Chinese Crypto Users Anti-Fraud Awareness Survey: User Trust in Exchanges Remains Strong

TechFlow Selected TechFlow Selected

Chinese Crypto Users Anti-Fraud Awareness Survey: User Trust in Exchanges Remains Strong

77.4% of users have encountered phishing links, and 60.8% have been exposed to the temptation of insider information and trading signals from "authoritative figures."

Written by: TechFlow

In recent years, the crypto world has gradually become one of the most dynamic investment areas. However, in this rapidly evolving digital frontier, risks and opportunities coexist, and security issues require constant vigilance.

To address this, Binance conducted a survey on "Cryptocurrency User Security and Anti-Scam Awareness," collecting 7,967 Chinese-language responses.

TechFlow analyzed the survey data and produced this report to help users navigate the crypto jungle safely and confidently.

This survey deeply examines users' awareness of security and ability to respond to risks in cryptocurrency trading, aiming to enhance users' anti-scam capabilities and strengthen risk management awareness to better protect their assets. Binance's industry survey not only provides users with practical educational resources but also reflects its ongoing commitment and dedication to user security education, demonstrating Binance’s responsibility and leadership as an industry-leading platform in advancing the security of the crypto ecosystem.

Key Highlights:

-

Crypto users demonstrate strong security awareness, such as proactively taking protective measures, improved risk identification abilities, and effectively leveraging centralized exchange risk control mechanisms:

-

80.8% of Binance users have enabled two-factor authentication (2FA).

-

Nearly four out of five users carefully verify recipient addresses or smart contract addresses before each transfer.

-

The percentage of users storing private keys/recovery phrases on paper (47.8%) far exceeds those storing them on electronic devices (30.7%).

-

58.9% of users would first contact the exchange to freeze assets after being scammed, indicating significant trust in exchanges.

-

85.5% of respondents expressed trust in exchange protection mechanisms (such as SAFU—the “Secure Asset Fund for Users”).

-

A high 97.2% of users are willing to participate in anti-scam simulation tests organized by trading platforms.

-

Continuous user security education is needed to combat new scam methods and enhance awareness of potential threats:

-

X (formerly Twitter, 63.9%) and Telegram (38.7%) are widely recognized as the most common channels for scam information dissemination.

-

77.4% of users have encountered phishing links, and 60.8% have been exposed to enticements involving so-called insider tips or trading signals from “authorities.”

-

Fewer than half (48.9%) explicitly stated they had not been exposed to scam messages.

Chinese-Speaking Cryptocurrency User Security Survey Report

This report consists of the following five sections:

Part 1: Respondent Profile

Part 2: Security Awareness and Behavioral Habits

Part 3: Scam Experiences and Responses

Part 4: Demand for Exchange Security Services

Part 5: Security Features and Education Preferences

Part One: Respondent Profile

This section aims to draw a comprehensive profile of respondents by collecting and analyzing basic information such as trading experience, frequency, and asset size, providing solid support for subsequent research and analysis.

-

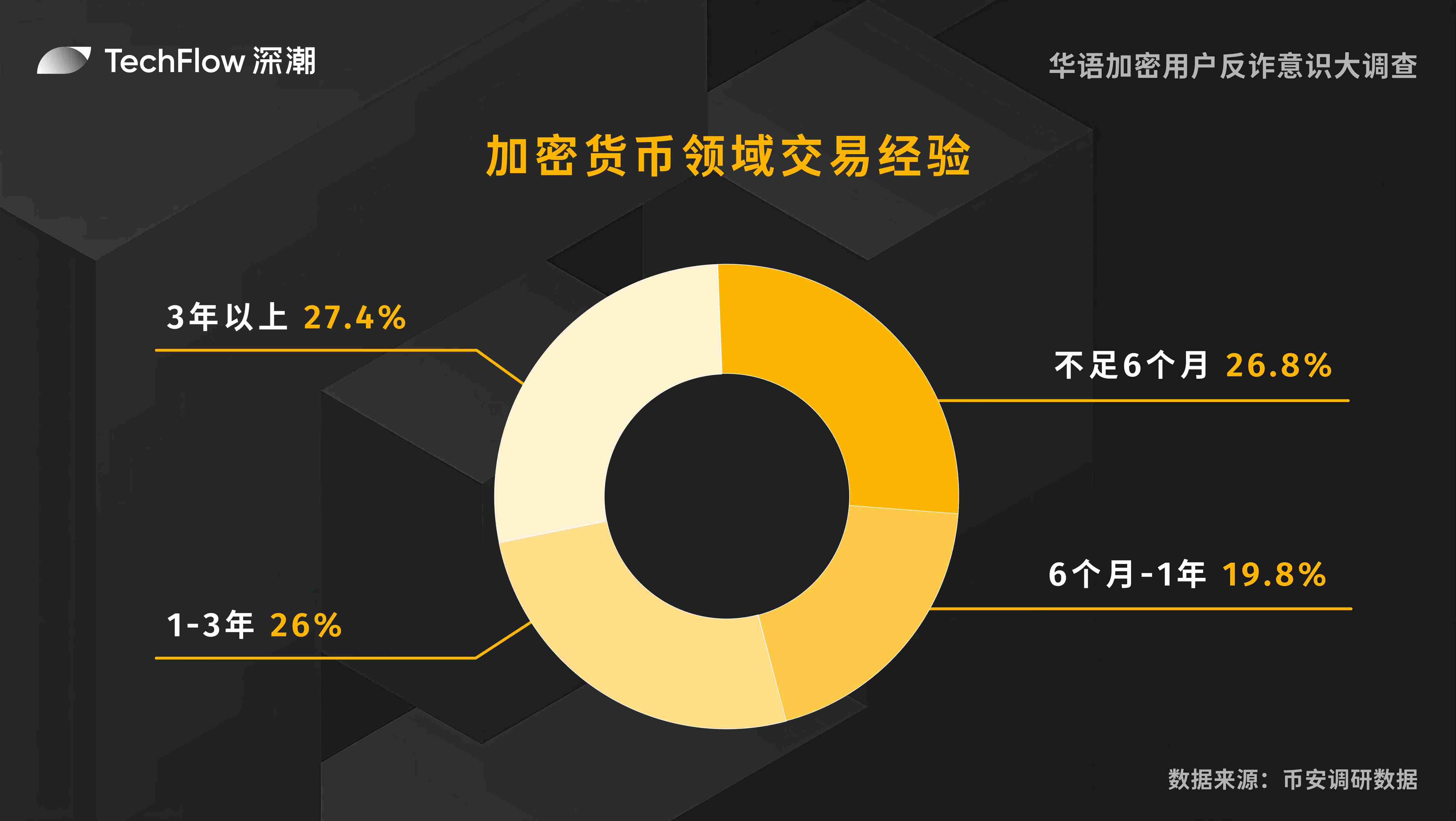

Cryptocurrency Trading Experience

In this survey, we collected data on respondents’ cryptocurrency trading experience. The data shows a relatively balanced distribution of experience among Chinese-speaking users, providing a stable and diversified user base that supports long-term market development.

Specifically, respondents with over three years of trading experience accounted for the largest proportion at 27.4%, followed by those with less than six months of experience at 26.8%. Respondents with 0.5–1 year and 1–3 years of experience made up 19.8% and 26%, respectively. This mix of new entrants and experienced users reflects market dynamism and vitality.

-

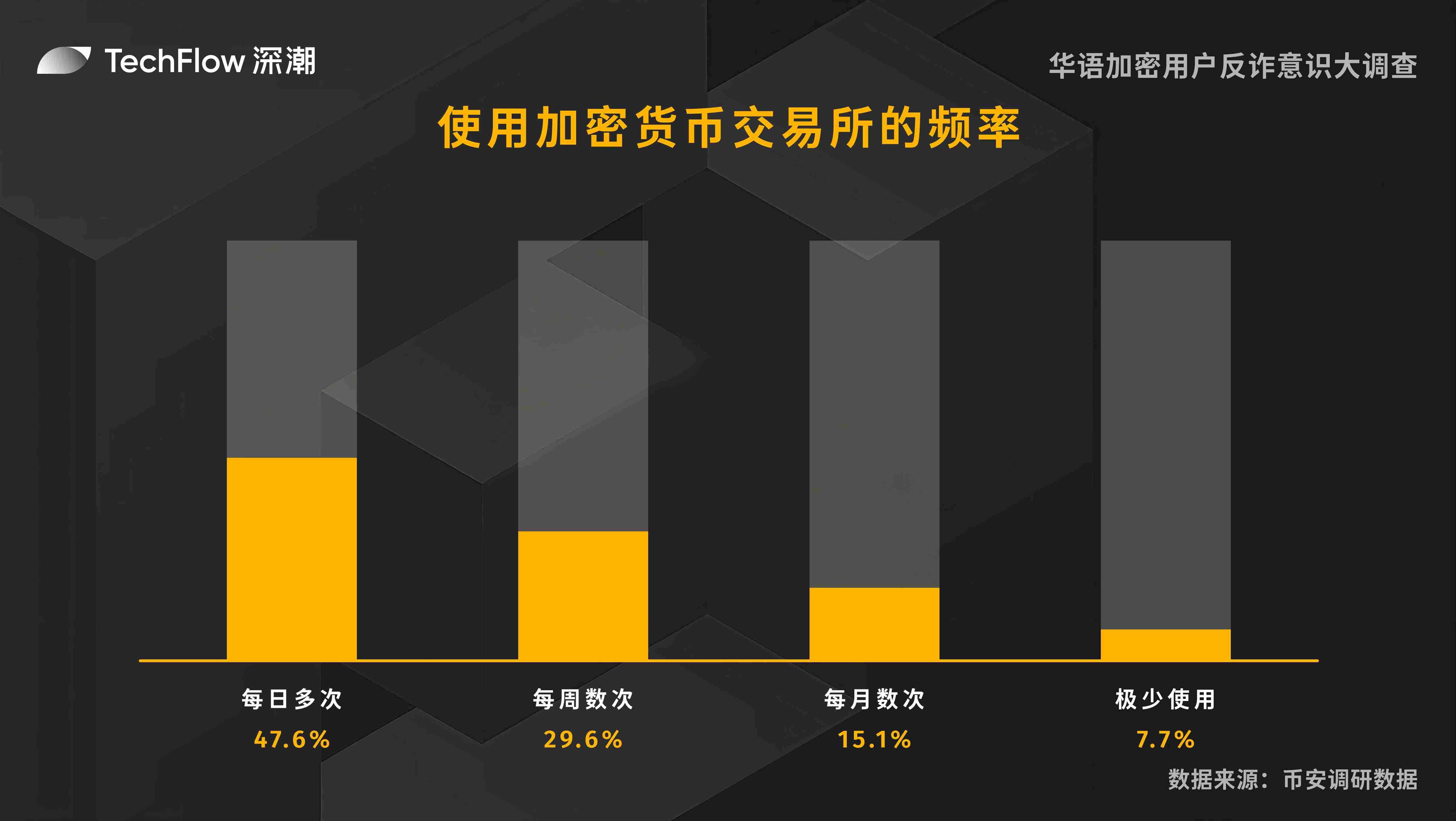

Frequency of Using Cryptocurrency Exchanges

This survey analyzed how frequently cryptocurrency traders use exchanges. Data shows that users who access exchanges multiple times per day represent the largest group, indicating most traders are highly dependent on exchanges.

