Infini Exits, U Cards in Decline? Insights into the Endgame and Way Forward for Crypto Payments

TechFlow Selected TechFlow Selected

Infini Exits, U Cards in Decline? Insights into the Endgame and Way Forward for Crypto Payments

The next PayFi game is no longer on the card.

By: Web3 Farmer Frank

On June 17, Infini suddenly announced the complete shutdown of all its Card services.

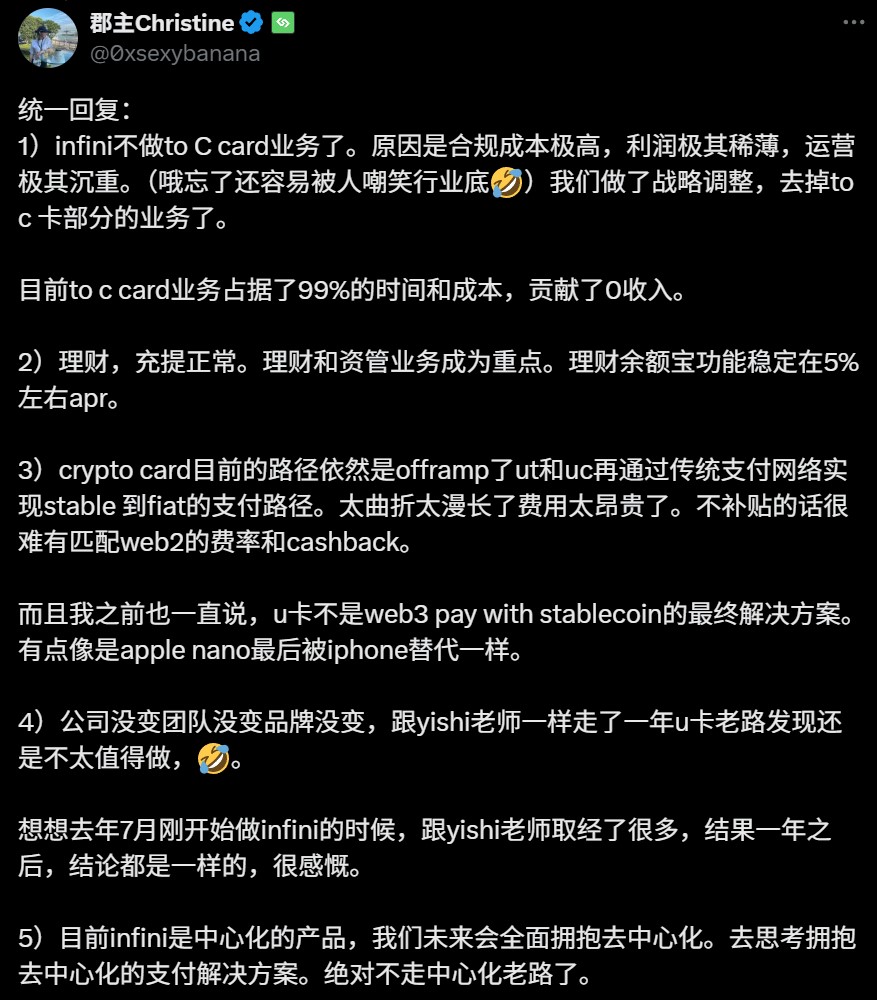

As a standout project during this latest wave of crypto payment cards, Infini had continued operations even after suffering an operational crisis involving the theft of approximately $50 million. Yet it has now chosen to exit voluntarily. The explanation from Infini co-founder @0xsexybanana is telling:

"Compliance costs are extremely high, profits are thin, and operations are burdensome... We've made a strategic adjustment and removed the consumer-facing card business."

