Racing to issue cards: the business behind crypto payment cards

TechFlow Selected TechFlow Selected

Racing to issue cards: the business behind crypto payment cards

Why has card issuance become popular?

Author: David

Crypto payment cards are becoming an industry-wide phenomenon.

On social media platforms like Twitter, it's common to see KOLs promoting various types of crypto cards with different fee structures;

From centralized exchanges such as Binance, Coinbase, and Bitget, to crypto infrastructure providers like Onekey Wallet, all have already entered this space, aiming to bridge the gap between digital assets and the real economy by launching their own branded cards;

Image source: beincrypto.com

Recently, DeFi applications have also started exploring card issuance.

In August, the decentralized stablecoin project Hope.money announced the launch of its HopeCard, which can be used for payments at any merchant globally that accepts VISA;

And just recently, Uniswap DAO initiated a proposal to vote on whether to issue a VISA card bearing the Uniswap logo...

Why has card issuance suddenly become so popular within the crypto community?

Exchanges, wallets, infrastructure providers, applications—even dedicated startup teams focused solely on issuing cards—when everyone wants a piece of the pie, is the crypto payment card business actually profitable?

Cashing Out and GPT: The Triggers That Ignited Demand

In fact, crypto payment cards are nothing new.

As early as 2015, Coinbase launched a Bitcoin-based crypto payment card. Even during the previous bull market cycles, although some organizations explored card issuance, the level of popularity and discussion never reached today’s intensity.

Why have crypto payment cards become especially popular this year?

The key catalyst may lie in the surge in demand driven by cashing out and ChatGPT.

The former reflects the crypto community’s desire for secure withdrawal channels, while the latter has unlocked new payment use cases.

First, cashing out remains an unavoidable topic.

As P2P (peer-to-peer) off-ramping has become mainstream, money laundering and illicit activities increasingly exploit this channel. You never know if your next transaction might get your card frozen due to someone else’s wrongdoing.

This is why we often see numerous online guides promising “perfect cash-out” methods, and off-ramp service providers marketing themselves with slogans like “no frozen cards”—all indicating a strong market demand for secure and reliable cash-out solutions.

Thus, crypto payment cards find their niche: Instead of spending effort navigating complex cash-out processes, users can simply link these cards to familiar payment systems and directly spend their crypto on everyday purchases.

Additionally, the emergence of subscription services like ChatGPT has significantly boosted demand for crypto payment cards.

For tech enthusiasts, GPT is undoubtedly the center of attention.

However, accessing upgraded features of GPT-4 requires a monthly Plus membership fee—and OpenAI does not accept most domestic Chinese credit or debit cards.

In such cases, crypto payment cards effectively solve the problem of geographic restrictions.

Most crypto payment cards have card numbers starting with 4 or 5, belonging to U.S.-based card networks (VISA / Mastercard / American Express, etc.), fully meeting OpenAI’s requirements and enabling users to convert crypto into USD for seamless top-ups.

Moreover, these cards are widely accepted on international e-commerce platforms (Amazon, eBay, Shopee, etc.) and support subscriptions to other software (Midjourney, Netflix, etc.). With the end of the pandemic, they also serve as a convenient option for users engaging in cross-border spending.

That said, many reports casually conflate terms like “crypto VISA card,” “crypto credit card,” or simply “crypto card.” Amidst widespread social media promotions, a large number of novice users remain unaware of exactly what kind of card they’re actually using.

When it comes to making payments, similar to traditional banking, there are two main types: credit cards (Credit Cards) and debit cards (Debit Cards).

The former allows you to spend beyond your balance—spend first, repay later—while the latter requires pre-funding before use.

In today’s market, prepaid crypto debit cards dominate: they don’t require linking to existing bank accounts, but users must first convert their cryptocurrency into fiat currency and load it onto the card.

Card-as-a-Service: The Driving Force Behind the Trend

Exchanges issue cards, wallets issue cards, payment startups issue cards… Can anyone really issue a crypto payment card?

Traditionally, issuing credit or debit cards is seen as a bank-exclusive privilege, requiring high technical and regulatory barriers. But in the world of crypto payment cards, this isn’t necessarily true.