Specifically, 47.6% of respondents use cryptocurrency exchanges multiple times daily, 29.6% use them several times weekly, 15.1% several times monthly, and only 7.7% use them rarely.

-

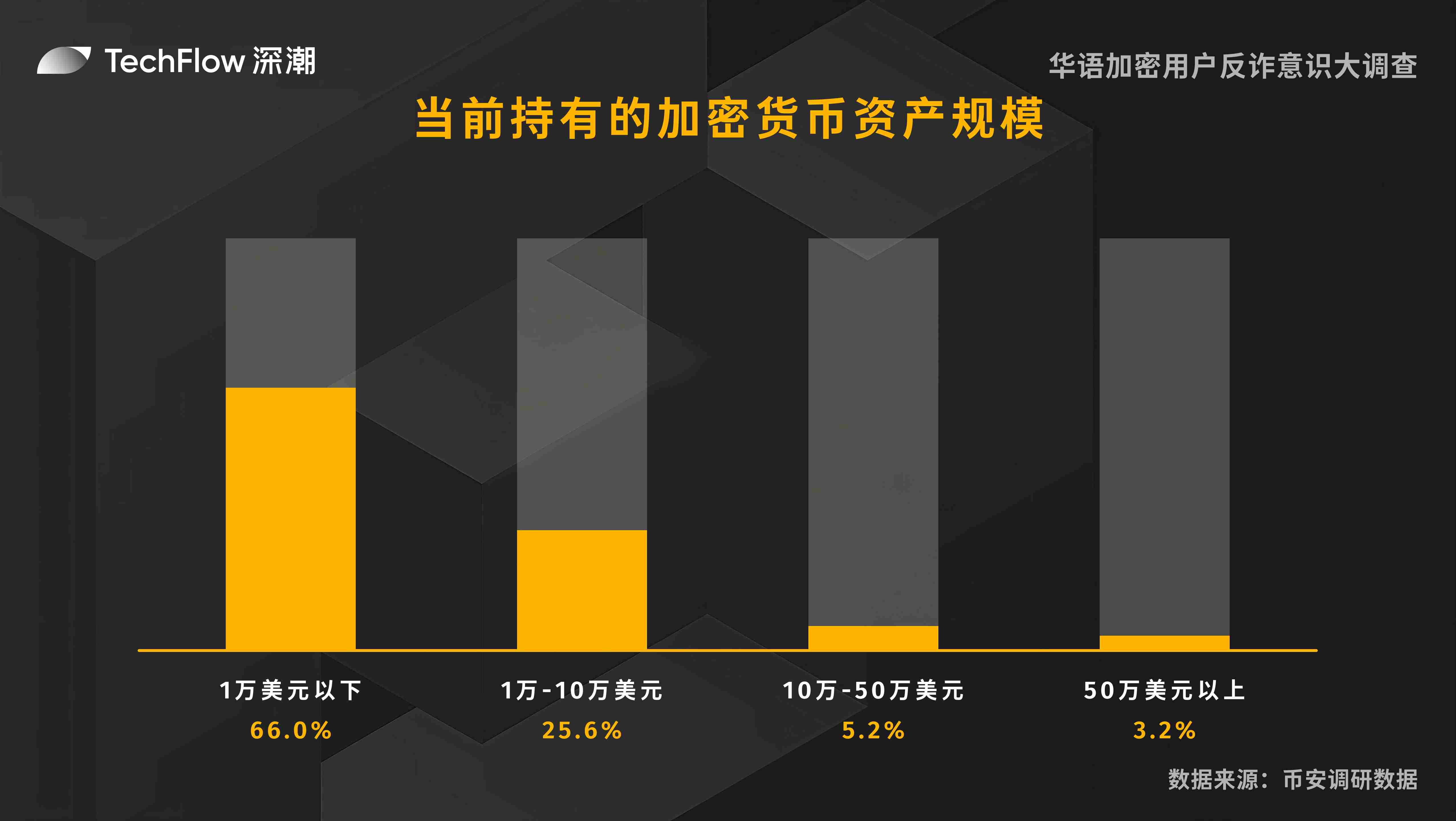

Current Size of Cryptocurrency Assets Held

Among cryptocurrency holders, the majority hold assets under $10,000, accounting for 66.0%. This suggests most investors remain cautious, possibly due to market volatility or limited investment experience.

Investors holding between $10,000 and $100,000 account for 25.6%, indicating deeper market understanding and confidence. Those holding between $100,000 and $500,000 make up only 5.2%, while high-net-worth investors with over $500,000 represent just 3.2%.

Part Two: Security Awareness and Behavioral Habits

In the cryptocurrency space, security and trust are among users’ top concerns. This section analyzes the security measures users have enabled on their Binance accounts, shedding light on user security awareness and strategies—including adopted protections, methods of storing private keys, and types of scams encountered—revealing key security challenges in crypto trading.

-

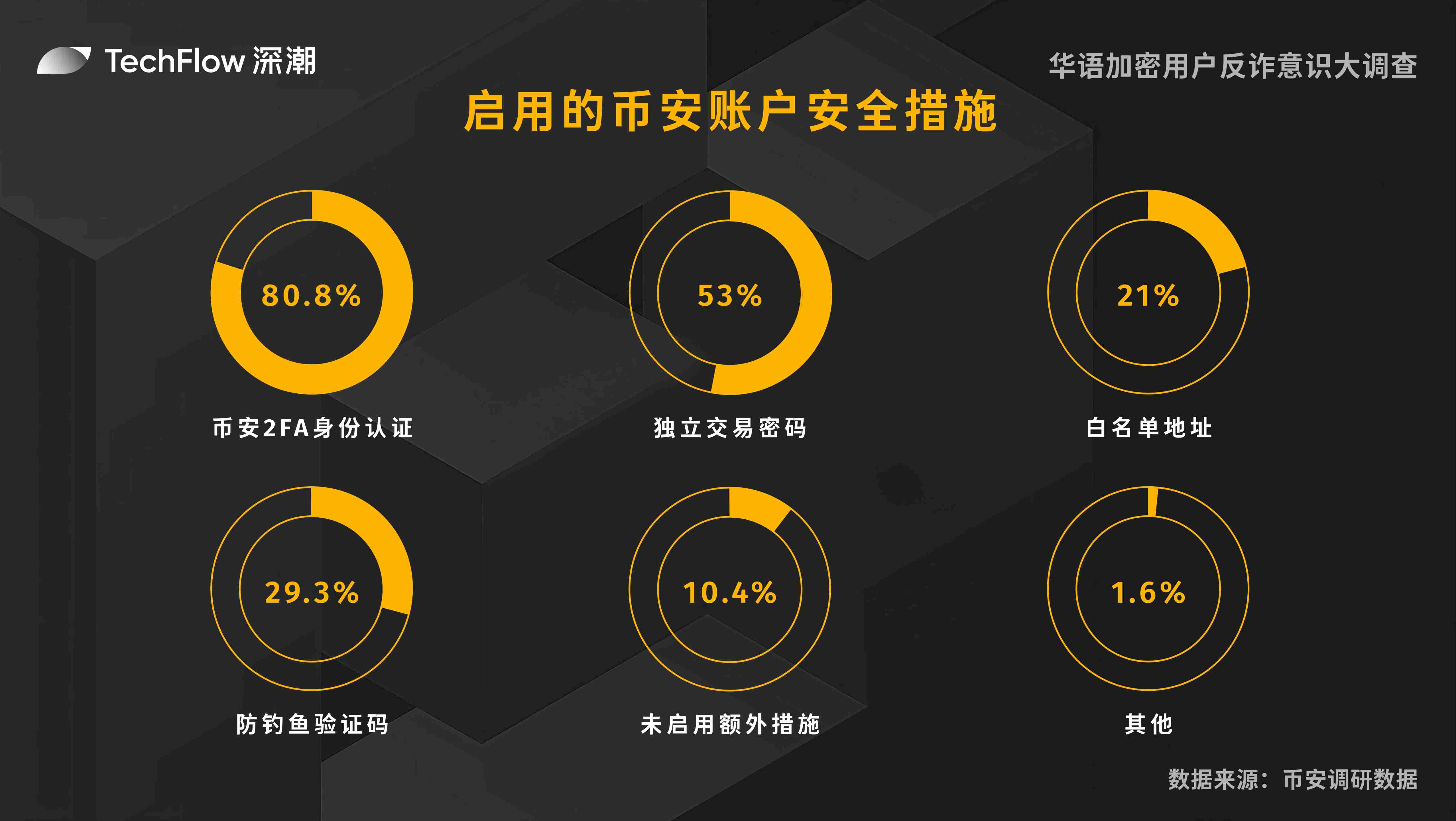

Binance Account Security Measures Enabled

This survey collected detailed data on the Binance account security measures enabled by respondents. This was a multiple-choice question allowing selection of multiple options. Specifically:

The highest proportion of users enabled two-factor authentication (2FA), reaching 80.8%—indicating most users recognize the importance of two-factor verification and prioritize it for account protection. Additionally, independent trading passwords were also valued, with over half (53%) setting one. Whitelisted withdrawal addresses were used by 21% of users, effectively preventing funds from being sent to unauthorized addresses. Anti-phishing codes were used by 29.3%, showing some awareness of phishing attacks. Moreover, 1.6% selected other security measures, reflecting diversity in user security strategies.

However, 10.4% of users did not enable any additional security measures, possibly due to low security awareness or perceived complexity.

Overall, most users have adopted multiple security measures to protect their Binance accounts, though some still need to improve awareness and practices.

