Can Raydium's new launchpad beat Pump.fun?

TechFlow Selected TechFlow Selected

Can Raydium's new launchpad beat Pump.fun?

The war between Raydium and Pumpfun continues.

By TechFlow

Last night (April 16), Raydium (@RaydiumProtocol) officially announced its own token launch platform—LaunchLab.

Yes, Raydium has built its own Pump-style launchpad.

For those following Solana meme tokens, the battle lines are already visible: after Pump.fun launched its in-house DEX, PumpSwap, aiming to cut out Raydium entirely from on-chain meme trading, Raydium’s new product is clearly a direct countermove targeting Pump.fun.

Let’s dive into the details of Raydium’s “counterattack.”

Raydium Fights Back

As a veteran DEX in the Solana ecosystem, Raydium has long been the primary marketplace for Solana meme token trading. Tokens launched via Pump.fun typically "graduate" from their internal markets to external pools—most often Raydium—once they reach a certain market cap, making Raydium a major beneficiary. Under this model, Pump.fun has historically paid millions of dollars annually in trading fees to external platforms like Raydium.

According to Blockworks, Pump.fun once contributed 41% of Raydium’s fee revenue, earning Raydium millions of dollars in 2024 alone.

But Pump.fun clearly had no intention of remaining dependent on Raydium forever.

In early 2025, Pump.fun launched its own DEX—PumpSwap. This meant tokens issued on Pump.fun could now trade directly on PumpSwap without relying on Raydium, and with zero migration fees. When the news broke, $RAY—the native token of Raydium—plummeted, and the market outlook for Raydium’s trading volume took a significant hit.

(Further reading: Meme Market Cooling Down, Pump.fun's自救: Can PumpSwap Sustain Its Future?)

Faced with this threat, Raydium wasn’t about to sit idle. Enter: LaunchLab.

Introducing LaunchLab

Raydium describes LaunchLab as an “all-in-one token launch platform for creators, developers, and communities” (complete with a salute emoji 🫡).

Raylight followed up with a detailed thread outlining LaunchLab’s key features:

-

"JustSendIt" Mode: Instant Token Launch

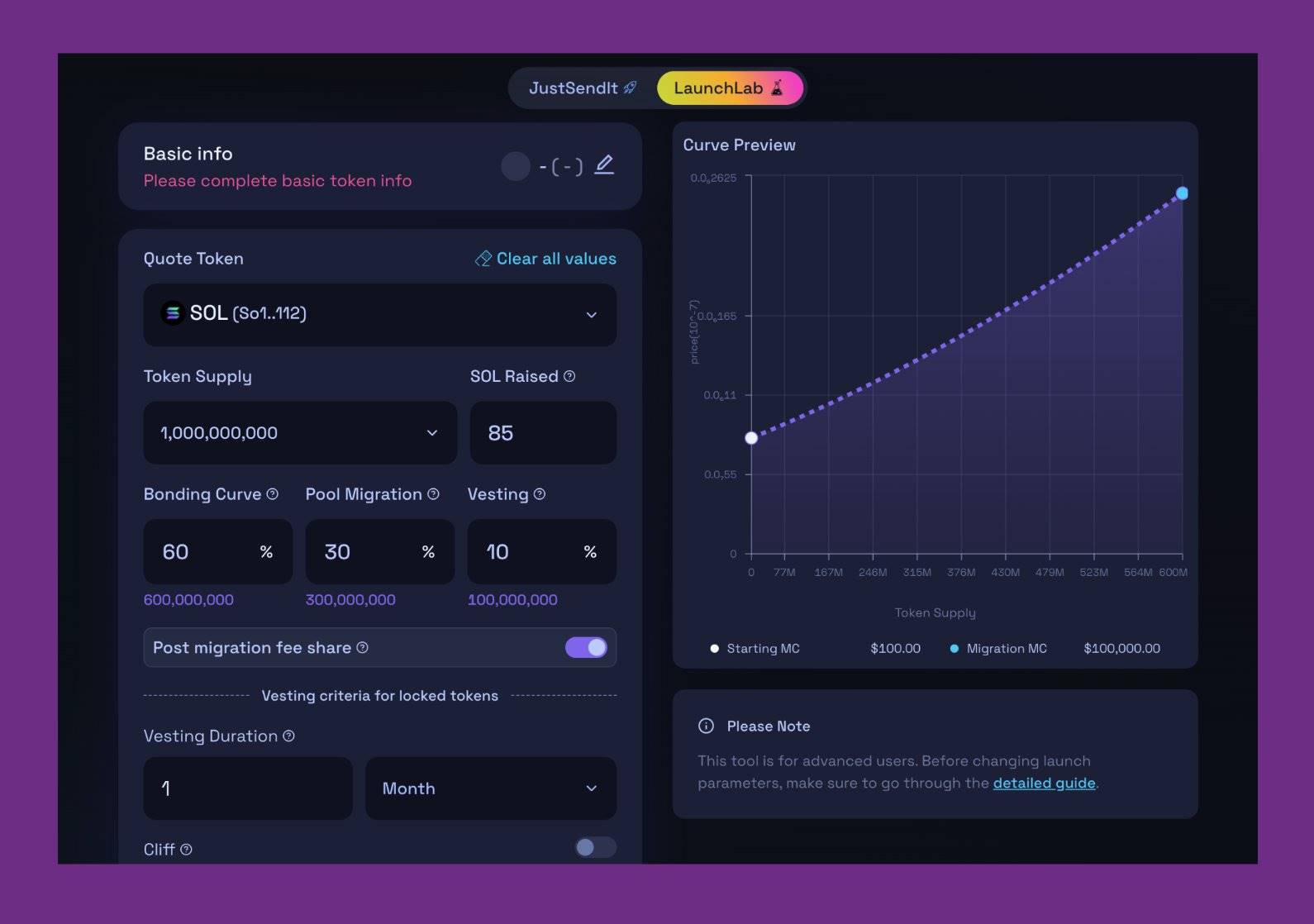

Raydium calls its token launch mechanism “JustSendIt.” To launch a token, users simply create it and raise 85 SOL (approximately $11,050 at SOL’s current price of $130). Once the target is met, liquidity is automatically migrated to Raydium’s AMM. The process incurs no migration fees or intermediaries. Raydium emphasizes “no gatekeepers,” meaning everything happens transparently and fully on-chain.

More details: Raydium Official Documentation

-

Customization: More Options for Devs

LaunchLab offers greater flexibility for token issuers.

While “JustSendIt” caters to beginners, the custom launch option is designed for advanced users. Creators can define total supply, fundraising targets, sales volume on bonding curves, and even set vesting periods—including an optional “cliff” (a waiting period before unlocking begins). A core feature, bonding curves determine how token prices scale with purchase volume. LaunchLab supports linear, exponential, and logarithmic curve types to suit different strategies.

LaunchLab includes a “Burn & Earn” mechanism: if developers (Devs) lock their LP tokens, they can earn a share of trading fees. This incentivizes long-term project sustainability and reduces rug-pull risks. (Editor’s note: Great in theory, less certain in practice 😢)

This can be enabled during token creation by selecting the "Post-Migration Fee Share" option.

-

Trading Fees & Referral Rewards

LaunchLab charges a 1% trading fee, distributed as follows: 50% goes to a community treasury (used for rewards like airdrops to creators and traders), 25% funds $RAY buybacks, and the remaining 25% supports infrastructure and operations.

Users who refer others via referral links earn 0.1% of the referred user’s trading volume in SOL.

-

Focus on Infrastructure Role

Although LaunchLab was introduced in response to traffic diversion caused by PumpSwap, Raydium isn’t shutting out other launch platforms. Instead, it aims to position LaunchLab as foundational infrastructure, encouraging third-party platforms to integrate and expand the ecosystem.

