trillion. Stablecoin market cap is $252.7 billion, up 0.36% over the past seven days, with USDT representing 62.47%.

The current total market capitalization of cryptocurrencies stands at $3.31 trillion, with BTC accounting for 64.8%, or $2.14 trillion. Stablecoin market cap is $252.7 billion, up 0.36% over the past seven days, with USDT representing 62.47%.

This week, BTC prices showed volatile upward movement, currently trading at $108,000; ETH remained range-bound, now priced at $2,494.

Among the top 200 projects on CoinMarketCap, a minority rose while most declined: SEI gained 31.68% over 7 days, PENGU rose 19.47%, MOVE increased by 39.06%, and DOG was up 22.29%.

This week, U.S. spot Bitcoin ETFs recorded net inflows of $2.216 billion; U.S. spot Ethereum ETFs saw net inflows of $283.8 million.

The "Fear & Greed Index" on June 27 was 49 (higher than last week), reflecting neutral sentiment for five days and fear for two days this week.

Market Outlook:

This week witnessed continued stablecoin issuance, significant net inflows into U.S. spot Bitcoin ETFs, and positive inflows into Ethereum ETFs. Both BTC and ETH maintained a volatile upward trend. The RSI index stood at 47.9, indicating neutrality, and the Fear & Greed Index remained mostly neutral. Federal Reserve Chair Powell's congressional testimony provided some dovish signals, stating that if data remains stable, rate cuts could be considered in the future—this boosted market sentiment, pushing BTC back above $107,000.

South Korea introduced a regulatory amendment for digital assets this week, and an increasing number of public companies are adopting BTC strategic reserves following the MicroStrategy model. The probability of a Fed rate cut in July is only 20.7%; however, if key data such as PCE remain stable, a September rate cut becomes likely. The expected BTC price range for next week is $103,000–$109,000. At this stage, small-scale accumulation on dips is advised. In July, barring major macroeconomic policy shifts, the market is expected to remain range-bound until August, when either the U.S. stablecoin bill is formally enacted or the Fed initiates rate cuts—both potential catalysts for substantial gains. Next week, focus should center on U.S. tariff agreement developments.

Understanding the Present

Recap of Major Events This Week

1. On June 23, Circle’s total market value surpassed the total market cap of its issued stablecoin USDC;

2. On June 24, former U.S. President Trump stated that the announced ceasefire between Iran and Israel was “a beautiful day for the world.” When asked how long it would last, he replied: “I think it’s indefinite. It will continue indefinitely”;

3. On June 24, Binance founder CZ responded to news that a team of crypto hedge fund executives plans to raise $100 million through a publicly listed company to invest in BNB as a “BNB version of MicroStrategy,” confirming that multiple firms are already exploring similar initiatives;

4. On June 23, Eyenovia, Inc. (Nasdaq: EYEN) announced it has entered into a securities purchase agreement (SPA) with institutional accredited investors for a $50 million private investment in public equity (PIPE) financing;

5. On June 23, cryptocurrency exchange OKX, which returned to the U.S. market in April, is considering an initial public offering (IPO) in the United States;

6. On June 24, Guotai Junan International announced that Guotai Junan International Holdings Limited (Stock Code: 1788.HK), a subsidiary under Guotai Haitong Group, officially received approval from the Hong Kong Securities and Futures Commission (SFC) to upgrade its existing securities trading license to include virtual asset trading services and related advisory capabilities. After the upgrade, clients can directly trade cryptocurrencies like Bitcoin and Ethereum, as well as stablecoins such as USDT, on its platform;

7. On June 25, DeFi Development Corp (formerly Janover), the “MicroStrategy of SOL,” launched a WIF validator node and plans to share WIF staking revenues and other validator rewards with the community;

8. On June 26, Coinbase announced the upcoming launch of American-style perpetual futures (US Perpetual-Style Futures) on its derivatives trading platform. This product retains core features of global perpetual contracts while fully complying with U.S. regulatory standards;

9. On June 26, White House digital asset policy advisor Bo Hines confirmed that the U.S. is building infrastructure for a strategic Bitcoin reserve;

10. On June 27, Dinari, a startup offering blockchain-based U.S. stock trading services, secured broker-dealer registration for its subsidiary. The company claims this makes it the first tokenized stock platform in the U.S. to receive such approval.

Macroeconomic Developments

1. On June 25, Federal Reserve Chair Powell said future trade agreements might allow the Fed to consider rate cuts. On the same day, the New York City mayor unveiled a cryptocurrency initiative aiming to enable municipal service payments via crypto;

2. On June 26, Cboe BZX Exchange filed a Form 19b-4 application with the U.S. Securities and Exchange Commission (SEC) for the Canary PENGU ETF;

3. On June 27, according to CME's "FedWatch": The probability of the Fed holding rates steady in July is 79.3%, while a 25-basis-point cut has a 20.7% chance. For September, the likelihood of unchanged rates drops to 8.2%, with a cumulative 73.3% chance of a 25-basis-point cut and an 18.5% chance of a 50-basis-point reduction;

