The chaotic era of crypto payment cards, a business model difficult to sustain?

TechFlow Selected TechFlow Selected

The chaotic era of crypto payment cards, a business model difficult to sustain?

The exit of "pure U cards" is just a matter of time—will the broader "card+" services be an exception in this cycle transition?

By: Web3 Farmer Frank

How many "U cards" do you currently hold?

From early entrants like Dupay and OneKey Card, to exchange-backed offerings from Bitget and Bybit, and further to crypto payment card services by Infini, Morph, and SafePal—even Coinbase and MetaMask have entered the space. Since this year, crypto payment cards (U cards) targeting the PayFi narrative have almost become a standard offering among Web3 projects.

Amid this new wave of players scrambling for market share, promotional posts and reviews about various U cards flood social media, reminiscent of the colorful shared bikes once lining every street. With so many choices, market attention has shifted beyond mere usability, becoming increasingly focused on nuanced comparisons such as registration/usage barriers and fee structures—seeking the ultimate cost-performance champion in this sea of cards.

Yet, viewed over a longer timeframe, the apparent prosperity of the U card赛道 conceals underlying fragility. In truth, the lifespan of a U card isn't necessarily longer than that of some meme coins: exit scams, shutdowns, and forced card replacements are common, and most crypto payment card providers from the last cycle have long since vanished.

The reasons are simple. Security and compliance remain the Damoclean sword hanging over every U card. Beyond heavily relying on partner banks' willingness to support compliant crypto operations, U cards inherently suffer from structural flaws—the custody of pooled funds lies with the service provider, posing immense challenges to both operational capability and ethical standards. If either the cooperating bank or the service provider falters, users may become innocent victims.

In today's "hundred-team battle," most U cards share similar underlying fee costs. User experience often depends on subsidies and high interest rates—short-term incentives that clearly cannot build genuine long-term competitiveness. Once subsidies taper off, faced with homogenized card-linked spending services, users will hardly remain loyal to any single brand.

Thus, as traditional U card models gradually hit their ceiling, new variables are emerging in crypto payment card services, with innovative attempts across wealth management, banking accounts, and other dimensions:

For example, star project Infini’s “card + wealth management” model leverages on-chain DeFi configurations to generate yield on users’ deposited crypto assets; veteran wallet SafePal’s “card + bank account” model allows users to truly own a personal, real-name Swiss bank account, enabling seamless EUR/CHF-based deposits and withdrawals with overseas brokers and CEXs.

Objectively speaking, whether these broader “card+” services can truly transcend cycles and become exceptions remains to be tested by the market. But one thing is certain: only those crypto payment card projects that achieve balance in security, compliance, and user experience may stand a chance of breaking the “short-lived” curse in this chaotic era.

Crypto Payment Cards: Far From Evergreen

Why have U cards transformed from a niche segment into a highly coveted prize everyone fights for?

There are two core reasons.

First, amid what could be described as bearish, bullish, or monkey markets (a bear when writing, possibly bull when published—what will it be when you read this?), crypto payment cards paradoxically represent a business that brings both attention and traffic. They offer clear monetization models and stable cash flow, while significantly boosting user engagement and community stickiness.

After all, one of the biggest pain points for Web3 users—especially those in mainland China—is depositing and withdrawing funds: how to directly use crypto for daily payments, or how to conveniently convert fiat into crypto in a compliant manner—these are naturally strong-demand use cases.

Therefore, for Web3 projects eager to expand their business scope, regardless of whether they were originally closely tied to the PayFi space, nearly all are keen to enter this arena. This makes U cards a rare “sure bet” and ideal expansion vector for many Web3 projects.