-

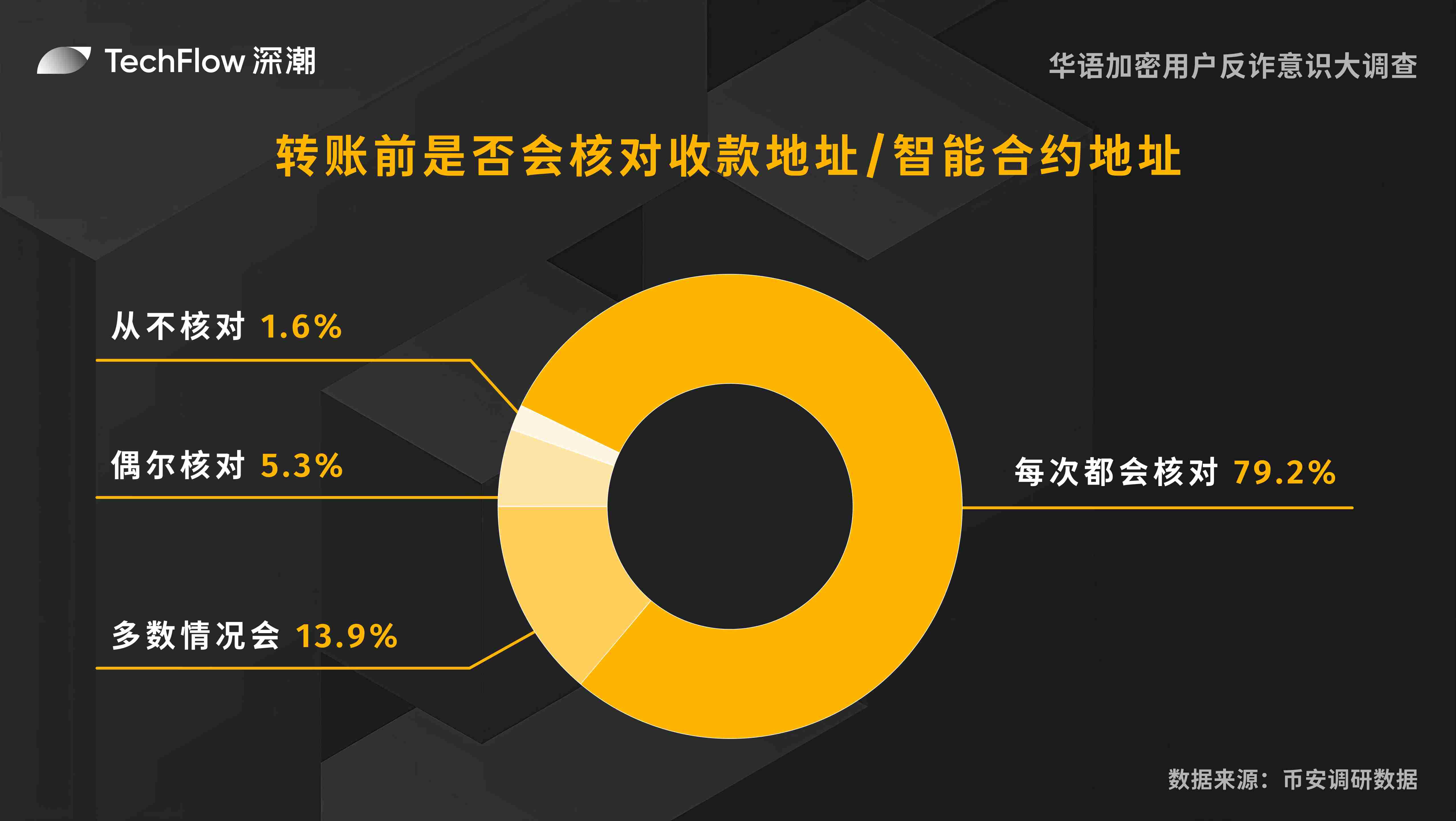

Do you verify recipient/smart contract addresses before transferring?

Survey results show that 79.2% of users carefully verify recipient or smart contract addresses before transfers, indicating widespread recognition of the importance of address verification to prevent errors and potential fund loss.

13.9% of users remain cautious most of the time but may skip verification in certain situations.

5.3% occasionally verify addresses, suggesting awareness but inconsistent habits.

Overall, the vast majority verify addresses before transfers, reflecting a strong emphasis on fund security. Notably, 1.6% never verify transfer addresses, highlighting the need for increased attention to transfer safety.

-

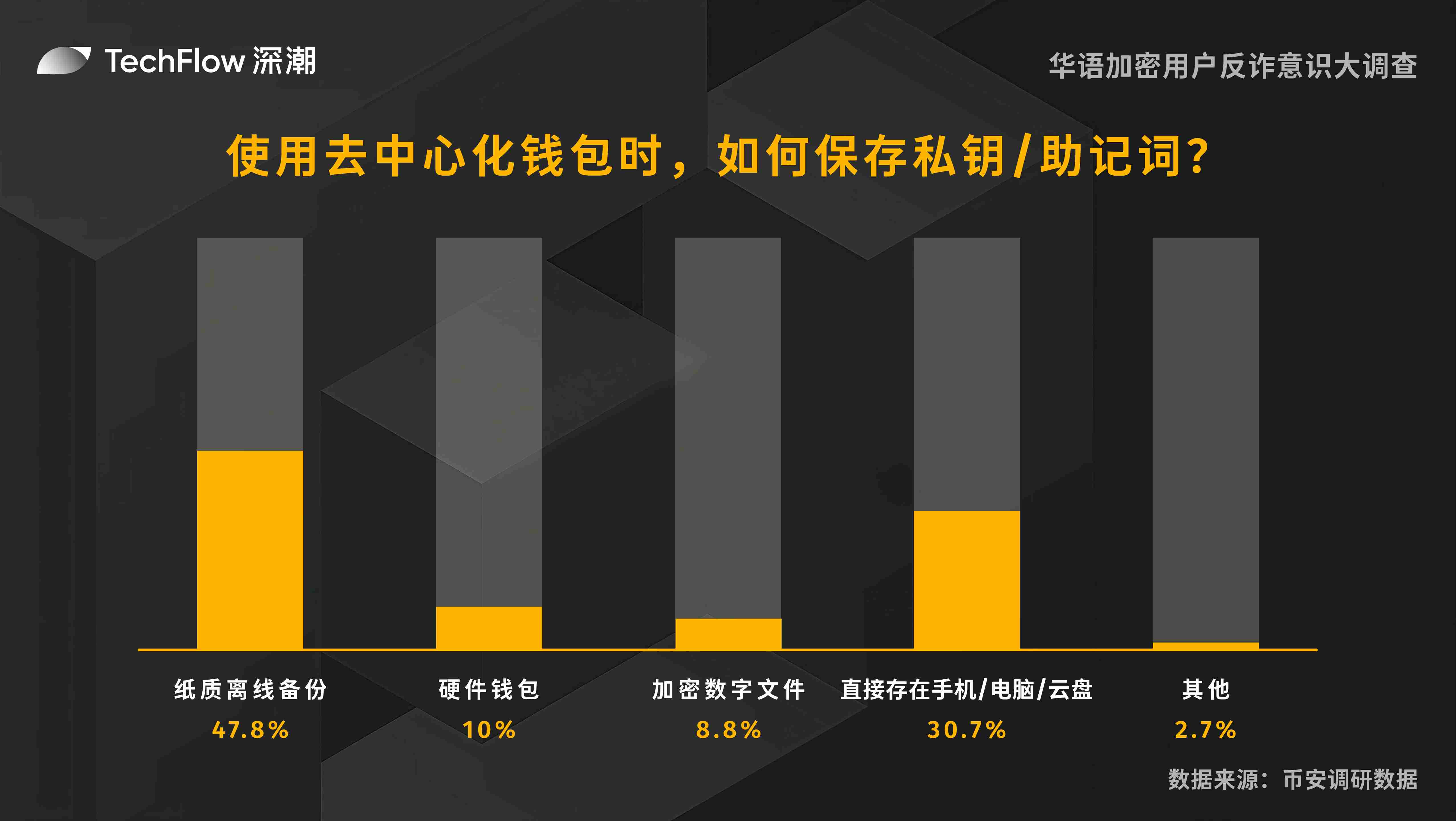

When using decentralized wallets, how do you store your private keys/recovery phrases?

Decentralized wallets allow users full control over their private keys and assets but also pose management difficulties and risks of key loss. In the survey, 47.8% of users chose offline paper backups when using decentralized wallets—a traditional and secure method effective against device failure or cyberattacks. Hardware wallet users accounted for 10%, indicating preference for dedicated devices for enhanced security. Another 8.8% stored encrypted digital files, balancing privacy protection with accessibility.

A significant proportion (30.7%) stored private keys or recovery phrases directly on phones, computers, or cloud storage. While convenient, this exposes users to risks like device theft or cyberattacks.

Additionally, 2.7% used other storage methods, reflecting diverse security strategies.

Overall, most users prefer relatively secure methods for storing private keys or recovery phrases, but some still need to improve awareness to avoid potential risks.

-

Types of scams encountered

This survey collected data on the types of cryptocurrency scams respondents have seen. Results show that although scam varieties are increasing, phishing links remain the most common. This was a multiple-choice question allowing multiple selections. Breakdown by category:

-

77.4% have seen phishing links—a common online scam that steals user information by impersonating legitimate websites.

-

60.8% encountered fake “authority figures” promoting insider tips or trading signals, exploiting trust in authority to mislead investment decisions.

-

51.7% saw scams involving leakage of private information such as passwords, private keys, or recovery phrases—directly threatening asset security.

-

56.6% encountered fraudulent airdrops, giveaways, or token presales, exploiting users’ desire for free items or discounts.

-

51.6% saw fake exchange apps or wallet apps, tricking users by mimicking legitimate applications.

-

48.8% encountered Ponzi schemes and MLM-style investment pools, which promise high returns and pay early investors with funds from later ones.

-

33.2% were victims of malware attacks, where malicious software steals information or takes control of devices.

-

44.9% encountered false investment promises (e.g., high-yield mining pools)—a common scam using unrealistic returns to lure investments.

-

2.3% saw other scam types, showing scams are becoming increasingly diverse and harder to detect.

Part Three: Scam Experiences and Response

This section focuses on actual scam incidents experienced by respondents, covering financial losses, post-scam actions, and common scam message channels. By comprehensively analyzing these real-world scenarios, we aim to help users stay alert and more effectively prevent cryptocurrency fraud.

