The Great Retreat of Encrypted U-Disk Cards

TechFlow Selected TechFlow Selected

The Great Retreat of Encrypted U-Disk Cards

As a "subsidiary" of traditional finance, the crypto industry has consistently failed to gain control in the payment sector.

By: TechFlow

The once-booming crypto payment card (U-card) business is now shrinking.

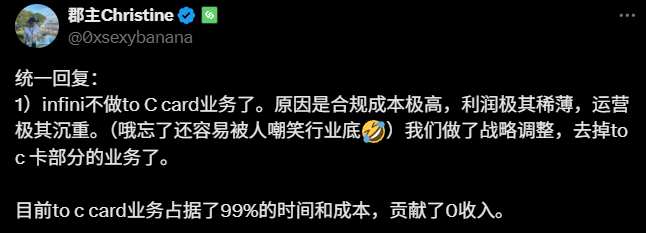

On June 17, Christine, co-founder of Infini, posted on X announcing the discontinuation of its consumer-facing crypto U-card service, citing high compliance costs, thin profit margins, and heavy operational burdens as key reasons:

High compliance costs, razor-thin profits, and significant operational overhead.

She admitted that the B2C card business consumed 99% of the company's time and resources while contributing almost nothing to revenue. This marks Infini’s strategic retreat from B2C card services, shifting focus instead toward wealth management and B2B offerings.

Yet just one to two years ago, U-cards were seen as a breakthrough innovation bridging cryptocurrency with traditional finance.

By enabling direct spending of stablecoins like USDT and USDC, U-cards quickly gained traction among crypto users. At the time, ChatGPT was also gaining momentum—many wanted to subscribe but lacked overseas bank cards for payments. U-cards thus became a new payment channel riding the AI wave.

Cash-out and ChatGPT—one represented the crypto community’s desire for secure off-ramps, the other unlocked new use cases for payments.

But looking at today’s landscape, neither need appears to be truly dependent on U-cards anymore. As more U-card projects shut down one after another, the difficulty of this business model has become increasingly evident.

Not an Isolated Case

Infini’s exit is not unique.

There are numerous examples of partial or complete shutdowns of U-card services based on public information, including:

-

In September 2024, OneKey announced it would halt new registrations and top-ups, officially ending its U-card service on January 31, 2025. While no detailed reason was given, industry speculation pointed to disruptions from upstream payment providers or mounting compliance pressure;

-

In December 2023, Binance terminated its card service in the European Economic Area and ended partnerships in parts of Latin America and the Middle East in August of the same year. These moves were widely interpreted as responses to tightening regional regulations;

-

As far back as 2018, Visa—one of the world’s largest payment networks—terminated its partnership with WaveCrest due to compliance concerns. WaveCrest acted as an intermediary providing issuance and payment processing for crypto cards, connecting them to the Visa network. Visa’s abrupt withdrawal left WaveCrest unable to serve its clients, including U-card providers such as Bitwala and Cryptopay.

These cases collectively point to a systemic challenge facing U-card businesses globally.

Loss of Upstream Control and Soaring Costs

From an end-user perspective, a U-card seems simple—what you see is what you get, ready to use upon receipt. The only trade-offs appear to be fees and wear-and-tear.

But from the provider’s standpoint, the core issues lie in complex supply chain dependencies and intense cost pressures.

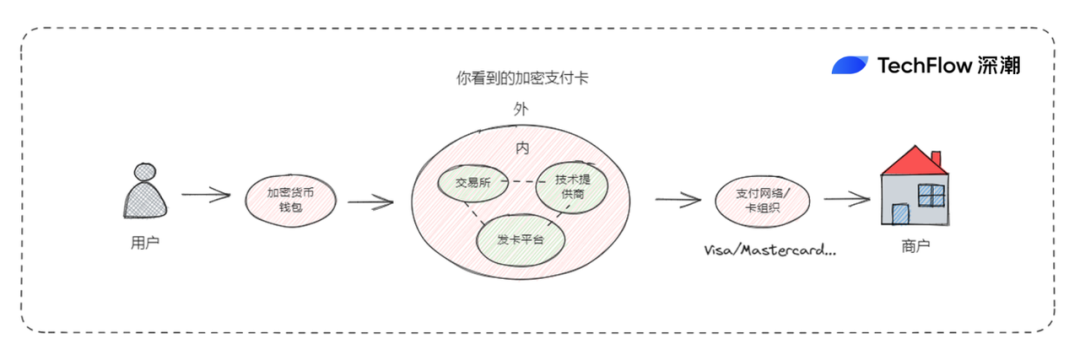

Firstly, U-card operations rely on multi-party coordination: users deposit stablecoins like USDT; card issuers (e.g., Infini) convert these into fiat via off-ramp services; then payment networks (like Visa or Mastercard), issuing banks, and processors handle settlement.

However, critical upstream components—especially payment networks and banks—are outside the control of the crypto ecosystem. This makes U-card providers effectively “vassals” of the traditional financial system, with little bargaining power.

So why do we see so many different branded U-cards?

Exchanges issue them, wallets issue them, startups launch them… Can anyone really issue a crypto payment card?

When a user receives a card bearing a cryptocurrency exchange brand and a VISA logo, what remains hidden is actually a collaboration between the issuer and a technology provider.

For example, Coinbase’s VISA card was previously powered by Marqeta, a fintech infrastructure provider that enabled real-time transaction authorization and fund conversion for crypto debit cards.

More broadly, the existence of these "technology providers" has significantly simplified the process of launching crypto payment cards.

These providers offer a "**card-as-a-service**" model: delivering essential security tech, payment processing systems, and user interfaces that enable organizations to issue and manage crypto-linked cards, perform currency conversions, and facilitate payments.

