Is Pump.fun worth $4 billion now?

TechFlow Selected TechFlow Selected

Is Pump.fun worth $4 billion now?

Can pump.fun stage a comeback by pivoting to "Kuaishou" during a bear market?

By Cookie, BlockBeats

It's no longer news that Pump.fun—the largest meme token launch platform in the industry—is raising $1 billion at a $4 billion valuation. As the meme coin frenzy cools and golden dogs (high-return tokens) are no longer emerging one after another, concerns have mounted across both Chinese and English communities about whether Pump.fun’s token launch could drain substantial liquidity from the market, potentially marking a temporary end to the meme coin cycle.

As a breakout application-layer leader in crypto, Pump.fun has long functioned as an industry-level money printer. But with fading liquidity and narrative momentum, Pump.fun itself is now attempting to pivot—learning from traditional internet platforms by cultivating native influencers to drive traffic. So, does Pump.fun still deserve its $4 billion valuation today?

Is the $4 Billion Valuation Justified?

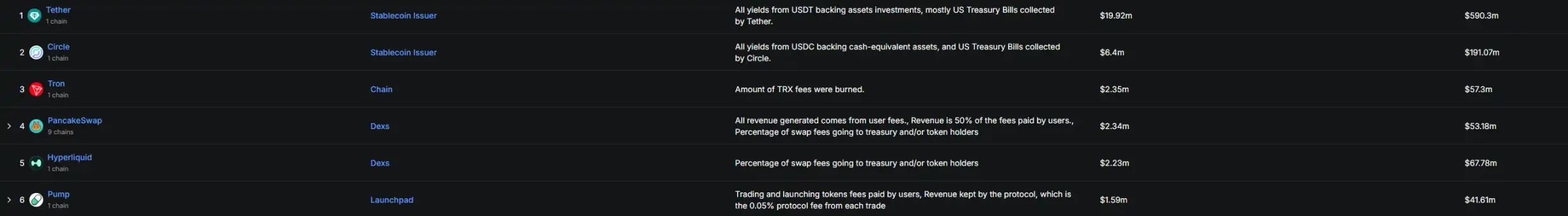

Pump.fun has generated approximately $758 million in total historical revenue, making it one of the most profitable projects in Web3. According to DefiLlama data, Pump.fun earned $41.61 million in the past 30 days. Only stablecoin-related projects (Tether, Circle, Tron) or major DEXs (PancakeSwap, Hyperliquid) surpass it in revenue—and no project within the Solana ecosystem comes close.

Annualizing recent monthly revenue gives roughly $500 million per year. At a $4 billion valuation, this results in a price-to-sales ratio of 8x—not an outrageous figure. However, skepticism centers less on whether Pump.fun *ever* deserved such a valuation, but rather whether *today’s* Pump.fun can justify it.

Pump.fun’s revenue fluctuates directly with overall meme coin market sentiment. In late November last year and late January this year, the platform saw peaks in new token "graduation rates"—reaching weekly highs of 1.67% and 1.62%, double today’s rate.

Daily revenues during those periods consistently exceeded $4 million—three to four times current levels—with single-day records surpassing $10 million. The number of newly launched tokens also exceeded 50,000 per day, twice the current volume.

No matter when Pump.fun chooses to issue its token, criticism is inevitable. Had it done so at its peak, the valuation would likely be much higher—but critics would accuse it of killing the meme bull run. Launching now invites accusations of pouring salt on the wound, siphoning liquidity from an already weak market. Yet perhaps a different question should be asked: Will meme coins ever return to their former glory, or will they fade like inscriptions? Moreover, every market has its survival strategies—bull or bear. What Pump.fun is doing in this tough environment may reveal whether it can revive the meme sector and maintain a competitive edge when the next wave arrives.

Diverging Perceptions Between Chinese and English Communities

In the Chinese-speaking community, aside from the dominant debate around Pump.fun’s potential token launch, attention mostly focuses either on possible gains for “platform concept” meme coins like $alon (linked to founder @a1lon9) or mascot token $cupsey, or shifts toward newer platforms like letsbonk.fun.

Two notable perspectives stand out. First, KOL Thecryptoskanda argues that Pump.fun possesses a unique “mass media” quality, dominating short attention spans among younger users.

While controversial, this view highlights a fascinating dynamic: meme traders, chasing profits, inadvertently become highly efficient “journalists,” spreading narratives globally. Meanwhile, traditional journalists—who often don’t trade crypto—report on these events, unknowingly acting as ambassadors for meme culture.

The second perspective comes from @memekiller365, reacting to @brainletcto’s recent “Meme Wars” chart. As $SPX rose steadily over the past month to reach new highs, a rivalry emerged between legacy meme coins and new tokens born on platforms like Pump.fun and letsbonk.fun, each backed by different factions.