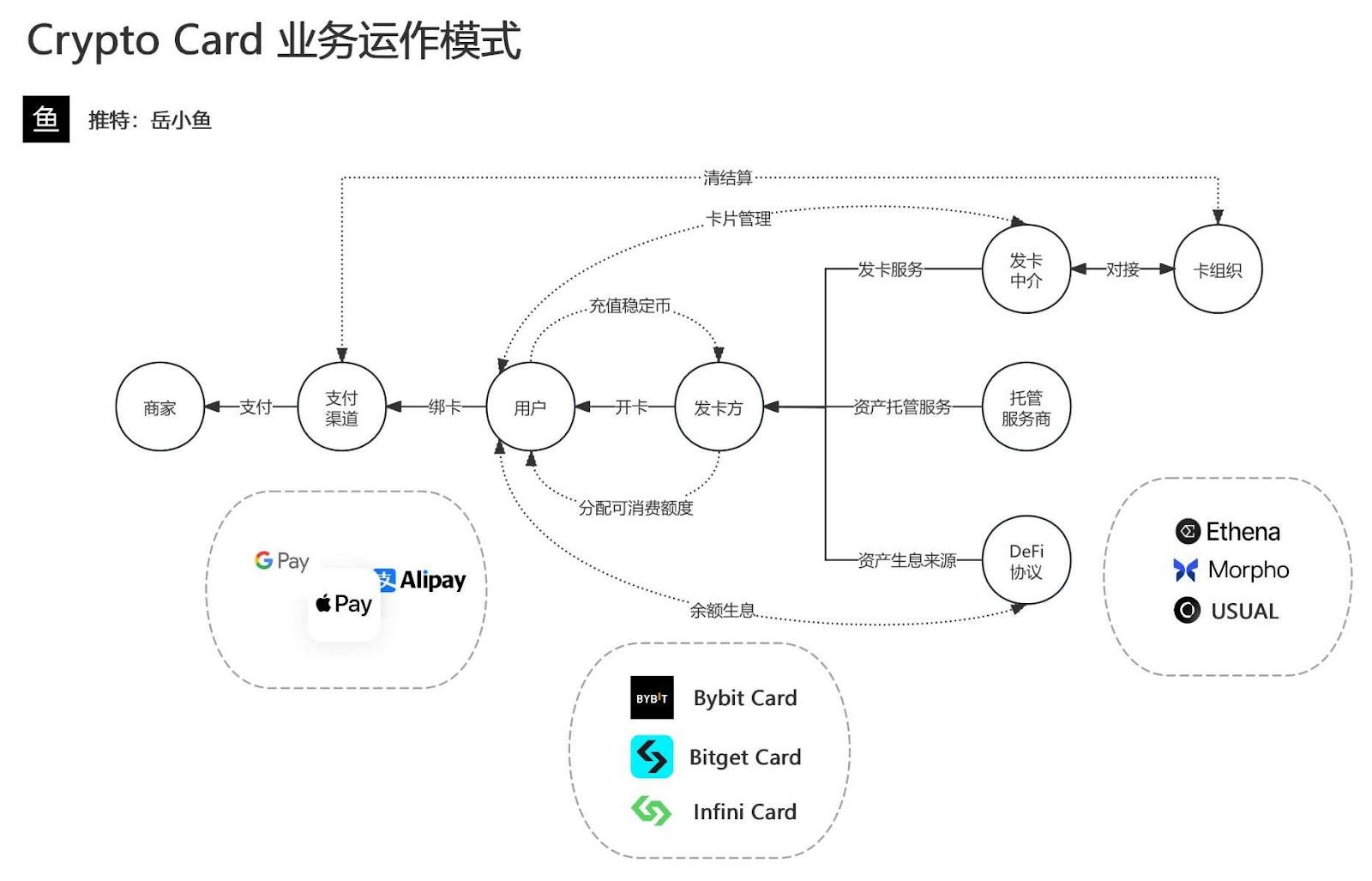

Second, beyond market demand, the relatively low barrier to issuing crypto payment cards also attracts numerous project teams. These cards are typically co-issued through partnerships between Web3 projects (such as Infini and Bybit mentioned earlier) and traditional financial institutions (banks and other card issuers), forming a three-tier structure: card network – issuing institution – Web3 project.

Source:@yuexiaoyu111

Take the common Mastercard-based U card on the market as an example:

-

Card Network: Mastercard itself. The BIN range (first six digits of the card number) allocated by the card network is a core resource in the payment system, directly authorized by the network to primary issuing institutions (licensed banks, e-money institutions);

-

Primary Issuing Institution: Licensed financial institutions like DCS Bank (DeCard) in Singapore, responsible for fund custody and BIN management at the compliance level;

-

Web3 Project: Acting as secondary issuers, they cannot directly obtain BINs and must collaborate with primary institutions to receive technical authorization, focusing on product design and operations for end-users;

The primary issuing institution plays a critical role in the chain, interfacing with the card network, managing transaction data, and handling risk control tasks such as freezing or suspending cards. The Web3 project focuses on branding and user operations, building a traffic-driven business model.