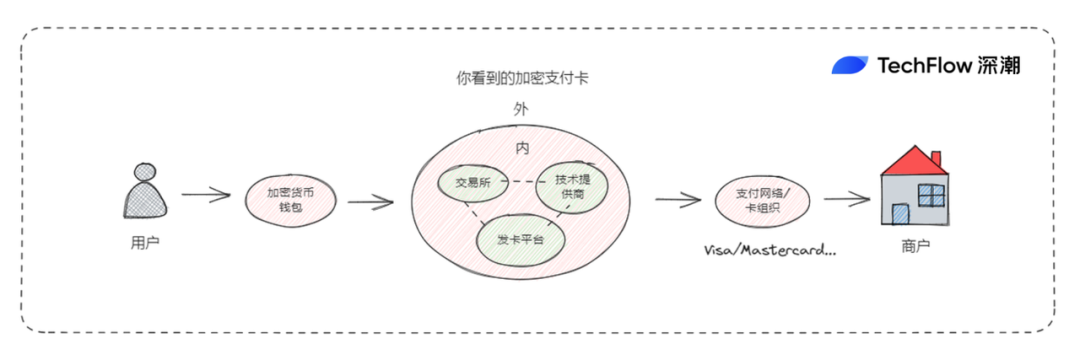

When users see a card branded with a crypto exchange and carrying the VISA logo, what often goes unnoticed is the behind-the-scenes partnership between the issuer and a technology provider.

For example, Coinbase’s VISA card is technically powered by Marqeta, which enables the issuance of crypto debit cards and provides real-time transaction authorization and fund conversion services. Other similar providers include Immersve, Reap, Striga, and Alchemy Pay, which may be more familiar to Chinese readers.

More importantly, thanks to the role of these technology providers, the process of issuing crypto payment cards has become much simpler.

Beyond the traditional roles of users, merchants, and card networks (Visa/Mastercard), technology providers offer a capability akin to "Card-as-a-Service":

By providing essential security technologies, payment processing systems, and user interfaces, they enable organizations to issue and manage crypto cards, handle currency conversion, and facilitate payments.

Issuers only need to integrate the provider’s API or SaaS solution to launch and manage their own crypto credit or debit cards.

Additionally, the “Card-as-a-Service” model includes functionalities such as transaction authorization, fund conversion, transaction monitoring, and risk management—all helping issuers streamline operations and improve efficiency.

Therefore, in theory, any organization under proper compliance regulation or holding relevant licenses can issue crypto payment cards with the support of a technology provider—this explains why we see so many different issuers in the market.

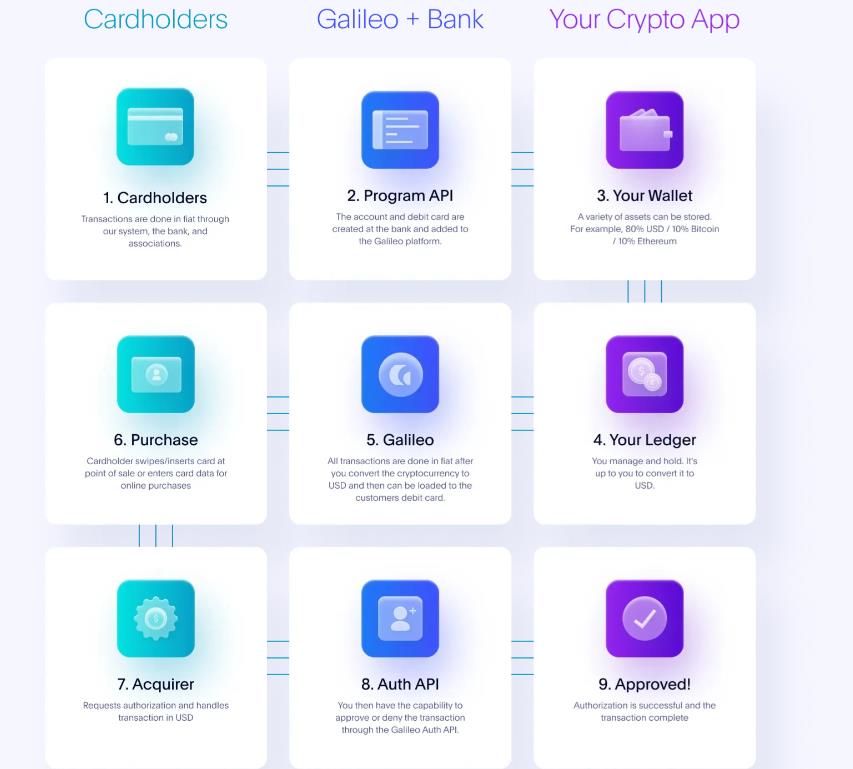

Take Galileo, a well-known overseas solution provider: its APIs are already integrated with payment networks like Visa and Mastercard, and it collaborates with issuing banks and other industry players. Clients can simply call its services to complete card issuance.