-

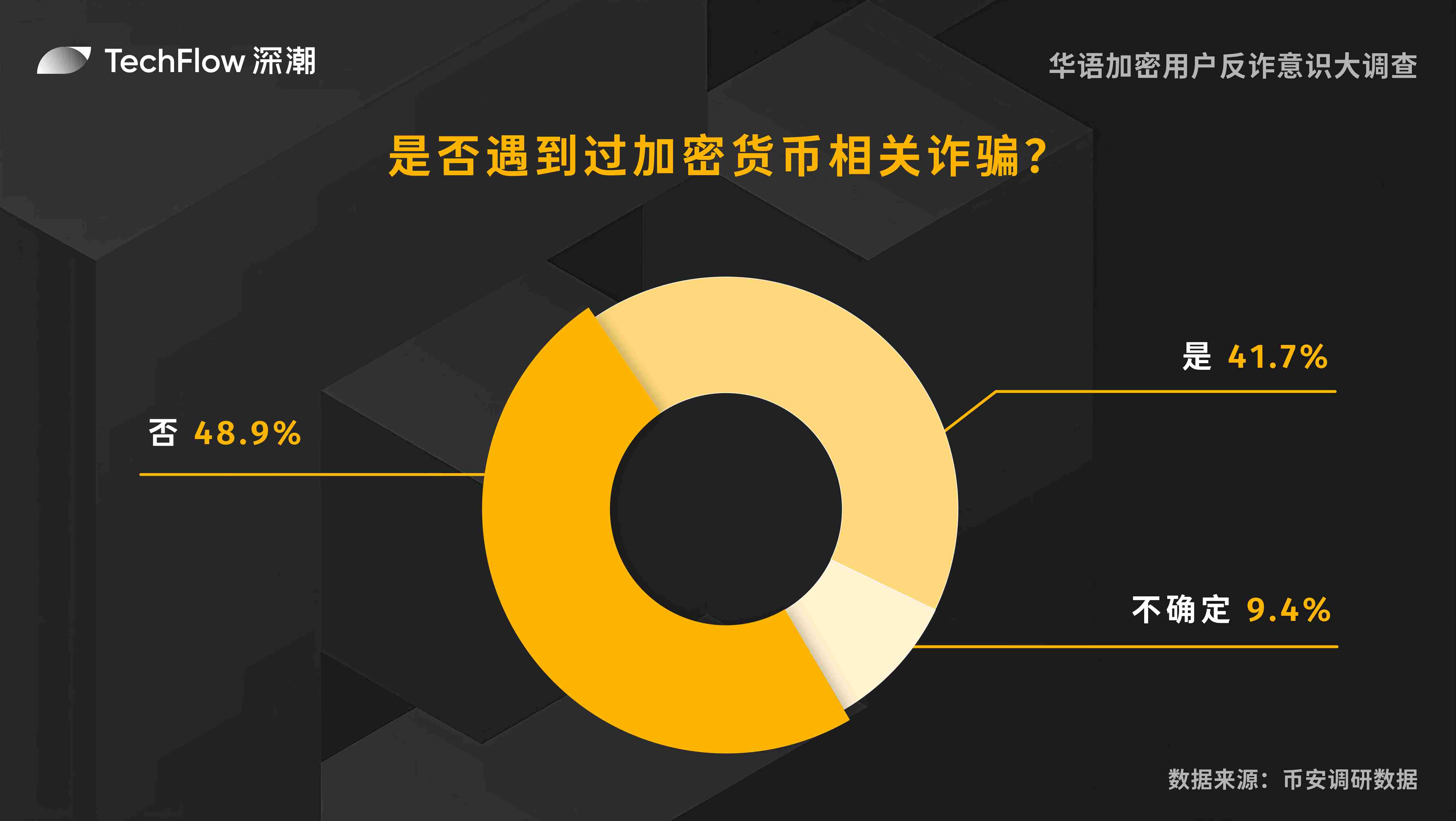

Have you ever experienced cryptocurrency-related scams?

We surveyed whether users had experienced cryptocurrency scams. Surprisingly, nearly half (41.7%) reported having encountered such scams; among others, 9.4% were unsure, and only 48.9% clearly stated they had not.

Overall, cryptocurrency scams remain a significant security issue requiring heightened vigilance and detection skills.

-

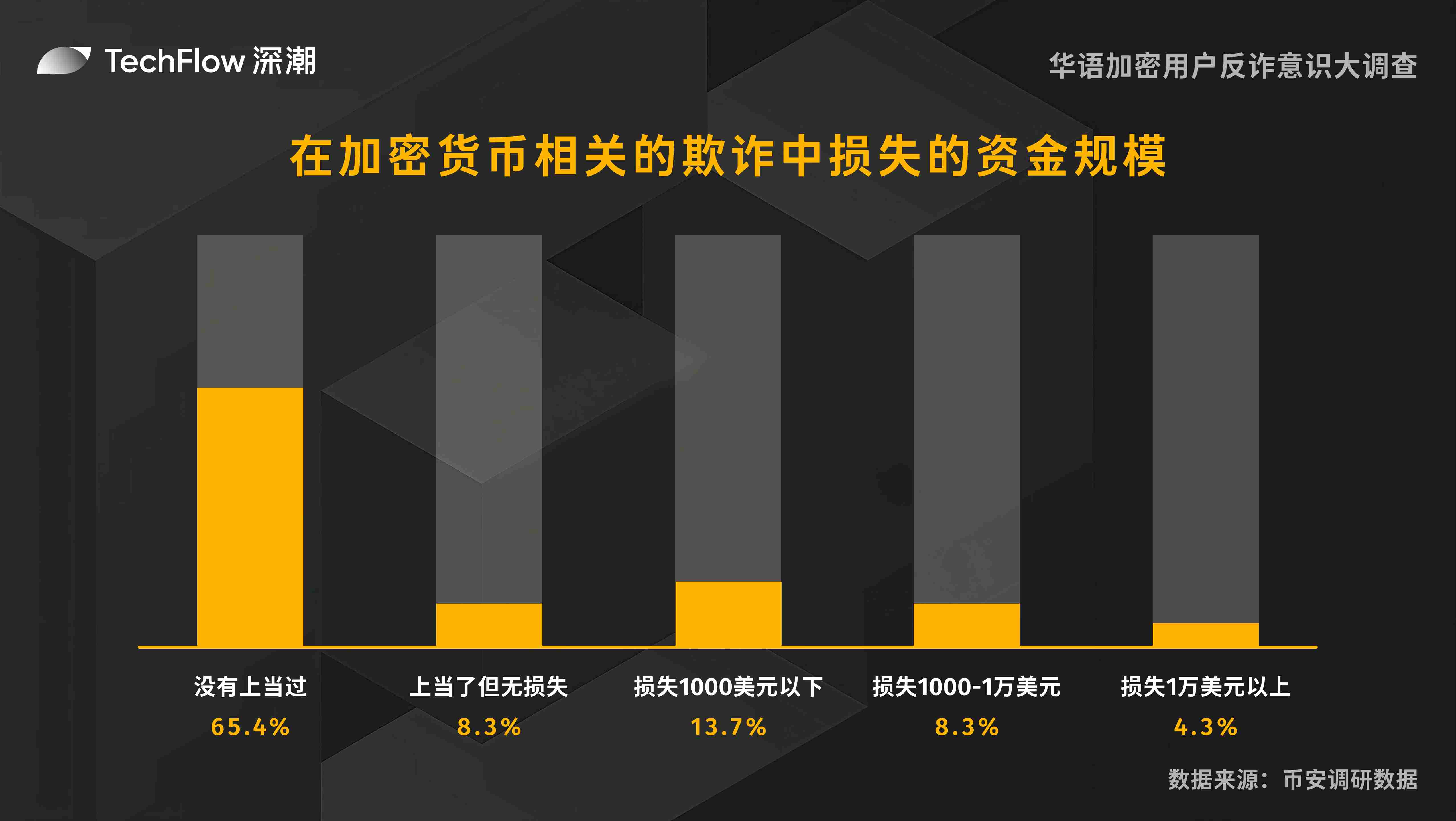

Amount lost in cryptocurrency-related fraud

We investigated the scale of financial losses users suffered due to cryptocurrency fraud. Data shows:

-

65.4% of users were not defrauded, indicating strong preventive awareness.

-

8.3% were tricked but incurred no loss, likely due to timely corrective actions.

-

13.7% lost less than $1,000, indicating small losses are common.

-

8.3% lost between $1,000 and $10,000, showing moderate losses occur.

-

4.3% lost over $10,000, indicating a few users suffered severe financial damage.

Overall, while most users avoided losses, continued vigilance is essential to prevent potential financial harm.

-

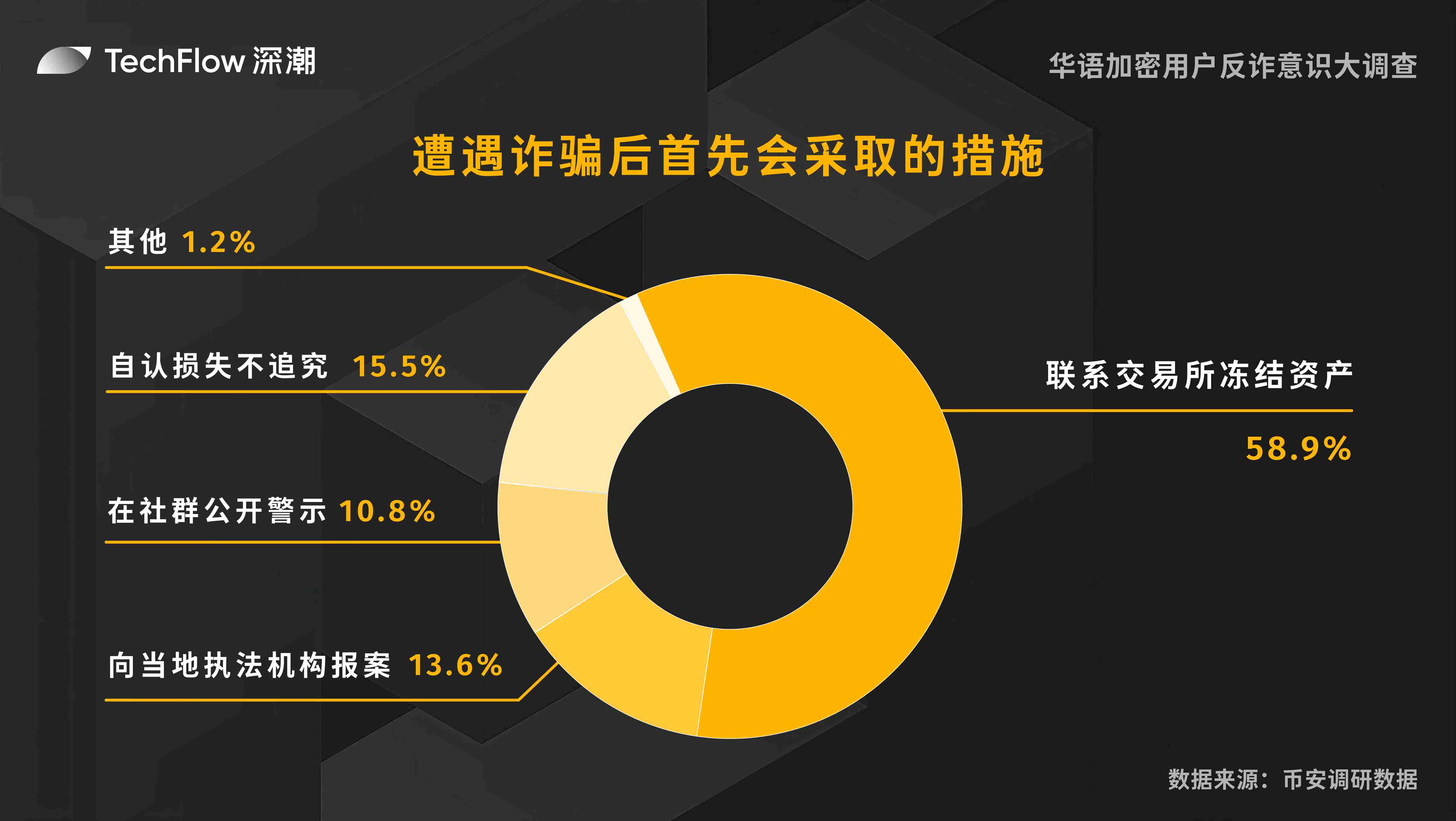

Immediate actions taken after being scammed

Due to blockchain’s decentralized nature, stolen cryptocurrency is often irrecoverable. Our survey shows over half of users first contact the exchange to freeze assets after being scammed. Notably, the second-largest group chooses to accept the loss without further action. Specific data:

-

58.9% first contact the exchange to freeze assets, reflecting strong concern for fund protection.