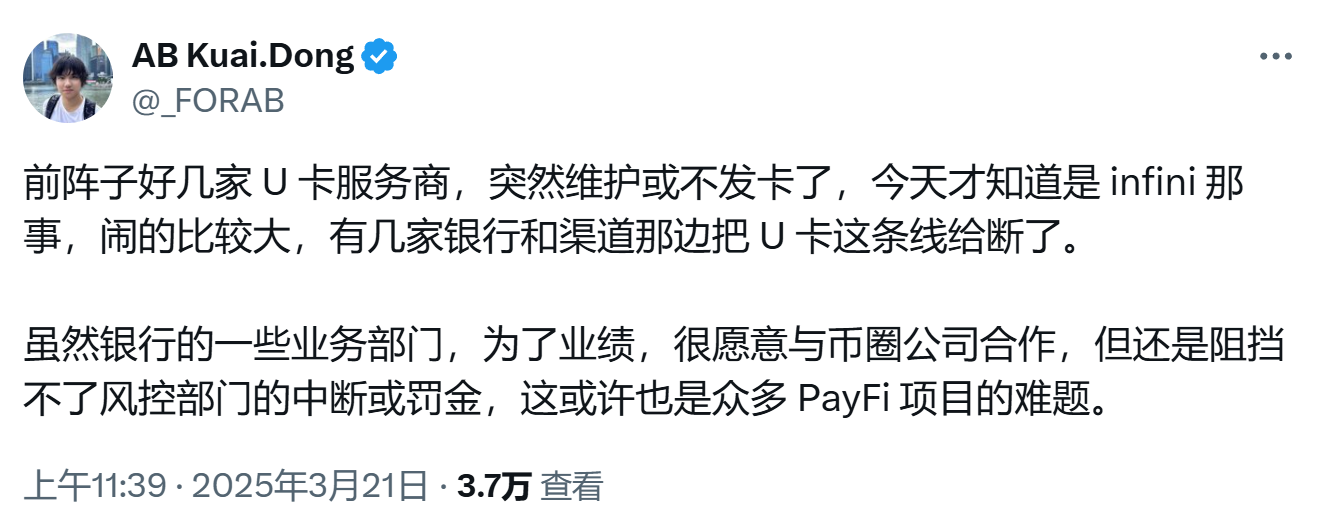

However, this is also where risks lie. If a secondary issuer is reported for violations (e.g., money laundering, unclear fund flows), the card network or regulators may impose penalties directly. Even without direct misconduct, some banks may tighten cooperation due to regulatory pressure or risk management concerns.

This exposes related U card services to constant risk of shutdown, explaining why so few of the many launched “U card” projects survive beyond a year or two.

Of course, there’s an even deeper issue—fund security risk. Under this structure, the vast majority of U cards are essentially prepaid cards: users first deposit funds with the project, receiving only a “spending limit” based on their deposit record, not independent custody of actual assets.

This is no different from familiar gym membership cards or supermarket gift cards. For instance, if you pay 5,000 RMB for a gym membership, the money goes directly into the gym’s bank account. The gym promises to deduct each session from your balance, but there's no separate 5,000 RMB physically stored for you—it instead becomes part of a pooled fund mixed with other members’ deposits.

The gym might use this pooled money to pay rent, buy equipment, or invest in new branches. But if the gym eventually fails or the owner absconds, your stored value becomes worthless. You never actually held “your own 5,000 RMB”—only a claim against the gym.

U cards work similarly. When you deposit 100 USDT/USDC, the funds go directly into a unified on-chain pool controlled by the secondary issuer. Each user’s “fiat quota” on the U card is merely a sub-account under the company account opened by the issuer at the issuing institution—used solely for payment settlement, with no actual fiat deposits behind it. You can spend it, but cannot freely transfer it.

In other words, most users’ deposited crypto assets flow directly into the project’s on-chain account rather than a true banking system. On the fiat side, no individual same-name accounts are created for users. Instead, spending limits are allocated via a centralized corporate account. Your “balance” is just a number—its redeemability entirely dependent on the platform’s survival and willingness to honor obligations.

This means the entire system’s safety and stability rely almost entirely on the project team’s ethics and risk management capabilities.

When accumulated user funds reach a significant scale, moral hazards (e.g., fund misappropriation, exit scams) or risk control failures (liquidity collapse, hacker attacks, inability to handle mass redemptions) could lead to irreversible user asset losses (online cases of U card scams are endless).

Currently, whether issued by exchanges or reputable flagship projects, most U cards on the market fall into the prepaid category, making them hard to sustain long-term. Of course, platforms with strong reputations and compliance capabilities can mitigate risks to some extent.

“Card+” Services: New Variables in Crypto Payment Cards?

Because of this, more and more project teams are no longer satisfied with standalone U card offerings and are actively exploring transitions toward more financially substantive and long-term valuable directions.

For instance, Bitget and SafePal have invested in financial-licensed, crypto-friendly banks (like DCS, Fiat24), shifting focus from pure “U card” services to building comprehensive “card + bank account” financial ecosystems—moving beyond single-purpose spending tools.

