What compliance risks are involved behind Ctrip's overseas version USDT payment?

TechFlow Selected TechFlow Selected

What compliance risks are involved behind Ctrip's overseas version USDT payment?

Life should return to life, let coins stay in wallets, and let compliance stay in awareness.

By: Deng Xiaoyu, Li Haojun

Introduction

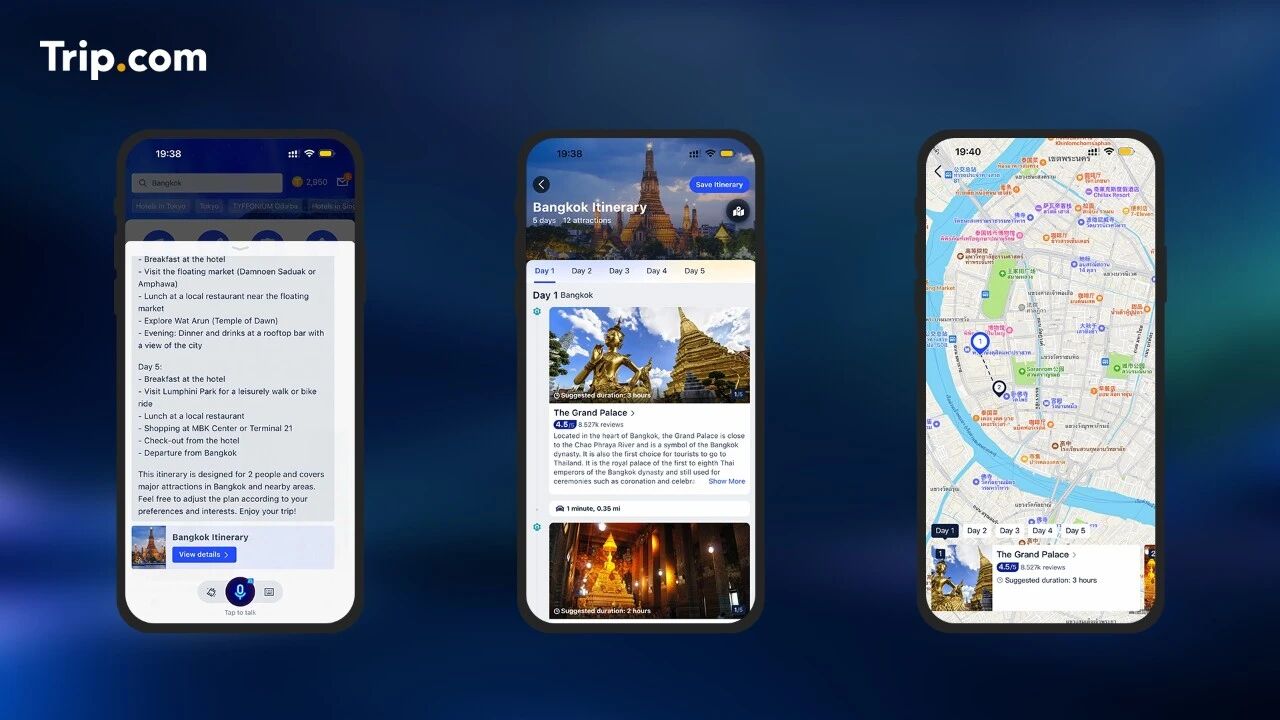

Recently, Trip.com officially launched its stablecoin payment feature. Web3 digital nomads exclaimed: "Finally, I can turn my USDT into real flights and hotel bookings!"

I believe practitioners in mainland China feel far more excitement about such an "application落地" than using a USDT card. Lawyer Deng Xiaoyu, a Trip.com member, feels欣慰about this payment implementation but believes it's necessary to remind digital nomads to pay attention to compliance during usage, collectively supporting bold innovative enterprises.

Why has Trip.com’s support for U payments caused such a sensation? Beyond so-called "payment freedom," there's actually an extremely shrewd economic calculation behind it.

First is the "natural discount" brought by exchange rate differences. In the stablecoin OTC market, the exchange rate for USDT often experiences "inversion" or premium fluctuations compared to official bank foreign exchange rates. By acquiring cheap stablecoins through specific OTC channels and deducting them at par value in USD, users can frequently book high-end flights and hotels at prices 5%-10% below market rates.

Second is avoiding cross-border payment "fees" and "limits." Traditional credit card cross-border transactions not only face currency conversion fees of 1.5%-3%, but are also constrained by an annual foreign exchange limit of $50,000. Using stablecoin payments achieves both "physical exit" of assets and bypasses layers of compliance reviews within banking systems. For Web3 professionals or high-net-worth individuals holding large amounts of U, this isn't just consumption—it's a "metaphor for liquidity realization."

However, these so-called "arbitrage opportunities" and "payment advantages" are precisely what fraudsters and bad actors see as lucrative targets—and will inevitably attract regulatory scrutiny. Therefore, before clicking "confirm payment," individual users must read this criminal risk avoidance guide for different scenarios.