-

13.6% report the incident to local law enforcement, seeking legal resolution.

-

10.8% warn others publicly in communities to raise awareness.

-

15.5% accept the loss without pursuing recovery, possibly due to small amounts or perceived futility.

-

1.2% take other measures, reflecting response diversity.

Overall, most users take proactive steps to protect their interests, with contacting the exchange being the most common choice—highlighting trust in exchanges like Binance. However, some choose to absorb the loss, underscoring the difficulty of recovering from crypto scams and warranting greater attention.

-

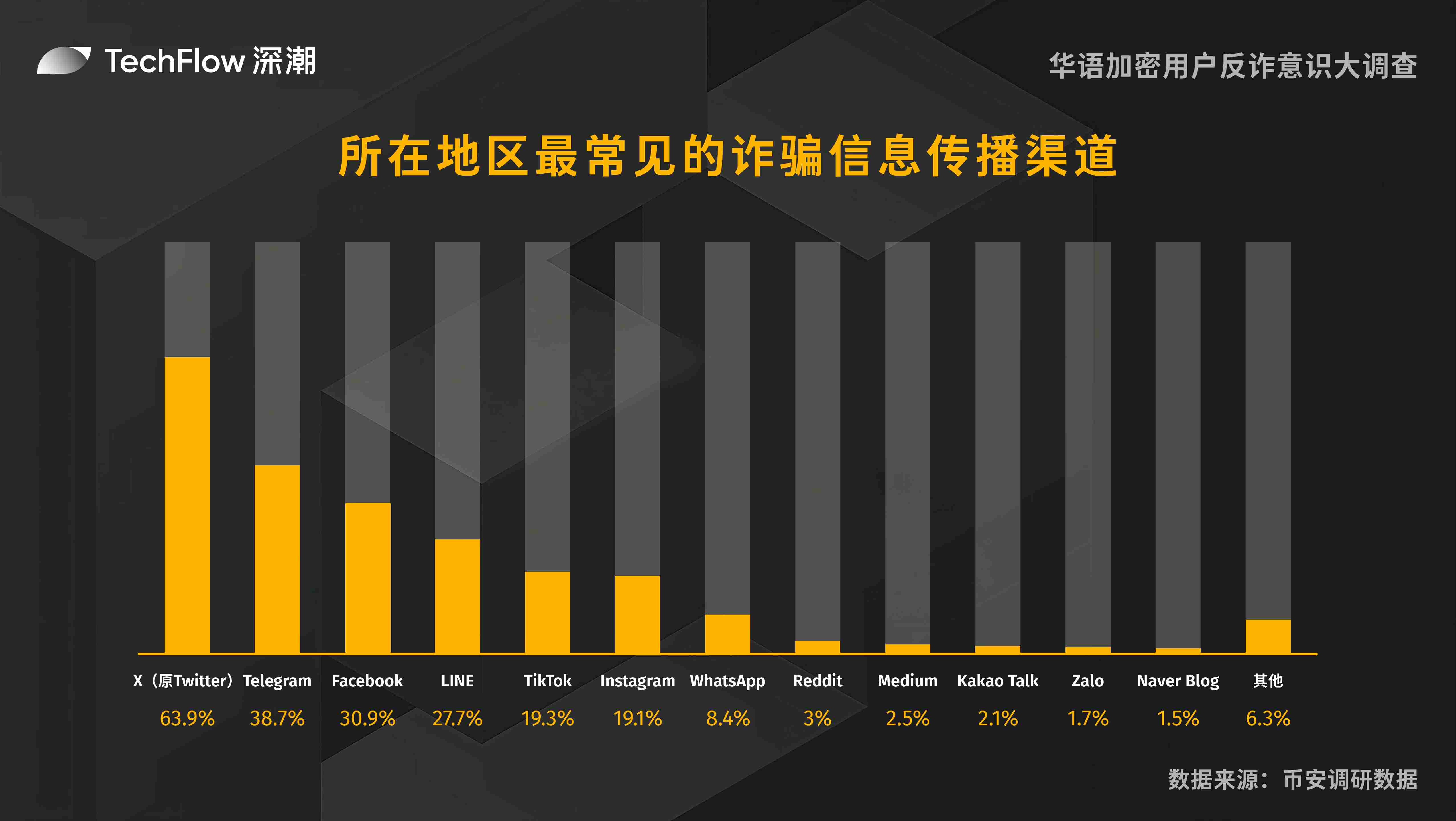

Most common social media channels for scam messages in your region

This survey collected detailed data on the most common channels for scam messages in respondents’ regions, helping us understand the influence of different social media platforms in spreading scam content. This was a multiple-choice question.

Main channels:

-

X (formerly Twitter): 63.9%—the most common channel, reflecting its powerful role in information dissemination.

-

Telegram: 38.7%—also significant, indicating widespread use in crypto communities.

-

Facebook: 30.9% and LINE: 27.7%—frequently mentioned, reflecting regional popularity.

Secondary channels:

-

TikTok: 19.3% and Instagram: 19.1%—showing visual content platforms are also used for scam dissemination.

-

WhatsApp: 8.4% and Other: 6.3%—indicating occasional exposure on other platforms.

Less commonly mentioned channels:

-

Reddit: 3%, Medium: 2.5%, KakaoTalk: 2.1%, Zalo: 1.7%, Naver Blog: 1.5%—lower percentages reflect regional usage differences.

Overall, while platforms like X and Telegram dominate scam messaging, other social media cannot be ignored. Users must remain vigilant across all platforms to guard against fraud.

Part Four: Demand for Exchange Security Services

This section explores Binance’s role in helping users combat cryptocurrency scams. Topics include Binance’s official verification channels, methods to confirm message authenticity, ways to seek Binance assistance, desired security enhancements for exchanges/decentralized wallets, and feedback on Binance’s security products and anti-scam education—painting a picture of Binance’s efforts in fraud prevention.

-

Binance Official Verification Channel

Binance’s official verification channel allows users to verify employee identities by checking URLs, email addresses, phone numbers, Telegram, or social media accounts to confirm legitimacy. This survey asked whether respondents knew they could use the “Binance Official Verification Channel” page to verify staff identity.

Data shows 50.5% knew about this verification method, while 49.5% did not.

Although half of users are aware, more promotion of this verification tool is needed.

-

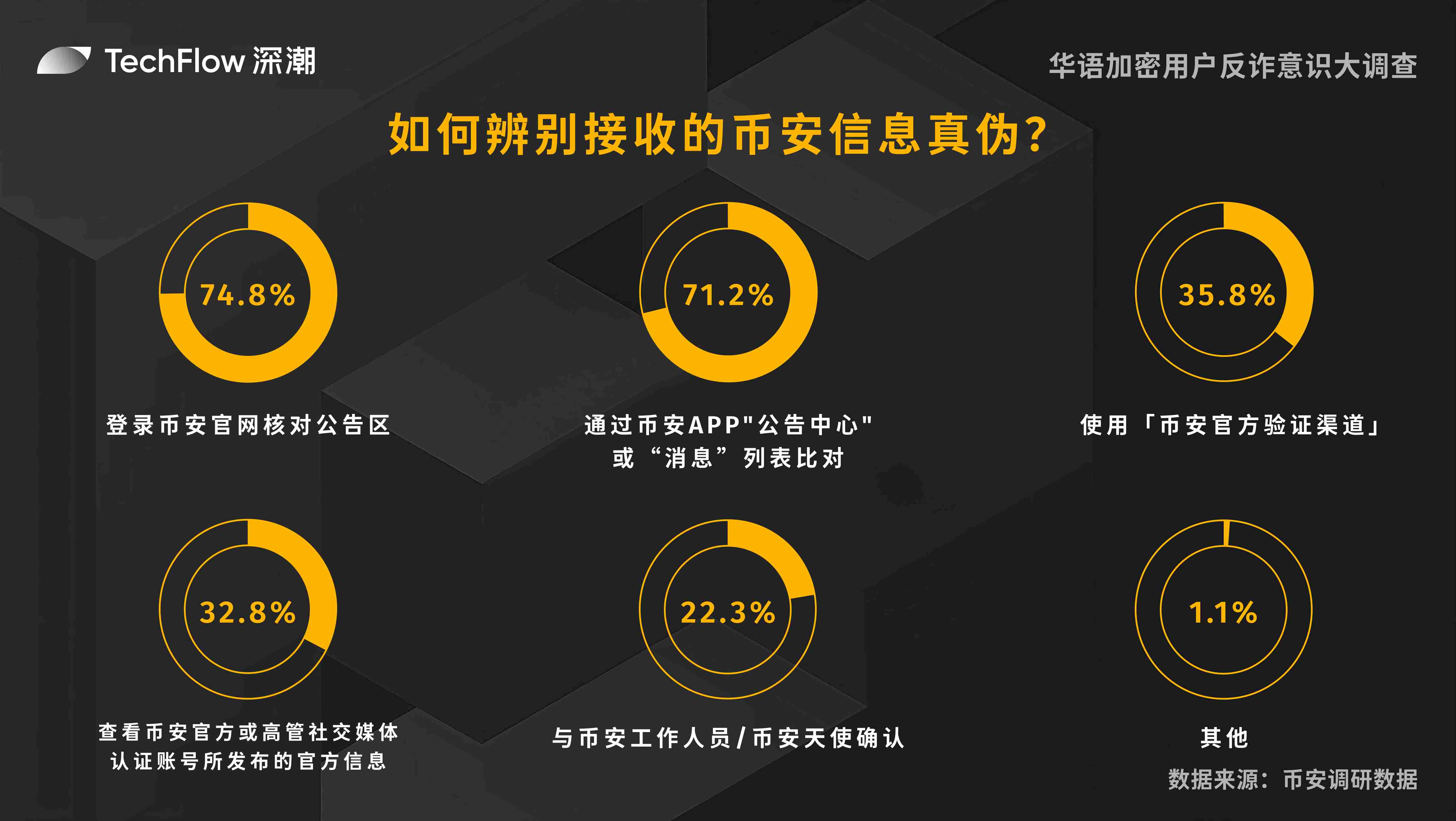

How do you verify the authenticity of Binance messages received?

This survey collected data on users’ methods for verifying Binance message authenticity, helping us understand their approaches. Multiple choices allowed. Based on results, we categorized methods into three groups:

Primary verification methods:

-

Log in to Binance website and check announcement section: The most common method—74.8% of users rely on the official website for authoritative information.

