Crypto Payment Cards in 2025: 40,000 Monthly Active Users, Average Spending Under $100 per Person

TechFlow Selected TechFlow Selected

Crypto Payment Cards in 2025: 40,000 Monthly Active Users, Average Spending Under $100 per Person

Looking ahead to 2026, as usage scales up, card service providers will need to strike a balance between expansion, the economics of cross-border and domestic traffic exchange, routing efficiency, and increasingly complex operational management.

Authors: @bobthedegen_, @samoyedscribes and @ahboyash

Compiled by: TechFlow

Introduction

2025 marks a milestone year for crypto card development, as they transitioned from niche onboarding tools to increasingly widely adopted payment instruments. Both in terms of deposits and spending, crypto cards demonstrated robust growth momentum throughout the year, a trend fueled by improved user experience, broader blockchain support, and a gradual increase in user acceptance of stablecoin-denominated spending.

This report provides an ecosystem-level overview of crypto card activity over the past two years (December 2023 to October 2025), focusing on analyzing the observable on-chain behavior of leading crypto card providers.

Executive Summary

- From Experimentation to Practical Use: In 2025, crypto cards moved from the experimentation phase towards practical application, with both deposits and spending showing sustained exponential growth trends.

- Deposits Dominate Spending: Stablecoins dominate deposit behavior, accounting for nearly all collateral assets, further reinforcing a low-volatility spending model akin to debit cards.

- @Rain Cards Lead in Usage: The @Rain series of crypto cards leads in usage rates, but most users still engage in small-amount spending, indicating their primary use for everyday "top-of-wallet" behavior.

- Future Growth Potential: This growth trend is expected to continue into 2026, with further development in profitability, exchange economics, and credit-related factors, moving beyond the singular goal of user acquisition.

Methodology and Scope

This report analyzes crypto card activity through verifiable data on the blockchain, prioritizing observable economic behavior over self-reported metrics.

- Card Coverage:

- Type 1 Cards: On-chain verifiable deposits and spending (e.g., Rain series cards, Gnosis Pay card, MetaMask card)

- Type 2 Cards: Only support on-chain verifiable deposits (e.g., WireX card, RedotPay card, Holyheld card)

- Type 3 Cards: Cards issued by centralized exchanges (CEX) (e.g., Binance card, Bybit card, Nexo card) → Excluded from analysis due to limited data availability

- Analytical Methods:

- Deposit Analysis: Includes Type 1 and Type 2 cards to capture a broader view of liquidity inflow.

- Spending Analysis: Limited to Type 1 cards, as their transaction behavior can be directly observed on-chain.

For wallet-native cards where spending does not follow a traditional deposit process, their spending activity is treated as deposits in the analysis for consistency. Non-stablecoin balances are normalized using the average price over the past 12 months, with all transaction volumes expressed in USD equivalents.

