Artemis Crypto Payment Card Report: An $18 Billion Market, Quietly Igniting the Crypto Payments Boom

TechFlow Selected TechFlow Selected

Artemis Crypto Payment Card Report: An $18 Billion Market, Quietly Igniting the Crypto Payments Boom

Cryptocurrency cards are becoming the key infrastructure for digital dollars to enter the real world.

Author: Artemis

Translation: TechFlow

TechFlow Editorial:

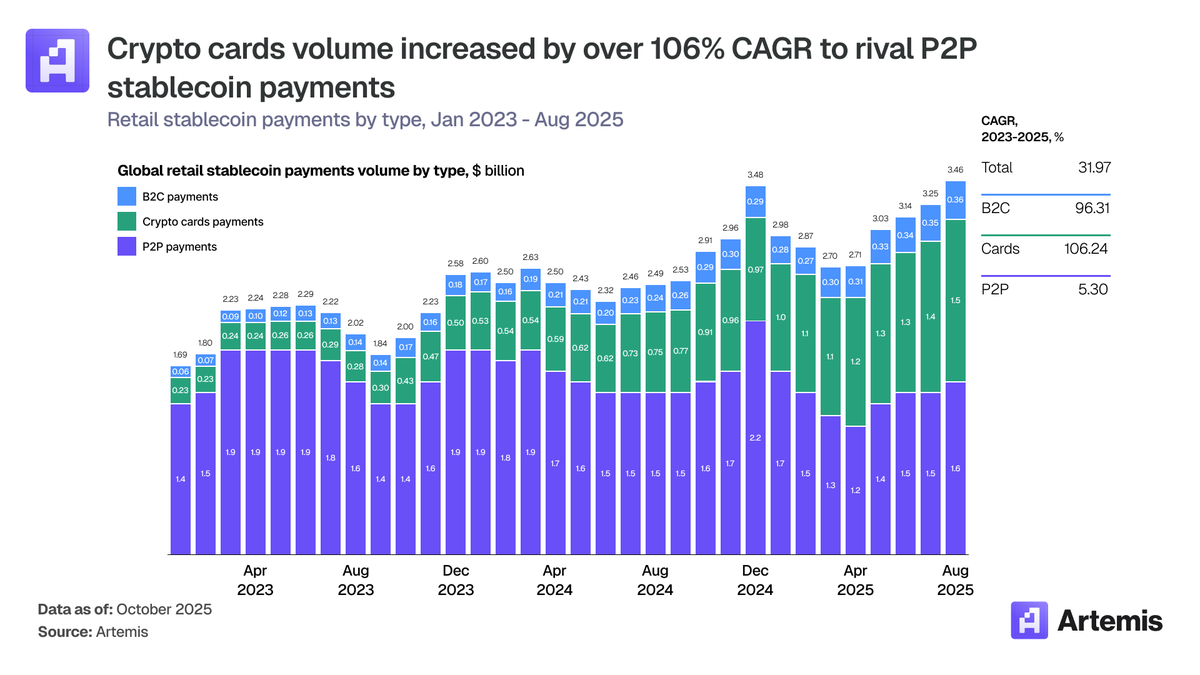

Crypto payments are undergoing a quiet "power shift." According to Artemis's latest research, the crypto card market has evolved from a niche segment in early 2023 into an $18 billion annualized behemoth, with monthly transaction volumes increasing 15-fold in just two years.

This article breaks down the three layers of the crypto payment stack and reveals a striking fact: Visa accounts for over 90% of on-chain card transaction volume. More importantly, the industry is approaching a structural turning point toward "full-stack issuance," as companies like Rain and Reap directly connect to Visa, bypassing traditional banks and completely rewriting the economic model. From crypto-backed lending in India to everyday stablecoin payments in Argentina, crypto cards are emerging as critical infrastructure enabling digital dollars to enter the real world.

The full text follows:

Big news: We’ve just released the most comprehensive research report on crypto cards to date.

And it’s not because this is a niche market — it’s because this space has quietly grown into an $18 billion market. In early 2023, monthly transaction volume for crypto cards was around $100 million. Today, that figure exceeds $1.5 billion.