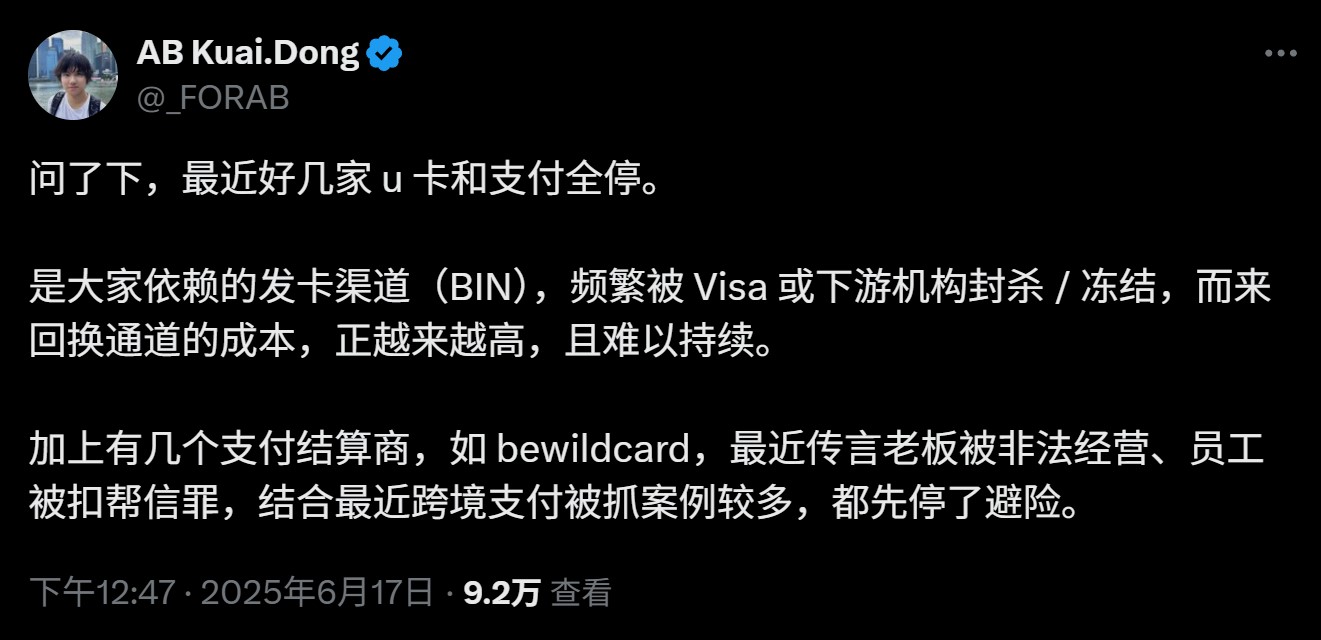

This reflects the true state of the industry—heavy compliance burdens, minimal margins, and high risk. After all, PayFi narratives have been booming since last year, especially in the first half of this year, with numerous U-card projects launching amid intense hype—until Infini’s sudden withdrawal.

Source: @0xsexybanana

This raises a critical question: Is the "U card" business actually viable?

The 'U Card' Was Never a Good Business

To understand the problems with U cards, we must first clarify one fundamental point: the skepticism isn't directed at the idea of “spending cryptocurrency,” but rather at the feasibility of the U card model itself—which heavily relies on traditional financial intermediaries.

To put it plainly, ever since the term "U card" gained popularity, it has generally referred to a specific operational model:

From early players like Dupay to later ones such as OneKey Card and Infini, these are essentially prepaid cards issued overseas. Web3 projects partner with financial institutions and card networks (like Mastercard or Visa) to obtain authorization, then package them into so-called "off-chain spending solutions" for crypto users.

In terms of functionality, this model aggregates third-party intermediaries to facilitate spending by converting stablecoins into fiat currencies like USD and loading them onto prepaid cards. It genuinely helps ease the pain point of Web3 users wanting to “spend crypto directly.” It serves as a convenient off-ramp solution and can be seen as a transitional product that bridges crypto assets with existing card payment systems during a specific historical phase.

However, commercially speaking, it's an extremely fragile business. The Achilles’ heel of the entire U card model lies in its heavy dependence on permissions and stability from third-party institutions.