Scenario One: Pure Personal Consumption

If your USDT comes from legal sources (e.g., early mining, investments via regulated exchanges) and you're only using it to book accommodations or tickets for personal overseas travel, this falls under "personal use."

While this may seem harmless, from China's foreign exchange regulatory perspective, the logic chain becomes "RMB → virtual currency → foreign currency abroad → flights/hotels." This essentially constitutes an "offset" between domestic and foreign funds, achieving de facto RMB-foreign currency exchange.

Although small-scale, occasional personal use is typically not prosecuted criminally in judicial practice, administratively it still violates foreign exchange control regulations. Once cumulative amounts become significant, fines from the foreign exchange authority could far exceed your hotel bill.

Another practical risk lies in the "toxicity" of fund origins.

The core pain point of Web3 payments is that you can hardly guarantee your U is absolutely clean. If the counterparty’s funds involved in your OTC purchase of USDT originate from telecom fraud, gambling, or other illicit activities, the U you pay to the platform becomes "dirty U." Police will trace the USDT transaction trail; once your payment is flagged, not only might you be unable to check into the hotel, but all your bank accounts, WeChat, and Alipay could face "complete freezing."

In a criminal investigation, proving "I really just wanted to book a room" is far more difficult and time-consuming than one might imagine.

Scenario Two: Booking on Behalf of Others for Profit

If you discover exchange rate differences or discounts through stablecoin payments and start posting on social platforms offering to book hotels or flights for others in exchange for RMB, the nature fundamentally changes. Once your actions become repetitive and profit-driven, this ceases to be consumption and becomes an "operational activity."

According to the "Interpretation by the Supreme People's Court and Supreme People's Procuratorate on Several Issues Concerning the Application of Law in Handling Criminal Cases of Illegal Fund Payment Settlement and Illegal Foreign Exchange Trading," engaging in illegal fund payment settlement or illegal foreign exchange trading, with illegal operating amounts exceeding 5 million RMB or unlawful gains exceeding 100,000 RMB, constitutes the crime of illegal business operations.

You may think you're exploiting platform loopholes, but regulators view you as essentially running an illegal underground bank using virtual currencies as intermediaries. Such "professional proxy booking" behavior directly triggers criminal enforcement.

Moreover, "price inversion" often implies "original sin." If you offer USDT booking services significantly below market price, judicial authorities will presume you subjectively knew the U sources were abnormal. In such cases, every commission you receive could be deemed aiding criminal proceeds "cash-out."

At this point, the risks extend beyond illegal business operations—you may also face charges of concealing or hiding criminal proceeds or aiding information network crimes. The criminal cost here absolutely outweighs any commission earned.

How to Be a "Compliant Traveler" Amid the Web3 Wave?

Technological advancement brings convenience, but the law’s "long arm" always monitors cross-border capital flow security. To help Web3 players enjoy technological benefits without ending up "in jail," Manqin Lawyers offer the following advice:

1. For personal-use consumers, adhere strictly to the principle of "de-financialization."

The payer's account name, Trip.com order name, and actual guest name must remain highly consistent. Never make payments on behalf of a "friend" for convenience—such identity mismatches are extremely hard to explain during judicial investigations. Meanwhile, retain complete evidence proving "clean funds."

If the stablecoins used were purchased via real-name verified transactions on compliant exchanges, be sure to save screenshots of those historical transaction records. Should your bank account be frozen or you face criminal inquiry, this serves as critical protection against presumed criminal intent.

In addition, post-stay water bills and flight boarding passes are indispensable evidence—they prove your payment had genuine consumption purposes rather than being fictitious transactions for illegal foreign exchange settlement.

2. For those seeking profit from exchange rate differences, our advice is simple: stop immediately.

Publicly advertising "U booking代理" services on domestic social platforms not only easily triggers charges of illegal business operations but also risks turning you into a "money laundering front" for illicit funds. Never accept RMB from strangers to pay U on their behalf—you never know how many victims' tears lie behind that money.

Remember, cheap U often carries heavy criminal costs. Absolutely avoid attempting to "launder dirty U into clean fiat" via "refund cash-out" methods.

Overseas platforms like Trip.com have robust anti-money laundering systems. Once such behavior triggers alerts, your Web3 assets and domestic bank accounts will face dual freezes, possibly even landing you on international anti-money laundering blacklists.

Conclusion

The dream of Web3 digital nomads is beautiful: lounging by a pool in Chiang Mai, booking a flight to London with stablecoins, ready to embark on spontaneous journeys anytime. Trip.com’s support for U payments indeed brings us much closer to this "payment freedom."

But as lawyers, we've seen too many tragedies where families’ bank accounts were frozen due to chasing minor exchange rate discounts. The price of such "smoothness" is often sleepless nights facing unprovable innocence during police interrogations.

We don’t recommend fully colliding your Web3 assets with real-life financial assets, nor risking serious criminal suspicion just to "conveniently book for a friend." Life should return to life—keep coins in your wallet, and compliance in your mind.

After all, every journey truly counts only when you return home safely. That ticket only becomes valid upon your safe return.

Don’t let one "smooth" payment turn into a prolonged criminal battle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News