We spent weeks diving deep into the data, infrastructure, and companies actually building this stack. Here are our key findings:

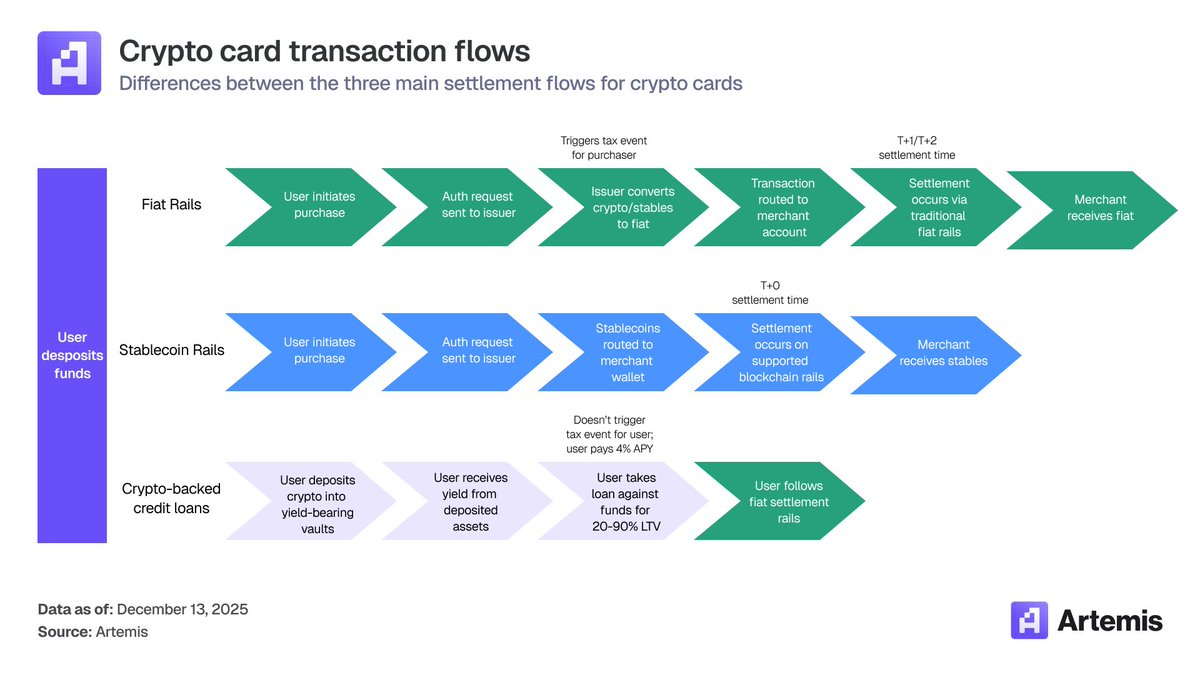

First, let’s clarify what’s actually happening. Crypto cards aren’t trying to replace Visa or Mastercard — they’re leveraging them.

Stablecoins fund the transactions, while cards provide merchant acceptance.

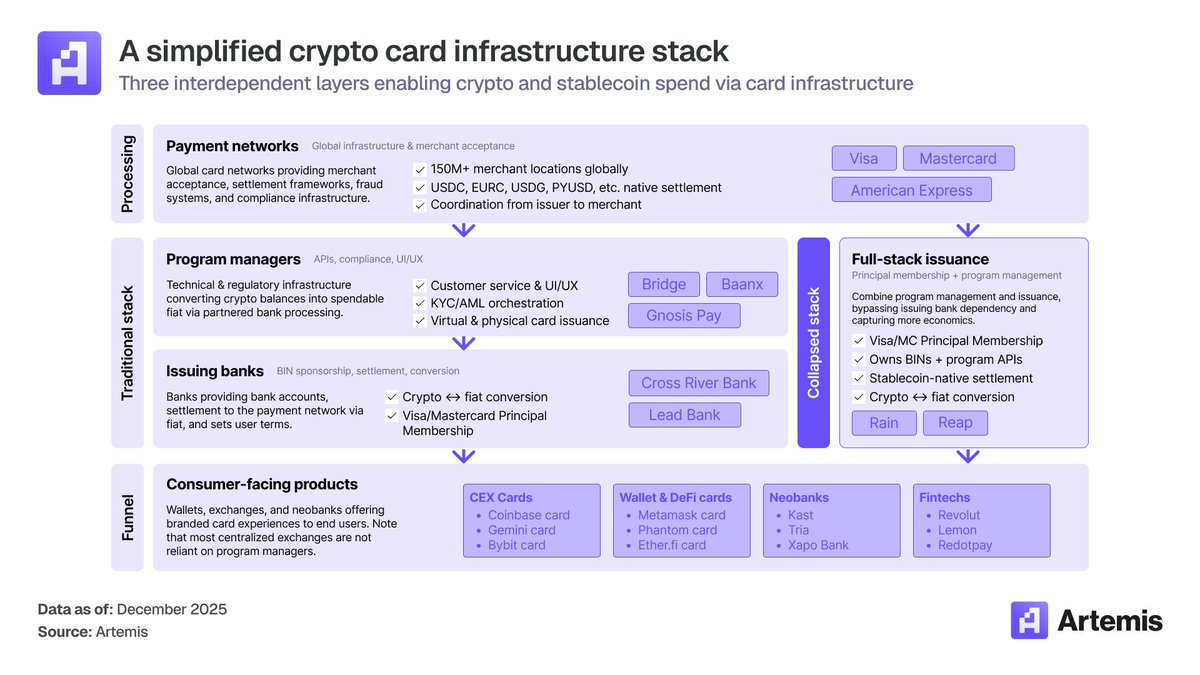

The stack consists of three layers:

- Network Layer: Visa, Mastercard

- Issuers & Program Managers: Baanx, Bridge, etc.

- Consumer Apps: Wallets, exchanges (e.g., MetaMask, Phantom)

This is where the fiercest power struggles are taking place.

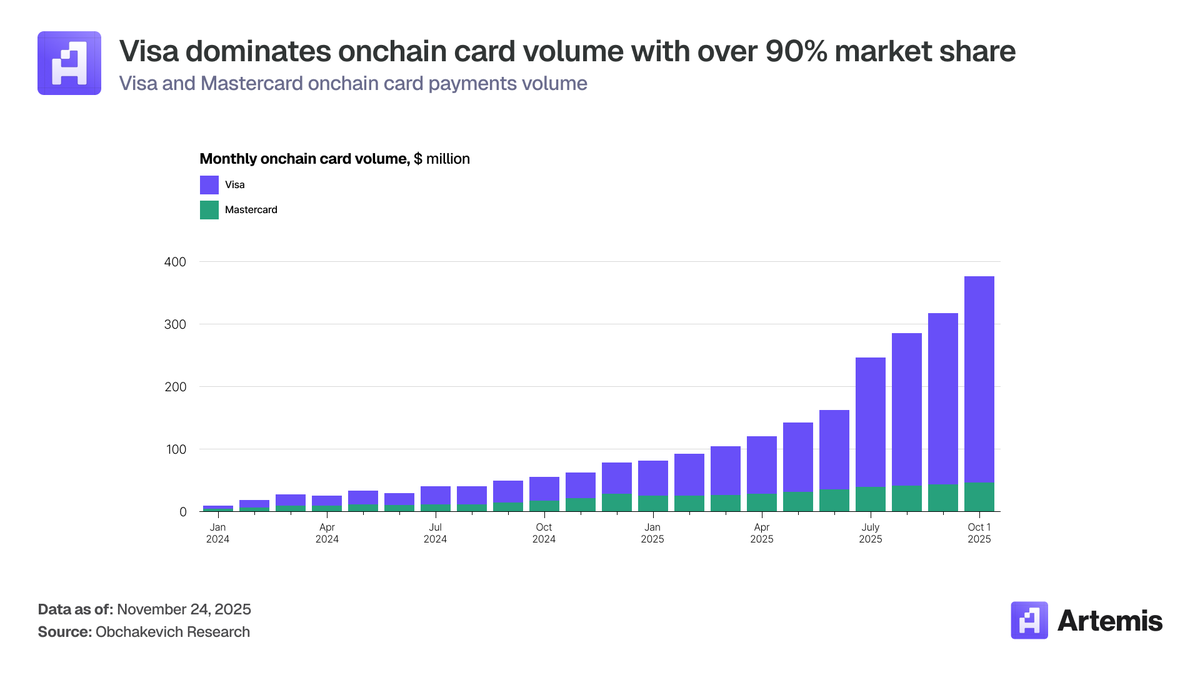

Despite both Visa and Mastercard having over 130 crypto partnerships each…

Visa captures over 90% of on-chain card transaction volume. The reason? Early and deep partnerships with the infrastructure layer.