-

Compare via Binance App “Announcements” or “Messages”: Chosen by 71.2% of users, official app announcements are highly trusted.

Secondary verification methods:

-

Verify sender info via “Binance Official Verification Channel”: Though official, only 35.8% use it, likely due to unfamiliarity.

-

Check official or executive social media verified accounts: 32.8% rely on social media for updates.

Other methods:

-

Contact Binance staff or Binance Angels for confirmation: 22.3% communicate with community staff to verify.

-

Other: A small minority (1.1%) use unique personal methods.

Overall, most users rely on official channels and apps to verify information, while some use social media or direct communication for cross-checking. This shows diverse strategies for ensuring accuracy, though most prioritize official website announcements.

-

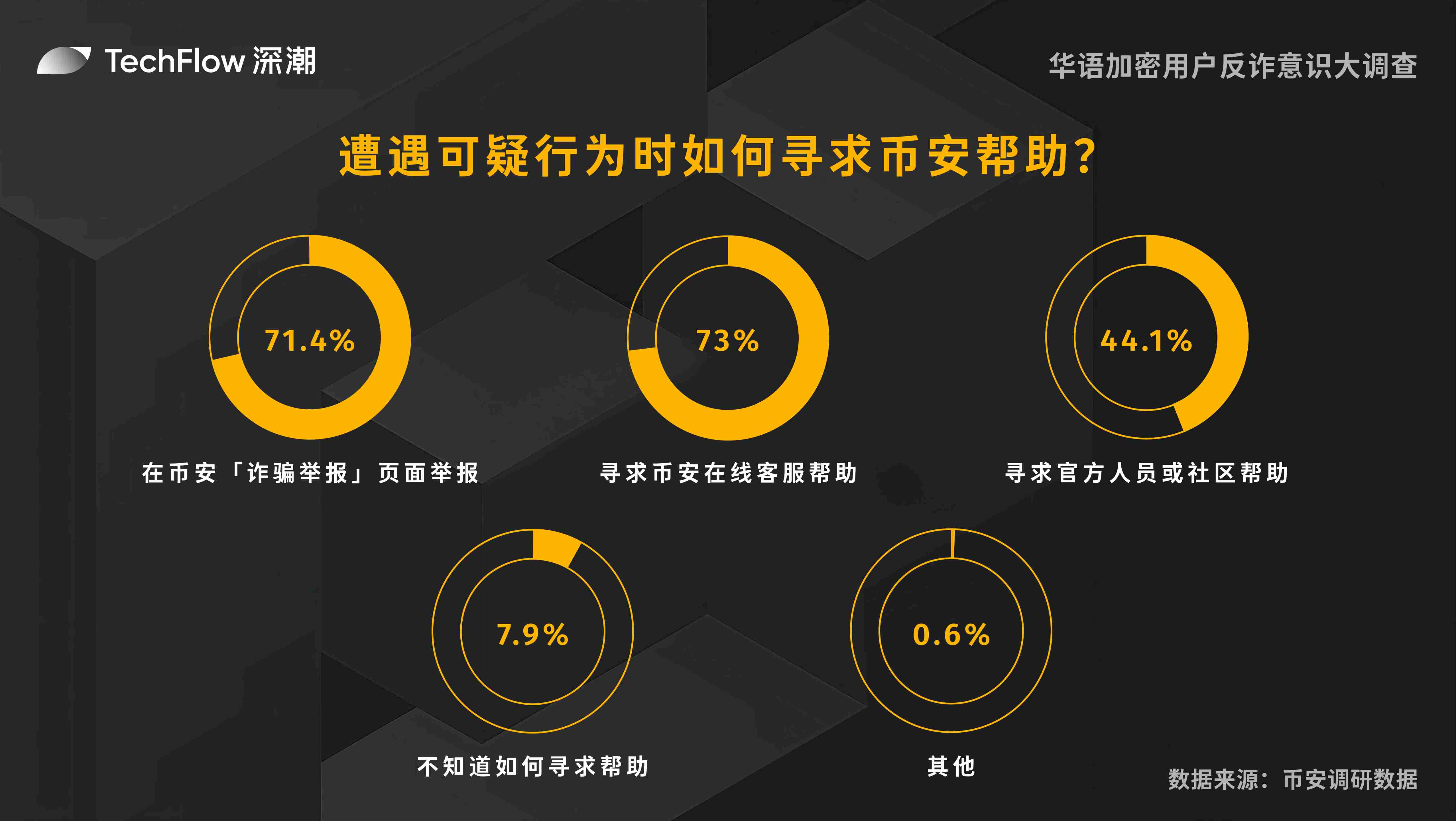

How do you seek Binance’s help when encountering suspicious activity during trading?

This survey examined how users seek help when facing suspicious behavior during trading. Multiple choices allowed. We categorized responses into three groups:

Primary methods:

-

Most users (73%) prefer contacting Binance online customer service directly.

-

71.4% file reports via Binance’s “Scam Reporting” page after being scammed.

Secondary methods:

-

44.1% seek help from official personnel or community members for additional support.

Other methods:

-

Notably, 7.9% are unsure how to seek help when problems arise.

-

0.6% use uncommon alternative methods.

Overall, most users turn to official channels like customer service and reporting pages. Binance’s Scam Reporting link is increasingly known and used. However, some rely on community support or are unsure how to act, indicating a need for stronger user education to ensure everyone can get timely help.

-

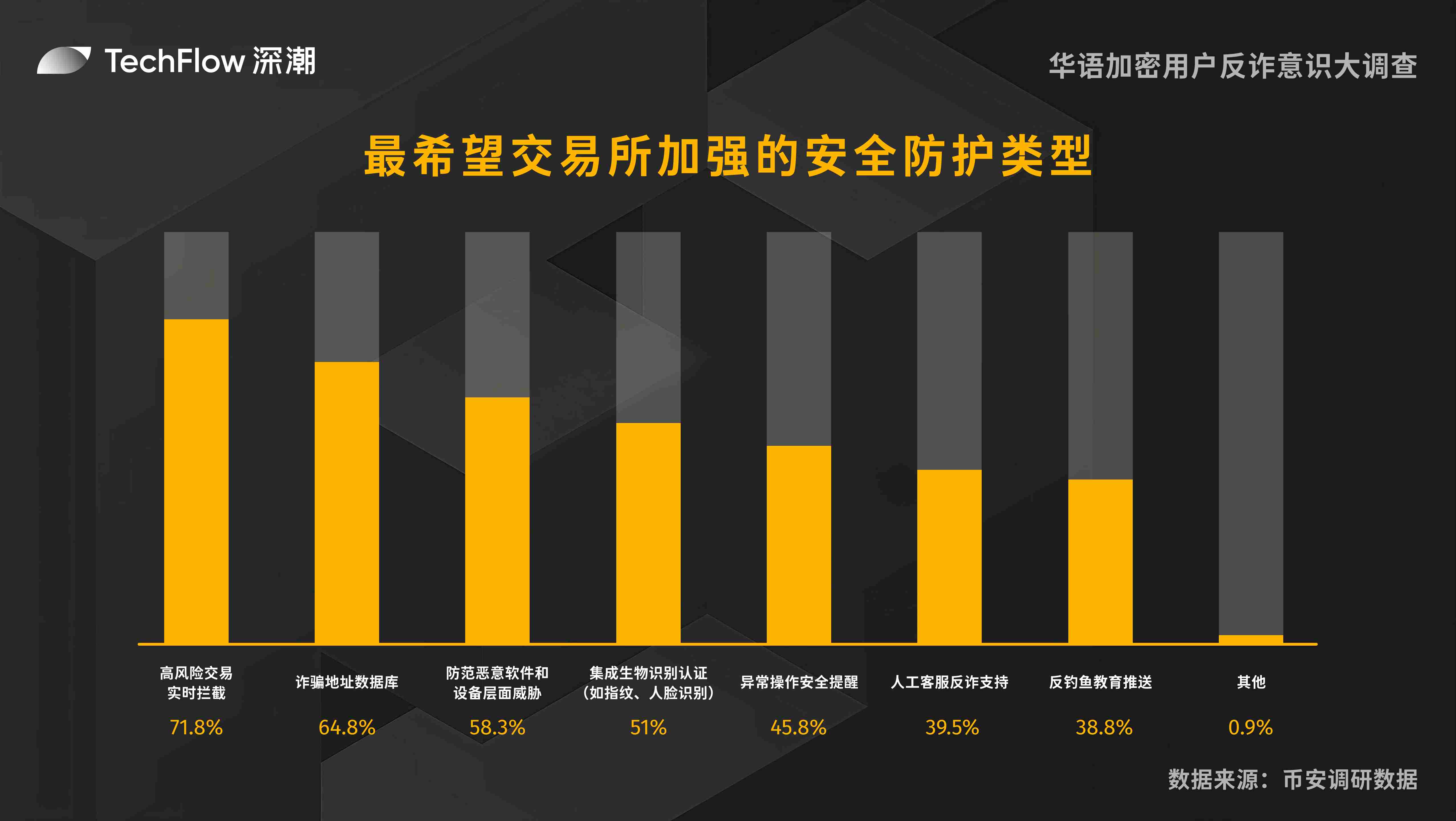

Most desired types of security enhancements for exchanges

This survey collected detailed data on the security features users want exchanges to strengthen. Multiple choices allowed. Results categorized by priority:

Top priorities:

-

71.8% want real-time interception of high-risk transactions, showing strong demand for proactive threat detection and blocking during trading.

-

64.8% want a comprehensive scam address database to check before transactions, reflecting demand for preventive protection against known scams.

Secondary priorities:

-

58.3% care about device security and want solutions against malware, recognizing its importance to overall trading safety.

-

51% are interested in biometric authentication, indicating openness to new technologies for identity verification.

Other considerations:

-

45.8% want alerts during abnormal operations, expecting timely notifications of potential risks.

-

39.5% want human customer service for anti-scam support, emphasizing the value of human assistance in complex fraud cases.

-

38.8% want more anti-phishing education, showing interest in improving personal security awareness.

-

0.9% have other specific personalized security needs.

Overall, user demands focus on real-time monitoring, preventive measures, and emerging tech, while also valuing education and human support to boost personal awareness. Exchanges must advance both technology and services to meet diverse security needs.