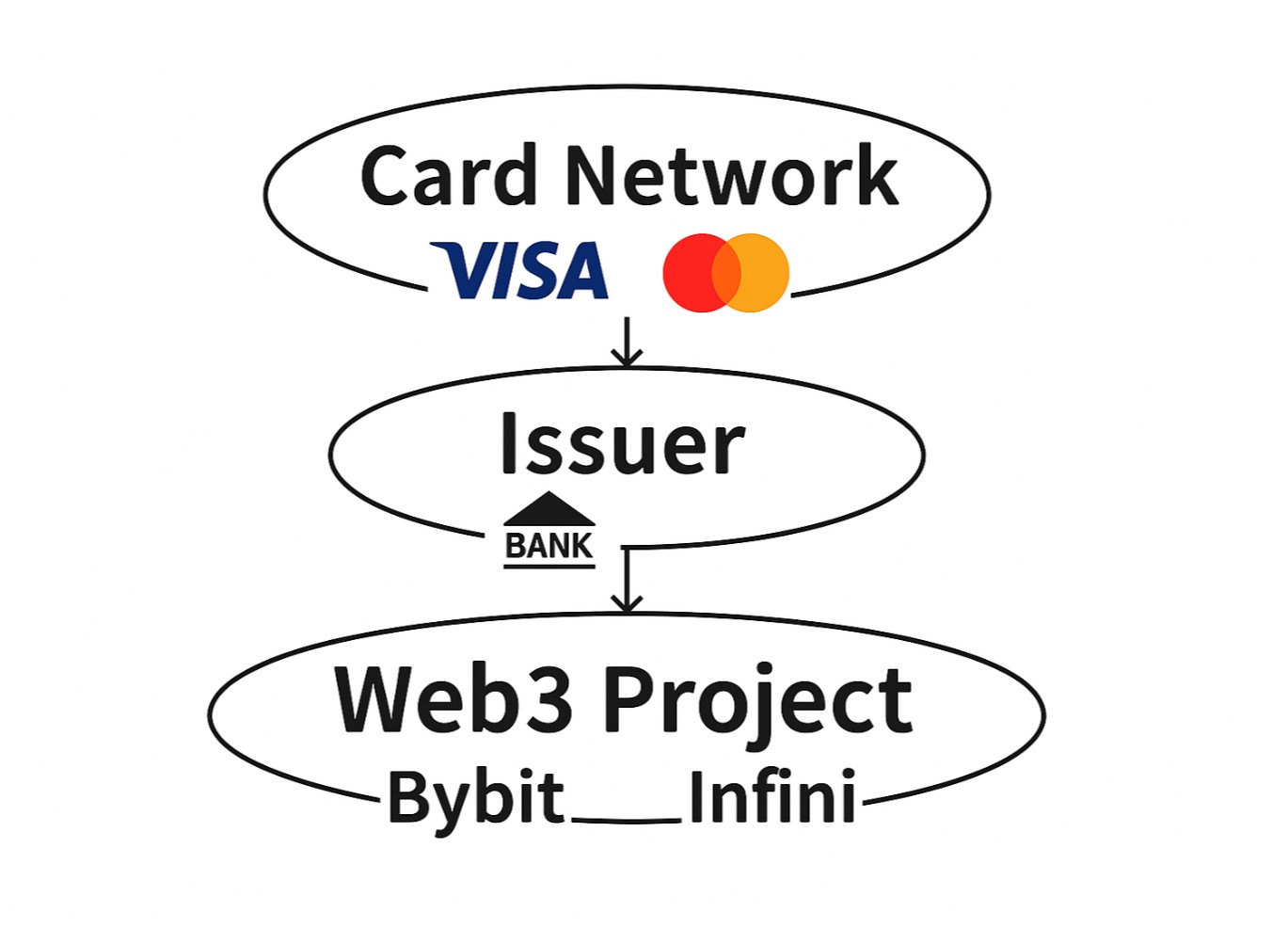

Taking common U card issuance models as an example, they typically involve collaboration between Web3 projects and traditional financial institutions (banks or issuing banks), forming a three-tier structure: Card Network – Issuing Bank – Web3 Project:

-

Card Networks (e.g., Visa, Mastercard): Control core BIN resources and access to clearing systems;

-

Primary Issuers (e.g., DCS, Fiat24, licensed financial institutions): Handle compliance, regulatory engagement, fund custody, and risk control;

-

Web3 Projects (e.g., Infini, Bybit): Responsible for front-end product design, user acquisition, and marketing—but are essentially secondary operators renting licenses.

This three-layer structure may appear well-organized, but in reality, the project team sits at the weakest link in the chain—holding the least authority while bearing the greatest responsibility and highest risk. They lack bargaining power over card networks and issuing banks. Even without clear violations, if user fund sources come under scrutiny or there's suspicion of money laundering or fraud-related inflows, issuing banks or card networks can suspend cards or freeze accounts based on “risk prudence principles.”

A more pressing issue is that U card businesses naturally face high risks of abuse by fraud groups. Unlike exchanges, which have fee-based revenue streams to cushion shocks, U card projects must directly absorb potential user losses and regulatory obligations.

In such cases, when regulatory incidents occur, card networks and upstream banks often pass all AML (anti-money laundering) penalties to the project side. This could mean anything from margin deductions to immediate termination of cooperation—while intermediary service providers and payment gateways simply collect fees without taking on real risk. This explains why many U card projects fail within months.

Hence, Infini’s founder stating that “99% of time and cost leads to zero income” is no exaggeration. In this value chain, most profits go to issuing institutions; project teams barely survive on slim margins. Real profitability requires massive transaction volume, asset deposits, and frequent usage scenarios—but compliance and operational costs grow exponentially with scale.

Moreover, this assessment assumes a fixed position: project teams remain stuck at the end of the supply chain, constrained by their role as “secondary operators,” unable to move upstream. But this suggests that the unsustainability of projects like Infini isn’t inevitable—it’s a matter of path choice.

Projects truly aiming to break through profit bottlenecks need to move upstream—into account systems and compliance layers—rather than relying solely on secondhand or even third- or fourth-hand capabilities provided by BIN sponsors like Interlace.