As shown in the diagram above, a crypto application needing to issue cards may only need to provide wallet addresses and manage ledgers (in purple), while consumer actions like card activation, transactions, authorizations, and settlements are all handled by Galileo (in blue).

Galileo’s technical approach is not unique.

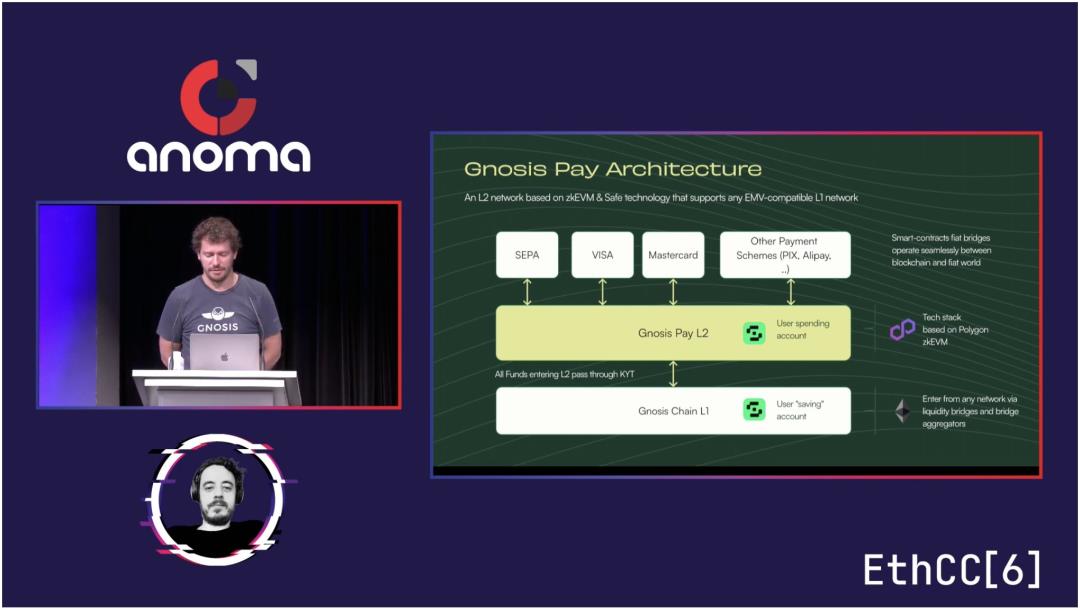

In July this year, the renowned multi-sig wallet Gnosis Safe launched Gnosis Pay, a dedicated network for crypto payments that supports Visa card issuance.

This solution connects crypto wallets on one end, integrates with banking systems, Visa, Mastercard, and third-party payment processors on the other, and builds a dedicated Polygon-based Layer 2 network in between to handle the conversion and settlement between crypto and traditional finance.

Similarly, Gnosis acts as a technology provider: offering developer integration tools and open APIs, allowing other crypto applications to customize their own payment cards.

Overall, technology providers function more like bridge builders—closing the gap between the crypto world and traditional finance, enabling more payment applications to run smoothly across this divide.