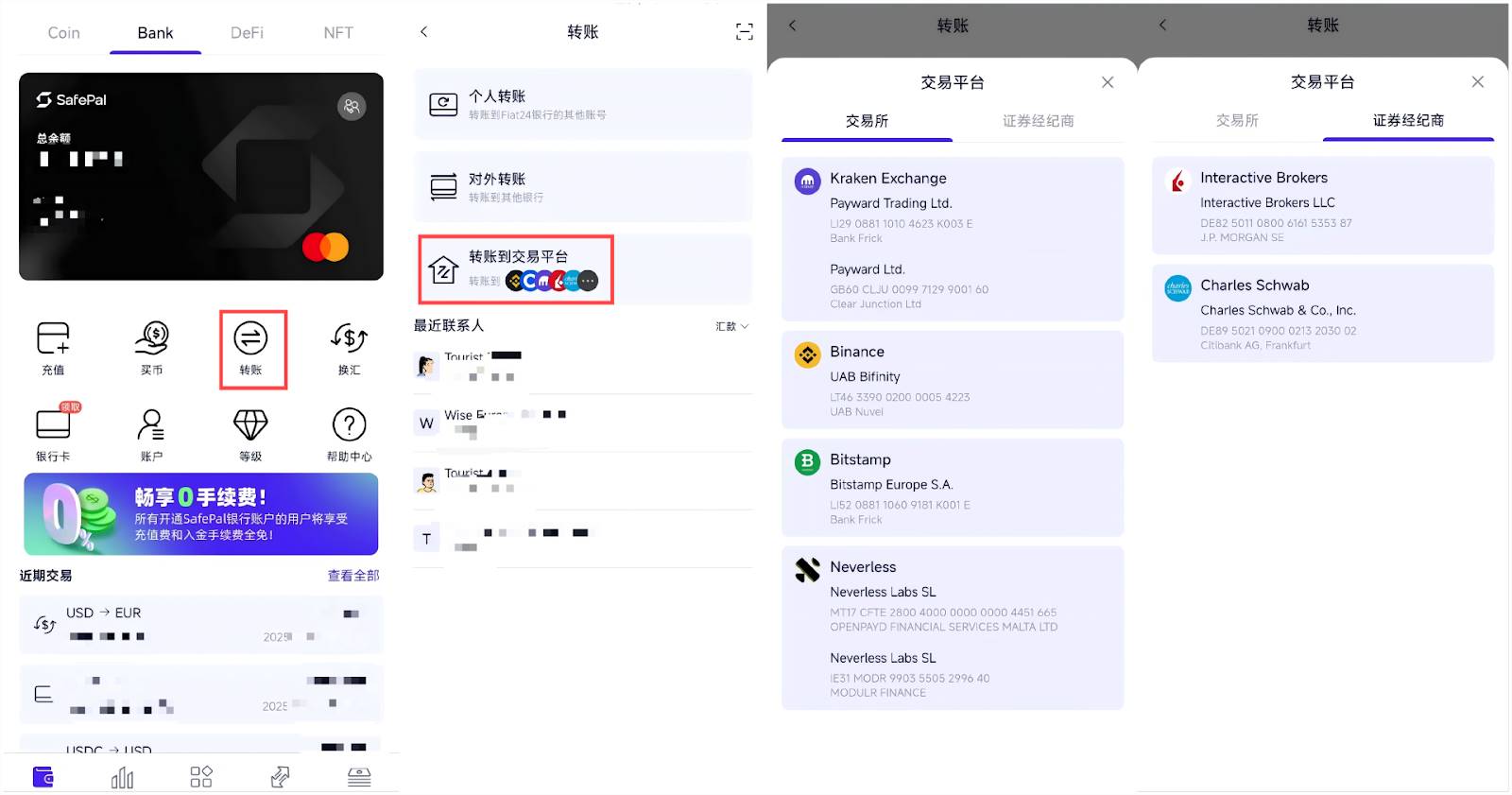

Take SafePal as an example: in early 2024, it disclosed a strategic investment in Swiss-compliant bank Fiat24, and by late last year officially launched personal Swiss bank accounts paired with co-branded Mastercards, available even to users from mainland China. I personally tested this “beyond-U-card” service model.

In short, the greatest advantage of this “non-U-card” model lies in fundamentally solving the fund security issues inherent in traditional U cards—users directly hold their own named bank accounts, with funds entering the real banking system instead of being pooled under the project operator. This effectively reduces risks of exit scams, bank runs, and default.