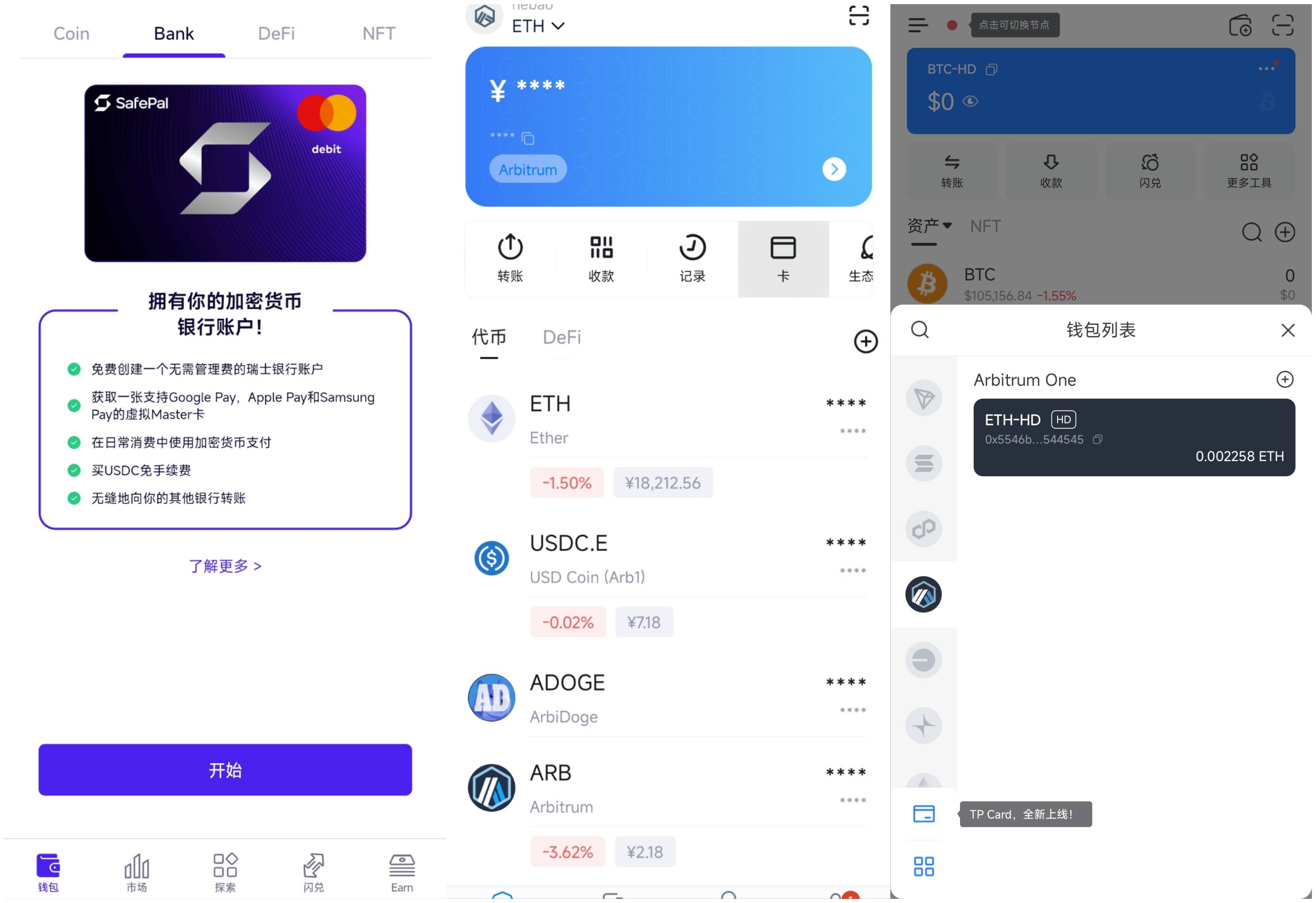

In fact, current providers still offering similar services are no longer pure “on-chain traffic + off-chain patchwork” U card products. Take SafePal, imToken, and TokenPocket as examples—behind each is integration with Swiss bank Fiat24. They share the same roots, differing only in integration paths and entry strategies:

-

SafePal combines personal banking accounts with co-branded Mastercards, placing Bank services prominently on its main page;

-

imToken, as a Fiat24 partner, focuses primarily on Mastercard services. Compared to SafePal, it hides the bank account function but still places the card service within primary navigation;

-

TokenPocket takes a subtler approach, burying the service deeper in secondary menus, also focusing on Mastercard services, with Android users needing to download the Google Play version to activate it.

Left to right: SafePal 'Bank' page, imToken Card entrance, TP Card entrance

Especially in SafePal’s case, its strategic investment in Fiat24 allows direct involvement in card issuance and account-level operations, moving beyond being just a downstream reseller. This fundamentally reduces friction and fees from middlemen, enabling benefits like waived account setup fees and zero deposit/withdrawal charges passed directly to users.

Still, for wallets and exchanges, U card-like services aren't core businesses—they’re value-added features enhancing Web3 custodial/non-custodial offerings. These services help attract users and build long-term loyalty and future AUM (assets under management). From this perspective, short-term unprofitability—or even losses—are acceptable.

Hence, today’s key players are almost exclusively wallets and exchanges. Wallets include SafePal, imToken, TokenPocket, Bitget Wallet; exchanges include top-tier platforms like Bybit and Bitget.