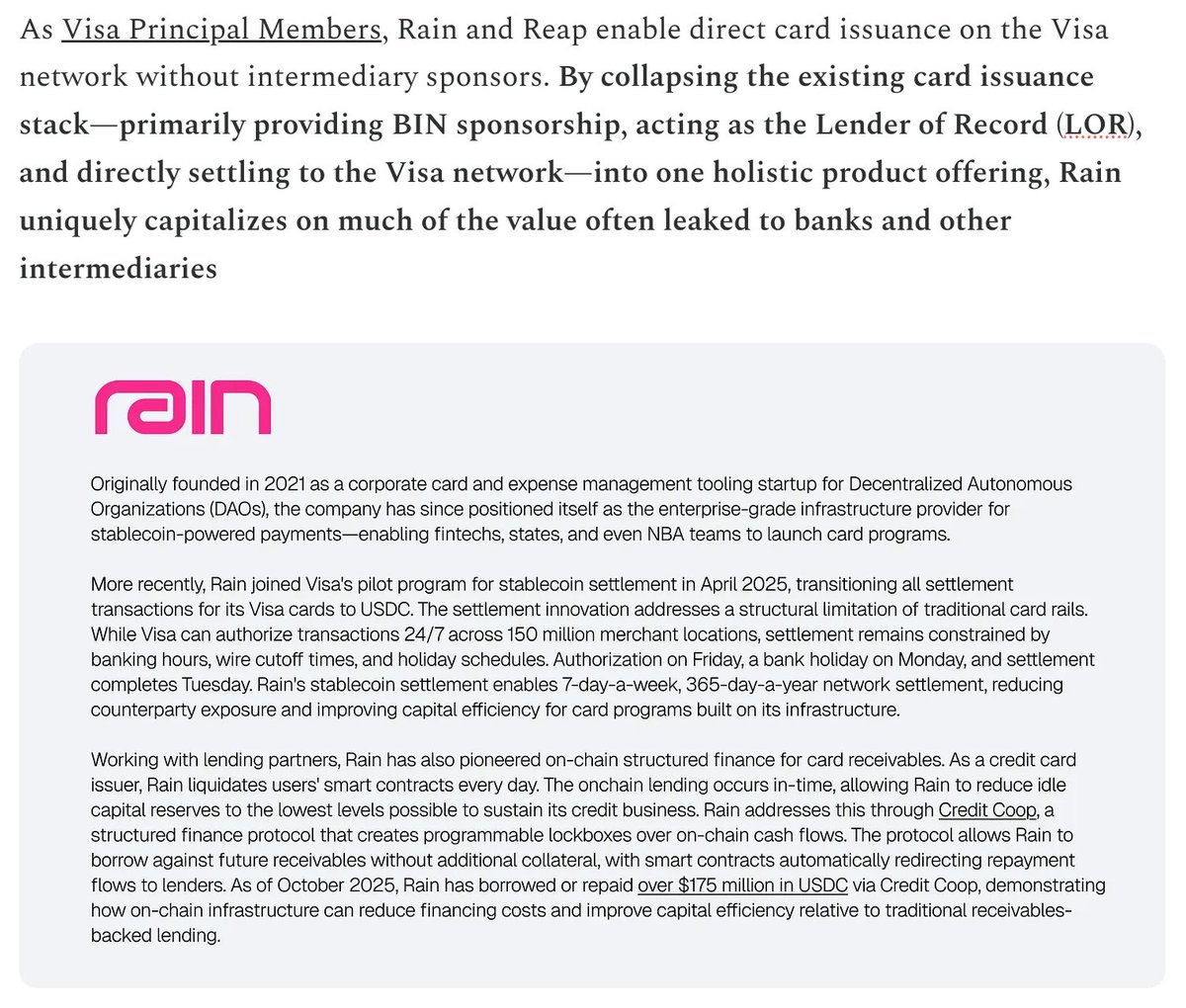

The biggest structural shift: Full-stack issuers.

Companies like Rain and Reap can now act as Visa Principal Members, issuing and settling cards directly with Visa.

No sponsor bank. More control. Better economics.