Deposits: How Liquidity Enters the System

Deposits Lead the Expansion with the Fastest Growth Rate

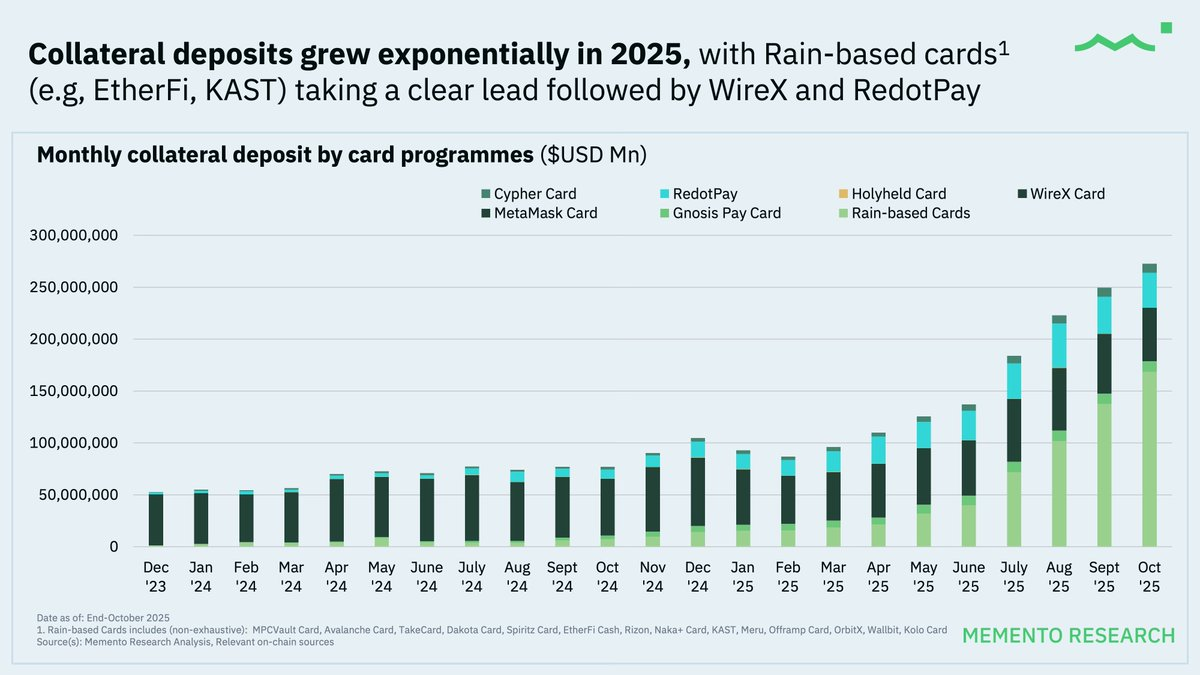

Throughout 2024, the monthly collateral deposit volume for crypto cards grew exponentially, accelerating further in 2025.

Card projects based on the Rain series of crypto cards consistently maintained a leading position in deposit volume, largely because they serve as core infrastructure for multiple popular crypto card projects, including @ether_fi Cash, @KASTxyz, @OfframpXYZ, and the Avalanche (@avax) card.