As previously discussed in “The Chaotic Era of Crypto Payment Cards: A Business Model That Can’t Last?” Web3 wallets naturally possess crypto asset management capabilities, making them ideal carriers for PayFi services. They—and exchanges alike—can build longer-term value structures around user acquisition, AUM growth, and user retention.

Ultimately, in such a tightly regulated, compliance-heavy, low-margin financial application scenario, attempting to push forward via partnerships and subsidies alone is extremely difficult for Web3 startups lacking strong traffic bases or deep financial expertise. This is precisely why Infini ultimately chose to abandon its consumer-facing U card business and refocus on wealth management and B2B services.

Crypto to TradFi: Now That’s a Real Business

Is the U card concept entirely obsolete?

No.

As noted earlier, at its historical moment, the U card did fulfill a temporary mission: enabling global crypto users to quickly spend their on-chain assets in daily life, bypassing complex fiat withdrawal processes. Through prepaid cards, crypto assets found a workaround into the real world.

Even though U cards rely heavily on traditional financial infrastructure like Visa and Mastercard and aren’t inherently profitable, they addressed genuine user needs.

If we draw an analogy, U cards resemble phone-based food ordering before platforms like Meituan or Ele.me existed—representing progress in user experience, yet remaining makeshift solutions within outdated frameworks. Lacking scalability and structural stability, they were always destined to be replaced by better alternatives.

Interestingly, shortly after Infini’s announcement, at around 00:00 Beijing time on June 18, the U.S. Senate passed the GENIUS Act—hailed as a landmark in crypto payments legislation—by a vote of 68 in favor and 30 opposed. The bill is likely to pass the House and be signed into law during Trump’s presidency.

Source: Politico

This signals that stablecoins and stablecoin payments are entering a new era of formalization and regulation. The wild west days are ending, and a fresh window of opportunity for PayFi is opening.

Thus, the real question becomes: What kind of financial gateway do crypto users truly need?

The answer may not be a card, but a compliant, stable, and extensible financial account system—one that doesn’t just let users “spend U,” but enables bidirectional flow between on-chain and off-chain worlds, achieving true asset circulation closure.

In other words, U cards will inevitably be replaced by licensed banks with regulatory credentials and risk management capabilities. Traditional financial institutions will increasingly embed themselves into Web3 payment flows and use cases, connecting user wallets, merchant collections, and asset deposits/withdrawals across the entire chain—all while ensuring compliance through bank accounts, payment channels, and clearing systems.

This is exactly the path taken by leading wallets like SafePal, imToken, and TokenPocket. Instead of centering on cards, they collaborate with licensed bank Fiat24 to open compliant financial gateways between crypto and traditional finance (TradFi), treating card services merely as supplementary tools.

As a Principal Member of MasterCard, Fiat24 can bypass intermediaries and connect directly with central banks (e.g., European Central Bank) and card networks, achieving lower card issuance and transaction fees. Its Swiss FINMA financial intermediary license also allows users to open regulated, named bank accounts, enabling compliant conversion between stablecoins and fiat—a clear upstream advantage over players like Infini.