4. On June 27, South Korean Democratic Party lawmaker Min Byung-deuk introduced an amendment to the Capital Markets and Financial Investment Business Act, aiming to classify digital assets (virtual assets) as underlying assets and trust properties for financial investment products. The bill would allow Bitcoin and other digital assets to serve as underlying assets for ETFs and provide legal grounds for trustees to custody and manage digital assets—a key campaign promise of President Lee Jae-myung;

5. On June 26, Opyl, an AI biotech company listed on the Australian Securities Exchange (ASX), announced the launch of a Bitcoin treasury strategy to address its financial crisis. The company purchased approximately 2 BTC worth around $214,500 via the ASX-listed DigitalX Bitcoin ETF, supported by a non-dilutive loan of up to $1.3 million at 6.5% annual interest provided by Tony G, chairman of blockchain firm SOL Strategies. Opyl had only $64,000 in cash at the end of Q1;

6. On June 27, UK-listed company Vinanz added another 5.85 BTC, bringing its total holdings to 65.03 BTC, with an average purchase price slightly above $98,200;

7. On June 28, U.S. President Trump stated, “We can extend or shorten the July 9 deadline for the tariff agreement.”

ETFs

From June 23 to June 27, net inflows into U.S. spot Bitcoin ETFs totaled $2.216 billion. As of June 27, GBTC (Grayscale) has experienced cumulative outflows of $23.203 billion, currently holding $19.786 billion in assets, while IBIT (BlackRock) holds $74.066 billion. The total market cap of U.S. spot Bitcoin ETFs stands at $135.266 billion.

Net inflows into U.S. spot Ethereum ETFs amounted to $283.8 million.

Looking Ahead

Event Preview

1. EthCC 8 will take place in Cannes, France, from June 30 to July 3, 2025;

2. IVS2025 KYOTO will be held in Kyoto, Japan, from July 2 to 4, 2025.

Project Updates

1. Fees for Circle’s Paymaster feature will be waived before June 30. This feature allows users to pay gas fees in USDC on Arbitrum and Base networks, charging a 10% fee per transaction;

2. Applications for the Ethereum Foundation’s Devconnect Scholar Program close on June 30. The 2025 cohort will include 100 scholars across categories: Ethereum community organizers, legal and public sector professionals, journalists, artists, developers, and other builders;

3. Kitanihon Spinning plans to launch its crypto business in early July, pending shareholder approval on June 30, including holding Bitcoin and issuing its own token;

4. Lightchain AI, a decentralized AI marketplace, will launch its mainnet in July;

5. Web3 social platform Noice revealed its plan to distribute a 20-billion-noice community pool, with the first airdrop launching on July 4, allocating 10% (2 billion tokens). Subsequent monthly airdrops will occur four times per month through November.

Key Events

1. Nigeria SEC’s new crypto marketing rules take effect on June 30. VASPs and KOLs must obtain approval to promote digital assets. Influencers must secure a “no-objection letter” from the Nigerian Securities and Exchange Commission before publishing digital asset advertisements. Non-compliance may result in penalties, including a minimum fine of 10 million Nigerian Naira (~$6,400) or up to three years in prison;

2. California’s Digital Financial Assets Law imposes stricter regulations on businesses operating in crypto, requiring individuals and companies to obtain a license from the Department of Financial Protection and Innovation (DFPI) to conduct digital financial asset activities. Licensees must retain records for five years, including monthly general ledgers listing all assets, liabilities, capital, income, and expenses;

3. July 4, 2026 marks the 250th anniversary of the signing of the U.S. Declaration of Independence.

Token Unlocks

1. Optimism (OP) will unlock 31.34 million tokens on June 30, valued at ~$16.85 million, representing 1.79% of circulating supply;

2. Sui (SUI) will unlock 44 million tokens on July 1, worth ~$117 million, or 1.39% of circulating supply;

3. dYdX (DYDX) will unlock 4.16 million tokens on July 1, valued at ~$2.02 million, or 0.56% of circulating supply;

4. EigenLayer (EIGEN) will unlock 1.29 million tokens on July 2, worth ~$1.43 million, or 0.41% of circulating supply;

5. Ethena (ENA) will unlock 40.63 million tokens on July 2, valued at ~$10.53 million, or 0.67% of circulating supply;

6. IOTA (IOTA) will unlock 8.63 million tokens on July 4, worth ~$1.35 million, or 0.22% of circulating supply.

About Us

Hotcoin Research, the core research hub within the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global cryptocurrency investors. We offer a comprehensive "trend analysis + value discovery + real-time tracking" service framework, delivering deep industry trend breakdowns, multi-dimensional project evaluations, and round-the-clock market monitoring. Through our weekly dual-updated strategy livestreams “Top Coin Selection” and daily news digest “Blockchain Today,” we equip investors at all levels with precise market insights and actionable strategies. Leveraging cutting-edge data analytics models and extensive industry networks, we empower novice investors to build solid knowledge frameworks and help institutional players capture alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly recommend that investors fully understand these risks and operate within a rigorous risk management framework to ensure capital safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News