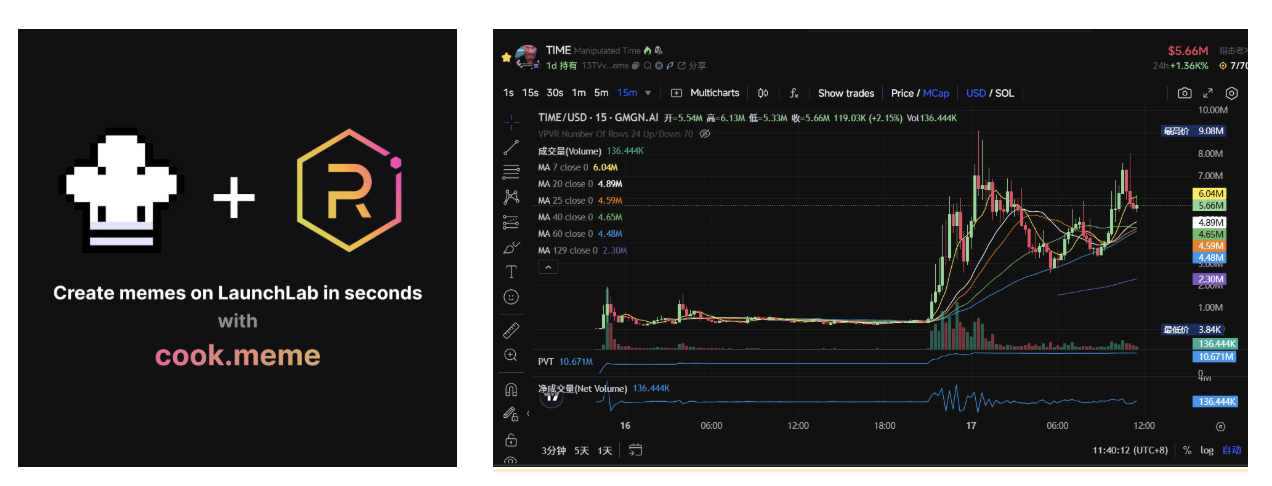

LaunchLab supports third-party integrations, allowing external launchpads to leverage its infrastructure to deploy tokens and migrate liquidity directly to Raydium’s AMM.

The leading platform under the LaunchLab concept, cook.meme, is already integrated with LaunchLab’s infrastructure. The first token launched via cook.meme using LaunchLab, $TIME, is currently the flagship LaunchLab-based meme token, with a market cap hovering around $5.6 million.

Raylight is also partnering with on-chain trading platforms like GMGN to increase visibility among active traders.

Can It Beat Pump.fun?

For Raydium, LaunchLab is a lifeline to reclaim market share and investor confidence in the memecoin space. After PumpSwap’s release, Raydium saw a clear decline in trading volume. However, upon news of LaunchLab, $RAY surged nearly 20%.

Moreover, LaunchLab isn’t just a copycat of Pump.fun. With developer customization and third-party integration capabilities, Raydium aims to expand deeper into the lucrative meme launch sector—evolving from a passive “fee collector” into an active “revenue generator.” Its strategic direction leans toward becoming a **versatile infrastructure hub** that connects broader ecosystem resources.

For Pump.fun, LaunchLab will (at least in the short term) divert some developers and users—especially those seeking more control or planning long-term projects, as well as early adopters drawn to innovation. With the meme market currently in a relatively quiet phase, competition between platforms may have an amplified effect on user acquisition. That said, Pump.fun has built strong user inertia over the past year. Unless LaunchLab delivers sustained wealth effects, its threat to Pump.fun remains limited.

For users, having more (or many) new platforms brings both pros and cons. On the positive side, players gain access to fresher experiences, innovative launch mechanisms, and potential new wealth opportunities. On the downside, fragmentation means capital dispersion. In the future, not only will we see battles over “uppercase vs lowercase” ticker names, but also disputes over “platform legitimacy”—whether a token launched on Pump.fun, Raydium, or even BSC. Ultimately, money flows where returns are highest.

As you navigate between trends and platforms, stay sharp—enjoy the hype, but cherish it wisely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News