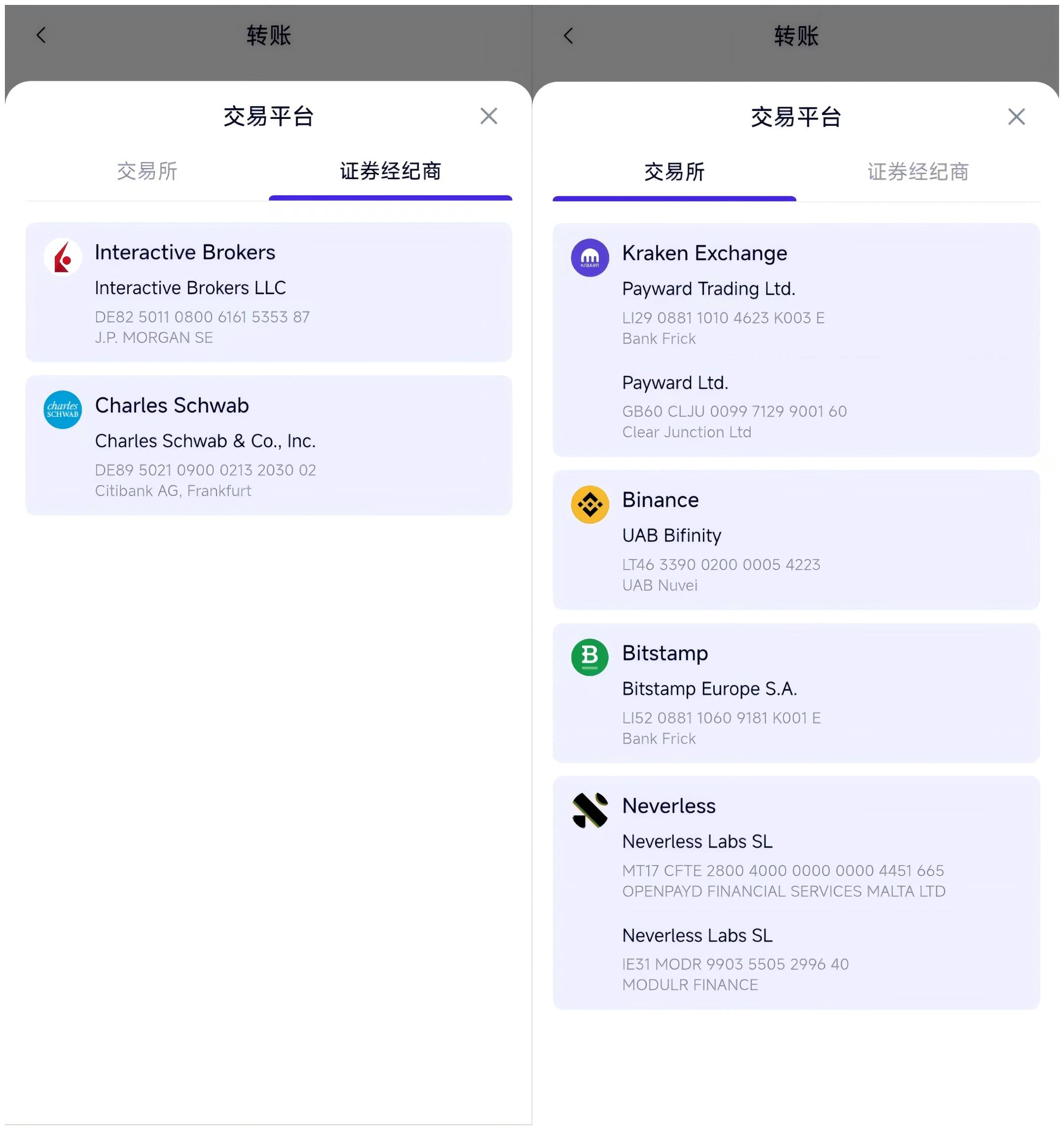

Brokerage and CEX deposit/withdrawal services supported by SafePal's 'Bank' service

Take SafePal’s “Bank” service: having strategically invested in Fiat24 back in 2023, it no longer operates as a reseller renting licenses. Unlike pure card-focused models like Infini, it breaks free from the limitations of being a “secondary operator” by directly controlling account systems and card issuance resources, achieving a far better balance between cost and risk control.

For instance, the community benefits such as free deposits/withdrawals and waived account/card opening fees offered by SafePal reflect structural cost advantages that most projects stuck in “outsourced card issuance” cannot match.