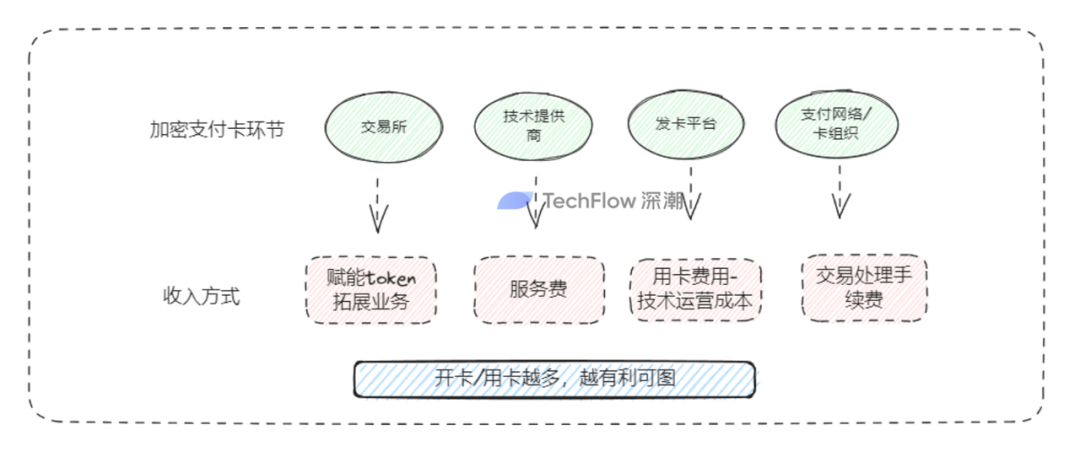

Everyone Takes a Cut: The Business Model Along the Payment Chain

So why is everyone rushing into the crypto payment card business?

As a multi-party business model, each participant along the payment chain has profit motives and distinct strategies.

For major exchanges: Launching crypto payment cards isn't just about earning small fees from issuance or transactions—it often complements their broader ecosystem:

-

Empowering native tokens: Users earn token cashback when spending via the card—such as BNB for Binance Card or CRO for Crypto.com—which boosts token visibility and adoption. Additionally, card benefits scale with the amount of BNB or CRO staked, incentivizing users to buy or lock up the platform’s token;

-

Expanding trading business: Exchanges already possess massive user traffic. Issuing cards allows them to move beyond pure crypto trading and expand into retail payment scenarios. Though constrained by regulations, the strategic logic is clear—similar to how WeChat leveraged social dominance to enter payments.

For crypto apps / technology providers: If they already offer hardware/software wallets, entering the payment card space is a natural progression. Since they already provide asset custody, enabling spending becomes the logical next step;

Other tech providers—like AlchemyPay, Galileo, or Gnosis—treat crypto cards as a SaaS business, charging B2B clients based on API usage or custom development;

For other issuers: Revenue comes from card issuance fees, annual/monthly subscriptions, and transaction fees. Additionally, some issuers invest user deposits in U.S. government bonds, earning yield from RWA (real-world assets);

For card networks: Visa and Mastercard adopt an inclusive strategy—the more cards issued, the better. Whether crypto or traditional, higher transaction volumes, values, and cross-border activity mean more interchange fees and greater revenue.

Everyone takes a cut. Every node along the crypto payment chain stands to benefit. Under stable regulations and macroeconomic conditions, this appears to be a win-win business for all parties involved.

A Slice of the Big Pie

Narratives in the crypto world evolve rapidly, but most still revolve within the ecosystem.

Crypto payment cards, however, represent a business inherently designed to “go outward”:

Whether driven by short-term needs like cashing out or subscribing to GPT services, or long-term goals of leveraging crypto’s advantages in cross-border payments to unlock more online and offline use cases, crypto payment cards aim to become gateways—entry and exit points—with enormous market potential.