What about the English-speaking community? They remain largely unfazed—business as usual, horses running, dances continuing. Still, greater attention is being paid to Pump.fun’s live streams, and some community tokens suggest even Pump.fun is slowing down amid current market conditions.

From “Fast-Paced Casino” to “Slow-Paced Media Platform”?

Gainzy, an Israeli national, is currently Pump.fun’s most popular streamer. Recently, due to regional conflict, he’s had to frequently retreat to bomb shelters mid-stream.

Over the past month, clips of Gainzy’s streams have gone viral across English crypto circles. As his popularity surged, the price of his self-launched stream token also climbed.

In May, Pump.fun founder alon joked about Gainzy: “He single-handedly revived Ethereum, Pump.fun livestreams, and hair removal clinics,” dubbing him the “ansem of the last bull market.”

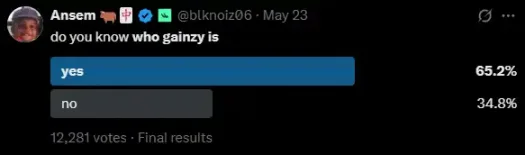

Then came the playful poll: “Do you know who Gainzy is?” Despite over 12,000 votes, 34.8% answered “No.” Even today, the Chinese community remains largely unfamiliar with Pump.fun’s new wave of stars, still anchored in the ansem era.

Who is Gainzy? As summarized by @StarPlatinumSOL, Gainzy quit his job in 2017 to go full-time crypto. He first entered controversy during the ICO bull run as the dev behind Obsidian, a rug-pull project. Later, he created and sold a trading bot in 2018.

He was also one of the earliest and most vocal promoters of FTX, earning up to $50,000 monthly in referral fees at his peak. Before joining Pump.fun, he streamed under Rollbit sponsorship, but stirred backlash again by publicly praising $RLB while secretly dumping his holdings.

ZachXBT called him out: “Why did you dump your entire $400K $RLB position less than a day after tweeting you’d bought it?”

Gainzy first gained notoriety after losing heavily on ETH and going on a live tirade, calling Vitalik and the Ethereum Foundation “SBs.” That stream, on May 8, oddly coincided with an ETH rebound, leading English speakers to joke that Gainzy “bottom-checked” Ethereum and saved the network.

His streams feature no sniping or dog-hunting—just chain after chain of cigarettes and unfiltered takes on crypto. Stylistically, he resembles a CSGO streamer like Qiezi: someone who made money but still broadcasts like a grassroots player. His rising fame attracted high-profile guests including Pudgy Penguins CEO Luca Netz and Yuga Labs co-founder Garga.eth.

The latest Pump.fun livestar is @rasmr_eth. Like Gainzy, he’s a major influencer with nearly 110,000 Twitter followers and over 10,000 Twitch subscribers. He kicked off his arrival with a Jobs-style keynote explaining why he brought his talents to Pump.fun.

$rasmr briefly hit a $15 million market cap but has since fallen below $6 million.

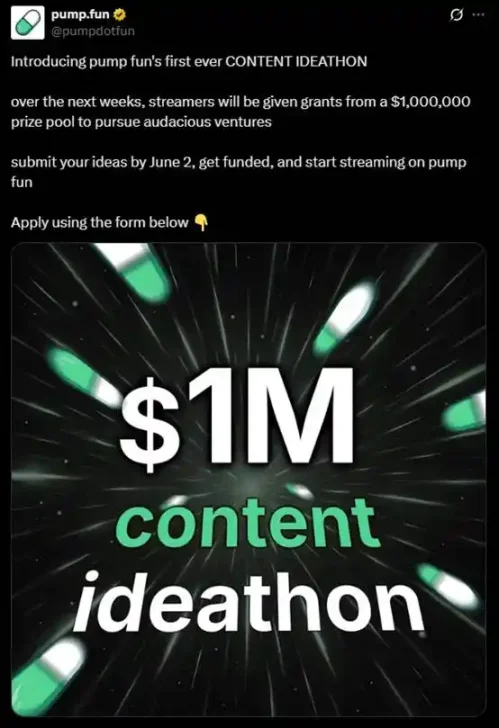

Rumors suggest Pump.fun paid both Gainzy and rasmr to stream on its platform. Unconfirmed, but the importance Pump.fun places on livestreaming is evident in its $1 million streaming incentive program launched at the end of May.