Beyond everyday spending, the Fiat24-backed banking system unlocks key closed-loop scenarios between on-chain and off-chain finance:

-

Brokerage Deposits/Withdrawals: Users can convert crypto assets into euros and transfer them via SEPA to major brokers like Interactive Brokers (IBKR), Charles Schwab, Tiger Brokers, etc., enabling cross-market allocation of on-chain assets;

-

CEX Deposit/Withdrawal Channels: Supports transfers to exchanges like Kraken and Bitstamp that accept euro deposits, or reverse withdrawals to personal bank accounts—avoiding gray-market OTC risks and establishing clear, compliant fiat-crypto pathways;

-

Off-chain Fund Repatriation: Using cross-border payment services like Wise, users can even indirectly route euros back to domestic bank accounts, Alipay, or WeChat Pay, completing a full-circle flow from blockchain to local financial systems.

This entire ecosystem goes far beyond the traditional U card model of “swipe once and done,” delivering real account attributes, compliance capabilities, and service extensibility.

From U Cards to Accounts, Toward the Future of 'Stablecoin Payments'

From a business logic standpoint, the “card + account” model clearly offers greater structural resilience and growth potential. Here, regulated banks lead on compliance, accounts, and settlement systems, while Web3 wallets focus on on-chain asset access and user interaction. This clear division of labor creates a sustainable collaborative framework—far more robust than standalone card-only initiatives.

I’ve always believed that crypto and TradFi aren’t opposing forces, but rather accelerating toward convergence and mutual empowerment. TradFi excels in compliance, account architecture, and risk control, while crypto brings inherent strengths in openness, programmability, and trustless execution.

Until the full transformation of payment systems occurs, the most practical, sustainable path remains one where licensed financial institutions lead on compliant accounts and clearing/settlement systems, while Web3 projects concentrate on on-chain access and asset management—forming an optimal blend of compliance and flexibility.

This hybrid model represents the present-day solution. While not necessarily high-profit, it boasts strong structural durability and is currently the most implementable PayFi approach—the very path taken by SafePal, imToken, and others: partnering with Fiat24 to offer usable IBAN accounts, Mastercard payment cards, SEPA channels, and compliant deposit/withdrawal capabilities for brokers and CEXs—achieving true on-chain/off-chain asset closure.

If we extend the timeline further, the ultimate form of PayFi might be a fully on-chain payment network independent of Visa/Mastercard:

-

Merchants accept stablecoin payments directly, without converting to fiat;

-

Users send transactions directly from their wallets, with self-custody and on-chain settlement;

-

Backed by compliant stablecoins and on-chain clearing networks—no need for Visa/Mastercard or SWIFT intermediaries;

This trend is already underway. From Circle launching Programmable Wallets and CCTP (cross-chain USDC clearing), to global payments giant Stripe acquiring Bridge—a stablecoin API provider—for $1.1 billion last November—both moves aim to connect on-chain accounts, stablecoin assets, and merchant收款 endpoints, bypassing traditional payment rails like issuing banks and card networks.

This shows that traditional payment giants are no longer resisting crypto but actively integrating on-chain capabilities, aligning with Web3 account structures and stablecoin clearing networks. Such a system could eventually overcome the high costs and inefficiencies of legacy payment infrastructures—and potentially surpass current cross-border solutions like Airwallex and Wise in both cost and user experience, becoming the next-generation global payment backbone.

But that’s for the future.

Clearly, U cards belong to the 'past tense,' the current compliant bank account model (e.g., SafePal/Fiat24) represents the 'present continuous,' and the on-chain stablecoin clearing network is the true 'future tense.'

In the end, only those who can navigate and integrate these three evolutionary stages will earn a seat at the table in the next paradigm shift in payments.

Final Thoughts

Therefore, Infini’s exit marks only the natural conclusion of a transitional product destined for replacement.

We might view it as Web3’s tentative attempt to interface with the real world before compliant channels were clearly defined—a model that, to some extent, fulfilled the historical mission of “making crypto spendable.”

Yet as regulatory boundaries become clearer and the status of stablecoins rises, user demands are shifting from “just being able to swipe” to “needing circulation, wealth management, and closed-loop functionality”—requiring real foundational capabilities, especially two-way synergy between crypto and TradFi.

The next round of the PayFi game is no longer about cards.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News