-

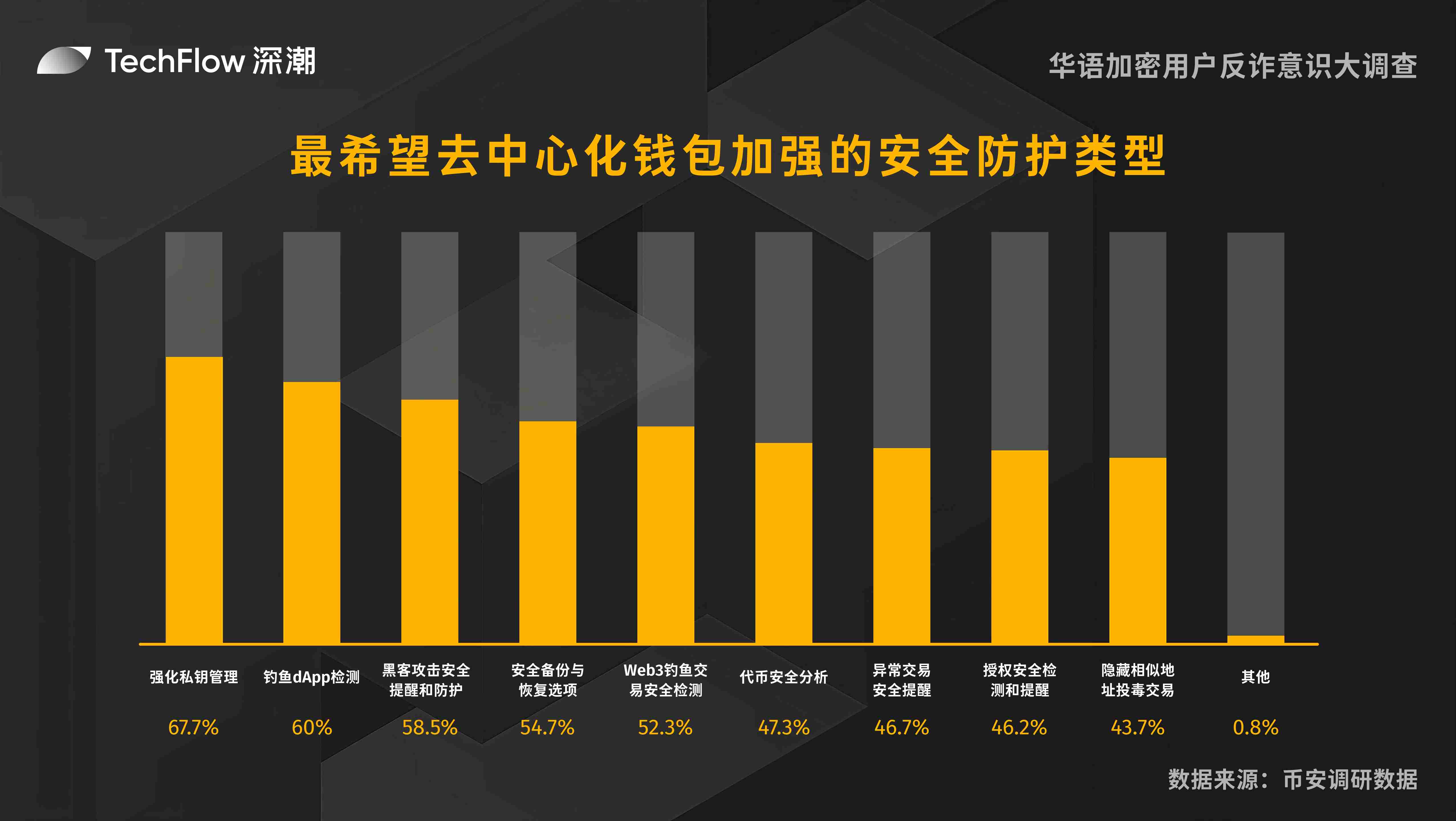

Most desired types of security enhancements for decentralized wallets

We surveyed users’ specific security needs for wallets. Multiple choices allowed.

-

On the wallet side, 67.7% want stronger private key management, and 54.7% want improved backup and recovery options.

-

Regarding external risks, 60% emphasize phishing dApp detection, 52.3% want better phishing transaction detection, and 58.5% want more efficient hacker attack identification. Additionally, 47.3%, 46.7%, 46.2%, and 43.7% want enhanced monitoring of tokens, transactions, authorizations, and address poisoning attacks, respectively.

-

0.8% have other personalized security requests.

These results indicate multifaceted user demands for decentralized wallet security, especially around private key management and phishing defense—providing clear directions for future platform optimization.

-

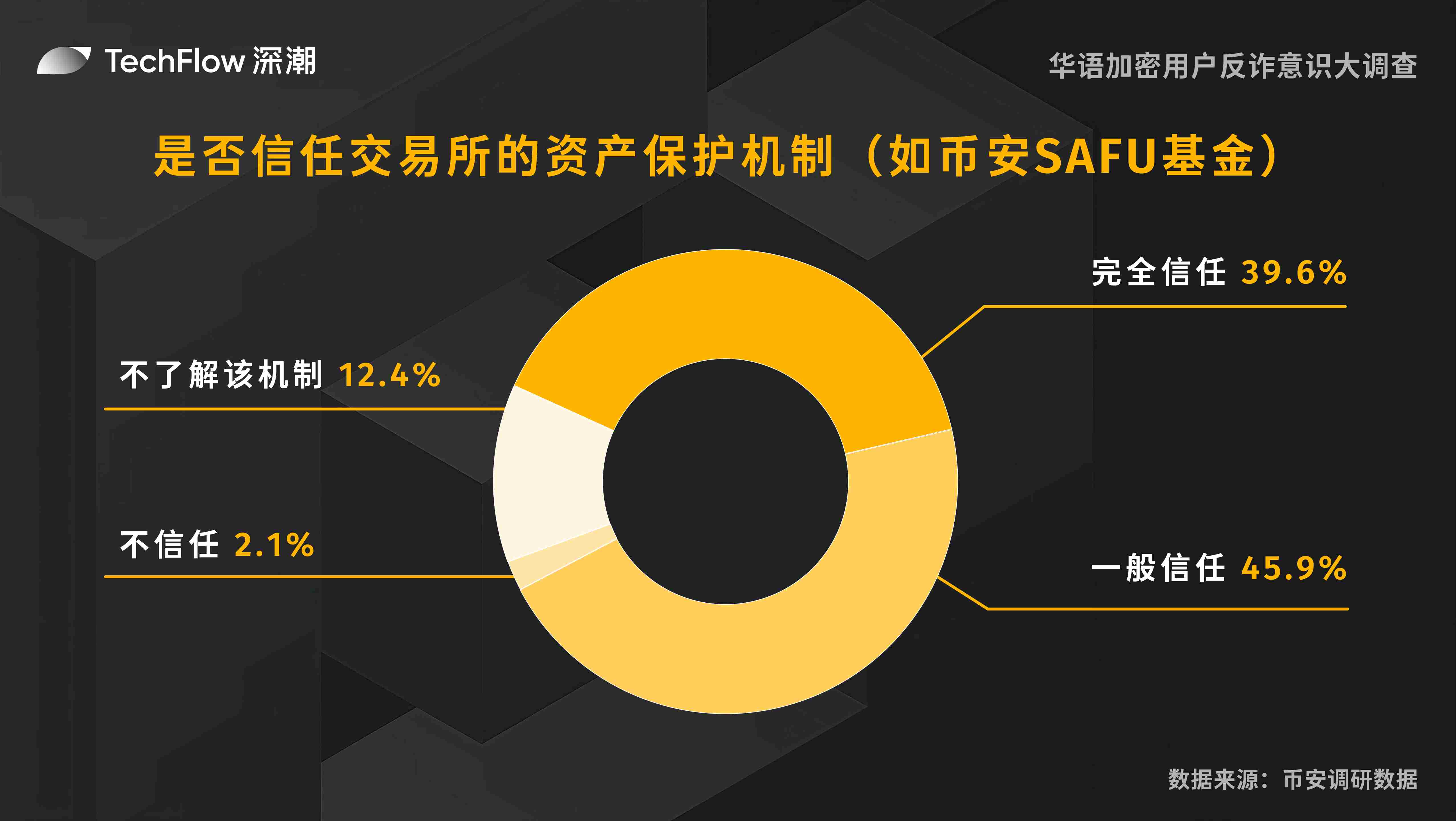

Do you trust exchange asset protection mechanisms (e.g., Binance SAFU Fund)?

Exchange asset protection mechanisms (like Binance’s SAFU Fund) play a crucial role in cryptocurrency trading. We surveyed user trust levels in these mechanisms.

Specifically, 39.6% fully trust the mechanisms, 45.9% generally trust them, only 2.1% distrust them, and 12.4% are unaware of them.

Results show most users have some level of trust in these mechanisms. However, some need more information to build stronger understanding and confidence. Exchanges can enhance trust through transparent disclosure and user education.

-

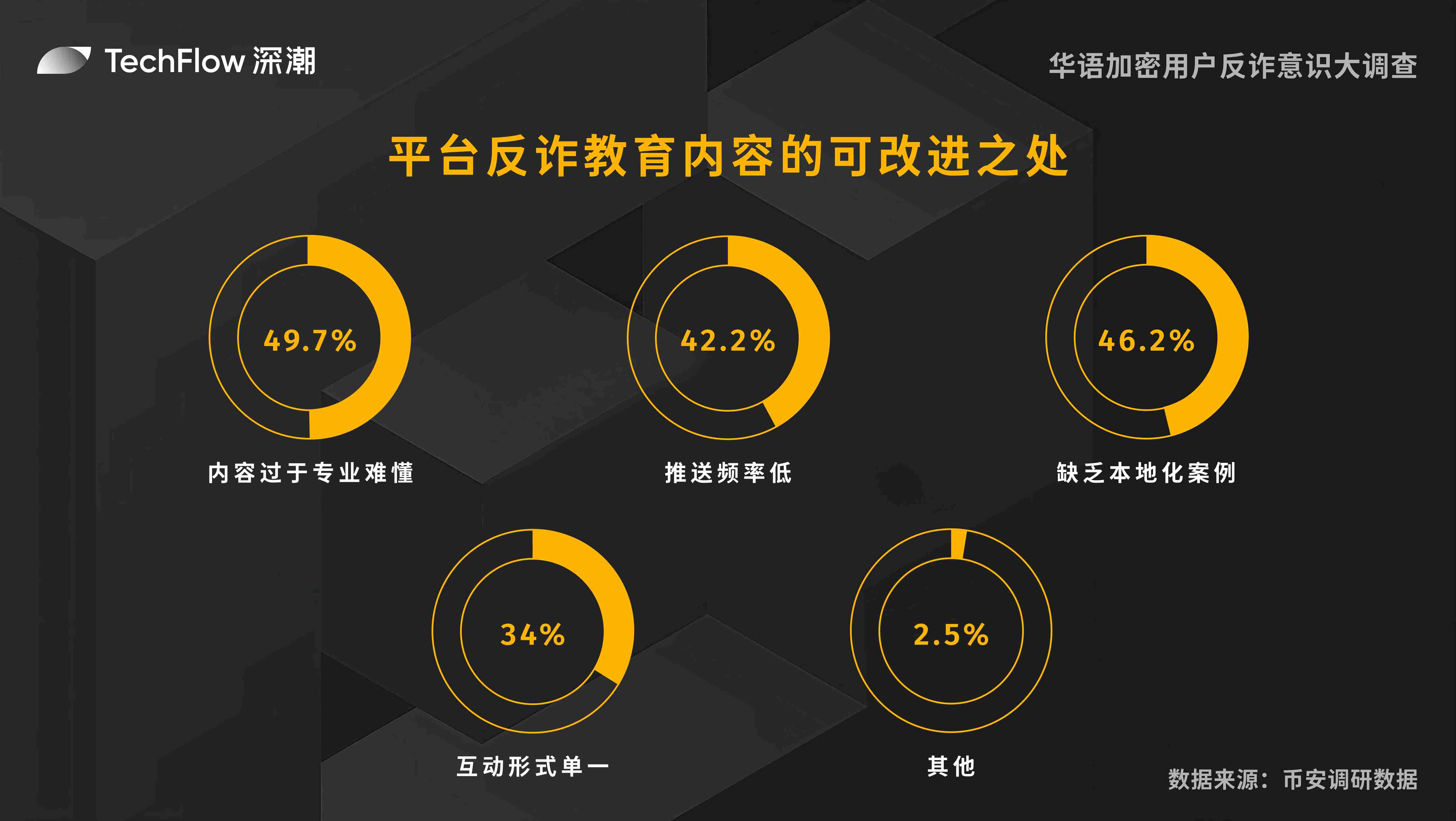

Possible improvements to platform anti-scam education content

As crypto-related scams evolve, the importance of anti-scam education grows. We surveyed user suggestions for improvement. Multiple choices allowed.