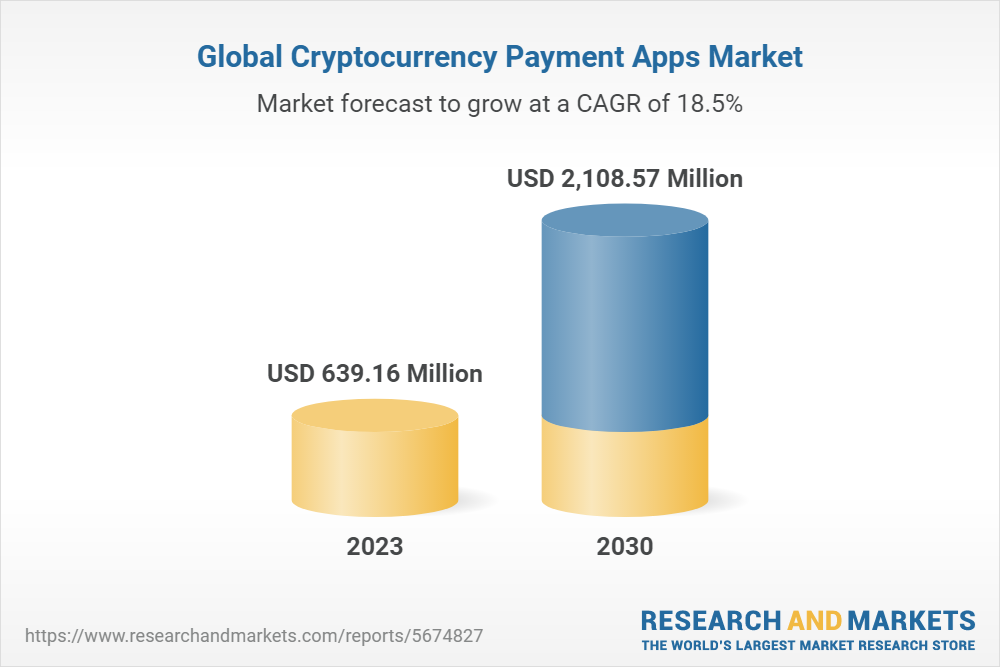

Research reports indicate that the global crypto payment application market is growing at a CAGR of over 18%, potentially reaching a billion-dollar scale.

Even capturing a small slice of this vast market promises substantial returns—likely a key reason driving widespread industry interest in crypto payment cards.

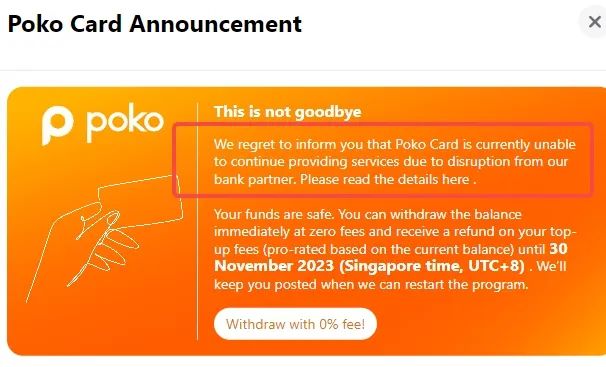

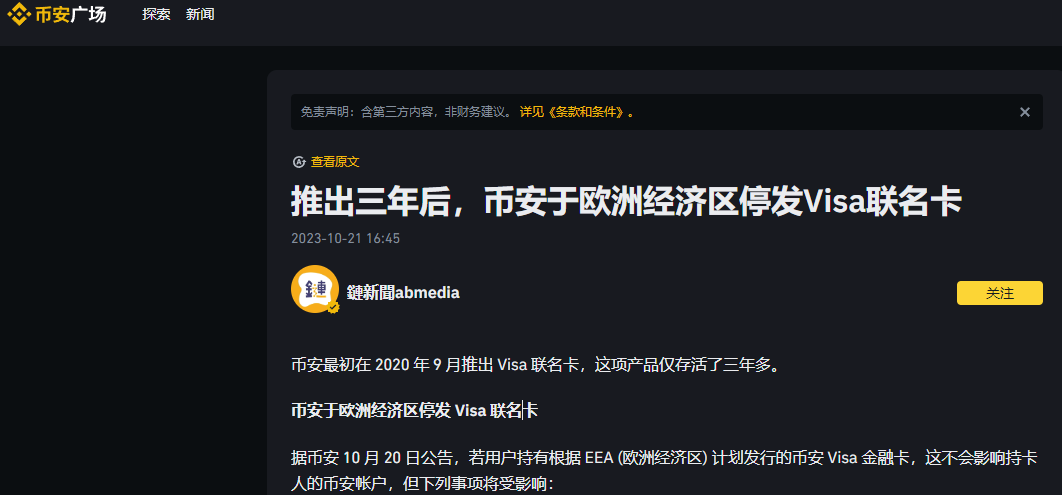

Yet in reality, every product carries risks and limitations.

Crypto payment cards may cease operations due to banking partnership issues; users who fail to regularly check emails or use their cards might miss withdrawal deadlines and suffer losses. Moreover, as regulations tighten and card networks shift policies, even industry giants like Binance could suspend card issuance.

The revolution is not yet complete; comrades must continue striving.

We look forward to seeing the pie grow larger, so that end users can eventually enjoy the benefits of crypto payment cards.

In our next article, we’ll conduct an in-depth analysis of the sign-up requirements, features, fees, and promotions of mainstream crypto payment cards on the market, offering practical and useful guidance for your card selection and usage—stay tuned.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News