Pump.fun launching its own AMM pool? Its intention to seize Raydium's profits is blatantly obvious

TechFlow Selected TechFlow Selected

Pump.fun launching its own AMM pool? Its intention to seize Raydium's profits is blatantly obvious

Time and fate.

Author: TechFlow

"For whoever has, more will be given; but whoever does not have, even what they have will be taken from them."

--- Matthew 25:29

On-chain, the Matthew effect—where the strong grow stronger—has never stopped.

For example, Pump.fun has quietly begun encroaching on Raydium’s territory: today it secretly launched its own AMM pool, attempting to siphon off liquidity revenue that previously belonged to Raydium.

Currently, this self-built AMM (http://amm.pump.fun) has a very simple interface—you can swap any token just like on other DeFi platforms.

However, the intentions behind this product may not be so simple.

Everyone knows that Pump.fun has attracted a large number of degens through its unique internal/external market mechanism and memecoin culture.

User trades are first matched internally within Pump.fun using the platform's own liquidity. When internal capacity is reached, trades are routed to the external market, which in reality relies on Raydium’s liquidity pools.

In this model, Pump.fun has long served as a "traffic provider" for Raydium, but has also been constrained by Raydium's rules. Each time trades flow externally, Pump.fun must pay part of the transaction fee, with those profits ultimately going to Raydium’s liquidity providers (LPs).

Raydium itself is one of the most important AMM platforms in the Solana ecosystem and a key infrastructure for DeFi users seeking liquidity. It provides liquidity pool services for numerous projects on Solana, with its TVL (total value locked) consistently ranking among the top on Solana.

As Solana’s "liquidity hub," Raydium holds a pivotal position in the ecosystem. Yet, Pump.fun’s new move is now challenging this status quo:

Pump.fun is no longer content being Raydium’s “traffic provider”—it now aims to become the controller of liquidity.

The Business Logic Behind Building Its Own AMM Pool

By building its own AMM, Pump.fun can shift external market liquidity away from Raydium to its own platform, thereby gaining full control over transaction fee distribution.

If Pump.fun’s strategy succeeds, Raydium will not only lose part of its liquidity source, but also face disruption to its revenue model and ecosystem standing.

So how exactly does the math add up?

-

Raydium’s Revenue Model: Pump.fun’s “Hidden Cost”

Under the current model, Pump.fun’s external trades rely on Raydium’s liquidity pools, and each trade incurs a fee that ultimately flows into Raydium’s ecosystem.

-

Raydium’s standard fee: Charges 0.25% per transaction, broken down as follows:

-

0.22% distributed to Raydium’s liquidity providers (LPs).

-

0.03% used for $RAY buybacks and ecosystem support.