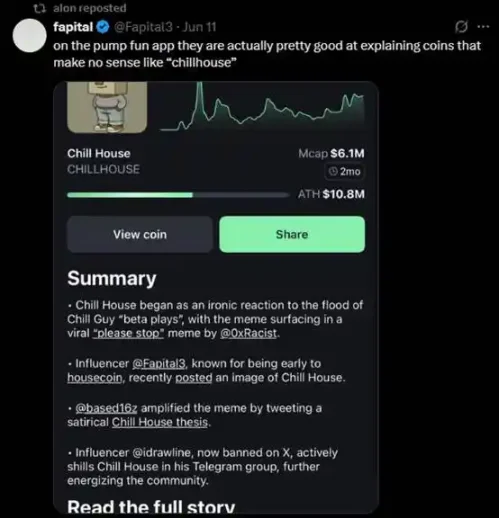

Beyond these stars, $HOUSE—a token that surged in late April—elevated new influencers like @Fapital3, @bigtonebigtone, and @Primed25. In the aforementioned “meme war chart,” the small-cap token $neet (under $5M market cap) earned inclusion thanks to strong backing from these three figures. It briefly approached a $25 million market cap.

“TYBT”—short for “Thank You Big Tone”—was one of Pump.fun’s hottest memes last month. But recently, big tone has stepped back, only appearing occasionally in private groups or Twitter Spaces.

Since the start of the year, several Web3 livestreaming platforms have emerged, but Pump.fun stands out as the one with the strongest internet-native feel. While many still remember the chaotic early days of Pump.fun streams, the platform now appears to be evolving beyond its Wild West roots, systematically building a content creator ecosystem. Today, Pump.fun sometimes feels eerily like a PVE (player vs. environment) game: from $FARTCOIN, a meme coin exceeding $1 billion market cap, to smaller ones like $neet and $chillhouse under $10 million, communities interact frequently and appear unusually cohesive.

(At the time of writing, $chillhouse has surpassed $10 million in market cap, peaking near $18 million.)

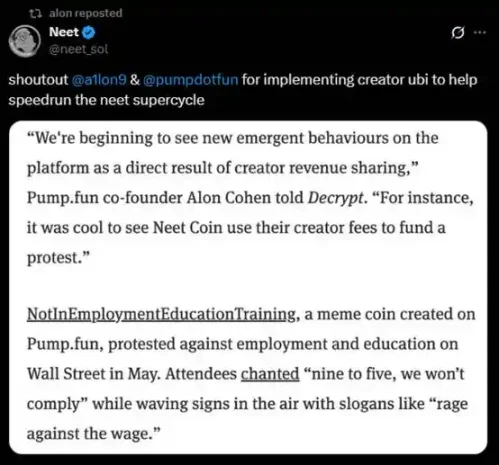

Pump.fun founder alon seems particularly attentive to these emerging, identity-driven tokens. In an interview with Decrypt, he highlighted $neet for using creator incentives to host an offline “anti-work” protest in Wall Street. After the project’s official account thanked him, alon retweeted it.

$chillhouse, meanwhile, went viral through the absurdly catchy slogan “Thoughts on chillhouse?” which spread rapidly across Pump.fun streams and KOL DMs. It became one of the platform’s hottest memes—pure nonsense, like drunk people graffitiing city walls. Alon also retweeted related posts.

$neet, symbolizing anti-work ethos, and $chillhouse, embracing chaotic absurdity—both tap into powerful youth identities. Pump.fun still holds the sharpest pulse on Gen Z subcultures within crypto, forming a “soft moat” that’s hard to replicate.

Naturally, criticisms persist—from creator grants to streamer incentives, many players argue Pump.fun is only opening its wallet because business is slowing down. But from a project operator’s standpoint, while constant golden dogs make ideal markets, quieter times demand strategy. Recruiting influencers, elevating new voices, and building a sustainable traffic engine are essential to ignite the next wave. After all, every explosive market begins with just one or two sparks.

Meme coins today face diminishing returns: a catchy image or a borrowed Web2 meme no longer excites buyers or inspires grand visions (“can’t dig in anymore”). So what’s the solution?

Pump.fun’s answer: focus on youth identity ($house, $neet), stop relying solely on fleeting trends or random viral hits, and instead support continuous meme evolution ($chillhouse) and livestream-driven engagement tailored to degens’ tastes.

Conclusion

I don’t believe Pump.fun’s token launch marks the end of meme coins—perhaps a temporary pause, but certainly not the finale. We often blame individual projects for an entire sector’s decline, like saying Blur killed NFTs. But if a single project can destroy a sector, that sector was already dead.

There are still countless young people seeking to change their fate, and cryptocurrency remains the most enduring and youth-attracting space we’ve seen. Traditional stock markets aren’t lacking narratives—they’re built on stories crafted by elites that people naturally trust. Meme coins won’t die, because grassroots communities need their own stories of transformation too.

As the tide recedes, I find myself hoping Pump.fun’s “media experiment” goes further. While “token stocks” draw attention and become playgrounds for elites, Pump.fun’s raw, youthful crypto spirit feels more relatable than ever.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News