Market Share: First Concentrated, Then Diversified

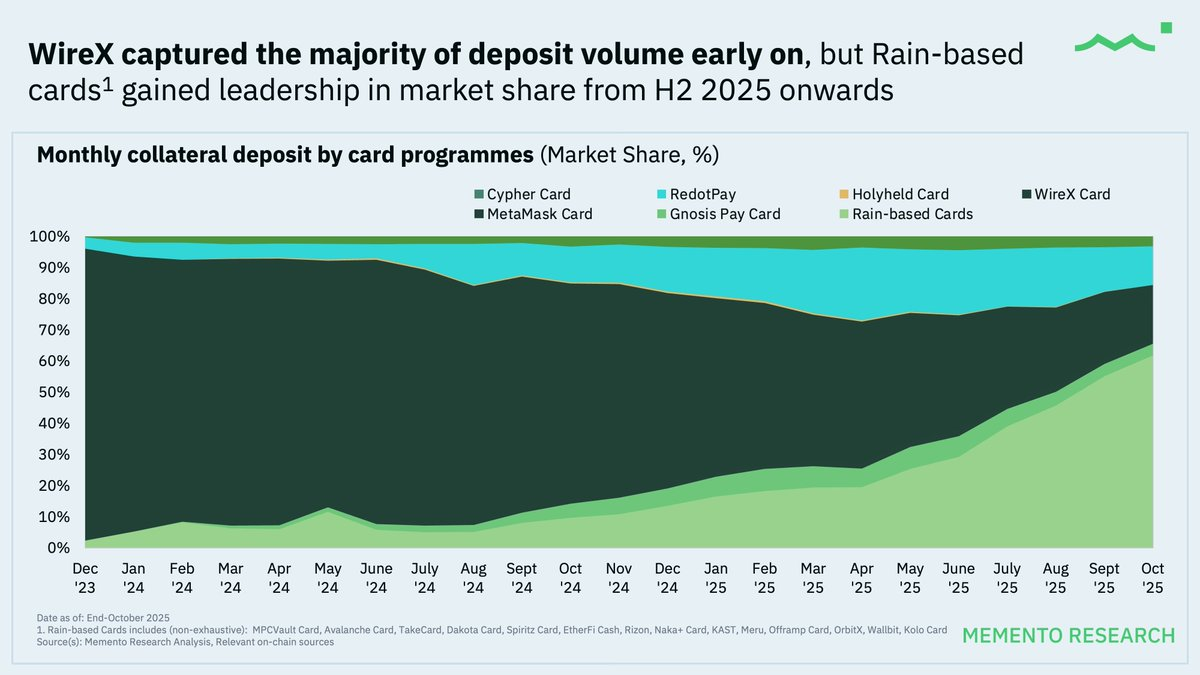

@wirexapp held the majority share of deposit volume for most of 2024, but since the second half of 2025, the Rain series of crypto cards has taken the lead in market share.

Key Insight: Since the second half of 2025, a wave of new crypto card projects has launched, choosing Rain as a core infrastructure partner. This trend has driven higher deposit inflows while accelerating new user acquisition.

Stablecoins Almost Universally Dominate

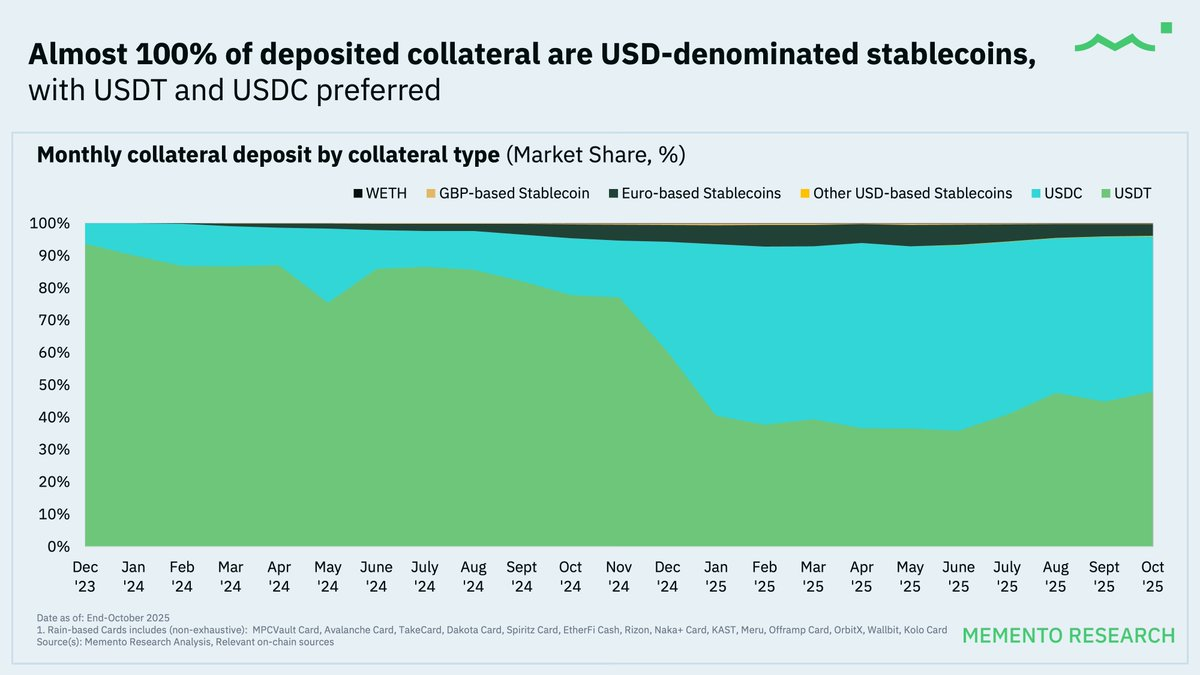

Throughout the dataset, nearly 100% of deposit collateral assets consist of USD-denominated stablecoins, with USDT and USDC as the primary leaders.

This phenomenon further demonstrates that current crypto cards more closely resemble international payment accounts rather than speculative spending tools, even for non-US users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News