Even in extreme scenarios where the Web3 project itself fails, users can still independently withdraw funds through the banking system—a level of fund independence and security unattainable under traditional U card models.

More importantly, this model opens wider deposit and withdrawal channels, achieving, in a sense, seamless connectivity between TradFi and the Crypto world. Taking SafePal & Fiat24’s bank account service again: users can not only freely deposit and withdraw from overseas brokers (e.g., Interactive Brokers, Charles Schwab) and CEXs via their personal bank accounts, but also transfer funds back to Alipay/WeChat or domestic banks via Wise (SEPA transfers in EUR), closing the loop between on-chain and off-chain asset flows (see extended reading: SafePal Practical Guide: Transfers, Broker/CEX Deposits & Withdrawals, the Ultimate Bridge Between Crypto and TradFi).

In contrast, most U card products remain stuck in subsidy and fee competition. Bybit, for example, uses high cashback rates to attract users, but 10% or higher rebates mean fee wars are nearing their limit. Once subsidies decline, homogenized user experiences won’t retain customers, let alone build real brand loyalty.

This structural contradiction ensures that most pure U card products are doomed to fail over time, while broader “card + bank account” models may represent the few viable breakout paths.

I’ve also compiled a rough comparison of current reputable crypto payment card products, evaluating them on account opening barriers, fee structures, and compliance functionality during actual usage:

This comparison clearly shows that SafePal’s current “card + bank account” model holds significant advantages in fund security, fees, and functionality—particularly in compliance and practical deposit/withdrawal scenario support—building a competitive moat difficult to replicate.

On the surface, crypto payment cards compete on fee subsidies, but in reality, the contest is over who controls genuinely scarce compliant resources and financial infrastructure. Only players holding licenses and bank-grade resources can hope to prevail in this chaotic era.

A New Narrative Curve: From “U Card” to “Card + Bank Account”

Starting in 2025, Web3 payments are experiencing something of a narrative turning point.

The key difference is that previously, the sector mostly focused on B2B enterprise-oriented crypto payment solutions. Now, more top-tier institutions are moving into B2C consumer scenarios. The most representative case is OKX’s newly launched OKX Pay, which directly targets the personal payments market, leveraging its traffic and ecosystem strengths to capture the mass market.

Looking at trends, the demise of the “pure U card” model is merely a matter of time. The market is gradually evolving from single-function payment tools toward integrated asset management platforms. After all, U cards only achieve “consumer endpoint access,” failing to create a closed-loop ecosystem for capital flow—for example, when users need to wire funds to Interactive Brokers, 99% of U cards fall silent.

Hence, surpassing the basic identity of a spending card and integrating savings, investment, and remittance functions into one is essential to catch the new narrative curve.

Like the SafePal & Fiat24 model, users can use their EUR account to directly fund stock trades on Interactive Brokers, and freely send money to Alipay via tools like Wise—achieving free movement between on-chain and off-chain funds, giving crypto wallets near-full functionality of a commercial bank account.

From this perspective, Web3 wallets inherently possess crypto asset management capabilities, making them the ideal carrier for PayFi services. This is precisely why OKX Pay, SafePal, and others are accelerating their push into the “card + bank account” model—they aim to deliver a new asset management experience combining the convenience of virtual cards, the security of compliant bank accounts, and the freedom of decentralization:

Users can enjoy decentralization via non-custodial wallets, conduct global spending through Visa and Mastercard networks, and access near-traditional banking services (transfers, remittances, deposits/withdrawals)—all while retaining the flexibility of crypto assets.

In the future, as crypto assets become further integrated into the global financial system, this model may well be the ultimate solution enabling massive user growth.

The evolution from “U card” to “card + bank account” has already clearly revealed the path forward for crypto payment cards—finding a new narrative curve, shifting from single-use spending tools to comprehensive asset management gateways.

The future competition won’t be about who offers more cashback, but who can truly bridge the last mile between Crypto and TradFi. This market ultimately belongs to long-term builders capable of constructing financial infrastructure and possessing compliant resources—not short-term arbitrageurs chasing traffic.

Final Thoughts

Returning to the original question: Can crypto payment cards become a sustainable business?

The term “short-lived” essentially reflects inherent flaws in the business model—over-reliance on subsidy-driven growth, lack of compliance moats, and genuine user stickiness. When subsidies fade and regulations tighten, this seemingly vibrant game naturally reaches its end.

But that doesn’t mean the story ends here.

In other words, “short-lived” isn’t destiny. To achieve “evergreen” status, a new business philosophy aligned with financial fundamentals—one capable of transcending cycles—must be forged.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News