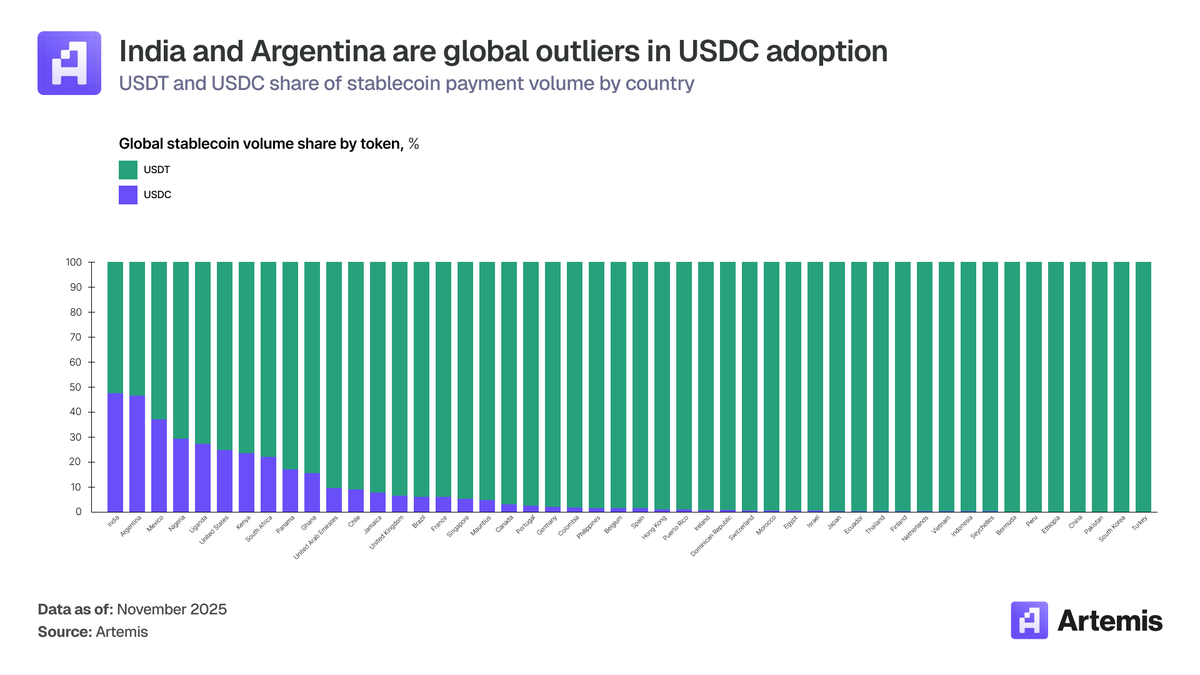

Geographic distribution reveals real-world use cases. India: $338 billion in crypto inflows. The opportunity here lies in crypto-collateralized credit (since UPI has already dominated debit payments). Argentina: Stablecoin debit cards used as inflation hedges.

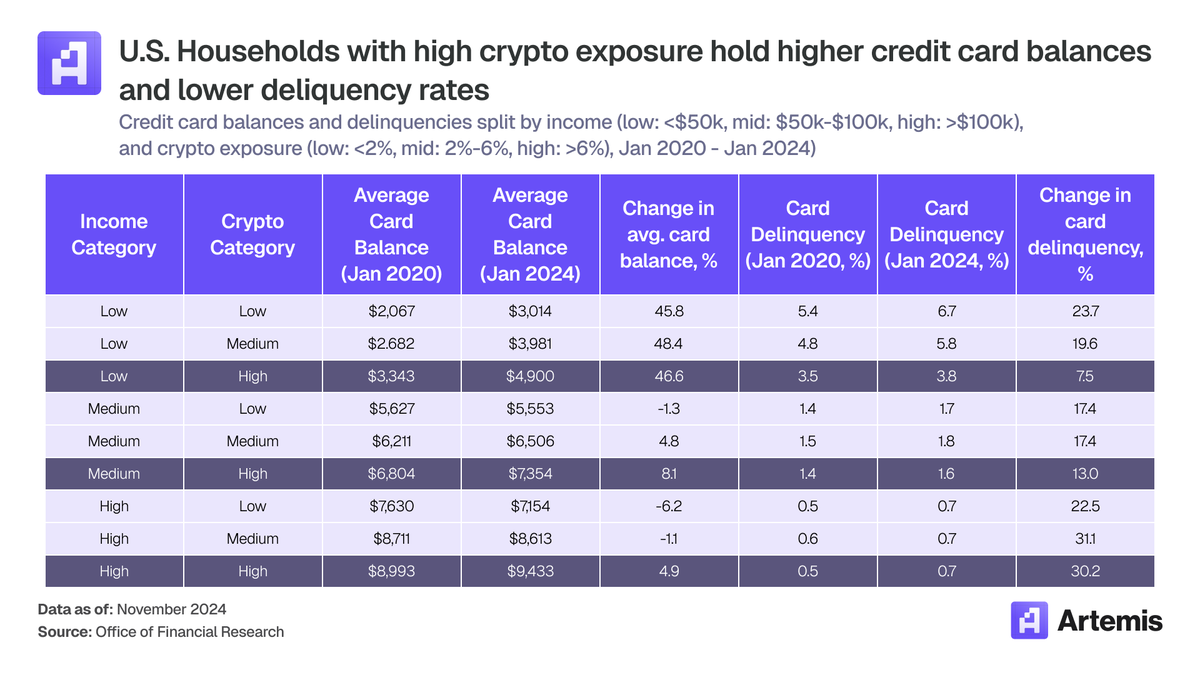

In developed markets, crypto cards don't solve a "must-have" need.

Instead, they target a new, high-value user segment: those already holding large stablecoin balances and wanting to spend them.

Our view is simple: stablecoins will continue to grow, and crypto cards will scale alongside them.

They are the infrastructure bringing digital dollars into the real world.

This post is a summary. Read the full report for deeper insights.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News