-

49.7% find current content too technical and hard to understand, suggesting simpler language for better comprehension and application.

-

42.2% say content is pushed too infrequently and recommend higher frequency to maintain awareness.

-

46.2% note a lack of localized case studies and want real-life examples relevant to their environment to increase relevance and practicality.

-

34% find current interactive formats too limited and suggest more varied engagement methods to boost participation and learning.

-

2.5% offered other suggestions, reflecting personalized needs.

Results show room for improvement in user understanding and acceptance of anti-scam education. Platforms should adapt content to better meet user needs and enhance effectiveness in helping users identify and prevent online fraud.

Part Five: Security Features and Education Preferences

This section focuses on user anti-scam awareness, particularly preferences for receiving security alerts and willingness to participate in platform-organized anti-scam simulation tests—helping platforms better assist users in identifying crypto-related scams before they occur.

-

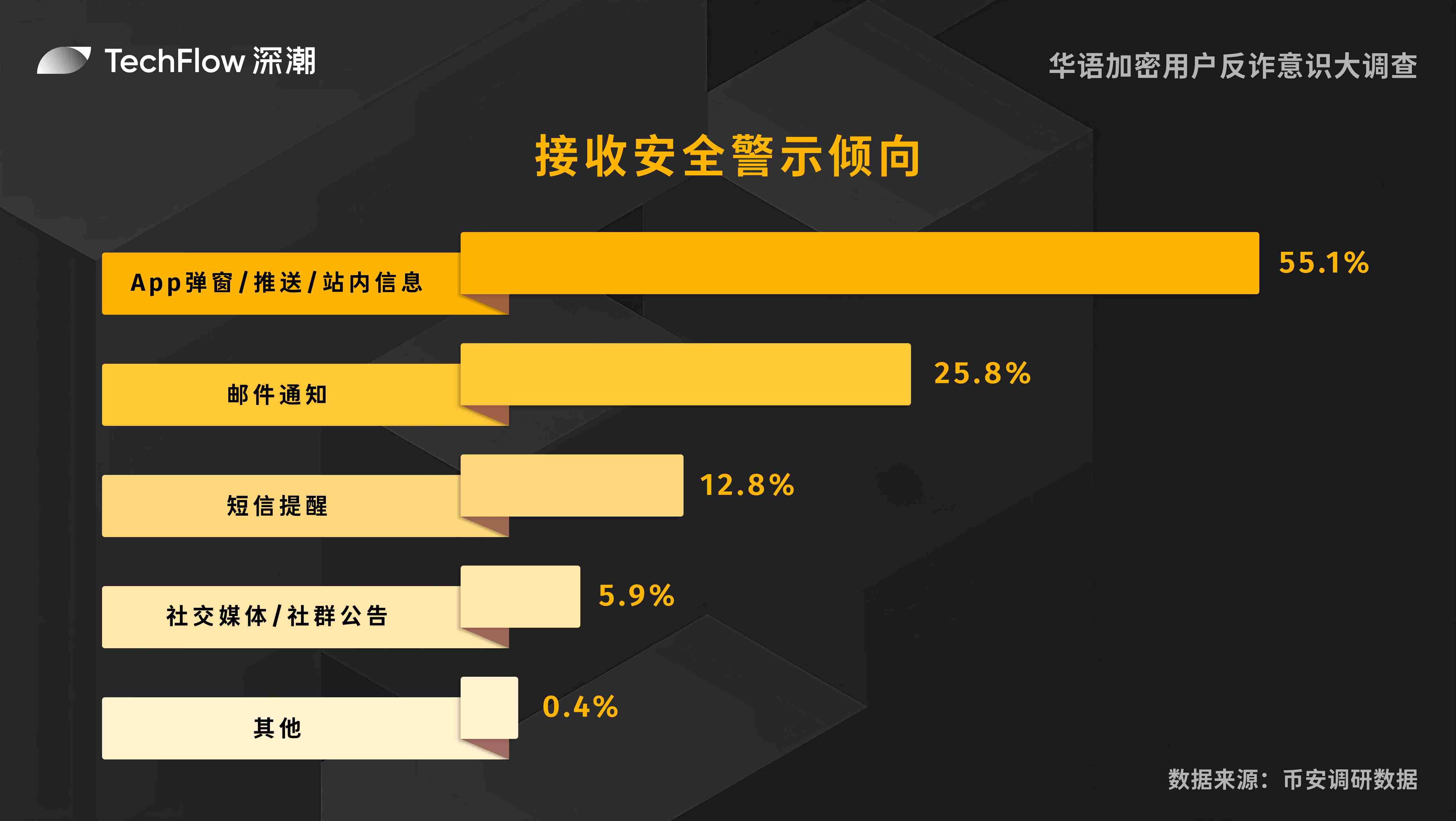

Preference for receiving security alerts

In today’s information-sensitive environment, users have varying preferences for receiving security alerts. We surveyed specific tendencies.

-

55.1% prefer app pop-ups, push notifications, or in-app messages—considered the most effective by most users.

-

25.8% prefer email alerts, suitable for users who frequently check emails.

-

12.8% choose SMS alerts, reminding us traditional methods still matter.

-

5.9% prefer social media or community announcements, though this method is less favored due to delayed access.

-

0.4% suggested other methods, reflecting niche personalized needs.

Results show most users prefer immediate app notifications. To accommodate diverse preferences, platforms should offer multiple alert channels to ensure timely and effective delivery to all users.

-

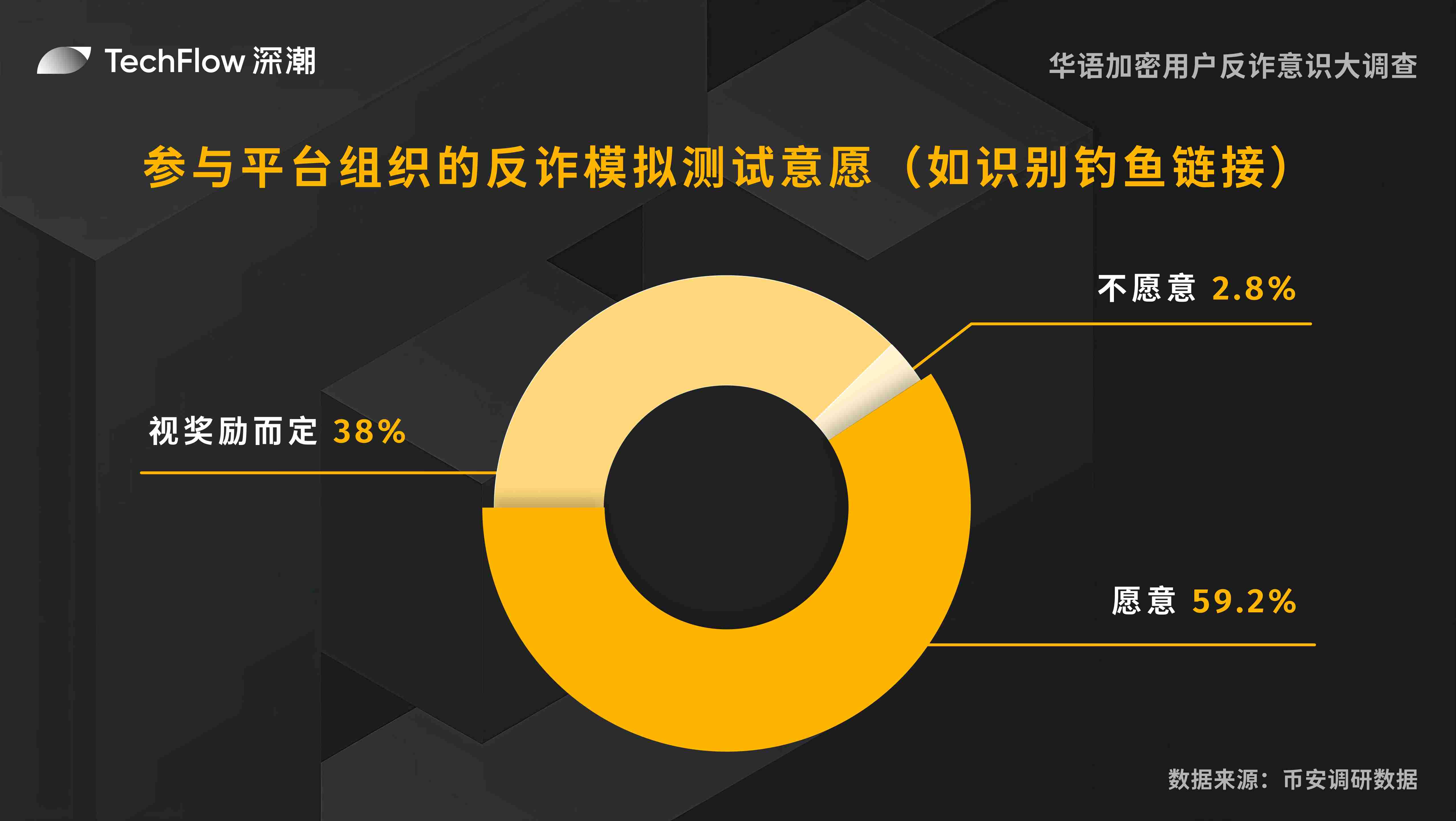

Willingness to participate in platform-organized anti-scam simulation tests (e.g., identifying phishing links)

Anti-scam simulation tests are vital for improving user security awareness and skills. We surveyed user willingness to participate.

Specifically, 59.2% are willing to participate, 38% depend on incentives, and only 2.8% are unwilling.

This indicates overwhelming openness to such tests. Platforms can boost participation through well-designed incentive programs, thereby strengthening user defenses and awareness.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News