Issuers only need to integrate via API or SaaS solutions offered by these providers to launch and operate credit/debit cards.

This “card-as-a-service” model often includes additional capabilities such as transaction authorization, funds conversion, monitoring, and risk management—helping issuers streamline operations and boost efficiency.

(For a deeper dive, see our previous article: The Business Behind the Hype: Why Everyone Wants to Issue Crypto Payment Cards)

In short, your U-card is the result of cooperation among multiple parties: the issuer, technology provider, bank, and payment network.

And with each party taking a cut, profits for those further downstream—issuers and brands—are naturally squeezed.

Revenue primarily comes from transaction fees, but 1–3% charges from payment networks, conversion costs for stablecoins, and account maintenance fees quickly erode already slim margins.

Low revenue can’t cover high fixed costs—and those fixed costs are hard to reduce.

Operating a U-card service isn't easy. Technical maintenance requires real-time transaction handling and robust security. Customer support must manage refund requests and inquiries—such as Infini’s promised 10-day refund policy, which entails substantial human resource investment.

On the user side, individuals may encounter various issues across different payment scenarios. But U-card operators bear full responsibility for resolving these personalized problems. Worse, when technical providers or card networks suffer outages or disruptions, the issuer often becomes the scapegoat despite having limited control.

Compliance Risks

Beyond economics, U-card services face stringent compliance requirements. KYC and AML (anti-money laundering) checks are baseline obligations. Expanding into North America or Europe brings even heavier regulatory loads, including registration with FinCEN in the U.S. and adherence to EU MiCA rules.

USDT itself is frequently used in illicit activities (e.g., money muling), meaning U-card providers must invest heavily in risk control measures.

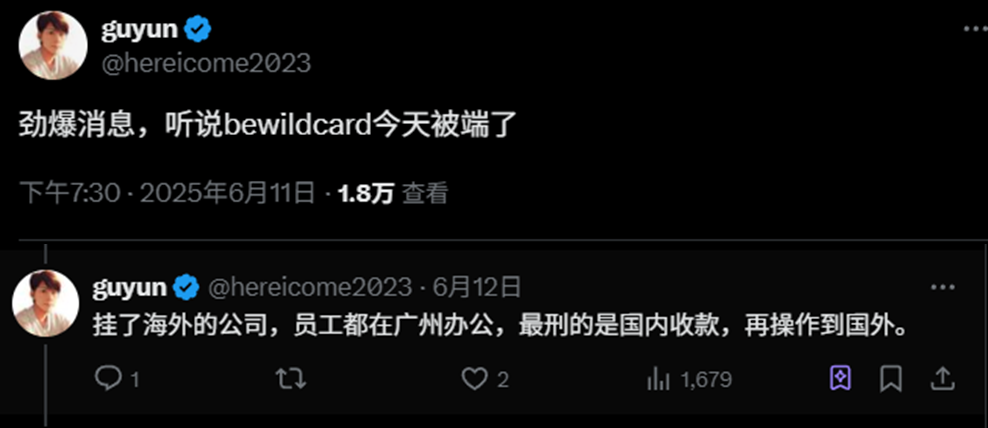

The situation worsens for companies operating under the model of “overseas incorporation with staff working domestically.” Given China’s strict stance on crypto-related businesses, such setups carry significant legal risks.

Recently, rumors have circulated on social media about certain U-card services being shut down. While we cannot verify the specifics, one thing is clear:

The effort required to comply with local regulations—and the risks arising from external factors—is far greater than for most on-chain businesses. Sometimes it's not even about the card itself—the associated funds, user behavior, and tightening public sentiment can all tarnish a U-card brand.

Hard work, no reward. High stress, low return. This may well describe the common plight of most U-card ventures entering the payments space.

Currently, U-card services may make more sense for centralized exchanges (CEXs). Since CEXs don’t depend on cards for profitability, they can treat them as customer loyalty tools or differentiating brand services—especially when trading revenues are sufficient.

For instance, Bybit and Bitget still offer U-cards. Meanwhile, Coinbase recently announced at the State of Crypto conference that it will launch the Coinbase One Card in fall 2025, offering up to 4% Bitcoin cashback per purchase, powered by American Express.

Everyone wants to issue a card—but who can actually pull it off depends increasingly on compliance resources and risk management capabilities. Judging by current trends, the U-card market is gradually becoming oligopolistic.

From Dependence to Independence

While crypto-native attempts at traditional financial services struggle, traditional finance is increasingly moving into crypto-related businesses.

Whether it's stablecoins, RWA (real-world assets), or publicly traded firms building crypto reserves, traditional financial institutions are leveraging their existing infrastructure and regulatory experience to profit from the crypto space.

Meanwhile, beyond native crypto activities like trading and asset creation on-chain, any expansion outward increasingly feels constrained and dependent.

The struggles of the U-card business reflect the broader awkward position of the crypto industry when interfacing with traditional finance. As a dependent player, crypto lacks autonomy in the payments arena.

Perhaps reducing reliance on fiat conversion—enabling direct wallet-to-wallet transactions settled on-chain, bypassing legacy payment rails—is closer to the original vision of crypto. But under current regulatory realities, this remains highly idealistic.

Alternatively, trying to gain control by acquiring banks, payment channels, or tech providers might solve dependency issues—but would dramatically increase costs, especially when user adoption remains uncertain.

Zooming out, the tension seen in the U-card space isn’t limited to payments alone—it runs through every attempt by crypto to expand beyond its native boundaries.

Until innovation and momentum can thrive beyond purely crypto-native soil, grassroots, independent breakthroughs into the mainstream remain elusive.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News