-

-

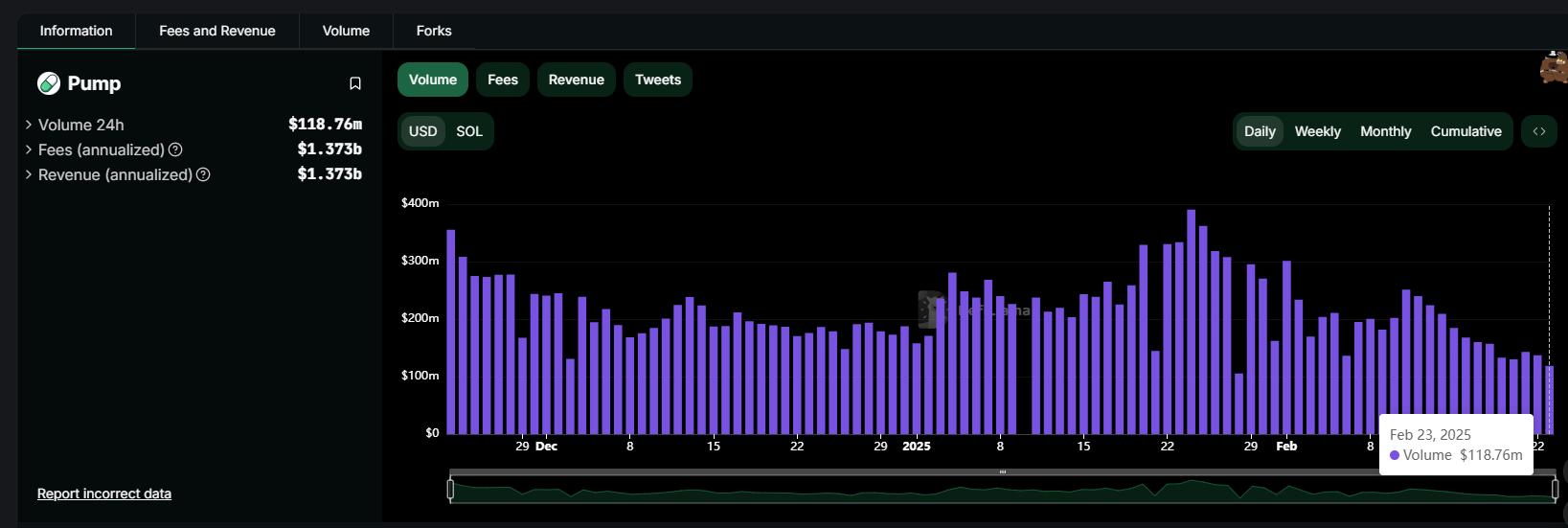

Pump.fun’s trading volume: Assuming Pump.fun processes $100 million in daily trading volume, with 5% (approximately $5 million) routed to Raydium’s external market.

-

Pump.fun’s hidden cost: At a 0.25% fee rate, Pump.fun pays $12,500 daily to Raydium, amounting to roughly $4.56 million annually.

For a rapidly growing platform, while this cost has decreased compared to earlier levels, it still represents a dependency on an external party.

-

Potential Gains from Building an In-House AMM

By building its own AMM, Pump.fun can redirect external liquidity from Raydium to its platform, gaining complete control over fee allocation. How much potential profit could this move generate?

-

New revenue stream: Suppose Pump.fun sets its AMM fees at the same level as Raydium (0.25%), but retains all fees:

-

Daily external trading volume remains at $5 million.

-

At 0.25% fees, Pump.fun earns $12,500 daily.

-

Annual income totals approximately $4.56 million.

-

-

Net gains after eliminating LP costs: If Pump.fun’s AMM doesn’t rely on external LPs and instead uses platform-provided liquidity, all income goes directly to the platform without sharing.

-

Beyond money: What else does Pump.fun stand to gain?

Building its own AMM not only boosts direct revenue but also significantly strengthens Pump.fun’s control over its ecosystem, laying the foundation for future growth.

Under the current model, Pump.fun depends on Raydium’s pools for external trades, meaning Raydium controls user trading experience and liquidity stability.

With its own AMM, Pump.fun will fully control pool rules and fee distribution, enhancing its authority over users.

Once it controls liquidity, Pump.fun can launch additional DeFi products (such as perpetual contracts, lending protocols, etc.), creating a closed-loop ecosystem.

For instance, Pump.fun could use its AMM to directly support memecoin issuance and trading, offering more utility to its community.

Price Movements of Relevant Tokens

After Pump.fun announced its self-built AMM, Raydium’s token $RAY dropped sharply, with a daily decline reaching 20%.

This may reflect market concerns about Raydium’s future revenue and position.

Pump.fun’s strategy poses a long-term threat to Raydium, especially regarding liquidity migration and fee income.

On the flip side, a MEME token called Crack, used to test the new AMM pool, surged in price, briefly reaching a market cap of $4 million.

CA:

CitRGsrgU7NjaXsxdMFc7sfsxtSnPdtkhHJqbPvhpump

Amid limited market excitement, test tokens for the AMM pool might continue to see momentum for some time.

Intentions to Challenge Are Now Clear

If its self-built AMM operates smoothly, Pump.fun will gain full control over external liquidity, significantly boosting revenue.

By integrating internal and external liquidity, Pump.fun can build a fully self-sustaining on-chain Meme DeFi ecosystem.

From capturing attention to directing capital flow, Pump.fun is clearly transitioning from "relying on external liquidity" to "owning its own liquidity."

Once an innovative platform gains sufficient user base, it naturally gains the ability to disrupt traditional DeFi standings and reshape the on-chain ecosystem.

Yet, whether Pump.fun can truly challenge Raydium’s dominance will depend on its ability to balance liquidity strategy and user growth—and more crucially, on whether the bull market continues.

Timing and fortune.

It’s not just retail investors battling it out—platforms are now locking horns in fierce competition too.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News